Fill Out Your Geico Claim Report Form

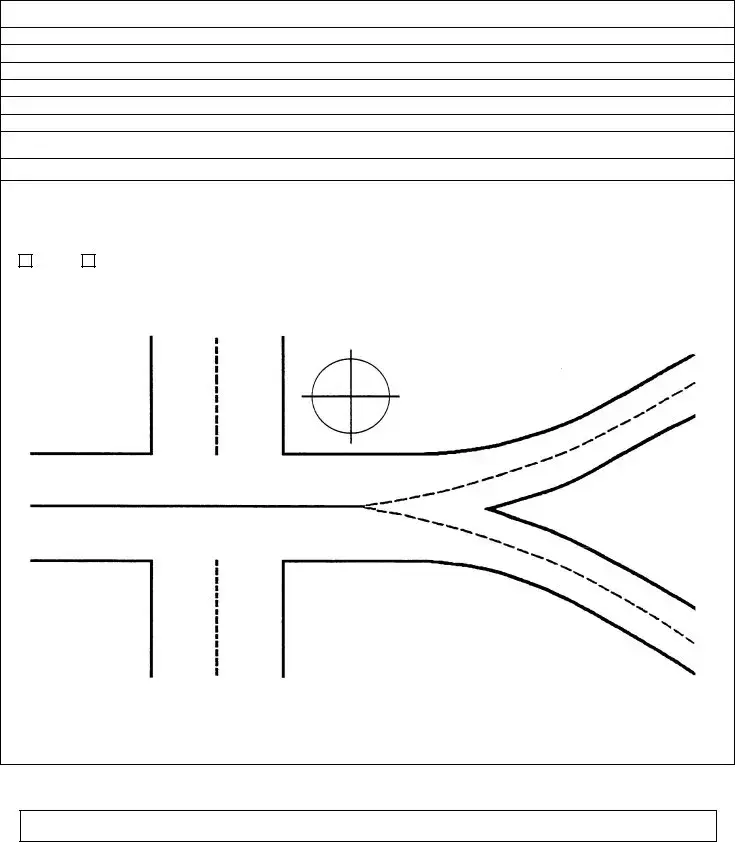

When involved in an automobile accident, it is vital to document all relevant details thoroughly to ensure a smooth claims process. The GEICO Claim Report form serves this essential purpose, guiding you through the intricacies of reporting the incident. It prompts for critical information such as your name, age, and occupation, as well as the name and policy details of the insured driver. You will also need to provide specifics about the accident itself, including the date, time, location, and conditions at the time, which can help clarify the circumstances surrounding the incident. Notably, the form asks about injuries sustained by you, passengers, or any other parties involved, along with their contact information. Additionally, there is a section for detailing damages to your vehicle and any other property impacted during the accident. Witness information is also gathered to lend credibility to your report. As you fill out the form, a diagram of the accident scene may be required, illustrating the positioning of all vehicles involved, stop signs, and any other pertinent traffic signals. Completing this report accurately not only aids GEICO in your claim assessment but also ensures that your perspective and experiences are clearly articulated. Understanding the importance of these elements can help facilitate the often overwhelming process of managing an accident claim.

Geico Claim Report Example

Instructions

The Accident Report is for you to document what happened. Please include the name of GEICO insured, your claim number, and complete details related to the accident, then sign and date the form.

(Form Below)

GOVERNMENT EMPLOYEES INSURANCE COMPANIES |

|

|

|

|

GEICO INSURED |

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

REPORT OF ACCIDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

GEICO CLAIM # |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YOUR NAME |

|

|

|

|

|

|

|

|

|

AGE |

|

|

|

|

|

|

OCCUPATION |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

ADDRESS |

|

(NUMBER) |

|

(STREET) |

(CITY) |

(STATE) (ZIP) |

|

PHONE NO. |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOME |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

NAME AND ADDRESS OF EMPLOYER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ARE YOU MARRIED? IF YES, G I V E FULL NAME OF SPOUSE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

