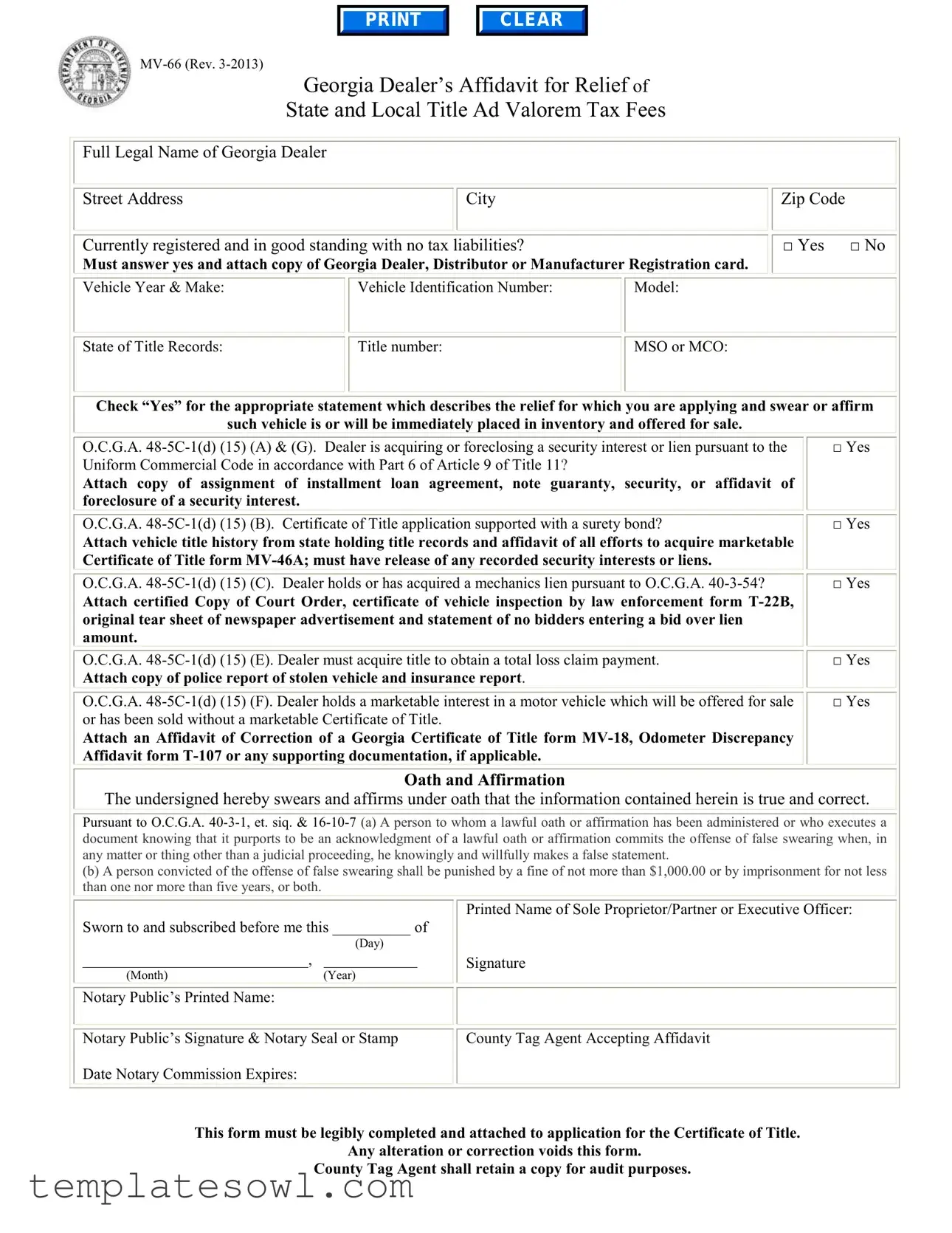

Fill Out Your Georgia Mv 66 Form

For motor vehicle dealers in Georgia, understanding and properly utilizing the MV-66 form is essential for navigating the complexities of vehicle titling and tax relief. This crucial document, known as the Dealer’s Affidavit for Relief of State and Local Title Ad Valorem Tax Fees, serves multiple purposes and assists dealers in obtaining tax exemptions under specific circumstances. Firstly, it verifies that the dealer is registered in good standing, requiring them to affirm that they have no outstanding tax liabilities while providing their full legal name and address. The form prompts the dealer to specify details about the vehicle, including the year, make, model, and identification number, to establish eligibility for tax relief. Various scenarios allow for tax exemption, such as acquiring a security interest under the Uniform Commercial Code or dealing with a vehicle that has experienced theft or is subject to a mechanics lien. To support claims, the dealer must include additional documentation, which may vary based on the specific relief being sought. Notably, the MV-66 form also emphasizes the importance of accuracy and truthfulness; any false statements can lead to serious legal consequences. Notarization is required to validate the submitted information, thus reinforcing the form’s integrity. As dealers navigate the intricacies of vehicle sales and registrations in Georgia, the MV-66 form remains a vital tool in their operational framework.

Georgia Mv 66 Example

CLEAR

Georgia Dealer’s Affidavit for Relief of

State and Local Title Ad Valorem Tax Fees

Full Legal Name of Georgia Dealer

Street Address |

|

City |

|

|

|

Currently registered and in good standing with no tax liabilities?

Must answer yes and attach copy of Georgia Dealer, Distributor or Manufacturer Registration card.

Zip Code

Zip Code

□ Yes □ No

Vehicle Year & Make:

Vehicle Identification Number:

Model:

State of Title Records:

Title number:

MSO or MCO:

Check “Yes” for the appropriate statement which describes the relief for which you are applying and swear or affirm

such vehicle is or will be immediately placed in inventory and offered for sale.

O.C.G.A.

Attach copy of assignment of installment loan agreement, note guaranty, security, or affidavit of foreclosure of a security interest.

O.C.G.A.

Attach vehicle title history from state holding title records and affidavit of all efforts to acquire marketable Certificate of Title form

