Fill Out Your Funds Distribution Request Form

The Funds Distribution Request form is a critical tool for individuals managing their State Farm Mutual Funds, specifically within the context of Individual Retirement Accounts (IRAs) and Archer Medical Savings Accounts (MSAs). It serves multiple purposes: allowing users to request a one-time distribution, set up a systematic withdrawal plan, or initiate Required Minimum Distribution (RMD) payments from various types of IRAs, such as Traditional IRA, Roth IRA, SEP IRA, and SIMPLE IRA. Each account necessitates a separate form, emphasizing the importance of ensuring that all information is accurately documented. While this form covers significant aspects related to distributions, certain accounts like Coverdell Education Savings Accounts and 401(k)s require different procedures. It is designed to guide users through important selections, including the reason for the distribution, the amount desired, and the preferred method of payment. Whether one is correcting an excess contribution, managing RMDs, or executing a rollover to an employer-sponsored retirement plan, understanding the details outlined in this form is essential. Users must also be aware of potential penalties associated with early distributions from their accounts and the applicable tax withholding rules. This comprehensive overview of the Funds Distribution Request form is designed to equip individuals with the knowledge they need to navigate their financial decisions effectively.

Funds Distribution Request Example

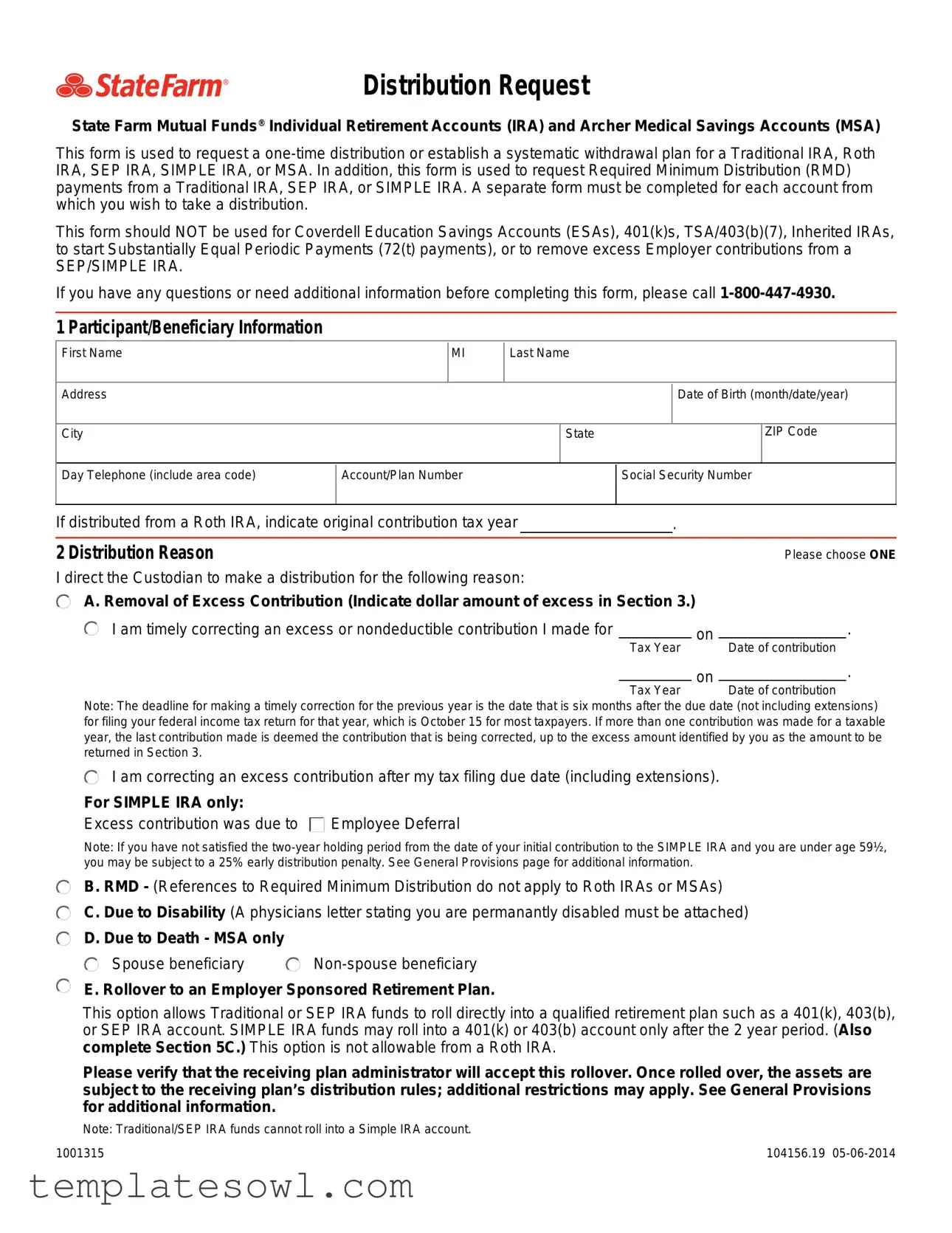

Distribution Request

State Farm Mutual Funds® Individual Retirement Accounts (IRA) and Archer Medical Savings Accounts (MSA)

This form is used to request a

This form should NOT be used for Coverdell Education Savings Accounts (ESAs), 401(k)s, TSA/403(b)(7), Inherited IRAs, to start Substantially Equal Periodic Payments (72(t) payments), or to remove excess Employer contributions from a

SEP/SIMPLE IRA.

If you have any questions or need additional information before completing this form, please call

1 Participant/Beneficiary Information

First Name |

|

MI |

Last Name |

|

|

|

||

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

Date of Birth (month/date/year) |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

Day Telephone (include area code) |

Account/Plan Number |

|

|

|

Social Security Number |

|||

|

|

|

|

|

|

|||

If distributed from a Roth IRA, indicate original contribution tax year |

. |

|

||||||

|

|

|

|

|

|

|

|

|

2 Distribution Reason |

|

|

|

|

|

|

|

Please choose ONE |

I direct the Custodian to make a distribution for the following reason:

A. Removal of Excess Contribution (Indicate dollar amount of excess in Section 3.)

I am timely correcting an excess or nondeductible contribution I made for |

|

on |

|

. |

|

Tax Year |

