Fill Out Your Georgia G 7 Form

The Georgia G 7 form, officially known as the G-7 Quarterly Return for Quarterly Payer, plays a critical role for employers in Georgia who need to report tax withholdings. This form is mandatory, even when no taxes were withheld during the quarter in question. A thorough understanding of the important components of the G 7 form can streamline your filing process. Essential information includes your GA Withholding ID and FEI Number, requirements for tax withheld, adjustments, and tax due. Importantly, timely submission is crucial, as the due date falls on the last day of the month following the end of the quarter. Should this date coincide with a weekend or holiday, the deadline shifts to the next business day. Penalties for late submissions can accumulate quickly, including a flat fee along with a percentage of the total tax withheld. To avoid complications, ensure that only the completed return is mailed—not the entire instruction document. For assistance, you can reach out to the Withholding Tax Unit, which stands ready to support you with any inquiries or concerns regarding the process.

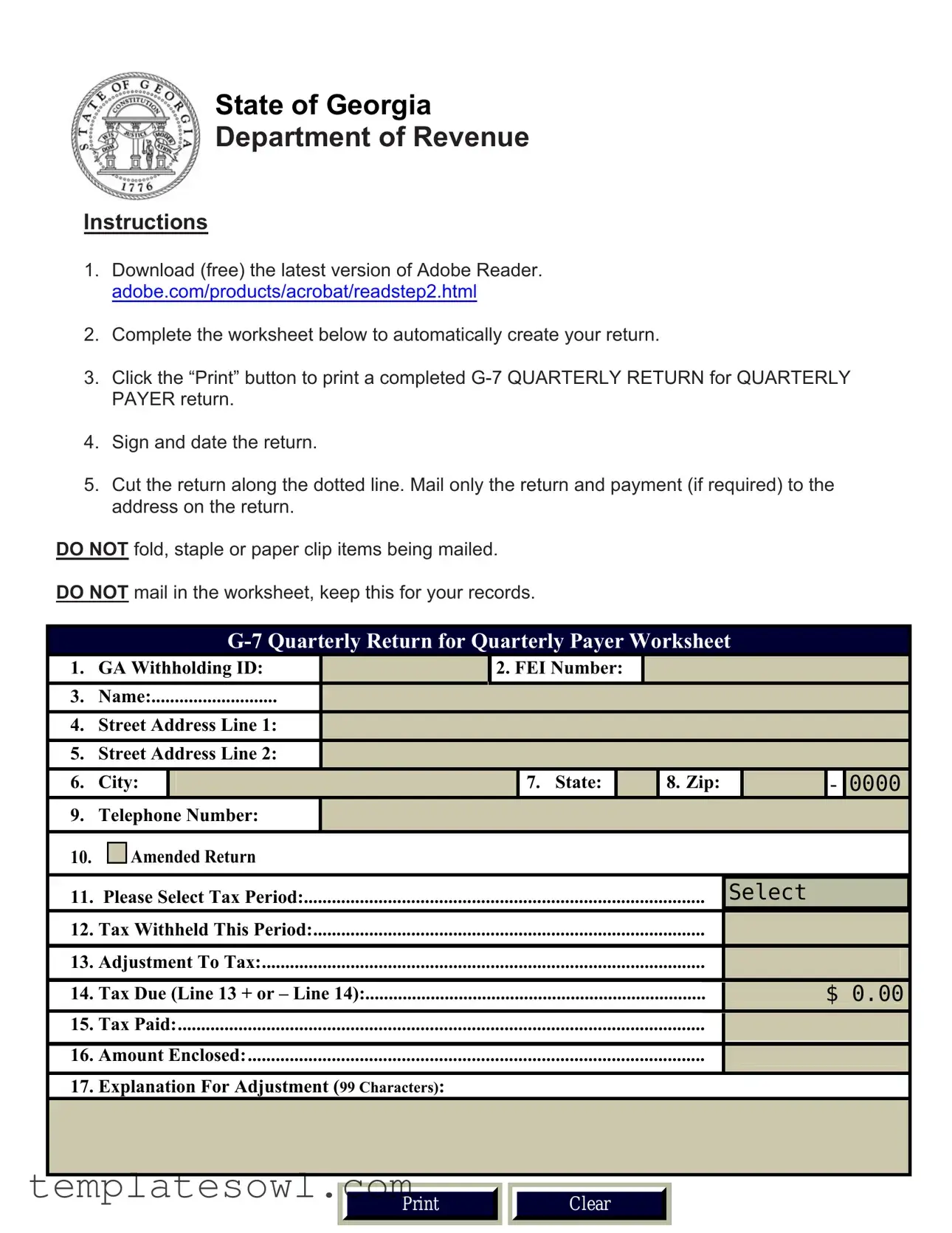

Georgia G 7 Example

State of Georgia

Department of Revenue

Instructions

1.Download (free) the latest version of Adobe Reader. adobe.com/products/acrobat/readstep2.html

2.Complete the worksheet below to automatically create your return.

