Fill Out Your Gift Deed Texas Form

When considering the transfer of property as a gift in Texas, the Gift Deed Texas form plays a pivotal role. This legal document allows an individual, referred to as the Grantor, to convey ownership of real estate to one or more Grantees, often family members, out of love and affection. A key aspect of the Gift Deed is its structure, which emphasizes the nature of the joint tenancy, ensuring that if one Grantee passes away, their share automatically transfers to the surviving Grantee. Unlike a tenancy in common, where heirs inherit individually, joint tenancy with right of survivorship simplifies the transition of property ownership. Essential details are included in the form, such as property descriptions, legal references, and clauses that ensure adherence to existing zoning laws and easements. Moreover, the form contains a notice highlighting confidentiality rights, allowing individuals to remove sensitive information before filing. With this understanding of the Gift Deed, individuals can effectively navigate the process of gifting property in Texas while safeguarding their interests and those of the Grantees.

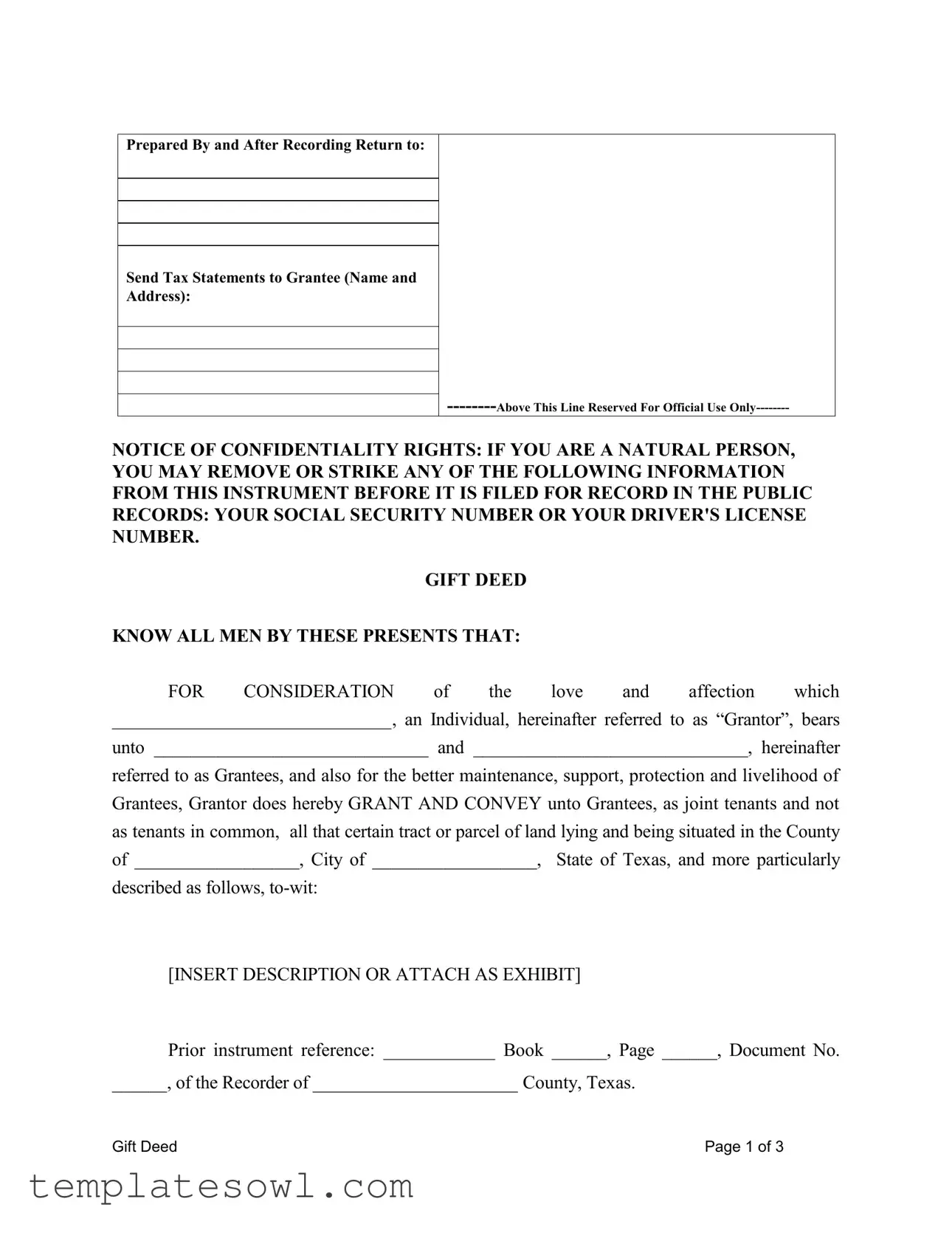

Gift Deed Texas Example

Prepared By and After Recording Return to:

