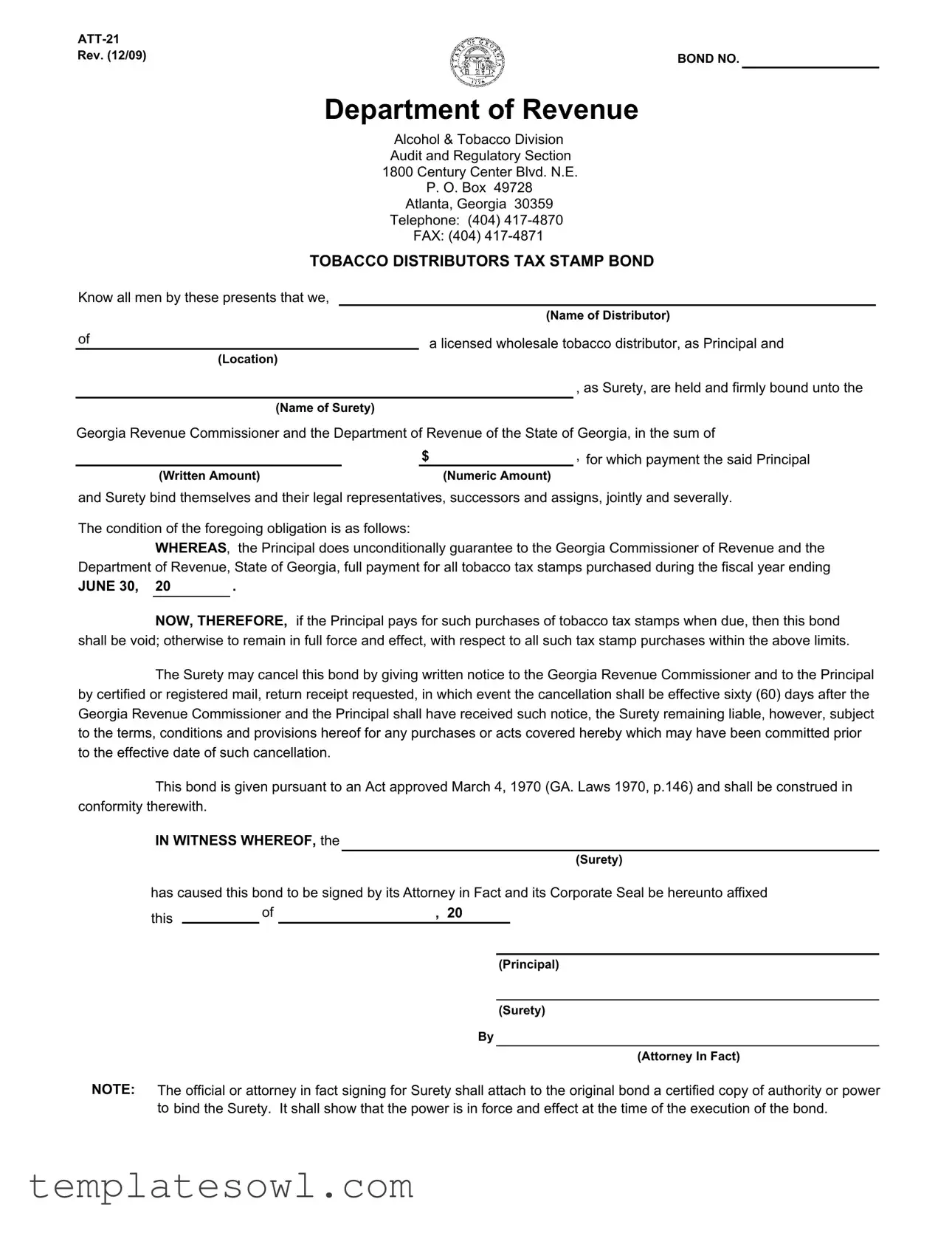

Fill Out Your Georgia Att 21 Form

The Georgia Att 21 form is a vital document that plays a crucial role in the administration of tobacco sales within the state. Designed as a Tobacco Distributor Tax Stamp Bond, this form ensures that wholesale tobacco distributors comply with state regulations surrounding the payment of tobacco taxes. When a distributor completes this form, they enter into a formal agreement that binds both the distributor and a surety company to a financial obligation, ensuring payment for all tobacco tax stamps acquired during a specified fiscal year. The form outlines the legal responsibilities of the principal—in this case, the tobacco distributor—and the surety, detailing the bond's conditions and terms of cancellation. This bond remains valid so long as the distributor fulfills their payment obligations. In the event of any nonpayment, the bond is activated, protecting the state by ensuring that funds are available to cover any unpaid taxes. Further, the bond allows the surety to withdraw from this obligation under specific conditions, giving them the ability to provide a written notice to the Georgia Revenue Commissioner and the distributor. Understanding the nuances of this form is essential for businesses involved in tobacco distribution, as noncompliance can lead to significant financial and legal consequences.

Georgia Att 21 Example

|

|

Rev. (12/09) |

BOND NO. |

|

Department of Revenue

Alcohol & Tobacco Division

Audit and Regulatory Section

1800 Century Center Blvd. N.E.

P. O. Box 49728

Atlanta, Georgia 30359

Telephone: (404)

FAX: (404)

TOBACCO DISTRIBUTORS TAX STAMP BOND

Know all men by these presents that we,

(Name of Distributor)

of |

|

a licensed wholesale tobacco distributor, as Principal and |

|||

(Location) |

|

|

|||

|

|

|

|

|

, as Surety, are held and firmly bound unto the |

(Name of Surety) |

|

|

|||

Georgia Revenue Commissioner and the Department of Revenue of the State of Georgia, in the sum of |

|||||

|

|

$ |

|

, for which payment the said Principal |

|

(Written Amount) |

(Numeric Amount) |

||||

and Surety bind themselves and their legal representatives, successors and assigns, jointly and severally.

The condition of the foregoing obligation is as follows:

WHEREAS, the Principal does unconditionally guarantee to the Georgia Commissioner of Revenue and the Department of Revenue, State of Georgia, full payment for all tobacco tax stamps purchased during the fiscal year ending

JUNE 30, 20 |

. |

|

|

|

|

NOW, THEREFORE, if the Principal pays for such purchases of tobacco tax stamps when due, then this bond shall be void; otherwise to remain in full force and effect, with respect to all such tax stamp purchases within the above limits.

