Fill Out Your Georgia Hire Reporting Form

The Georgia Hire Reporting Form is an essential tool for employers in the state, ensuring compliance with both federal and state laws. New laws require all employers—whether public or private—to report information about all newly hired, rehired, or returning employees to the New Hire Reporting Program. Timeliness is key; reports must be submitted within 10 days of the employee's hire or rehire date. Failure to provide the necessary information can result in delays, as incomplete forms will not be processed. To facilitate this process, employers can easily access guidance and online reporting options at www.GA-newhire.com. Moreover, the reporting form can be sent via mail or fax to the Georgia New Hire Reporting Program, with dedicated phone lines available for any inquiries. This reporting initiative not only helps in the prevention of fraud but also aids in the administration of various public assistance programs. Ultimately, understanding the requirements of the Georgia Hire Reporting Form is crucial for all employers looking to meet their legal obligations while successfully managing their workforce.

Georgia Hire Reporting Example

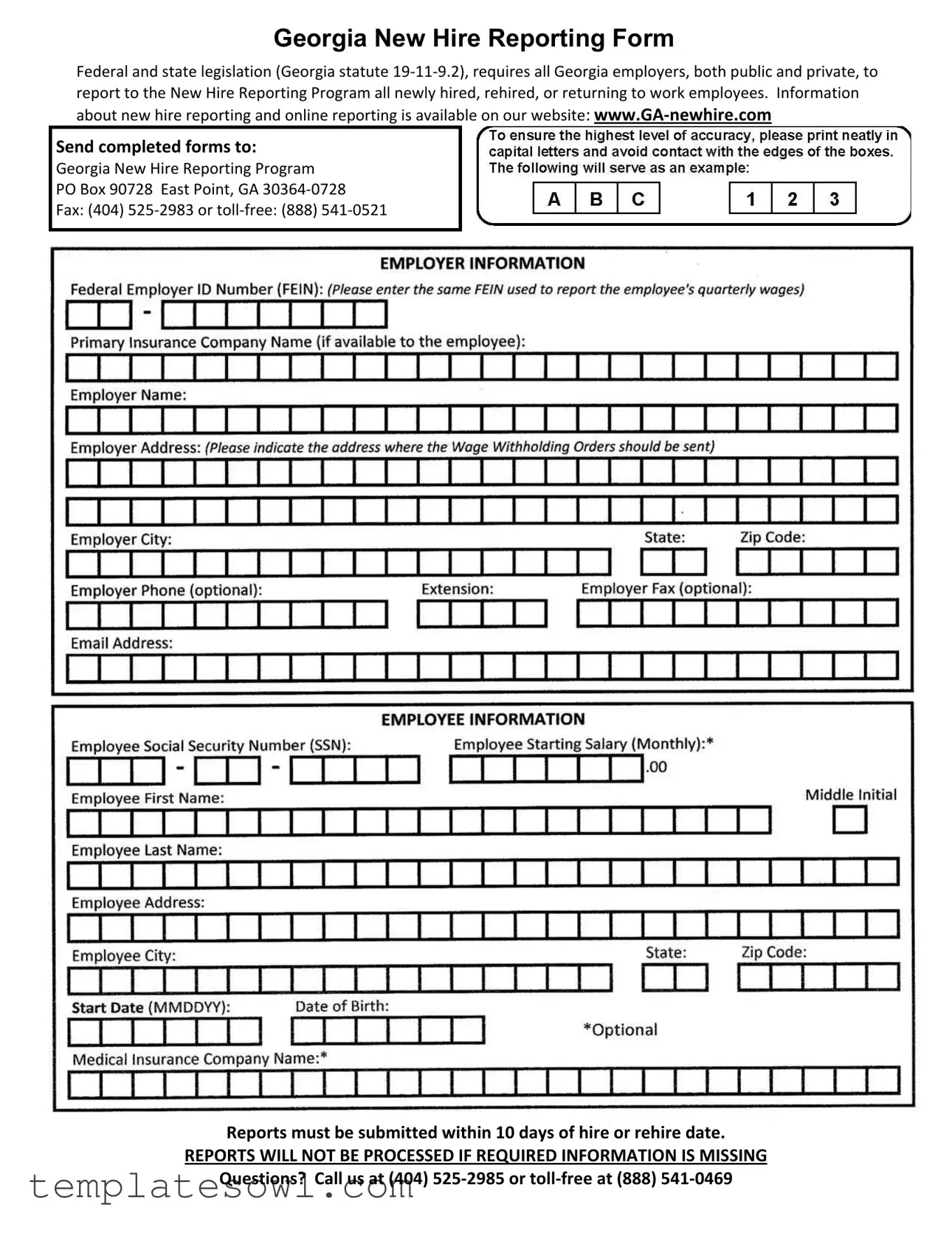

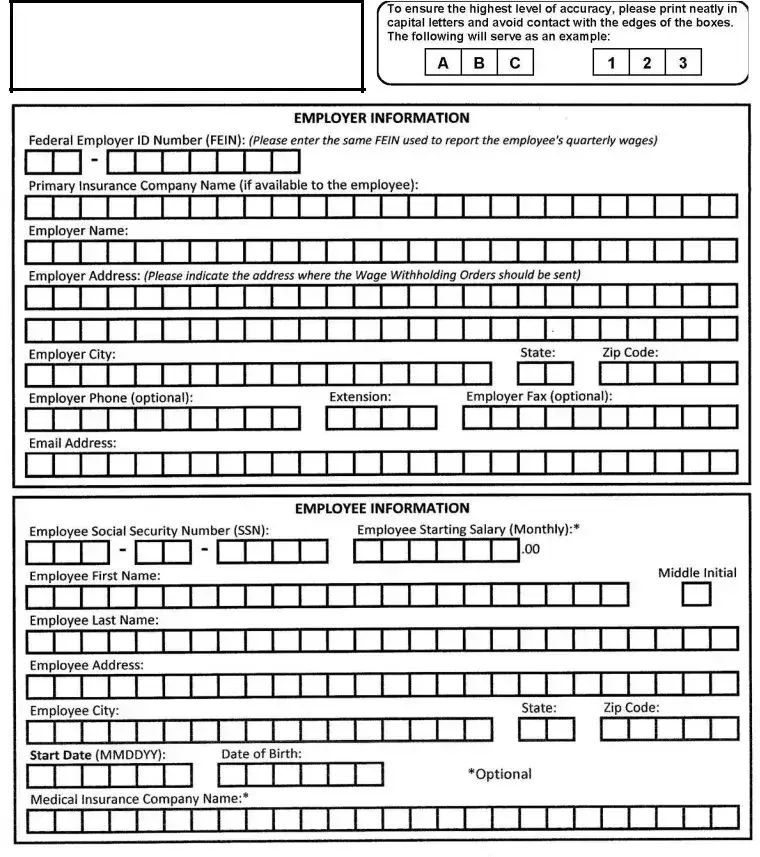

Georgia New Hire Reporting Form

Federal and state legislation (Georgia statute 19‐11‐9.2), requires all Georgia employers, both public and private, to report to the New Hire Reporting Program all newly hired, rehired, or returning to work employees. Information about new hire reporting and online reporting is available on our website: www.GA‐newhire.com

Send completed forms to:

Georgia New Hire Reporting Program

PO Box 90728 East Point, GA 30364‐0728

Fax: (404) 525‐2983 or toll‐free: (888) 541‐0521

Reports must be submitted within 10 days of hire or rehire date.

REPORTS WILL NOT BE PROCESSED IF REQUIRED INFORMATION IS MISSING

Questions? Call us at (404) 525‐2985 or toll‐free at (888) 541‐0469