Send Tax Statements to Grantee (Name and

Address):

NOTICE OF CONFIDENTIALITY RIGHTS: IF YOU ARE A NATURAL PERSON, YOU MAY REMOVE OR STRIKE ANY OF THE FOLLOWING INFORMATION FROM THIS INSTRUMENT BEFORE IT IS FILED FOR RECORD IN THE PUBLIC RECORDS: YOUR SOCIAL SECURITY NUMBER OR YOUR DRIVER'S LICENSE NUMBER.

GIFT DEED

KNOW ALL MEN BY THESE PRESENTS THAT:

FOR CONSIDERATION of the love and affection which

______________________________, an Individual, hereinafter referred to as “Grantor”, bears

unto ______________________________ and ______________________________, hereinafter

referred to as Grantees, and also for the better maintenance, support, protection and livelihood of Grantees, Grantor does hereby GRANT AND CONVEY unto Grantees, as joint tenants and not as tenants in common, all that certain tract or parcel of land lying and being situated in the County of __________________, City of __________________, State of Texas, and more particularly

described as follows,

[INSERT DESCRIPTION OR ATTACH AS EXHIBIT]

Prior instrument reference: ____________ Book ______, Page ______, Document No.

______, of the Recorder of ______________________ County, Texas.

Gift Deed |

Page 1 of 3 |

TO HAVE AND TO HOLD the above described premises together with all and singular the rights and appurtenances thereto in anywise belonging unto the above named Grantees, their successors and assigns forever; and Grantor herein hereby binds itself, its successors, assigns, and administrators to WARRANT AND FOREVER DEFEND all and singular the said premises unto the above named Grantee, their successors and assigns, against every person whomsoever lawfully claiming or to claim the same or any part thereof.

Grantees, TO HAVE AND TO HOLD as joint tenants, with right of survivorship and not as tenants in common, their heirs, personal representatives, executors and assigns forever: it being the intention of the parties to this conveyance, that (unless the joint tenancy hereby created is severed or terminated during the joint lives of the grantees herein) in the event one Grantee herein survives the other, the entire interest in fee simple shall pass to the surviving Grantee, and if one does not survive the other, then the heirs and assigns of the Grantees herein shall take as tenants in common.

This conveyance is made and accepted subject to the following matters, to the extent same are in effect at this time: Any and all restrictions, covenants, conditions and easements, if any, relating to the hereinabove described property, but only to the extent they are still in effect, shown of record in the hereinabove mentioned County and State; and to all zoning laws, regulations and ordinances of municipal and/or other governmental authorities, if any, but only to the extent that they are still in effect, relating to the hereinabove described property.

The property herein conveyed is not a part of the homestead of Grantor, or is part of the homestead of Grantor and the conveyance is joined by both Husband and Wife.

WITNESS Grantor’s hand this the ______ day of __________________, 20______.

Grantor

Type or Print Name

Gift Deed |

Page 2 of 3 |

STATE OF TEXAS

COUNTY OF __________________

This instrument was acknowledged before me on __________________ (date) by

____________________________________ (name of representative) as

____________________________________ (title of representative) of

________________________________________________ (name of entity or person

represented).