The Surety may cancel this bond by giving written notice to the Georgia Revenue Commissioner and to the Principal by certified or registered mail, return receipt requested, in which event the cancellation shall be effective sixty (60) days after the Georgia Revenue Commissioner and the Principal shall have received such notice, the Surety remaining liable, however, subject to the terms, conditions and provisions hereof for any purchases or acts covered hereby which may have been committed prior to the effective date of such cancellation.

This bond is given pursuant to an Act approved March 4, 1970 (GA. Laws 1970, p.146) and shall be construed in conformity therewith.

IN WITNESS WHEREOF, the

(Surety)

has caused this bond to be signed by its Attorney in Fact and its Corporate Seal be hereunto affixed

this |

|

of |

, 20 |

|

|

|

(Principal)

(Surety)

By

(Attorney In Fact)

NOTE: The official or attorney in fact signing for Surety shall attach to the original bond a certified copy of authority or power to bind the Surety. It shall show that the power is in force and effect at the time of the execution of the bond.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The ATT 21 form serves as a Tobacco Distributors Tax Stamp Bond in Georgia, ensuring that distributors pay for tobacco tax stamps purchased during the fiscal year. |

| Governing Law | This bond is governed by the Act approved on March 4, 1970 (GA. Laws 1970, p.146), which establishes the legal framework for tobacco tax payment in Georgia. |

| Bond Amount | Distributors must specify the bond amount, which guarantees payment to the Georgia Revenue Commissioner for tax stamps purchased. |

| Principal and Surety | The form requires the names of both the Principal (the distributor) and the Surety (the bonding company), clearly establishing their roles in the bond agreement. |

| Cancellation Procedure | The Surety can cancel the bond by providing written notice to the Georgia Revenue Commissioner and the Principal, with cancellation effective 60 days after notice is received. |

| Void Condition | The bond remains in effect unless the Principal fulfills its obligation by paying for tobacco tax stamps when due, marking a key condition for its validity. |

| Signature Requirements | The bond must be signed by the Surety's Attorney in Fact, who must also attach a certified copy of their authority to bind the Surety at the time of execution. |

Guidelines on Utilizing Georgia Att 21

Completing the Georgia Att 21 form is a necessary process for tobacco distributors. This form serves as a bond that involves multiple parties, including the distributor and a surety. Below are the steps to accurately fill out this document.

