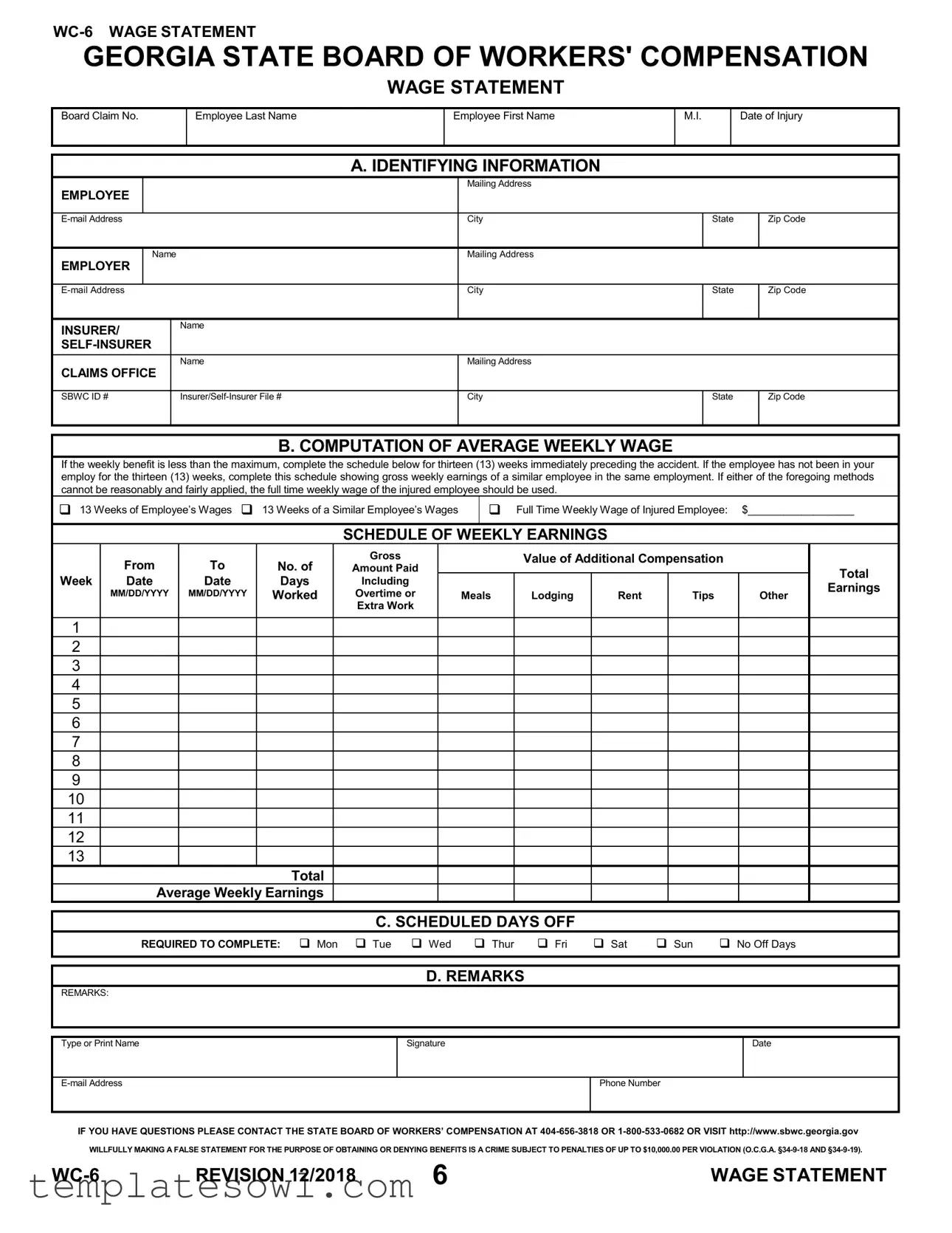

Fill Out Your Ga Wc 6 Form

The GA WC-6 form is an essential document for both employees and employers involved in the Georgia workers' compensation system, providing a clear structure for wage reporting in relation to workplace injuries. This form captures critical identifying information including the board claim number, employee details, and specifics regarding the insurance provider. A significant portion of the form focuses on the computation of the average weekly wage, which is key for determining the appropriate benefits an injured worker may receive. By detailing the employee’s wages over the thirteen weeks preceding an injury, the form allows for a transparent assessment of earnings that may influence compensation calculations. It also accommodates for cases where the injured worker has not been employed for the full duration by enabling the inclusion of gross weekly earnings from a comparable employee. Additionally, the form incorporates a remarks section and requires the signatures and contact information of relevant parties, reinforcing accountability and accuracy. Failure to provide truthful information on the GA WC-6 can lead to severe penalties, emphasizing the urgency of meticulous completion. As navigating workers' compensation claims can be intricate, understanding the nuances of the GA WC-6 form is vital for both parties to ensure a smooth claims process.

