Fill Out Your Gic Certificate Sample Form

When embarking on the exciting journey of studying in Canada, understanding the nuanced requirements of the Scotiabank Student GIC Program (SSGP) Application Form becomes paramount. This form serves as your gateway to obtaining a Guaranteed Investment Certificate (GIC) that provides financial support during your first year in Canada, facilitating a smoother transition as you settle into your new academic environment. The application process traditionally begins with the completion of essential sections, where you'll provide personal information, passport details, and specifics about your intended college or university. Alongside this, you’ll need to submit crucial documents, including your valid passport and a Letter of Acceptance from a recognized educational institution. Scotiabank emphasizes the importance of reading the GIC Terms and Conditions, which outline your obligations as well as what you can expect from the bank. Once you’ve compiled everything, sending a neatly scanned PDF to the designated email constitutes the final step. Throughout this process, it's important to remember the financial aspects, where a total investment of $10,000 CAD, coupled with a $100 administrative fee, sets the stage for a structured release of funds—ensuring you receive your initial $2,000 upon arrival and subsequent payments every two months thereafter. Moreover, this GIC not only offers you financial security but also complies with the Canadian immigration requirements for your study permit application. With clarity and preparation, the SSGP application can pave your way to a successful academic adventure in Canada.

Gic Certificate Sample Example

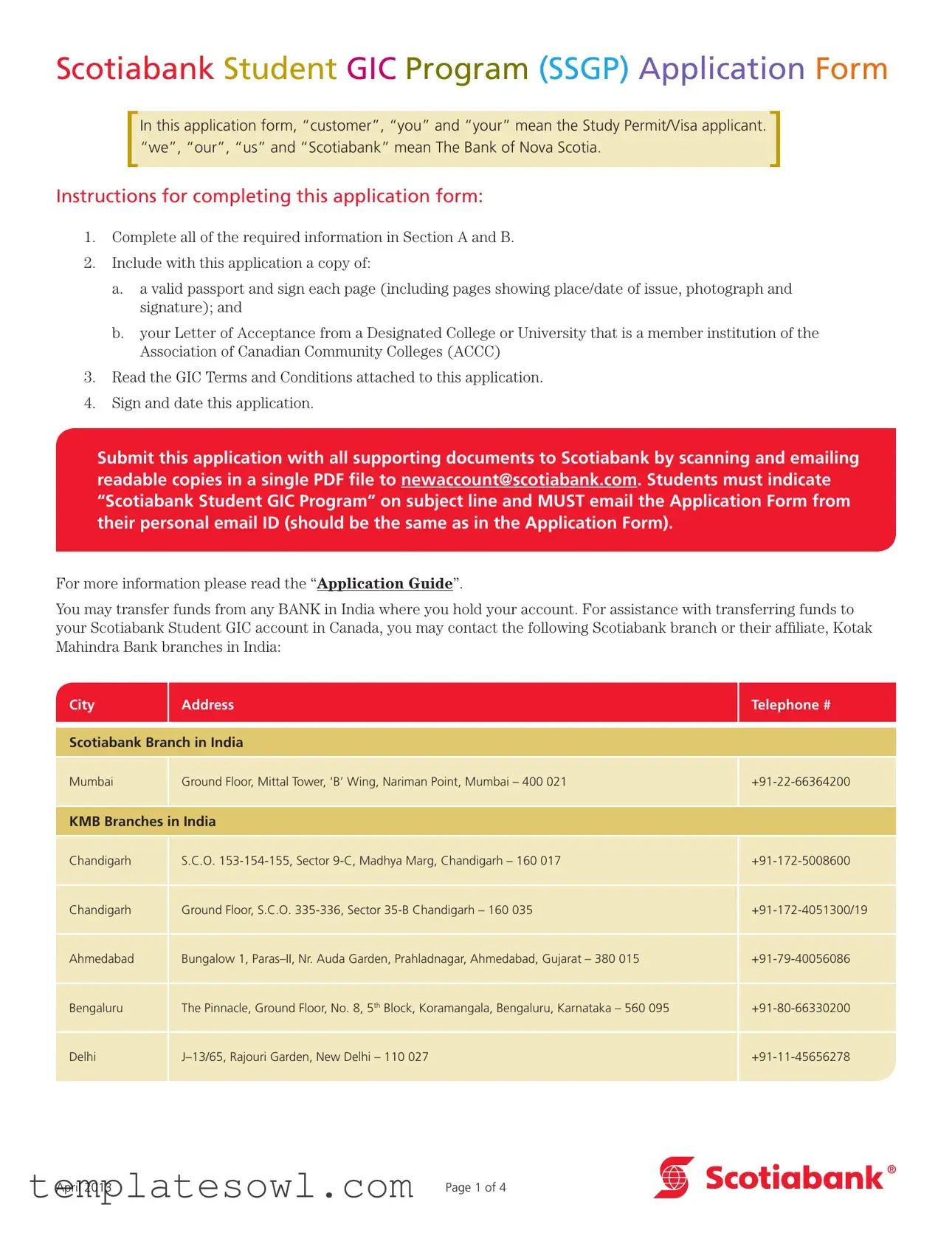

