Fill Out Your Ga Tax Wage Report Form

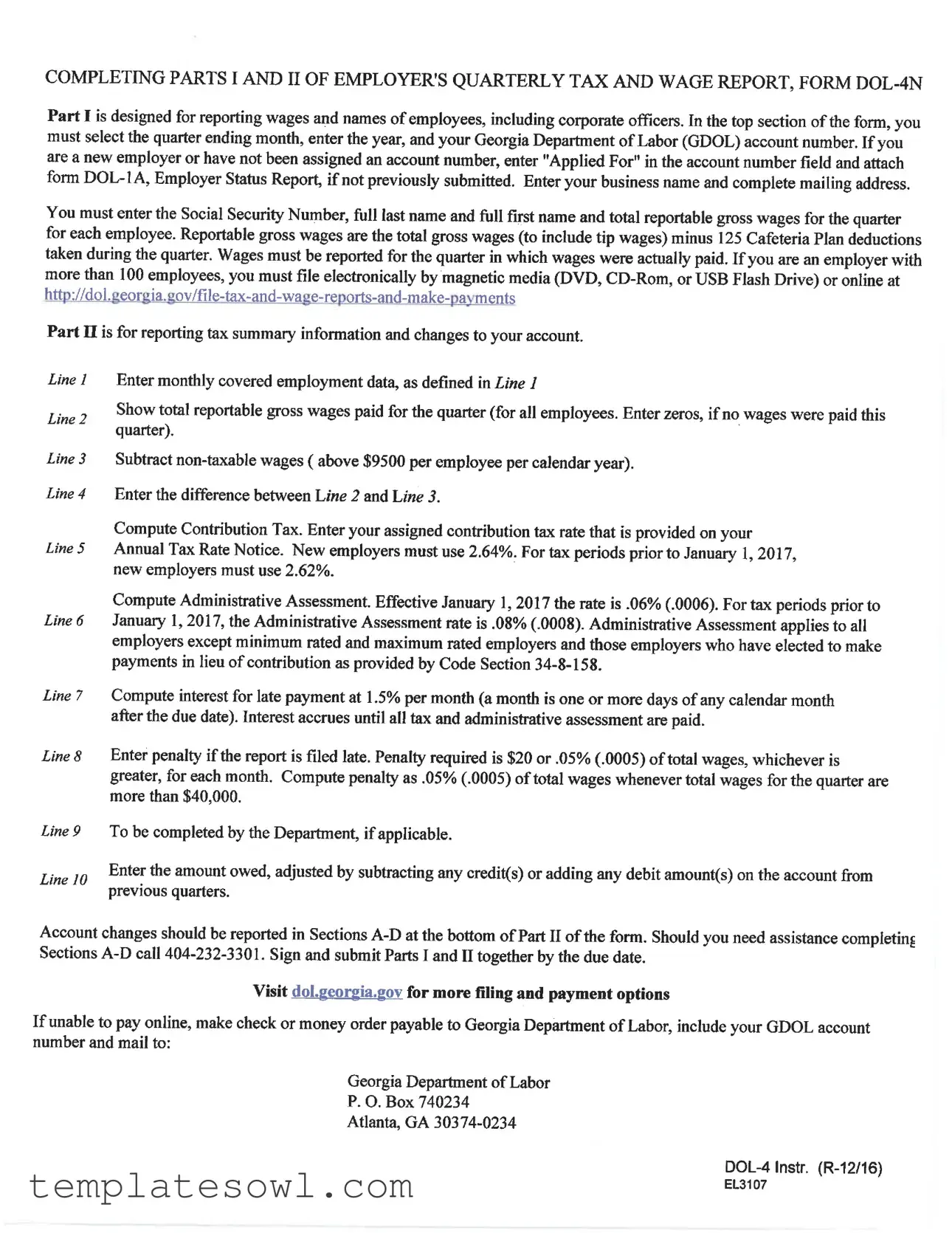

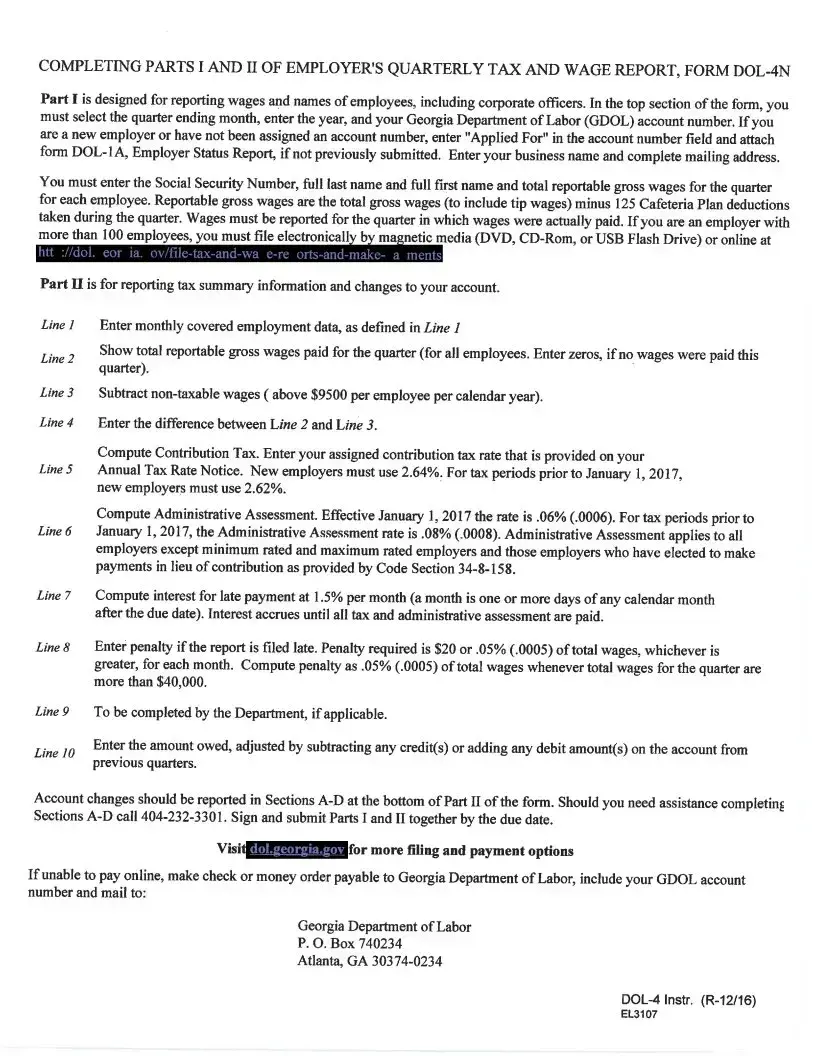

Understanding the Georgia Tax Wage Report form is crucial for employers navigating their tax responsibilities. This form, officially known as the Employer's Quarterly Tax and Wage Report, allows organizations to fulfill their reporting obligations with the Georgia Department of Labor (GDOL). Comprising two primary parts, the form requires employers to document wages paid to employees, which includes corporate officers. In Part I, employers must record employee names, Social Security numbers, and total gross wages for the quarter. It's essential to report only those wages actually paid during the specified quarter and to comply with the requirements set forth for electronic submission for larger employers. Part II focuses on summarizing tax information, where employers account for non-taxable wages and compute contribution taxes based on their assigned tax rates. Significant penalties for late filings underscore the urgency of meticulous reporting. Failure to meet these obligations may result in tax liens and additional fees, thus making timeliness paramount. For new employers or those who have recently changed their business status, a separate status report may need to accompany their submission. With the deadline for reporting approaching, understanding and accurately completing this form is essential for compliance and avoiding severe repercussions.

