Fill Out Your Georgia St 5 Form

The Georgia ST-5 form serves as an essential tool for those seeking to navigate sales tax exemptions within the state. This certificate allows the purchaser to claim tax-free status on various transactions, provided they meet specific criteria. It covers a range of purchases, including tangible personal property intended for resale, property acquired by government entities, and items used by recognized nonprofit organizations. The form ensures that the exemption process is clear for qualifying buyers, which can include everything from churches and public schools to local authorities providing essential services. Important to note, the form requires careful consideration of how the purchased items will be used, as tax-free treatment does not apply if the products are consumed or utilized beyond the stated exemptions. Proper completion of the Georgia ST-5 form not only protects the interests of the purchaser but also establishes a clear line of accountability for suppliers, as they are responsible for maintaining accurate documentation of exemption certificates. Understanding these details is crucial for any purchaser looking to take advantage of Georgia's sales tax exemption laws.

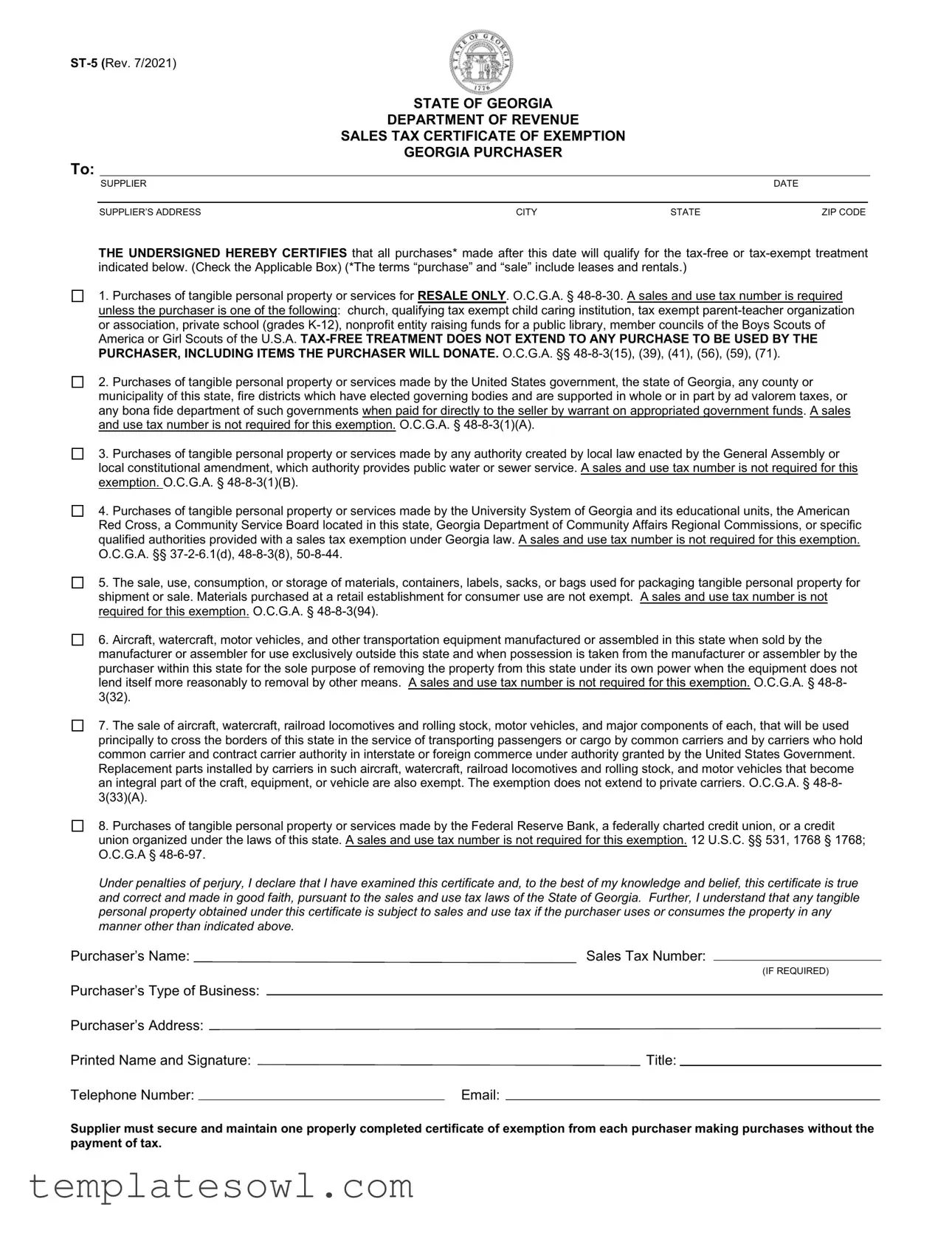

Georgia St 5 Example

STATE OF GEORGIA

DEPARTMENT OF REVENUE

SALES TAX CERTIFICATE OF EXEMPTION

GEORGIA PURCHASER

To:

|

SUPPLIER |

|

|

DATE |

|

|

|

|

|

|

|

SUPPLIER’S ADDRESS |

CITY |

STATE |

ZIP CODE |

||

THE UNDERSIGNED HEREBY CERTIFIES that all purchases* made after this date will qualify for the

1. Purchases of tangible personal property or services for RESALE ONLY. O.C.G.A. §

2. Purchases of tangible personal property or services made by the United States government, the state of Georgia, any county or municipality of this state, fire districts which have elected governing bodies and are supported in whole or in part by ad valorem taxes, or any bona fide department of such governments when paid for directly to the seller by warrant on appropriated government funds. A sales and use tax number is not required for this exemption. O.C.G.A. §

3. Purchases of tangible personal property or services made by any authority created by local law enacted by the General Assembly or local constitutional amendment, which authority provides public water or sewer service. A sales and use tax number is not required for this exemption. O.C.G.A. §

4. Purchases of tangible personal property or services made by the University System of Georgia and its educational units, the American Red Cross, a Community Service Board located in this state, Georgia Department of Community Affairs Regional Commissions, or specific qualified authorities provided with a sales tax exemption under Georgia law. A sales and use tax number is not required for this exemption. O.C.G.A. §§

5. The sale, use, consumption, or storage of materials, containers, labels, sacks, or bags used for packaging tangible personal property for shipment or sale. Materials purchased at a retail establishment for consumer use are not exempt. A sales and use tax number is not required for this exemption. O.C.G.A. §

6. Aircraft, watercraft, motor vehicles, and other transportation equipment manufactured or assembled in this state when sold by the manufacturer or assembler for use exclusively outside this state and when possession is taken from the manufacturer or assembler by the purchaser within this state for the sole purpose of removing the property from this state under its own power when the equipment does not lend itself more reasonably to removal by other means. A sales and use tax number is not required for this exemption. O.C.G.A. §

7. The sale of aircraft, watercraft, railroad locomotives and rolling stock, motor vehicles, and major components of each, that will be used principally to cross the borders of this state in the service of transporting passengers or cargo by common carriers and by carriers who hold common carrier and contract carrier authority in interstate or foreign commerce under authority granted by the United States Government. Replacement parts installed by carriers in such aircraft, watercraft, railroad locomotives and rolling stock, and motor vehicles that become an integral part of the craft, equipment, or vehicle are also exempt. The exemption does not extend to private carriers. O.C.G.A. §

8. Purchases of tangible personal property or services made by the Federal Reserve Bank, a federally charted credit union, or a credit union organized under the laws of this state. A sales and use tax number is not required for this exemption. 12 U.S.C. §§ 531, 1768 § 1768; O.C.G.A §

Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, this certificate is true and correct and made in good faith, pursuant to the sales and use tax laws of the State of Georgia. Further, I understand that any tangible personal property obtained under this certificate is subject to sales and use tax if the purchaser uses or consumes the property in any manner other than indicated above.

Purchaser’s Name: |

Sales Tax Number: |

|

|||

|

|

|

|

|

(IF REQUIRED) |

Purchaser’s Type of Business: |

|

|

|

|

|

|

|

|

|

||

Purchaser’s Address: |

|

|

|

||

Printed Name and Signature: |

Title: |

|

|||

Telephone Number: |

|

|

Email: |

||

Supplier must secure and maintain one properly completed certificate of exemption from each purchaser making purchases without the payment of tax.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Georgia ST-5 form serves as a Sales Tax Certificate of Exemption, allowing certain purchases to be made tax-free. |

| Governing Law | The form is governed by the Official Code of Georgia Annotated (O.C.G.A.) § 48-8-30 and related sections. |

| Purchaser Eligibility | Eligible purchasers include churches, nonprofit entities, and certain government bodies, among others. |

| Tax Number Requirement | A sales and use tax number is required for some purchases but not for government-related exemptions. |

| Exempt Purchases | Exemptions apply to various items, including tangible personal property for resale and services for specific governmental authorities. |

| Certification Declaration | The signer must declare that the certificate is accurate and understand that misuse of the exemption can lead to tax liability. |

Guidelines on Utilizing Georgia St 5

Filling out the Georgia ST-5 form is essential for those who qualify for tax-exempt purchases. Following these steps will help ensure that you complete the form accurately and fulfill necessary requirements. Once you've filled out the form correctly, you'll submit it to your supplier for their records.

