Fill Out Your General Partnership Agreement Form

When starting a business with one or more partners, a General Partnership Agreement form serves as a foundational document that outlines key aspects of the partnership. This agreement typically details the type of business the partners will engage in and the name under which they will operate. It specifies the term of the partnership, providing clear start and end dates, and can include provisions for renewal or termination. Importantly, the agreement establishes the principal place of business, ensuring both partners know where their operations will take place. Financial contributions also take center stage, as the initial capital each partner will contribute must be clearly defined. The agreement outlines how profits and losses will be shared, emphasizing a transparent and fair distribution process. In addition to financial matters, responsibilities regarding management and authority are laid out, ensuring all partners understand their roles. Record-keeping expectations, including how and when to account for income and expenditures, are also included to maintain financial integrity. Lastly, the agreement addresses potential scenarios such as the withdrawal of a partner, valuation of partnership interest upon dissolution, and implications of a partner's death, promoting smooth transitions and protecting all parties involved. Such clarity and detail provide a solid foundation for any business venture, fostering trust and collaboration among partners.

General Partnership Agreement Example

Sample General Partnership Agreement

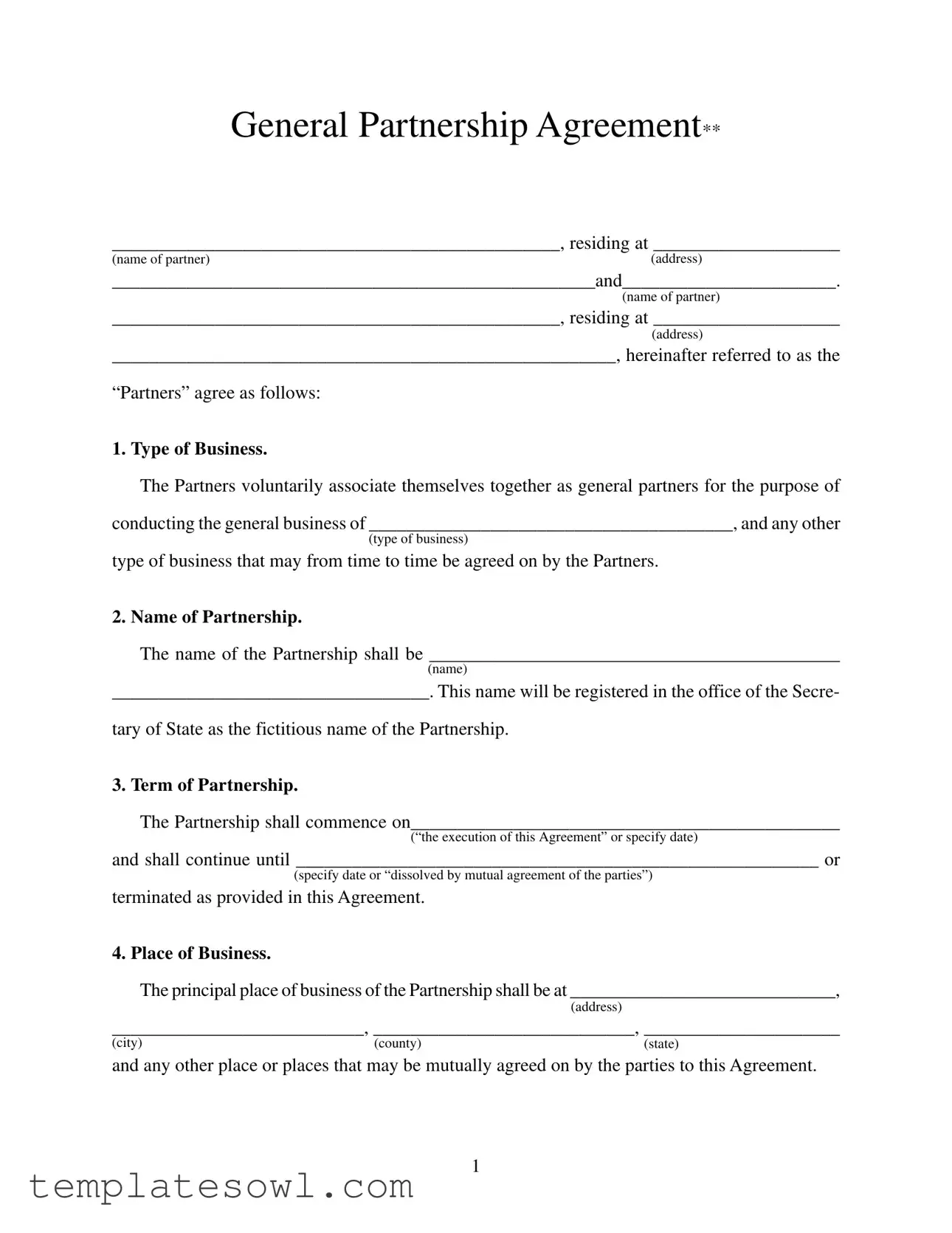

General Partnership Agreement**

________________________________________________, residing at ____________________

(name of partner)(address)

____________________________________________________and_______________________.

(name of partner)

________________________________________________, residing at ____________________

(address)

______________________________________________________, hereinafter referred to as the

“Partners” agree as follows:

1. Type of Business.

The Partners voluntarily associate themselves together as general partners for the purpose of conducting the general business of _______________________________________, and any other

(type of business)

type of business that may from time to time be agreed on by the Partners.

2. Name of Partnership.

The name of the Partnership shall be ____________________________________________

(name)

__________________________________. This name will be registered in the office of the Secre-

tary of State as the fictitious name of the Partnership.

3. Term of Partnership.

The Partnership shall commence on______________________________________________

and shall continue until ________________________________________________________ or