Scotiabank Student GIC Program (SSGP) Application Form

In this application form, “customer”, “you” and “your” mean the Study Permit/Visa applicant. “we”, “our”, “us” and “Scotiabank” mean The Bank of Nova Scotia.

Instructions for completing this application form:

1.Complete all of the required information in Section A and B.

2.Include with this application a copy of:

a.a valid passport and sign each page (including pages showing place/date of issue, photograph and signature); and

b.your Letter of Acceptance from a Designated College or University that is a member institution of the Association of Canadian Community Colleges (ACCC)

3.Read the GIC Terms and Conditions attached to this application.

4.Sign and date this application.

Submit this application with all supporting documents to Scotiabank by scanning and emailing readable copies in a single PDF file to newaccount@scotiabank.com. Students must indicate “Scotiabank Student GIC Program” on subject line and MUST email the Application Form from their personal email ID (should be the same as in the Application Form).

For more information please read the “Application Guide”.

You may transfer funds from any BANK in India where you hold your account. For assistance with transferring funds to your Scotiabank Student GIC account in Canada, you may contact the following Scotiabank branch or their affiliate, Kotak Mahindra Bank branches in India:

City |

Address |

Scotiabank Branch in India

Telephone #

Mumbai

Ground Floor, Mittal Tower, ‘B’ Wing, Nariman Point, Mumbai – 400 021

KMB Branches in India

Chandigarh |

S.C.O. |

|

Chandigarh |

Ground Floor, S.C.O. |

|

Ahmedabad |

Bungalow 1, |

|

Bengaluru |

The Pinnacle, Ground Floor, No. 8, 5th Block, Koramangala, Bengaluru, Karnataka – 560 095 |

