Fill Out Your Ga Lottery Application Form

The Georgia Lottery Application form serves as a crucial document for businesses seeking to become authorized lottery retailers within the state. This comprehensive form is divided into multiple parts, each designed to collect essential information about the business and its owners. Part 1 focuses on business information, requiring details such as the legal name of the business, its address, contact information, and principal owners. A processing fee of $125 per business location is also required, with a partial refund policy in case of application denial. Furthermore, applicants are encouraged to identify any minority ownership, although this section is optional. In Part 2, personal information about the business owner and other key individuals is gathered, with stringent requirements for identification and a notarization process. Part 3 outlines the necessary steps for electronic funds transfer authorization, where the lottery retailer must establish a dedicated bank account to manage lottery funds. Lastly, Part 4 presents the retailer contract, which further elaborates on the obligations and rights of the retailer, detailing aspects such as ticket sales, payment processes, and promotional responsibilities. The application thus establishes a framework that ensures compliance and accountability for businesses engaged in lottery ticket sales in Georgia.

Ga Lottery Application Example

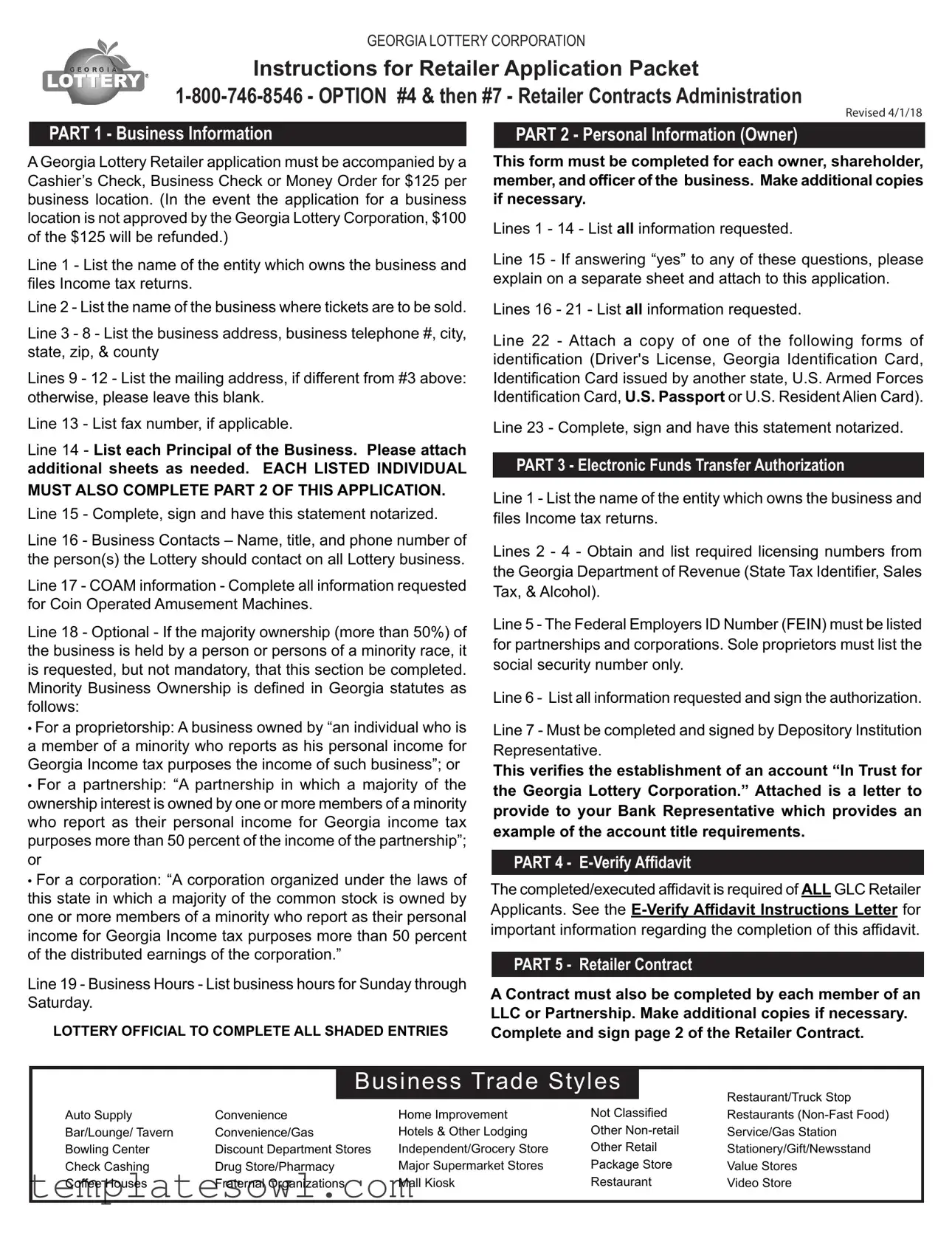

GEORGIA LOTTERY CORPORATION

Instructions for Retailer Application Packet

Revised 4/1/18

|

|

|

|

PART 1 - Business Information |

|||

|

PART 2 - Personal Information (Owner) |

||

|

|

|

A Georgia Lottery Retailer application must be accompanied by a Cashier’s Check, Business Check or Money Order for $125 per business location. (In the event the application for a business location is not approved by the Georgia Lottery Corporation, $100 of the $125 will be refunded.)

This form must be completed for each owner, shareholder, member, and officer of the business. Make additional copies if necessary.

Lines 1 - 14 - List all information requested.

Line 1 - List the name of the entity which owns the business and files Income tax returns.

Line 2 - List the name of the business where tickets are to be sold.

Line 3 - 8 - List the business address, business telephone #, city, state, zip, & county

Lines 9 - 12 - List the mailing address, if different from #3 above: otherwise, please leave this blank.

Line 13 - List fax number, if applicable.

Line 14 - List each Principal of the Business. Please attach additional sheets as needed. EACH LISTED INDIVIDUAL MUST ALSO COMPLETE PART 2 OF THIS APPLICATION.

Line 15 - Complete, sign and have this statement notarized.

Line 16 - Business Contacts – Name, title, and phone number of the person(s) the Lottery should contact on all Lottery business.

Line 17 - COAM information - Complete all information requested for Coin Operated Amusement Machines.

Line 18 - Optional - If the majority ownership (more than 50%) of the business is held by a person or persons of a minority race, it is requested, but not mandatory, that this section be completed. Minority Business Ownership is defined in Georgia statutes as follows:

•For a proprietorship: A business owned by “an individual who is a member of a minority who reports as his personal income for

Georgia Income tax purposes the income of such business”; or

•For a partnership: “A partnership in which a majority of the ownership interest is owned by one or more members of a minority who report as their personal income for Georgia income tax purposes more than 50 percent of the income of the partnership”; or

•For a corporation: “A corporation organized under the laws of this state in which a majority of the common stock is owned by one or more members of a minority who report as their personal income for Georgia Income tax purposes more than 50 percent of the distributed earnings of the corporation.”

Line 19 - Business Hours - List business hours for Sunday through Saturday.

