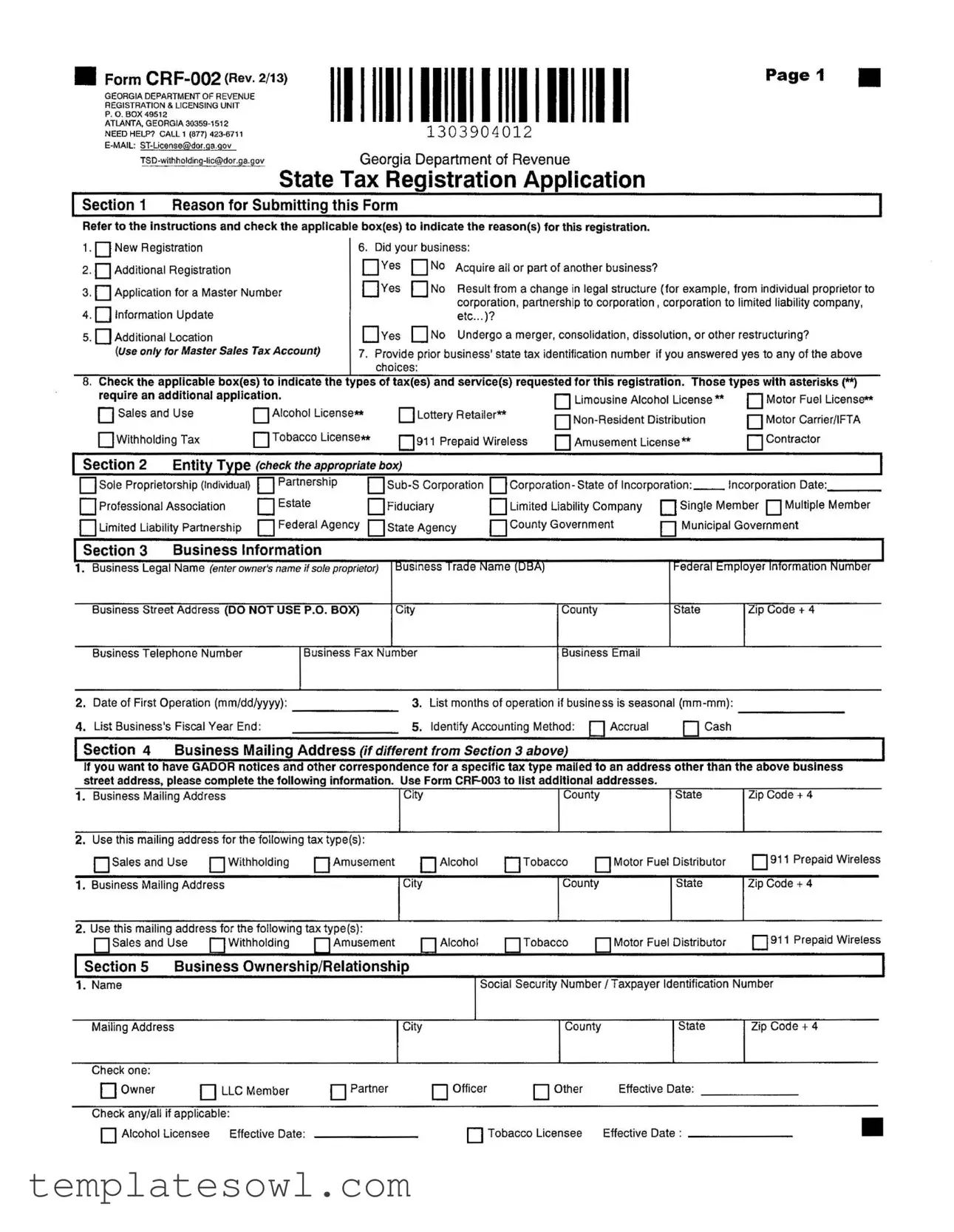

Fill Out Your Georgia State Tax Instruction Form

Understanding the Georgia State Tax Instruction form is crucial for business owners looking to register their operations in the Peach State. This single-page document, formally known as Form CRF-002, provides a comprehensive framework that guides users through the registration process with the Georgia Department of Revenue. The form is divided into several key sections. In the first section, registrants must provide their reasons for submitting the form, whether it's for a new registration, information update, or application for a master number. Identifying the type of tax involved—from sales and use to withholding taxes—helps streamline the registration process. The second section requests details about the entity type, enabling the Department to understand the nature of your business structure—be it a sole proprietorship, corporation, or limited liability company. The third section delves into essential business information, such as the legal and trade names, addresses, and contact information. There's even space to specify the mailing address for tax correspondence, ensuring businesses receive important notices in a timely manner. Furthermore, understanding ownership dynamics is vital, and the form accommodates various ownership structures and responsibilities. Finally, the document includes a section for authorized contact information, emphasizing the seriousness of accurate reporting under Georgia law. In summary, Form CRF-002 is not just a bureaucratic step; it serves as the foundation for your business's relationship with state tax authorities, impacting operations in various ways.

Georgia State Tax Instruction Example

■ Form |

1303904012 |

Page 1 |

GEORGIA DEPARTMENT OF REVENUE REGISTRATION & LICENSING UNIT

P. O. BOX 49512

ATLANTA, GEORGIA

ОЛППЛЛЛ1 n

l3039040l2

Georgia Department of Revenue

State Tax Registration Application

Section 1 Reason for Submitting this Form

Refer to the instructions and check the applicable box(es) to indicate the reason(s) for this registration.

1 • New Registration

2.Additional Registration

3.Application for a Master Number

4.Information Update

5.Additional Location

(Use only for Master Sales Tax Account)

6. Did your business:

Yes |

No |

Acquire all or part of another business? |

Yes |

No |

Result from a change in legal structure (for example, from individual proprietor to |

