Fill Out Your Gift Letter For Mortgage Form

When navigating the process of securing a mortgage, one crucial document often comes into play: the Gift Letter for Mortgage form. This form serves as a formal declaration to the lender that a sum of money is being given as a gift to support the homebuyer’s financial needs. Typically required when the funds are supplied by relatives or close friends, the letter reinforces that the financial support is a genuine gift without expectations of repayment. Within its structure, important details are outlined, including the giver’s and recipient’s names, the specific amount of the gift, and the property involved, ensuring that all necessary information is conveyed clearly. Moreover, the form necessitates documentation to validate the transaction, such as bank statements showing the gift’s origins and confirmation that the funds have reached the buyer’s account prior to settlement. Importantly, it indicates that the funds should not derive from parties involved in the sale, maintaining transparency in the transaction. As adherence to federal regulations is essential, the form also highlights the serious repercussions of providing inaccurate information, emphasizing the legal importance of accuracy. This simple yet vital document plays a key role in enhancing the financial profile of those looking to purchase a home.

Gift Letter For Mortgage Example

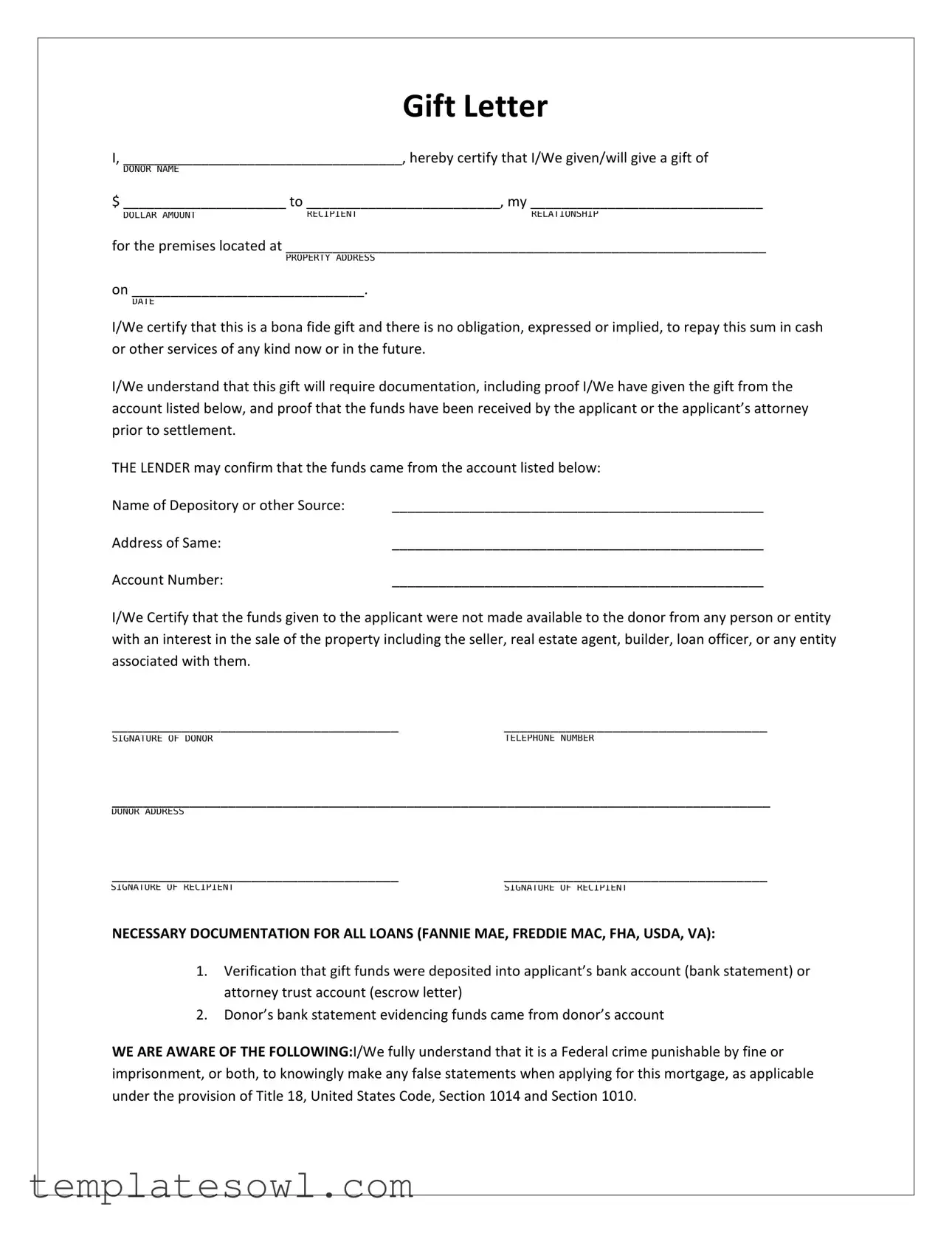

Gift Letter

I, ____________________________________, hereby certify that I/We given/will give a gift of

$ _____________________ to _________________________, my ______________________________

for the premises located at ______________________________________________________________

on ______________________________.