Ga Wc 6 Example

GEORGIA STATE BOARD OF WORKERS' COMPENSATION

WAGE STATEMENT

Board Claim No.

Employee Last Name

Employee First Name

M.I.

Date of Injury

A. IDENTIFYING INFORMATION

EMPLOYEE |

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

EMPLOYER |

Name |

|

Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

INSURER/ |

|

Name |

|

|

|

|

|

|

|

|

|

||

CLAIMS OFFICE |

|

Name |

Mailing Address |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

SBWC ID # |

|

City |

State |

Zip Code |

||

|

|

|

|

|

|

|

B. COMPUTATION OF AVERAGE WEEKLY WAGE

If the weekly benefit is less than the maximum, complete the schedule below for thirteen (13) weeks immediately preceding the accident. If the employee has not been in your employ for the thirteen (13) weeks, complete this schedule showing gross weekly earnings of a similar employee in the same employment. If either of the foregoing methods cannot be reasonably and fairly applied, the full time weekly wage of the injured employee should be used.

13 Weeks of Employee’s Wages 13 Weeks of a Similar Employee’s Wages |

Full Time Weekly Wage of Injured Employee: $__________________ |

SCHEDULE OF WEEKLY EARNINGS

|

From |

To |

No. of |

Gross |

|

Value of Additional Compensation |

|

|

||

|

Amount Paid |

|

|

|

|

|

Total |

|||

Week |

Date |

Date |

Days |

Including |

|

|

|

|

|

|

|

|

|

|

|

Earnings |

|||||

|

MM/DD/YYYY |

MM/DD/YYYY |

Worked |

Overtime or |

Meals |

Lodging |

Rent |

Tips |

Other |

|

|

|

|||||||||

|

|

|

|

Extra Work |

|

|

|

|

|

|

1

2

3

4

5

6

7

8

9

10

11

12

13

Total

Average Weekly Earnings

C. SCHEDULED DAYS OFF

REQUIRED TO COMPLETE: Mon Tue Wed Thur Fri Sat Sun No Off Days

REMARKS:

Type or Print Name

D. REMARKS

Signature |

Date |

Phone Number

IF YOU HAVE QUESTIONS PLEASE CONTACT THE STATE BOARD OF WORKERS’ COMPENSATION AT

WILLFULLY MAKING A FALSE STATEMENT FOR THE PURPOSE OF OBTAINING OR DENYING BENEFITS IS A CRIME SUBJECT TO PENALTIES OF UP TO $10,000.00 PER VIOLATION (O.C.G.A.

REVISION 12/2018 |

6 |

WAGE STATEMENT |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The WC-6 form is a Wage Statement used to report an employee's earnings for the purpose of determining workers' compensation benefits in Georgia. |

| Governing Law | This form is governed by the Georgia Workers' Compensation Act, specifically referencing O.C.G.A. §34-9-18 and §34-9-19, which address the reporting and verification of wage information. |

| Completion Requirement | To accurately complete the form, an employer must provide wage information for the thirteen weeks preceding the injury date or for a similar employee if the injured employee has not been employed that long. |

| Penalties | Submitting false statements on this form can lead to significant penalties, including fines of up to $10,000 per violation. |

Guidelines on Utilizing Ga Wc 6

Filling out the GA WC 6 form requires careful attention to detail. Once you've gathered the necessary information, it’s important to follow the steps to ensure accuracy and completeness. This process will help you submit the information effectively, facilitating the proper handling of your claim.

- Begin by identifying the claimant: Input the “Board Claim No.”, “Employee Last Name”, “Employee First Name”, and “M.I.” in the designated fields.

- Provide the SSN: Enter the employee's Social Security Number or Board Tracking Number.

- Date of Injury: Fill in the date when the injury occurred.