LOTTERY OFFICIAL TO COMPLETE ALL SHADED ENTRIES

Line 15 - If answering “yes” to any of these questions, please explain on a separate sheet and attach to this application.

Lines 16 - 21 - List all information requested.

Line 22 - Attach a copy of one of the following forms of identification (Driver's License, Georgia Identification Card, Identification Card issued by another state, U.S. Armed Forces Identification Card, U.S. Passport or U.S. Resident Alien Card).

Line 23 - Complete, sign and have this statement notarized.

PART 3 - Electronic Funds Transfer Authorization

Line 1 - List the name of the entity which owns the business and files Income tax returns.

Lines 2 - 4 - Obtain and list required licensing numbers from the Georgia Department of Revenue (State Tax Identifier, Sales Tax, & Alcohol).

Line 5 - The Federal Employers ID Number (FEIN) must be listed for partnerships and corporations. Sole proprietors must list the social security number only.

Line 6 - List all information requested and sign the authorization.

Line 7 - Must be completed and signed by Depository Institution Representative.

This verifies the establishment of an account “In Trust for the Georgia Lottery Corporation.” Attached is a letter to provide to your Bank Representative which provides an example of the account title requirements.

PART 4 -

The completed/executed affidavit is required of ALL GLC Retailer

Applicants. See the

important information regarding the completion of this affidavit.

PART 5 - Retailer Contract

A Contract must also be completed by each member of an LLC or Partnership. Make additional copies if necessary. Complete and sign page 2 of the Retailer Contract.

Business Trade Styles

Restaurant/Truck Stop

Auto Supply |

Convenience |

Home Improvement |

Not Classified |

Restaurants |

Bar/Lounge/ Tavern |

Convenience/Gas |

Hotels & Other Lodging |

Other |

Service/Gas Station |

Bowling Center |

Discount Department Stores |

Independent/Grocery Store |

Other Retail |

Stationery/Gift/Newsstand |

Check Cashing |

Drug Store/Pharmacy |

Major Supermarket Stores |

Package Store |

Value Stores |

Coffee Houses |

Fraternal Organizations |

Mall Kiosk |

Restaurant |

Video Store |

Retailer Application

GEORGIA LOTTERY CORPORATION

P.O. Box 56486 • Atlanta, GA 30343

Please submit completed application with $125 fee per business location

(Cashier’s Check, Business Check, or Money Order only).

1 of 4

Revised 4/1/18

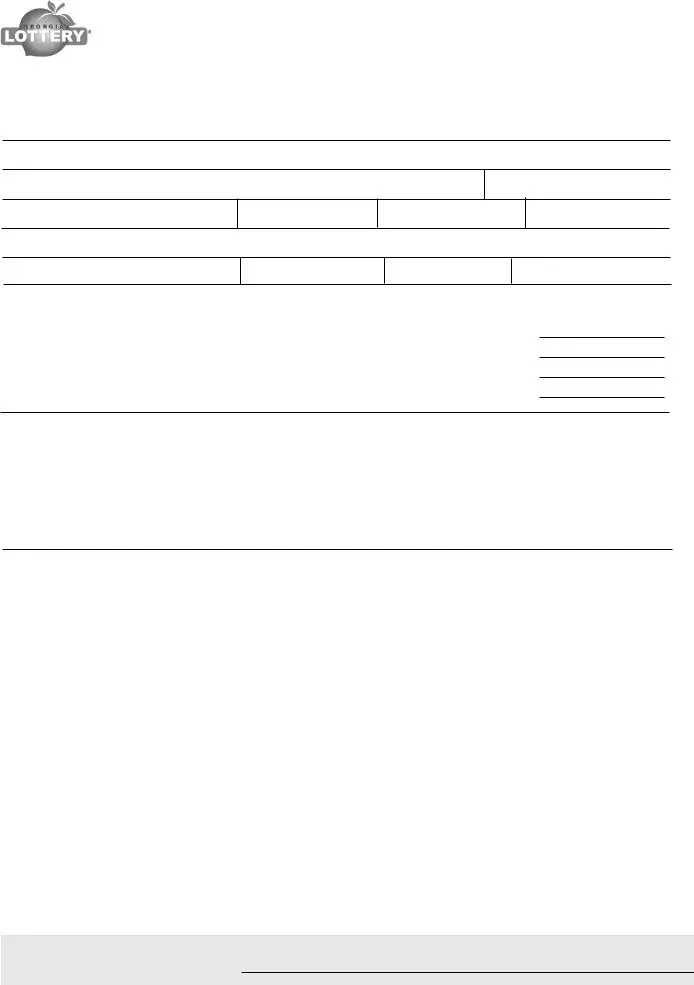

PART 1 - Business Information |

PLEASE PRINT |

Lottery Retailer ID#: |

|

1.Corporate or legal name (List the name of the legal entity which owns the business and files income tax returns):

2.Store Name or d/b/a (list the name of the business where tickets are to be sold):

3. |

Business Location: |

(Street Number and Name of the location where lottery tickets are to be sold) |

4. Business Telephone Number: |

|

5. |

City: |

6. State: |

7. Zip Code: |

8. County: |

9. Mailing Address (if different) (P.O. Box Number or Street Number and Name) :

10. City:

11. State:

12. Zip Code:

13. Fax Number:

14.List each owner, shareholder, member and officer of the Business (for example, sole proprietors, general partners, corporate officers, directors and shareholders). EACH LISTED INDIVIDUAL MUST COMPLETE PART 2 OF THIS FORM. Please attach additional sheets as needed:

a. |

Name: |

|

Percent of Ownership: |

|

b. |

Name: |

|

Percent of Ownership: |

|

c. |

Name: |

|

|

Percent of Ownership: |

d. |

Name: |

|

|

Percent of Ownership: |

15.Applicant certifies that the information contained on this form or otherwise submitted to the Georgia Lottery Corporation (“GLC”) in connection with this application to become a Retailer is true and correct in every respect. The undersigned certifies that he is duly authorized to act on behalf of the Retailer Applicant. Applicant understands, agrees, and consents that the GLC may make any and all investigations necessary in order to satisfy the GLC requirements for qualification of the Applicant as a GLC Retailer. Applicant hereby authorizes GLC to request criminal history record information, a credit report, or conduct any other investigation as may be necessary to process Applicant’s request to become a GLC Retailer.