- Begin with the "To" section: Write the name of the supplier in the first line.

- Enter the supply details: Complete the date, supplier's address, city, state, and zip code.

- Certify purchases: Check the applicable box that corresponds to the type of exemption you are claiming. Each option pertains to specific categories, such as resale or government purchases.

- Complete the purchaser’s information: Fill in your name, sales tax number (if required), type of business, and your address.

- Sign and print: Provide your printed name and signature, along with your job title.

- Contact details: Lastly, add your telephone number and email address for further correspondence.

Once you have reviewed the completed form for accuracy, submit it to the supplier. Remember, it is crucial to maintain a copy for your records as well.

What You Should Know About This Form

What is the Georgia St 5 form?

The Georgia St 5 form, also known as the Sales Tax Certificate of Exemption, is a document used by purchasers in Georgia to certify their eligibility for sales tax exemption. This form allows individuals or entities to make purchases without paying sales tax, provided they meet specific criteria outlined in the form.

Who should use the Georgia St 5 form?

This form is designed for various purchasers, including churches, non-profit organizations, government entities, educational institutions, and certain businesses that intend to resell items. If you qualify under one of the exemptions listed, you should complete and submit the form to the supplier.

What types of purchases qualify for exemption using this form?

The form covers several types of purchases, such as items for resale, purchases made by government entities, and items used in transportation. It also includes exemptions for specific educational and non-profit organizations. Individual criteria apply, so it's essential to review these carefully to determine eligibility.

Do I need a sales tax number to use the Georgia St 5 form?

A sales tax number is generally required for most purchasers using the form. However, certain exempt entities, such as churches and non-profit organizations, may not need a sales tax number. It is important to verify your specific situation before submitting the form.

Are there any restrictions on items purchased with this exemption?

Yes, the exemption does not apply if the purchaser uses the items for personal use or purposes other than what is explicitly allowed on the form. For instance, donations made by the purchaser are not exempt. Misusing the exemption can lead to penalties or back taxes.

How does one properly complete the Georgia St 5 form?

To complete the form, purchasers must provide their name, sales tax number, type of business, and contact information. Additionally, the purchaser must check the appropriate boxes for exemption categories that apply to their purchases. The form should be signed and dated by an authorized representative.

What happens if I misuse the Georgia St 5 form?

Misuse of the form can lead to serious consequences, including penalties and interest on unpaid sales tax. State authorities may impose these penalties if there is evidence that the form was used improperly. It is crucial to understand your obligations under the sales tax law.

Is the Georgia St 5 form valid indefinitely?

No, the validity of the Georgia St 5 form is not indefinite. It applies to purchases made after the stated date on the form. It is advisable to renew the certificate periodically or whenever there are changes in the purchaser's status or activities that could affect tax exemption eligibility.

Where should I send the completed Georgia St 5 form?

The completed form should be given directly to the supplier. The supplier must maintain a copy of each properly completed certificate to document sales made without sales tax. Ensure that the form is complete before submission to avoid any issues.

Can I obtain the Georgia St 5 form online?

Yes, the Georgia St 5 form can typically be found on the Georgia Department of Revenue's website. Downloading the form is straightforward, and it's usually available in PDF format. Always ensure you are using the most current version of the form for your transactions.

Common mistakes

Filling out the Georgia ST-5 form can be straightforward, but many people make common mistakes that can lead to issues. One of the first errors is failing to check the correct exemption box. Each box is designed for specific situations, and choosing the wrong one can invalidate the exemption and create complications when filing taxes. Carefully read the descriptions before making a selection to avoid this pitfall.

Another common mistake is neglecting to provide complete information. Some individuals forget to fill out essential details such as the purchaser’s name or the sales tax number when required. This omission can delay approval or lead to the rejection of the exemption. It’s crucial to double-check all sections to ensure nothing is left blank.

Inaccurate information is another frequent issue. Providing incorrect addresses or business types can lead to confusion. It’s vital to verify that every detail entered is accurate and corresponds correctly to the business or entity in question.