3.Click the “Print” button to print a completed

4.Sign and date the return.

5.Cut the return along the dotted line. Mail only the return and payment (if required) to the address on the return.

DO NOT fold, staple or paper clip items being mailed.

DO NOT mail in the worksheet, keep this for your records.

1. |

GA Withholding ID: |

|

|

2. FEI Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

...........................Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Street Address Line 1: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5. |

Street Address Line 2: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

6. |

City: |

|

|

|

|

|

|

7. State: |

|

|

|

|

8. Zip: |

|

|

|

|

- |

|

0000 |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

Telephone Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

10. |

|

|

Amended Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. |

Please Select Tax Period: |

|

|

|

|

|

|

|

|

|

Select |

||||||||||||||

12. |

Tax Withheld This Period: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

13. |

Adjustment To Tax: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

14. |

.........................................................................Tax Due (Line 13 + or – Line 14): |

|

|

|

|

|

|

|

|

|

$ 0.00 |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

15. |

.................................................................................................................Tax Paid: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

16. |

Amount Enclosed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17. |

Explanation For Adjustment (99 Characters): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clear

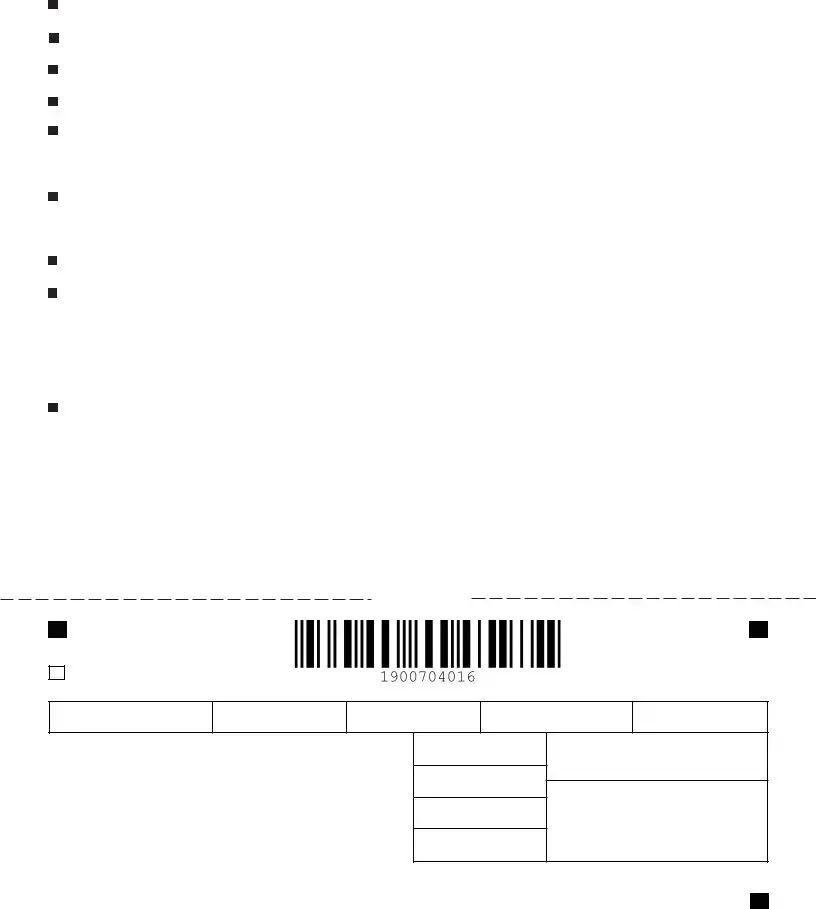

Instructions for Completing the

Form

If the due date falls on a weekend or holiday, the tax shall be due on the next day that is not a weekend or holiday.

Enter the “Tax Withheld”, “Tax Due”, and “Tax Paid” in the appropriate blocks.

Enter the payment amount in the “Amount Paid” section.

If applicable, enter any adjustment amount in the “Adjustment to Tax” block. This block should be used when using a credit from a prior period or paying additional tax due for a period. Explain adjustments in the indicated area of the form.

Submit Form

Do not use this form for nonresident withholding; use Form

Mail this completed form with your payment to:

Processing Center

Georgia Department of Revenue

PO Box 105544

Atlanta, Georgia

Contact the Withholding Tax Unit at

PLEASE DO NOT mail this entire page. Please cut along dotted line and mail only voucher and payment.