|

|

corporation, partnership to corporation, corporation to limited liability company, |

|

|

etc...)? |

Yes |

No |

Undergo a merger, consolidation, dissolution, or other restructuring? |

7.Provide prior business' state tax identification number if you answered yes to any of the above choices:

8. Check the applicable box(es) to indicate the types of tax(es) and service(s) requested for this registration. Those types with asterisks (**)

require an additional application. |

|

|

Limousine Alcohol License** |

Motor Fuel License** |

|||||

| | Sales and Use |

| |

| Alcohol License** |

Lottery Retailer** |

||||||

Motor Carrier/IFTA |

|||||||||

|

|

|

|

|

|

||||

Withholding Tax |

□Tobacco License** |

911 Prepaid Wireless |

Amusement License** |

| | Contractor |

|||||

| Section 2 |

Entity Type (check the appropriate box) |

|

|

|

] |

||||

Sole Proprietorship (Individual) |

| |

| Partnership |

| Corporation - State of Incorporation: |

Incorporation Date:. |

|||||

Professional Association |

| |

| Estate |

Fiduciary |

Limited Liability Company |

Single Member | | Multiple Member |

||||

Limited Liability Partnership |

|

Federal Agency |

State Agency |

County Government |

[ | Municipal Government |

||||

| Section 3 |

Business Information |

|

|

|

j |

||

1. |

Business Legal Name (enter owner's name if sole proprietor) |

Business Trade Name (DBA) |

Federal Employer Information Number |

||||

|

Business Street Address (DO NOT USE P.O. BOX) |

City |

County |

State |

Zip Code + 4 |

||

|

Business Telephone Number |

Business Fax Number |

Business Email |

|

|

||

2. |

Date of First Operation (mm/dd/yyyy): |

|

3. |

List months of operation if business is seasonal |

|

||

4. |

List Business's Fiscal Year End: |

|

5. |

Identify Accounting Method: □Accrual |

□Cash |

|

|

I Section 4 Business Mailing Address (if different from Section 3 above)

If you want to have GADOR notices and other correspondence for a specific tax type mailed to an address other than the above business street address, please complete the following information. Use Form

1. Business Mailing Address |

City |

County |

State |

Zip Code + 4 |

2. Use this mailing address for the following tax type(s):

Salesand Use | [Withholding □Amusement [ | Alcohol | |Tobacco | [Motor Fuel Distributor | |911 Prepaid Wireless

