Fill Out Your Fsa Form

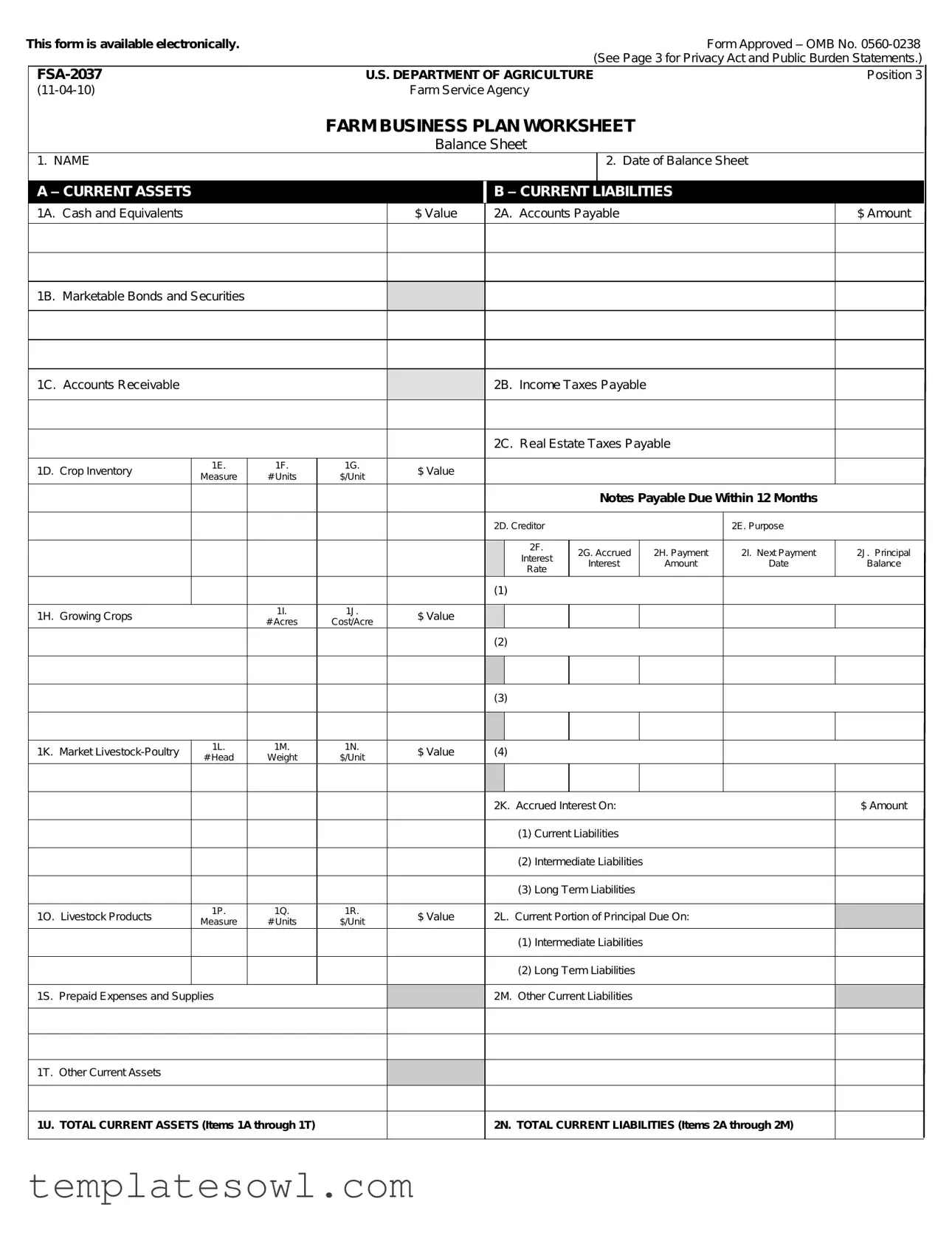

The Farm Service Agency (FSA) Form, specifically the FSA-2037, serves as a crucial tool for farmers and agricultural businesses striving to create a comprehensive outline of their financial standing. This worksheet enables the meticulous documentation of assets and liabilities across various categories, such as current, intermediate, and long-term segments. Farmers can record pertinent details about their current assets, including cash, accounts receivable, and crop inventories, as well as current liabilities, which consist of payables and taxes due. The form also addresses intermediate assets and liabilities, capturing information about machinery and equipment along with the loans secured against them. The long-term section details real estate holdings and related financial obligations. Notably, it requires the declaration of personal assets and liabilities, thus presenting a full financial picture for evaluation. Farmers sign the form to certify the accuracy of the provided information, which is vital for loan and grant eligibility assessments. The form contains essential privacy notices and warns about the consequences of providing false information. Ultimately, the FSA-2037 aids in ensuring that agricultural businesses maintain a clear understanding of their financial health and assists in navigating the complexities of funding processes for farmers.

Fsa Example

This form is available electronically.

Form Approved

U.S. DEPARTMENT OF AGRICULTURE |

Position 3 |

|

Farm Service Agency |

|

FARM BUSINESS PLAN WORKSHEET

Balance Sheet

1. NAME

2. Date of Balance Sheet

|

A |

|

|

|

|

|

|

|

B |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1A. Cash and Equivalents |

|

|

|

|

$ Value |

|

|

2A. Accounts Payable |

|

|

|

$ Amount |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1B. Marketable Bonds and Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

1C. Accounts Receivable |

|

|

|

|

|

|

|

2B. Income Taxes Payable |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

2C. Real Estate Taxes Payable |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1D. |

Crop Inventory |

1E. |

1F. |

1G. |

|

$ Value |

|

|

|

|

|

|

|

|

|

|

|

|

Measure |

# Units |

$/Unit |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes Payable Due Within 12 Months |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2D. Creditor |

|

|

|

2E. Purpose |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2F. |

2G. Accrued |

|

2H. Payment |

2I. Next Payment |

|

2J. Principal |

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