PLEASE DO NOT STAPLE OR PAPER CLIP. PLEASE REMOVE ALL CHECK STUBS.

Cut on dotted line

Name and Address: |

|

|

|

FOR QUARTERLY PAYER (Rev. 03/23/18) |

|

Amended Return |

|

GA Withholding ID

FEI Number

Period Ending

Due Date

Vendor Code

040

PLEASE DO NOT STAPLE OR PAPER CLIP. REMOVE ALL CHECK STUBS.

PROCESSING CENTER

GEORGIA DEPARTMENT OF REVENUE

PO BOX 105544

ATLANTA GA

Tax withheld this period

Adjustment to tax

Tax Due (Line 1 + or - Line 2)

Tax Paid

Explanation of adjustments

Under penalty of perjury, I declare that this return has been examined by me and to the best of my knowledge and belief it is true, correct and complete.

Signature |

Title |

|

|

Telephone |

Date |

Amount Paid $

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The G-7 form is governed by Georgia state tax laws, specifically under the Georgia Department of Revenue regulations. |

| Filing Requirement | Form G-7 must be filed every quarter, regardless of whether any tax was withheld during that period. |

| Submission Deadline | The form is due on the last day of the month following the end of the quarter. |

| Late Penalties | If filed late, penalties include a $25.00 fee plus an additional 5% of the total tax withheld for each month overdue, capping at 25%. |

| Required Information | Key information like GA Withholding ID, FEI Number, and tax amounts must be accurately entered on the form. |

| Adjustment Description | When applicable, adjustments to tax should be detailed in the designated area on the form for clarity. |

| Mailing Instructions | Only the completed return and payment should be mailed to the Georgia Department of Revenue, not the entire worksheet. |

| Contact Information | For assistance, taxpayers can contact the Withholding Tax Unit at 1-877-GADOR11 (1-877-423-6711). |

Guidelines on Utilizing Georgia G 7

Filling out the Georgia G-7 form involves several key steps to ensure accurate submission. It's essential to follow these instructions closely to avoid penalties and to ensure compliance with state requirements.

- Download the latest version of Adobe Reader from adobe.com.

- Complete the worksheet with the following information:

- GA Withholding ID

- FEI Number

- Name

- Street Address Line 1

- Street Address Line 2 (if applicable)

- City

- State

- Zip Code (with four additional digits)

- Telephone Number

- Select if this is an amended return

- Select the tax period

- Enter the tax withheld for the period

- Enter any adjustments to the tax

- Calculate the total tax due

- Enter the tax paid amount

- Fill in the amount enclosed

- Provide an explanation for any adjustments (99 characters max)

- Click the “Print” button to generate your completed G-7 Quarterly Return.

- Sign and date the printed return to validate your submission.

- Cut the return along the dotted line to separate it from the worksheet.

- Mail only the return along with any payment (if required) to the address specified on the return.

Ensure that you do not fold, staple, or use paper clips when mailing. Keep the worksheet for your records, as it is not to be submitted. The G-7 form must be submitted by the last day of the month following the end of the quarter, and be mindful of potential penalties for late submissions.

What You Should Know About This Form

What is the Georgia G 7 form?

The Georgia G 7 form is used for reporting income tax withheld for employees in Georgia. Specifically, it is for those who pay quarterly. Businesses and employers must file this form even if there was no tax withheld during a given quarter.

Who needs to file the G 7 form?

If you are an employer who withholds Georgia income tax from your employees’ paychecks, you need to file the G 7 form. This is true even if no tax was withheld during a particular quarter. It’s important to stay compliant with state tax regulations.

When is the G 7 form due?

The G 7 form must be submitted by the last day of the month following the end of the quarter. If the due date falls on a weekend or holiday, it is due the next business day. It's crucial to meet this deadline to avoid penalties.

What happens if I miss the G 7 form deadline?

If you file the G 7 form late, you may incur a penalty. The penalty consists of $25.00 plus 5% of the total tax withheld, each month the return is late. However, the penalty will not exceed $25.00 plus a total of 25% of the tax withheld.

What information do I need to complete the G 7 form?

To fill out the G 7 form, you will need your Georgia Withholding ID, FEI number, company name, address, tax withheld for the period, any adjustments, and the tax paid. The form has designated spaces for each of these items, making it straightforward to complete.

Can I file an amended G 7 form?

Yes, there is an option to file an amended return on the G 7 form. If you are submitting corrections to a previously filed form, make sure to check the box for "Amended Return" and provide explanations for any adjustments made.