Applicant authorizes GLC to share any such information, privileged, confidential or otherwise, necessary to consider its application to become a GLC

Retailer. Applicant further consents to allow GLC to use and share such information in all manner consistent with all applicable laws and necessary to effectuate, administer or enforce all rights, orders and obligations arising out of the relationship between Applicant and GLC. Applicant understands that providing inaccurate or misleading information is grounds for rejection of this application or cancellation of the Retailer Contract, and may subject the Applicant to the penalties set forth in O.C.G.A.

|

Signature of Owner or Principal |

|

|

Print or Type Name |

|

|

|

|

|

|

Title |

|

|

|

|

Date |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

NOTARY |

|

STATE OF: |

|

|

|

|

|

|

COUNTY OF: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

SEAL |

|

SWORN TO AND SUBSCRIBED BEFORE ME ON THIS |

|

|

|

|

DAY OF |

|

|

|

|

|

(MONTH) |

|

|

|

(YEAR) |

||||||||||||||||||||||||||

|

Notary Public Seal and Signature: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

My Commission Expires: |

|

|

|

|

|

|

|||||||||||||||||||||

HERE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

Personal Identification (ID) is required to be presented to and verified by Notary Public. Type of ID: |

|

|

ID Number: |

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. Business Contacts (Persons Authorized to Conduct |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title/Function |

|

|

|

|

Cell Phone # |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

17. Is this business location licensed for Coin Operated Amusement Machines (COAM)? ___Yes |

|

___No |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

If Yes, provide the following: |

# of Class A Machines:_________ |

|

# of Class B Machines:_________ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

COAM Location License #_________________________ |

|

COAM Master License # __________________________ |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

18. (OPTIONAL) Is Business Ownership more than 50% of a minority race? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

If yes, Specify: African American |

Native American |

Asian |

Hispanic |

Other (specify): |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

19. Business Hours: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

Sunday |

Monday |

|

Tuesday |

|

Wednesday |

|

|

Thursday |

|

|

Friday |

|

|

|

Saturday |

|

|

|

|

|

||||||||||||||||||||

|

Open |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Close |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To be completed by Lottery Representative

Business Trade Style: (see Instruction Sheet)

|

|

|

|

|

|

|

Retailer Application |

|

|

|

|

|

|

|

|

|

2 of 4 |

||||||||||||||||||||||||||

|

|

|

|

|

|

GEORGIA LOTTERY CORPORATION |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make additional |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

P.O. Box 56486 • Atlanta, GA 30343 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

copies if necessary. |

|||||||||||||||||||||||||||||

|

|

|

#4 & then #7 - Retailer Contracts Administration |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

This form must be completed for each owner, shareholder, member, and officer of the business. |

Revised 4/1/18 |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

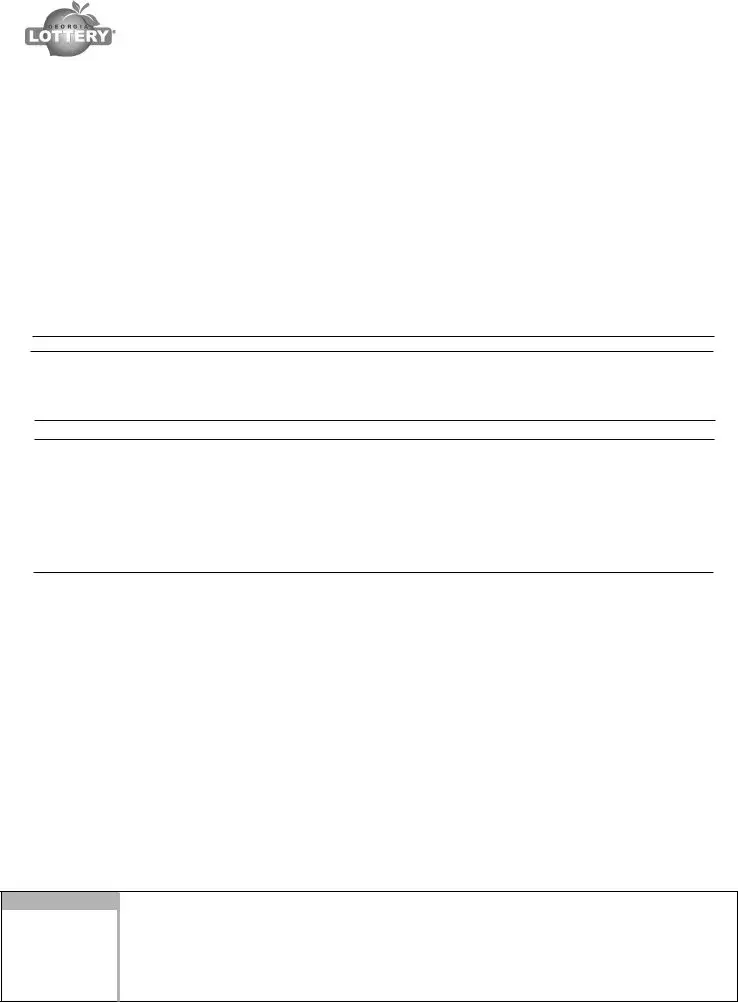

PART 2 - Personal Information (Owner) |

|

|

PLEASE PRINT |

|

Lottery Retailer ID#: |

|

|

|

|

||||||||||||||||||||||||||||||||

|

1. Type of Ownership: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Sole Proprietor Partnership |

Corporation |

|

LLC (Corporation) LLC (Partnership) |

Other(specify): |

|

|||||||||||||||||||||||||||||||||||

2. |

First, Middle & Last Name of Owner or Principal (no initials): |

|

|

3. |

M or F: |

4. Place of Birth: |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

5. |

Title: |

|

6. |

Race: |

|

|

|

|

|

7. Percent of Ownership: |

|

|

|

|

8. Date of Birth: |

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

9. |

Home Street Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. City/State/Zip Code: |

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

11. |

Home Phone Number: |

12. Cell Phone Number: |

|

13. |

|

Social Security |

Number: |

|

|

|

|

|

|

14. |

|

|

|

|

|||||||||||||||||||||||||

( |

) |

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

15. |

•Do you reside in the same |

household as any officer or |

employee of the Georgia Lottery Corporation? |

|

Yes |

No |

|||||||||||||||||||||||||||||||||||||

|

|

|

•Are you a vendor, employee or agent of any vendor of the Georgia Lottery Corporation? |

|

|

|

|

|

|

|

Yes |

No |

|

||||||||||||||||||||||||||||||

|

|

|

•Have you been convicted of a criminal offense related to the security or integrity of the lottery in this or any other jurisdiction? If yes, |

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

where? and when? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

||||

•Have you been convicted of any illegal gambling activity, false statements, false swearing or perjury in this or any other jurisdiction or

convicted of any crime punishable by more than one year of imprisonment or a fine of more than $1,000.00 or both ? If yes, where?

and when? |

Yes |

No |

•Are you delinquent in taxes, fees or other obligations owed to the State of Georgia? |

Yes |

No |

•Have you filed bankruptcy in the last seven (7) years? |

Yes |

No |

•Are you related to a COAM Class B Master Licensee? |

Yes |

No |

Note: If you answered “Yes” to any of the above questions, please explain on a separate sheet and attach to this application.