|

Amount |

Date |

|

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

Rate |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1H. Growing Crops |

|

1I. |

1J. |

|

$ Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# Acres |

Cost/Acre |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1K. |

Market |

1L. |

1M. |

1N. |

|

$ Value |

(4) |

|

|

|

|

|

|

|

|||

|

# Head |

Weight |

$/Unit |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2K. Accrued Interest On: |

|

|

|

$ Amount |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(1) Current Liabilities |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(2) Intermediate Liabilities |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(3) Long Term Liabilities |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1O. |

Livestock Products |

1P. |

1Q. |

1R. |

|

$ Value |

|

|

2L. |

Current Portion of Principal Due On: |

|

|

|

||||

|

Measure |

# Units |

$/Unit |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

(1) Intermediate Liabilities |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

(2) Long Term Liabilities |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1S. |

Prepaid Expenses and Supplies |

|

|

|

|

|

|

2M. |

Other Current Liabilities |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1T. |

Other Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1U. TOTAL CURRENT ASSETS (Items 1A through 1T)

2N. TOTAL CURRENT LIABILITIES (Items 2A through 2M)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 4 |

||||

|

C |

|

|

|

|

|

|

|

|

E |

|

|

|||||||

|

3A. |

Machinery & Equipment/Farm Vehicles (Entered on Page 4) |

|

|

|

|

5A. Creditor |

|

|

5B. Purpose |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3B. |

|

|

3C. |

3D. |

|

3E. |

|

$ Value |

|

|

|

5C. |

5D. Accrued |

5E. Payment |

5F. Next Payment |

5G. Principal |

|

|

|

|

|

|

|

|

|

|

Interest |

||||||||||

|

|

Breeding Stock |

|

Raised/Purch |

# Head |

|

$/Head |

|

|

|

|

Interest |

Amount |

Date |

Balance |

||||

|

|

|

|

|

|

|

|

|

Rate |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3F. |

Notes Receivable |

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

3G. Not Readily Marketable Bonds and Securities |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3H. |

Other Intermediate Assets |

|

|

|

|

|

|

|

(7) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3I. TOTAL INTERMEDIATE ASSETS (Items 3A through 3H) |

|

|

|

|

5H. TOTAL INTERMEDIATE LIABILITIES (Item 5G (1 through 7)) |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