terminated as provided in this Agreement.

4. Place of Business.

The principal place of business of the Partnership shall be at _____________________________,

(address)

___________________________, ____________________________, _____________________

(city) |

(county) |

(state) |

and any other place or places that may be mutually agreed on by the parties to this Agreement.

1

Sample General Partnership Agreement

5. Initial Capital.

The initial capital of this Partnership shall be the sum of $____________________________,

(amount)

to which each Partner shall contribute by depositing in a checking account in the name of the

Partnership at the _________________________________ in ___________________________

(bank)(city)

___________________ on or before_____________________________, the following amounts:

(state)(date)

____________________________ shall contribute $ _______________

(name)

____________________________ shall contribute $ _______________

(name)

6. Withdrawal of Capital.

No Partner shall withdraw any portion of the capital of the Partnership without the express written consent of the other Partners.

7. Profits and Losses.

Any net profits or losses that may accrue to the Partnership shall be distributed to or borne by the Partners.

____________________________________________________________________________

(in equal proportions or in the following proportions: __________ specify proportions. e.g. [name], 60%; [name], 40%)

____________________________________________________________________________

____________________________________________________

8. Partnership Books.

At all times during the continuation of the Partnership, the Partners shall keep accurate books of account in which all matters relating to the Partnership, including all of its income, expenditures,

assets, and liabilities, shall be entered. These books shall be kept on ________________________

(Accrual or Cash)

basis and shall be open to examination by either Partner at any time.

9. Fiscal Year.

The fiscal year of the Partnership shall end on the ___________ day of ___________________

(month)

each year.

2

Sample General Partnership Agreement

10.Accountings.

A complete accounting of the Partnership affairs as of the close of business on the last day of

March, June, September, and December of each year shall be rendered to each Partner within

____________ days after the close of each of those months. On each accounting, the net profits of

(Number)

the Partnership shall be distributed to the Partners as provided in this Agreement to the extent that

cash is available for this distribution. Except as to manifest errors discovered within ____________

(Number)

days after its rendition, each accounting shall be final and conclusive to each Partner.