MAKE OF OUR INSURED”S |

|

YEAR |

|

|

MODEL |

|

|

|

LIC NO |

|

|

STATE |

|

|||||||||||||||

AUTO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF OUR INSURED DRIVER |

|

|

|

|

|

|

|

|

|

|

|

DRIVER”S LICENSE # |

|

|

|

|

AGE |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

WHAT COMPANY(S) INSURES |

|

NAME OF COMPANY (S) |

|

|

POLICY NO. |

|

DOES THE POLICY CONTAIN |

|||||||||||||||||||||

YOUR AUTOMOBILE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDICAL COVERAGE FOR |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDICAL EXPENSES? |

|

||||

|

|

|

|

|

|

PHONE # |

|

|

|

|

|

CLAIM # |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

||

DATE OF |

|

|

|

|

TIME |

PLACE OF ACCIDENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ACCIDENT |

|

|

|

|

M. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MAKE OF YOUR AUTO |

|

|

|

YEAR |

|

MODEL |

|

|

|

LIC. NO. |

|

|

|

|

|

|

|

|

|

STATE |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OF REGISTERED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME AND ADDRESS OF DRIVER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DRIVER'S LICENSE # |

|

AGE |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

WAS DRIVER ON |

|

|

|

|

|

IF YES, FOR WHAT PURPOSE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ERRAND FOR OWNER? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

NAME, ADDRESS, AND TELEPHONE NUMBER OF OCCUPANTS OF YOUR AUTOMOBILE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

NAME |

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

TELEPHONE NO. |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WERE YOU HURT? YES |

|

NO |

WAS ANYONE HURT? YES |

NO IF SO, G I V E NAME, ADDRESS AND TEL. NO. OF OTHER PERSONS INJURED: |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEAT BELTS |

|||

|

NAME |

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

TEL. NO. |

|

|

|

IN USE? |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NATURE OF YOUR INJURIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

NAME AND ADDRESS OF DOCTOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

NAMES AND ADDRESSES OF ALL WITNESSES (OTHER THAN OCCUPANTS OF YOUR CAR): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

NAME |

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

IF AFTER DARK, WERE ALL VEHICLES LIGHTED? |

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

CONDITION OF ROAD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEATHER CONDITONS |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(PLEASE COMPLETE OTHER SIDE)

STATE FULL DETAILS OF HOW THE ACCIDENT HAPPENED:

WHERE CAN CAR BE SEEN DURING THE DAY?

LIST THE AREAS OF YOUR CAR WHICH WERE DAMAGED IN THE ACCIDENT:

DESCRIBE DAMAGED PROPERTY OTHER THAN YOUR AUTO

ARE YOU MAKING A CLAIM? |

AGAINST WHOM? |

|

|

|

|

|

FOR WHAT AMOUNT? |

|||||

|

|

YES |

|

NO |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||

DID YOU REPORT THE ACCIDENT TO |

WHERE? (DEPT. ADDRESS) |

|

|

|

|

|

|

|||||

POLICE? |

|

|

|

|

|

|

|

|

|

|

||

|

|

YES |

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

WAS ANYONE CHARGED? |

WHO |

|

|

|

|

CHARGES |

||||||

|

|

YES |

|

NO |

|

|

|

|

|

|

|

|

DRAW A SKETCH OF THE ACCIDENT USING THIS DIAGRAM: |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Show by arrow in this |

|

|

||

|

|

|

|

|

|

|

|

circle which way is |

|

|||

|

|

|

|

|

|

|

|

North. |

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Please label autos, stop |

|

|

|

|

|

|

|

|

|

|

|

|

signs, traffic signals, |

|

||||

|

|

|

|

|

|

|

objects, street names, etc. |

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

DATE |

|

|

|

|

|

|

|

|

|

|

||

Any person who knowingly and with intent to defraud or solicit another to defraud an insurer: (1) by submitting an application, or (2) by filing a claim containing a false statement as to any material fact, may be violating state law