16.List all other names you have used, including nicknames; if female, furnish 17. Citizenship

maiden names. If you have ever used any surnames other than your true name, |

a. Present citizenship (Country): |

|

|

||||||||||||

during what period and what circumstances were these used? If you have ever legally |

b. Citizenship acquired by: |

Birth Marriage Naturalization |

|||||||||||||

changed your name, give date, place, and court. (Attach additional page as needed): |

c. Naturalization Certificate Number: |

||||||||||||||

|

|

||||||||||||||

|

|

d. Date and place Naturalized: |

|

|

|||||||||||

|

|

||||||||||||||

|

|

e. Resident Alien Number: |

|

|

|

|

|

|

|

|

|

|

|||

|

|

18. |

Height: |

|

|

|

|

19. Weight: |

|

|

|||||

|

|

20. |

Hair Color: |

|

|

|

|

21. Eye Color: |

|

|

|||||

22.Attach a copy of one of the following forms of identification for each owner. The following is a list of acceptable forms of identification: Driver's License, Georgia Identification Card, Identification Card issued by another state, U.S. Armed Forces Identification Card, U.S. Passport, or U.S. Resident Alien Card.

23.CONSENT AND AUTHORIZATION FOR RELEASE OF PERSONAL BACKGROUND INFORMATION:

I hereby certify that the information contained on this form or otherwise submitted by me to the Georgia Lottery Corporation (“GLC”) in connection with this application to become a GLC Retailer is true and correct in every respect. I understand, agree and consent that GLC may make any and all investigations of my background in order to satisfy the GLC requirements for qualification of the Applicant as a GLC Retailer, which investigations may include, without limitation, criminal history record information, credit history records, tax records, public records and other official records, and the investigation generally of any other matter relating to the Applicant being a GLC Retailer. As a potential Retailer or current Retailer for the Georgia Lottery Corporation (“GLC”), or as an owner of same, I am required to furnish certain information for use in determining my qualifications. I hereby authorize GLC to request a credit report, conduct a criminal background investigation, or conduct any other investigation as may be necessary to process my Retailer Application to become a GLC Retailer. I authorize GLC to share any such information, privileged, confidential or otherwise, necessary to consider the application to become a GLC Retailer. I further consent to allow GLC to use and share such information in all manner consistent with all applicable laws and necessary to effectuate, administer or enforce all rights, orders and obligations arising out of the relationship between the Retailer Applicant and GLC. A photocopy of this release will be valid as an original thereof, even though said photocopy does not contain an original writing of my signature. This release will expire upon the final termination of my Retailer’s contractual obligations with the GLC.

|

|

|

|

|

|

Signature |

|

Print Name |

|

Date |

|

The foregoing authorization notwithstanding, for the limited purposes of initially qualifying a Georgia Lottery Retailer, the GLC will not order, as a routine business practice, credit reports or criminal record history reports for individuals owning 10% or less of the equity ownership interests in the Georgia Lottery Retailer applicant. The GLC does reserve the right in its sole discretion to order such reports in accordance with business exigencies.

NOTARY

SEAL

HERE

STATE OF: |

|

COUNTY OF: |

|

|

|

|

|

|

|

|

|

|

|

|

SWORN TO AND SUBSCRIBED BEFORE ME ON THIS |

|

DAY OF |

|

|

|

(MONTH) |

|

|

(YEAR) |

|||||

Notary Public Seal and Signature: |

|

|

|

|

|

My Commission Expires: |

|

|

||||||

Personal Identification (ID) is required to be presented to and verified by Notary Public. Type of ID: |

|

|

ID Number: |

|

|

|||||||||

Retailer Application |

3 of 4 |

||

GEORGIA LOTTERY CORPORATION |

|||

P.O. Box 56486 • Atlanta, GA 30343 |

|

|

|

Revised 4/1/18 |

|||

|

|

|

|

PART 3 - Lottery Retailer Electronic Funds Transfer Authorization |

Lottery Retailer ID#: |

|

|

|

|

|

|

|

|

|

|

1. Corporate or Legal Name (list the name of the legal entity which owns the business and files income tax returns):

2. Georgia State Tax Identifier Number (11

3. Georgia Alcohol License Number (if any, 7 digits):

4. Georgia Sales Tax Number (9

Service Business

Only

5.Federal Employers ID Number. 9 digit number used to file Federal business income tax return. (For Sole Proprietor use Social Security Number)

INSTRUCTIONS: The Retailer must establish a separate electronic funds transfer (EFT) bank account for the preservation and transfer of

lottery funds. The separate bank account must be specified “IN TRUST FOR THE GEORGIA LOTTERY CORPORATION.” The Retailer’s depository institution must confirm the establishment of the Georgia Lottery Corporation Trust Account by signing in the space below.

6.RETAILER AUTHORIZATION: I (we) hereby authorize the Georgia Lottery Corporation to initiate debit and credit entries in any available and appropriate amount to my (our) account indicated below and authorize the depository named below to debit or credit the same to such account. I (we) hereby further authorize and direct the depository institution named below to release any information regarding such account, including, but not limited to, account balance information, payment history, and overdraft information to the Georgia Lottery Corporation upon request by an authorized representative of the Georgia Lottery Corporation. My (our) authorization is given in accordance with subsection

(e)(2) of Section 502 of the

(us) in writing. Any such revocation shall be deemed to have been properly given if sent by hand delivery, or by overnight courier, to such depository institution at the address set forth below. Such revocation shall be deemed to have been delivered on the date of delivery if by hand delivery or if by overnight courier, on the next business day following the deposit of such communication with the overnight courier.

Bank Account Name: |

|

|

|

|

|

|

/“IN TRUST FOR THE GEORGIA LOTTERY CORPORATION.” |

|||||||||||||||||||||||||||

|

|

Corporate or legal name of entity which owns the business and files income tax returns: (see attached example) |

|

|||||||||||||||||||||||||||||||

Bank Name (print): |

|

|

|

|

|

|

|

|

|

|

|

|

Branch: |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Bank Street Address: |

|

|

|

|

|

|

|

|

|

|

|

|

City: |

|

|

State: |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

EFT Bank Route Transit Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

EFT Bank Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Signature of Owner or Principal: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: |

|

|

|||||||||

Printed Name of Owner or Principal: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

THE SECTION BELOW MUST BE COMPLETED BY DEPOSITORY INSTITUTION (BANK)

7.DEPOSITORY INSTITUTION ACKNOWLEDGMENT: The above account has been established “IN TRUST FOR THE GEORGIA LOTTERY CORPORATION.” We acknowledge that our customer, the Retailer, has directed us to provide information concerning the above referenced account to the Georgia Lottery Corporation upon request by an authorized representative of the Georgia Lottery Corporation. We further acknowledge that the Retailer has directed us to provide this information in accordance with subsection (e)(2) of Section 502 of the “Gramm-

Depository Institution Representative (print): |

|

Telephone Number: |

|

|||

Signature of Depository Institution Representative: |

|

|

Date: |

|||

|

|

|

|

|

|

|

|

|

|

Retailer Application |

4 of 4 |

|

GEORGIA LOTTERY CORPORATION |

|||

|

|

|||

|

P.O. Box 56486 • Atlanta, GA 30343 |

|

||

Revised 4/1/18 |

||||

|

|

|

|

|

Part 4 – Lottery Retailer |

|

|

Lottery Retailer ID#: |

|

|

|

|

|

|

The GLC Retailer, signed below, confirms and verifies its compliance with Georgia law (See OCGA

Legal Business Name of Georgia Lottery Retailer/Applicant:

____1. Has registered with, is authorized to use, and uses the federal work authorization program commonly

known as

_______________________________________________

Federal Work Authorization User Identification Number

This number is at least 4 or more digits in length, does not contain letters and is NOT your Federal Employer Identification Number (FEIN).