1. Business Mailing Address |

City |

County |

State |

Zip Code + 4 |

2. Use this mailing address for the following tax type(s):

[ [Sales and Use I [Withholding I [Amusement | | Alcohol | | Tobacco | | Motor Fuel Distributor 911 Prepaid Wireless

Section 5 |

Business Ownership/Relationship |

|

|

|

| |

||

1. Name |

|

|

|

Social Security Number/Taxpayer Identification Number |

|||

Mailing Address |

|

|

City |

|

County |

State |

Zip Code + 4 |

Check one: |

|

|

|

|

|

|

|

Owner |

|

LLC Member |

Partner |

Officer |

Other |

Effective Date: |

|

Check any/all if applicable: |

|

|

|

|

|

||

Alcohol Licensee |

Effective Date: |

|

|

Tobacco Licensee |

Effective Date : |

|

|

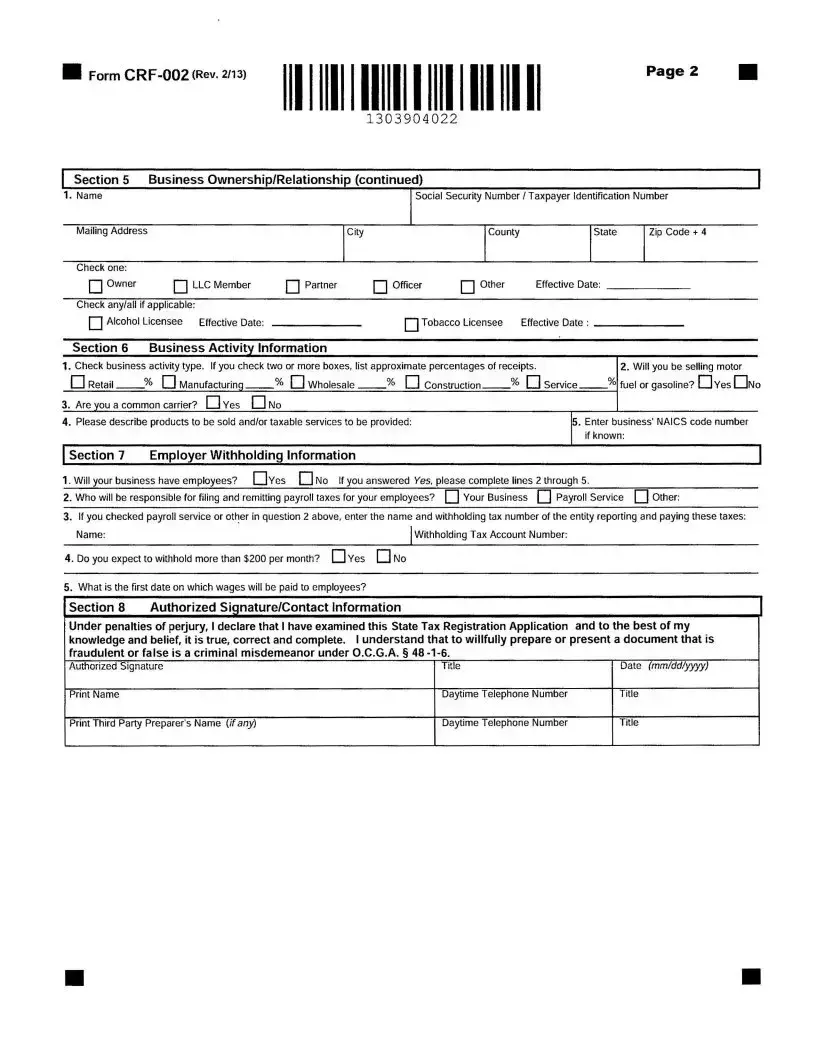

■ Form |

1303904022 |

Page 2 |

■ |

1303904022

| |

Section 5 |

|

Business Ownership/Relationship (continued) |

|

|

|

|

| |

|||||

1. |

Name |

|

|

|

|

|

|

Social Security Number/Taxpayer Identification Number |

|||||

|

Mailing Address |

|

|

|

City |

|

|

County |

|

State |

Zip Code + 4 |

||

|

Check one: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner |

|

I |

I LLC Member |

| |

| Partner |

| | Officer |

| | Other |

|

Effective Date: |

|

||

|

Check any/all if applicable: |

|

|

|

|

|

|

|

|

|

|||

|

I I Alcohol Licensee |

Effective Date: |

|

|

| |

| Tobacco Licensee |

|

Effective Date : |

|

||||

|

Section 6 |

|

Business Activity Information |

|

|

|

|

|

|

|

|||

1. Check business activity type. If you check two or more boxes, list approximate percentages of receipts. |

|

2. Will you be selling motor |

|||||||||||

1 |

1 Retail |

% П Manufacturing |

% 1 |

1 Wholesale |

% 1 |

1 |

Construction |

% П Service |

% fuel or gasoline? CH Yes CHNo |

||||

3. Are you a common carrier? П Yes П No |

|

|

|

|

|

|

|

|

|||||

4. |

Please describe products to be sold and/or taxable services to be provided: |

|

|

|

5. Enter business' NAICS code number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

if known: |

|

Section 7 |

|

Employer Withholding Information |

|

|

|

|

|

|

| |

||||

1. Will your business have employees? □Yes Д No If you answered Yes, please complete lines 2 through 5.

2. Who will be responsible for filing and remitting payroll taxes for your employees? |

Your Business | | Payroll Service | | Other: |

3.If you checked payroll service or other in question 2 above, enter the name and withholding tax number of the entity reporting and paying these taxes: Name:_______________________________________________________ [withholding Tax Account Number:

4. Do you expect to withhold more than $200 per month? |

Yes EH No |

5.What is the first date on which wages will be paid to employees?

Section 8 |

Authorized Signature/Contact Information |

| |

Under penalties of perjury, 1 declare that 1 have examined this State Tax Registration Application and to the best of my knowledge and belief, it is true, correct and complete. 1 understand that to willfully prepare or present a document that is fraudulent or false is a criminal misdemeanor under O.C.G.A. § 48