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Geico Claim Report form serves to document accident details. |

| Insured Information | Must include the name of the GEICO insured and the claim number. |

| Accident Details | Report details such as time, place, and nature of the accident. |

| Witness Information | All witnesses' names and addresses should be listed, excluding occupants of your car. |

| Injury Reporting | Indicate if anyone was hurt, providing injury details and doctor information. |

| State-Specific Requirement | In states like California, false claims can lead to misdemeanor charges under California Penal Code §550. |

| Sketch Requirement | A sketch of the accident is required to illustrate the scene, including directions and key objects. |

| Submission Process | Once completed, sign and date the form before submission to GEICO. |

Guidelines on Utilizing Geico Claim Report

Filling out the GEICO Claim Report form is an essential step in documenting your accident. This process requires you to provide specific information about the incident, yourself, and any other parties involved. Ensuring that all fields are accurately completed will facilitate the claims process.

- Begin by writing the name of the GEICO insured.

- Enter your claim number.

- Fill in your name, along with your age and occupation.

- Provide your address (number, street, city, state, ZIP).

- List your home phone number.

- Include the name and address of your employer and their phone number.

- Indicate whether you are married, and if yes, provide the full name of your spouse.

- Complete details about the insured vehicle including make, model, year, license number, and state.

- Fill in the name and address of the insured driver and their driver's license number and age.

- List the insurance company, including the policy number and whether the policy has automobile medical coverage.

- State the date, time, and place of the accident.

- Provide details about your vehicle including make, model, year, license number, and state.

- Document the name and address of the registered owner

- Indicate if the driver was on an errand for the owner.

- List the occupants of your vehicle with their names, addresses, and phone numbers.

- Specify whether you or anyone else was hurt.

- If others were injured, provide their names, addresses, and phone numbers.

- Indicate whether seat belts were in use.

- Describe the nature of your injuries.

- List the names and addresses of all witnesses who are not occupants of your car.

- Indicate if all vehicles were lighted if the accident occurred after dark.

- Provide the condition of the road and weather conditions.

- Detail the sequence of events that led to the accident.

- State where the car can be seen during the day.

- List the areas of your car that were damaged.

- Describe any damaged property other than your vehicle.

- Indicate if you are making a claim, against whom, and for what amount.

- Note if you reported the accident to the police and where.

- State whether anyone was charged and provide details on the charges.

- Draw a sketch of the accident using the provided diagram section.

- Sign and date the form at the end.

What You Should Know About This Form

What is the purpose of the GEICO Claim Report form?

The GEICO Claim Report form is designed for individuals involved in an accident to document what occurred. This includes listing the GEICO insured's name, your claim number, and detailed information about the accident such as time, place, and any injuries. Completing this form accurately is crucial for processing your claim efficiently.

How do I fill out the GEICO Claim Report form?

To fill out the form, start by providing your personal information, including your name, age, and contact details. Next, fill in details concerning the GEICO insured, such as their vehicle information and driver’s license number. Outline the specifics of the accident, including the conditions at the time, any injuries incurred, and whether the police were involved. Make sure to print clearly and sign your name at the end of the form.

Do I need to report the accident to the police?

What happens after I submit the claim report?

Once you submit the GEICO Claim Report form, the claims team at GEICO will review the information you provided. They may reach out for further details or clarification if necessary. Depending on the complexity of the claim, it can take time to process, but you will be kept updated on its status throughout the process.

Can I submit additional information after I have sent in the claim report?

Yes, you can submit additional information even after you have submitted your initial claim report. If you remember more details or obtain new evidence such as witness statements or photographs, you should reach out to GEICO to provide this information. Keeping them informed can help ensure your claim is handled accurately and promptly.

Common mistakes

Filling out the Geico Claim Report form can seem straightforward, but several common mistakes can complicate the process. One significant error involves failing to include essential personal information. Many people neglect to provide their complete name, claim number, and contact details. Omitting such vital information can delay the processing of the claim and create confusion.