I/We certify that this is a bona fide gift and there is no obligation, expressed or implied, to repay this sum in cash or other services of any kind now or in the future.

I/We understand that this gift will require documentation, including proof I/We have given the gift from the account listed below, and proof that the funds have been received by the applicant or the applicant’s attorney prior to settlement.

THE LENDER may confirm that the funds came from the account listed below:

Name of Depository or other Source: |

________________________________________________ |

Address of Same: |

________________________________________________ |

Account Number: |

________________________________________________ |

I/We Certify that the funds given to the applicant were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent, builder, loan officer, or any entity associated with them.

_______________________________________________________________________

_____________________________________________________________________________________

_______________________________________________________________________

NECESSARY DOCUMENTATION FOR ALL LOANS (FANNIE MAE, FREDDIE MAC, FHA, USDA, VA):

1.Verification that gift funds were deposited into applicant’s bank account (bank statement) or attorney trust account (escrow letter)

2.Donor’s bank statement evidencing funds came from donor’s account

WE ARE AWARE OF THE FOLLOWING:I/We fully understand that it is a Federal crime punishable by fine or imprisonment, or both, to knowingly make any false statements when applying for this mortgage, as applicable under the provision of Title 18, United States Code, Section 1014 and Section 1010.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose of the Gift Letter | The Gift Letter for Mortgage form certifies that funds given to a mortgage applicant are a genuine gift and not a loan that must be repaid. |

| Required Documentation | The donor must provide proof of the gift through bank statements or escrow letters showing the transfer of funds before closing. |

| Confirmation of Funds | The lender may verify that gift funds originated from the donor's account, preventing any conflict of interest in the property's sale. |

| Legal Consequences | Providing false information on the Gift Letter can lead to criminal charges under Title 18, United States Code, Sections 1014 and 1010. |

| State-Specific Regulations | In some states, specific laws govern gift letters and their usage in mortgage applications. For example, California requires adherence to its civil code when validating gifts. |

Guidelines on Utilizing Gift Letter For Mortgage

Completing the Gift Letter for Mortgage form is an important step in securing financing for your property. This letter serves to confirm the details of a financial gift provided to you, which can be crucial for lenders. Follow these instructions carefully to ensure that all required information is included and accurately filled out.

- Begin by entering your full name in the first blank space provided at the top of the letter.

- In the next blank, write the amount of the gift in dollars.

- Indicate the name of the recipient of the gift in the corresponding space.

- Specify your relationship to the recipient in the designated section.

- Clearly write the address of the property that the gift is intended to support.

- Fill in the date you are signing the gift letter.

- In the next section, you must state the name of the bank or financial institution from which the gift funds will come.

- Provide the address of that bank or institution in the specified area.

- Write your account number in the appropriate field, ensuring it is accurate.

- Certify that the funds given are a true gift by ticking the box or signing where indicated, and reiterate that there’s no obligation for repayment.

- Sign and date the form to finalize your declaration.

- Make sure to gather the necessary documentation: a bank statement showing the gift funds have been deposited and a bank statement from the donor evidencing the funds before submission.

After completing the form, review it alongside your documentation to ensure everything is in order. This will speed up the loan approval process. Keep a copy of the signed letter and the documentation for your records. Your lender may reach out for confirmation, so maintaining clear communication throughout this process is important.

What You Should Know About This Form

What is a Gift Letter for a Mortgage?

A Gift Letter for a Mortgage is a formal document that certifies that a monetary gift has been provided to a homebuyer, often a family member or close friend. This letter serves to explain the source of funds that will be used for the down payment on a home and confirms that there is no expectation of repayment. Lenders typically require this document to ensure that the gift complies with their requirements and federal regulations.

Why do lenders require a Gift Letter?

Lenders need to ensure that all funds used for a mortgage down payment are legitimate and do not involve any obligations that could impact a borrower's financial stability. The Gift Letter assists in verifying that the funds are a true gift and not a loan in disguise. This helps prevent potential issues related to loan qualification and financial responsibility for the buyer.

What information should be included in the Gift Letter?