Additionally, individuals often misunderstand the term “purchases.” It includes not just tangible items but also rentals and leases. Some might incorrectly believe that only physical goods qualify. Clarity on the definition can help prevent incomplete or false claims.

People sometimes fail to realize that tax exemptions do not apply if the items will be used personally or donated. This misunderstanding can result in a costly mistake. Ensure the intended use of the items aligns with the exemption guidelines stated in the form.

Many users do not know the requirements for special exemptions. For instance, government entities have different rules regarding the necessity of a sales tax number. Misunderstanding these nuances can lead to misfiled forms. Familiarizing oneself with these differences is highly recommended.

Another mistake occurs when the signature or printed name is missing. This may seem minor, but omitting a signature invalidates the certificate. Both fields need to be filled out correctly to finalize the document.

Moreover, some individuals forget to include a valid phone number or email address. This information is crucial for any potential follow-up or clarification needed from the supplier. Always include a reachable contact method to ensure smooth communication.

Finally, failing to keep a copy of the completed certificate for personal records is a mistake not to overlook. Documentation is key for future reference and to protect oneself in the event of an audit. Saving copies can facilitate easier accountability and verification later on.

Documents used along the form

The Georgia ST-5 form is a critical document for certifying sales tax exemption in the state. However, several other forms and documents are often used in conjunction with it to facilitate various transactions and comply with state regulations. Below are some of these essential documents.

- Georgia ST-3 Sales Tax Certificate of Exemption: This form allows buyers to certify that they are exempt from sales and use taxes on specific purchases for resale or other qualified purposes. It is crucial for businesses purchasing items to resell.

- Form ST-4 Exempt Organizations Certificate: Nonprofit organizations use this form to claim exemption from sales taxes on purchases related to their exempt activities. Proper documentation must be maintained to confirm the organization’s qualifying status.

- Form ST-5A Agricultural Exemption Certificate: Farmers and agricultural producers utilize this form to obtain sales tax exemption on purchases of items used specifically in agricultural production. It ensures compliance with relevant state laws.

- Form ST-6 Direct Pay Permit: This form allows certain businesses to pay sales tax directly to the state instead of the seller at the time of the transaction. Suitable for large volume purchasers, it simplifies tax payment processes.

- Form ST-7 Exemption for the U.S. Government: This document certifies that a sale to the U.S. government is tax-exempt. It must be provided to sellers to avoid charging sales tax on government purchases.

- Form ST-8 College and University Exemption Certificate: This certificate is used by educational institutions to exempt purchases made for school purposes from sales tax. It reflects the institution's nonprofit status.

- Form ST-10 Sales Tax Exemption Certificate for Interstate Commerce: This form serves businesses engaged in interstate commerce, allowing them to certify that certain purchases are exempt from sales tax due to their out-of-state use.

- Form ST-11 Religious Organizations Exemption Certificate: Churches and religious organizations use this document to claim an exemption from sales tax on purchases related to their religious functions. Valid documentation is essential to maintain compliance.

Understanding and utilizing these forms is vital for ensuring compliance with Georgia's sales tax laws while maximizing tax savings. Each document serves a unique purpose but collectively supports the proper application of exemptions in various contexts.

Similar forms

The Georgia St 5 form serves as a Sales Tax Certificate of Exemption, indicating the circumstances under which certain purchases are exempt from sales tax. Several other documents serve similar purposes in various contexts. Below is a list of these documents and their similarities with the Georgia St 5 form:

- IRS Form W-9: This form is used to provide taxpayer identification information to businesses for tax reporting purposes. Like the Georgia St 5, it offers a means of certifying information relevant to tax exemptions.

- Uniform Sales & Use Tax Certificate: Used in multiple states, this document allows purchasers to claim exemption from sales tax. Similar to the Georgia St 5, it specifies qualifying purchases and requires the purchaser's information.

- Florida Tax Exemption Certificate: This document enables certain organizations in Florida to make tax-exempt purchases. Both forms require specific details about the purchaser and the nature of the exemption.

- California Resale Certificate: This certificate is utilized to purchase goods intended for resale without paying sales tax. Like the Georgia St 5, it specifies the conditions under which tax exemption applies.

- Texas Sales and Use Tax Resale Certificate: This form allows Texas purchasers to buy items for resale without incurring sales tax. It similarly requires the purchaser to provide their sales tax number and business type.

- New York State Exempt Organization Certificate: This document permits qualifying organizations to make tax-exempt purchases in New York. Similar to the Georgia St 5, it has checkboxes for exemption types and requires organization details.