Another common mistake is not fully documenting the details of the accident. Instead of providing a clear and factual account, some individuals offer vague descriptions. It is crucial to include specific information such as the time and place of the accident. Additionally, describing the conditions at the time of the incident—including weather and road conditions—can be beneficial.

Many people also overlook the importance of identifying all parties involved. They may mention only the other driver but forget to list witnesses or occupants in their vehicle. Documenting everyone involved helps to establish a clearer picture of what occurred, which may assist in resolving the claim.

Completing the section regarding injuries can pose another challenge. Individuals often forget to indicate whether they or anyone else were hurt. If injuries exist, it is important to list all affected individuals and include their contact information. Failing to do so may complicate any claims for medical expenses later on.

Another mistake relates to the completion of the diagram indicating the accident's scene. Some people will skip this section altogether, thinking it unnecessary. However, a well-labeled sketch can provide clarity regarding the events that transpired and can be invaluable in supporting a claim.

Providing inadequate or incomplete insurance information is yet another frequent pitfall. Some claimants neglect to specify the make, model, and insurance details of their vehicle. This omission can create delays as the insurance company tries to verify coverage, ultimately slowing down the claim process.

Lastly, individuals sometimes fail to sign and date the form. This step, while simple, is critical. An unsigned document is often deemed invalid, which can lead to the dismissal of the claim. Taking these extra moments to review and ensure accuracy can make a significant difference in the claims process.

Documents used along the form

The Geico Claim Report form is an essential document for detailing information related to automotive accidents. It serves as a record of the accident, providing necessary details about the parties involved, the circumstances of the accident, and any injuries sustained. Additionally, several other forms and documents are often utilized in conjunction with this report to facilitate the claims process. Below are four common documents that may be relevant.

- Police Report: This document is generated by law enforcement following an accident. It includes details such as the names of those involved, the circumstances surrounding the incident, and any citations issued. The report often serves as an official account of the accident, which can be critical for insurance claims.

- Witness Statements: These are accounts provided by individuals who observed the accident. Witness statements can substantiate claims and clarify the events leading up to the accident. Their perspectives are valuable in assessing liability and determining the circumstances surrounding the incident.

- Medical Records: If injuries are sustained during the accident, medical records document treatment and diagnoses. This documentation is essential for establishing the extent of injuries, which can directly impact compensation amounts sought through insurance claims.

- Claim Adjustment Notes: These notes are created by the insurance adjuster assigned to the claim. They outline the findings from their investigation, including assessments of damages and potential liabilities. This information can influence the outcome of the claim and affect any settlement discussions.

These documents, in conjunction with the Geico Claim Report form, contribute to a comprehensive understanding of the accident, facilitating the claims process for all parties involved.

Similar forms

- Accident Report Form: Much like the GEICO Claim Report, an Accident Report Form captures crucial details about the incident. It requires information such as the names of involved parties, the nature of damages, and the circumstances surrounding the accident.

- Auto Insurance Claim Form: Similar to the GEICO Claim Report, an Auto Insurance Claim Form provides a structured way to document injuries and damages incurred from an auto accident. It often requires policy numbers and relevant personal details.

- Personal Injury Claim Form: This document is akin to the GEICO Claim Report in that it collects comprehensive details about injuries sustained in an accident, medical treatment received, and other relevant personal data.

- Witness Statement Form: It serves a similar purpose by formally documenting what witnesses observed during the accident. The form usually gathers names, contact details, and their account of events.

- Vehicle Damage Report: Like the GEICO report, this document specifically details the damage to each vehicle involved in an incident. It includes sections for photos and descriptions of injuries.

- First Report of Injury: Comparable to the GEICO Claim Report, this document is commonly used to report injuries sustained in workplace accidents. It gathers information about the employee, the nature of the injury, and relevant circumstances.