- Complete the identifying information: Fill in the “County of Injury”, “Address”, “City”, “State”, and “Zip Code” for the employee.

- Employee E-mail Address: Record the employee’s email address.

- Employer Information: Provide the employer's name, address, email address, city, state, and zip code.

- Insurer/Self-Insurer Details: Enter the name of the insurer or self-insurer, along with the SBWC ID number if applicable.

- Claims Office Details: Include the claims office address and email, as well as any relevant file number.

- Computation of Average Weekly Wage: If applicable, complete the schedule for the thirteen weeks immediately preceding the accident. If the employee has worked for less than thirteen weeks, use a similar employee's information.

- Fill in the Schedule of Weekly Earnings: List the “From” and “To” dates, number of days worked, gross value of additional compensation, and any other earnings for each week.

- Total Average Weekly Earnings: Calculate and record the total average weekly earnings based on the weekly earnings listed.

- Remarks Section: If necessary, include any remarks in the comments section.

- Final Steps: Type or print your name, include your email address and signature, and date the form. Ensure your phone number is also provided for follow-up.

After the form is completed, review it thoroughly to check for any errors or omissions. Once you are confident everything is correct, submit the form as per the instructions provided by the State Board of Workers' Compensation. If you have any questions during this process, don’t hesitate to reach out to their office for assistance.

What You Should Know About This Form

What is the purpose of the GA WC 6 form?

The GA WC 6 form, also known as the Wage Statement, is a crucial document used to communicate the earnings of an employee who has suffered a work-related injury. The information collected helps determine the average weekly wage (AWW) for calculating potential workers' compensation benefits. Proper completion of this form is essential for both the employee and the employer to ensure that the injured worker receives fair compensation.

Who is responsible for completing the GA WC 6 form?

The employer is primarily responsible for filling out the GA WC 6 form. It requires detailed information about the employee's wages, including weekly earnings over the 13 weeks preceding an injury. However, the injured employee should also be engaged in the process to ensure accuracy in reporting their earnings and employment status.

What information is required on the GA WC 6 form?

Key information includes identifying data such as the employee's name, Social Security Number or Board Tracking Number, and the date of the injury. The form also necessitates details on the employer and insurer, alongside a computation of the employee’s average weekly wage based on earnings during the 13 weeks prior to the injury. This helps establish any additional compensation the employee might be entitled to receive.

How should I fill out the average weekly wage section?

When filling out the average weekly wage section, you need to provide the total gross earnings for each of the 13 weeks prior to the injury. If the employee has not been with the employer for that duration, comparable data from a similar employee can be used instead. This ensures that the calculations reflect the employee's earning power as accurately as possible, which is fundamentally important for benefit determination.

What should I do if I notice an error after submitting the GA WC 6 form?

If an error is discovered after submission, it is critical to act swiftly. Contact the State Board of Workers’ Compensation immediately to notify them of the mistake. Providing corrected information as soon as possible will help avoid delays in benefit processing and ensure that the injured worker receives the appropriate compensation.

Are there any penalties for submitting false information on the form?

Yes, there are serious consequences for knowingly submitting false information on the GA WC 6 form. If someone willfully makes false statements to obtain or deny benefits, they may face penalties of up to $10,000. Such actions are deemed criminal violations, highlighting the importance of ensuring all information is truthful and accurate.

Where can I find assistance if I have questions about the GA WC 6 form?

If you have inquiries regarding the GA WC 6 form, resources are available. You can contact the State Board of Workers' Compensation directly at 404-656-3818 or 1-800-533-0682. Additionally, visiting their official website at http://www.sbwc.georgia.gov will provide valuable guidance and further information about the workers' compensation process.

How does the GA WC 6 form impact the injured worker's benefits?

The information provided on the GA WC 6 form plays a pivotal role in determining the injured worker's benefits. An accurate average weekly wage calculation allows the injured individual to receive the proper compensation, which can cover medical expenses and provide financial support during their recovery. Thus, the completion of this form is critical for a fair and just outcome in the workers' compensation claim process.

Common mistakes

Filling out the Ga WC-6 form correctly is essential for ensuring a smooth process when claiming workers' compensation benefits in Georgia. However, many individuals encounter difficulties, leading to common mistakes that can delay their claims or result in denials. One such error occurs when people forget to provide complete identifying information, including all names, addresses, and Social Security numbers. Missing even one piece of information can slow down processing and complicate matters significantly.

