Fill Out Your Gerber Life Insurance Claim Form

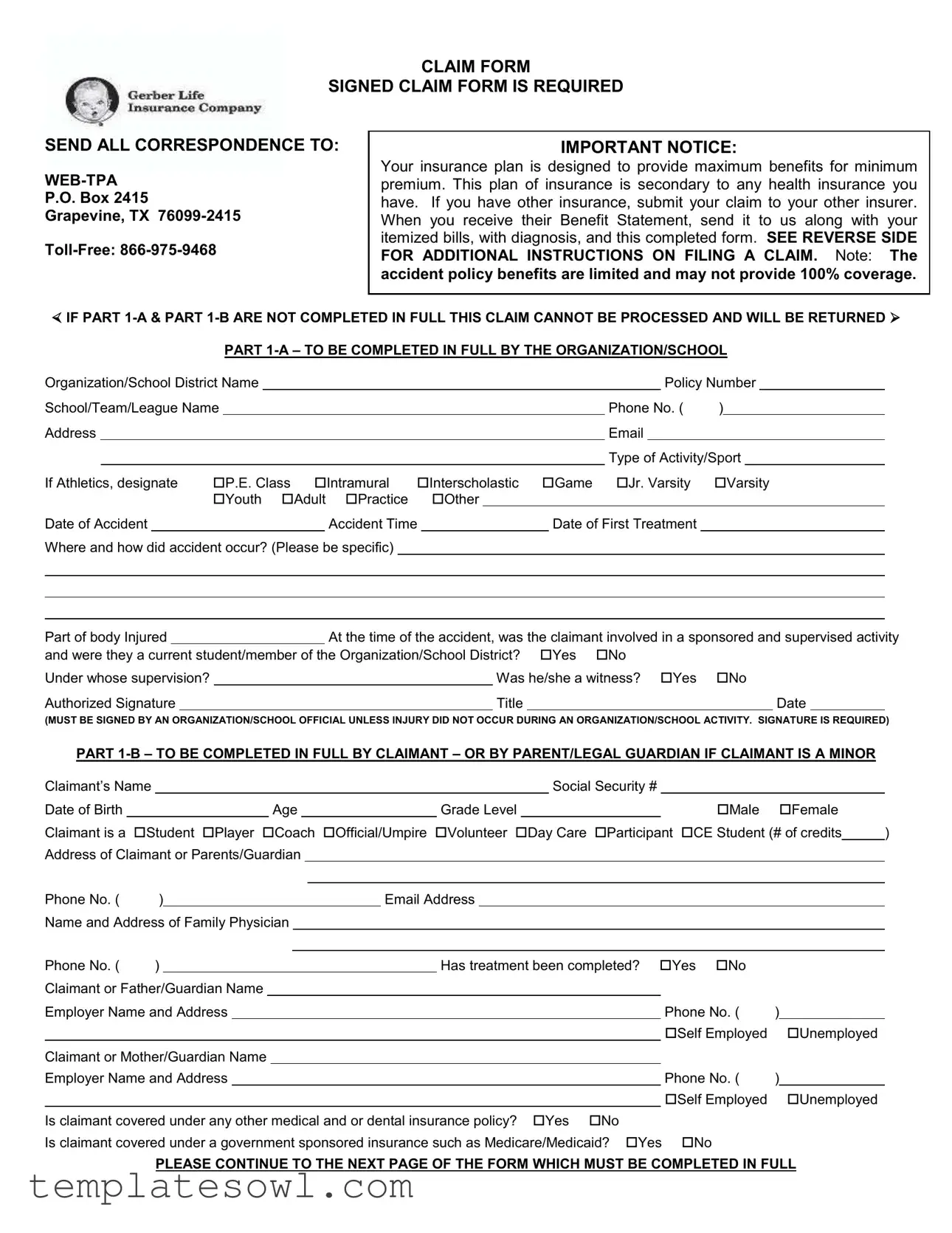

When it comes to filing a claim for benefits with Gerber Life Insurance, the right form is essential for a smooth process. The Gerber Life Insurance Claim Form includes several sections that ensure all necessary information is captured to process your claim effectively. Each claim must start with a signed claim form; details about the organization or school involved, the nature of the accident, and specifics about the injured party are critical. Notably, part 1-A requires input from the organization regarding the policy number, the type of activity during the incident, and information about when and how the accident occurred. At the same time, part 1-B is meant for the claimant, or a parent or guardian if the claimant is a minor. Here, important details such as the claimant's personal information, medical history, and any other coverage must be thoroughly filled out. Adhering to the instructions on the form helps prevent delays in processing claims. It's important to remember that submitting a claim does not guarantee payment, as each claim is reviewed according to the insurance policy provisions. Whether you’re a student, player, or volunteer, understanding how to properly complete this form can make a significant difference in receiving the benefits you're entitled to.