Date of contribution |

||

|

|

on |

|

. |

|

Tax Year |

Date of contribution |

||

Note: The deadline for making a timely correction for the previous year is the date that is six months after the due date (not including extensions) for filing your federal income tax return for that year, which is October 15 for most taxpayers. If more than one contribution was made for a taxable year, the last contribution made is deemed the contribution that is being corrected, up to the excess amount identified by you as the amount to be returned in Section 3.

I am correcting an excess contribution after my tax filing due date (including extensions).

For SIMPLE IRA only:

Excess contribution was due to  Employee Deferral

Employee Deferral

Note: If you have not satisfied the

B. RMD - (References to Required Minimum Distribution do not apply to Roth IRAs or MSAs)

C. Due to Disability (A physicians letter stating you are permanantly disabled must be attached)

D. Due to Death - MSA only

Spouse beneficiary |

E. Rollover to an Employer Sponsored Retirement Plan.

This option allows Traditional or SEP IRA funds to roll directly into a qualified retirement plan such as a 401(k), 403(b), or SEP IRA account. SIMPLE IRA funds may roll into a 401(k) or 403(b) account only after the 2 year period. (Also complete Section 5C.) This option is not allowable from a Roth IRA.

Please verify that the receiving plan administrator will accept this rollover. Once rolled over, the assets are subject to the receiving plan’s distribution rules; additional restrictions may apply. See General Provisions for additional information.

Note: Traditional/SEP IRA funds cannot roll into a Simple IRA account. |

|

1001315 |

104156.19 |

F. Rollover to a State Farm 401(k) Plan administered by AscensusSM.

This option allows SEP or SIMPLE IRA funds to roll directly into a State Farm 401(k) Plan administered by Ascensus. SIMPLE IRA funds may roll into the 401(k) account only after the 2 year period. (Also complete

Section 5D.)

If distributing from a SIMPLE IRA, please indicate the date you began participation |

|

. |

If you have not satisfied the two year holding period from the date of your initial contribution to the SIMPLE IRA, you are not eligible for a direct rollover.

G. Qualified Funding Distribution to Health Savings Account (HSA)

The distribution must be made directly to the HSA from a Traditional IRA, Roth IRA, Medical Savings Account (MSA), or an inactive SEP/SIMPLE IRA. See General Provisions page for additional information. (Also complete

Section 5C.)

H. Distribution other than those listed above |

. |

Note for SIMPLE IRA accounts: If you have not satisfied the two year holding period from the date of your initial contribution to the SIMPLE IRA and you are under age 59½, you may be subject to a 25% early distribution penalty. See General Provisions page for additional information.