D |

|

|

|

|

|

|

|

|

F |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4A. |

Building and Improvements |

|

|

|

|

|

$ Value |

|

|

6A. Creditor |

|

|

6B. Purpose |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6C. |

6D. Accrued |

6E. Payment |

6F. Next Payment |

6G. Principal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest |

Amount |

Date |

Balance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rate |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

4B. Real |

4C. Total |

4D. Crop |

4E. |

|

4F. $/Acre |

|

|

|

|

|

|

|

|

|

|

|||

|

Acres |

Acres |

%Owned |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

(3) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(5) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(6) |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4G. Other Long Term Assets |

|

|

|

|

|

$ Value |

|

(7) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4H. TOTAL LONG TERM ASSETS (Items 4A through 4G) |

|

|

|

|

|

6H. TOTAL LONG TERM LIABILITIES (Item 6GA (1 through 7)) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

|

4I. TOTAL FARM ASSETS (From Items 1U, 3I and 4H) |

|

|

|

|

|

6I. TOTAL FARM LIABILITIES (From Items 2N, 5H, and 6H) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6J. TOTAL FARM EQUITY (Item 4I minus Item 6I) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 of 4 |

|||

|

G |

|

H |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ Value |

|

8A. |

Creditor |

|

|

8B. Purpose |

|

|

|

7A. Cash and Equivalents |

|

|

|

|

8C. |

8D. Accrued |

8E. Payment |

8F. Next Payment |

8G. Principal |

|

|

|

|

|

|

Interest |

||||||

|

|

|

|

|

Interest |

Amount |

Date |

Balance |

|||

|

|

|

|

|

|

|

Rate |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

7B. |

Stocks, Bonds |

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7C. Cash Value Life Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7D. |

Other Current Assets |

|

|

(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7E. Household Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7F. |

Car, Recreational Vehicle, Etc. |

|

|

(3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7G. |

Other Intermediate Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7H. |

Retirement Accounts |

|

|

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7I. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7J. |

|

|

8H. |

Other Liabilities |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

7K. Other Long Term Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

7L. TOTAL PERSONAL ASSETS (Items 7A through 7K) |

|

|

8I. TOTAL PERSONAL LIABILITIES |

|

|

|||||

|

|

|

|

|

|

|

|||||

|

7M. TOTAL ASSETS (Item 4I and Item 7L) |

|

|

8J. TOTAL LIABILITIES (Item 6I and Item 8I) |

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

8K. TOTAL EQUITY (Item 7M minus Item 8J) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

||

|

I - WARNING |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

I certify that the information provided is true, complete, and correct to the best of my knowledge and is provided in good faith. (Warning: Section 1001 of Title 18, United States Code, provides for criminal penalties to those who provide false statements. If any information is found to be false or incomplete, such finding may be grounds for denial of the requested action.)

9A. SIGNATURE

9B. DATE

10. COMMENTS

NOTE: The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified on this form is the Consolidated Farm and Rural Development Act, as amended (7 U.S.C. 1921 et. seq.). The information will be used to determine eligibility and feasibility for loans and loan guarantees, and servicing of loans and loan guarantees. The information collected on this form may be disclosed to other Federal, State, and local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in the applicable Routine Uses identified in the System of Records Notice for

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

THIS COMPLETED FORM TO YOUR COUNTY FSA OFFICE.

The U.S. Department of Agriculture (USDA) prohibits discrimination in all of its programs and activities on the basis of race, color, national origin, age, disability, and where applicable, sex, marital status, familial status, parental status, religion, sexual orientation, political beliefs, genetic information, reprisal, or because all or part of an individual’s income is derived from any public assistance program. (Not all prohibited bases apply to all programs.) Persons with disabilities who require alternative means for communication of program information (Braille, large print, audiotape, etc.) should contact USDA’s TARGET Center at (202) 720- 2600 (voice and TDD). To file a complaint of discrimination, write to USDA, Assistant Secretary for Civil Rights, Office of the Assistant Secretary for Civil Rights, 1400 Independence Avenue, S.W., Stop 9410, Washington, DC

|

|

|

|

|

|

Page 4 of 4 |

|||

|

J |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

11A. |

11B. |

|

11C. |

11D. |

11E. |

11F. |

11G. |

11H. |

|

Qty. |

Description |

|

Manufacturer |

Size/Type |

Condition |

Year |

Serial Number |

$ Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11I TOTAL $ VALUE OF (ITEM 1H)

