Fill Out Your Ga Wc 10 Form

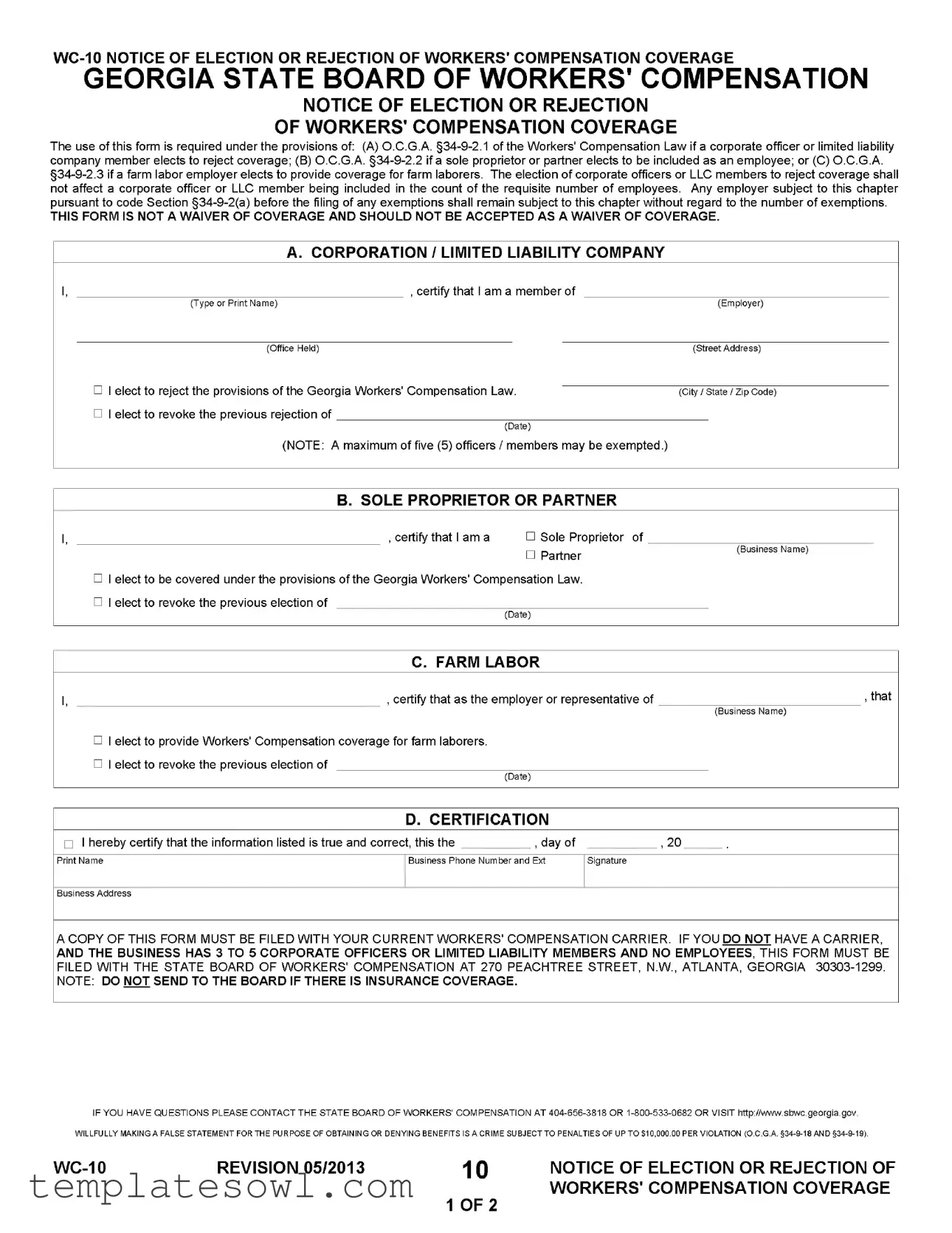

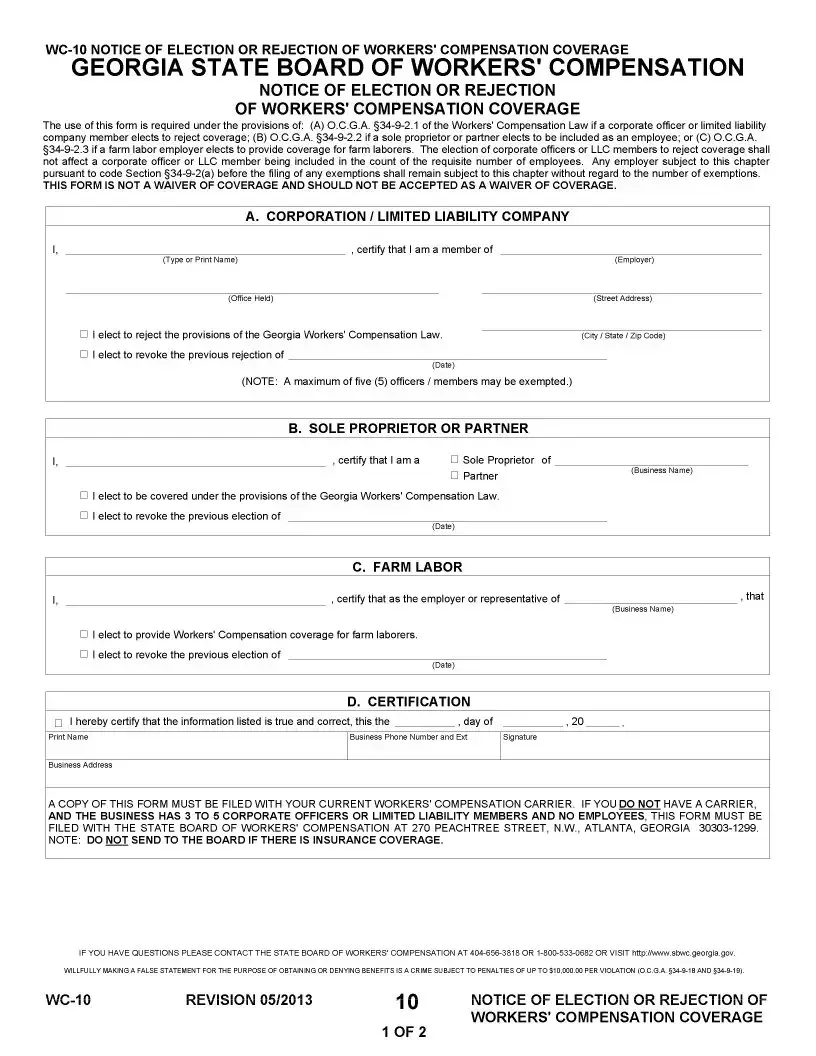

The GA WC 10 form, also known as the Notice of Election or Rejection of Workers’ Compensation Coverage, is a crucial document for businesses operating in Georgia. This form serves various essential purposes under the state's Workers' Compensation Law. Corporations and limited liability companies (LLCs) use this form to formally elect to reject workers' compensation coverage for up to five corporate officers or members, while sole proprietors and partners can choose to be included under the law's protections. Additionally, farm labor employers can utilize this form to provide coverage specifically for their farm laborers. It is important to note that submitting this form does not eliminate any legal obligations for workers' compensation coverage; it merely reflects choices made by business owners. As businesses navigate their insurance options, they must understand that filing this form does not constitute a waiver of coverage. Employers with three or more employees are mandated to carry workers' compensation insurance, regardless of any exemptions declared on the GA WC 10 form. To ensure compliance and protect both employees and employers, it is vital to complete this document accurately and file it with the appropriate entities, such as the insurance carrier or the Georgia State Board of Workers' Compensation.