Authorized Signature |

Title |

Date (mm/dd/yyyy) |

Print Name |

Daytime Telephone Number |

Title |

Print Third Party Preparer's Name {if any) |

Daytime Telephone Number |

Title |

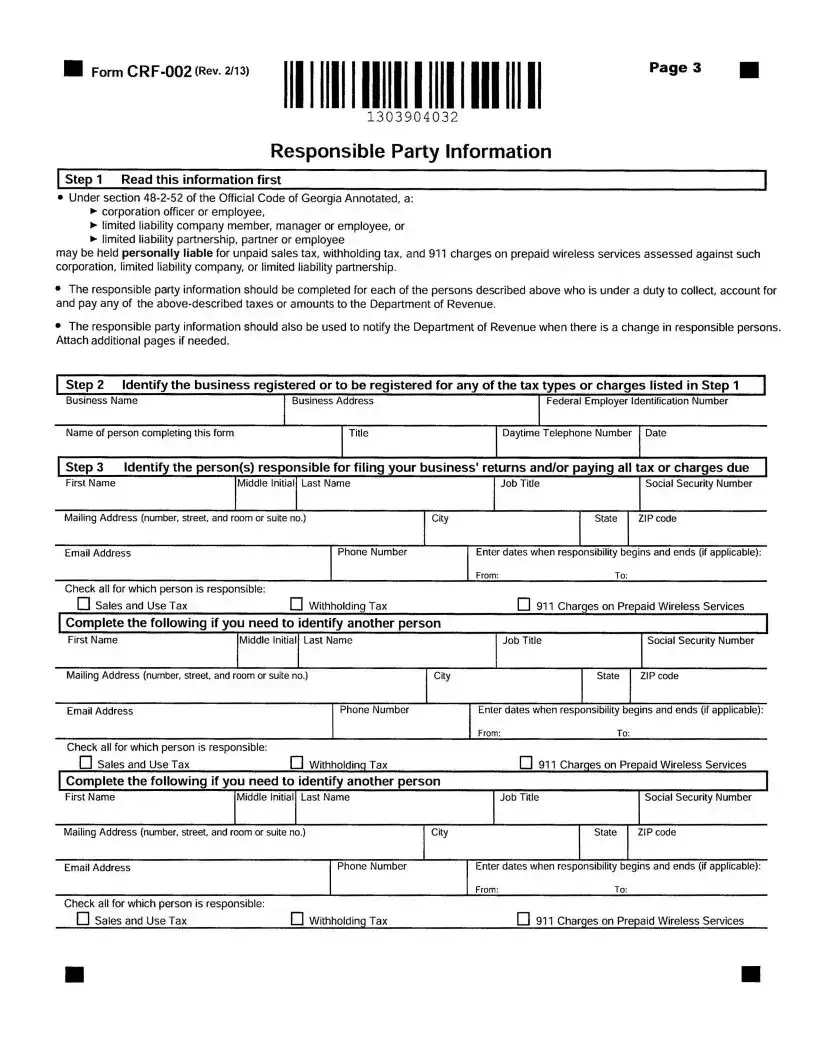

И Form |

1303904032 |

Page 3 |

1303 904032

Responsible Party Information

Step 1 Read this information first |

| |

•Under section

►corporation officer or employee,

►limited liability company member, manager or employee, or

►limited liability partnership, partner or employee

may be held personally liable for unpaid sales tax, withholding tax, and 911 charges on prepaid wireless services assessed against such corporation, limited liability company, or limited liability partnership.

•The responsible party information should be completed for each of the persons described above who is under a duty to collect, account for and pay any of the

•The responsible party information should also be used to notify the Department of Revenue when there is a change in responsible persons. Attach additional pages if needed.

Check all for which person is responsible: |

|

|

□ Sales and Use Tax |

Д Withholding Tax |

□ 911 Charges on Prepaid Wireless Services |

Form Characteristics

| Fact Number | Fact |

|---|---|

| 1 | The Georgia State Tax Registration Application is officially known as Form CRF-002. |

| 2 | This form was last revised on February 13, 2013. |

| 3 | Submissions can be made for various reasons, including new registrations and updates to existing information. |

| 4 | Filers must check applicable boxes to indicate the specific types of tax registrations requested. |

| 5 | Specific taxes that may require an additional application include alcohol licenses and lottery retailer licenses. |

| 6 | The responsible party may face personal liability for unpaid sales tax, withholding tax, or other tax amounts, as per O.C.G.A. § 48-2-52. |

| 7 | Information about business structure such as type of entity must be provided under Section 2 of the form. |

| 8 | Filers must supply their business's legal name, trade name, and physical address in Section 3. |