How do I submit the G 7 form once completed?

After completing the G 7 form, cut it along the dotted line and mail only the return and payment to the address provided in the instructions. It’s essential not to fold, staple, or paperclip the documents you’re mailing.

What payment methods are accepted for the G 7 form?

When submitting your G 7 form, you should enclose a check or money order. Make sure it is payable to the Georgia Department of Revenue. Follow the instructions on the form for the correct mailing address.

Who should I contact if I need help with the G 7 form?

If you have questions or need assistance, you can contact the Withholding Tax Unit at 1-877-GADOR11 (1-877-423-6711). They can provide you with the information and guidance you need.

Common mistakes

Filling out the Georgia G 7 form accurately is essential to ensure timely processing and prevent potential penalties. However, many individuals make common mistakes. One frequent error occurs in the entry of the GA Withholding ID and FEI Number. This information must be correct and match the records of the Georgia Department of Revenue. Missing or incorrect numbers can lead to delays in processing.

Another mistake relates to the address fields. Omitting details in the “Street Address Line 2” section can lead to confusion, especially if the address is lengthy or complex. It's important to provide complete information to ensure the return is processed properly and without delay.

People often overlook the requirement to file a G-7 even when no tax has been withheld. This form is mandatory, regardless of withholding status. Neglecting to file can result in unexpected penalties.

Moreover, individuals sometimes neglect to select the correct tax period. Not specifying the period can create issues when reconciling records with the Department of Revenue. It’s advisable to double-check this selection before submission.

The section for “Tax Withheld This Period” can often be misunderstood. This figure should reflect the total amount withheld for the quarter, and entering an incorrect amount could lead to discrepancies in tax reporting and potential penalties.

Adjustments to tax are another area prone to error. When claiming credits or adjustments, be sure to fill out the “Adjustment To Tax” section accurately. Miscalculating here could result in improper tax due amounts, leading to unintended consequences.

Completing the “Explanation For Adjustment” can be overlooked or inadequately addressed. This section is essential for providing context to the adjustments made, and failing to explain changes might lead to questions or delays from the state.

Individuals may also miss signing and dating the form before submission. Unsigned forms can be returned or rejected, causing unnecessary delays. So, remember to check for a signature.

The instructions clearly state not to staple or paper clip the return. Ignoring this guideline can lead to processing issues. Keeping the form flat and properly prepared ensures it gets processed smoothly.

Finally, it’s crucial to mail only the completed voucher and not the entire instruction page. If the wrong items are sent, it could result in complications. Ensuring that only the appropriate documents are mailed avoids any processing hiccups.

By being aware of these common mistakes, individuals can fill out the Georgia G 7 form with greater accuracy and confidence, leading to a smoother filing process.

Documents used along the form

When filing your taxes in Georgia, understanding the forms and documents required is essential. The Georgia G 7 form, used for reporting quarterly withholding taxes, often works alongside other important forms. Each document serves a specific purpose in ensuring accurate tax reporting and compliance.

- Form G-7 NRW: This form is specifically for nonresident withholding. It is utilized when taxes are withheld from wages or payments made to nonresident employees or contractors in Georgia.

- Form WT-4: This is the Withholding Exemption Certificate. Employees use this form to claim exemptions from withholding, adjusting the amount of tax withheld based on their personal circumstances.

- Form G-1003: This form is necessary for requesting a refund of taxes withheld in error. Taxpayers can use it to reclaim any overpaid amounts from the Georgia Department of Revenue.

- Form 1099: Issued for reporting miscellaneous income, this form is essential for independent contractors or freelancers. It documents payments made that may require withholding tax consideration.

By familiarizing yourself with these additional forms, you can ensure a smoother tax filing process. Each document contributes to accurate reporting, supporting your financial responsibilities and helping to avoid potential penalties.

Similar forms

The Georgia G 7 form is similar to several other tax forms used for various purposes. Each form has its unique focus but shares common elements like reporting taxes withheld, payer information, and the submission process. Here’s a list of eight documents that are similar to the Georgia G 7 form:

- W-2 Form: This form summarizes an employee's annual wages and taxes withheld. Like the G 7, it collects essential information about tax withholdings for reporting to the IRS.

- W-3 Form: This is the transmittal form sent to the Social Security Administration, summarizing the totals from multiple W-2 forms. Similar to G 7, it links multiple submissions for a clear accounting of withheld taxes.

- 1099-MISC Form: Used for reporting payments made to independent contractors, this form also requires the reporting of taxes withheld, much like the G 7 does for employees.

- 940 Form: The Employer’s Annual Federal Unemployment (FUTA) Tax Return is used to report annual unemployment taxes. Both forms require reporting of tax liabilities in a structured format.