Ga Wc 10 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The WC-10 form is used to elect or reject workers’ compensation insurance coverage in Georgia. |

| Governing Law | The form is required under the Georgia Workers' Compensation Law, specifically O.C.G.A. §34-9-2.1, §34-9-2.2, and §34-9-2.3. |

| Exemption Eligibility | Corporate officers or LLC members can elect to reject coverage; up to five members can be exempted. |

| Filing Requirements | A copy of the form must be filed with the current workers' compensation carrier or the State Board of Workers' Compensation. |

| Misconceptions | Many business owners wrongly believe the WC-10 form serves as a waiver of coverage; this is not correct. |

| Coverage Necessity | Businesses with three or more employees must obtain workers' compensation insurance, regardless of exemption. |

| Contractual Relationships | General contractors may require proof of coverage as part of their contractual terms, irrespective of state requirements. |

| False Statements Penalty | Making a false statement to obtain or deny benefits is a crime, punishable by penalties of up to $10,000. |

| No Waiver Program | Georgia does not offer a formal waiver program for workers' compensation insurance coverage. |

Guidelines on Utilizing Ga Wc 10

Completing the GA WC 10 form involves several straightforward steps. This form serves as a notice of your decision regarding workers' compensation coverage and it's important to fill it out correctly to avoid any issues. Once you have filled out the form, make sure to submit it as required, either to your insurance carrier or to the State Board of Workers' Compensation, depending on your situation.

- Begin by entering the name of the corporate officer or LLC member who is signing the form in the designated space.

- Next, specify the title or office held by the person signing.

- Select whether the signer elects to reject coverage or revoke a previous rejection by marking the appropriate option.

- If applicable, fill out the date of the current election or rejection.

- If you are a sole proprietor or partner, state your business name and address, and mark your election regarding coverage.

- If you are an employer of farm labor, enter your business name and choose to provide coverage for farm laborers.

- Complete the certification section, including the name printed clearly, business address, business phone number and extension, and provide your signature.

- Finally, make sure to confirm that a copy of the form is filed with your current workers' compensation carrier or, if no carrier exists, with the State Board of Workers’ Compensation in Atlanta, Georgia.

What You Should Know About This Form

What is the purpose of the GA WC-10 form?

The GA WC-10 form serves as a notice of election or rejection of workers' compensation coverage. It is necessary when a corporate officer or LLC member opts to reject coverage, or when a sole proprietor or partner decides to be included as an employee. Additionally, it may be used by farm labor employers who want to provide coverage for farm laborers.

Who needs to file the GA WC-10 form?

Corporations, LLCs, sole proprietors, partners, and farm labor employers are required to file the GA WC-10 form if they are making a decision regarding workers' compensation coverage. Specifically, corporate officers or LLC members must file if they want to reject coverage, and sole proprietors or partners must file if they wish to obtain coverage. Farm labor employers must also file if they choose to provide coverage for their laborers.