Gerber Life Insurance Claim Example

CLAIM FORM

SIGNED CLAIM FORM IS REQUIRED

SEND ALL CORRESPONDENCE TO:

P.O. Box 2415

Grapevine, TX

IMPORTANT NOTICE:

Your insurance plan is designed to provide maximum benefits for minimum premium. This plan of insurance is secondary to any health insurance you have. If you have other insurance, submit your claim to your other insurer. When you receive their Benefit Statement, send it to us along with your itemized bills, with diagnosis, and this completed form. SEE REVERSE SIDE FOR ADDITIONAL INSTRUCTIONS ON FILING A CLAIM. Note: The accident policy benefits are limited and may not provide 100% coverage.

IF PART

Organization/School District Name |

|

|

|

|

|

|

|

|

|

|

Policy Number |

|

||||||||

School/Team/League Name |

|

|

|

|

|

|

|

Phone No. ( |

) |

|

|

|||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Activity/Sport |

|

|||||

If Athletics, designate |

P.E. Class |

Intramural |

Interscholastic |

Game Jr. Varsity |

Varsity |

|||||||||||||||

|

|

|

|

Youth Adult Practice |

|

Other |

|

|

|

|

|

|

|

|

|

|

||||

Date of Accident |

|

|

|

|

|

Accident Time |

|

|

Date of First Treatment |

|

|

|

|

|||||||

Where and how did accident occur? (Please be specific)

Part of body Injured |

|

|

At the time of the accident, was the claimant involved in a sponsored and supervised activity |

|||||||||||||||||||||||||||||

and were they a current student/member of the Organization/School District? |

Yes |

No |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Under whose supervision? |

|

|

|

|

|

|

Was he/she a witness? |

Yes |

No |

|

|

|

|

|

||||||||||||||||||

Authorized Signature |

|

|

|

|

|

|

Title |

|

|

|

|

|

|

Date |

|

|

||||||||||||||||

(MUST BE SIGNED BY AN ORGANIZATION/SCHOOL OFFICIAL UNLESS INJURY DID NOT OCCUR DURING AN ORGANIZATION/SCHOOL ACTIVITY. SIGNATURE IS REQUIRED) |

||||||||||||||||||||||||||||||||

PART |

|

|||||||||||||||||||||||||||||||

Claimant’s Name |

|

|

|

|

|

|

|

|

Social Security # |

|

|

|

|

|

|

|

|

|||||||||||||||

Date of Birth |

|

|

|

|

|

|

|

|

|

Age |

|

|

|

|

Grade Level |

|

|

|

|

|

|

Male |

|

Female |

|

|||||||

Claimant is a |

Student Player Coach |

Official/Umpire Volunteer Day Care |

Participant |

CE Student (# of credits |

) |

|||||||||||||||||||||||||||

Address of Claimant or Parents/Guardian |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Phone No. ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name and Address of Family Physician |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Phone No. ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Has treatment been completed? |

Yes |

No |

|

|

|

|

|

||||||||

Claimant or Father/Guardian Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Employer Name and Address |

|

|

|

|

|

|

|

|

|

|

Phone No. ( |

) |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self Employed |

|

Unemployed |

|

||||

Claimant or Mother/Guardian Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Employer Name and Address |

|

|

|

|

|

|

|

|

|

|

Phone No. ( |

) |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self Employed |

|

Unemployed |

|

||||

Is claimant covered under any other medical and or dental insurance policy? |

Yes |

No |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Is claimant covered under a government sponsored insurance such as Medicare/Medicaid? Yes |

No |

|

|

|

|

|

|

|||||||||||||||||||||||||

PLEASE CONTINUE TO THE NEXT PAGE OF THE FORM WHICH MUST BE COMPLETED IN FULL

Name of all companies providing claimant insurance coverage or prepaid health plans

Name of Company |

Address |

Policy # |

|

|

|

|

|

|

|

|

|

Are benefits due for this claim under these other insurance coverages? Yes No (See IMPORTANT NOTICE at top of form on page 1)

Does your son or daughter have medical insurance coverage as an eligible dependent from a previous marriage as mandated in a divorce decree? Yes No If yes, please give name, address and phone number of responsible party

AFFIDAVIT: I verify that the above statement on other insurance is accurate and complete. I understand that the intentional furnishing of incorrect information via the U.S. Mail may be fraudulent and violate federal laws as well as state laws. I agree that it is determined at a later date that there are other insurance benefits collectible on this claim I will reimburse Gerber Life Insurance Company to the extent for which Gerber Life Insurance Company would not have been liable.