Ga Tax Wage Report Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The form DOL-4N is used for reporting wages and names of employees, including corporate officers. |

| Quarter Selection | Employers must select the quarter ending month and enter the year and GDOL account number at the top of the form. |

| Employee Information | Report each employee’s Social Security Number, full name, and total reportable gross wages for the quarter. |

| Filing Requirements | Employers with over 100 employees must file electronically via magnetic media or online. |

| Gross Wages Calculation | Reportable gross wages are total gross wages minus allowable Cafeteria Plan deductions taken during the quarter. |

| Governing Laws | This form is governed by Georgia Code Section 34-8-158, which outlines the tax and assessment regulations. |

| Assistance Contact | For help completing the form, call 404-232-3301 to speak with a representative at GDOL. |

Guidelines on Utilizing Ga Tax Wage Report

Filling out the Georgia Tax Wage Report form requires accurate reporting of your employees' wages and tax information. Each section must be completed meticulously to ensure compliance with state regulations. Here are the steps to help you fill out the form correctly.

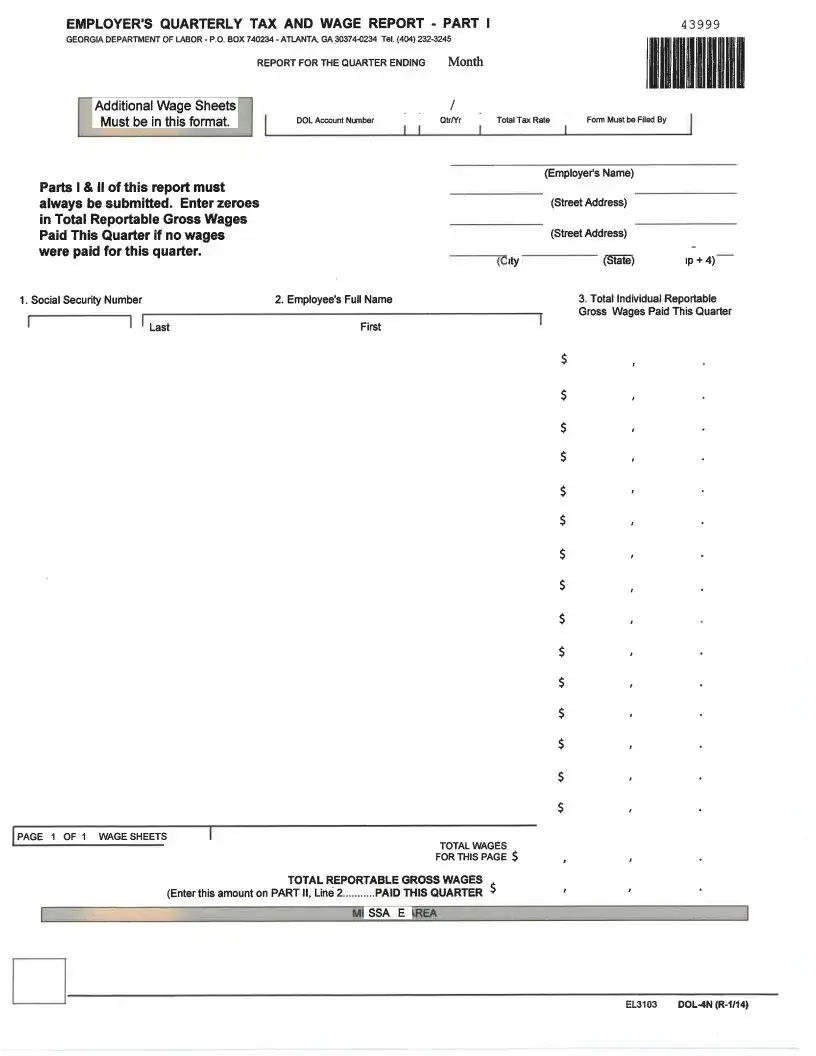

- Start at the top of Part I. Select the ending month of the quarter and enter the year.

- Provide your Georgia Department of Labor (GDOL) account number. If you’re a new employer and do not have an account number, write “Applied For” and attach form DOL-1A.

- Enter your business name and complete mailing address.

