Fill Out Your Generic 401K Enrollment Form

Completing the Generic 401K Enrollment Form is a vital step for employees looking to secure their financial future through a retirement savings plan. This form captures essential personal information, including names, contact details, and employment specifics. Employees must indicate their preferences regarding electronic and paper statements from Perfect401(k), ensuring they receive important updates and information in their preferred format. Participants select their involvement level by choosing to enroll in the 401(k) Retirement Plan, update existing investment elections, or opt out entirely. The form also guides individuals through critical financial decisions, such as determining salary deferral amounts for both pre-tax and after-tax contributions, including options for catch-up contributions for those over age 50. It provides choices for investment profiles, including professionally managed portfolios or self-directed accounts, allowing flexibility based on individual risk tolerance and investment strategy. Employees who choose customized or self-directed options must allocate their investments wisely across a variety of funds. Lastly, the form culminates with a signature and date, signifying authorization for payroll deductions and investment allocations, underscoring the importance of informed decision-making for a secure retirement.

Generic 401K Enrollment Example

Enrollment & Investment Update Form

First Name |

|

MI |

|

Last Name |

|

|

Employer Name |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

Day Phone |

|

Social Security No. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

Zip Code |

|

|

|

|

|

|||

I would like to receive ELECTRONIC statements from Perfect401(k) |

|

|

|

|

|

|

|

|||||

|

|

Date of Hire |

|

Date of Birth |

||||||||

|

|

|

|

|

|

|

|

|

||||

I would like to receive PAPER statements from Perfect401(k)

Select One |

Enroll in 401(k) Retirement Plan. |

Update/ Change My Investment Elections. |

|

|

|

(1) Option: |

I DO NOT Want to Participate in |

Transfer Funds from Prior 401(k) or IRA only. |

|

||

|

the 401(k) Plan at this time. |

(Attach Completed Rollover Valet™ form) |

STEP 1: SALARY DEFERRAL AMOUNT

Traditional |

I elect to withhold |

% |

or |

$ |

|

of compensation per pay period on a |

|

Roth |

I elect to withhold |

|

or |

$ |

|

of compensation per pay period on an |

|

|

% |

|

|||||

|

|

|

|

|

|

|

|

Catch Up

Contributions: If you will be 50 years old as of the last day of the year, you are entitled to make additional