Signature: Claimant, Parent or Guardian |

|

Date: |

SIGNATURE IS REQUIRED

AUTHORIZATION TO RELEASE INFORMATION: I hereby authorize any employer, health plan, insurance company, hospital, physician, health care profession, clinic, laboratory, pharmacy, medical facility or other person that has provided treatment, payment, or services in connection with this claim to disclose, when requested to do so, all information with respect to any injury, policy coverage, medical history, consultations, prescription or treatment, and copies of all hospital or medical records and itemized bills to WebTPA, Inc. and Gerber Life Insurance Company, it’s agents, employees and representatives.

I hereby authorize WebTPA, Inc. to discuss any information related to medical expenses incurred or treatments rendered in connection with this claim, with Special Markets Insurance Consultants, Inc. representatives and their assigned agents and to officials at the school or organization through which this policy is issued. A photo static copy of this authorization shall be considered as effective and valid as the original.

Signature: Claimant, Parent or Guardian |

|

Date: |

PLEASE READ

PLEASE FOLLOW THESE INSTRUCTIONS TO FILE A CLAIM

ALL INFORMATION MUST BE PROVIDED IN ORDER FOR CLAIM TO BE PROCESSED

NOTE: The accident policy benefits are limited and may not provide 100% coverage. Completion of a claim form does not guarantee benefit payment. Each claim is reviewed according to the policy provisions.

♦Answer all questions in detail (including all signatures on the front and back of the form). A claim form needs to be completed for each accident.

♦If you have other insurance, submit your claim to your other insurer. When you receive the explanation of benefits notice from your primary carrier, send it to us along with the corresponding itemized bills and with the fully completed claim form. You must submit itemized bills; balance due statements will not be processed. Itemized bills include:

1)

2)

♦If you already paid the bill, include a paid receipt or a copy of your cancelled check. Otherwise payment will be made to the providers of service (Hospital, Physician or Others), unless a paid receipt statement accompanies the bill at the time the claim is submitted.

♦Send all correspondence to WebTPA, Inc., P.O. Box 2415 Grapevine, TX

♦If you change your address, please notify WebTPA, Inc. by sending notification to WebTPA so that there is no delay in processing any claims.

♦Please contact WebTPA, Inc. by calling

Common Causes For Delays In Processing Claims

1.Claim Forms Not Completed In Full or Not Submitted.

2.Balance Due, Balance Forward, or Past Due Statements Submitted for Bills.

3.Explanation of Benefits from Primary Carrier Not Provided with the Bills.

KEEP COPIES OF ALL CLAIM FORMS, BILLS, AND CORRESPONDENCE FOR YOUR OWN RECORDS UNTIL YOUR

CLAIM HAS BEEN PROCESSED.

FRAUD NOTICE STATEMENTS

NOTICE TO APPLICANTS: “ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR INSURANCE OR STATEMENT OF CLAIM CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT WHICH IS A CRIME AND MAY SUBJECT SUCH PERSON TO CRIMINAL AND CIVIL PENALTIES.”

RESIDENTS OF ALASKA APPLICANTS: “A PERSON WHO KNOWINGLY AND WITH INTENT TO INJURE, DEFRAUD OR DECEIVE AN INSURANCE COMPANY FILES A CLAIM CONTAINING FALSE, INCOMPLETE OR MISLEADING INFORMATION MAY BE PROSECUTED UNDER STATE LAW.”

RESIDENTS OF ARKANSAS APPLICANTS: “ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR KNOWINGLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO FINES AND CONFINEMENT IN PRISON.”

RESIDENTS OF ARIZONA APPLICANTS: "FOR YOUR PROTECTION ARIZONA LAW REQUIRES THE FOLLOWING STATEMENT TO APPEAR ON THIS FORM. ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS IS SUBJECT TO CRIMINAL AND CIVIL PENALTIES."