Notary Public

My commission expires:

Type or Print Name

Mailing Address of Grantee:

Name

Address

Gift Deed |

Page 3 of 3 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Legal Framework | The Gift Deed in Texas is governed by the Texas Property Code. |

| Consideration | Gift Deeds rely on love and affection as consideration rather than monetary payment. |

| Joint Tenancy | Grantees are granted ownership as joint tenants with right of survivorship. |

| Homestead Considerations | The property conveyed may or may not be part of the Grantor’s homestead. |

| Notarization Requirement | The Gift Deed must be notarized to be legally valid. |

| Confidentiality Notice | Grantors can protect their private information by removing specific details before filing. |

| Description Requirement | A detailed description of the property is necessary, either inserted or attached. |

| Restrictions and Easements | The deed is subject to existing restrictions, covenants, and easements affecting the property. |

| Record Keeping | The completed Gift Deed must be recorded with the local county clerk's office. |

Guidelines on Utilizing Gift Deed Texas

After completing the Gift Deed form, the document should be signed and notarized for it to be legally binding. Once properly filled out, the deed can be filed with the local county recorder's office. It is also advisable to keep copies for personal records.

- Begin by entering the name of the Grantor at the top of the form.

- Next, list the names of the Grantees who will receive the property.

- Fill in the county, city, and state where the property is located.

- Provide a detailed description of the property being transferred. This can also be attached as an exhibit.

- If applicable, reference any prior instruments by entering the Book, Page, and Document Number.

- Indicate the date of the deed on the designated line.

- Have the Grantor sign the document.

- Complete the acknowledgment section, including the name of the notary and the date.

- Fill in the mailing address for the Grantee at the bottom of the form.

What You Should Know About This Form

What is a Gift Deed in Texas?

A Gift Deed in Texas is a legal document that allows a person, known as the Grantor, to transfer ownership of property to someone else, referred to as the Grantee, without expecting anything in return. This transfer can be made out of love and affection and is typically used to give property to family members or friends.

Who can be a Grantor or Grantee in a Gift Deed?

Any adult individual can act as a Grantor, as long as they own the property they intend to gift. Grantees can also be any individuals, including family members, friends, or even organizations. However, it's important that the Grantees are legally able to own property.

Is a Gift Deed the same as a sale?

No, a Gift Deed differs from a sale. In a sale, the Grantor receives payment or consideration, while in a Gift Deed, the transfer is made without any payment. The motivation for a Gift Deed usually stems from affection or a desire to help the Grantee.

Do I need to pay taxes on a Gift Deed in Texas?

Generally, the Grantor may not have to pay capital gains tax on the gift if it's a personal residence. However, the Grantee could have tax implications when selling the property later. Always consult a tax professional for advice tailored to your situation.

What information must be included in a Gift Deed?

A Gift Deed must include the names of the Grantor and Grantee, a description of the property being transferred, and the signature of the Grantor. Additional notary acknowledgment may also be required to validate the document.

Does a Gift Deed need to be recorded?

Yes, it is recommended to record the Gift Deed with the county clerk's office where the property is located. Recording the deed helps protect the Grantee's ownership rights and provides public notice of the transfer.

What happens if a Grantee dies before the Grantor?

If a Grantee dies before the Grantor and if the deed establishes joint tenancy with right of survivorship, the surviving Grantee automatically inherits the entire interest in the property. If there are no surviving Grantees, the property often passes to the deceased Grantee's heirs.

Can I include restrictions in a Gift Deed?

Yes, the Grantor can lay out specific conditions or restrictions regarding the use of the property in the Gift Deed. These must be clearly stated in the document so that all parties understand them.

What if the Gift Deed is completed and I change my mind?

If the Gift Deed has already been executed and recorded, it may be difficult to reverse the transaction. However, the Grantor might be able to reclaim the property through a legal process, or by mutual agreement with the Grantee. Consulting with a legal professional is advisable in such cases.

Can a Gift Deed be used for any type of property?

A Gift Deed can be used for various types of property including real estate, personal property, and sometimes even business interests. However, the specific laws regarding the transfer can vary based on the type of property, so ensure you comply with any relevant regulations.

Common mistakes

When filling out the Gift Deed Texas form, many common mistakes can lead to complications. One significant error is failing to clearly identify all parties involved. Both Grantor and Grantees must have accurate names provided. Omitting or misspelling names can invalidate the deed and create confusion over ownership.

Another frequent issue is the incomplete description of the property. The document requires a detailed description of the property being transferred. Simply writing “my house” is insufficient. Include the legal description or an exhibit with the full details to avoid potential disputes.