K

12A. |

12B. |

12C. |

12D. |

12E. |

12F. |

12G. |

12H. |

Qty. |

Description |

Manufacturer |

Size/Type |

Condition |

Year |

Serial Number/VIN |

$ Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12I. TOTAL $ VALUE OF (12H)

12J. TOTAL $ VALUE OF (ITEMS 11I AND 12I) TRANSFER TO ITEM 3A)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Availability | The FSA-2037 form is available electronically. |

| OMB Approval | This form is approved under OMB No. 0560-0238. |

| Last Revision Date | The form was last revised on November 4, 2010. |

| Uses of Information | Information collected is used to determine eligibility for loans and loan guarantees. |

| Privacy Act Compliance | The form fulfills requirements of the Privacy Act of 1974 (5 USC 552a). |

Guidelines on Utilizing Fsa

Filling out the FSA form is an important task that requires careful attention to detail. This step-by-step guide will help you through the process, ensuring all necessary information is accurately recorded. Once you complete the form, you can submit it to your county Farm Service Agency office for review.

- Begin by entering your name in the designated space at the top of the form.

- Next, write the date of the balance sheet next to your name.

- In section A, list your current assets:

- Record cash and equivalents, marketable bonds and securities, accounts receivable, crop inventory, growing crops, market livestock-poultry, livestock products, prepaid expenses, and any other current assets.

- In section B, enter your current liabilities:

- Include accounts payable, income taxes payable, real estate taxes payable, accrued liabilities, and other current liabilities.

- Proceed to section C for intermediate assets:

- Document machinery and equipment, breeding stock, notes receivable, and any other intermediate assets.

- Move to section E for intermediate liabilities:

- List creditors and their purposes, along with accrued amounts and payment details.

- In section D, record long-term assets:

- Include buildings, land, crops, and other long-term assets.

- In section F, detail long-term liabilities:

- Note creditors, purpose, accrued amounts, and payment information.

- Continue with section G for personal assets:

- Write down cash equivalents, stocks, bonds, life insurance, household goods, vehicles, retirement accounts, and other personal assets.

- Document personal liabilities in section H:

- List creditors and their respective purposes along with payment details.

- Complete section I by calculating and entering total values for assets, liabilities, and equity based on the information recorded.

- Finally, sign and date the form in section J, affirming that the information is true and complete.

What You Should Know About This Form

What is the FSA-2037 form?

The FSA-2037 form is a Farm Business Plan Worksheet utilized by the U.S. Department of Agriculture's Farm Service Agency. It helps farmers and ranchers document their financial status, including assets, liabilities, and overall equity. This structured approach allows for a clear assessment of a farm business's financial health, which is essential for securing loans and managing finances effectively.

Who needs to fill out the FSA-2037 form?

This form should be completed by farmers and ranchers who are seeking loans or loan guarantees from the USDA. It is critical for those looking to demonstrate their creditworthiness and financial viability, thus making it easier to obtain financial assistance for agricultural operations.

How can I access the FSA-2037 form?

The FSA-2037 form is available electronically, making it more accessible for farmers and ranchers. It can often be downloaded from the USDA's Farm Service Agency website or obtained directly from local FSA offices.

What information is required on the form?

The form requires detailed information regarding both current and long-term assets and liabilities. This includes cash on hand, value of properties, accounts payable, machinery, and livestock, among other financial items. Personal assets and liabilities may also need to be included, contributing to a comprehensive view of the applicant's financial situation.

What are current assets and liabilities?

Current assets refer to what the farm or ranch owns that can be easily converted into cash within a year, including cash, inventories, and receivables. Current liabilities are debts that need to be settled within the same timeframe, such as accounts payable or short-term loans. Understanding these components is vital for assessing financial stability.