_______________________________________________

Date of Authorization

OR

____2. Employs no employees, or otherwise does not fall within the requirements of OCGA

I hereby declare under penalty of perjury that the foregoing is true and correct.

Executed on _______________ DAY OF __________, 20 in _________________(city) _____________(state).

_________________________________________________________

Signature of Authorized Owner/Officer

____________________________________________________

Printed Name and Title of Authorized Owner/Officer

SUBSCRIBED AND SWORN BEFORE ME ON THIS THE ______ DAY OF __________, 20___.

____________________________________________________________

NOTARY PUBLIC

My Commission Expires: ______________________________________

Important

Revised 4/1/18

Dear Valued GLC Lottery Retailer Applicant:

The Georgia Security and Immigration Compliance Act (OCGA

As a result, all new GLC Retailers contracted after July 1, 2013 must submit an

Under the amended law, a new GLC retailer must submit an

The

a)Complete Section 1 of this affidavit to provide the GLC an

b)Your

Federal Employer Identification Number (FEIN).

c)If your business has NO employees, place a check mark in section 2 and ensure a copy of an approved

d)Once an

e)The notarized affidavit must be returned to the GLC with your completed GLC Retailer Application package.

If you have any questions, please contact your GLC Sales Representative, or the RCA (Retailer Contracts Administration) department at

PART 5 - Retailer Contract

Lottery Retailer ID:

Revised 4/1/18

THIS RETAILER CONTRACT is between GEORGIA LOTTERY CORPORATION (GLC), a public corporation created pursuant to the Georgia Lottery for Education Act (Act), and the undersigned Retailer. Capitalized terms used herein shall have the meanings set forth in Appendix A to GLC's Retailer Rules and Regulations, unless otherwise defined in context. Subject to approval by GLC of Retailer’s application to sell lottery Tickets, Retailer and GLC hereby agree as follows:

1.Retailer Rules. Retailer agrees to comply with and be bound by the Act, the Rules and Regulations of GLC, and all other applicable laws, rules, regulations, ordinances and orders. Retailer agrees at all times to meet the minimum qualifications for a GLC Retailer and to notify GLC of any changes in its business, as specified in the Act and the Rules and Regulations. Copies of the Act and all

Rules and Regulations are always available upon request from GLC.

2.Term and Renewal, Unless earlier terminated, the term of this Retailer Contract shall begin as of the date it is executed by Retailer, as shown below, shall remain in effect for a period of one (1) year, and may be renewable annually at the sole discretion of

GLC. In the event that GLC and Retailer have entered into any Retailer Contract(s) dated prior to the date of this Retailer Contract, GLC and Retailer agree that from the beginning of the term hereof, this Retailer Contract shall amend, renew, replace, and restate any prior Retailer Contract in its entirety for each Retailer Business Location listed below.

3.Contract Termination. This Retailer Contract may be canceled by Retailer upon twenty (20) calendar days prior written notice to GLC. If the CEO determines, in her/his sole discretion, that cancellation, denial, revocation, suspension or termination of this Retailer Contract is in the best interest of GLC, the State of Georgia or the public welfare, the CEO may cancel, deny, revoke, suspend or terminate this Retailer Contract upon written notice to Retailer; provided, however, Retailer shall be entitled to a hearing on such cancellation, denial, revocation, suspension or termination in accordance with the Act and the Rules and Regulations; provided, further, that the CEO may temporarily suspend Retailer’s rights under this Retailer Contract without prior notice, pending any prosecution, hearing or investigation, in accordance with the Act. In addition to the foregoing, GLC may immediately cancel, deny, revoke, suspend, terminate, or refuse to renew this Retailer Contract for any of the reasons set forth in Exhibit A on the next page hereof.

4.Ticket Sales, Retailer agrees to sell lottery Tickets for all the games authorized by GLC, in GLC‘s sole discretion, and only at its

Retailer Business Locations listed below for which GLC has issued a Certificate of Authority under this Retailer Contract. Retailer agrees that it shall sell no other lottery Tickets in the State of Georgia, except those provided to it for sale by GLC. Retailer agrees that it shall adopt safeguards to assure that it will not sell lottery Tickets or pay prizes to persons under the age of 18 years. Retailer agrees that it shall sell lottery Tickets only at the prices, and only subject to the terms and conditions, fixed by GLC unless prior written authorization is received from the CEO in each instance. In accordance with the amounts specified in the Act and the Rules and Regulations, as full and complete compensation under this Retailer Contract, GLC will pay Retailer Commissions and other compensation for lottery Tickets sold and for winning lottery Tickets paid by Retailer.

5.Electronic Funds Transfer. Retailer shall have a fiduciary duty to preserve and account for all proceeds from the sale of lottery

Tickets collected by it and shall be responsible and liable for all such proceeds. All proceeds from the sale of lottery Tickets and all other funds due the GLC shall constitute a trust fund in favor of the GLC until paid to the GLC. Subject to the Act and the Rules and Regulations, Retailer agrees. (i) to maintain for the purpose of this Retailer Contract a separate bank account in the name of the Retailer as "Trustee for the Georgia Lottery Corporation”, with a bank acceptable to GLC which is a member of an automated clearing house association; (ii) to deposit daily into that bank account all proceeds from the sale of lottery Tickets and other funds due the GLC; (iii) to authorize GLC to initiate Electronic Funds Transfer (EFT) to and from that account for the net settlement due from the sales of GLC lottery Tickets; and (iv) that sufficient funds shall be available in the designated account on the dates specified by GLC to cover the amounts due GLC, as determined by GLC.

6.Prize Payments. During its normal business hours, Retailer agrees to immediately validate and pay all lottery Tickets winning prizes up to and including $600 for all lottery games that it is authorized by GLC to sell, in accordance with the Act and the Rules and Regulations. Such payment for winning Tickets shall not be in amounts greater or less than the amounts authorized by GLC, and shall never be subject to restrictions or conditions other than those imposed by GLC.

7.Promoting Sales. Retailer agrees to prominently display, in locations accessible to the public, point‑of‑sale advertising and other public information material and supplies provided from time to time by GLC and its Vendors and suppliers. Retailer agrees to attend all training sessions, as requested from time to time by GLC. In order to assist Retailer with sales of lottery Tickets, GLC and its Vendors and suppliers may provide certain equipment (such as Lottery Terminals, Ticket dispensers, Ticket vending machines, play stations, etc.) to be held in the custody and control of Retailer without any transfer of ownership of such equipment to Retailer; Retailer agrees to return any such equipment and supplies upon request of the owner and agrees to be financially liable and responsible for the use, preservation and protection of such equipment and supplies, normal wear and tear excepted.