3 Amount of Distribution

Please choose ONE

A. Distribute the entire account balance. The automatic investment, if any, will be discontinued in the State Farm Mutual Funds account you are distributing from. To continue your current automatic investment or change the amount and/or fund, please call

OR

B. Partial Distribution in the amount of:

Gross Amount |

or |

Net Amount |

|

Dollars |

|

Shares |

Fund |

(if you do not indicate a fund, your

redemption will be taken proportionally

from each fund)

$ |

|

or |

|

shares |

from |

$ |

|

or |

|

shares |

from |

$ |

|

or |

|

shares |

from |

$ |

|

or |

|

shares |

from |

If redeeming shortly after purchasing, there may be a delay sending the proceeds. If requesting Gross Amount, the amount you receive will be reduced by any federal/state tax withholding, CDSC, and expedited delivery fees. If requesting Net Amount, the amount redeemed will be increased to cover any applicable federal/state tax withholding, CDSC, and expedited delivery fees, so the amount you receive will equal the amount you requested. If no election is made, the gross amount will be redeemed.

1001315 |

104156.19 |

4 Instructions for Systematic Withdrawals

You must own shares of the Fund indicated with a current value of at least $5,000 before establishing this service. The $5,000 balance requirement does not apply if you are withdrawing your required minimum distribution or systematically exchanging between funds within the same account. We will begin your systematic withdrawal as soon as possible upon receipt of this form.

Please indicate if you have an Automatic Investment Plan (AIP) or payroll deduction.

I understand it will be stopped once the systematic withdrawal plan is established.

New Request |

or |

Change Existing Systematic Withdrawal to the following: |

|||

Frequency: (choose one) |

Monthly |

Quarterly |

Annually |

||

|

|

|

(Jan., April, July, Oct.) |

(Jan. and July) |

Indicate Month |

Day of the month to withdraw

Note: Unless specified, withdrawals will be made on the 10th calendar day of the month. If the 10th or the day you select is a

Installment Type (Choose all that apply):

A. Installments for the amount of the RMD calculated by State Farm Investment Management Corp. (SFIMC), on

behalf of State Farm Bank® for each fund position beginning in |

|

|

, |

|

|

|

|

. |

|

||

Month |

|

Year |

|||||||||

|

|

|

|

|

|

|

|||||

B. Distribute the entire account over a period of |

|

years beginning in |

|

|

|

|

, |

|

|

. |

|

|

|

|

|

|

Month |

|

|

|

Year |

||

C.

|

Installments beginning on |

|

|

|

, |

|

in the amount of ($100 minimum): |

||

|

|

Month |

|

Year |

|

|

|||

|

Dollars |

|

Shares |

|

Fund |

||||

$ |

|

|

or |

|

|

|

shares |

from |

|

$ |

|

|

or |

|

|

|

shares |

from |

|

$ |

|

|

or |

|

|

|

shares |

from |

|

$ |

|

|

or |

|

|

|

shares |

from |

|

5 Method of Payment |

|

|

Please choose ONE |

A. Invest proceeds into my State Farm Mutual Fund Account # |

Fund |

||

B. Cash Distribution |

|

|

|

Make check payable to Participant and mail to address of record. Allow 10 days to receive check using standard mail.

Express mail to address of record - available for distributions of $1,000 or more. Delivery is generally within

Make check payable to a third party (For this method a signature guarantee is required in Section 8)

Make check payable to:

Mail check to:

Electronic Funds Transfer (EFT) redemption proceeds are usually deposited to designated bank account within 2 or 3 business days after processing the redemption request. (The electronic funds transfer will not be granted unless a voided check is attached or is on file.) Please tape voided check on the following page.

Wire Transfer - available for distributions of $1,000 or more. Redemption proceeds are usually deposited to designated bank account within

1001315 |

104156.19 |

You must contact your bank to obtain correct wire instructions, including your bank account number and special wire transfer routing number (this may be different than the routing number for your account).

Name of Bank |

Wire Transfer Routing Number |

Payee Account Number |

For Further Credit to (if applicable) |

By signing this form, I authorize State Farm Investment Management Corp. (“SFIMC”), on behalf of State Farm Bank, to transfer funds from the above mentioned mutual fund account/plan number to my bank/credit union (“Depository”) account via electronic funds transfer (if so selected). I also authorize SFIMC to initiate (if necessary) adjustments with a debit or credit to my Depository account and/or mutual fund account/plan number for any previous transfers made in error. The EFT remains in effect until SFIMC receives written notification from the Participant/Beneficiary completing this form of its revocation at a time that affords SFIMC a reasonable opportunity to implement the request, or until cancelled by SFIMC or Depository.

|

|

|

Checking Account |

Savings Account |

|

|

|

|

|

|

One Time Use Only. This account will |

Replace any bank account |

Add this bank account and do not |

||||||||

not be retained for future use. |

already on file |

delete any on file |

||||||||

|

|

|

|

|

account (default) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5302 11st St. |

|

000 |

|

|

|

||

|

|

|

Joe Doe |

|

|

|

|

|

|

|

|

|

|

Anywhere, USA 12345 |

VOID |

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Please tape your voided check here.