Why is accuracy important when filling out the FSA-2037 form?

Providing accurate information is crucial for several reasons. Firstly, it builds trust with lenders and ensures that the recipient of funds is financially responsible. Secondly, inaccurate or incomplete information can result in penalties or a denial of the loan application, hindering the farmer's ability to receive necessary financial support.

How long does it take to complete the FSA-2037 form?

Completing the FSA-2037 form typically requires an estimated 1.25 hours. This estimate includes reviewing instructions, gathering financial data, and completing the form. It is essential to allocate sufficient time to ensure that the information is thorough and accurate.

What should I do if I have questions while filling out the form?

If questions arise while completing the FSA-2037 form, it's advisable to contact your local FSA office. Staff members are usually equipped to provide guidance and clarify any uncertainties. Additionally, online resources may also be available to assist in navigating the form's requirements.

Common mistakes

Filling out the FSA form can be a daunting task, and mistakes can lead to delays or denials. One common mistake is failing to provide complete information. Each section of the form requires specific data. When sections are left blank or incomplete, it may raise red flags during the review process. It's crucial to double-check that all fields are filled out accurately.

Another mistake often made is the misreporting of numbers. Accuracy is key when entering financial figures. Rounding errors or incorrect unit measures can result in significant discrepancies. Always double-check calculations and ensure that the unit values match to avoid potential issues later.

Many applicants also forget to sign and date the form. The certification section at the end is not just a formality. It confirms the truthfulness of the information provided. A missing signature or date can render the application void, requiring resubmission and additional delay.

Using outdated forms is another mistake that can create complications. The FSA regularly updates its forms and instructions. Using an old version fails to incorporate the latest requirements and may lead to an incomplete submission. Always ensure that you are using the most current form version, which can be retrieved from the official website.

Finally, neglecting to review the privacy and burden statements can be detrimental. These sections outline important guidelines about data handling and its implications. Understanding these details ensures that applicants are aware of their rights and responsibilities when providing information. Familiarization with these statements can provide clarity and prevent misunderstandings throughout the application process.

Documents used along the form

The Farm Service Agency (FSA) Form is an essential document for farmers seeking loans or loan guarantees. When submitting the FSA form, several additional documents can provide crucial information about your agricultural business and financial standing. Below is a list of commonly used forms and documents that often accompany the FSA form, each playing a unique role in the application process.

- Business Plan: This comprehensive document outlines the goals of the farming operation, including financial projections, management strategies, and specific marketing plans. A well-prepared business plan demonstrates the viability of your farming enterprise to lenders.

- Balance Sheet: This financial statement provides a snapshot of the farm's assets, liabilities, and equity at a specific point in time. It helps lenders assess the financial health and stability of your farming business.

- Cash Flow Statement: This document illustrates the inflow and outflow of cash over a period. It allows lenders to evaluate how effectively your farm generates cash to meet its obligations.

- Profit and Loss Statement (Income Statement): This statement summarizes revenues and expenses over a specific period, helping to measure profitability. It's essential for lenders to understand the operational success of the farm.

- Tax Returns: Providing the last few years of tax returns offers lenders insight into your income, expenses, and overall financial condition. It helps verify the information presented in other financial documents.

- Personal Financial Statement: This document outlines an individual’s personal finances, including income, expenses, assets, and liabilities. Lenders use it to evaluate your financial stability and ability to repay any borrowed money.

- Loan Application Form: A standard application form is often required by lenders to collect specific information regarding the loan being requested, including the amount and use of funds. This document facilitates the loan approval process.

- Asset Inventory: This detailed list includes all equipment, livestock, and land owned by the farmer. Providing a current inventory helps lenders assess collateral value, which can aid in securing financing.

- Market Analysis: This report evaluates current market conditions, demand, and price trends for the products you produce. It assists in projecting future revenue and shows lenders that you are aware of the market dynamics affecting your business.

These documents collectively create a clearer picture of the farm's current state and its potential for growth, making it easier for lenders to make informed decisions. Having them well-prepared can significantly enhance the chances of obtaining financial support for your agricultural endeavors.