8.Acceptance and Return of Instant Tickets, Subject to the conditions and reporting requirements more fully set forth in the

Rules and Regulations: (i) each Retailer shall have a fiduciary duty and responsibility to preserve and account for all Instant Tickets accepted from the GLC or its distributor, as well as cash proceeds from the sale of any lottery products; (ii) any Instant Tickets not properly accounted for by the Retailer upon termination of the Retailer Contract, upon demand by the GLC, or at the End of Game date for the corresponding Instant Game, regardless of the reason, shall be deemed to have been purchased by the Retailer; (iii)

Retailer shall be responsible for the full price of Instant Tickets, less any applicable Commissions, for all Instant Tickets which may be lost, stolen, or damaged after delivery to Retailer; and (iv) GLC will accept full and partial Instant Ticket Pack returns within (3) weeks of the termination, cancellation, suspension, revocation or non‑renewal of this Retailer Contract.

Page 1 of 2

Lottery Retailer ID:

Revised 4/1/18

9.Contract Changes. This Retailer Contract, including the Act and the Rules and Regulations, is the entire contract between GLC and

Retailer. This Retailer Contract may not be modified or amended except by a writing signed by both parties hereto or by amendment to the Act or the Rules and Regulations. To the extent of any conflict, the provisions of the Act shall govern the Rules and Regulations, and the Rules and Regulations shall govern the Retailer Contract.

IN WITNESS WHEREOF, GLC and the undersigned Retailer have executed, or caused their duly authorized representatives to execute, this Retailer Contract as of the date noted below.

1.Corporate or legal name (list the name of the legal entity which owns the business and files income tax returns):

2.Business Address where tickets are to be sold:

(Street) |

|

|

|

|

|

|

|

||

(City, State & Zip) |

|

|

|

|

|

GEORGIA LOTTERY CORPORATION |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Printed Name and Title: |

|

|

|

|

|

By: |

|||

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

4. By (signature): |

|

|

5. Date: |

|

|

|

|

||

|

|

|

|

|

|

Gretchen Corbin, President and CEO |

|||

|

|

|

|||||||

EXHIBIT A to Retailer Contract

Notice of Specific Reasons for which a Retailer Contract may be Terminated

GLC may immediately cancel, deny, revoke, suspend, terminate, or refuse to renew any Retailer Contract if a Retailer or any of its owners:

a.violates a provision of the Act or of the Rules and Regulations; or

b.is or has been, or retains an employee involved in the sale of lottery Tickets who is or has been, convicted of a criminal offense related to the security or integrity of GLC or a lottery in any other jurisdiction; or

c.is or has been, or retains an employee involved in the sale of lottery Tickets who is, or has been, convicted of a gambling‑related offense, false statements, false swearing or perjury in this or any other jurisdiction or a crime punishable by more than one year of imprisonment or a fine of more than $1,000.00 or both unless the person’s civil rights have been restored and at least five (5) years have elapsed from the date of the completion of the sentence without a subsequent conviction of a crime described above; or

d.commits fraud, misrepresentation or deceit; or

e.provides false or misleading information to GLC; or

f.acts in a manner prejudicial to the security or integrity, or the public confidence in the security or integrity, of GLC; or

g.conducts business for the sole purpose of selling lottery Tickets; or

h.is delinquent in the payment of any federal, state or local taxes owed by it; or

i.changes any Retailer Business Location for which GLC has issued a Certificate of Authority under this Retailer Contract; or

j.fails to accurately or timely account for proceeds or prizes from the sale of lottery Tickets; or

k.fails to accurately or timely account for lottery Tickets received from GLC; or

l.fails to comply with any term of this Retailer Contract; or

m.fails to maintain a minimum level of sales, as established by GLC from time to time; or

n.substantially changes the ownership of Retailer without prior written notice to, or consent of, GLC; or,

o.files for or is placed in bankruptcy, receivership, insolvency or similar proceedings or fails to pay its debts as they become due; or

p.resides in the same household as any director, officer or employee of GLC; or

q.contracts with any other person or entity for lottery goods or services without the prior written approval of GLC; or

r.fails to meet any of the objective criteria established by GLC pursuant to the Act, or

s.is subjected to any material change, as determined to be material in the sole discretion of GLC, in any matter considered by GLC in entering this Retailer Contract; or

t.fails to maintain the designated account from which Electronic Funds Transfers (EFT) payments are to be made, fails to authorize GLC to initiate EFT transactions to and from such designated account, or fails to have sufficient funds available in such designated account on the dates specified by GLC.

Page 2 of 2

Revised 4/1/18

Dear Bank Representative:

Thank you for assisting our Retailer applicant. The Retailer must establish a separate electronic funds transfer (EFT) bank account in order to complete their Georgia Lottery Corporation application. This separate bank account must be specified “In Trust For the Georgia Lottery Corporation.”

Example:

XYZ, Inc.

D/B/A RCA Food Mart

In Trust for the Georgia Lottery Corporation

Please ensure that the account is not titled “Lottery Account.”

If you need any additional information, or have any questions, please contact Retailer Contracts Administration at

GEORGIA LOTTERY CORPORATION |

Revised 4/1/18 |

Helpful Hints for completing the GLC Retailer Application Package

In order to facilitate the efficient processing of your GLC Retailer Application,

we’ve itemized some helpful hints for you.

Also, be sure to carefully read the Retailer Application instructions.

1.When making corrections, please use a single line to cross through the incorrect information. Then initial your correction.

Do not use white out. Applications with white out cannot be accepted.

2.Please ensure that all information on the application is accurate and complete before submitting to the Georgia Lottery

Corporation. An incomplete or inaccurate application will only slow down the processing of your application.

3.Please maintain a copy of the application for your reference during the application process.

4.Identification:

Please submit one of the following forms of valid identification. No other forms of identification can be accepted:

·Driver’s License

·Georgia Identification Card

·Identification Card issued by another state

·U.S. Armed Forces Identification Card

·U.S. Passport (must be signed)

·U.S. Resident Alien Card

5.Application Fee:

·The Application fee should be in the form of a cashier’s check, business check, or money order only.

·No personal checks or counter checks can be accepted.

·Please do not submit the application fee with a check from the Lottery EFT account.

6.Business Registration/Tax ID #s (Part 3 of the application):

·Federal Employers ID number: Obtain from the IRS by calling

·All Corporations and Limited Liability Corporations must be properly registered with the Secretary of State.

·Further information can be obtained by contacting the Corporations Division of the Secretary of State at

·All businesses must be registered with the Georgia Department of Revenue. Please call (404)

·Georgia State Tax Identifier Number & Georgia Sales Tax Number:

If already registered, this number can be found on your Georgia Department of Revenue registration certificate.

7.Legal Business Name/Ownership Type:

·Corporate or Legal Name: The legal entity which owns the business and files income tax returns.

·Store Name or DBA Name: The name of the business where tickets are sold. This name should match the Georgia Department of Revenue registration.

·Sole Proprietor: Your legally given name.

·Partnership: Partnership name should match the name on the Internal Revenue Service notification of the Federal Employers Identification Number.