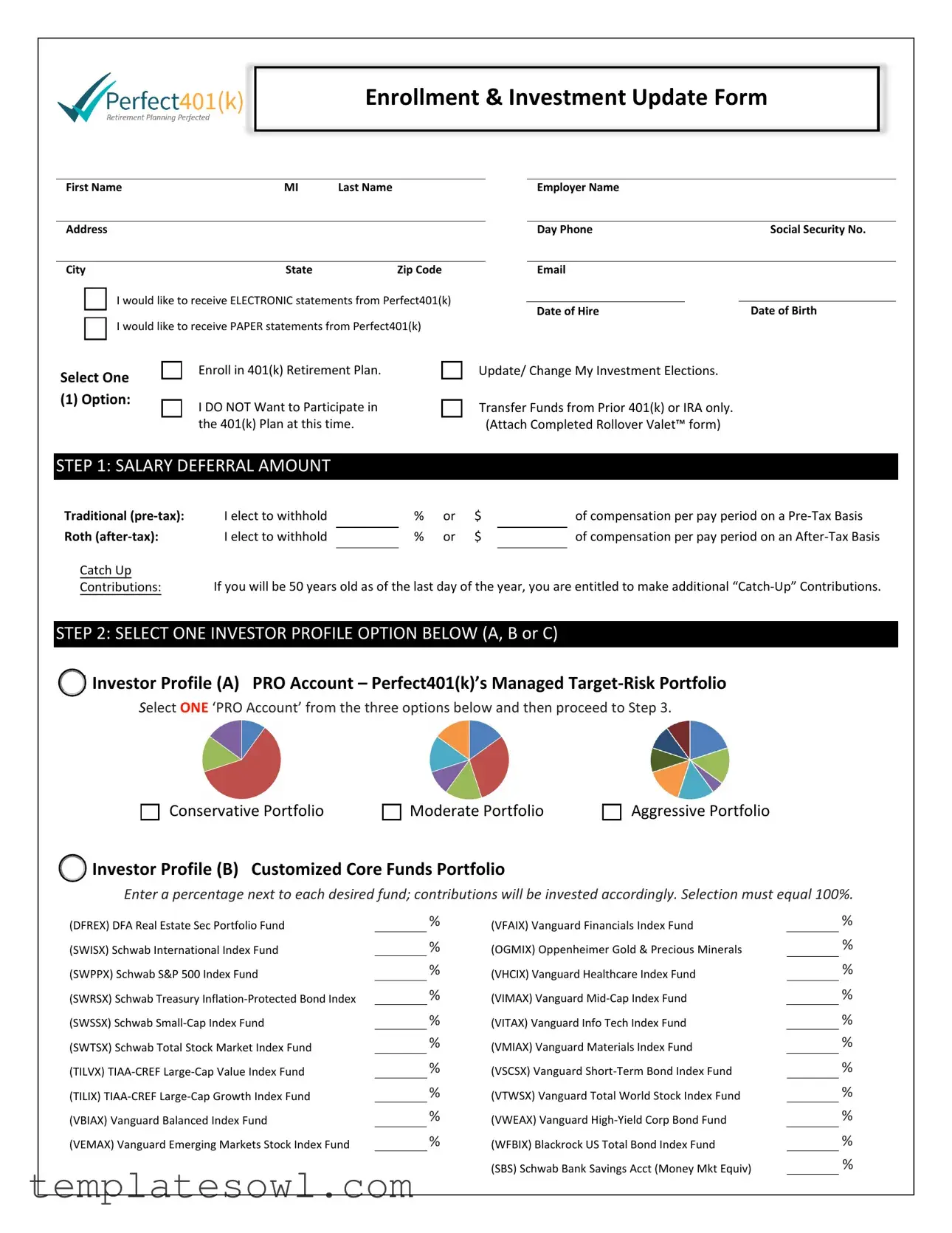

STEP 2: SELECT ONE INVESTOR PROFILE OPTION BELOW (A, B or C)

☐Investor Profile (A) PRO Account – Perfect401(k)’s Managed

Select ONE ‘PRO Account’ from the three options below and then proceed to Step 3.

☐ Conservative Portfolio |

☐ Moderate Portfolio |

☐ Aggressive Portfolio |

☐Investor Profile (B) Customized Core Funds Portfolio

Enter a percentage next to each desired fund; contributions will be invested accordingly. Selection must equal 100%.

(DFREX) DFA Real Estate Sec Portfolio Fund |

|

% |

(VFAIX) Vanguard Financials Index Fund |

|

% |

||

(SWISX) Schwab International Index Fund |

|

|

% |

(OGMIX) Oppenheimer Gold & Precious Minerals |

|

% |

|

(SWPPX) Schwab S&P 500 Index Fund |

|

% |

(VHCIX) Vanguard Healthcare Index Fund |

|

% |

||

(SWRSX) Schwab Treasury |

% |

(VIMAX) Vanguard |

% |

||||

|

|

|

|

|

|

|

|

(SWSSX) Schwab |

|

% |

(VITAX) Vanguard Info Tech Index Fund |

|

% |

||

(SWTSX) Schwab Total Stock Market Index Fund |

|

% |

(VMIAX) Vanguard Materials Index Fund |

|

% |

||

(TILVX) |

% |

(VSCSX) Vanguard |

% |

||||

|

|

|

|

|

|

|

|

(TILIX) |

|

% |

(VTWSX) Vanguard Total World Stock Index Fund |

|

% |

||

(VBIAX) Vanguard Balanced Index Fund |

|

% |

(VWEAX) Vanguard |

|

% |

||

(VEMAX) Vanguard Emerging Markets Stock Index Fund |

|

% |

(WFBIX) Blackrock US Total Bond Index Fund |

|

% |

||

|

|

|

|

|

(SBS) Schwab Bank Savings Acct (Money Mkt Equiv) |

|

% |

☐Investor Profile (C) Participant

Open your own

For more information about any of the above investments, please go to an appropriate financial website (Ex: Yahoo® Finance).

STEP 3: SIGN & DATE

As a participant, I hereby authorize payroll deductions from my compensation as indicated in Step 1 to be contributed by my employer to the Plan as a salary deferral contribution for my account. I have indicated my investment elections in Step 2. I hereby authorize that any company contributions made on my behalf and any contributions made pursuant to a salary deferral agreement or other sources under the Plan be invested according to my investment elections above. I further understand that the

to maintain a minimum of 2% in the Plan’s Core Money Market Fund. Investments in mutual funds are not FDIC insured and may lose value.