|

Delhi |

April 2013 |

Page 1 of 4 |

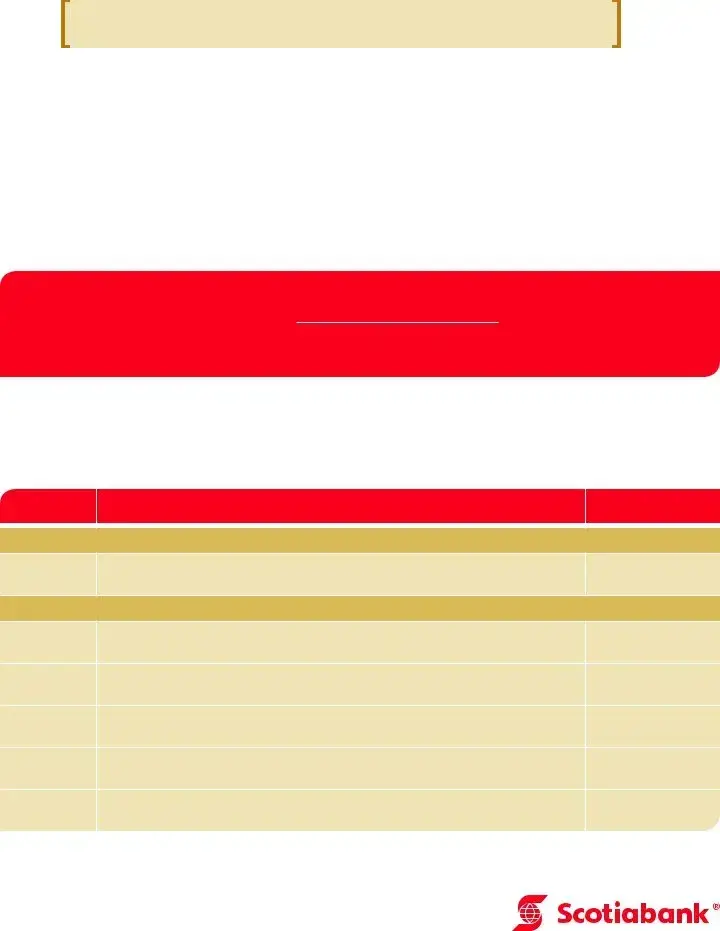

Personal Information (required)

First and Last Name (Legal) |

|

|

Birth Date (YYYY/MM/DD) |

|

|

Current Address |

House/Flat |

Building |

|

Number |

Name |

|

Street Number and Name |

|

|

Locality or |

|

|

Neighbourhood |

|

|

CITY |

Postal |

|

Code (PIN) |

|

|

|

|

|

State |

Country |

Current Phone Number |

|

|

(please include country/city code) |

|

|

Personal Email Address |

|

|

(all communications from Scotiabank |

|

|

will be sent to this address) |

|

|

City and Province of Arrival |

|

|

in Canada |

|

|

Expected Date of Arrival |

|

|

in Canada (YYYY/MM/DD) |

|

|

Community College |

|

|

or University in which |

|

|

enrolled |

|

|

Passport Information (required)

Passport Number

Country of Issue

Expiry Date (YYYY/MM/DD)

Guaranteed Investment Certificate – Summary

Issuer |

Scotiabank |

Interest Payment |

Annual interest paid on maturity |

Investment Amount |

$10,000 CAD |

Term |

1 year |

Issue Date |

The date the funds (including principal amount and applicable fees) are received by Scotiabank via wire transfer |

Annual Interest Rate |

Posted rate on the Issue Date (current rates can be found at http://www.scotiabank.com/ca/en/0,,1115,00.html) |

Disbursement Details |

Initial payment of $2,000 will be made when you arrive in Canada and provide suitable verifiable identification |

to Scotiabank. Four subsequent payments of $2,000 will be made every 2 months thereafter, until the funds are |

|

|

depleted. |

Note:

Following receipt of this application form, Scotiabank will send you an email with wire transfer instructions within

5 business days to enable you to fund the GIC. You will be required to remit 10,000 CAD plus 100 CAD in administrative fees to Scotiabank.

April 2013 |

Page 2 of 4 |

A confirmation of the GIC details (such as issue date, maturity date, and interest rate) will be sent to you via encrypted

If the Study Permit application is rejected by the applicable Canadian High Commission Office, please provide a copy of the Refusal Letter from the Canadian High Commission (“CHC”), the original TT Receipt and the completed Refund Wire Transfer Form (scan and email a copy in a single (1) PDF file to newaccount@scotiabank.com) in order to have your GIC cashed out and get the refund. Upon receipt of confirmation from the CHC, Scotiabank will refund the GIC amount to your

With regards to the refund time lines and all related queries please read the “Application Guide”. Direct all queries respecting the Scotiabank Student GIC Program to studentgic@scotiabank.com.