- 941 Form: This form is for employers to report quarterly federal payroll taxes. The timing of filing and the purpose of both forms are similar, as they track tax withholdings by quarter.

- G-7 NRW Form: Specifically for nonresident withholding, this form focuses on a similar area of tax but caters to a different set of payees. It includes similar processes for reporting tax withheld.

- G-4 Form: The Georgia Employee Withholding Allowance Certificate is used to determine the amount of state tax withholding, like the G 7 which summarizes what was withheld during the quarter.

- G-500 Form: This form is for Georgia's sales tax, requiring businesses to report taxes collected. While focused on sales, it echoes the G 7's objective of tax reporting and payment processing.

This list outlines the relationships among these forms, highlighting how they each play a role in the overall tax reporting process. Understanding their similarities can help clarify your tax responsibilities.

Dos and Don'ts

When filling out the Georgia G 7 form, keep the following guidelines in mind:

- Do download the latest version of Adobe Reader to ensure compatibility with the form.

- Do complete all required fields accurately, including GA Withholding ID and FEI Number.

- Do sign and date your return before mailing it to avoid processing delays.

- Do mail only the printed G-7 form and payment, cutting along the dotted line as instructed.

- Don't fold, staple, or paper clip the documents you send; they could be damaged in processing.

- Don't mail the worksheet; keep it for your records instead.

- Don't ignore the due date; late submissions incur penalties.

- Don't use the G-7 form for nonresident withholding; use Form G-7 NRW instead.

Misconceptions

The Georgia G 7 form is often surrounded by various misconceptions. Understanding these can help ensure compliance and accurate reporting. Here are six common myths about the form, clarified for better understanding:

- Myth 1: The G 7 form is only necessary if taxes were withheld.

- Myth 2: It is okay to submit the entire packet of instructions with the form.

- Myth 3: Mail can be sent with staples or paper clips.

- Myth 4: Late returns incur only a flat penalty.

- Myth 5: Any adjustments to tax can be made freely without explanation.

- Myth 6: Form G-7 is appropriate for all types of withholding situations.

This is incorrect. The G 7 form must be filed even if no tax was withheld during the quarter. This requirement helps maintain consistent reporting and compliance with state regulations.

This misconception can lead to processing delays. Only the completed G 7 return and payment should be mailed. The instructions and worksheet should be retained for personal records.

This is a mistake that can cause issues in processing. The instructions specifically state not to staple or paper clip any items when mailing the return. Adhering to this guideline helps ensure that your submission is processed efficiently.

In reality, late returns are assessed a specific penalty structure. Each month the return is late incurs a $25 plus 5% fee of the total tax withheld, not exceeding $25 plus 25%. Timely submissions are crucial to avoid these additional charges.

This is misleading. If adjustments are made, they must be entered in the designated block on the form along with a clear explanation. Proper documentation aids in clarity and compliance.

This is not accurate. The G 7 is specifically for quarterly withholding. For nonresident withholding, a different form, the G-7 NRW, should be used. Choosing the correct form is essential for proper tax management.

Clarifying these misconceptions can ensure that individuals and businesses navigate the filing of the Georgia G 7 form accurately and efficiently. Being well-informed reduces the risk of issues with tax reporting and compliance.

Key takeaways

The Georgia G 7 form is crucial for taxpayers required to report quarterly withholding tax. Here are some key takeaways for effectively filling out and using this form:

- Complete All Required Sections: Ensure that you fill in all necessary information, including your GA Withholding ID, FEI Number, and tax amounts. Each section must be completed accurately for successful processing.

- Sign and Date: You must sign and date the form before submission. This verifies that the information provided is accurate and complete to the best of your knowledge.

- Timely Submission: Submit the G 7 form by the last day of the month following the end of the quarter. If the due date lands on a weekend or holiday, it is due the next business day.

- Mailing Instructions: Only mail the completed return and payment; do not send the worksheet. Ensure to cut along the dotted line and avoid stapling or using paper clips when mailing your documents.

- Penalties for Late Submission: Late returns may incur penalties. Expect to pay $25, plus 5% of the total tax withheld, each month the return is late, up to a maximum of $25 plus 25% of the total tax withheld.

For questions or more information, reach out to the Georgia Department of Revenue's Withholding Tax Unit at 1-877-GADOR11 (1-877-423-6711).

Browse Other Templates

Wegovy Medical Mutual - This request form ultimately supports patient health by ensuring timely access to vital medications through proper channels.

Wellpoint Prior Authorization Form - Providers should include both the billed amount and the amount received for clarity.