O.C.G.A.

Attach certified Copy of Court Order, certificate of vehicle inspection by law enforcement form

O.C.G.A.

□Yes

□Yes

□Yes

□Yes

O.C.G.A.

Attach an Affidavit of Correction of a Georgia Certificate of Title form

Oath and Affirmation

□ Yes

The undersigned hereby swears and affirms under oath that the information contained herein is true and correct.

Pursuant to O.C.G.A.

(b)A person convicted of the offense of false swearing shall be punished by a fine of not more than $1,000.00 or by imprisonment for not less than one nor more than five years, or both.

Sworn to and subscribed before me this __________ of

|

(Day) |

_____________________________, |

____________ |

(Month) |

(Year) |

|

|

Notary Public’s Printed Name: |

|

|

|

Notary Public’s Signature & Notary Seal or Stamp Date Notary Commission Expires:

Printed Name of Sole Proprietor/Partner or Executive Officer:

Signature

County Tag Agent Accepting Affidavit

This form must be legibly completed and attached to application for the Certificate of Title.

Any alteration or correction voids this form. County Tag Agent shall retain a copy for audit purposes.

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The Georgia MV-66 form serves as a Dealer’s Affidavit for Relief of State and Local Title Ad Valorem Tax Fees. |

| Governing Law | The form is governed by O.C.G.A. 48-5C-1(d) for tax relief applications. |

| Eligibility Requirements | Dealers must confirm their registration status and tax liabilities by answering "Yes" and attaching their registration card. |

| Vehicle Information | Necessary vehicle details include year, make, and VIN, which must all be accurately provided on the form. |

| Documentation Needed | Additional documentation may be required based on the relief sought, such as loan agreements or title histories. |

| Notary Requirement | The form must be notarized to attest to the truthfulness of the information provided and to comply with legal standards. |

| Consequences of False Statements | A person may face penalties, including fines or imprisonment, for making false statements in the affidavit under O.C.G.A. 16-10-7. |

Guidelines on Utilizing Georgia Mv 66

To successfully complete the Georgia MV-66 form, follow the detailed steps below. Completing this form accurately is crucial for processing your application, and all required attachments must be included for a smooth submission.

- Enter your full legal name as a Georgia dealer.

- Fill in your street address, city, and zip code.