RESIDENTS OF COLORADO APPLICANTS: “IT IS UNLAWFUL TO KNOWINGLY PROVIDE FALSE, INCOMPLETE, OR MISLEADING FACTS OR INFORMATION TO AN INSURANCE COMPANY FOR THE PURPOSE OF DEFRAUDING OR ATTEMPTING TO DEFRAUD THE COMPANY. PENALTIES MAY INCLUDE IMPRISONMENT, FINES, DENIAL OF INSURANCE, AND CIVIL DAMAGES. ANY INSURANCE COMPANY OR AGENT OF AN INSURANCE COMPANY WHO KNOWINGLY PROVIDES FALSE, INCOMPLETE, OR MISLEADING FACTS OR INFORMATION TO A POLICYHOLDER OR CLAIMANT FOR THE PURPOSE OF DEFRAUDING OR ATTEMPTING TO DEFRAUD THE POLICYHOLDER OR CLAIMANT WITH REGARD TO A SETTLEMENT OR AWARD PAYABLE FROM INSURANCE PROCEEDS SHALL BE REPORTED TO THE COLORADO DIVISION OF INSURANCE WITHIN THE DEPARTMENT OF REGULATORY AGENCIES.”

RESIDENTS OF DISTRICT OF COLUMBIA APPLICANTS: “WARNING: IT IS A CRIME TO PROVIDE FALSE OR MISLEADING INFORMATION TO AN INSURER FOR THE PURPOSE OF DEFRAUDING THE INSURER OR ANY OTHER PERSON. PENALTIES INCLUDE IMPRISONMENT AND/OR FINES. IN ADDITION, AN INSURER MAY DENY INSURANCE BENEFITS IF FALSE INFORMATION MATERIALLY RELATED TO A CLAIM WAS PROVIDED BY THE APPLICANT.”

RESIDENTS OF FLORIDA RESIDENTS APPLICANTS: “ANY PERSON WHO, KNOWINGLY AND WITH INTENT TO INJURE, DEFRAUD, OR DECEIVE ANY INSURER FILES A STATEMENT OF CLAIM OR AN APPLICATION CONTAINING ANY FALSE, INCOMPLETE OR MISLEADING INFORMATION IS GUILTY OF A FELONY OF THE THIRD DEGREE.”

RESIDENTS OF KANSAS APPLICANTS: “ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON CAUSES TO BE PRESENTED OR PREPARES WITH KNOWLEDGE OR BELIEF THAT IT WILL BE PRESENTED TO OR BY AN INSURER, PURPORTED INSURER, BROKER OR ANY AGENT THEREOF, ANY WRITTEN STATEMENT AS PART OF, OR IN SUPPORT OF, AN APPLICATION FOR THE ISSUANCE OF, OR THE RATING OF AN INSURANCE POLICY, OR A CLAIM FOR PAYMENT OR OTHER BENEFIT PURSUANT TO AN INSURANCE POLICY WHICH SUCH PERSON KNOWS TO CONTAIN MATERIALLY FALSE INFORMATION CONCERNING ANY FACT MATERIAL THERETO, OR CONCEALS, FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT WHICH IS A CRIME AND MAY SUBJECT SUCH PERSON TO CRIMINAL AND CIVIL PENALTIES.”

RESIDENTS OF KENTUCKY APPLICANTS: “ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR INSURANCE CONTAINING ANY “MATERIALLY” FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT WHICH IS A CRIME.”

RESIDENTS OF LOUISIANA APPLICANTS: “ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR KNOWINGLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO FINES AND CONFINEMENT IN PRISON.”

RESIDENTS OF MAINE APPLICANTS: “IT IS A CRIME TO KNOWINGLY PROVIDE FALSE, INCOMPLETE OR MISLEADING INFORMATION TO AN INSURANCE COMPANY FOR THE PURPOSE OF DEFRAUDING THE COMPANY. PENALTIES MAY INCLUDE IMPRISONMENT, FINES OR A DENIAL OF INSURANCE BENEFITS.”

RESIDENTS OF MARYLAND APPLICANTS: “ANY PERSON WHO KNOWINGLY AND WILLFULLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR WHO KNOWINGLY AND WILLFULLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO FINES AND CONFINEMENT IN PRISON.”

RESIDENTS OF MINNESOTA APPLICANTS: “ANY PERSON WHO, WITH INTENT TO DEFRAUD OR KNOWING THAT HE/SHE IS FACILITATING A FRAUD AGAINST ANY INSURER, SUBMITS AN APPLICATION OR FILES A CLAIM CONTAINING A FALSE OR DECEPTIVE STATEMENT IS GUILTY OF INSURANCE FRAUD.”

