Fill Out Your Ftc Identity Theft Affidavit Form

When dealing with the aftermath of identity theft, having the right tools and resources is crucial. The FTC Identity Theft Affidavit form serves as a vital document for victims seeking to report identity theft and resolve issues stemming from it. This voluntary form allows individuals to officially file a report with law enforcement and dispute inaccuracies with credit reporting agencies and creditors. Completing the affidavit typically takes about ten minutes and requires personal details, including the victim's full name, date of birth, and Social Security number. The form also asks for relevant information about the fraud, including the accounts that were tampered with or opened fraudulently. To enhance its effectiveness, the FTC recommends placing a fraud alert on credit reports before filling out the form and documenting any fraudulent activity, such as unauthorized accounts or transactions. Victims can access a secure online version of the affidavit at ftc.gov/idtheft, ensuring that they can easily print a copy for their records. As identity theft can lead to far-reaching consequences, this form is a critical step in protecting individuals’ rights and restoring their financial well-being.

Ftc Identity Theft Affidavit Example

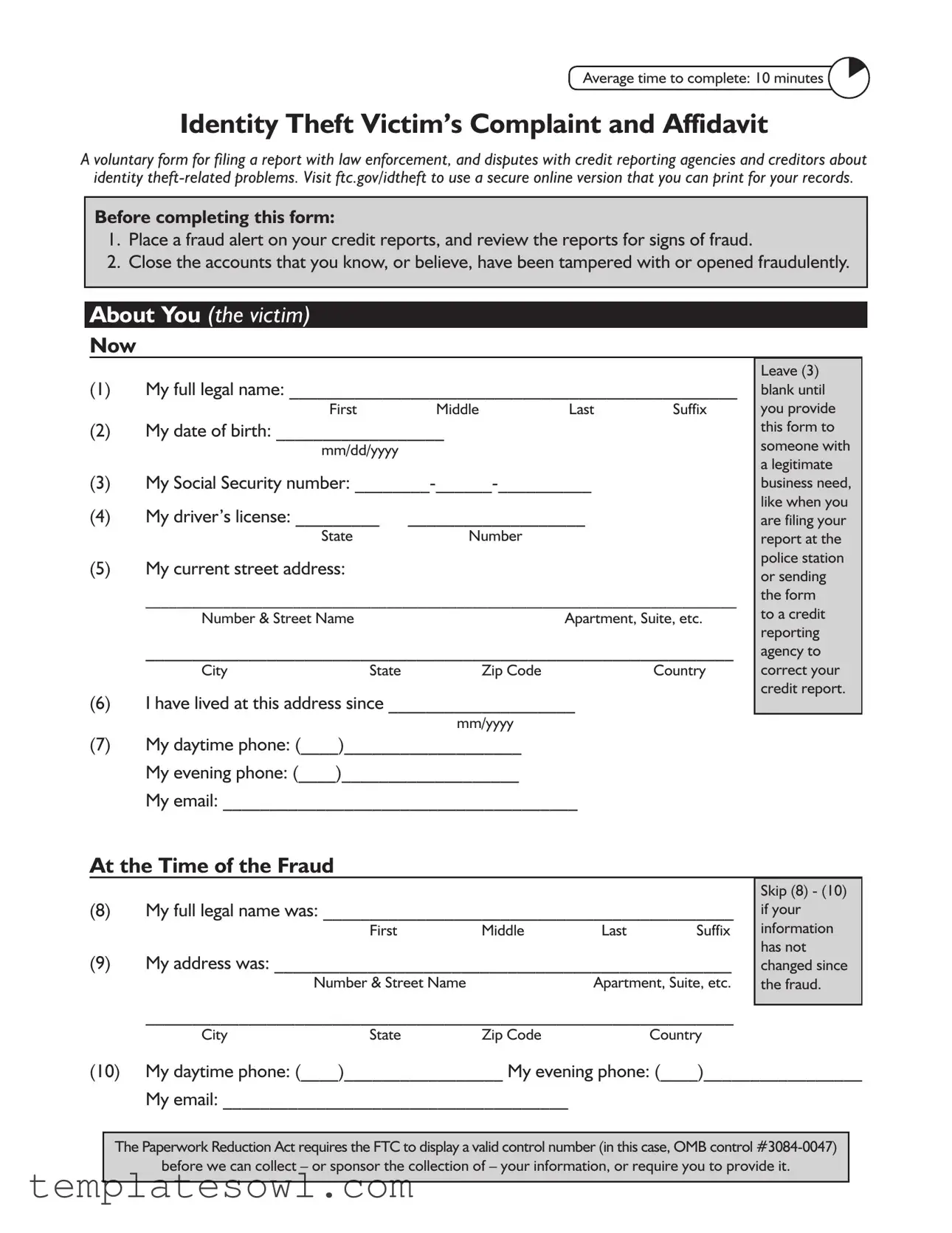

Average time to complete: 10 minutes

Identity Theft Victim’s Complaint and Affidavit

A voluntary form for filing a report with law enforcement, and disputes with credit reporting agencies and creditors about identity

Before completing this form:

1.Place a fraud alert on your credit reports, and review the reports for signs of fraud.

2.Close the accounts that you know, or believe, have been tampered with or opened fraudulently.

About You (the victim)

Now

(1)My full legal name: ________________________________________________