11. Time Devoted to Partnership.

Each Partner shall devote his or her undivided time and attention and use the utmost of his or her skills and ability in furtherance of the Partnership business.

12.Management and Authority.

Each Partner shall have an equal voice in the management of the Partnership and shall have

authority to bind the Partnership in making contracts and incurring obligations in the name and on the credit of the firm. However, no Partner shall incur any obligations in the name or on the credit of the firm exceeding $_____________________ without the express written consent of the other

Partner. Any obligation incurred in violation of this provision shall be charged to and collected from the individual Partner incurring the obligation.

13.Salaries.

As compensation for his or her services in and to the Partnership business, each Partner shall be

entitled to a salary of $______________ each month, which shall be deducted by the Partnership

as an ordinary and necessary business expense before determination of net profits. The salary of any Partner may, however, be increased or reduced at any time by mutual agreement of all the Partners.

3

Sample General Partnership Agreement

14.Net Profits Defined.

The term “net profits” as used in this Agreement shall mean the net profits of the Partnership as

determined by generally accepted accounting principles for each accounting period provided for in this Agreement.

15.Withdrawal of Partner.

Any Partner may withdraw from the Partnership at the end of any accounting period by giving

the other Partner ____________________ days, written notice of his or her intention to do so.

(Number)

16.Option to Purchase Terminated Interest.

On dissolution of the Partnership by the withdrawal or other act of a Partner, the remaining

Partner, on written notice to the other Partner within __________________ days of the dissolution,

(Number)

may continue the Partnership business by purchasing the interest of the other Partner in the assets and good will of the Partnership. The remaining Partner shall have the option to purchase the interest of the withdrawing Partner by paying to this Partner or the Partner’s personal representa- tive the value of the interest determined as provided in Paragraph 17 of this Agreement.

17.Purchase Price of Partnership Interest.

On exercise of the option described in Paragraph 16 above, the remaining Partner shall pay to

the person who is legally entitled to it the net book value of the interest as shown on the last regular accounting of the Partnership preceding the dissolution together with the full unwithdrawn portion of the deceased, withdrawing, or terminated Partner’s distributive share of any net profits earned by the Partnership between the date of the accounting and the date of dissolution of the Partnership.

18.

If the Partnership is dissolved by the death of a Partner, the remaining Partner shall have the

obligation within _________________ days from the death of the deceased partner to purchase the

(Number)

interest of the deceased Partner in the Partnership and to pay to the personal representative of the deceased Partner the value of that interest as provided in Paragraph l7 of this Agreement. During

4

Sample General Partnership Agreement

this

(Number)

continue the business of the Partnership but the estate or personal representative of the deceased Partner shall not be liable for any obligations incurred in the Partnership business that are greater than any amount includable in the estate of the deceased Partner that was previously invested or involved in the Partnership and remained so on the date of death. The estate of the deceased Partner shall be obligated to sell his or her Partnership interest as provided in this Agreement and shall be entitled, at the election of the personal representative of the deceased Partner, either to

the net profits earned by the Partnership business during this

(Number)

interest for the use during this period of the deceased’s interest in the Partnership business at the rate of ______________ percent a year on the value of the partnership interest determined as pro-

vided in Paragraph 17 of this Agreement.

19.Duties of Purchasing Partner.

On any purchase and sale pursuant to the provisions of Paragraphs 16, 17, or 18 of this Agree-

ment, the remaining Partner shall assume all obligations and shall hold the withdrawing Partner, the personal representative and estate of a deceased Partner, and the property of any withdrawing or deceased Partner, free and harmless from all liability for these obligations. Furthermore, the re- maining partner, at his or her own expense, shall immediately cause to be prepared, filed, served, and published all notices that may be required by law to protect the withdrawing Partner or the personal representative or estate of a deceased Partner from liability for the future obligations of the partnership business.