By signing below:

•You are applying to purchase the GIC upon the terms set out in this application, including the GIC Terms and Conditions attached.

•You agree that the payment you receive from the GIC will be used to cover living expenses for your first year in Canada.

•You confirm that the information you have given is true and complete.

•You acknowledge that email is not a secure means of communication and therefore there are risks involved in emailing your application form and other documents that include your personal and other sensitive information

•You agree to check the interest rate of the GIC at http://www.scotiabank.com/ca/en/0,,1115,00.html on the day that you send your wire payment. The Interest Rate is Scotiabank’s posted rate for a

•You authorize Scotiabank to send you the GIC confirmation to the personal email address you have provided in this application form following the successful purchase of your GIC. The GIC confirmation will include details such as the principal amount, term and interest rate will be included in the email.

•You authorize Scotiabank to send your name, date of birth, and passport number to the Canadian High Commission (“CHC”) following the successful purchase and/or prior to refund of your GIC. The CHC will use this

•You confirm that you have reviewed the following documents online through www.scotiabank.com:

→Privacy Agreement and Brochure – http://www.scotiabank.com/ca/en/0,,351,00.html

→Investment Companion Booklet – www.scotiabank.com/ca/en/files/12/05/investment_companion_booklet.pdf

•You consent to receiving the above documents in an electronic format at the links provided above and through this application form only, and acknowledge that you have read and agree to the terms and conditions set out in those documents as they apply to you. You are responsible for printing or downloading a copy of these documents for your records. You acknowledge and agree that all documents relating to the application will be drawn up

•You acknowledge that the GIC is not transferrable.

•You confirm that this account is being opened for your benefit and will not be used to conduct business on behalf

Customer

(print full name)

Customer’s Signature

Date (YYYY/MM/DD)

April 2013 |

Page 3 of 4 |

|

Terms and Conditions

General

“You” and “Your” mean the applicant for the GIC. “We”, “our”, “us” and “Scotiabank” mean The Bank of Nova Scotia, the issuer of the GIC. “CAD” means Canadian dollars.

Eligibility

To be eligible to purchase the SSGP Guaranteed Investment Certificate (“GIC”), you are required to have been accepted to an educational institution that is a member of the Association of Canadian Community Colleges (the “Canadian Educational Institution”) and have provided suitable verifiable identification to Scotiabank.

Product Information

Purchase Amount/(Starting Principal): 10,000 CAD

Interest Rate: The Interest Rate is Scotiabank’s posted rate for a

Term: One year.

Issue Date: The Issue Date is the date that we receive your wire transfer for the Purchase Amount plus applicable fees. If the date that we receive your wire transfer is not a business day, the Issue Date will be the next business day.

Maturity Date: One year after the Issue Date.

Calculation of Interest

Interest is accrued daily on the principal balance at the end of each day during the Term, including the leap day in a leap year, but not the Maturity Date. If the Maturity Date falls on a holiday or Sunday the Term will be extended to the next business day and interest will be accrued up to but not including that next business day.

If any part of the principal, including the initial principal payment of 2,000 CAD (see “Payments of Principal and Interest” below), is redeemed within 30 days of the Issue Date, no interest is earned or paid on that part of the principal.

Payments of Principal and Interest

All payments of principal and interest will be paid to your Scotiabank personal deposit account that you must open at a Scotiabank branch after your arrival in Canada* in accordance with the following schedule:

•Initial principal payment of 2,000 CAD on the day the Scotiabank personal deposit account is opened.

•Four (4) subsequent principal payments of 2,000 CAD will be made every two months beginning two months after the initial payment was made. The initial principal payment and four subsequent payments are hereinafter referred to as the “Scheduled Payments”.

•If a Scheduled Payment date falls on a holiday or Sunday, the Scheduled Payment will be made on the next business day.

•Accrued interest will be paid on the date of the final Scheduled Payment.

*You must present identification acceptable to us in order to open the personal deposit account.