| 9 | Sections also cover employer withholding information with guidelines on liability and reporting requirements. |

Guidelines on Utilizing Georgia State Tax Instruction

Filling out the Georgia State Tax Instruction form can seem overwhelming, but it’s a straightforward process. By following these steps, you can ensure that your application is completed correctly. Prepare to provide specific information about your business and its activities as you go through each section carefully.

- Begin with Section 1. Indicate the reason for submitting this form by checking the appropriate box or boxes. Options include New Registration, Additional Registration, Application for a Master Number, and others.

- In Section 2, select the type of entity that your business represents. Choose from options like Sole Proprietorship, Corporation, or others.

- Provide your Business Information in Section 3. Fill in your business legal name, trade name, street address (avoid using P.O. Box), city, zip code, and other contact details. Include your date of first operation, months of operation if seasonal, and your fiscal year-end.

- If the mailing address differs from the business address, complete the Business Mailing Address section in Section 4. Indicate the types of tax that need correspondence at this address.

- List Business Ownership/Relationship details in Section 5. Include names, addresses, and Taxpayer Identification Numbers for owners, officers, or members.

- In Section 6, select the type of business activity you are involved in. Supply approximate percentages of receipts and describe the products or services you plan to offer.

- For Employer Withholding Information in Section 7, confirm if your business will have employees. If yes, provide additional details about payroll tax responsibilities.

- In Section 8, provide an authorized signature and print the names and titles of those involved in completing the form. This also includes the date for submission.

- Finally, read the Responsible Party Information at the end. If necessary, list individuals who will be responsible for collecting or paying taxes.

What You Should Know About This Form

What is the Georgia State Tax Instruction form used for?