RESIDENTS OF NEW JERSEY APPLICANTS: “ANY PERSON WHO INCLUDES ANY FALSE OR MISLEADING INFORMATION ON AN APPLICATION FOR AN INSURANCE POLICY IS SUBJECT TO CRIMINAL AND CIVIL PENALTIES.”

RESIDENTS OF NEW MEXICO APPLICANTS: “ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR KNOWINGLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO CIVIL FINES AND CRIMINAL PENALTIES.”

RESIDENTS OF NEW YORK APPLICANTS: “ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR INSURANCE OR STATEMENT OF CLAIM CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME AND SHALL ALSO BE SUBJECT TO A CIVIL PENALTY NOT TO EXCEED FIVE THOUSAND DOLLARS AND THE STATED VALUE OF THE CLAIM FOR EACH SUCH VIOLATION.”

RESIDENTS OF OHIO APPLICANTS: “ANY PERSON WHO, WITH INTENT TO DEFRAUD OR KNOWING THAT HE/SHE IS FACILITATING A FRAUD AGAINST ANY INSURER, SUBMITS AN APPLICATION OR FILES A CLAIM CONTAINING A FALSE OR DECEPTIVE STATEMENT IS GUILTY OF INSURANCE FRAUD.”

RESIDENTS OF OKLAHOMA APPLICANTS: “ANY PERSON WHO KNOWINGLY AND WITH INTENT TO INJURE, DEFRAUD OR DECEIVE ANY INSURER, MAKES ANY CLAIM FOR THE PROCEEDS OF AN INSURANCE POLICY CONTAINING ANY FALSE, INCOMPLETE OR MISLEADING INFORMATION IS GUILTY OF A FELONY.”

RESIDENTS OF OREGON APPLICANTS: “ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD OR SOLICIT

ANOTHER TO DEFRAUD AN INSURER: (1) BY SUBMITTING AN APPLICATION, OR (2) BY FILING A CLAIM CONTAINING A FALSE STATEMENT AS TO ANY MATERIAL FACT, MAY BE VIOLATING STATE LAW.”

RESIDENTS OF PENNSYLVANIA APPLICANTS: “ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES AN APPLICATION FOR INSURANCE OR STATEMENT OF CLAIM CONTAINING ANY MATERIALLY FALSE INFORMATION OR CONCEALS FOR THE PURPOSE OF MISLEADING INFORMATION CONCERNING ANY FACT MATERIAL THERETO COMMITS A FRAUDULENT INSURANCE ACT WHICH IS A CRIME AND SUBJECTS SUCH PERSON TO CRIMINAL AND CIVIL PENALTIES.”

RESIDENTS OF TENNESSEE APPLICANTS: “IT IS A CRIME TO KNOWINGLY PROVIDE FALSE, INCOMPLETE OR MISLEADING INFORMATION TO AN INSURANCE COMPANY FOR THE PURPOSE OF DEFRAUDING THE COMPANY. PENALTIES INCLUDE IMPRISONMENT, FINES AND DENIAL OF INSURANCE BENEFITS.”

RESIDENTS OF TEXAS APPLICANTS: IF A LIFE, HEALTH AND ACCIDENT INSURER PROVIDES A CLAIM FORM FOR A PERSON TO USE TO MAKE A CLAIM, THAT FORM MUST CONTAIN THE FOLLOWING STATEMENT OR A SUBSTANTIALLY SIMILAR STATEMENT: "ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR THE PAYMENT OF A LOSS IS GUILTY OF A CRIME AND MAY BE SUBJECT TO FINES AND CONFINEMENT IN STATE PRISON."

RESIDENTS OF VERMONT APPLICANTS: “ANY PERSON WHO KNOWINGLY PRESENTS A FALSE STATEMENT IN AN APPLICTION FOR INSURANCE MAY BE GUILTY OF A CRIMINAL OFFENSE AND SUBJECT TO PENALTIES UNDER STATE LAW.”

RESIDENTS OF VIRGINIA APPLICANTS: “IT IS A CRIME TO KNOWINGLY PROVIDE FALSE, INCOMPLETE OR MISLEADING INFORMATION TO AN INSURANCE COMPANY FOR THE PURPOSE OF DEFRAUDING THE COMPANY. PENALTIES MAY INCLUDE IMPRISONMENT, FINES AND DENIAL OF INSURANCE BENEFITS.”