Signature:Date:

EMPLOYEES - Submit completed form(s) to your Employer | EMPLOYERS - Submit form(s) to Everington

Questions? Ask your employer or contact Perfect401(k) directly by phone at (877)

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Title | Generic 401K Enrollment and Investment Update Form |

| Eligibility | Employees can enroll or update their 401K plans through this form, including options for salary deferral and investment elections. |

| Investment Options | Participants can choose from managed portfolios or a self-directed brokerage account to manage their investments. |

| Salary Deferral | You can elect to withhold a percentage or a specific dollar amount of compensation from each pay period, either on a pre-tax or after-tax basis. |

| Catch-Up Contributions | Individuals aged 50 or older qualify for additional catch-up contributions to enhance their retirement savings. |

| Statement Delivery | Participants can choose to receive their account statements electronically or in paper format. |

| Submission Process | Completed forms must be submitted to your employer, who will then forward them to the appropriate parties. |

Guidelines on Utilizing Generic 401K Enrollment

Filling out the Generic 401(k) Enrollment form is a straightforward process that allows you to establish your retirement savings plan. This step-by-step guide will help you complete the form accurately. Make sure to have your personal and financial information handy, as you will need it while filling out the form.

- Personal Information: Fill in your first name, middle initial, last name, employer name, address, day phone, Social Security number, city, state, zip code, and email address. Indicate whether you prefer electronic or paper statements from Perfect401(k).

- Employment Details: Enter your date of hire and date of birth.

- Participation Selection: Choose your participation option by selecting one of the following:

- Enroll in the 401(k) Retirement Plan.

- Update/Change My Investment Elections.

- I DO NOT want to participate in the 401(k) Plan at this time.

- Transfer Funds from a Prior 401(k) or IRA only (attach the completed Rollover Valet form).

- Salary Deferral Amount: Specify the percentage or dollar amount you wish to defer from your compensation on a pre-tax basis (Traditional) and after-tax basis (Roth). If you are 50 years old or older, make sure to note any additional “Catch-Up” contributions.

- Select Investor Profile: Choose one of the three investor profile options (A, B, or C):

- Investor Profile (A): Select a PRO Account from Conservative, Moderate, or Aggressive Portfolio.

- Investor Profile (B): Enter the percentage for each core fund you want to invest in. Ensure that your selections add up to 100%.

- Investor Profile (C): Indicate your desire to open a Self-Directed Brokerage-Window account.

- Signature and Date: Sign and date the form to authorize your employer to deduct the specified amounts from your compensation and to invest them according to your selected investment elections. Make sure to read and understand all terms regarding participation and investment options.

- Submission: Submit the completed form to your employer. If you have questions, contact Perfect401(k) directly or reach out to your employer for assistance.

What You Should Know About This Form

What information do I need to provide on the Generic 401K Enrollment form?

You will need to provide several key pieces of personal information, including your first name, middle initial, last name, employer name, address, phone number, and Social Security number. Additionally, you must include your date of hire and date of birth. If you choose to receive electronic statements, be sure to provide your email address. Any missing information may delay the enrollment process.

How do I select my investment options on the form?

The enrollment form provides multiple options for investment selection. You can choose between three investor profiles: Profile A (Managed Target-Risk Portfolio), Profile B (Customized Core Funds Portfolio), or Profile C (Self-Directed Brokerage Window). For Profiles A and B, you will indicate your preferred allocation by selecting corresponding portfolios or entering percentages next to each desired fund in Profile B. Ensure that the total percentage adds up to 100% for Profile B to validate your choices.

What are "Catch-Up Contributions" and who is eligible?

Catch-Up Contributions allow participants aged 50 and older to contribute additional amounts to their 401(k) plans beyond the standard contribution limits. This provision helps boost retirement savings closer to retirement age. If you will be 50 years old by the end of the year, you can indicate your election to make these additional contributions directly on the enrollment form.

What happens if I want to transfer funds from a prior 401(k) or IRA?

If you wish to transfer funds from a previous 401(k) or IRA into your new 401(k) plan, you must complete the appropriate Rollover Valet™ form and attach it to your enrollment form. This ensures that the transfer process aligns with regulatory requirements and helps maintain the tax-advantaged status of your retirement savings. Remember to check with your previous plan for any specific procedures or requirements related to rollovers.

Where do I submit my completed Generic 401K Enrollment form?

Once you have completed the enrollment form, it must be submitted to your employer for processing. Employers are responsible for forwarding these forms to the appropriate parties. If you have any questions or need assistance with the form, reach out to your employer or contact Perfect401(k) directly by phone at (877) 836-1993 or via email at info@perfect401k.com.