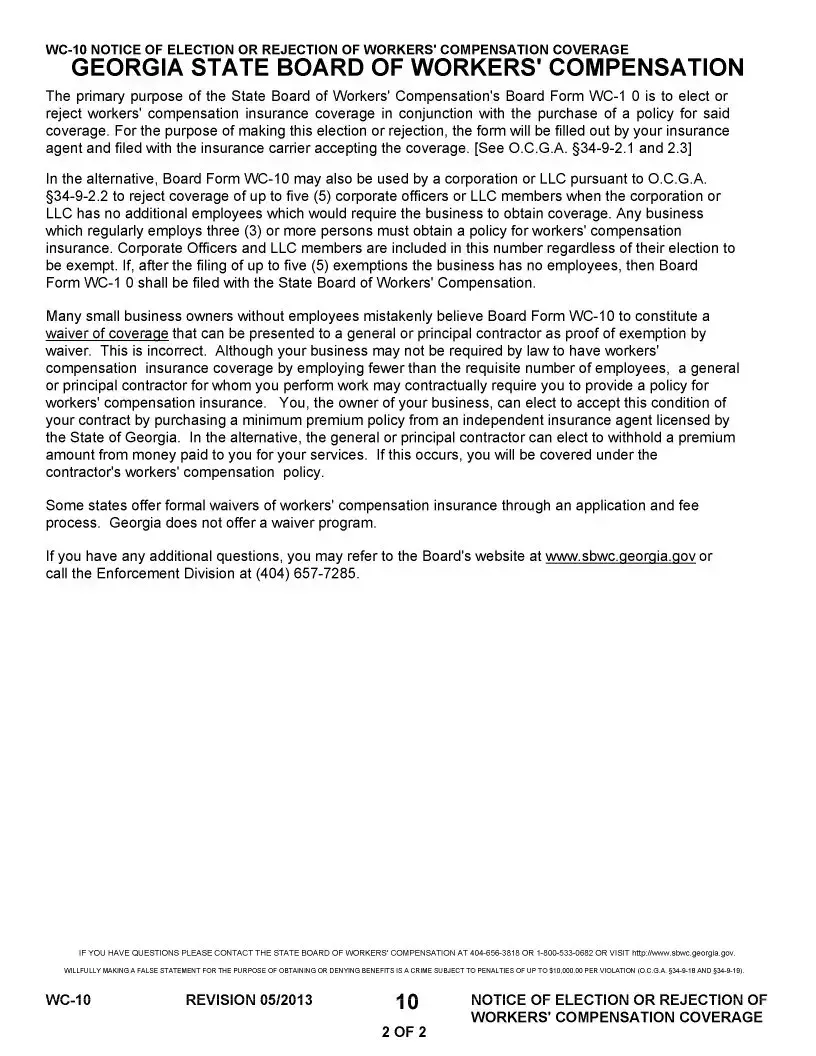

Is filing the GA WC-10 form a waiver of coverage?

No, the GA WC-10 form is not a waiver of coverage. Many small business owners mistakenly believe that this form can serve as proof of exemption from workers' compensation insurance. However, it does not replace the need for workers' compensation coverage if required by law or by contractual agreements with other parties involved in business operations.

What happens if my business has three or more employees?

If your business regularly employs three or more people, you must obtain a workers' compensation insurance policy. The GA WC-10 form may be used to exempt up to five corporate officers or LLC members, but these individuals will still count toward the total number of employees. Therefore, the business must maintain the necessary coverage regardless of any exemptions filed.

How many corporate officers or LLC members can elect to reject coverage?

A maximum of five corporate officers or LLC members may elect to reject workers' compensation coverage using the GA WC-10 form. This is important for ensuring that the requirements of the Georgia Workers' Compensation Law are met while still allowing for some flexibility in terms of coverage for specific individuals.

Where do I need to send the completed GA WC-10 form?

Once completed, a copy of the GA WC-10 form must be filed with your current workers' compensation insurance carrier. If you do not have a carrier and your business has no employees, but you have three to five corporate officers or limited liability members, you must file the form with the State Board of Workers' Compensation at their Atlanta office.

What if I have further questions about the GA WC-10 form?

If you have additional questions, you can contact the State Board of Workers' Compensation by phone at 404-656-3818 or toll-free at 1-800-533-0682. Alternatively, you can visit their website for more information and resources regarding workers' compensation coverage in Georgia.

What are the penalties for providing false information on the GA WC-10 form?

Providing false information on the GA WC-10 form is a crime in Georgia and can result in significant penalties. Individuals may face fines of up to $10,000.00 per violation if they willfully make false statements aimed at obtaining or denying benefits. It's crucial to ensure all information provided on the form is accurate and truthful.

Common mistakes

Filling out the GA WC 10 form correctly is crucial for business owners looking to manage their workers' compensation coverage. However, many individuals make mistakes that can lead to complications. One common error is not including the correct name of the business. This information must match the official business records to avoid delays in processing. When names do not match, it creates confusion and requires additional paperwork.

Another frequent mistake involves skipping the certification section. Business owners must certify that the information provided is accurate. This oversight might seem minor, but it can create significant delays and even result in the rejection of the form. That certification acts as a declaration of the truthfulness of the details given, making it essential for completion.

Many people also fail to indicate the office held accurately. Whether you're a corporate officer, LLC member, sole proprietor, or partner, choosing the right designation is important. Misclassifications can result in legal issues, including the potential loss of coverage.