RESIDENTS OF WASHINGTON APPLICANTS: “IT IS A CRIME TO KNOWINGLY PROVIDE FALSE, INCOMPLETE, OR MISLEADING INFORMATION TO AN INSURANCE COMPANY FOR THE PURPOSES OF DEFRAUDING THE COMPANY. PENALTIES INCLUDE IMPRISONMENT, FINES, AND DENIAL OF INSURANCE BENEFITS.”

RESIDENTS OF WEST VIRGINIA APPLICANTS: "ANY PERSON WHO KNOWINGLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR KNOWINGLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO FINES AND CONFINEMENT IN PRISON."

Form Characteristics

| Fact | Details |

|---|---|

| Required Submission | The claim form must be signed and fully completed for processing. |

| Submission Address | All correspondence should be sent to: Web-TPA, P.O. Box 2415, Grapevine, TX 76099-2415. |

| Insurance Coordination | The policy is secondary to any existing health insurance. Claims should first be submitted to primary insurers. |

| Completion Requirement | Parts 1-A and 1-B of the form must be fully filled out; incomplete forms will be returned. |

| Additional Instructions | Refer to the reverse side of the claim form for further filing details and claim submission instructions. |

| Fraud Notice | Providing false information on insurance claims is a crime and may lead to severe penalties. |

| State-Specific Laws | Residents in various states have specific legal disclaimers regarding the provision of false information, which can be reviewed directly in the form. |

Guidelines on Utilizing Gerber Life Insurance Claim

When filling out the Gerber Life Insurance Claim form, it's important to provide complete and accurate information to avoid delays in processing. Follow these steps carefully to ensure a smooth submission.

- Obtain the Gerber Life Insurance Claim form.

- Complete Part 1-A by entering the organization/school name, policy number, phone number, address, email, type of activity or sport, date and time of the accident, and details about the incident.

- Indicate if the claimant was involved in a sponsored activity and their relationship with the organization. Provide the supervisor's name and state if they were a witness.

- Sign and date the form in Part 1-A. An authorized signature is required from an organization or school official.

- Complete Part 1-B with the claimant’s personal information, including their name, Social Security number, date of birth, age, grade level, and if they are a student, player, or coach.

- Provide contact details including the address and phone number for the claimant or their parent/guardian. Include the family physician’s information as well.

- Answer questions regarding the claimant’s treatment status, employment, and any other insurance coverage that may be applicable.

- If applicable, provide details about other insurance companies and the responsible party related to coverage from a previous marriage.

- Sign the affidavit in Part 1-B to verify the accuracy of the information provided concerning other insurance coverage.

- Authorize the release of information by signing the authorization section.

- Review the entire claim form to ensure all sections are completed. Make sure all signatures are present.

- Send the completed claim form along with itemized bills and any explanations of benefits from other insurers to WebTPA, P.O. Box 2415, Grapevine, TX 76099-2415.

Keep copies of all documents for your records until the claim has been processed. If necessary, follow up with WebTPA regarding the status of your claim.

What You Should Know About This Form

What is the purpose of the Gerber Life Insurance Claim form?

The Gerber Life Insurance Claim form is used to request benefits from an insurance policy when an accident occurs. It must be completed accurately and submitted to ensure that the claim is processed efficiently. Proper submission allows insured individuals to receive necessary support following an accident.

How do I fill out the claim form correctly?

To fill out the claim form correctly, complete all sections thoroughly. Make sure to provide all required information, including details about the incident, any involved parties, and insurance coverage. Specific parts of the form must be signed by both the organization/school and the claimant. If any information is missing, the form may be returned unprocessed, delaying the claim.

What should I include when submitting my claim?

When submitting your claim, include the completed claim form, itemized bills related to the medical treatment, and the primary insurer's explanation of benefits, if applicable. If you have already paid any medical bills, attach a paid receipt or canceled check. Failing to include all required documents can result in processing delays.

What happens if I have other insurance?

If you have other health insurance, you must submit your claim to that insurer first. After receiving their benefit statement, send it to Gerber Life along with the completed claim form and itemized bills. Since Gerber’s plan acts as secondary coverage, they will review your initial insurance response before processing your claim.

Where do I send the completed claim form?

The completed claim form, along with any supporting documents, should be sent to WebTPA, P.O. Box 2415, Grapevine, TX 76099-2415. Ensure your submission is made within 90 days from the date of the first medical care received to avoid any delays in processing.

What should I do if my claim is delayed?

If your claim is delayed, check to ensure that all information on the form was completed fully and accurately. Additionally, ensure that you have sent all necessary documents. You can contact WebTPA at the toll-free number 866-975-9468 to inquire about the status of your claim or for clarification on any issues that may have arisen during processing.