- For each employee, list the Social Security Number, full first name, full last name, and total reportable gross wages for the quarter.

- Calculate and enter the reportable gross wages. Remember, this includes all wages minus any Cafeteria Plan deductions.

- If you have more than 100 employees, ensure you file electronically either online or through magnetic media.

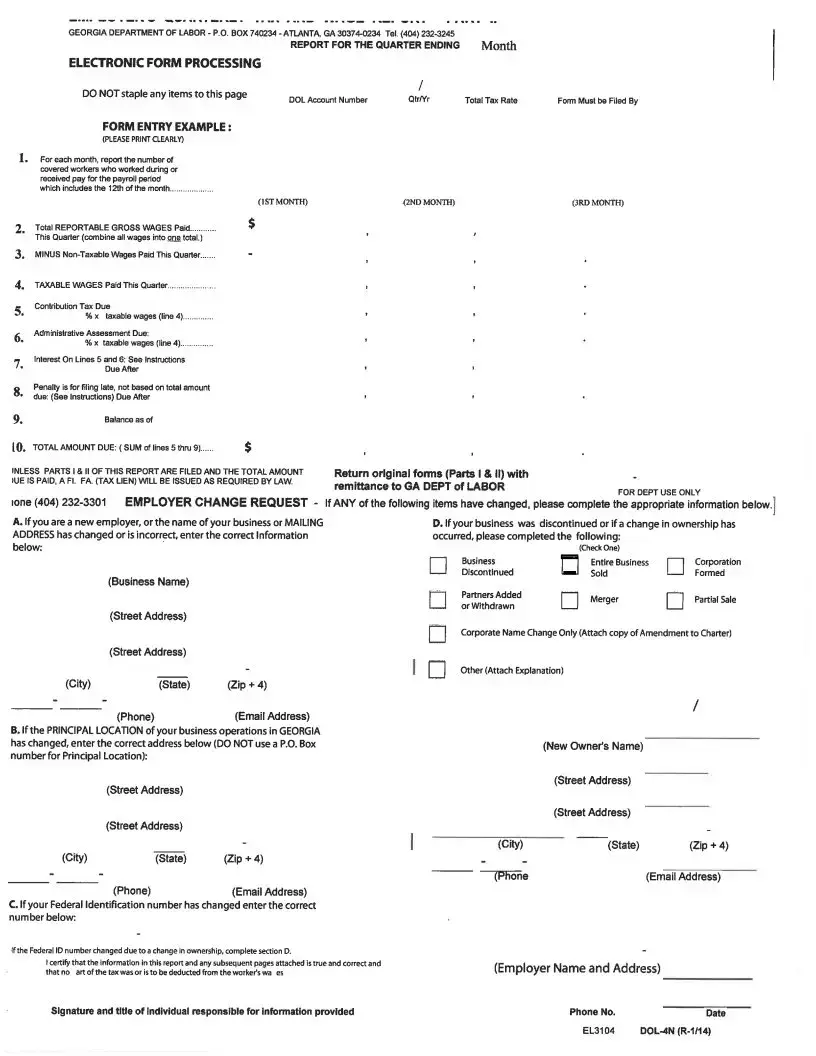

- Move to Part II. Enter the number of employees who worked or received pay for the month.

- Report the total reportable gross wages paid for the quarter on Line 2. If no wages were paid, enter zero.

- Subtract any non-taxable wages on Line 3. These are the amounts exceeding $9,500 per employee per year.

- Calculate taxable wages and enter the result on Line 4.

- Enter your assigned contribution tax rate on Line 5. New employers typically use 2.64%.

- Calculate the administrative assessment on Line 6 at the applicable rate (0.06% for periods after January 1, 2017).

- On Line 7, compute interest for any late payments at the rate of 1.5% per month.

- Enter any penalties on Line 8 for late filing, which is either $20 or 0.05% of total wages, whichever is greater.

- Line 9 is for department use and may be completed by the Department.