20.Dissolution.

On dissolution of the Partnership other than as provided in Paragraphs 16, 17, and 18 of this

Agreement, the affairs of the Partnership shall be wound up, the assets of the Partnership liqui- dated, the debts paid, and the surplus divided equally among the Partners.

5

Sample General Partnership Agreement

21.Notices.

All notices between the parties provided for or permitted under this Agreement or by law shall

be in writing and shall be deemed duly served when personally delivered to a Partner or, instead of personal service, when deposited in the United States mail, as certified, with postage prepaid, and addressed to the partner at the address of the principal place of business of the Partnership or to another place that may from time to time be specified in a notice given pursuant to this paragraph as the address for service of notice on the Partner.

22.Consents and Agreement:

All consents and agreements provided for or permitted by this Agreement shall be in writing

and a signed copy of them shall be filed and kept with the books of the Partnership.

23.Sole Agreement.

This instrument contains the sole agreement of the parties relating to their Partnership and

correctly sets forth the rights, duties and obligations of each to the other in connection with is as of its date. Any prior agreements, promises, negotiations, or representations not expressly set forth in this Agreement are of no force or effect.

Executed this ___________________ day of _________________________ , 19__________

at ______________________________ County_________________________________(State).

_____________________________________

(Signature of Partner)

_____________________________________

(Signature of Partner)

**PLEASE NOTE: The above document is a sample document only and will require indi- vidual tailoring to the needs and purposes of each individual general partnership. Important consid- erations to incorporate in every partnership agreement include tax issues, sharing of profits based on contribution and a

6

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose of the Agreement | The General Partnership Agreement outlines the roles, responsibilities, and expectations of each partner in conducting a business together. |

| Partnership Name | The partners must select and register a fictitious name for their partnership with the Secretary of State. |

| Initial Capital Contributions | Each partner must contribute a specified amount of initial capital, which is deposited into a partnership bank account. |

| Profit Sharing | Net profits and losses are distributed among partners based on agreed proportions, which can be equally or differently weighted. |

| Management Authority | All partners share equal management authority and can bind the partnership in contracts, subject to specified limitations. |

| Governing State Laws | General Partnership Agreements are generally governed by state laws, which can vary. It's important to consult local statutes. |

Guidelines on Utilizing General Partnership Agreement

Completing a General Partnership Agreement is crucial for establishing a clear understanding between partners regarding their roles, responsibilities, and the management of the partnership. By following these steps carefully, partners can ensure they address all necessary aspects of their business relationship.

- Gather basic information: Collect the names and addresses of all partners involved in the partnership.

- Define the business type: Specify the type of business you will operate together and include any additional types that may be agreed upon later.

- Name your partnership: Choose a name for your partnership and make sure to register it appropriately with the Secretary of State.

- Establish the term: Indicate when the partnership will start and when it will end, if applicable.

- Determine place of business: Specify the principal place of business, including the complete address.

- Set initial capital contributions: Decide on the total initial capital and document how much each partner will contribute, along with the specified bank for deposits.

- Outline capital withdrawal rules: State that no partner may withdraw capital without the written consent of the other partners.

- Define profit and loss distribution: Clarify how profits and losses will be divided among partners.

- Establish record-keeping methods: Agree on maintaining accurate books of account and the basis of accounting.

- Set fiscal year-end: Choose the day and month when the partnership fiscal year will end.

- Plan for accountings: Decide how often financial reports will be generated and distributed to partners.

- Agree on time commitment: Specify the obligation of each partner to devote adequate time and attention to the partnership's affairs.

- Define management roles: State how management decisions will be made, including stipulations on binding contracts.

- Determine salaries: Document the agreed-upon salaries for partners and note that these can change by mutual consent.

- Clarify net profit definition: Define what "net profits" means within the context of your accounting practices.

- Withdrawal procedures: Describe the procedure for a partner's withdrawal from the partnership.