- Medical Expense Report: This document seeks to detail medical expenses and healthcare providers, reflecting a similar goal of summarizing the impact of an incident, much like the GEICO Claim Report aims to do.

- Claims Adjustment Form: This form is like the GEICO Claim Report in that it facilitates the claims adjustment process, summarizing the details of the accident for review and consideration by insurance adjusters.

Dos and Don'ts

When filling out the Geico Claim Report form, it is crucial to follow certain guidelines to ensure accuracy and effectiveness in processing your claim. Here’s a concise list of do's and don’ts:

- Do provide clear and detailed information about the accident.

- Do include all necessary personal details, such as your name, claim number, and contact information.

- Do answer all questions honestly, especially regarding injuries and damages.

- Do sign and date the form to validate your submission.

- Don't leave any sections blank; complete every required field.

- Don't embellish or provide misleading information about the accident.

- Don't forget to include witness information, if available.

- Don't neglect to report the accident to law enforcement if applicable.

Misconceptions

When it comes to filing a claim with GEICO, many individuals harbor a number of misconceptions about the Claim Report form. Clearing up these misunderstandings can streamline the process and help you navigate your claim more effectively.

- Misconception 1: The form is optional and can be filled out at leisure.

- Misconception 2: Only the GEICO insured must fill out the form.

- Misconception 3: Minor injuries don’t need to be reported.

- Misconception 4: The diagram is not necessary.

- Misconception 5: The form is to be submitted solely to GEICO.

- Misconception 6: Once submitted, there is no need to follow up.

Many people believe that they can take their time with the Claim Report form. However, it is crucial to fill it out as soon as possible after the accident. Timeliness helps ensure that you provide accurate details while the event is still fresh in your mind.

Some think that only the insured party needs to complete the report. In reality, if you were involved in the accident, your input is equally important. Including both parties' perspectives can give a clearer picture of the event.

A common belief is that only serious injuries should be documented. Even minor injuries should be included. It is best to mention every detail to safeguard against future health problems or claims.

Another misunderstanding is that drawing a sketch is optional. The diagram is vital; it provides visual context for the accident's circumstances, helping the claims adjuster make informed decisions.

Many individuals fail to realize that the Claim Report also needs to be filed with law enforcement if applicable. This step is essential for legal documentation and can back up your account of the accident.

Some believe that submitting the form marks the end of their responsibility. This isn’t accurate. Regular follow-ups with GEICO are advisable to check on the status of the claim and ensure that all details are processed correctly.

By understanding these misconceptions, you can approach the GEICO Claim Report form with greater confidence and clarity. This proactive mindset can greatly improve your experience during what may already be a challenging time.

Key takeaways

Here are key takeaways for filling out and using the Geico Claim Report form:

- Include essential information: Start with the name of the Geico insured, your claim number, and detailed accident specifics.

- Signature and date: Make sure to sign and date the form to validate it.

- Accurate personal details: Provide your name, age, occupation, and contact information.

- Insurance details: Document the make, model, and license information of involved vehicles, including the other driver’s insurance details.

- Accident specifics: Clearly state the date, time, and location of the accident, and describe how it occurred.

- Injury reporting: Indicate whether you or anyone else was injured. Note the names, addresses, and contact details of other injured parties.

- Witnesses: List names and addresses of any witnesses to the accident, excluding your vehicle’s occupants.

- Document damage: Specify the areas of your vehicle that were damaged and detail any other property affected.

- Claims status: Indicate if you are making a claim, against whom, and the amount sought.

Ensure you report the accident to the police if applicable and note whether someone was charged. When completing the form, clarity and thoroughness will aid in processing your claim effectively.

Browse Other Templates

Osha Basic Plus Training Online - Detailed instructions for registration will be provided online.

Massachusetts Probate Law - It's important to file promptly to adhere to all legal timelines involved in probate.

Screen Printing Quotes - For orders needed within two days, expect a 100% rush charge increase.