Form Characteristics

| Fact Name | Description |

|---|---|

| Legal Requirement | All Georgia employers, both public and private, are required by state law (Georgia statute 19‐11‐9.2) to report new hires. |

| Reporting Timeline | Employers must submit reports within 10 days of the employee's hire or rehire date. |

| Types of Employees to Report | Employers must report newly hired, rehired, or returning to work employees. |

| Submission Methods | Reports can be sent by mail, fax, or completed online via the Georgia New Hire Reporting Program website. |

| Mailing Address | Completed forms should be sent to Georgia New Hire Reporting Program, PO Box 90728, East Point, GA 30364‐0728. |

| Fax Information | Employers can fax reports to (404) 525‐2983 or toll-free at (888) 541‐0521. |

| Online Reporting | Details about online reporting can be found at www.GA‐newhire.com. |

| Incomplete Reports | Reports will not be processed if any required information is missing. |

| Contact Information | For questions, employers can call (404) 525‐2985 or toll-free at (888) 541‐0469. |

| Program Purpose | The New Hire Reporting Program helps in locating individuals who owe child support, preventing unemployment insurance fraud, and ensuring workforce accountability. |

Guidelines on Utilizing Georgia Hire Reporting

Once you have filled out the Georgia Hire Reporting form, you'll need to submit it promptly. Ensure that all sections are completed accurately to avoid delays. After submission, the information will be processed, contributing to compliance with state laws regarding employee reporting.

- Begin by downloading or accessing the Georgia New Hire Reporting Form, which can be found on the Georgia New Hire website.

- Fill out the personal information section. This includes the employee's name, social security number, and any other identifying details required.

- Enter the employer's information, such as the company name, address, and contact details.