First |

Middle |

Last |

Suffix |

(2)My date of birth: __________________

mm/dd/yyyy

(3)My Social Security number:

(4) |

My driver’s license: _________ |

___________________ |

|

State |

Number |

(5)My current street address:

____________________________________________________________________________

Number & Street NameApartment, Suite, etc.

_______________________________________________________________

City |

State |

Zip Code |

Country |

(6)I have lived at this address since ____________________

mm/yyyy

(7)My daytime phone: (____)___________________

My evening phone: (____)___________________

My email: ______________________________________

Leave (3) blank until you provide this form to someone with

alegitimate business need, like when you are filing your report at the police station or sending the form

to a credit reporting agency to correct your credit report.

At the Time of the Fraud

(8)My full legal name was: ____________________________________________

First |

Middle |

Last |

Suffix |

(9)My address was: _________________________________________________

Number & Street Name |

Apartment, Suite, etc. |

Skip (8) - (10) if your information has not changed since the fraud.

_______________________________________________________________

City |

State |

Zip Code |

Country |

(10)My daytime phone: (____)_________________ My evening phone: (____)_________________

My email: _____________________________________

The Paperwork Reduction Act requires the FTC to display a valid control number (in this case, OMB control

before we can collect – or sponsor the collection of – your information, or require you to provide it.

Victim’s Name _______________________________ Phone number (____)_________________ Page 2

About You (the victim) (Continued)