People often overlook the implications of joint tenancy. Stating the intention for Grantees to hold the property as joint tenants, with rights of survivorship, is crucial. If this is not explicitly mentioned, it may lead to misunderstandings about how the property will be handled upon the death of one of the Grantees.

Missing signatures is an urgent problem that can halt the process. All necessary parties need to sign the document. Even if one party forgets to sign, the deed may not be legally binding. Additionally, ensuring the signature date is accurate is essential.

Individuals frequently neglect the proper acknowledgment by a notary public. This step is vital for the deed to be recorded officially. Without this acknowledgment, the deed may not be accepted by the county recorder’s office, and it can cause further delays in the transfer process.

Tax statements require careful attention. Filling in the name and address for where tax statements should be sent is necessary to ensure the Grantees receive all relevant documents. Incorrect information here can cause confusion in future property tax obligations.

Omitting any conditions or restrictions related to the property can also be a critical oversight. If there are existing easements, covenants, or conditions affecting the property, they must be disclosed within the deed. Failure to include this information can lead to legal troubles down the road.

Another mistake includes misunderstanding the homestead declaration. If the property is part of the Grantor's homestead, both spouses must join in the conveyance. Neglecting this can result in challenges to the validity of the gift.

Finally, individuals often forget to keep a copy of the completed deed. After the deed is executed and acknowledged, it should be recorded with the county, and a copy should be retained for personal records. This step is crucial for future reference and proof of ownership.

Documents used along the form

When completing a Gift Deed in Texas, several related documents may be necessary to ensure the transaction is valid and properly recorded. Each of these forms serves a unique purpose, providing crucial information or legal assurance. Here’s a brief overview of common documents associated with a Gift Deed.

- Title Policy: This document provides protection against any defects in the title of the property being gifted. A title policy assures the grantee that the property is free of claims that could affect ownership.

- Property Description: While the Gift Deed requires a legal description of the property, a separate document may sometimes provide a more detailed account or boundary description, especially in complex transactions.

- Notice of Gift: This notice is often required by local or state authorities to inform them of the transfer. It may also provide a formal declaration of the intention to gift property.

- Tax Affidavit: This document outlines any potential tax implications of the property transfer. It's important to clarify whether or not the gift is subject to taxation.

- Affidavit of No Consideration: This affidavit confirms that the transfer is a gift and that no money or valuable consideration is exchanged, which can affect tax treatment.

- Joint Tenancy Agreement: If the gift involves joint tenants, documentation may clarify the terms of shared ownership and rights of survivorship between the grantees.

- Warranty Deed (if applicable): While not always necessary, this document may be included if the grantor wants to reassure the grantee of their ownership and transfer rights through warranties.

- Tax Statement Request: This form may be needed to ensure that tax statements are directed to the correct grantee after the transfer is complete, thereby ensuring accurate future tax billing.

Properly preparing these documents along with the Gift Deed can help facilitate a smooth transfer of property and mitigate any future legal complications. Each form plays a vital role in the conveyance and safeguarding of everyone's interests involved in the transaction.

Similar forms

- Warranty Deed: Like a Gift Deed, a Warranty Deed transfers property ownership. However, a Warranty Deed includes guarantees from the seller about the title’s validity, ensuring that the buyer receives clear ownership without legal claims.

- Quitclaim Deed: Similar to a Gift Deed in that it transfers ownership without financial consideration, a Quitclaim Deed does not guarantee the title's legitimacy. It simply conveys whatever interest the grantor has, if any, leaving the grantee with uncertain title security.

- Deed of Trust: Both documents are related to property transactions, yet a Deed of Trust secures a loan by transferring property rights as collateral. In contrast, a Gift Deed involves a transfer of ownership without any expectation of repayment.

- Special Warranty Deed: This document is also used to transfer property while providing some assurances about title issues. It differs from a Gift Deed in that it only covers claims that arose during the grantor’s ownership, rather than guaranteeing a clear title from the beginning.

- Life Estate Deed: A Life Estate Deed creates a present interest for one party while preserving future rights for another. While both documents involve property transfer, a Gift Deed fully transfers ownership at the moment of signing without reserved future rights.

- General Power of Attorney: While not a deed, this document grants someone the authority to act on another's behalf, including property transactions. A Gift Deed requires the direct involvement of the grantor and grantee in conveying property without granting representation rights.