·Corporation and Limited Liability Corporation: Please ensure that the legal business name and Secretary of

State registered name match.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Application Fee | The application for becoming a Georgia Lottery Retailer requires a fee of $125 per business location. If the application is not approved, $100 of the fee will be refunded. |

| Notarization Requirement | The applicant must complete and sign a statement, which also requires notarization to ensure authenticity. |

| Identification Requirement | A copy of a valid form of identification must be attached to the application, such as a Driver's License or U.S. Passport. |

| Minority Ownership Disclosure | While optional, applicants are encouraged to disclose if more than 50% of the business's ownership is held by individuals of minority races. This is welcomed but not compulsory. |

| Governing Law | The application form is governed by the Georgia Lottery for Education Act (O.C.G.A. §50-27-28) and related Georgia statutes. |

| Electronic Funds Transfer | Retailers must establish a separate electronic funds transfer bank account specifically for the Georgia Lottery Corporation, ensuring proper handling of lottery related funds. |

Guidelines on Utilizing Ga Lottery Application

To effectively fill out the Georgia Lottery Application form, precise information about your business is required. Each step demands attention to detail, as the integrity of the submitted information is crucial for approval. Follow these instructions carefully to ensure all necessary sections are completed correctly.

- Prepare the required fee of $125 per business location, using a Cashier’s Check, Business Check, or Money Order.

- Complete Part 1, starting with the name of the entity that owns the business. Provide accurate tax filing information.

- List the business name where lottery tickets will be sold and ensure existing business address, telephone number, city, state, zip code, and county are accurately filled out.

- If the mailing address is different, complete it, otherwise leave it blank in Line 9.

- Provide a fax number in Line 13, if applicable.

- List all principals involved in the business in Line 14. If more space is needed, attach additional sheets as necessary.

- Sign and have the certification statement in Line 15 notarized.

- For Line 16, provide the names, titles, and phone numbers of individuals who will be contacted for lottery-related business.

- If applicable, complete Line 17 regarding minority ownership. Understanding this is optional.

- Note business operating hours for each day of the week under Line 18.

- Each owner must now complete Part 2, including personal identification and background information on all business principals.

- Complete the identification section in Line 22 by attaching a copy of an acceptable ID, like a Driver's License or Passport.

- Sign and notarize the consent statement in Line 23, ensuring it's completed before submission.

- Move to Part 3 for Electronic Funds Transfer Authorization. Fill in all pertinent business information.

- Secure required licensing numbers from the Georgia Department of Revenue to complete Lines 2-4.

- List Federal Employers ID Number (FEIN) for corporations and partnerships or Social Security Number for sole proprietors.

- Obtain a depository institution representative's signature to verify the trust account required for the lottery funds.

- Last, each member of LLCs or partnerships must complete Part 4, adhering to all requirements outlined for the Retailer Contract.

Once you've meticulously filled out each section of the application form, review all information for accuracy. After verifying, submit the completed application package alongside the payment. The verification process will follow on the lottery's end, after which further instructions or communication will be provided regarding your application status.

What You Should Know About This Form

What is the cost to apply for the Georgia Lottery Retailer Application?

The application requires a fee of $125 per business location. This fee must be submitted as a Cashier's Check, Business Check, or Money Order. If the application for a business location is not approved by the Georgia Lottery Corporation, $100 of the initial fee will be refunded.

What information must be provided in Part 1 of the application?

Part 1 focuses on Business Information. Applicants need to list the legal entity's name, business name, business location, contact details, mailing address (if different), and business hours. Additionally, information regarding the principal owners and the business’s contacts should be provided. If applicable, minority ownership status may also be noted in this section.

How many individuals must complete Part 2 of the application?

Every owner, shareholder, member, and officer of the business must complete Part 2. This ensures that all individuals with significant stakes in the lottery retailer application are vetted. If more space is required, additional forms can be printed and submitted.

What forms of identification are acceptable for the application?

For identity verification, applicants must attach a copy of one of the following forms of identification: a Driver's License, a Georgia Identification Card, an identification card issued by another state, a U.S. Armed Forces Identification Card, a U.S. Passport, or a U.S. Resident Alien Card.

What is required for the Electronic Funds Transfer Authorization section?

This section requires details about the legal entity owning the business, including licensing numbers from the Georgia Department of Revenue and the Federal Employers ID Number (FEIN) for corporations and partnerships. It is essential to establish a separate bank account labeled as "In Trust for the Georgia Lottery Corporation" and authorize EFT transactions related to lottery funds.

Is it mandatory to disclose minority ownership status in the application?

While it is requested to complete the minority ownership section if applicable, it is not mandatory. This section aims to gather information on minority business ownership, which can potentially aid the business in meeting certain state requirements or initiatives.

What are the conditions surrounding the refund of the application fee?

Out of the $125 application fee, $100 will be refunded if the Georgia Lottery Corporation does not approve the application for a business location. Applicants should be aware that the refund will only be processed under this specific circumstance.

How should the application and the fee be submitted?

The completed application should be mailed to the Georgia Lottery Corporation along with the $125 fee per business location. Payments must be made through Cashier's Check, Business Check, or Money Order. The application can be submitted via the designated mailing address provided by the Georgia Lottery Corporation.

How long is the Retailer Contract effective?

The Retailer Contract remains effective for one year from the date it is executed by the retailer. It may be renewed annually at the discretion of the Georgia Lottery Corporation.

What responsibilities does a retailer have towards lottery ticket sales?

Retailers must sell lottery tickets for all authorized games and validate winning tickets up to $600. They must ensure compliance with all pricing and regulatory requirements imposed by the Georgia Lottery Corporation. Additionally, retailers need to adopt safeguards to prevent sales to individuals under the age of 18.

Common mistakes

Completing the Georgia Lottery application form can be a straightforward process, but there are common mistakes that applicants often make. Avoiding these errors is crucial to ensure a smooth application process and to prevent delays or denials.

1. Incomplete Information: One frequent mistake is leaving sections of the application blank. Each line of the form requires specific information, such as the business name, address, and contact details. Omitting even a single detail can lead to processing delays. It is essential to complete every section thoroughly. Double-check that all information is provided before submitting.

2. Insufficient Identification: Many applicants neglect to attach the required identification documents. The form specifies that applicants must include a copy of an accepted form of ID. Failing to do so is a common pitfall. Without the necessary identification, the application cannot be processed. Ensure that you provide valid documentation as outlined in the application instructions.

3. Incorrect Payment Method: The application requires a payment of $125 per business location. A common error arises when an applicant does not use an accepted payment method. Only cashier’s checks, business checks, or money orders are acceptable. Personal checks or cash are not permitted. Verify that the correct payment method is used to prevent application rejection.

4. Not Notarizing the Application: Applicants often forget to have their signatures notarized, which is a requisite for the application to be valid. Notarization confirms that the information provided is accurate and is signed willingly. Ensure any required statements are signed and notarized before submission, as this can be a critical step.

5. Ignoring Contact Information: When listing business contacts, applicants sometimes fail to provide complete and accurate contact information. If there is a need for the Lottery Corporation to reach out regarding the application, having up-to-date contact information is vital. This includes the contact person's name, title, and phone number. Inaccurate information can lead to communication gaps and potential issues with the application.