- Provide the employment details for the new hire, including the hire date and the employee's job title.

- Review the completed form for any missing or erroneous information to ensure all required fields are filled out.

- Once verified, submit the form either by mailing it to the address provided: Georgia New Hire Reporting Program, PO Box 90728, East Point, GA 30364-0728, or by faxing it to (404) 525-2983 or toll-free at (888) 541-0521.

- Make sure to submit the form within 10 days of the hiring or rehire date to comply with the reporting requirements.

If you have any questions at any stage, don't hesitate to reach out to the dedicated support lines provided—either at (404) 525-2985 or toll-free at (888) 541-0469.

What You Should Know About This Form

What is the Georgia Hire Reporting form?

The Georgia Hire Reporting form is a document that employers in Georgia must complete to report new hires, rehired employees, or employees returning to work. This is a legal requirement mandated by both federal and state laws to ensure proper tracking of employment for various purposes, including child support enforcement.

Who is required to submit the Georgia Hire Reporting form?

All employers in Georgia, whether public or private, must submit the Georgia Hire Reporting form for each newly hired, rehired, or returning employee. This includes businesses of all sizes and types, regardless of their industry.

When must the reporting be completed?

Employers must submit the report within 10 days of the hire or rehire date. It is crucial to meet this deadline to comply with the law, as delays may lead to penalties or processing issues.

What happens if required information is missing from the form?

If the Georgia Hire Reporting form is submitted without the necessary information, the report will not be processed. It is essential to ensure that all required fields are completed accurately to avoid complications.

How do I submit the Georgia Hire Reporting form?

You can submit the completed form by mailing it to the Georgia New Hire Reporting Program at PO Box 90728, East Point, GA 30364‐0728. Alternatively, you can send it via fax to (404) 525‐2983 or toll-free at (888) 541‐0521. Online reporting is also available on the website www.GA-newhire.com.

Where can I get assistance with the Georgia Hire Reporting form?

If you have questions or need help, you can call the Georgia New Hire Reporting Program at (404) 525‐2985 or toll-free at (888) 541‐0469. They can provide guidance and answer any questions you may have about the reporting process.

Common mistakes

Filling out the Georgia Hire Reporting form is a crucial task for employers. However, many individuals make errors that can lead to complications. One common mistake is forgetting to submit the form within the required timeframe. According to Georgia law, reports must be sent within 10 days of the hire or rehire date. Missing this deadline can result in penalties or delays in processing the new hire's information.

Another frequent error involves not providing complete information. The form requires specific details about the new employee, and failing to include any required data can prevent the report from being processed. Employers should carefully review the form to ensure all sections are filled out accurately. Incomplete forms will delay the reporting process and potentially cause issues down the line.

Many people also overlook the option for online reporting. While there’s a paper form, the online route is often faster and more efficient. Not taking advantage of this digital option can lead to unnecessary delays, especially for those who might be more comfortable with technology. Employers should explore online resources available at www.GA-newhire.com for easier submission.

Lastly, some employers fail to keep a record of their submitted forms. It’s important to have documentation for your records. If any questions arise later about a new hire, having proof of submission can aid in resolving any discrepancies. Keeping a copy of the submitted report can save time and stress in the future.

Documents used along the form

The Georgia Hire Reporting form is an essential document that aids in maintaining accurate records of newly hired, rehired, or returning employees. In addition to this form, there are several other documents that commonly accompany the reporting process. These forms are crucial for ensuring compliance with both federal and state regulations, and they assist employers in managing their workforce effectively. Below is a list of related documents that may be required or beneficial to complete and submit alongside the Georgia Hire Reporting form.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax withholding from an employee's paycheck.

- I-9 Form: This document is required by the U.S. Citizenship and Immigration Services (USCIS) for verifying the identity and employment authorization of individuals hired for employment in the United States.

- Employee Handbook Acknowledgment: Employees typically sign an acknowledgment form to confirm they have received the employee handbook. This document clarifies workplace policies and expectations.

- Direct Deposit Authorization Form: This form authorizes the employer to deposit employees' paychecks directly into their bank accounts, streamlining the payment process.

- Benefits Enrollment Form: If the employer offers benefits, this form allows new employees to enroll in health insurance, retirement plans, and other available benefits.

- Emergency Contact Form: Employees complete this document to provide contact information for someone to reach in case of an emergency at work.

- State Tax Withholding Form: Similar to the W-4, this form is state-specific and outlines the amount of state tax to be withheld from an employee's paycheck.

- Job Description Agreement: This document provides a clear description of the employee’s role and responsibilities within the organization, ensuring mutual understanding of job expectations.