Common mistakes

Filling out the Gerber Life Insurance Claim form can be straightforward, but there are common mistakes that can lead to delays or rejection of the claim. One frequent error is failing to complete all necessary sections. Parts 1-A and 1-B must be filled out entirely. Incomplete information will result in the claim being returned and could prolong the process unnecessarily.

Another mistake is not providing the correct details about the accident. The section requesting specifics about where and how the accident occurred is essential. A vague description fails to convey the necessary context and can cause confusion. Additionally, listing the right activity type is important. Not specifying whether it was a practice or game, for example, can delay processing.

Individuals often neglect to include required signatures. Part 1-A requires an official signature from an organization or school representative, except in certain cases. Omitting this signature means the claim will not be processed. Similarly, the claimant or a parent/guardian must sign part 1-B.

Another common issue involves submitting claims without accompanying documentation. Providing itemized bills is crucial. Sending balance due statements will not suffice. If prior insurance claims were made, attaching the Explanation of Benefits notice alongside itemized bills is a requirement that many forget.

Claimants may also fail to include all necessary insurance information. If the claimant has coverage under another medical policy, this should be disclosed clearly. Missing this detail can result in unnecessary complications or denials.

Sometimes, claimants overlook the importance of timely submission. Claims must be sent within 90 days of receiving medical care. Delays in submission can lead to automatic rejections, regardless of the claims’ validity.

Another overlooked aspect is providing the employer information for both parents or guardians, particularly when the claimant is a minor. Details about their employer or confirmation of unemployment should be accurate and included to avoid delays.

In some cases, people forget to verify the declared statements. The affidavit regarding other insurance must be accurate. Providing misleading information, even unintentionally, can jeopardize the claim.

Lastly, failing to maintain personal copies of the submitted claim forms and related documents is a notable mistake. Keeping these records until the claim has been processed provides essential proof in case of disputes or follow-ups.

Documents used along the form

The Gerber Life Insurance Claim form is often accompanied by additional documents that help support the claim process. Each of these documents serves a distinct purpose, ensuring that the claim is processed efficiently and accurately. Below is a list of common forms and documents that may be required along with the claim form.

- Itemized Bills: These statements detail the individual costs associated with medical services received, including diagnosis codes and treatment descriptions.

- HCFA-1500 Form: This is a standard form used by healthcare providers to bill insurance companies for medical services provided.

- UB-04 or UB-92 Form: These forms are used by hospitals to submit claims for services rendered to patients, detailing all necessary billing information.

- Denial Letter: If a claim has been rejected by another insurer, a denial letter detailing the reasons must be included to assist with the current claim.

- Explanation of Benefits (EOB): This document outlines the benefits covered by the primary insurance, including amounts paid and remaining balances.

- Proof of Payment Receipts: Receipts or canceled checks demonstrating payments made for medical services should be submitted if applicable.

- Authorization to Release Information: This signed document allows the insurance company to request medical information from healthcare providers for processing the claim.

- Accident Report: A formal report summarizing the details of the accident may be required to substantiate the claim.

- Child's Enrollment Verification: Documentation confirming the child’s enrollment in a covered program, if applicable, may also need to be submitted.

- Copy of the Policy Document: Providing a copy of the insurance policy can help clarify coverage details relevant to the claim.

Submitting these documents along with the Gerber Life Insurance Claim form can facilitate a smoother claims process. It is important to keep copies of all submitted documents for personal records until the claim is formally resolved.

Similar forms

- Health Insurance Claim Form: This form is used to submit claims for benefits under a health insurance policy. Much like the Gerber Life Insurance Claim form, it requires detailed information about the insured individual, medical treatments received, and any other relevant health insurance coverage.

- Accident Claim Form: Similar to the Gerber form, this document serves to report injuries resulting from accidents. It is often necessary to include specific details about the accident, treatment received, and identify other insurance coverage that may be applicable.

- Life Insurance Claim Form: This document initiates the process of claiming life insurance benefits after a policyholder passes away. Like the Gerber form, it demands information about the deceased and often requires corroborative documents from multiple parties.

- Disability Insurance Claim Form: This form helps individuals file for disability benefits. It parallels the Gerber form in that it necessitates thorough information about the claimant's health status and the events leading to their request for benefits.

- Workers' Compensation Claim Form: Used when an employee is injured on the job, this form captures details surrounding the accident, treatment, and employer information, similar to the necessary disclosures in the Gerber Life Insurance Claim form.