STARTER AND COUNTER CHECKS WILL BE REJECTED

Important: For checking accounts, a voided check is required. For savings accounts, a deposit slip with information necessary to complete electronic

funds transfers including: routing number, account number and account registration is required or documentation with complete information on your bank’s letterhead.

Note: If the Mutual Fund Account owner(s) and the Depository account owner(s) are different, please have each Mutual Fund account owner and at least one Depository account owner sign below and have all signatures notarized; otherwise, the Applicant’s/Mutual Fund account owner’s signature at the end of this form authorizes the EFT.

Mutual Fund Account Owner’s Signature |

|

Depository Account Owner’s Signature |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mutual Fund Account Owner’s Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

State of |

|

|

County of |

|

|

|

|

|

|

|

|

|||||

Subscribed and sworn to before me this |

day of |

, |

. |

|||||||||||||

|

|

|

|

|

|

|

|

|

Month |

|

|

|

Year |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Notary Public |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

My Commission Expires: |

, |

|

|

|

. |

|

|

|

|

|

||||||

|

|

Month, Day |

|

|

|

|

Year |

|

|

|

|

|

|

|

||

1001315 |

|

|

|

|

|

|

|

|

|

|

|

|

104156.19 |

|||

C. Rollover to Qualified Retirement Plan sponsored by your employer. Also complete for a Roth/Traditional IRA qualified funding distribution to your HSA account. This check will be made payable to the new Financial Institution or Plan FBO Participant Name and will be sent directly to the new institution or plan. Please provide the required information below. (For this method a signature guarantee is required in Section 8.)

Receiving Financial Institution or Plan Name

FBO

Participant Name |

New Account Number (if known) |

Receiving Financial Institution or Plan mailing address:

D. Rollover to State Farm 401(k) Plan administered by Ascensus. This check will be made payable to Frontier Trust Company FBO Participant Name and will be sent directly to the plan sponsor. (Signature guarantee is not required.) Please provide the required mailing information below:

Plan Sponsor mailing address:

6 Withholding Election - Does not Apply to MSAs

The taxable portion of your proceeds may be subject to federal income tax withholding, at a rate of at least 10%, and state income tax withholding, if applicable to your state of residence, unless you elect for federal and state withholding not to apply. If you elect not to have withholding apply or do not have enough tax withheld, you may be responsible for payment of estimated taxes, and there may be tax penalties if your withholding and estimated payments are not sufficient. You may change this withholding election by checking the appropriate box below. This election will remain in effect on distributions taken according to the systematic withdrawal plan from your IRA until revoked by you, if applicable.

Federal Income Tax Withholding – If you do NOT check one box, State Farm Bank* is required to withhold 10% of the distribution from all IRAs except MSAs and Roth IRAs. If you want withholding on a Roth IRA the box must be completed.

Choose One

Do not withhold federal income tax.

Skip to Section 7. Some states require state withholding even if federal is not withheld.

Withhold federal income tax at a rate of |

|

% (not less than 10%) |

State Income Tax Withholding — If you have questions regarding state withholding, contact your tax advisor or your state’s taxing authority. If federal tax is withheld, State Farm Bank will withhold at least the minimum amount required by your state unless you specify a higher amount below. Some states require state withholding even if federal is not withheld. (Note: State Farm Bank will only withhold if you live in a state that requires us to withhold.)

Choose One (Complete only if you elected to have federal income tax withheld.)

Do not withhold state income tax. I understand this election will not apply in states that do not permit persons to elect out of withholding.

Withhold my state’s minimum requirement. |

|

Withhold this amount $ |

. (We will withhold at least your state’s minimum requirement.) |

*State Farm Investment Management Corp. (“SFIMC”) withholds taxes on behalf of State Farm Bank.

1001315 |

104156.19 |

7 Signature

I certify that I am the proper party to receive distributions from this account. All decisions regarding this withdrawal are my own. I understand that it is my sole responsibility to ensure compliance with the distribution regulations governing my account(s).