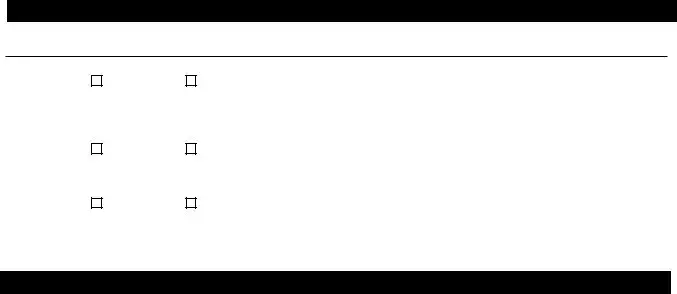

Declarations

(11) |

I |

did |

OR |

did not |

authorize anyone to use my name or personal information to |

|

|

|

|

|

obtain money, credit, loans, goods, or services — or for any |

|

|

|

|

|

other purpose — as described in this report. |

(12) |

I |

did |

OR |

did not |

receive any money, goods, services, or other benefit as a |

|

|

|

|

|

result of the events described in this report. |

(13) |

I |

am |

OR |

am not |

willing to work with law enforcement if charges are brought |

|

|

|

|

|

against the person(s) who committed the fraud. |

About the Fraud

(14) I believe the following person used my information or identification |

(14): |

||||

Enter what |

|||||

documents to open new accounts, use my existing accounts, or commit other |

you know |

||||

fraud. |

|

|

|

about anyone |

|

|

|

|

|

you believe |

|

Name: ___________________________________________________ |

was involved |

||||

(even if you |

|||||

First |

Middle |

Last |

Suffix |

||

don’t have |

|||||

|

|

|

|

||

Address: __________________________________________________ |

complete |

||||

information). |

|||||

Number & Street Name |

Apartment, Suite, etc. |

|

|||

__________________________________________________________ |

|

||||

City |

State |

Zip Code |

Country |

|

|

Phone Numbers: (____)_______________ (____)________________

Additional information about this person: _____________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

Victim’s Name _______________________________ Phone number (____)_________________ Page 3

(15)Additional information about the crime (for example, how the identity thief gained access to your information or which documents or information were used):

________________________________________________________________

________________________________________________________________

________________________________________________________________

(14)and (15): Attach additional sheets as needed.

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

______________________________________________________________________________

Documentation

(16)I can verify my identity with these documents:

A valid

A valid

If you are under 16 and don’t have a

Proof of residency during the time the disputed charges occurred, the loan was made, or the other event took place (for example, a copy of a rental/lease agreement in my name, a utility bill, or an insurance bill).

Proof of residency during the time the disputed charges occurred, the loan was made, or the other event took place (for example, a copy of a rental/lease agreement in my name, a utility bill, or an insurance bill).

(16): Reminder: Attach copies of your identity documents when sending this form to creditors

and credit reporting agencies.

About the Information or Accounts

(17)The following personal information (like my name, address, Social Security number, or date of birth) in my credit report is inaccurate as a result of this identity theft:

(A)__________________________________________________________________________

(B)__________________________________________________________________________

(C)__________________________________________________________________________

(18)Credit inquiries from these companies appear on my credit report as a result of this identity theft:

Company Name: _______________________________________________________________

Company Name: _______________________________________________________________

Company Name: _______________________________________________________________

Victim’s Name _______________________________ Phone number (____)_________________ Page 4

(19)Below are details about the different frauds committed using my personal information.

___________________________________________________________________

Name of InstitutionContact Person Phone Extension

___________________________________________________________________

Account Number |

|

Routing Number |

Affected Check Number(s) |

|||

Account Type: |

Credit |

Bank |

Phone/Utilities |

Loan |

|

|

|

Government Benefits |

Internet or Email |

Other |

|||

Select ONE:

This account was opened fraudulently.

This account was opened fraudulently.

This was an existing account that someone tampered with.

This was an existing account that someone tampered with.

___________________________________________________________________

Date Opened or Misused (mm/yyyy) Date Discovered (mm/yyyy) Total Amount Obtained ($)

___________________________________________________________________

Name of InstitutionContact Person Phone Extension

___________________________________________________________________

Account Number |

|

Routing Number |

Affected Check Number(s) |

|||

Account Type: |

Credit |

Bank |

Phone/Utilities |

Loan |

|

|

|

Government Benefits |

Internet or Email |

Other |

|||

Select ONE:

This account was opened fraudulently.

This account was opened fraudulently.

This was an existing account that someone tampered with.

This was an existing account that someone tampered with.

___________________________________________________________________

Date Opened or Misused (mm/yyyy) Date Discovered (mm/yyyy) Total Amount Obtained ($)

___________________________________________________________________

Name of InstitutionContact Person Phone Extension

___________________________________________________________________

Account Number |

|

Routing Number |

Affected Check Number(s) |

|||

Account Type: |

Credit |

Bank |

Phone/Utilities |

Loan |

|

|

|

Government Benefits |

Internet or Email |

Other |

|||

Select ONE:

This account was opened fraudulently.

This account was opened fraudulently.

This was an existing account that someone tampered with.

This was an existing account that someone tampered with.

___________________________________________________________________

Date Opened or Misused (mm/yyyy) Date Discovered (mm/yyyy) Total Amount Obtained ($)

(19):

If there were more than three frauds, copy this page blank, and attach as many additional copies as necessary.