- Start by providing the name of the distributor in the first blank space.

- In the next field, enter the location of the distributor.

- Insert the name of the surety in the appropriate section.

- Specify the total bond amount in both numeric and written form. For example, enter the amount as “$10,000” and “Ten Thousand Dollars.”

- Complete the fiscal year information by entering the year ending on June 30th in the designated blank.

- Sign the bond where it states "By" under the Principal section.

- Have the surety's Attorney in Fact sign where indicated, and ensure the corporate seal is affixed.

- Attach a certified copy of the authority or power of attorney for the Surety to the bond.

- Make sure all signatures are dated appropriately.

What You Should Know About This Form

What is the Georgia Att 21 form?

The Georgia Att 21 form, also known as the Tobacco Distributors Tax Stamp Bond, is a legal document required for licensed wholesale tobacco distributors in Georgia. It establishes a financial guarantee that the distributor will fully pay for all tobacco tax stamps purchased during a specified fiscal year. The bond protects the state by ensuring tax revenue is collected, and it holds the distributor and the surety jointly and severally responsible.

Who needs to complete the Att 21 form?

Only licensed wholesale tobacco distributors in Georgia are required to complete the Att 21 form. If you are involved in the distribution of tobacco products and hold a valid license, you must submit this bond as part of your tax obligations to the state. This ensures that the state receives the necessary revenues from tobacco taxes.

What is the purpose of this bond?

The purpose of the Tobacco Distributors Tax Stamp Bond is to guarantee prompt payment for tobacco tax stamps purchased by the distributor. Should the distributor fail to pay for these stamps when due, the bond remains in effect, protecting the state from potential revenue loss. Effectively, the bond serves as a safety net for the state’s tax collections.

How can the bond be cancelled?

The surety company can cancel the bond by providing written notice to the Georgia Revenue Commissioner and the distributor. This notice must be delivered via certified or registered mail and will take effect 60 days after both parties have received it. However, it is important to note that the surety remains liable for any obligations that arose before the cancellation takes effect.

What are the consequences of not paying for tobacco tax stamps?

If the distributor fails to pay for tobacco tax stamps as stipulated, the bond will remain in full effect. This means that the surety may be called to fulfill the payment obligation on behalf of the distributor. Non-payment could also result in further legal actions, fines, or penalties from the state, jeopardizing the distributor's ability to operate in the future.

What documentation do I need to provide with the bond?

When submitting the Att 21 form, the surety must attach a certified copy of the authority or power of attorney that proves the individual signing on behalf of the surety has the legal authority to do so. This documentation is crucial, as it confirms that the bond is valid and legally binding at the time of execution.

How is the bond amount determined?

The bond amount is stamped directly on the Att 21 form and is determined based on the anticipated cost of tobacco tax stamps that the distributor may purchase during the fiscal year. It serves as a financial guarantee that the distributor can cover these costs, ensuring the state's revenues are protected.

Common mistakes

Filling out the Georgia Att 21 form can be a straightforward process, but several common mistakes can lead to delays or complications. One significant mistake is failing to include the correct name of the distributor. This field is crucial, as it identifies who is responsible for the bond. A misspelled name or an outdated one can complicate matters and require additional paperwork to rectify.

Another common error involves the surety's information. People often forget to fill in the location of the surety or provide inaccurate details. This can lead to confusion regarding who is backing the bond and may cause issues during verification.

Many individuals neglect to double-check the amounts written in both numerals and words. This inconsistency can be problematic. The amount must match precisely. If they do not, the form may be rejected or delayed for clarification, causing unnecessary stress.