The Georgia State Tax Instruction form, specifically Form CRF-002, is primarily used by businesses to register for various state taxes. This includes applications for new registrations, additional locations, changes in business structure, or updates to existing information. The form allows businesses to declare the type of entity they operate, the locations they serve, and the specific taxes they need to register for, such as sales tax or withholding tax. By completing this form, businesses ensure they comply with state tax laws, which helps prevent any potential legal issues down the road.

Who needs to fill out this form?

Any business entity operating in Georgia that intends to collect or pay state taxes is required to fill out this form. This includes sole proprietors, partnerships, corporations, limited liability companies, and government agencies. If a business is newly established, is expanding, or has undergone any changes that affect its tax obligations, completing the Georgia State Tax Instruction form is crucial. This applies even to businesses that might not yet have employees but anticipate needing a tax identification number.

What information is required on the form?

The form collects a variety of information essential for registration purposes. Businesses must provide their legal names, trade names, and contact details such as addresses and phone numbers. Additionally, business owners need to indicate their type of entity and specify any tax types they are registering for. It is also important for businesses to disclose ownership details and potential relationships affecting tax responsibilities. This thoroughness ensures that the Georgia Department of Revenue has accurate information to manage tax obligations effectively.

What happens after submitting the Georgia State Tax Instruction form?

Once the form is submitted to the Georgia Department of Revenue, it will be reviewed for completeness and accuracy. If any information is incorrect or missing, the department may reach out for clarification. Once approved, the business will receive a state tax identification number and any applicable licenses, which are necessary for lawful operations. It is essential to keep a record of the submission and any communication from the department to maintain compliance moving forward.

Common mistakes

Filling out the Georgia State Tax Instruction Form can be a straightforward process, but there are common mistakes that people often make. These errors can lead to delays and complications in registering your business. Understanding these missteps can help you avoid them.

One significant mistake is not selecting the correct reason for submitting the form. It’s crucial to carefully read the instructions and check the appropriate box. Whether you are registering a new business, updating existing information, or applying for a master number, ensuring that you choose the right option will guide the process correctly. Skipping this step or making an incorrect choice may lead to unnecessary confusion.

Another frequent error involves overlooking the business information section. Individuals sometimes forget to provide all required details, such as the business legal name, trade name, and address. This section must be filled out accurately. Addressing it correctly helps establish your business identity with the state and prevents issues later.

Many applicants also neglect the mailing address section. If the business mailing address differs from the main address, entering the correct information is essential. Failing to do so results in correspondence being sent to the wrong location. This oversight can delay important notices, which could impact your business operations.

It's important to be careful with the entity type selection as well. Selecting the right classification—such as sole proprietorship, partnership, or corporation—affects tax filings and legal responsibilities. Misidentifying your entity type can complicate your tax obligations and may lead to penalties.

Finally, many people forget to sign the application at the end. Not having an authorized signature renders the document invalid. Ensuring you sign, along with the date, confirms that the information provided is accurate. This is a necessary step to finalize your submission.

By paying close attention to these common mistakes, you can make the registration process smoother and more efficient. Take your time and double-check each section before submitting the form to the Georgia Department of Revenue.

Documents used along the form

The Georgia State Tax Instruction form helps businesses in Georgia register for state taxes. Along with this form, several other documents are often required to ensure compliance with tax regulations. Here are some additional forms you might need.

- Form CRF-003: This form allows businesses to provide additional mailing addresses for tax correspondence. If a business wants GADOR notices sent to a different address, this form must be completed for specific tax types.

- Form CRF-004: This form serves as a Business Information Change form. Use it to report any changes in ownership, business structure, or contact information for existing registrations.

- Form CRF-001: This is the Business Tax Certificate application. Businesses must submit this form to obtain a certificate that allows them to operate legally in Georgia, ensuring they are properly registered for all necessary taxes.

- Form CRF-002A: Businesses that need to register for specific tax types, such as sales or use tax, will complete this form. It outlines the specific tax obligations for different business activities.

In conclusion, understanding these forms is crucial for any business operating in Georgia. Completing all necessary documents helps prevent issues with state tax compliance. Keep this information on hand to ensure your business meets all regulations efficiently.