Enter any applicable information that you have, even if it is incomplete or an estimate.

If the thief committed two types of fraud at one company, list the company twice, giving the information about the two frauds separately.

Contact Person: Someone you dealt with, whom an investigator can call about this fraud.

Account Number: The number of the credit or debit card, bank account, loan, or other account that was misused.

Dates: Indicate when the thief began to misuse your information and when you discovered the problem.

Amount Obtained: For instance, the total amount purchased with the card or withdrawn from the account.

Victim’s Name _______________________________ Phone number (____)_________________ Page 5

Your Law Enforcement Report

(20)One way to get a credit reporting agency to quickly block identity theft- related information from appearing on your credit report is to submit a detailed law enforcement report (“Identity Theft Report”). You can obtain an Identity Theft Report by taking this form to your local law enforcement office, along with your supporting documentation. Ask an officer to witness your signature and complete the rest of the information in this section. It’s important to get your report number, whether or not you are able to file in person or get a copy of the official law enforcement report. Attach a copy of any confirmation letter or official law enforcement report you receive when sending this form to credit reporting agencies.

Select ONE:

I have not filed a law enforcement report.

I have not filed a law enforcement report.

I was unable to file any law enforcement report.

I was unable to file any law enforcement report.

I filed an automated report with the law enforcement agency listed below.

I filed an automated report with the law enforcement agency listed below.

I filed my report in person with the law enforcement officer and agency listed below.

I filed my report in person with the law enforcement officer and agency listed below.

____________________________________________________________________

Law Enforcement DepartmentState

____________________________ |

_____________________ |

Report Number |

Filing Date (mm/dd/yyyy) |

(20):

Check “I have not...” if you have not yet filed a report with law enforcement or you have chosen not to. Check “I was unable...” if you tried to file a report but law enforcement refused to take it.

Automated report:

Alaw enforcement report filed through an automated system, for example, by telephone, mail, or the Internet, instead of a

____________________________________________________________________

Officer’s Name (please print)Officer’s Signature

____________________________ |

(____)_______________ |

|

|

Badge Number |

Phone Number |

|

|

Did the victim receive a copy of the report from the law enforcement officer? |

Yes OR |

No |

|

Victim’s FTC complaint number (if available): ________________________ |

|

|

|

Victim’s Name _______________________________ Phone number (____)_________________ Page 6

Signature

As applicable, sign and date IN THE PRESENCE OF a law enforcement officer, a notary, or a witness.

(21)I certify that, to the best of my knowledge and belief, all of the information on and attached to this complaint is true, correct, and complete and made in good faith. I understand that this complaint or the information it contains may be made available to federal, state, and/or local law enforcement agencies for such action within their jurisdiction as they deem appropriate. I understand that knowingly making any false or fraudulent statement or representation to the government may violate federal, state, or local criminal statutes, and may result in a fine, imprisonment, or both.

_______________________________________ |

_________________________________________ |

Signature |

Date Signed (mm/dd/yyyy) |

Your Affidavit

(22)If you do not choose to file a report with law enforcement, you may use this form as an Identity Theft Affidavit to prove to each of the companies where the thief misused your information that you are not responsible for the fraud. While many companies accept this affidavit, others require that you submit different forms. Check with each company to see if it accepts this form. You should also check to see if it requires notarization. If so, sign in the presence of a notary. If it does not, please have one witness

_______________________________________

Notary

Witness:

_______________________________________ |

_________________________________________ |

Signature |

Printed Name |

_______________________________________ |

_________________________________________ |

Date |

Telephone Number |

Form Characteristics

| Fact Name | Description |

|---|---|

| Completion Time | The average time to complete the FTC Identity Theft Affidavit form is 10 minutes. |

| Purpose of the Form | This form serves as a complaint and affidavit for filing a report with law enforcement and disputing issues with credit reporting agencies and creditors related to identity theft. |

| Online Access | Individuals can visit ftc.gov/idtheft to access a secure online version of the form, which can be printed for personal records. |