The Gift Letter should contain specific information such as the names of both the donor and the recipient, the amount of the gift, the relationship between the two parties, and a statement clarifying that the funds do not need to be repaid. Additionally, the letter should include details of the bank account from which the funds will be transferred and confirm that the gift is not connected to any entity involved in the property transaction.

What documentation is necessary to support a Gift Letter?

To back up the Gift Letter, lenders typically request documentation such as a bank statement from the donor that shows the funds were available in their account. They may also require proof that the funds have been deposited into the recipient's account. In some cases, an escrow letter from an attorney managing trust funds may be needed, particularly if the transaction is time-sensitive.

Are there any legal implications for providing false information in a Gift Letter?

Yes, providing false information in a Gift Letter can have serious legal consequences. Under federal law, it is considered a crime punishable by fines or imprisonment to knowingly submit false statements related to mortgage applications. It's essential for both the donor and recipient to ensure that all information provided is accurate and true. This protects both parties and complies with federal guidelines.

Common mistakes

When filling out the Gift Letter for a mortgage, it's easy to overlook important details. One common mistake is not providing complete information in the blanks. For instance, if the donor's name is missing or the relationship to the recipient is not specified, it could raise questions later. Always ensure that every section is accurately filled out and includes necessary identification.

Another frequent error involves misstating the gift amount. It is crucial to write the exact amount of the gift clearly. Discrepancies between the written amount and the numerical value can create confusion. If there is any uncertainty about the gift's total, it’s best to double-check before submitting.

Some people forget to include proof of the allocated funds. The form requires documentation showing that the gift came from the donor's bank account. By failing to attach the necessary bank statements, the lender may request additional information, which can delay closing the mortgage.

Additionally, donors sometimes overlook signing the document. A signature demonstrates the donor's intent and commitment to providing the gift. Without this important step, the letter may not hold up, which could complicate the mortgage application process.

Misunderstanding the intent behind the gift can lead to issues as well. A bona fide gift means that there is no expectation of repayment. If the donor suggests or implies that repayment is required, this can jeopardize the mortgage approval.

Lastly, not documenting the source of the funds thoroughly is a significant oversight. The lender needs assurance that the gift does not come from any party with an interest in the property transaction. This requirement is meant to ensure that the gift is legitimate and independent, so transparency about the source is crucial.

By avoiding these common mistakes, the process of securing a mortgage can go more smoothly. Paying attention to detail when completing the Gift Letter for a mortgage will make it easier for both donors and recipients, ensuring the transaction is successful and meets lender expectations.

Documents used along the form

When securing a mortgage, a Gift Letter is just one essential piece of the puzzle. Several other documents often accompany it to ensure everything is clear and compliant with regulations. Here’s a brief overview of some key forms you might encounter.

- Bank Statement: This document shows recent transactions and account balances, providing evidence that the gift funds have been deposited into the homebuyer’s bank account. It helps the lender verify that the full amount is available for the mortgage process.

- Escrow Letter: This letter confirms that the gift funds have been placed into an attorney trust account. It assures the lender that the funds are secure and available to finalize the home purchase once all conditions are met.

- Donor's Bank Statement: This document demonstrates that the gift funds originated from the donor’s account. Lenders require this proof to ensure that the money is legitimate and the transaction is transparent.

- Income Verification Documents: These include pay stubs or tax returns that assess the borrower’s financial stability. Though not directly related to the gift, lenders consider this information vital during the mortgage approval process.

Having these documents ready not only helps streamline the application process but also builds trust with your lender. Being organized can make a significant difference when it comes time to close on your new home.

Similar forms

The Gift Letter for Mortgage form plays a significant role in documenting a financial gift meant to assist with a mortgage application. Several other documents share similarities with the Gift Letter due to their respective purposes in proving financial assistance or claims. Below are nine documents that are similar to the Gift Letter for Mortgage form, along with brief explanations of their similarities:

- Loan Agreement: Like the Gift Letter, this document outlines the terms of a loan, including provision of funds and clear statements confirming the absence of repayment obligations.

- Affidavit of Support: This document shows affirmation about a person’s financial ability to support another, similar to how a Gift Letter demonstrates the donor's intent to give financial assistance without repayment expectations.

- Bank Statement: It offers proof of funds available, just as the Gift Letter requires documentation showcasing that the funds were deposited into the recipient's account.

- Settlement Statement (HUD-1): This document details the financial transactions in a real estate closing, much like the Gift Letter that outlines the financial gift involved in the transaction.

- Loan Gift Affidavit: Similar to the Gift Letter, this affidavit provides a sworn statement about the gift, including its nature and the intent not to repay, ensuring clarity in the mortgage process.