Furthermore, the date fields are often overlooked. It's important to fill in the date of election or revocation accurately. Leaving a date blank may lead to confusion regarding the effectiveness of the coverage election. To avoid complications, take the time to complete this essential part of the form properly.

Additionally, many individuals neglect to provide their business address correctly. An incomplete or incorrect address can delay correspondence regarding coverage. This could lead to missed notifications or important updates from the State Board of Workers' Compensation.

Some business owners mistakenly believe that submitting the form to the State Board suffices if they have no employees. In reality, this form must be filed with your current insurance carrier or, if required, with the State Board of Workers' Compensation, depending on your situation. Detailed attention to these requirements ensures compliance and effective coverage.

Another common error involves failing to understand the implications of rejecting coverage. By electing to reject coverage, business owners must be aware of the legal responsibilities and risks involved. Misunderstanding these obligations can lead to significant financial liability should an employee file a claim.

Oftentimes, people submit the form without verifying its accuracy against the latest requirements set by the State Board. Regulations can change, and using outdated forms or information can lead to the rejection of the submission. Always ensure that you are using the most recent version of the form prior to completing it.

Lastly, individuals frequently misunderstand that the form does not serve as a waiver of coverage. Although some may think that submitting the GA WC 10 form allows them to bypass coverage requirements altogether, this is incorrect. Awareness of this fact is vital to avoid potential legal ramifications.

Documents used along the form

The WC-10 form, or Notice of Election or Rejection of Workers’ Compensation Coverage, is important for employers in Georgia regarding their workers' compensation insurance coverage. Alongside this form, several other documents may be utilized to facilitate the proper management of workers’ compensation status. Below are common forms associated with the WC-10.

- WC-1 Form: This form, known as the Employer's Report of Injury, must be filed whenever there is a workplace injury or illness. It provides essential information about the incident and is used to initiate the claims process with the workers' compensation insurance provider.

- WC-2 Form: Known as the Wage Statement, this document is submitted to report an injured employee's earnings and is used to calculate wage loss benefits. Employers must fill out this form whenever there is a change in the employee's income due to the injury.

- WC-3 Form: This form serves as a Notice of Claim, which must be filed by the employer in cases where they deny liability for an employee's workers' compensation claim. It outlines the rationale for the denial and is essential in the appeal process.

- WC-6 Form: This is a Report of Change in Benefits form. Employers use it to report any changes in the benefits provided to an injured employee, such as a shift from temporary total disability to permanent partial disability, ensuring that all parties have accurate and up-to-date information.

Using these forms in conjunction with the WC-10 helps maintain compliance with Georgia's workers' compensation laws and facilitates the appropriate handling of claims and benefits. Familiarity with these documents can assist employers in navigating the complexities of workers’ compensation insurance effectively.

Similar forms

The WC-10 form plays a critical role in the context of workers' compensation coverage in Georgia. There are several other documents that share similarities with the WC-10 form in their purpose or process. Here’s a brief overview of those forms:

- WC-1 Form (Employer's First Report of Injury): This form is used to report an injury or incident in the workplace. It must be submitted to the State Board of Workers' Compensation and is essential in initiating a claim. Just like the WC-10, it requires accurate details to ensure compliance with Georgia's workers' compensation laws.

- WC-2 Form (Employee's Claim for Benefits): Similar to the WC-10 in that it addresses coverage, this form allows employees to formally claim benefits after an injury. Both documents require clear declarations of rights and choices regarding workers' compensation.

- WC-3 Form (Notice of Payment of Compensation): This form is used to inform the Board of compensation payments made to an employee. Like the WC-10, it reflects the financial responsibilities regarding workers’ compensation and ensures transparency in transactions.

- WC-4 Form (Notice to Employee of Coverage): This document informs employees that they are covered under a workers' compensation policy. Its purpose aligns with the WC-10 in that both must provide clarity on coverage status and selected options.