No GIC Redemption

You can only redeem your GIC prior to the Maturity Date if you provide us with proof that (i) your Study Permit has been declined (i.e.by providing us with a copy of the “Refusal Letter” issued by the Canadian High Commission); (ii) your application for admission to a Canadian Educational Institution has been declined; or (iii) you have withdrawn from enrolment at the Canadian Educational Institute after your arrival in Canada. Please provide us with a copy of the cancelled Visa and Study Permit from the Canadian High Commission office in India. Upon receipt of proof of any of these events and confirmation from the Canadian High Commission, we will redeem the outstanding principal plus, for GICs outstanding for more than thirty days, any accumulated interest. You may also contact us to cancel the GIC within 15 business days after the Issue Date. The amount to be refunded in each case will be transferred to the bank account in your country from which your original payment was remitted. Any redemption of your GIC prior to the Maturity Date (for the initial term or the renewal term), other than as a result of your Scheduled Payments, will disqualify you from participation in the Scotiabank Student GIC program.

Maturity and Renewal

If the initial term of the GIC expires prior to all Scheduled Payments being made, the GIC will automatically be renewed for a one year term at the then current posted rate. The GIC will expire at the end of the renewal term or when the final Scheduled Payment has been made, whichever occurs first. The same rules respecting cancellation and redemption apply to the renewed GIC.

Fees

In addition to the 10,000 CAD principal amount, you are required to remit an additional 100 CAD for a total of 10,100 CAD. The 100 CAD fee is for purposes of covering administrative expenses and no interest is earned on it.

April 2013 |

Page 4 of 4 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Issuer | The Guaranteed Investment Certificate (GIC) is issued by Scotiabank, officially known as The Bank of Nova Scotia. |

| Initial Investment | The minimum investment amount required is $10,000 CAD. |

| Interest Rate | The annual interest rate is Scotiabank’s posted rate on the issue date. Current rates are available on the bank's website. |

| Eligibility | Applicants must be accepted by a designated college or university in Canada that is a member of the Association of Canadian Community Colleges (ACCC). |

| Disbursement Schedule | Payments are allocated as an initial amount of $2,000 upon arrival in Canada, followed by four payments of $2,000 every two months. |

| Refund Process | If the study permit is declined, a refund can be requested by submitting the necessary documents to Scotiabank, including the original TT receipt and a completed refund transfer form. |

Guidelines on Utilizing Gic Certificate Sample

Completing the GIC Certificate Sample form is an essential step for students planning to study in Canada. This form helps facilitate your application for a Guaranteed Investment Certificate required for the Scotiabank Student GIC Program. Here is a simple guide to help you fill it out correctly.

- Provide your first and last name as it appears on your legal documents.

- Enter your birth date using the format YYYY/MM/DD.

- Fill in your current address, including the house/flat number, street name, locality, city, postal code, state, and country.

- List your current phone number, ensuring to include the country code.

- Supply your personal email address, noting that all communications from Scotiabank will be sent here.

- Indicate your city and province of arrival in Canada.

- State your expected date of arrival in Canada using the format YYYY/MM/DD.

- Write the name of the community college or university you will be attending.

- For passport information, fill in your passport number, the country of issue, and the expiry date in the format YYYY/MM/DD.

- Ensure you read the attached GIC Terms and Conditions carefully.

- Sign and date the application form.

- Include a copy of your valid passport, signed on each page, and your Letter of Acceptance from a recognized Canadian educational institution.

- Submit your application by emailing a readable PDF copy to newaccount@scotiabank.com. Use "Scotiabank Student GIC Program" in the subject line and ensure you're sending it from your personal email address.

Once you have submitted your application, Scotiabank will reach out with wire transfer instructions. This will enable you to complete the funding for your GIC account and support your initial living expenses in Canada.

What You Should Know About This Form

What is the Scotiabank Student GIC Program (SSGP) and how do I apply?