Additionally, missing the fiscal year end date is a frequent oversight. Applicants sometimes overlook this detail, which is essential for the bond’s validity. Accurate dates ensure that the bond covers the correct period for any tax stamp purchases.

Signatures are another area where errors often occur. The form requires both the Principal and the Surety to sign it. Sometimes, individuals forget to include the necessary signatures or fail to have the Attorney in Fact sign as well. These omissions can invalidate the bond and lead to further complications.

Furthermore, not attaching a certified copy of authority or power to bind the Surety is a crucial mistake. This documentation is a requirement that many overlook. Without it, the bond may not be considered valid.

In addition, it is important to remember that bonds must be submitted in a timely manner. Delays in submission may lead to penalties or lapses in coverage. Being aware of deadlines and submitting the form promptly is essential to avoid complications.

Another mistake occurs when applicants fail to read the instructions thoroughly. The form includes specific requirements for completion. Not following these can result in incomplete submissions, which may be sent back for revision.

Lastly, it is crucial to ensure that the information is clearly legible. Illegible handwriting can lead to misunderstandings and mistakes. Taking the time to write clearly or type the information can help prevent these issues.

By being aware of these common mistakes, individuals can take the necessary steps to fill out the Georgia Att 21 form accurately, thereby avoiding potential delays and complications.

Documents used along the form

The Georgia ATT-21 form is crucial for tobacco distributors, as it serves as a bond ensuring payment of tobacco tax stamps. However, there are several other documents that you may need alongside this form to navigate regulatory and compliance requirements smoothly. Below is a list of related documents that can facilitate this process.

- Tobacco Distributor License Application: This application is necessary for obtaining a license to operate as a tobacco distributor in Georgia. It includes details about the business and its owners and must be submitted to the Department of Revenue.

- Tax Exemption Certificate: If you qualify for any tax exemptions, this certificate allows you to purchase goods without paying certain taxes upfront. It's vital for distributors looking to manage costs effectively.

- Form ST-5 (Sales Tax Exemption Certificate): This form is typically used by businesses to purchase items tax-free that will be resold. Distributors can include this when they purchase tobacco products for sale.

- Monthly or Quarterly Tobacco Tax Return: This return outlines the sales and the tax collected on tobacco products during a specified period. Timely submission helps maintain compliance with state laws.

- Surety Bond Agreement: This document often accompanies the ATT-21 form and outlines the terms of the bond between the distributor and the surety company, ensuring a clear understanding of obligations.

- Notice of Change of Ownership: Should there be any changes in ownership of the business, this notice must be filed to update the Department of Revenue and maintain compliance with regulations.

- Financial Statements: These statements, including profit and loss reports, may need to be submitted to demonstrate the financial viability of the business and support the bond application process.

- Insurance Certificates: Proof of insurance coverage is often required to ensure that businesses have adequate protection against liabilities and operational risks.

- Letter of Intent: If a distributor intends to enter into specific agreements or partnerships, a letter articulating this intent may be necessary for record-keeping and compliance purposes.

- Compliance Checklists: These checklists can help ensure that all regulatory obligations are met. They provide a systematic way to track required submissions and necessary steps in maintaining legal and operational standards.

Understanding and preparing these additional documents will help you stay compliant and manage your tobacco distribution business more effectively. Each document plays a role in adhering to legal requirements, facilitating smooth operations, and protecting against potential liabilities.

Similar forms

Surety Bond: Similar to the Georgia Att 21 form, a general surety bond serves as a guarantee for financial obligations. Both documents involve a principal, a surety, and ensure that specified payments are made to a governing body.

Performance Bond: This document is also used to guarantee payment, particularly in construction projects. Like the Georgia Att 21, it establishes a relationship between the obligee and principal, ensuring project completion and adherence to terms.

License Bond: A license bond is required by certain regulatory agencies to ensure compliance with laws and payment of taxes or fees. It operates under similar principles as the Georgia Att 21, where the principal agrees to uphold obligations to the state.

Payment Bond: This type of bond assures that subcontractors and suppliers will be paid by the principal. Similar to the Georgia Att 21, it protects against non-payment and guarantees financial responsibility.