Another frequent mistake involves incorrect calculations in the computation of the average weekly wage. Some individuals may overlook or misinterpret the instructions requiring a complete schedule of earnings for the 13 weeks preceding the injury. This oversight can jeopardize the accuracy of the wage statement, potentially leading to an incorrect determination of benefits.

Additionally, using vague descriptions for "gross earnings" can create confusion. It’s important to list specific amounts for various components of earnings, such as overtime, tips, or other compensations. If these details are not clearly articulated, the claims office may misunderstand the employee's true earnings, adversely affecting the calculation of benefits.

Some individuals also provide inconsistent information between different sections of the form. For example, if an employee lists a higher wage in the computation section than what is reported in the weekly earnings schedule, it raises a red flag. Clear and consistent reporting is crucial in avoiding unnecessary complications.

Additionally, leaving the remarks section blank can be a missed opportunity to clarify any nuances about the employee's situation. Including any pertinent notes can provide context that may be beneficial for the case, thus helping claims adjusters understand the nuances of the claim more comprehensively.

Providing outdated contact information can be another stumbling block. If the email address or phone number listed on the form is incorrect, it becomes difficult for the claims office to reach out for clarification or additional information, which may lead to delays or additional requests for information.

Another common oversight is failing to sign or date the form. An unsigned or undated form cannot be processed, leading to delays or outright rejection. It is vital to ensure that all signatures are present and that the date reflects when the form is submitted.

Moreover, many submitters neglect to double-check their calculations. Errors in arithmetic—whether in total wages or average weekly earnings—can seriously undermine the accuracy of the information provided. A careful review process can help catch these mistakes before submission.

Some individuals may submit the form without including essential documentation, such as pay stubs or tax returns, that substantiate their reported earnings. These attachments can provide the necessary backup for claims and help corroborate the information included in the form.

Lastly, there’s the mistake of not reaching out for help when needed. Many mistakenly assume they can handle the form without any assistance. However, consulting with a knowledgeable individual can not only help clarify the process but also prevent missteps that could jeopardize a claim.

Documents used along the form

The GA WC-6 form is an important document in the workers' compensation process in Georgia. It provides essential details about an employee's wage upon injury and is crucial for determining benefits. Various other forms accompany the GA WC-6 to ensure a complete application. Here are some commonly used documents:

- WC-1 Report of Injury: This form initiates the workers' compensation claim process. It must be filed by the employer within a specific timeframe after an injury occurs to notify the State Board of Workers' Compensation.

- WC-3 Notice of Claim Invalidation: Used by insurers to notify the employee when a claim has been denied. This document outlines the reasons for denial and provides information on appeal options.

- WC-4 Temporary Total Disability (TTD) Benefits: This form is submitted to request temporary total disability benefits for an employee who is unable to work following an injury. It helps in determining eligibility for these benefits.

- WC-5 Wage Statement Claims: Similar to the WC-6, this is used when calculating average weekly wages. It may be required if a different calculation method is necessary for claims adjustments.

- WC-7 Return to Work: This document indicates an employee's return to work status. It informs the employer and insurer of the employee's capability to resume their job duties.

- WC-8 Employee’s Attending Physician’s Report: This form documents the employee's medical status and treatment plan. It is crucial for assessing ongoing disability and determining necessary medical care.

- WC-14 Final Report: Employers use this form to report the conclusion of the workers' compensation claim. It includes final payment information and signifies the end of the claim period.

These forms work together to create a transparent process for addressing workplace injuries and ensuring that both employees and employers understand their rights and responsibilities. Being familiar with these documents can ease the complex nature of workers' compensation claims.

Similar forms

-

WC-1 Form (Employer's First Report of Injury): Similar to the WC-6 Wage Statement, the WC-1 form is used in workers' compensation claims in Georgia. Both documents require essential employee information and details about the incident leading to the claim. They must be submitted to the State Board of Workers' Compensation for processing, ensuring a clear record of the injury.

-

WC-3 Form (Employee's Wage Statement): The WC-3 is another wage-related document that reports an employee's wage history for workers' compensation purposes. Like the WC-6, it captures the last wages earned by the employee before the injury and is critical for calculating benefits. Both forms highlight essential earnings data over a specific period.