- On Line 10, indicate the total amount due, subtracting any credits or adding any debits from previous quarters.

- Complete sections A-D at the bottom of Part II if there are any account changes. For assistance, call 404-232-3301.

- Sign and submit both Parts I and II by the due date. For payment, if paying by check, make it payable to the Georgia Department of Labor and include your GDOL account number.

Once you have completed these steps, review the form for accuracy before submission. Timely and correct filing is important to avoid penalties. If any adjustments are needed down the line, ensure to follow the correct procedures for updating your information with the Georgia Department of Labor.

What You Should Know About This Form

What is the purpose of the Georgia Tax Wage Report form?

The Georgia Tax Wage Report form, specifically Form DOL-4N, is utilized by employers to report wages and names of employees to the Georgia Department of Labor (GDOL). It contains two parts: Part I is for reporting individual employee wages, while Part II summarizes tax information and any changes to the employer's account. This ensures compliance with state labor regulations and accurate tracking of employee earnings for tax purposes.

Who needs to file the Georgia Tax Wage Report form?

All employers operating in Georgia, including those with corporate officers, must file this report if they have employees. New employers who have not yet been assigned a GDOL account number can indicate “Applied For” in the account number field and submit an Employer Status Report (Form DOL-1 A) if they have not already done so. If an employer has 100 or more employees, they are required to file electronically.

What information is required in Part I of the form?

Part I requires the employer to input the quarter ending month, the year, and their GDOL account number. Additionally, the business name and mailing address should be provided. For each employee, the form necessitates the Social Security Number, full name, and total reportable gross wages for the quarter. Reportable gross wages include total gross wages minus any deductions from Cafeteria Plans taken within the quarter.

What should I do if no wages were paid during the quarter?

If there were no wages paid during the quarter, it is essential to enter zeros in the "Total Reportable Gross Wages Paid This Quarter" field. This ensures that the Georgia Department of Labor accurately reflects that no wages were disbursed, maintaining compliance while preventing potential penalties for not filing.

How do I report non-taxable wages on the form?

To report non-taxable wages, first, identify any wages above $9,500 paid to an employee during the calendar year. These amounts must be subtracted from the total reportable gross wages in Line 3 of Part II of the form. This serves to ensure that only taxable wages are considered when calculating the contribution tax due.

What are the deadlines for submitting the tax wage report?

The Georgia Tax Wage Report must be filed quarterly, and the specific due date depends on the quarter being reported. Generally, the reports are due within 30 days after the last day of each quarter. It is crucial to check the GDOL's website for the exact deadlines to avoid late penalties.

What penalties are incurred for late filing or payment?

If the report is filed late, a penalty of either $20 or 0.05% of total wages, whichever is greater, will be applied for each month past the due date. Interest on any outstanding tax amount also accrues at a rate of 1.5% per month until the total tax and administrative assessments are paid in full.

How can I submit the Georgia Tax Wage Report form?

Employers can submit the Georgia Tax Wage Report form either electronically or by mail. For those filing electronically, options include magnetic media or online submission via the GDOL's portal. If opting to mail, checks or money orders should be made payable to the Georgia Department of Labor, including the GDOL account number, and sent to the specified mailing address.

Where can I find assistance if I need help with the form?

If assistance is required in completing the Georgia Tax Wage Report, employers can call the GDOL at 404-232-3301. This number can help clarify any questions regarding sections or provide guidance on specific requirements related to the form.

Common mistakes

Completing the Georgia Tax Wage Report form correctly is essential for compliance and avoiding penalties. Mistakes can lead to delays and potential fines. One common error occurs when employers fail to enter their GDOL account number accurately. This number is vital for identifying the employer's account, and entering "Applied For" without attaching the Employer Status Report can create complications, especially for new employers.

Many individuals also neglect to specify the correct quarter for which they are reporting. This oversight can confuse the tax authorities regarding the timeframe of reported wages. Accurate record-keeping and attention to detail are crucial in this context. Missing to indicate the quarter can result in the report being rejected or delayed.