- Select Yes or No to indicate whether you are currently registered and in good standing with no tax liabilities. If you select Yes, attach a copy of your Georgia Dealer, Distributor, or Manufacturer Registration card.

- Provide the vehicle year & make, vehicle identification number, model, state of title records, and title number.

- If applicable, indicate whether you are applying for relief due to the acquisition or foreclosure of a security interest or lien by selecting Yes. Attach the relevant documentation.

- If you are applying for relief supported with a surety bond, indicate Yes and attach the required documentations including the vehicle title history and affidavit of efforts to acquire a marketable certificate of title.

- Select Yes if you hold or have acquired a mechanics lien and attach the necessary certified copy of the court order and other required documentation.

- If applicable, indicate that you must acquire title for a total loss claim payment by selecting Yes and attach the police report and insurance report.

- If you have a marketable interest in a vehicle offered for sale or already sold without a title, select Yes, and attach supporting documentation.

- Complete the Oath and Affirmation section by checking Yes to affirm that the information is true and correct.

- Sign and date the form.

- Have a notary public witness your signature and complete their section, including their printed name, signature, seal or stamp, and commission expiration date.

- Print the name of the sole proprietor, partner, or executive officer and provide their signature.

- Submit the form along with your application for the Certificate of Title. Ensure all alterations or corrections are avoided, as they may void the form.

- Remember, the County Tag Agent will retain a copy for audit purposes.

What You Should Know About This Form

What is the purpose of the Georgia MV-66 form?

The Georgia MV-66 form is a Dealer’s Affidavit for Relief of State and Local Title Ad Valorem Tax Fees. It is used by licensed Georgia dealers to apply for relief from certain fees associated with the title ad valorem tax when specific criteria are met. This form helps dealers demonstrate their eligibility for exemptions and facilitates the proper handling of vehicle sales and titles.

Who is eligible to fill out the MV-66 form?

Only licensed Georgia dealers, distributors, or manufacturers can complete the MV-66 form. They must be registered and in good standing with the state, having no outstanding tax liabilities. To confirm their registration, dealers must attach a copy of their Georgia Dealer, Distributor, or Manufacturer Registration card when submitting the form.

What information is required on the MV-66 form?

The form requires several key pieces of information including the dealer’s full legal name, street address, city, and zip code. Additionally, the dealer must provide details about the vehicle in question, such as its year, make, Vehicle Identification Number (VIN), state of title records, and title number. This information ensures that the application is tied to a specific vehicle.

What should a dealer do if they are foreclosing a lien?

If a dealer is acquiring or foreclosing a lien under the Uniform Commercial Code, they need to check the relevant box on the form and attach supporting documentation. This may include a copy of the assignment of the installment loan agreement, a note guaranty, or an affidavit of foreclosure. This documentation is crucial to validate the dealer's claim for relief.

Can the MV-66 form be used if the dealer does not have a marketable Certificate of Title?

Yes, it can. Dealers may indicate they hold or have acquired a vehicle without a marketable Certificate of Title. In this case, they must provide additional supporting documentation, such as an Affidavit of Correction or an Odometer Discrepancy Affidavit, to explain the circumstances and demonstrate their rights to the vehicle.

What happens if the information provided on the MV-66 form is false?

Providing false information on the MV-66 form is a serious offence known as false swearing. If convicted, the offender may face a fine of up to $1,000 or even imprisonment for one to five years, or both. It is essential that all information on the form is accurate and truthful to avoid legal repercussions.

Is a notary required for the MV-66 form?

Yes, the MV-66 form must be sworn to and subscribed before a notary public. The notary's signature, printed name, and official seal must be included on the form, along with the date the notary commission expires. This requirement adds a layer of verification and ensures that the affidavit is executed properly.

What should I do if I make a mistake on the MV-66 form?

Any alteration or correction to the MV-66 form will void it. Therefore, it is important to complete the form legibly and accurately from the start. If a mistake is made, it is advisable to fill out a new form rather than trying to correct the original one, ensuring it remains valid for submission.

How is the MV-66 form submitted?

The completed MV-66 form must be attached to the application for the Certificate of Title. It is typically submitted to the County Tag Agent, who will review it for completeness and accuracy before processing the title application. Dealers should keep a copy for their records as the County Tag Agent retains another for audit purposes.