- Financial Statement: This document presents an individual's financial situation, akin to the Gift Letter that verifies the donor's capacity to provide the gift without obligation.

- Certification of No Repayment Obligation: This certification explicitly states that the funds provided do not need to be repaid, just as the Gift Letter asserts that the gift is free from any repayment duty.

- Promissory Note: While this typically indicates a promise to repay a loan, it can also serve to clarify that a financial contribution is a gift if it includes necessary disclaimers similar to those in a Gift Letter.

- Gift Tax Return (Form 709): Although intended for tax reporting, this document confirms the transfer of a gift, emphasizing its non-repayable nature much like what is asserted in a Gift Letter.

Understanding these documents can aid individuals in navigating the complexities of borrowing and gifting processes in real estate transactions.

Dos and Don'ts

When filling out the Gift Letter for Mortgage, it's important to ensure accuracy and compliance with all necessary requirements. Here are ten dos and don’ts to keep in mind:

- Do clearly state the amount of the gift in dollars to avoid any ambiguity.

- Do specify the relationship between the donor and the recipient to establish eligibility.

- Do ensure that the gift letter is dated; this offers a timeline for the documentation.

- Do provide complete bank account details to confirm the source of the funds.

- Do keep copies of all documentation for your records, including bank statements.

- Don't forget to sign and print names where required; your acknowledgment is critical.

- Don't misrepresent the nature of the gift; it must be a true gift without expectations of repayment.

- Don't use vague language when describing the premises; specificity is key.

- Don't leave any sections blank; ensure that all information is fully filled out and accurate.

- Don't ignore the importance of providing supporting documentation; lenders will require it.

By following these guidelines, you can help ensure a smoother process when submitting your gift letter for the mortgage. It’s essential to be thorough and precise, as this form plays a vital role in the loan approval process.

Misconceptions

Understanding the nuances of the Gift Letter for Mortgage form is crucial for anyone considering using gifted funds for a home purchase. Unfortunately, several misconceptions can lead to confusion. Below is a list of common misunderstandings surrounding this form:

- Gift letters are only necessary for large amounts. Many people believe that gift letters are only required when the amount exceeds a certain threshold. In reality, lenders may ask for a gift letter regardless of the amount to ensure clarity regarding the funds' origin.

- A gift letter is the same as a loan. Some assume that a gift letter implies a loan. However, it explicitly states that the funds are a gift with no expectation of repayment, distinguishing it from borrowed money.

- Any form of documentation is acceptable. There’s a belief that any document showing that money was transferred is sufficient. In fact, specific documentation, such as bank statements or escrow letters, is required by lenders to verify the transaction.

- Gifts can be received from anyone. Another misconception is that gifts can come from any source. The lender typically requires confirmation that the funds did not come from any individual with a vested interest in the property, such as the seller or real estate agent.

- Once the gift is given, no further steps are needed. Some think that once the gift is transferred, the process ends there. However, proper documentation must be maintained and provided before closing on the property.

- Gift letters are overly complicated. There is a perception that gift letters involve a tedious and complex process. In reality, while the requirement of documentation is clear, the actual form itself is straightforward and easy to understand.

Clearing these misconceptions can help smooth the mortgage process, ensuring both lenders and borrowers understand their roles and responsibilities concerning gifted funds.

Key takeaways

- Gifting funds must be documented. A gift letter must include details such as the donor's name, the recipient's name, the amount of the gift, and a statement confirming it is a genuine gift.

- Verification of the transaction is required. Financial institutions typically require bank statements showing that the funds have been transferred to the recipient’s account.

- The donor cannot receive any compensation in return for the gift. The letter should clearly state that there is no expectation of repayment, either in cash or services.

- Documentation must be provided both to the lender and potentially to the applicant’s attorney. This includes proof that the funds were deposited into the appropriate account before the closing of the mortgage.

- The donor must not have any affiliation with the sale of the property. Funds originating from any party with a stake in the transaction, such as sellers or agents, cannot qualify as gifts.

- Legal implications exist for false statements. Misrepresenting information on the gift letter form may lead to severe penalties under federal law, including fines and imprisonment.

Browse Other Templates

Maritime College Scholarship Application,New York State Cadet Scholarship Form,SUNY Maritime Cadet Program Application,Excellence in Maritime Education Scholarship,Cadet Appointment Program Application,Leadership and Adventure Scholarship Form,SUNY M - By joining Maritime College, students become part of a long-standing tradition of excellence in maritime education.

Rosebud Sioux Tribe - The form collects essential data including name, date of birth, and enrollment status.

Texas Health and Human Services Forms - The form correlates observations with specific care routines and learning activities.