Tax Bond: Used to ensure that taxes owed will be paid in accordance with regulations, the tax bond shares the same objective as the Georgia Att 21. It secures the tax responsibilities of the principal to the government.

Construction Bond: These bonds are often required in public construction projects to ensure compliance with contracts and regulations. Like the Georgia Att 21, it secures adherence to financial commitments.

Franchise Tax Bond: A franchise tax bond is a financial guarantee that the business will pay any applicable franchise taxes. It functions similarly to the Georgia Att 21 by ensuring the principal fulfills tax obligations.

Customs Bond: This bond guarantees that importers will pay customs duties and comply with regulations. Just like the Georgia Att 21, it ensures compliance with financial commitments required by governmental entities.

Dos and Don'ts

When filling out the Georgia Att 21 form, it is crucial to ensure accuracy and compliance. Here are ten important things to do and avoid:

- Do: Provide accurate and complete information for the distributor's name.

- Do: Ensure the location of the surety is properly filled out.

- Do: Write the correct amount in both numeric and written forms.

- Do: Include the fiscal year ending date clearly.

- Do: Have the bond signed by the Attorney in Fact with the corporate seal.

- Don’t: Forget to attach a certified copy of authority for the person signing on behalf of the surety.

- Don’t: Leave any required fields blank; all sections must be completed.

- Don’t: Use incorrect or outdated forms; verify that you have the latest version.

- Don’t: Delay submitting the form; ensure it is sent in a timely manner.

- Don’t: Assume that verbal agreements are sufficient; everything must be documented in the form.

Misconceptions

Understanding the nuances of the Georgia ATT 21 form is essential for anyone involved in tobacco distribution. However, several misconceptions often arise. Here are five common misunderstandings and the facts to dispel them:

- Misconception 1: The ATT 21 form is only needed for initial tobacco distributors.

- Misconception 2: Once submitted, the ATT 21 form doesn't require any changes.

- Misconception 3: The bond guarantees that taxes won't be due if I make purchases.

- Misconception 4: The surety can cancel the bond at any time without notice.

- Misconception 5: A personal signature is sufficient; no additional documentation is required.

This is incorrect. All wholesalers must file this form annually to guarantee payment for tobacco tax stamps, not just those starting out.

Not true! If any details change, such as the distributor's name or address, updating the bond is necessary to reflect those changes.

This is misleading. The bond guarantees payment for taxes owed; it does not eliminate the tax obligation itself. Distributors must still pay for all tax stamps purchased.

This is false. The surety must provide written notice to both the Georgia Revenue Commissioner and the Principal, allowing a cancellation period of sixty days.

This is a common error. When signing the ATT 21 form, the official must also provide a certified copy of their authority to bind the surety, ensuring everything is in order.

Key takeaways

Here are key takeaways for effectively filling out and using the Georgia Att 21 form:

- Understand Your Role: Identify your role as either the Principal (the distributor) or the Surety (the surety company).

- Complete All Required Information: Ensure that you accurately fill in the name of the distributor, location, surety name, and the bond amount.

- Payment Guarantee: This bond guarantees full payment for all tobacco tax stamps purchased during the fiscal year ending June 30.

- Joint Responsibility: Both Principal and Surety are responsible for the bond. They bind themselves, their successors, and assigns jointly.

- Cancellation Notice: Should you need to cancel the bond, the Surety must send a written notice to the Georgia Revenue Commissioner and the Principal.

- Compliance is Key: The bond remains valid unless all tax stamp purchases are paid for as scheduled.

- Attach Documentation: The Surety's Attorney in Fact must attach a certified copy of their authority to the bond.

- Act Reference: This bond is issued under specific state law, so being familiar with those regulations is essential.

- Legal Signatures: Ensure that the bond is signed by the appropriate representatives from both the Principal and Surety, including the official seal.

By following these guidelines, you can properly fill out and use the Georgia Att 21 form. This ensures compliance and protects all parties involved.

Browse Other Templates

Placer County Dba - Forms may be rejected for legibility issues.

Maryland Rental Application - Be aware of Maryland laws regarding application fees.