Common mistakes

When filling out the Generic 401K Enrollment form, many individuals make common mistakes that can impact their retirement savings. Awareness of these pitfalls can help ensure that you maximize your contributions and make informed investment decisions.

One frequent error is not providing complete and accurate personal information. Double-check that your first name, last name, address, and social security number are correct. Inaccurate information can delay your enrollment or cause misallocations of funds.

Another mistake lies in neglecting to specify salary deferral amounts. It's crucial to clearly indicate the percentage or dollar amount you wish to withhold from your paycheck. Inadequate contributions could mean you miss out on potential growth over time.

Many people fail to take full advantage of the Catch-Up Contributions. If you are nearing retirement age, ensure that the catch-up option is selected if applicable. This allows you to contribute more than the standard limit, which can significantly bolster your savings.

Choosing the wrong investor profile is also a common oversight. Participants often rush through Step 2 and select an option that does not align with their risk tolerance and investment goals. Take the time to evaluate each portfolio option before making a decision.

Another mistake involves failing to allocate contributions correctly among chosen funds. In the Customized Core Funds Portfolio, ensure that the total percentage adds up to 100%. Any discrepancy can result in unexpected outcomes for your investments.

Often, applicants overlook the importance of reading the disclosure and authorization sections. This section explains how your contributions will be managed and the risks associated with your investments. Understanding these details is key to making informed choices.

Finally, many individuals forget to sign and date the form. This simple omission can lead to delays or rejection of your application. Always ensure that all sections are complete before submitting your enrollment form.

By avoiding these mistakes, individuals can better position themselves for a secure financial future through effective 401K enrollment and investment strategies.

Documents used along the form

When enrolling in a 401(k) plan, several other forms and documents frequently accompany the Generic 401K Enrollment form. These additional documents ensure that participants are fully informed about their options, contributions, and benefits. Below is a list of commonly used forms related to 401(k) enrollment.

- 401(k) Plan Summary Description: This document provides an overview of the company’s 401(k) plan, including eligibility requirements, contribution limits, and benefits. It serves as a guide for employees to understand the plan’s structure.

- Salary Deferral Agreement: This form outlines the amount that an employee wishes to contribute to their 401(k) through payroll deductions. It typically includes both the percentage and dollar amount of salary deferrals.

- Beneficiary Designation Form: Employees use this form to specify who should receive their 401(k) benefits in the event of their death. This designation is important for ensuring that assets are distributed according to the participant's wishes.

- Investment Election Form: This document allows employees to choose how their contributions will be invested within the 401(k) plan. Employees can select from various investment funds or options available under the plan.

- Rollover Contribution Form: When participants wish to transfer funds from another retirement account, this form facilitates the rollover process. It includes instructions and requirements for completing the transfer.

- Loan Request Form: If the plan permits, participants may use this document to apply for a loan against their 401(k) balance. The form outlines loan terms and repayment details.

- Hardship Withdrawal Application: This form is necessary for employees seeking to withdraw funds from their 401(k) due to a financial hardship. It requires documentation of the hardship and may have additional requirements.

Having these additional forms readily available can streamline the enrollment process and provide employees with essential information regarding their retirement savings options. Understanding each document's purpose can lead to more informed decisions about retirement planning.

Similar forms

- Retirement Savings Account Application: Similar to the 401(k) Enrollment form, this document collects personal information such as name and Social Security number. Both forms facilitate enrollment in retirement plans, allowing individuals to select their contribution amounts and investment preferences.

- IRA Application Form: This document also captures basic personal details and enables individuals to specify their desired contributions. It provides options for traditional and Roth IRA accounts, similar to the choices offered in the 401(k) Enrollment form.

- Health Savings Account (HSA) Application: Both forms require personal information to establish an account. Each allows participants to select the contribution amounts, creating a systematic approach to save for future healthcare expenses.

- Flexible Spending Account (FSA) Enrollment Form: Like the 401(k) form, this document gathers personal data and allows employees to choose their contribution levels. Both are aimed at encouraging individuals to set money aside for future needs—in this case, medical expenses.

- Employer Stock Purchase Plan (ESPP) Enrollment Form: This form shares similarities in terms of capturing employee information and allowing option selection. Participants can choose how much of their salary to defer for purchasing company stock, rather like making investment elections in a 401(k).

- College Savings Plan Enrollment Form: This document also collects personal details and allows individuals to set contributions for future educational expenses. Both forms share the intent of growing savings through systematic contributions over time.