By signing below, I/we, my/our agents, heirs, executors, administrators and assigns (each an “Indemnifying Party”) agree to jointly and severally indemnify and hold harmless State Farm Investment Management Corp., State Farm VP Management Corp., State Farm Mutual Fund Trust, State Farm Associates’ Funds Trust, State Farm Variable Product Trust, all affiliated companies, all assigns, and their officers, directors, representatives, employees and agents from and against any claim, liability, expense, tax ramification, or loss incurred by a third party which in any way arises out of an Indemnifying Party’s misrepresentation, negligent or intentional act, or omission in any way connected with this Account/ Plan.

By signing below, I/we, my/our agents, heirs, executors, administrators and assigns (each a “Releasor”) agree to release and discharge State Farm Investment Management Corp., State Farm VP Management Corp., State Farm Mutual Fund Trust, State Farm Associates’ Funds Trust, State Farm Variable Product Trust, all affiliated companies, all assigns, and their officers, directors, representatives, employees and agents from and against any and all claims of any kind whatsoever a Releasor has which may in any way arise out of a Releasor’s misrepresentation, negligent or intentional act, or omission in any way connected with this Account/Plan.

Participant or Beneficiary Signature |

Date |

8 Signature Guarantee

A signature guarantee is required if the distribution is over $100,000 or if the check is made payable to someone other than the shareowner or mailed to an address other than the address of record. A signature guarantee is written representation signed by an officer or authorized employee of the guarantor, showing that the signature of the shareowner is genuine. Your Registered State Farm Agent can assist with providing a signature guarantee. Or, you may take this form to a bank,

Note: Signature guarantee requirements are waived if State Farm is the receiving company for the direct rollover.

Authorized Guarantor’s Signature |

Date |

Authorized by

STAMP

1001315 |

104156.19 |

General Provisions

You may want to seek tax advice regarding your particular distribution situation.

Tax Penalties for Early Distributions - Because IRAs are intended to be used for income during retirement years, withdrawals that you make from your IRA before you reach age 59½ are generally subject to a federal income tax penalty. The penalty is 10% of the taxable portion of your distribution. The penalty tax may not apply in limited situations. Please see your State Farm Mutual Funds IRA Disclosure Statement and consult your tax advisor to determine the tax consequences, if any, of this distribution.

SIMPLE IRA - If you have not satisfied the 2 year holding period from the date of your initial contribution to the SIMPLE IRA to the date of the distribution and you are under age 59½, you may be subject to a 25% early distribution penalty. In addition, if you elect to rollover a SIMPLE IRA to another employer sponsored retirement plan and you have not satisfied the 2 year holding period from the date of your initial contribution to the SIMPLE IRA, you are not eligible for the direct rollover. A transfer from a SIMPLE IRA to another SIMPLE IRA before the 2 year period qualifies as a

MSA - A withdrawal from your MSA for

Removal of Excess Contribution - State Farm will calculate Net Income Attributable (NIA) per Internal Revenue Service (IRS) regulations. The amount withdrawn will be more or less than the original contribution, depending on investment gain/loss.

RMD - You must take an RMD in each calendar year following the year you attain age 70½. If the installment amount is less than the RMD, State Farm Bank as Custodian shall not be responsible for any tax penalties or other damages that result from a failure to make distributions in accordance with minimum distribution rules. You may, at any time, increase or decrease your installment payments. Your request to change your distribution method must be made to SFIMC, on behalf of State Farm Bank, in a form acceptable to SFIMC.

IRA or MSA Qualified Funding Distribution to HSA - Generally only one qualified funding distribution is allowed during the lifetime of an individual. The distribution amount is limited to your HSA maximum contribution for the current year. See your tax advisor or review IRS Publication 969 for additional important information.

Additional Information

Further information concerning distributions can be obtained by contacting the Internal Revenue Service directly or at www.IRS.gov. Helpful IRS publications include Publication 590 – Individual Retirement Arrangements (IRAs), IRS Publication 560 – Retirement Plans for Small Business (SEP, SIMPLE, and Qualified Plans), and IRS Publication 969 – Health Savings Accounts and Other

Instructions

This form may be faxed

1.The check is made payable to the participant and mailed to the address of record, or if requesting the EFT option in Section 5 and these privileges have already been established.

2.This distribution is for $100,000 or less and a signature guarantee is not required.

3.Notarized signatures are not required in Section 5.