Similar forms

The FSA form, which serves as a Farm Business Plan Worksheet, is akin to other important financial documents designed for similar purposes. Here are four documents that share similarities with the FSA form:

- Personal Financial Statement: Like the FSA form, the personal financial statement collects information about current assets and liabilities. It helps individuals assess their overall financial situation, much like farmers use the FSA to evaluate their business health.

- Balance Sheet: This document, often used by businesses, summarizes assets, liabilities, and equity at a specific point in time. The FSA form follows a similar structure, allowing farmers to detail their financial standing regarding their farm and personal assets.

- Cash Flow Statement: Both the cash flow statement and the FSA form identify sources and uses of funds. While the cash flow statement focuses on cash movements over a period, the FSA form assesses cash equivalents and obligations at a chosen moment.

- Budget Worksheet: Budgets estimate future income and expenses based on past information. The FSA form also requires farmers to input values for various assets and liabilities, serving as a foundation for future farm financial planning.

Dos and Don'ts

When filling out the FSA form, consider the following best practices:

- Read the instructions carefully before starting the form.

- Ensure all personal and business information is accurate and complete.

- Use clear and legible handwriting or type the information electronically.

- Double-check all calculations to avoid errors in financial reporting.

- Keep a copy of the completed form for your records.

Avoid these common mistakes:

- Do not leave any required fields blank.

- Avoid guesswork for financial figures; use actual amounts.

- Do not provide false information or misrepresent any data.

- Refrain from submitting the form without a final review.

- Do not forget to sign and date the form in the designated spots.

Misconceptions

Understanding the FSA-2037 form is crucial for many individuals involved in agriculture and farming. Unfortunately, several misconceptions surround this important document. Here are seven common misunderstandings, clarifying the truth behind each one:

- It’s only for large farms. This form is not exclusively for large farming operations. Whether you run a small hobby farm or a large commercial enterprise, the FSA-2037 is applicable.

- Filling out the form is optional. While participation is voluntary, providing accurate information is essential for determining eligibility for loans and loan guarantees. Not completing the form can result in missed opportunities.

- The FSA-2037 is outdated and irrelevant. On the contrary, the form has been regularly updated to reflect current standards in agricultural finance. Its relevance cannot be overstated in today’s farming economy.

- You need to submit the form every year. It’s true that annual updates may be required, but only if significant changes occur in your financial situation. Regularly reviewing your information is recommended.

- All information provided is confidential. While the USDA strives to protect your data, certain information may be shared with other authorized agencies. Be mindful about what you include.

- You can only submit the form by mail. The FSA-2037 form is now available electronically, making it easier and faster to submit your application.

- It’s not possible to receive help while filling it out. Assistance is available! Local FSA offices and online resources can guide you through the process, ensuring you complete the form correctly.

Being informed about these misconceptions helps you make better decisions regarding your agricultural business. If you find yourself in need of assistance or have further questions, don't hesitate to contact your local FSA office. Time is of the essence when it comes to securing your farm's financial future!

Key takeaways

Completing the FSA form is essential for a successful farm business plan. Here are key takeaways to keep in mind:

- The form is electronically available, making it accessible and easy to fill out.

- Always ensure that the information provided is accurate and truthful. False statements can lead to serious penalties.

- Structuring your financial data correctly is crucial. Use the specified sections for assets and liabilities.

- Break down your assets into categories: current, intermediate, and long-term to enhance clarity.

- Include all types of assets, from cash and inventory to machinery and personal assets.

- Be thorough with your liabilities, recording both current and long-term obligations accurately.

- The total farm equity should be calculated by subtracting total liabilities from total assets.

- Submit the completed form to your local FSA office to initiate your request.

- Understand that this data can be shared with other agencies to determine your loan eligibility.

- Follow the time estimates for each section, which average around 1.25 hours for completion.

Browse Other Templates

Audit List - Tracks past, family, and social history of the patient.

Broome County Sheriff's Office - Applicants should maintain copies of all submitted documents for their records.