The Scotiabank Student GIC Program (SSGP) is designed for international students who are applying for a study permit in Canada. To apply, fill out the GIC Certificate Sample form completely, including all required personal information. Attach a valid passport copy and your Letter of Acceptance from a designated educational institution. Submit the application to Scotiabank via email with supporting documents in a single PDF file. Make sure to use your personal email address for all communications.

What documents do I need to submit with my application?

You must include two main documents: a copy of your valid passport and your Letter of Acceptance from a recognized Canadian educational institution. It is essential to sign each page of your passport copy. If any part of these documents is missing, it could delay the processing of your application.

How does the funding and payment schedule work?

The total amount required for the GIC is $10,100 CAD, which includes a principal amount of $10,000 CAD and an administrative fee of $100 CAD. Upon your arrival in Canada and after you provide suitable identification, an initial payment of $2,000 CAD will be released to you. Four subsequent payments of $2,000 CAD each will be disbursed every two months until the full amount is exhausted. It’s crucial to ensure that you complete the identification process promptly to access these funds.

What should I do if my study permit application is rejected?

If your study permit application is rejected, you need to act quickly. Collect a copy of the refusal letter from the Canadian High Commission, the original Transfer Receipt, and complete the Refund Wire Transfer Form. Send these documents as a single PDF file to Scotiabank. Upon receipt of your documents and confirmation from the High Commission, your GIC amount will be refunded to you.

Common mistakes

Many individuals encounter challenges when completing the Scotiabank Student GIC Program (SSGP) application form. One common mistake is failing to provide all of the required personal information. The form clearly outlines that sections A and B must be filled in completely. Missing or incorrect information can lead to delays in processing your application. Always double-check that you've entered your first and last name, birth date, and any other required details accurately.

Another frequent issue arises from the submission of necessary documents. The guidelines specify that applicants must include valid identification, such as a passport, along with their Letter of Acceptance from a recognized Canadian educational institution. If these documents are not attached or are submitted in illegible form, it can result in rejections or further complications. Ensuring that all documents are scanned clearly and included in one PDF file is essential for a smooth application process.

A third mistake often occurs when students ignore the instructions regarding communication. The application must be sent from the personal email address provided in the form, and if it is sent from a different email, it may not be processed. This is crucial because all correspondence from Scotiabank, including confirmations and instructions, will be directed to the address listed in the application. Keeping this detail in mind can help applicants avoid unnecessary confusion.

Lastly, some applicants overlook the necessity to review the GIC Terms and Conditions thoroughly. This document includes important information about interest rates, maturity dates, and withdrawal policies. Without understanding these terms, individuals may find themselves in unexpected situations regarding their investment or financial requirements while studying in Canada. Reading and comprehending these details is essential for informed decision-making regarding funds and their usage.

Documents used along the form

When applying for the Scotiabank Student GIC Program, there are several other forms and documents that you might need to prepare and submit alongside the GIC Certificate Sample form. Each document plays a vital role in ensuring that your application is complete and that you comply with all necessary requirements.

- Study Permit Application: This document is essential for international students wishing to study in Canada. It allows you to apply for permission to study at a designated education institution.

- Letter of Acceptance: Issued by your educational institution, this letter confirms your admission and is a requirement for both the GIC application and your study permit.

- Wire Transfer Receipt: After transferring funds, this receipt serves as proof of payment and is often required for your GIC application to demonstrate that the necessary funds have been remitted to Scotiabank.

- Refund Wire Transfer Form: If your study permit application is denied, this form allows you to request a refund for your GIC. Fill it out to initiate the cashing-out process of your GIC.

- Privacy Agreement: This document outlines how your personal information will be handled by Scotiabank. It is crucial to understand your rights regarding privacy when engaging in financial transactions.

- Investment Companion Booklet: This booklet offers detailed information about the GIC investment, including policies, interest rates, and terms. Review it to better understand your investment.