Mail completed form to:

State Farm Mutual Funds

PO Box 219548

Kansas City, Missouri

State Farm Mutual Funds are not insurance products and are available through State Farm VP Management Corp., 1 State Farm Plaza, Bloomington, Illinois

1001315 |

104156.19 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form is used to request a one-time distribution or to establish a systematic withdrawal plan for various types of IRAs and MSAs. |

| Types of Accounts | Eligible accounts include Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, and MSA, but not Coverdell ESAs, 401(k)s, or Inherited IRAs. |

| Required Minimum Distributions (RMD) | This form can be used to request RMD payments from Traditional, SEP, and SIMPLE IRAs, but not from Roth IRAs or MSAs. |

| Multiple Accounts | A separate form must be filled out for each account from which you wish to take a distribution. |

| Distribution Reasons | Reasons for distribution can include removal of excess contributions, disability, or rollover to an employer-sponsored plan. |

| Withdrawal Methods | Participants can choose to distribute the entire account balance or a partial amount, with tax implications varying based on the selected method. |

| Systematic Withdrawals | To establish a systematic withdrawal, a minimum balance of $5,000 in the account is required, except when withdrawing RMDs. |

| Tax Withholding | Distributions may be subject to federal and state income tax withholding; participants can elect their withholding preferences. |

Guidelines on Utilizing Funds Distribution Request

Are you ready to receive funds from your Individual Retirement Account (IRA) or a Medical Savings Account (MSA)? Filling out the Funds Distribution Request form is straightforward, and following these steps will ensure that your request is processed efficiently. Make sure to gather all the necessary information before you begin.

- Provide Participant/Beneficiary Information: Fill in your first name, middle initial, last name, address, date of birth, city, state, ZIP code, and phone number. Don’t forget your account or plan number and Social Security number. If you're withdrawing from a Roth IRA, be sure to note the tax year of your original contribution.

- Select a Distribution Reason: Choose one reason for your distribution from the list provided, such as removal of excess contribution, required minimum distribution (RMD), disability, or others. Make sure to provide any necessary details, like the contribution date or amount.

- Indicate the Amount of Distribution: Choose whether you would like to distribute the entire account balance or a partial amount. If you opt for a partial distribution, specify the gross or net amount along with any relevant fund details.

- Complete Instructions for Systematic Withdrawals (if applicable): If you're establishing a systematic withdrawal plan, ensure you own at least $5,000 in shares. Select the frequency for the withdrawals, the specific month and day, and whether you require an automatic investment plan.

- Choose Method of Payment: Indicate how you would like to receive your distribution. Options include cash distribution, electronic funds transfer to your bank, or a rollover to another qualified retirement plan. Be sure to provide any extra required banking information or voided checks as needed.

- Fill out the Withholding Election (if applicable): Indicate whether you want federal income tax withholding on the distribution. Make sure to specify the percentage, if required, and state tax withholding preferences as relevant.

- Sign and Date the Form: Finally, be sure to sign and date the form. If you're using electronic funds transfer, ensure you provide additional signatures if the bank account owners differ from the mutual fund account owner.

Once the form is completed, submit it according to the provided instructions. Your request for funds will be processed as soon as possible, and you can expect to receive your distribution shortly thereafter. If you have any further questions during the process, don't hesitate to reach out to customer service for assistance.

What You Should Know About This Form

1. What is the purpose of the Funds Distribution Request form?

The Funds Distribution Request form is designed to facilitate either a one-time distribution or a systematic withdrawal plan for various types of individual retirement accounts (IRAs) and medical savings accounts (MSAs). This includes Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. Additionally, it allows for the request of Required Minimum Distribution (RMD) payments from certain accounts. It is important to note that this form is not applicable for Coverdell Education Savings Accounts, 401(k)s, or Inherited IRAs, among others.

2. Can I submit a single form for multiple accounts?

No, each account from which you wish to take a distribution requires a separate Funds Distribution Request form. This ensures that each request is processed accurately and in accordance with the specific rules governing each account type.

3. What happens if I need to make a correction to an excess contribution?

To correct an excess contribution, you must indicate the dollar amount in Section 3 of the form. For timely corrections, ensure that the request is submitted by October 15 of the following tax year. If you miss this deadline, you may still request a correction, but there are specific guidelines to follow, especially for SIMPLE IRAs which have additional rules regarding early distribution penalties.

4. What types of distributions can I request using this form?

You can request various types of distributions including full account withdrawals, partial distributions, required minimum distributions, and more. Specific reasons for withdrawal are to be indicated on the form, ensuring that the distribution aligns with regulatory requirements.