- Automobile Accident Claim Form: Individuals use this to claim insurance after a car accident. Like the Gerber form, it requests thorough information about all involved parties and circumstances of the accident.

- Medical Records Release Form: This document permits healthcare providers to share medical records as part of a claim process. Both the Gerber form and this one require signatures to validate the release of sensitive information.

- Comprehensive Claim Process Form: Certain insurance companies may utilize this form for various claims. It often includes sections to claim for each type of insurance, similar to how the Gerber form addresses additional coverage issues.

- Subrogation Claim Form: This form is filed when an insurance company seeks reimbursement from another party responsible for a claim. In both documents, claimants must disclose detailed injury and accident information, showcasing parallel processes.

- Patient Responsibility Acknowledgment Form: Here, patients acknowledge their responsibility for understanding charges and services related to their care. Similar to Gerber’s claim form, it emphasizes transparency about involved parties and expected outcomes.

Dos and Don'ts

Filling out the Gerber Life Insurance Claim form can seem daunting, but following a few simple guidelines can smooth the process and improve your chances of a successful claim. Here’s a concise list of things to keep in mind.

- Do ensure that all sections of the claim form are completed fully. Missing information can lead to delays or rejection.

- Do attach all necessary documentation. This includes itemized bills and any relevant insurance benefit statements from other insurers.

- Do submit your claim within 90 days of receiving medical care. This timely submission is crucial for processing.

- Do keep copies of everything you send. These records will be helpful if any issues arise later.

- Don't provide incomplete or unclear information. Ensure that every detail is filled out with precision to avoid potential issues.

- Don't send balance due statements instead of itemized bills. Only itemized documents will be accepted for processing.

- Don't forget to inform WebTPA of any address changes. This helps prevent delays in claim updates and correspondence.

- Don't assume that completing the claim form guarantees payment. Claims are reviewed based on policy provisions and may be subject to limitations.

Misconceptions

The Gerber Life Insurance Claim form can sometimes create confusion. Here are eight common misconceptions that many have regarding this form:

- Completion Guarantees Payment: Some people believe that simply filling out the claim form ensures that they will receive payment. However, the completion of the form does not guarantee that a claim will be paid. Each claim is subject to review according to specific policy provisions.

- Only One Insurance Provider: A common misconception is that the Gerber policy is the only insurance that covers a claim. In reality, if you have other health insurance, you must submit your claim to that insurer first. Gerber Life Insurance will require a Benefit Statement from your primary insurer.

- Claims Processes Effortlessly: Many believe that claims are processed without complications. Delays often occur when forms are incomplete or if necessary documents, like itemized bills, are missing.

- Claims Must Be Submitted Immediately: There's an assumption that you must send the claim immediately after the accident. In fact, you have up to 90 days from the date you first received medical care to submit the claim.

- Only Active Members Can Claim: Some individuals think that only current members of the organization or school can file a claim. However, a claim can also be submitted if the injury does not occur during a sponsored activity, as long as the form is completed properly.

- Signature Requirements Are Flexible: It's assumed that any signature will suffice on the claim form. However, the form specifically requires an authorized signature from an organization or school official, unless the injury did not occur during an organizational activity.

- Itemized Bills Aren't Always Necessary: People often think they can submit balance due statements. In contrast, only itemized bills are accepted; balance statements will not be processed.

- Correction of Errors Is Simple: Many believe that it is easy to correct mistakes on the claim form. However, if parts of the form are incomplete or incorrect, it could lead to a return of the claim, necessitating re-submission and additional delays.

Understanding these misconceptions can help streamline the claims process and ensure all necessary documentation is correctly submitted.

Key takeaways

When navigating the Gerber Life Insurance Claim process, it is essential to understand the critical steps to ensure successful submission and processing. Here are five key points to consider:

- Complete All Sections: Both Part 1-A and Part 1-B of the claim form must be filled out completely. Incomplete forms will lead to delays, as your claim cannot be processed until all required information is provided.

- Provide Itemized Bills: Always submit itemized bills along with your claim form. Simply sending balance due statements will not suffice. Acceptable documentation includes HCFA-1500 and UB-04 forms. If you paid the

Browse Other Templates

Cdl Driving Record - The MV2896 allows for different types of record requests, including for minors by guardians.

Form 126 - Your Social Security Number is needed for record identification purposes.

Louisiana Amended Tax Return - Being thorough in your submission can prevent delays during the review of your request.