| Fraud Alert | Before completing the form, individuals should place a fraud alert on credit reports and review them for signs of fraud. |

| Identity Verification | Submit documents to verify identity such as a government-issued photo ID or proof of residency during the time of the disputed charges. |

| Documentation Requirements | Individuals are reminded to attach copies of identity documents when sending the form to creditors and credit reporting agencies. |

| Law Enforcement Report | Filing a law enforcement report, known as an "Identity Theft Report", is recommended to help block false information from appearing on credit reports. |

| Control Number | The form displays a valid control number, OMB control #3084-0047, as required by the Paperwork Reduction Act. |

| State-Specific Forms | Some states may have specific laws governing identity theft; individuals should check local laws for additional requirements. |

Guidelines on Utilizing Ftc Identity Theft Affidavit

Filling out the FTC Identity Theft Affidavit form is an important step in addressing identity theft issues. By completing this form, you can report the situation to law enforcement and dispute any discrepancies with credit reporting agencies. It normally takes about 10 minutes to complete.

- Start by writing your full legal name, including any suffix.

- Enter your date of birth in mm/dd/yyyy format.

- Fill in your Social Security number, leaving the last three digits blank for discretion.

- Provide your driver's license number and the state where it was issued.

- List your current street address including the apartment or suite number, if applicable. Make sure to include the city, state, and zip code.

- Indicate how long you've lived at this address by filling in the date in mm/yyyy format.

- Write down your daytime and evening phone numbers, and include your email address.

- If your information changed at the time of the fraud, list your full legal name and address as they were then, along with updated phone numbers and email.

- Indicate whether you authorized anyone to use your name or information.

- Note if you received any benefits from the fraudulent activities.

- State if you are willing to cooperate with law enforcement on this matter.

- Detail any individuals you believe used your information, along with addresses and phone numbers if known.

- Describe how the identity theft occurred and what documents were involved. Attach additional sheets if needed.

- Collect documentation to prove your identity, such as a government-issued ID and proof of residency.

- Identify any inaccuracies in your credit report due to identity theft.

- List any companies that made inquiries into your credit as a result of the theft.

- Document details about each fraud committed using your information, including institution names, contact persons, account numbers, and amounts involved. If you have more than three incidents, you can copy the page and add it as needed.

- Complete the law enforcement report section. Indicate whether you filed your report in person or online and provide the report number and filing date.

- Have a police officer witness your signature and fill in their details.

After completing the form, make sure to keep copies for your records. File it with local law enforcement to create an official report, then send copies to credit reporting agencies as necessary to correct your records. Being thorough and accurate helps in resolving identity theft issues swiftly.

What You Should Know About This Form

What is the FTC Identity Theft Affidavit form used for?

The FTC Identity Theft Affidavit form is a voluntary document designed for individuals who have fallen victim to identity theft. It allows victims to file a report with law enforcement and dispute any fraudulent activities with credit reporting agencies and creditors. By completing this form, victims can record the details of their experience and begin the process of reclaiming their identity and addressing the impact of the theft.

How do I complete the FTC Identity Theft Affidavit form?

Completing the FTC Identity Theft Affidavit form requires gathering specific information about yourself and the fraudulent activity. You'll need to provide your full legal name, date of birth, Social Security number, and details about your current address and contact information. You will also document the circumstances of the fraud, including any individuals involved and the nature of the fraudulent activities. Remember to attach any supporting documents that can verify your identity or show evidence of the theft.

Where can I submit the FTC Identity Theft Affidavit form?

You can submit the FTC Identity Theft Affidavit form to multiple recipients. First, take the form to your local law enforcement agency to file a report. They may provide an official report or confirmation letter, which is essential for your records. Additionally, send the completed form to credit reporting agencies and your creditors to dispute any fraudulent accounts opened in your name. It’s essential to keep a copy for your personal files.

What should I do before filling out the FTC Identity Theft Affidavit?