5. Is there a minimum balance required to set up systematic withdrawals?

Yes, there is a minimum balance requirement of $5,000 to establish a systematic withdrawal plan, except if you are withdrawing your required minimum distribution or if you're systematically exchanging between funds within the same account.

6. How can I receive the proceeds from my distribution?

There are several methods for receiving your distribution. You can choose to reinvest the proceeds into a State Farm Mutual Fund account, receive a cash distribution via check, or opt for an electronic funds transfer (EFT) to your bank account. For a wire transfer option, you must have at least $1,000 and be aware that a fee may apply.

7. Are there tax withholding options available when I take a distribution?

Yes, there are options for federal and state tax withholding on your distribution. Unless you elect otherwise, Federal income tax withholding at a minimum rate of 10% could apply. This withholding remains in effect for systematic withdrawals until you revoke it. It's important to consult with a tax advisor to understand your specific situation before making a choice.

8. What should I do if I need assistance while filling out the form?

If you have any questions or need assistance while completing the Funds Distribution Request form, do not hesitate to call 1-800-447-4930. Representatives are available to provide the necessary guidance and ensure that your form is filled out correctly.

9. What documentation is required to support my distribution request due to disability?

If you are requesting a distribution due to disability, a physician's letter confirming your permanent disability must be attached to your request. This documentation is crucial to validate your claim for accessing your funds under this condition.

10. How long will it take to process my distribution request?

After submitting the Funds Distribution Request form, processing will begin as soon as possible. However, if you are redeeming shortly after a purchase, there may be a delay in sending the proceeds. For cash distributions via check, allow approximately 10 days for standard mail delivery. Express mail is available for a fee and can expedite the process to 2-3 business days.

Common mistakes

Completing the Funds Distribution Request form might seem straightforward, but many individuals make avoidable mistakes. One common error is failing to use the correct form for the intended purpose. This form is specifically designed for various types of Individual Retirement Accounts (IRA) and Medical Savings Accounts (MSA). Some people mistakenly attempt to use it for other financial products like 401(k)s or Coverdell ESAs, leading to delays or outright rejections of their requests.

Another frequent issue arises from not filling out the participant information accurately. Errors in names, addresses, or social security numbers can cause significant setbacks. Accurate data is critical; even a small typo might result in fund distribution delays or misdirected funds. Review the information carefully before submitting the form to ensure it matches official records.

People often overlook the significance of selecting a distribution reason. The form requires participants to choose one of several options clearly. If a selection is missed or if multiple choices are indicated, the request may be returned for correction. This can add unnecessary time to what should be a straightforward process. Ensuring that only one reason is selected helps streamline the distribution process.

Finally, one prevalent mistake pertains to the payment method. Many individuals fail to attach the required voided check for electronic funds transfers or wire transfers. Without this critical attachment, the request will be delayed. Instead, participants should ensure they have included this document to facilitate timely access to their funds. Double-checking which payment method is selected and ensuring all necessary documents are attached can prevent these issues.

Documents used along the form

The Funds Distribution Request form is crucial for managing individual retirement accounts and medical savings accounts. When completing this form, several other documents may also be required. Below is a list of other forms and documents commonly used in conjunction with the Funds Distribution Request form, along with brief descriptions for each.

- Direct Rollover Request Form: This form is used to request the transfer of funds directly from an individual retirement account to another qualified retirement plan without incurring tax penalties. It is important for ensuring that the rollover is treated correctly for tax purposes.

- Account Closure Request Form: This document is necessary when the account holder wishes to completely close their account. Completing this form ensures that all procedures related to the closure are properly followed.

- Beneficiary Designation Form: This form identifies who the beneficiaries are for the assets in the accounts should the account holder pass away. It is important for estate planning and ensures that the funds are distributed according to the account holder's wishes.

- Tax Withholding Election Form: This form allows the account holder to specify their preference for federal and state tax withholding on distributions. Proper completion of this form helps manage tax liabilities associated with distributions.

- Notice of Distribution Form: This document serves to inform account holders about the timing and amount of their distributions, as well as any relevant tax implications. It is crucial for keeping the account holder informed regarding their account activity.

- Physician's Certification for Disability: This document is required when distributions are requested due to disability. It must be completed by a licensed physician to confirm the account holder's disability status.

- Voided Check: A voided check may be required when requesting an electronic funds transfer (EFT) for distributions. This ensures that the correct banking information is on file for prompt and secure transfers.