- Affidavit of Heirship: This document establishes the heirs of a deceased person and may help in property transfers. Both may involve property disposition, but a Gift Deed actively transfers ownership while an Affidavit of Heirship simply identifies heirs.

- Bill of Sale: Although it is typically used for personal property, a Bill of Sale is similar in that it transfers ownership without monetary exchange. The difference lies in the type of property expressed—a Gift Deed pertains specifically to real estate, while a Bill of Sale deals with movable assets.

Dos and Don'ts

When completing the Gift Deed Texas form, there are several important guidelines to follow. Here’s a straightforward list to help you navigate the process:

- Do ensure that all names are written clearly, including both the grantor and the grantees.

- Don’t forget to include a specific and clear description of the property being transferred.

- Do provide accurate information regarding the county and city where the property is located.

- Don’t leave out signatures or dates, as these are critical for validation.

- Do check for any existing restrictions or easements that may affect the property.

- Don’t overlook the confidentiality rights; consider removing sensitive information.

- Do seek guidance from a legal professional if you have questions about the process.

By following these points, you can help ensure that the process goes smoothly and that the gift deed is properly executed.

Misconceptions

There are several misconceptions surrounding the Gift Deed Texas form that are important to clarify. Understanding these common misunderstandings can help individuals navigate property transfers with greater confidence.

- You Cannot Use a Gift Deed for Real Estate Transfers: Many believe that Gift Deeds are only for personal items. In fact, they are valid for transferring real estate from one person to another without monetary compensation.

- Gift Deeds Need to be Notarized to be Valid: Some people think that notarization is optional. However, for a Gift Deed in Texas, notarization is typically required to ensure its legal validity.

- You Must Pay Taxes on Gift Deeds: There is a misconception that gifts must always be taxed. While the donor may have to file a gift tax return if the gift exceeds a certain amount, Texas does not impose a property tax on the transfer of property through a Gift Deed.

- Gift Deeds are the Same as Wills: A common misunderstanding is that a Gift Deed is equivalent to a will. Unlike a will, which only takes effect after death, a Gift Deed transfers ownership immediately upon execution.

- You Do Not Need to Notify Anyone of the Gift: Some believe they can transfer property without notification. It's crucial to inform relevant parties, such as other co-owners or heirs, about the property transfer.

- Only Individuals Can be Grantors: There is the belief that only individual persons can create a Gift Deed. In reality, entities such as corporations or trusts can also serve as grantors in this type of deed.

- Gift Deeds Can Be Easily Revoked: Many assume that a Gift Deed can be revoked at any time. While it is possible, revocation typically requires specific legal processes and may not be as straightforward as it seems.

By dispelling these misconceptions, individuals can ensure they are making informed decisions when considering a Gift Deed in Texas.

Key takeaways

- Purpose: A Gift Deed is used to transfer property from one person (the Grantor) to another (the Grantees) without any payment involved, based on love and affection.

- Confidentiality: If you’re a natural person, you can remove your Social Security or driver’s license number from the document before filing.

- Joint Tenancy: The deed grants ownership to Grantees as joint tenants, meaning if one passes away, the other automatically inherits the entire property.

- Property Description: It’s essential to provide a clear description of the property being transferred. This can be done by inserting details or attaching an exhibit.

- Legal Acknowledgment: The document must be acknowledged by a notary public to make it valid and enforceable.

- No Payment Needed: Unlike traditional property sales, no monetary consideration is required for a Gift Deed.

- Tax Statements: Ensure tax statements are sent to the Grantees' correct address after the deed is recorded.

- Restrictions and Regulations: The property is subject to any existing conditions, easements, and local zoning laws that are in effect at the time of the deed.

- Homestead Considerations: The Grantor must clarify if the property is part of their homestead and if both spouses are joining in the conveyance if applicable.

Browse Other Templates

Family Support Information Sheet,Army Reserve Family Data Form,Servicemember Family Contact Worksheet,Reserve Component Family Registration,Military Family Program Contact Form,Dependent Information Data Collection,Family Programs Participation Works - Listed languages help ensure effective communication between families and support staff.

Ss Forms - Assessment of vital signs is a critical component of the report.

What Is Use Tax in Arizona - The form also covers exemptions for transactions with governmental entities.