Completing these forms in conjunction with the Georgia Hire Reporting form can help create a smooth onboarding process for new employees. Staying organized and thorough in your record-keeping will not only help you comply with necessary regulations but also foster a positive work environment for your employees.

Similar forms

The Georgia Hire Reporting form shares similarities with several other documents related to employee reporting and compliance. Here is a list of nine documents that are comparable:

- Federal New Hire Reporting Form: Similar to the Georgia form, it is mandated by federal law that all employers report newly hired and re-hired employees to their respective state programs within a specified timeframe.

- State Unemployment Insurance Report: This report requires employers to submit information on newly hired employees to help monitor and manage unemployment insurance claims, just as the Georgia Hire Reporting form does.

- W-4 Form: The IRS Form W-4 is filled out by employees to determine federal tax withholding. Both the W-4 and the Georgia Hire Reporting form collect essential information about new employees.

- Employee Eligibility Verification Form (I-9): The I-9 form is used to verify a new employee's identity and employment authorization, similar to the reporting requirements for new hires in Georgia.

- State Tax Withholding Forms: Each state has its own withholding form that must be completed by new employees. Like the Georgia form, these documents are crucial for tax reporting purposes.

- Employee Information Form: Many organizations have their own employee information forms that gather data on new hires, paralleling the data collected in the Georgia Hire Reporting form.

- Health Insurance Marketplace Form: Employers must provide information about new hires to the health insurance marketplace as required by the Affordable Care Act, akin to the reporting obligations defined by Georgia law.

- Workers' Compensation Insurance Reporting: When hiring new staff, employers must often report this to their workers' compensation insurance provider, reflecting the proactive approach seen in the Georgia Hire Reporting form.

- EEO-1 Report: This report is mandatory for certain employers under federal law and requires demographic information about employees, which aligns with the reporting focus of the Georgia form.

Dos and Don'ts

Filling out the Georgia Hire Reporting form requires careful attention to ensure compliance with the law. Here’s a helpful guide to navigate the process. Below are things you should and shouldn’t do.

- Do complete the form accurately with all required information.

- Don’t leave any mandatory fields blank; missing information will delay processing.

- Do submit the form within 10 days of the new hire or rehire date.

- Don’t forget to include the employee's Social Security Number; it is vital for identification purposes.

- Do use the designated addresses and fax numbers provided for submitting the form.

- Don’t use outdated forms; always check for the most current version on the website.

- Do keep a copy of the completed form for your records.

- Don’t hesitate to reach out if you have questions; resources are available for assistance.

Following these guidelines will help ensure a smooth submission process and compliance with Georgia state regulations.

Misconceptions

Many people hold misconceptions about the Georgia Hire Reporting form. Understanding the facts can help ensure compliance and avoid unnecessary complications. Below are eight common misconceptions:

- Only some employers need to report new hires. All Georgia employers, regardless of size or type, must report newly hired, rehired, or returning employees.

- Reports can be submitted at any time. Employers must submit reports within 10 days of the hire or rehire date to satisfy legal requirements.

- All forms can be submitted online. While online reporting is available, completed forms can also be mailed or faxed to the program.

- Missing information won’t affect the submission. Reports that lack required information will not be processed, which can lead to delays and issues.

- The program is only for full-time employees. Reporting is mandatory for all types of employment arrangements, including part-time and temporary workers.

- Only new employees need to be reported. Rehired employees or those returning to work after a break in service also require reporting.

- There are no penalties for late reporting. Delayed submissions can result in fines or additional complications for employers.

- The reporting process is overly complicated. The form is designed for simplicity, and resources are available to assist with any questions or concerns.

Clarifying these misconceptions can help employers navigate the reporting process more effectively.

Key takeaways

Here are some essential takeaways regarding the Georgia Hire Reporting form:

- Mandatory Reporting: Every employer in Georgia, whether public or private, is legally required to report new hires, rehired, or returning employees.

- Submission Timeline: Reports must be submitted within 10 days of the hire or rehire date to comply with state regulations.

- Complete Information: Incomplete reports will not be processed, so it is crucial to ensure all required information is provided.

- Various Submission Methods: Completed forms can be sent through mail, fax, or online, offering flexibility to employers.

- Contact Resources: Employers can obtain assistance with questions by calling either the local number (404) 525-2985 or the toll-free number (888) 541-0469.

- Online Information: Additional resources and information can be found on the official website: www.GA-newhire.com.

Understanding and adhering to these points will help ensure compliance with Georgia's new hire reporting requirements.

Browse Other Templates

Fim Meaning - Evaluating problem-solving skills and decision-making abilities.

How to Ask for Donations Examples - Walmart’s donation support is designed for local organizations committed to making a difference.

How to Make a Job Application Form - The form prompts candidates to identify which of their previous jobs they enjoyed the most.