- Purchasing interest upon withdrawal: Set out the process for a remaining partner to buy out a withdrawing partner's interest.

- Outline procedures for death: Detail the obligations and rights of partners in the event of a partner's death.

- Duties during transitions: Specify the roles and responsibilities of the purchasing partner after a withdrawal or death.

- Dissolution guidelines: Clarify how the partnership will be dissolved and how assets will be handled.

What You Should Know About This Form

What is a General Partnership Agreement?

A General Partnership Agreement is a legal document that outlines the shared responsibilities, management, and operational guidelines for partners in a business. It establishes the framework under which the partners will operate, detailing everything from capital contributions to profit sharing and responsibilities. This agreement is essential for clarifying expectations and protecting the rights of each partner.

Why do I need a General Partnership Agreement?

A General Partnership Agreement is crucial for several reasons. First, it helps prevent misunderstandings by clearly stating each partner’s roles and contributions. Additionally, it provides a structure for addressing disputes and outlines what happens if a partner withdraws or if the partnership dissolves. Having this agreement in place can save time, money, and relationships in the long run.

What should be included in a General Partnership Agreement?

The agreement should include key details such as the name of the partnership, the type of business, the contributions of each partner, profit and loss distribution, management roles, and procedures for withdrawal or dissolution. It is also advisable to specify how decisions are made and any limitations on partner obligations. By including these elements, the agreement covers important aspects of partnership operations.

How are profits and losses shared in a General Partnership?

Typically, profits and losses are shared according to the proportions agreed upon in the partnership agreement. This could be equal, or it may reflect the amount each partner contributed. Clear guidelines regarding financial accountability and distributions help ensure that all partners are on the same page and reduce potential conflicts.

Can a partner withdraw from the partnership?

Yes, a partner can withdraw. The General Partnership Agreement should specify the process for withdrawal, including any required notice periods. Generally, written notice must be provided prior to the end of an accounting period. This ensures that all partners are aware and can prepare for the transition.

What happens if a partner dies?

In the unfortunate event of a partner's death, the General Partnership Agreement typically outlines the procedure for handling the partnership interest of the deceased partner. The surviving partner may have the right to purchase the deceased’s share, ensuring that the deceased partner's estate is compensated for their interest according to the terms specified in the agreement.

How long does a General Partnership last?

The duration of a General Partnership is defined in the partnership agreement. It can be established for a specific period or continue indefinitely until certain conditions lead to dissolution. Common reasons for dissolution include the withdrawal of a partner, completion of a business goal, or mutual agreement among partners.

Do I need a lawyer to create a General Partnership Agreement?

While it is possible to draft a General Partnership Agreement without legal assistance, consulting a lawyer is highly recommended. A lawyer experienced in business law can provide guidance, ensure compliance with local regulations, and help tailor the agreement to effectively meet the unique needs of the partnership. This professional input can prevent future legal issues and misunderstandings.

Common mistakes

When filling out the General Partnership Agreement form, many individuals overlook critical details that can lead to misunderstandings or disputes later on. Here are nine common mistakes to avoid:

One frequent error is failing to specify the name of the partnership. The name should not be left blank or filled in casually. It’s crucial for identification and registration purposes. Without a clear name, partners could face legal challenges down the line when representing the business to clients or in court.

Another common mistake pertains to the term of the partnership. Partners often leave the commencement and termination dates incomplete. If these dates aren’t specified, it leaves too much room for ambiguity regarding when responsibilities begin and how long they last, which could lead to confusion over commitments and obligations.

Some individuals neglect to detail the capital contributions made by each partner. Each partner should be clear about how much they are contributing and the deadlines for these contributions. Overlooking this can result in financial disputes, especially if the partnership grows and changes over time.

Additionally, the lack of clarity on profit-sharing is a significant misstep. It’s not enough to state that profits will be shared; specific percentages or formulas should be included. Unclear profit distribution can create conflicts among partners who may have different expectations about financial returns.