- Oregon Sales Tax Exemption Certificate: In Oregon, this certificate is utilized to assert tax-exempt status for specific purchases. Similarities include purchaser certification and exemption categories.

- Massachusetts Sales Tax Resale Certificate: This form is used by retailers in Massachusetts to buy items for resale without paying sales tax, paralleling the Georgia St 5 in its focus on the resale of tangible personal property.

Each of these documents, like the Georgia St 5 form, serves to clarify tax status and ensure compliance with state tax laws. Accurate completion is essential for purchasers to secure the intended exemptions.

Dos and Don'ts

When filling out the Georgia ST-5 form, there are several important guidelines to follow in order to ensure accuracy and compliance. Here’s what you should and shouldn’t do:

- Do check the applicable box that reflects the reason for tax exemption.

- Do provide your Sales Tax Number if required for your type of business.

- Do ensure that the purchaser’s name and address are filled out completely and accurately.

- Do review the federal and state laws referenced to understand eligibility for exemptions.

- Don't misrepresent the purpose of the purchases as this could lead to penalties.

- Don't forget to sign and date the certificate to validate it.

- Don't include any purchases intended for personal use, as these do not qualify for exemption.

- Don't forget to keep a copy of the completed form for your records.

Following these guidelines can help ensure your form is completed correctly and that all necessary information is provided. This can protect you from potential issues down the line and support your compliance with Georgia’s sales tax laws.

Misconceptions

Here are 7 misconceptions about the Georgia ST-5 form:

- Tax Exemption Applies to All Purchases: Many believe that the ST-5 form allows tax-free purchases for any item. This is incorrect. Tax exemption only applies to specific categories, such as items for resale or purchases made by exempt organizations.

- All Organizations Qualify Automatically: Some assume that any organization can use the ST-5 form to make tax-exempt purchases. However, only qualifying entities like nonprofits, schools, and government bodies are eligible.

- A Sales Tax Number is Always Required: There's a common belief that a sales tax number is necessary for all uses of the ST-5 form. In truth, certain exemptions allow for purchases without requiring a sales tax number.

- All Items Used in Business Qualify: It's a misconception that any item used in business is exempt from sales tax under the ST-5. The exemption does not cover items for internal use, even if utilized for business purposes.

- The Form is Just a Purchase Receipt: Some think the ST-5 is nothing more than a receipt for tax-free transactions. In reality, it is a legal declaration that certifies the intent of the buyer regarding tax-exempt purchases.

- It Can Be Used for Donated Items: A misunderstanding exists that items purchased with the ST-5 for resale can be donated tax-free. This is false; tax-exempt purchases cannot be used for items the purchaser intends to donate.

- Once Submitted, No Further Actions Are Needed: People often believe that completing the ST-5 suffices for all future purchases. In fact, the supplier must keep the completed form on file for verification in case of an audit.

Key takeaways

Understanding the Georgia St 5 form is essential for tax-exempt transactions. Here are the key takeaways:

- Certification Requirement: The form certifies that all purchases made after the specified date are tax-exempt.

- Applicable Purchases: You must specify the type of purchase. Options include resale, government purchases, educational institutions, and more.

- Sales Tax Number: A sales tax number is required for some exemptions. Ensure compliance to avoid unexpected tax liabilities.

- Not for Personal Use: The tax-exempt status does not cover any purchase used for personal use, including donations.

- No Exemption for Retail Purchases: Items intended for consumer use are not exempt, even if they are packaging materials.

- Proper Completion: Ensure the form is filled out correctly. Incomplete forms can lead to complications with tax authorities.

- Retention of Records: Suppliers must maintain the completed St 5 form for all tax-exempt sales for their records.

- Legal Declaration: The form includes a declaration that it is accurate to the best of the signer’s knowledge, carrying legal weight.

- Signature and Contact Information: Remember to include contact details and signatures. This information is crucial for verification purposes.

Using the Georgia St 5 form correctly can simplify tax processes and ensure compliance with state laws. Always double-check your entries for accuracy.

Browse Other Templates

Trampoline Arena Participant Waiver,Airheads Liability Release Form,Trampoline Activity Agreement,Airheads Safety and Risk Acknowledgment,Trampolining Participation Agreement,Airheads Risk Acceptance Form,Trampoline Arena Waiver of Liability,Airheads - The Airheads Agreement is essential for managing risks during trampoline activities.

Imm1017b - This form collects personal information and medical history from the applicant.