- WC-5 Form (Request for Hearing): While the WC-10 is about electing or rejecting coverage, the WC-5 is used to initiate a dispute regarding workers' compensation claims. It underscores the importance of maintaining proper documentation to protect rights within the system.

- WC-6 Form (Election of Coverage for Sole Proprietors): This form allows sole proprietors to officially elect coverage, echoing the provisions outlined in the WC-10. It underscores the need for clear choices about participation in workers' compensation.

- WC-7 Form (Coverage Exemption Request): This document requests an exemption from workers' compensation coverage. It shares procedural similarities with the WC-10, focusing on the election or rejection of insurance obligations.

- WC-8 Form (Notification of Coverage)**: This form again serves to notify the Board and employees about the coverage status of a business. It echoes the informational role seen in the WC-10, emphasizing the importance of communication regarding coverage.

- WC-9 Form (Employee's Choice of Healthcare Provider): While focusing on healthcare decisions post-injury, the WC-9 is linked to the WC-10 through its role in guiding coverage procedures and ensuring the right choices are made in treatment.

These forms highlight the interconnectedness of documentation within the workers' compensation process in Georgia. Each form has its own purpose, but they collectively aim to protect both employees and employers while ensuring compliance with state laws.

Dos and Don'ts

When filling out the Ga Wc 10 form, certain actions will help ensure a smooth process. There are also things to avoid to prevent mistakes that could cause issues. Here’s a list of what you should and shouldn't do.

- Do make sure you clearly print your name and title in the appropriate sections.

- Do check the date carefully before submitting the form.

- Do understand which section applies to your situation: corporate officer, sole proprietor, partner, or farm labor.

- Do keep a copy of the completed form for your records.

- Do file the completed form with your current workers' compensation carrier.

- Don't confuse the Ga Wc 10 form with a waiver of coverage; it does not serve as a waiver.

- Don't forget to include all necessary details, such as business address and contact information.

- Don't submit the form to the State Board if you already have insurance coverage.

- Don't make false statements; doing so could lead to serious penalties.

- Don't underestimate the importance of understanding your obligations under the law.

Misconceptions

Misunderstandings about the WC-10 form can lead to confusion for business owners. Here are four common misconceptions:

- The WC-10 form is a waiver of coverage. This form does not serve as a waiver. It is merely used to elect or reject workers' compensation insurance coverage.

- Using the WC-10 form exempts business owners from liability. Even if a business has no employees, owners may still need coverage, especially if a contractor requires it for work performed.

- All businesses need to submit the WC-10 if they have corporate officers or LLC members. Only businesses with no employees and up to five corporate officers or LLC members need to file this form for exemption.

- Georgia offers a formal waiver program for workers' compensation insurance. This is not true. Georgia does not have a waiver program like some other states. Businesses must comply with coverage requirements as stated.

Key takeaways

Understanding the process and implications of filling out the GC WC-10 form is crucial for business owners in Georgia. Here are some key takeaways to keep in mind:

- Purpose of the Form: The WC-10 form is used to elect or reject workers' compensation coverage. This must be done in conjunction with purchasing a policy or to exempt certain corporate officers and LLC members from coverage requirements.

- Who Should File: Corporations, LLCs, sole proprietors, and farm labor employers can use this form based on their specific needs. Up to five corporate officers or LLC members can elect to reject coverage.

- Not a Waiver: It is important to note that submitting the WC-10 form does not act as a waiver of coverage. It cannot be used as proof of exemption by general contractors.

- Filing Requirements: The completed form must be filed with a current workers' compensation carrier. If there is no carrier and the business has no employees, it must be submitted to the State Board of Workers' Compensation.

- Legal Obligations: Any false statements made on this form can result in severe penalties. Accurate and truthful information must be provided to avoid legal consequences.

Being aware of these aspects can help business owners navigate their responsibilities regarding workers' compensation coverage in Georgia effectively.

Browse Other Templates

Syndicate Bank Savings Account Interest Rate - The form includes an authorization for transferring excess funds into fixed deposits automatically.

How Does Champva Work With Medicare - Make sure to include the mailing address where the prescriptions should be sent.