What are the consequences of not having a notary on the MV-66 form?

The absence of a notary on the MV-66 form will result in the form being considered invalid. Notarization serves to confirm the identity of the person signing the affidavit and guarantees that the information is provided under oath. Dealers should ensure this step is completed to avoid delays in processing their title applications.

Common mistakes

Completing the Georgia MV-66 form is a critical step for dealers seeking relief from title ad valorem tax fees. However, errors during this process can lead to delays or rejections. Understanding common mistakes can help ensure a smoother experience. Below are five frequent missteps.

First, many individuals fail to confirm their current registration status. The form requires the dealer to answer whether they are "currently registered and in good standing with no tax liabilities." A simple "yes" does not suffice. Dealers must also attach a copy of their Georgia Dealer, Distributor, or Manufacturer Registration card. Neglecting to provide this documentation can cause the application to be incomplete.

Another mistake involves the vehicle information section. Some applicants do not accurately fill in the title number or the Vehicle Identification Number (VIN). Missing or incorrect VINs can lead to significant complications, including disputes over vehicle ownership or delays in processing. Accuracy and clarity are paramount in this portion of the form.

The third common error revolves around the attachments required for different relief categories. For instance, if a dealer is applying under the mechanics lien provision, they must attach a certified copy of the court order and other specified documents. Failing to include the necessary paperwork can prevent the application from moving forward, leading to frustration and delays.

Additionally, many dealers overlook the oath and affirmation section. This part requires the dealer to swear that the information provided is true. If this section is not properly filled out, the application may be considered false, which can carry serious penalties. Understanding the implications of false swearing is essential before submitting the form.

Lastly, applicants often forget to check the necessary boxes indicating their reason for relief. Each option requires a corresponding attachment. If any required box is left unchecked, it indicates that no relief is sought, which nullifies the purpose of the form. Attention to detail in this area is crucial for compliance and to avoid denial.

By avoiding these five common mistakes—ensuring proper registration confirmation, accurately filling in vehicle information, attaching the correct documents, completing the oath section, and checking all appropriate boxes—dealers can streamline their application process. Thoroughness in completing the Georgia MV-66 form not only fosters efficiency but also supports compliance with state regulations.

Documents used along the form

The Georgia MV 66 form is an important document used by dealers in the state when applying for relief from state and local Title Ad Valorem Taxes. It is part of a broader process that often requires additional forms and documents to fulfill various legal and regulatory requirements. Below are other forms commonly associated with the MV 66 form.

- MV-46A: This is an application for a Certificate of Title supported by a surety bond. It requires a vehicle title history and an affidavit detailing efforts to acquire the original title. This form helps in situations where the title cannot be readily acquired.

- T-22B: This form is a vehicle inspection certificate that law enforcement officers complete. It is necessary for dealers who hold or acquire a mechanics lien and must provide evidence of the vehicle's condition.

- MV-18: Known as the Affidavit of Correction of a Georgia Certificate of Title, this form is used when corrections are needed on a title. It helps establish accurate ownership and vehicle history.

- T-107: This is an Odometer Discrepancy Affidavit, used when there is a mismatch between the recorded odometer reading and the actual miles driven. This form assists in clarifying discrepancies during the title transfer process.

- Insurance Report: When a vehicle is considered a total loss, dealers must provide a report from the insurance company confirming the loss status. This document supports the claim for title acquisition.

- Police Report: In cases where a vehicle is stolen, a police report must be provided to substantiate the theft. This is important for processing insurance claims and obtaining a new title.

- Certified Copy of Court Order: Required when a dealer has acquired a mechanics lien, this document shows legal authority to possess the vehicle, affirming the validity of the claim over the vehicle.

- Assignment of Installment Loan Agreement: This document is attached for dealers acquiring a security interest in a vehicle. It outlines the agreement terms and rights over the vehicle being financed.

- Original Tear Sheet: For mechanics lien claims, dealers need to provide a tear sheet from a newspaper advertisement. This demonstrates compliance with required notice provisions before the lien was enforced.

Each of these supporting documents plays a crucial role in the context of the MV 66 form, ensuring compliance with Georgia law and facilitating the proper transfer and registration of vehicle titles. Accurate completion and accompanying these documents can streamline the process, minimizing potential delays or legal complications.