Understanding these additional forms can streamline the distribution process and ensure compliance with regulations. Accurate completion of all required documentation is essential for a smooth transaction.

Similar forms

The Funds Distribution Request form is essential for managing distributions from certain retirement accounts. There are other documents that serve similar functions. Here are four such documents:

- Withdrawal Request Form: This form is specifically designed for making withdrawals from various financial accounts. Like the Funds Distribution Request, it outlines the type of withdrawal being made and the reasons behind it, guiding the user through the process of requesting funds.

- Rollover Request Form: This document allows account holders to rollover funds from one retirement account to another. Similar to the Funds Distribution Request, it includes sections for identifying the amounts, account types, and any necessary confirmations regarding the rollover process.

- Direct Deposit Enrollment Form: This form is used for setting up direct deposits of distributions into bank accounts. It shares similarities with the Funds Distribution Request by requiring account information for accurate transfers and outlining the various options available for recipients.

- Required Minimum Distribution (RMD) Request Form: This specialized form is for requesting RMDs from retirement accounts when they become applicable. Just as with the Funds Distribution Request, it provides detailed instructions and options on how to calculate and withdraw the required amounts.

Dos and Don'ts

- Do: Ensure that you fill out the form completely, including all required personal information.

- Do: Indicate clearly the reason for the distribution by selecting only one option in the designated section.

- Do: Choose the correct method of payment based on your needs and follow all instructions regarding voided checks if applicable.

- Do: Keep copies of the filled form and any attachments for your records after submission.

- Don't: Use this form for accounts that are not specified, such as Coverdell Education Savings Accounts or Inherited IRAs.

- Don't: Forget to review any relevant tax implications, particularly if you are choosing to withhold federal or state taxes.

- Don't: Submit the form without ensuring that all information is accurate to avoid delays in processing your request.

Misconceptions

Understanding how the Funds Distribution Request form works can help you navigate your financial decisions more effectively. Unfortunately, some common misconceptions can lead to confusion. Here are five misconceptions explained clearly:

- This form is only for Traditional IRAs. Many people believe that the Funds Distribution Request form is restricted to Traditional IRAs. In fact, it can be used for various accounts, including Roth IRAs, SEP IRAs, SIMPLE IRAs, and Medical Savings Accounts (MSAs).

- There’s only one way to request a distribution. While some may think there is a single distribution option, the form provides several requests, including a one-time distribution, systematic withdrawals, and required minimum distributions (RMDs) for certain retirement accounts.

- Excess contributions can be corrected at any time. It's a misconception that you can correct excess contributions whenever you please. There’s a specific deadline for timely corrections, which is typically six months after the tax return due date for the previous year, affecting your tax filings.

- Rollover options are universally applicable. Many assume that rollover options apply to all types of accounts. However, not all IRAs can roll over into others, especially Roth IRAs. Ensure you know the specific rules that pertain to your account type to avoid mistakes.

- All distributions are immediately accessible. Some individuals may think that once they complete the form, they will receive their funds instantly. In reality, processing times can vary. Depending on the method chosen, there may be delays, especially if you're requesting check delivery.

Clearing up these misconceptions helps you feel more confident about your financial choices. Always read the instructions carefully and reach out for assistance when needed.

Key takeaways

Understanding how to properly fill out and use the Funds Distribution Request form is critical for managing your retirement accounts. Here are five key takeaways to keep in mind:

- One Form per Account: You must complete a separate form for each account from which you wish to take a distribution. This ensures clarity and accuracy in your requests.

- Choose Your Distribution Reason Wisely: The form allows various reasons for distributions, such as removal of excess contributions or required minimum distributions. Carefully select the one that applies to your situation.

- Specify the Amount: Indicate whether you want to distribute the entire account balance or a partial amount. If you opt for a partial distribution, be prepared to specify the exact amount or shares to withdraw.

- Method of Payment Matters: Choose how you would like to receive your funds, whether as a check, electronic funds transfer, or rollover to another account. Each method has different processing times and implications.

- Review Tax Withholding Options: Depending on your choice of distribution, the taxable portion may be subject to federal and state income tax withholding. Make sure to review and select your preferred withholding options to avoid surprises at tax time.

Browse Other Templates

Escort Service Employment Contract - Details on the escort's obligations help clarify their role in the agency's operations.

Employee Self Evaluation Form - Self-reflect on tasks you find somewhat challenging.

State Farm Change of Beneficiary Form - Filing for the Change of Beneficiary form can help you ensure that your heirs receive their intended inheritance promptly.