- Pension Plan Enrollment Form: This form is akin to the 401(k) Enrollment by requesting personal information and enabling participants to make choices regarding their contributions. Each serves to prepare individuals for retirement by establishing a structured savings plan.

Dos and Don'ts

When filling out the Generic 401K Enrollment form, it is essential to follow certain guidelines to ensure accuracy and compliance. The following lists outline what to do and what to avoid.

- Double-check your personal information for accuracy, including your name, address, and Social Security number.

- Clearly indicate your desired salary deferral amount and investment preferences.

- Consider consulting with a financial advisor to choose the best investment options for your retirement goals.

- Review the investor profile options thoroughly before making a selection.

- Make sure to complete all required sections of the form.

- Do not leave any sections blank unless instructed to do so.

- Avoid guessing on your salary deferral amount; use concrete figures or percentages.

- Don’t forget to read the fine print regarding investment risks and withdrawal rules.

- Refrain from rushing through the form; take your time to ensure clarity and correctness.

- Do not submit the form without signing and dating it.

By adhering to these guidelines, you can help facilitate a smoother enrollment process and make more informed decisions regarding your retirement savings.

Misconceptions

When it comes to the Generic 401K Enrollment form, several misconceptions often emerge. Here is a list of ten common misunderstandings along with explanations.

- Misconception 1: The form is only for new hires.

- Misconception 2: I cannot change my investment elections once I submit the form.

- Misconception 3: The salary deferral amount is fixed once chosen.

- Misconception 4: I can only choose one investment option.

- Misconception 5: The enrollment process is complicated and time-consuming.

- Misconception 6: I will lose all my money if the market goes down.

- Misconception 7: I need to employ a financial advisor to fill out the form.

- Misconception 8: The 401K plan is not accessible until retirement.

- Misconception 9: Electronic statements mean less privacy.

- Misconception 10: Completing the form means I am locked into certain investment choices.

The 401K Enrollment form can be used by anyone looking to enroll in the plan, including current employees who want to make changes to their contributions or investment choices.

Submitting the form allows you to set your investment choices, but you can revise these elections in the future as circumstances change.

You can adjust your salary deferral amount at any time. The enrollment form allows for flexibility in your contributions.

Participants have the option to choose multiple investment funds or one of the target-risk portfolios according to their preferences.

While the form collects necessary information, the enrollment process is designed to be straightforward and efficient for participants.

While investments can fluctuate in value, 401(k) plans typically offer diversified investment options, which can help manage risk over time.

Employees can complete the form by themselves. However, consulting an advisor may provide additional insights into making investment choices.

While the primary purpose is retirement saving, participants can access funds in certain circumstances, such as hardship withdrawals or loans.

Electronic statements are secure and often provide an environmentally-friendly alternative to paper statements, while maintaining privacy guidelines.

Choosing investments is not a permanent decision. Participants can regularly adjust their investment portfolios to align with their financial goals.

Key takeaways

Here are key takeaways for filling out and using the Generic 401K Enrollment form:

- Provide Accurate Information: Ensure all personal details, such as your name, Social Security number, and employment information, are filled in correctly to avoid processing delays.

- Choose Your Participation: Decide whether you want to enroll in the 401(k) plan, update your investment elections, or transfer funds. Make your selection clear by checking the appropriate box.

- Salary Deferral Amount: Specify the amount you'd like to contribute on a pre-tax or after-tax basis. You can choose a percentage of your salary or a specific dollar amount.

- Catch-Up Contributions: If you are 50 or older, you can make additional contributions. Be sure to check for eligibility and add this option if applicable.

- Select an Investor Profile: Choose from one of the three investor profiles. Each option reflects different risk levels and investment strategies, so select one that aligns with your financial goals.

- Understand Investment Risks: Familiarize yourself with the investment options. Recognize that mutual funds are not FDIC insured and may fluctuate in value.

- Submit the Form Correctly: Employees must submit the completed form to their employer, while employers are responsible for forwarding it to Everington. Ensure you retain a copy for your records.

Review these points carefully as you prepare to fill out the form. Making informed choices today can greatly impact your financial future.

Browse Other Templates

TSP Withdrawal Request,TSP Full Disbursement Form,TSP Account Closure Form,TSP Distribution Application,TSP Account Withdrawal Memo,Joint Life Annuity Request,TSP Beneficiary Withdrawal Form,TSP Disbursement Notification,TSP Account Finalization Form - Section IV allows participants to detail their preferred withdrawal methods and amounts.

How Long Do You Have to File Workers Comp - In cases of suspected pesticide poisoning, additional steps must be taken to notify health authorities.