Similarly, not articulating how decisions are to be made within the partnership can lead to friction. The agreement should lay out whether decisions will be made unanimously, by majority vote, or some other method, ensuring all partners have a clear understanding of how authority is structured.

Some partners also overlook the need for regular accountings. The agreement should specify how often financial reports will be shared among the partners and outline what these reports should include. A lack of routine accounting can lead to distrust and accusations of mismanagement.

Moreover, not specifying the process for a partner's withdrawal can cause potential turmoil. The agreement should include how and when a partner can leave the partnership, as well as how their share will be valued. Without clear guidelines, emotions and financial stakes can complicate departures.

It is equally important to address the issue of partner death. Outlining the procedures following a partner's death, including the valuation of their interest and the obligations of the remaining partners, is crucial. Failing to address this can lead to unnecessary strife for survivors during an already difficult time.

Lastly, many partnerships neglect to address the process of dissolution. If the partnership needs to end, having a clear dissolution process ensures that the assets are divided fairly and all parties understand their rights. This can save partners from future legal entanglements.

By avoiding these mistakes, partners can create a more robust General Partnership Agreement, leading to smoother operations and clearer expectations for all involved.

Documents used along the form

A General Partnership Agreement serves as the foundational document for a business partnership. It establishes the terms and conditions under which the partners will operate their business together. In addition to this agreement, several other forms and documents are often utilized to support the partnership’s operations and legal compliance. Below is a list of these frequently used documents, each briefly described for clarity.

- Partnership Registration Form: This document is typically filed with the relevant state authority to officially register the partnership. It helps in establishing the legal existence of the partnership and is often required for compliance with state laws.

- Operating Agreement: Although not mandatory for partnerships, this document outlines the internal management structure and procedures for the partnership. It clarifies the roles and responsibilities of each partner in greater detail than the General Partnership Agreement.

- Partnership Tax Return (Form 1065): The partners must file this federal form with the IRS to report the partnership’s income, deductions, gains, and losses. This is essential for tax purposes and helps ensure compliance with federal tax regulations.

- Bank Account Opening Documents: When establishing a bank account in the name of the partnership, specific documents must be presented, such as the General Partnership Agreement and identification for all partners. This helps separate personal and business finances.

- Business Licenses and Permits: Depending on the nature of the business, local and state regulations may require various licenses and permits. These ensure that the partnership operates legally and adheres to local laws concerning its business activities.

- Buy-Sell Agreement: This is a crucial document that outlines how a partner's share of the business may be transferred in specific circumstances, such as death or voluntary withdrawal. It protects the interests of remaining partners and provides clarity on share valuation.

- Minutes of Partnership Meetings: Keeping a record of meetings where partners discuss business matters is important for transparency and accountability. These minutes serve as documentation of decisions made and can be referenced in the future as needed.

In summary, alongside the General Partnership Agreement, a variety of additional documents help ensure that partnerships operate smoothly and in accordance with legal requirements. Each document plays a distinct role in maintaining the partnership's integrity and guiding its operational framework. It is essential for partners to be aware of these documents to fully understand their obligations and rights within the partnership.

Similar forms

Limited Partnership Agreement: Similar to a General Partnership Agreement, a Limited Partnership Agreement outlines the relationship between general partners and limited partners. While general partners manage the business, limited partners typically contribute capital while having limited involvement in operations.

Joint Venture Agreement: This document establishes a partnership for a specific project or activity. It shares some elements with a General Partnership Agreement, like profit-sharing and capital contribution, but typically has a defined time frame and purpose.

Operating Agreement: For LLCs, an Operating Agreement serves a purpose similar to that of a General Partnership Agreement. It outlines the management structure, contributions, and share of profits, but focuses on the limited liability company format.