-

WC-4 Form (Employer's Wage Statement): This form serves a similar purpose to the WC-6, as it details wages and compensatory earnings related to the injury. The WC-4 is filled out by the employer, whereas the WC-6 is completed with a focus on the employee's detailed wage structure. Both forms contribute to understanding income loss due to work-related injuries.

-

WC-5 Form (Employer's Report): The WC-5 form is an employment verification document that complements the information found in the WC-6. While the WC-6 focuses on wage calculations, the WC-5 provides data on employment status and job description, establishing a comprehensive view of the employee's working context and compensation.

-

Georgia Workers' Compensation Claim Form (Form WC-102): This form is essentially a claim initiation document that shares similarities with the WC-6 regarding necessary documentation for a workers' compensation claim. Both forms collect vital information to determine eligibility for benefits, although the scope and purpose differ slightly.

Dos and Don'ts

When filling out the Georgia WC-6 Wage Statement form, there are some important dos and don'ts to keep in mind. Here’s a helpful list:

- Do ensure all identifying information is accurately provided, including the employee's name and Social Security Number.

- Don't leave any sections blank. Each part of the form must be completed to avoid delays.

- Do double-check the dates of injury and the weeks for wage reporting to ensure they align correctly.

- Don't embellish or provide false information regarding wages or earnings, as this could lead to serious penalties.

- Do calculate the average weekly earnings based on the actual wages for the thirteen weeks prior to the accident.

- Don't mix up the wages of the injured employee with those of a similar employee. Keep those figures distinct.

- Do sign and date the form. An unsigned form may be considered invalid.

- Don't forget to provide contact information for follow-up questions or issues related to the claim.

- Do reach out to the State Board of Workers’ Compensation for any questions or clarifications before submission.

By following these guidelines, you can ensure that the process of completing the WC-6 form goes smoothly and aids in the efficient handling of the workers' compensation claim.

Misconceptions

The WC-6 form, officially known as the Wage Statement, is an important document in the workers' compensation process in Georgia. However, several misconceptions about this form can lead to confusion. Here are four common misconceptions, along with clarifications for each.

- Misconception 1: The WC-6 form is only needed if the employee was injured on the job.

- Misconception 2: Only the employer is responsible for completing the WC-6 form.

- Misconception 3: The information on the WC-6 form does not impact the benefits an injured worker may receive.

- Misconception 4: Once the WC-6 form is submitted, it cannot be altered.

This is not true. The form is also required to accurately calculate the average weekly wage prior to the injury, even if the injury has not yet been reported. This helps ensure proper compensation calculations.

While the employer plays a significant role, employees may also need to provide information. Both parties must collaborate to ensure all necessary details are accurately captured, facilitating a smoother claims process.

This is incorrect. The calculations of average weekly wage from the WC-6 form directly influence the benefits awarded. Accurate reporting is essential for fair compensation, making it crucial to ensure that all earnings are reported truthfully.

This misconception can lead to issues down the line. In fact, if any errors or changes are identified after submission, it is possible to submit a corrected version. Timely communication is key in these situations to prevent penalties or delays in benefits.

Key takeaways

The GA WC-6 form serves as a crucial document in the workers' compensation process in Georgia. Key points regarding the form include:

- Accurate Information is Essential: Fill in all identifying information about both the employee and the employer to avoid delays. Missing data can impede the processing of claims.

- Computation of Average Weekly Wage: It is important to provide a detailed account of the employee's earnings over the thirteen weeks prior to the injury. If the employee has not worked for that duration, use a similar employee's earnings to ensure fairness.

- Clearly Document Additional Compensation: Include all forms of compensation, such as overtime, tips, or other earnings, as they contribute to the total wage calculation and can affect benefit amounts.

- Signature and Date Requirements: Ensure that the form is signed and dated before submission. This step verifies the accuracy of the information provided and serves as a formal acknowledgment of the data included.

Review the completed form for accuracy and consult the State Board of Workers' Compensation if any questions arise. Properly filling out the GA WC-6 can facilitate timely benefits processing for injured employees.

Browse Other Templates

How to Change Llc Address in Georgia - This document is crucial for anyone interested in forming an LLC in Georgia.

How to Get a Title for a Car Without Title - Filing the ADM 9050 is part of the DMV licensing process for business entities and individuals.

Mandatory Liability Insurance Alabama - Ensure you have the correct vehicle identification number (VIN) listed for accurate processing.