Before diving into the form, ensure you take some crucial preliminary steps. Start by placing a fraud alert on your credit reports. This alert notifies creditors to take extra steps to verify your identity before allowing new accounts to be opened in your name. Next, thoroughly review your credit reports to identify any signs of fraudulent activities. Lastly, close any accounts that you believe have been tampered with or opened without your permission.

Can I use this form if I haven’t filed a police report?

Yes, you can still use the FTC Identity Theft Affidavit form even if you haven't filed a police report. The form itself serves to document your victimization and can assist in disputes with creditors and credit reporting agencies. However, filing a police report strengthens your case and helps expedite the process of blocking fraudulent information from your credit report. If you choose not to file a report, simply indicate that on the form where prompted.

Common mistakes

When completing the FTC Identity Theft Affidavit form, one common mistake is omitting full legal names. It is essential to provide all parts of the name, including first, middle, last, and any suffixes. Leaving out any part can lead to confusion later on.

Another frequent error involves entering an incorrect Social Security number. This number must be accurate, as it represents a critical piece of personal information. A mistake in this section might hinder the investigation process.

Many people also forget to include a date of birth or enter it in the wrong format. The form requires mm/dd/yyyy, so ensuring this detail is correct is vital. An incorrect date can create additional complications.

In the section concerning current addresses, individuals often neglect to include sufficient details. Missing elements like apartment numbers or ZIP codes can delay communication or misdirect documents.

Not indicating how long the victim has lived at the current address is another oversight. This information helps establish residency and can support claims of identity theft.

Some individuals skip the optional contact information fields. Even though leaving these blank until the form is shared with a legitimate business need is advised, it is critical to revisit this section before finalizing the form.

Another mistake occurs in the declarations section. Not clearly stating whether consent was given for the use of personal information can lead to confusion. Each response should be completed as definitively as possible.

When detailing the fraud, it’s common to provide incomplete or vague descriptions. Comprehensive information about any involved parties is necessary to facilitate a thorough investigation.

Finally, individuals sometimes fail to attach supporting documents. This can undermine the validity of the affidavit. Always include a copy of a valid identification, proof of residency, and any additional evidence related to the identity theft.

Documents used along the form

When dealing with identity theft, several forms and documents may accompany the FTC Identity Theft Affidavit. Each serves a specific purpose in helping to document the situation and assist in resolving issues related to the theft. Below is a list of commonly used documents.

- Police Report: A formal record created by law enforcement when a victim reports identity theft. This report may be necessary for creditors and credit agencies when disputing fraudulent charges.

- Fraud Alert Request Form: This form is used to request a fraud alert on your credit reports. It notifies creditors to take extra precautions before extending credit in your name.

- Credit Report Dispute Form: This document is used to dispute inaccuracies found on your credit report due to identity theft. It helps in correcting wrong information that may affect your credit score.

- Identity Theft Recovery Plan: This personalized plan outlines the steps a victim can take to recover from identity theft. It serves as a guide to restoring one’s identity and financial standing.

Gathering these documents can be daunting, but doing so is crucial in combating the effects of identity theft. Each form plays a role in protecting your rights and helps to restore your identity effectively.

Similar forms

- Identity Theft Report: Similar to the FTC Identity Theft Affidavit, this report is created when you report identity theft to your local law enforcement. It helps confirm the crime and can be used to dispute fraudulent accounts or charges.

- Fraud Alert Request: Placing a fraud alert on your credit report warns creditors to take extra steps to verify your identity before opening new accounts. The FTC Affidavit encourages doing this as a first step in the identity theft recovery process.

- Credit Dispute Letter: This document is used to formally dispute inaccuracies in your credit report. Like the FTC's Affidavit, it focuses on correcting misinformation resulting from identity theft.

- Consumer Complaint Form: This form allows individuals to report fraudulent activities to various authorities. It aligns with the FTC Affidavit’s purpose of documenting identity theft incidents.

- Power of Attorney (POA): A POA can authorize someone to act on your behalf, especially when dealing with financial institutions after identity theft. This relates to the FTC Affidavit in that both seek to empower individuals facing fraud-related challenges.