Another frequent mistake is not reporting all employees' wages accurately. Employers sometimes omit certain employees or miscalculate their total reportable gross wages. Each employee’s Social Security Number, full name, and total wages must be entered correctly. Additionally, employers must deduct any non-taxable wages appropriately before calculating the taxable wage amount.

Additionally, failing to file electronically when required can be an issue for employers with more than 100 employees. Such employers must submit their forms electronically through the specified formats, like magnetic media or online options. Failure to comply may lead to additional scrutiny or penalties.

Employers may also misinterpret the instruction to enter zeros if no wages were paid during the quarter. Forgetting to include zeros creates confusion and can lead to an incomplete submission that may automatically trigger penalties.

Another mistake involves inaccurately computing the contribution tax rate. Each employer receives an annual notice that includes their assigned tax rate. Using an outdated or incorrect rate can lead to underpayment or overpayment, both of which have financial implications. It’s crucial to double-check these figures before finalizing the report.

Lastly, many employers neglect to sign the completed report. A signed report is necessary for validation and is often a crucial requirement for processing. Omitting a signature not only delays the filing but may also indicate incomplete filings to the Department of Labor.

Documents used along the form

The Georgia Tax Wage Report form, also known as Form DOL-4N, is essential for employers to report wages and taxes to the Georgia Department of Labor. However, there are other documents that often accompany this form to ensure compliance and accurate reporting. Below is a list of related forms and documents commonly used alongside the Georgia Tax Wage Report form.

- DOL-1 A: Employer Status Report - This form is used by new employers to establish their account with the Georgia Department of Labor. It captures essential information such as business name, type of organization, and contact details.

- Wage Sheets - These sheets provide a detailed record of individual employee wages. Employers must use them to list employee names, Social Security numbers, and reportable gross wages for the quarter. It is crucial for supporting the information submitted on Form DOL-4N.

- Annual Tax Rate Notice - This document outlines the assigned contribution tax rate for employers. Employers must reference this to determine the correct tax rate while completing their tax calculations on Form DOL-4N.

- Employer Change Request Form - If there are any changes in the employer's information, such as business name or ownership, this form should be completed. It ensures that the Georgia Department of Labor has up-to-date information for compliance and reporting purposes.

- Payment Remittance Form - Along with the wage report, employers might need to submit a payment remittance form if they are unable to pay electronically. This form ensures the correct allocation of payments to the respective tax accounts.

Understanding these documents and their purposes is vital for employers in Georgia who aim to maintain compliance with state labor regulations. This combination of forms creates a comprehensive reporting framework that supports both the employer's obligations and the state's administrative needs.

Similar forms

- IRS Form 941: Like the Ga Tax Wage Report, this form is used to report employer taxes on employee wages. It summarizes the wages paid, the federal income tax withheld, and the Social Security and Medicare taxes due.

- State Unemployment Insurance (SUI) Report: This document provides similar information on wages and employment for unemployment tax calculations. It allows states to track employer contributions to unemployment funds.

- W-2 Forms: These forms detail annual wages and tax withholdings for each employee. Both documents require accurate reporting of employee earnings, fostering transparency between employers and taxing authorities.

- monthly payroll records: Employers maintain these records to track wages, hours worked, and tax withholdings. Both the wage report and payroll records serve as vital tools for compliance with tax regulations.

- Form 1099-MISC: This form is similar in that it reports payments made to non-employees or independent contractors. Both documents are essential for accurate reporting of payments and maintaining tax compliance.

- Employer’s Annual Federal Unemployment Tax Return (Form 940): This document summarizes annual unemployment taxes owed by the employer, paralleling the Ga Tax Wage Report in purpose and data collection.

- State Income Tax Withholding Reconciliation Report: This report, like the Ga Tax Wage Report, is used to reconcile state income tax withholding for employees, ensuring compliance with state taxation laws.

- Employment Report for Insurance Purposes: Similar in function, this report is used to detail employee wages for workers' compensation insurance calculations, just as the Ga Tax Wage Report aids in understanding tax obligations.