Shareholders' Agreement: This agreement governs the relationship between shareholders in a corporation. Like the General Partnership Agreement, it addresses voting rights, profit-sharing, and management responsibilities, although it does so within a corporate structure.

Franchise Agreement: A Franchise Agreement can share elements with a General Partnership Agreement, such as business operation guidelines and profit distribution. However, it establishes a formal relationship between a franchisor and franchisee, allowing for brand use and operational guidelines.

Buy-Sell Agreement: This document outlines what happens to a business interest in the event of certain specified circumstances, like a partner's death or withdrawal. It operates similarly to sections within a General Partnership Agreement that address capital withdrawal and partner exit strategies.

Dos and Don'ts

When filling out the General Partnership Agreement form, here are some important guidelines to follow:

- DO ensure that all names and addresses of partners are accurate and clearly stated.

- DO specify the type of business you will conduct together.

- DO clearly outline the capital contributions each partner will make.

- DO provide a defined term for the partnership, including start and end dates.

- DO keep a copy of the completed agreement for reference.

- DON'T leave any required fields blank; fill out all sections completely.

- DON'T make changes to the form without initialing and dating the changes.

- DON'T forget to review the document with all partners before signing.

- DON'T ignore local regulations regarding the registration of the partnership name.

- DON'T skip discussing profit-sharing and loss responsibilities among partners.

Misconceptions

Understanding the General Partnership Agreement form is crucial for anyone entering into a partnership. However, several misconceptions may cloud judgment. Below is a list of common misunderstandings.

- All partnerships are the same. Each partnership can have unique terms and conditions. A General Partnership Agreement outlines the specific details agreed upon by the partners.

- Verbal agreements suffice. While oral agreements may be made, documented agreements like a General Partnership Agreement provide legal protection and clarity.

- Partners share profits equally. Profit distribution can be tailored according to specific terms in the agreement. It does not have to be equal unless expressly stated.

- One partner cannot be held liable for debts. In a general partnership, all partners share liability for the debts and obligations, which can affect personal assets.

- All decisions require unanimous consent. The agreement can specify majority rules for certain decisions. Not every choice needs unanimous approval unless outlined in the document.

- Partnerships do not need formal agreements. While a partnership can start informally, a formal agreement is important for defining roles, responsibilities, and expectations.

- Changes to the agreement require a new contract. Amendments can typically be made to the existing agreement without drafting an entirely new document, provided all partners agree.

- Partners can leave at any time without notice. The agreement usually specifies how and when a partner can withdraw, ensuring a structured exit process.

- All partners have equal authority. Although partners often manage the business collectively, the agreement can grant specific management powers to individual partners.

- Death of a partner terminates the business. The General Partnership Agreement can detail procedures for continuity after a partner's death, including options for buyouts.

Clarifying these misconceptions can help partners navigate their business relationship more effectively. A well-structured General Partnership Agreement is a valuable investment in protecting the interests of all partners involved.

Key takeaways

Clearly Define the Partnership: The agreement should specify the names of each partner, their addresses, and the type of business the partnership will conduct. Clarity helps avoid confusion about roles and responsibilities.

Establish Financial Contributions: Each partner must agree on the initial capital contributions. Documenting this ensures everyone knows their financial commitment and helps manage expectations.

Outline Profit and Loss Sharing: The method for distributing profits and losses should be explicitly stated. Whether it’s equal sharing or based on specific percentages, having this clarity is essential for future financial discussions.

Include Dispute Resolution Mechanisms: It's wise to incorporate procedures for resolving potential disagreements. This could include conditions under which partners can withdraw or how to handle issues arising from a partner’s death.

Browse Other Templates

Is Mpp Warranty Worth It - Verify that all required attachments are included before submission.

Hud Application Form for Housing - This form serves to protect the rights of applicants by outlining their ability to contest any incorrect findings made during verification.

The Cornell Method of Note Taking - Utilizing this template can streamline study sessions and improve focus.