By being mindful of these common mistakes, applicants can navigate the Georgia Lottery application process with greater ease and increase their chances of approval. Attention to detail is paramount, so take the time to review the application thoroughly before submission.

Documents used along the form

The application process to become a Georgia Lottery retailer requires various forms and documents to ensure compliance with regulations and facilitate the establishment of the business. The following list outlines several key documents often used in conjunction with the Georgia Lottery Application form. Each document serves a specific purpose, contributing to a comprehensive understanding of the business and its ownership structure.

- Business License: This document verifies that the business has been authorized to operate within Georgia. It demonstrates compliance with local regulations and is essential for legal operation.

- Fictitious Name Registration: Also known as "doing business as" (DBA) registration, this document is necessary if the business conducts operations under a name different from its legal business name.

- Tax Identification Numbers: Businesses must provide both their Federal Employer Identification Number (FEIN) and State Tax Identification Number. These numbers are crucial for tax reporting and compliance.

- Ownership Disclosure Forms: Each owner, shareholder, or principal must submit a disclosure regarding their percentage of ownership in the business. This form helps maintain transparency about the business's ownership structure.

- Background Check Authorization Form: This document authorizes background checks for business owners, ensuring the integrity and security of lottery operations.

- Bank Account Information Form: Retailers need to establish a separate bank account specifically designated for lottery funds, called "In Trust for the Georgia Lottery Corporation." This ensures the proper handling of lottery revenues.

- Notarized Affidavit: This is a sworn statement by the business owner affirming the accuracy of the information provided in the application. It carries legal significance and assures the authorities of the truthfulness of disclosures.

- Insurance Verification: Proof of liability insurance may be required to protect the business and consumers involved in lottery transactions. This document outlines the coverage details.

- Retailer Contract: A formal agreement between the Georgia Lottery Corporation and the retailer, detailing the rights and responsibilities of each party. This contract establishes the framework for conducting lottery sales.

- Electronic Funds Transfer Authorization Form: This document authorizes the Georgia Lottery Corporation to conduct electronic transfers to and from the retailer's bank account, facilitating efficient handling of lottery proceeds.

Each of these documents plays a significant role in the application process for becoming a Georgia Lottery retailer. Together, they ensure that businesses operate transparently, comply with regulations, and handle public funds responsibly. Applicants should prepare these documents with care, as they contribute to the overall integrity and success of the retailer's operations.

Similar forms

Business License Application: Similar to the Ga Lottery Application, a Business License Application requires detailed information about the business and its owners. Both forms typically ask for identifiers like the business's legal name, ownership structure, and contact details. Licenses ensure compliance with local regulations.

Retailer Agreement: Much like the Ga Lottery Application, a Retailer Agreement outlines the responsibilities and commitments of a retailer. This document commonly covers details such as permissible sales, compliance requirements, and termination conditions, just as a lottery retailer must adhere to specific rules.

Tax Registration Form: A Tax Registration Form is designed to gather information on the business's tax obligations. Similar to the Ga Lottery Application, it requests a Federal Employers ID Number and the names of the principals responsible for tax filings, ensuring accountability and transparency.

Franchise Application: Like the Ga Lottery Application, a Franchise Application demands thorough business information and owner details. Both documents facilitate the assessment of potential applicants for their suitability and compliance with specific operational standards.

Commercial Lease Agreement: A Commercial Lease Agreement, similar to the Ga Lottery Application, requires specifics about the business location and the entities involved. Both forms often require notarization and signatures from all involved parties, ensuring legal validation.

Vendor Application: This document is comparable to the Ga Lottery Application as it collects information about the vendor's business structure and relevant contacts. The aim is to verify credibility and ensure compliance with the standards required to partner with other businesses.

Employment Application: An Employment Application, like the Ga Lottery Application, necessitates detailed personal and business information. Both types of applications include sections that require background checks and identifiers to ensure the legitimacy of the applicants.

Loan Application: A Loan Application often mirrors the Ga Lottery Application, as it requests business identification, ownership details, and financial history. Both forms help institutions assess the borrower’s credibility and the risks associated with lending.

Insurance Application: Similar to the Ga Lottery Application, an Insurance Application gathers extensive information about the business and its owners. Both documents ensure that all parties are comprehensively evaluated to mitigate risks and satisfy underwriting criteria.

Dos and Don'ts

Things You Should Do:

- Carefully read all instructions before starting the application.

- Provide accurate and complete information for each line to avoid delays.

- Include a cashier’s check or money order for $125 with your application.

- Make sure each principal of the business completes Part 2 of the application.

- Attach a government-issued ID when submitting personal information.

- Sign and notarize the application where required.

- If applicable, document and explain any "yes" answers on a separate sheet.

Things You Shouldn't Do:

- Do not submit the application without the required fee.

- Do not provide misleading or inaccurate information.

- Avoid leaving any sections blank unless specifically instructed.

- Do not forget to include valid business contact information.

- Do not rush; take the time needed to ensure accuracy.

- Do not send in photocopies of documents unless specified.

- Avoid assuming that your application will be approved without proper checks.

Misconceptions

- Application Is Only for Large Corporations: Many people believe that only large businesses can apply to be Georgia Lottery Retailers. In reality, the application is open to all types of businesses, including sole proprietorships and small establishments.

- Application Fee Is Non-Refundable: There's a misconception that the initial application fee of $125 is non-refundable. However, if the application is not approved, you can receive a $100 refund.

- Only One Owner Needs to Apply: Some individuals think that only the primary owner of the business is required to fill out the application. In fact, every owner, shareholder, or officer associated with the business must complete a portion of the application.

- Identification Requirements Are Too Strict: There is a belief that the identification requirements for application are overly complicated. In truth, you just need to provide one of several acceptable forms of identification, making it straightforward.

- Minority Ownership Information Is Mandatory: While there is a section regarding minority ownership, it's important to note that completing this section is optional. It is not required unless the majority ownership is by individuals of a minority race.

- The Application Process Takes Months: Many think that the application process is lengthy and tedious. Though thorough, the process is designed to be efficient. Most applications are reviewed in a timely manner.

- There Are No Support Resources Available: Lastly, some people believe that they must navigate this process alone. On the contrary, assistance is readily available through the Georgia Lottery Corporation's Retailer Contracts Administration, reachable via a dedicated phone line.

Key takeaways

Key Takeaways for Filling Out and Using the Georgia Lottery Application Form:

- Each business location requires a $125 fee, which is refundable if the application is denied.

- Provide detailed and accurate information about both the business and individual owners; inaccuracies can lead to rejection.

- Secure notarization for both the business statement and personal information sections; this is essential for validation.

- Attach necessary identification documents for all owners or principals; accepted IDs include driver's licenses and passports.

- Establish a designated bank account explicitly labeled "IN TRUST FOR THE GEORGIA LOTTERY CORPORATION" for managing proceeds.

Browse Other Templates

Form 126 - The form supports travel and associated benefits for foreign service employees.

Bankruptcy Chapter 7 Forms - Do not include the debtor’s name in the creditor matrix.

What to Bring to Behind the Wheel Test - Signatures from both the driver and examiner authenticate the evaluation process.