- Canadian High Commission Refusal Letter: In the event your study permit application is rejected, this letter is necessary for processing a refund. It officially documents the refusal from the Canadian authorities.

- Verifiable Identification: This could include a government-issued ID such as a passport or driver's license. You must present suitable identification when interacting with Scotiabank and for opening a personal deposit account in Canada.

- Proof of Address in Canada: Some banks may require a document proving your Canadian address once you arrive. This could be a utility bill or a rental agreement.

Make sure to gather all these documents carefully before submitting your application. Having everything in order can help facilitate a smoother application process and ensure that you meet all necessary requirements efficiently.

Similar forms

- Bank Loan Application: Similar to the GIC Certificate Sample form, a bank loan application requires personal information, proof of identity, and an indication of how the funds will be used. Both documents serve as a means for financial institutions to assess a customer's eligibility for financial products.

- Investment Application Form: Like the GIC form, an investment application form necessitates detailed personal information and outlines the terms and conditions of the investment. Both documents also include sections for the applicant's signature, which signifies their agreement to the terms presented.

- Scholarship Application Form: The process for applying for a scholarship parallels that of the GIC in that both forms require personal details, documentation proving acceptance to an educational institution, and a section for the applicant's signature. Additionally, both forms serve to secure financial support for educational purposes.

- Certificate of Deposit (CD) Application: Similar to the GIC Certificate Sample form, a CD application form requires a minimum deposit to open an account, as well as personal information. Both documents illustrate the terms of the investment and specify interest rates and payment schedules.

Dos and Don'ts

When filling out the GIC Certificate Sample form, there are important dos and don’ts to keep in mind. Following these guidelines ensures your application is complete and processed efficiently.

- Do complete all required information in Sections A and B.

- Do attach a valid copy of your passport, signing each page, and your Letter of Acceptance from a designated educational institution.

- Do read the GIC Terms and Conditions before submission.

- Do sign and date the application to confirm your agreement to the terms.

- Don’t forget to submit your application and supporting documents to the provided email in a single PDF file.

- Don’t use an email address that does not match the one provided in your application form.

Misconceptions

There are several misconceptions regarding the GIC Certificate Sample form associated with the Scotiabank Student GIC Program. Below are five of these misconceptions clarified:

- Misconception 1: The GIC is free of charge.

- Misconception 2: You can access the entire GIC amount immediately.

- Misconception 3: The GIC is transferable to another person.

- Misconception 4: You can redeem the GIC anytime without restrictions.

- Misconception 5: The GIC does not accumulate interest if redeemed early.

Many believe that the GIC requires only the initial investment amount. In reality, applicants must remit an additional 100 CAD to cover administrative fees, totaling 10,100 CAD.

Contrary to this belief, the GIC funds are disbursed in installments. An initial payment of 2,000 CAD is provided upon arrival in Canada, followed by four subsequent payments of 2,000 CAD every two months.

This misconception stems from a misunderstanding of the GIC's nature. The GIC is not transferable, meaning it cannot be assigned to another individual.

Redemptions before maturity are limited. Funds can only be accessed prior to maturity if the holder’s study permit is declined, or if there is proof of admission rejection by a Canadian educational institution.

Some think that accrued interest applies regardless of redemption circumstances. In reality, if any principal amount is redeemed within 30 days of the issue date, no interest is earned on that principal amount.

Key takeaways

- Complete Sections A and B: Ensure all required information is filled out in both sections of the application form.

- Include necessary documents: Attach a signed copy of your valid passport and your Letter of Acceptance from a recognized educational institution.

- Review GIC Terms: Read through the attached Terms and Conditions before submitting your application.

- Submit via email: Scan and send the completed application along with documents as a single PDF to Scotiabank.

- Understand fund transfer process: Use a bank in India to transfer the required amount to your Scotiabank account.

- Follow up after application: Expect confirmation of your GIC details via encrypted email within three business days after the wire transfer is received.