Similar forms

- IRS Form SS-4: This form is used to apply for an Employer Identification Number (EIN). Both this form and the Georgia State Tax Instruction form are fundamental in initiating the registration process for a business with tax authorities.

- IRS Form 1040: This is the individual income tax return form. Similar to the Georgia form, it collects essential information about the taxpayer's identity and business status for state or federal tax purposes.

- IRS Schedule C: As part of the individual income tax return, this schedule reports income or loss from a business. The purpose is similar to the Georgia form in detailing business financial data to tax authorities.

- IRS Form 940: This annual form reports your federal unemployment tax, covering many of the same business activities reflected in the Georgia tax form regarding payroll and employee information.

- Georgia Form CRF-003: This form is used for additional addresses for tax notifications. Like the State Tax Instruction form, it ensures that all information is kept updated with the Georgia Department of Revenue.

- Georgia Sales and Use Tax Registration Form: This is a specific registration for businesses selling taxable goods. It shares similarities with the Georgia form by allowing businesses to register for specific types of tax collecting duties.

- IRS Form W-2: Used to report wages paid to employees and taxes withheld, this form intersects with the information collected in the Georgia form concerning employee wages and tax responsibilities.

- Georgia Partnership Tax Return (Form 700): This form is essential for partnerships in Georgia. Both forms capture critical partnership details and tax-related information crucial for compliance.

- IRS Form 941: This quarterly form reports income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. It has shared purposes as it collects necessary employee tax information that appears on the Georgia tax form.

- Georgia Corporation Tax Return (Form 600): This form is required for corporations doing business in Georgia. Similar to the State Tax Instruction form, it consolidates the necessary details to comply with state tax regulations and obligations.

Dos and Don'ts

When filling out the Georgia State Tax Instruction form, it’s important to stay organized and accurate. The process can be straightforward if you adhere to a few key guidelines.

- Do read the instructions carefully before starting.

- Do double-check all entries for accuracy to avoid delays.

- Do provide the correct Federal Employer Identification Number (FEIN), if applicable.

- Do ensure your business name matches official records.

- Don’t use a P.O. Box for the business street address, as it's not permitted.

- Don’t leave any required fields blank; incomplete forms will be rejected.

Misconceptions

Understanding the Georgia State Tax Instruction Form can be challenging due to common misconceptions. Below are some of these misconceptions explained clearly.

- All business types must use the same form. Many believe that every business structure, whether a sole proprietary business or a corporation, must complete the same form. However, specific sections and requirements can differ based on entity type.

- A single form submission covers all tax types. It is a misconception that submitting the registration form addresses all tax obligations. Individuals must check specific boxes for various tax types and, in some cases, complete additional applications.

- The registration information is private. Some assume the information provided is confidential. However, certain details may be publicly accessible, especially if they relate to business registration.

- Filing the form guarantees quick approval. A common belief is that once the form is submitted, the approval will come swiftly. In reality, processing times may vary, and further documentation might be requested.

- Only new businesses need to register. It's incorrect to think that only startups need to fill out this form. Existing businesses that undergo specific changes, like a change in ownership, must also register anew.

- It’s unnecessary to provide accurate contact information. Some believe that incorrect or incomplete contact information won't impact the registration process. On the contrary, accurate details are essential for effective communication regarding the application status.

Key takeaways

- Begin by clearly identifying the reason for submitting the Georgia State Tax Registration Application. Choose the appropriate box under Section 1.

- Differentiate between types of registrations, such as new or additional registrations, and remember to check all relevant boxes for the types of taxes and services you require.

- Provide accurate business information. This includes the legal and trade names, address, and contact details. Avoid using P.O. Boxes.

- If your business is seasonal, note the months of operation. This helps in the accurate reporting of your business's activity.

- Understand your responsibilities regarding withholding taxes if you will have employees. Specify how payroll taxes will be managed and report any expected monthly withholding amounts.

- Ensure you include all required signatures, including that of the authorized person and any third-party preparer if applicable. This validates the application.

Browse Other Templates

Signs of Neglect - It specifies categories of abuse including physical, emotional, and sexual mistreatment.

Quicktax Kcmo - This form helps ensure compliance with local tax regulations specific to Kansas City.