Dos and Don'ts

When filling out the FTC Identity Theft Affidavit form, it's important to follow specific guidelines to ensure that your submission is effective and will facilitate the resolution of your identity theft issue. Here are six important do's and don'ts:

- Do place a fraud alert on your credit reports before filling out the form.

- Do close any accounts that you believe have been tampered with or opened fraudulently.

- Do provide accurate and complete information about yourself and the fraud incident.

- Do attach copies of identity verification documents when sending the form to creditors.

- Don't leave any required fields blank; ensure to fill out all necessary sections of the form.

- Don't forget to keep a copy of your completed affidavit and any supporting documents for your records.

Misconceptions

Misconceptions about the FTC Identity Theft Affidavit form can hinder your ability to address identity theft effectively. Here are nine common misunderstandings explained:

- This form is mandatory for all victims of identity theft. Many people believe that they must complete the affidavit to report identity theft. However, it is a voluntary form designed to assist victims with filing reports and disputes, not a requirement.

- Submitting the affidavit automatically resolves my identity theft issues. It is crucial to understand that submitting the form does not guarantee resolution. Victims must actively follow up with credit reporting agencies and law enforcement to ensure that their identity theft claims are addressed.

- The affidavit serves as a legal document in court. This form is primarily for reporting and disputing issues related to identity theft; it is not a legal tool for court proceedings. Additional legal action may be necessary to pursue claims in court.

- Filing the affidavit is sufficient to protect my credit. While the form can help initiate investigations, it is essential to take further steps, such as placing fraud alerts and monitoring credit reports, to protect your financial information actively.

- Only individuals with Social Security numbers can use the affidavit. Anyone who has experienced identity theft can file the affidavit, regardless of their Social Security number status. It can also address identity theft involving children or other family members.

- I'm required to provide extensive personal information. Although the form requests various details, it is designed to collect only necessary information. Victims should provide information they feel comfortable disclosing and may leave optional fields blank.

- The affidavit must be submitted in person. While it can be helpful to submit it in person to law enforcement, victims can also file the affidavit online or via mail. It is adaptable based on the victim's preferences.

- Once I fill out the affidavit, my identity theft issues will disappear. The process of resolving identity theft can be lengthy. Submitting the affidavit is just one step in a broader effort to regain control over your identity and finances.

- The FTC guarantees confidentiality with this form. While the FTC takes privacy seriously, submitting the affidavit does not guarantee full confidentiality. Victims should be cautious about sharing sensitive information on public platforms.

Understanding the correct use of the FTC Identity Theft Affidavit form is critical for effective action against identity theft. Knowing these misconceptions allows victims to navigate the process more efficiently.

Key takeaways

Here are key takeaways for filling out and using the FTC Identity Theft Affidavit form:

- Time Investment: Completing the form generally takes about 10 minutes.

- Purpose: This affidavit allows victims to file a report with law enforcement and dispute charges with credit reporting agencies.

- Fraud Alert: Before filling out the form, place a fraud alert on your credit reports and review them for signs of fraudulent activity.

- Account Closure: Close any accounts you suspect have been tampered with or opened fraudulently.

- Accurate Information: Ensure all personal information, such as your name and contact details, is accurate at the time of filling out the form.

- Supporting Documentation: Include copies of relevant documents like a government-issued ID and proof of residency when submitting the form.

- Law Enforcement Assistance: Obtain a detailed law enforcement report to help block fraudulent information from appearing on your credit report.

- Filing Options: You can file the affidavit in person with law enforcement or use an automated reporting system.

- Important Declarations: Be prepared to confirm whether you authorized the use of your personal information and if you've received any benefits due to the fraud.

- Attachments: If necessary, attach additional sheets to provide further details about the fraud incidents.

Browse Other Templates

Calipatria State Prison Visiting - Keep a copy of your completed questionnaire for your records.

Proof of Civil Service Document,Civil Personal Service Verification,Personal Service Confirmation Form,Civil Service Affidavit,Service Documentation for Civil Cases,Civil Process Service Record,Legal Document Service Proof,Affidavit of Personal Servi - Inaccuracies in the form could potentially delay further action in the case.