Dos and Don'ts

Things to Do When Filling Out the GA Tax Wage Report Form:

- Carefully select the quarter ending month and enter the correct year.

- Include your GDOL account number or write "Applied For" if you’re a new employer.

- Provide your business name and complete mailing address accurately.

- Report all employees’ full names and Social Security Numbers.

- Calculate the total reportable gross wages correctly, including tip wages.

- Submit Parts I and II of the report together by the due date.

- File electronically if you have more than 100 employees.

- Add any applicable credits or debits to the amounts owed.

Things Not to Do When Filling Out the GA Tax Wage Report Form:

- Do not leave any fields blank; provide zeros if no wages were paid.

- Avoid using a P.O. Box for the principal location of your business.

- Do not forget to attach Form DOL-1 A if you’ve applied for a GDOL account number.

- Don’t report wages paid in a different quarter than when they were paid.

- Refrain from assuming previous account information is still valid; always verify.

- Do not wait until the last minute to file; penalties apply for late submissions.

- Don’t provide incomplete or incorrect Social Security Numbers.

- Never deduct any part of the tax from workers’ wages.

Misconceptions

- Misconception 1: The GA Tax Wage Report is only for large employers.

- Misconception 2: You can report wages for any quarter, at any time.

- Misconception 3: Reporting one employee’s information is sufficient.

- Misconception 4: Filing late only incurs a small penalty.

- Misconception 5: You only need to file if you have wages to report.

This is untrue. All employers, regardless of size, are required to submit the GA Tax Wage Report. Even small businesses with just a handful of employees must comply. Missing this requirement can lead to penalties.

This misconception can be costly. Wages must be reported for the quarter in which they are paid. Delaying or altering reporting periods can lead to incorrect filings, which may incur penalties and interest.

It's critical to report the information for every employee, including corporate officers. Omitting an employee could trigger audits or result in penalties.

Late filings can be much costlier than anticipated. The penalty is either $20 or 0.05% of total wages, whichever amount is greater. Consistent late filings can accumulate significant fees over time, impacting your business finances.

Even if no wages were paid during the quarter, you must still file and enter zeros in the appropriate fields. Failure to file can lead to audits and penalties, as authorities expect regular reporting regardless of payroll activity.

Key takeaways

When filling out the Georgia Tax Wage Report form, consider these important points:

- Know the Form Parts: The form consists of two parts. Part I is for reporting employee wages, while Part II focuses on tax summary information.

- Quarterly Reporting: Ensure that you report wages for the specific quarter in which they were actually paid.

- GDOL Account Number: You must provide your Georgia Department of Labor account number. If you are a new employer without an account number, write "Applied For" and include form DOL-1A.

- Employee Information: Report the Social Security Number, full names, and total reportable gross wages for each employee, including corporate officers.

- Electronic Filing Requirement: Employers with over 100 employees must file electronically, either online or on magnetic media.

- Calculating Taxes: Carefully compute taxable wages and applicable contribution tax rates found on your Annual Tax Rate Notice.

- Report Non-Taxable Wages: Subtract any non-taxable wages exceeding $9,500 per employee per calendar year from your gross wages.

- Late Payment Penalties: Be aware that interest accrues at 1.5% per month for overdue payments. Additionally, late filings incur a penalty of at least $20 or 0.05% of total wages.

- Deadline for Submission: Submit both parts of the report by the due date to avoid penalties and ensure compliance.

For further assistance, particularly with certain sections, contact the Georgia Department of Labor.

Browse Other Templates

What Is a Vehicle Lien - The state reserves the right to unilaterally cancel the contract with proper notification.

Dd2766 - Each section is designed to lead the reader through key aspects of the project, aiding comprehension.

Transcript Release Form,Academic Record Request,Student Academic Transcript Application,Official Transcript Request,Student Transcript Authorization Form,Transcript Requisition Document,College Transcript Application,Request for Transcript Release,So - The form is necessary for anyone wishing to transfer credits.