Similar forms

- Certificate of Title Application (Form MV-46A): This document is similar to the MV-66 in that it serves as a formal request to obtain a title for a vehicle. Both forms require supporting documentation and information concerning the current ownership status and any liens on the vehicle.

- Affidavit of Correction (Form MV-18): Like the MV-66, the Affidavit of Correction addresses situations where there are inaccuracies in the title documents. This form provides a way for dealers to correct issues related to the vehicle’s title while ensuring compliance with state regulations.

- Odometer Discrepancy Affidavit (Form T-107): This document is used when there is a difference between the odometer reading on the title and the actual mileage of the vehicle. Similar to the MV-66, it ensures that the motor vehicle sale is compliant with state requirements and helps protect against fraud.

- Mechanics Lien Documentation: The mechanics lien documentation is required when a dealer claims a lien on a vehicle for services rendered. This document parallels the MV-66 in its verification of a claim against the vehicle, along with a requirement for supporting legal documentation.

- Security Interest Documentation under UCC: Like the MV-66, this documentation is crucial for dealers who are obtaining or foreclosing a security interest in a vehicle. It involves the Uniform Commercial Code and ensures the proper handling of security interests in transactions.

- Application for Total Loss Claim Payment: This form is necessary when a dealer needs to file a claim for a vehicle that has been declared a total loss. It shares similarities with the MV-66 regarding the need for certifying information and providing supporting evidence to finalize a claim.

Dos and Don'ts

When filling out the Georgia MV-66 form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here’s a list of important dos and don’ts to consider:

- Do provide your full legal name as a Georgia dealer.

- Do ensure that the dealer is currently registered and in good standing, answering "yes" if applicable.

- Do attach the necessary supporting documentation for the relief category you are applying under.

- Do use clear and legible handwriting when completing the form.

- Don't leave any sections of the form blank; all required fields must be filled out.

- Don't make any alterations to the form, as corrections can void it.

- Don't provide false information; doing so can result in criminal charges.

- Don't forget to obtain a notary signature and seal, as this is a critical step for the affidavit.

Misconceptions

The Georgia MV-66 form often generates confusion. Here are five common misconceptions along with clarifications:

-

Only licensed dealers can complete the MV-66 form.

While the form is primarily for Georgia dealers, it can also be utilized by distributors or manufacturers. This includes any entity involved in the vehicle sales process.

-

Filling out the MV-66 form guarantees tax relief.

The submission of the form does not automatically ensure that the dealer will receive tax relief. Eligibility depends on meeting specific conditions outlined in the form and relevant laws.

-

All documents required must be submitted with the MV-66 form.

While certain documents need to be attached depending on the claim being made, not every submission guarantees the same required paperwork. Each situation may vary, so it's important to read the instructions carefully.

-

There is no penalty for providing false information on the form.

Providing incorrect information can lead to serious repercussions. Under O.C.G.A. 40-3-1 and 16-10-7, false swearing is a punishable offense, which may result in fines or imprisonment.

-

The MV-66 form can be altered after submission.

Any modifications made to the MV-66 form render it void. It is crucial to ensure all information is accurate and complete at the time of submission to avoid complications.

Key takeaways

When completing and using the Georgia MV-66 form, keep the following key points in mind:

- Correct Information: Ensure all information is accurate and complete. This includes your legal name, address, and vehicle details such as make, model, and VIN.

- Regulatory Compliance: Verify that you are registered as a Georgia dealer and in good standing. Attach a copy of your registration card if applicable.

- Required Attachments: Depending on your situation, attach any necessary documents, such as an affidavit of foreclosure, a police report, or a title history. Each situation has specific requirements.

- Oath of Truthfulness: Sign the form under oath, affirming that your statements are true. False statements can lead to serious consequences, including fines or imprisonment.

Remember to keep a copy of the form for your records and submit it along with your Certificate of Title application. Incomplete forms or any alterations made can lead to rejection of the affidavit.

Browse Other Templates

Ssa Forms - Comprehensive instructions accompany the form to assist applicants in completing it accurately.

Jobapscloud Ct - The current version of the form became effective on October 1, 2010; ensure you’re using the right one.