Fill Out Your Gift Of Equity Letter Form

The Gift Of Equity Letter is an essential document that facilitates the transfer of equity from a donor to a borrower, commonly a family member or close friend. This form outlines the specifics of the gift, stating the names of the donor and borrower, their relationship, and the precise amount of equity being gifted to assist in property acquisition. The letter confirms that this transfer is a genuine gift, with no expectation of repayment, whether in cash or through services rendered. Both donor signatures are required, ensuring that all parties involved understand the agreement clearly. This simple yet powerful document serves as a vital tool in real estate transactions, enabling borrowers to secure financing while maintaining a straightforward and transparent relationship with their benefactors.

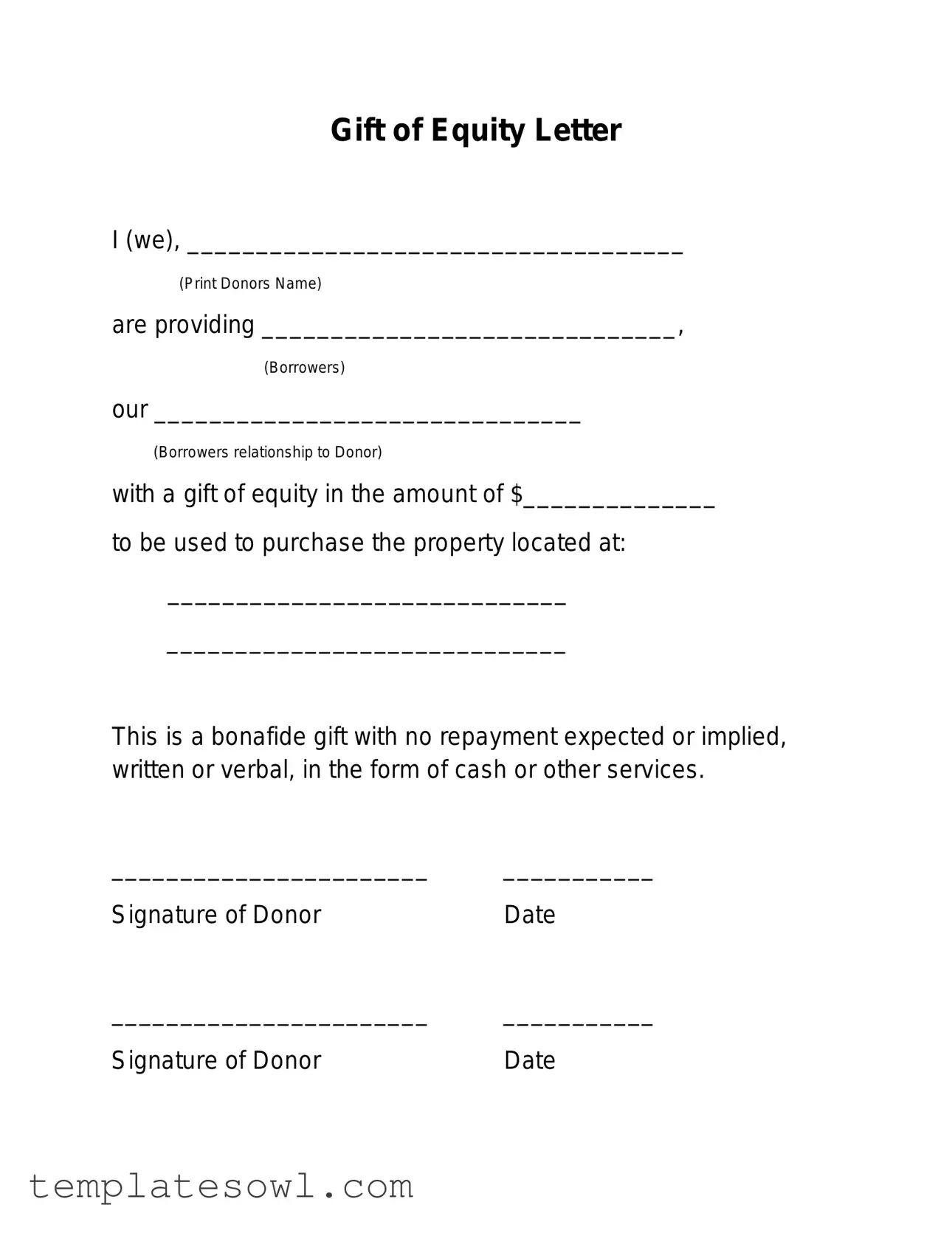

Gift Of Equity Letter Example

Gift of Equity Letter

I (we), ____________________________________

(Print Donors Name)

are providing ______________________________,

(Borrowers)

our _______________________________

(Borrowers relationship to Donor)

with a gift of equity in the amount of $______________

to be used to purchase the property located at:

_____________________________

_____________________________

This is a bonafide gift with no repayment expected or implied, written or verbal, in the form of cash or other services.

_______________________ |

___________ |

Signature of Donor |

Date |

_______________________ |

___________ |

Signature of Donor |

Date |

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose | The Gift of Equity Letter serves to document a gift of equity to help a borrower purchase a property. |

| Recipient Details | It includes the recipient’s name, their relationship to the donor, and the equity amount provided. |

| Gift Amount | The letter clearly states the amount of equity being gifted, making it transparent for all parties involved. |

| No Repayment Clause | This gift is made with no expectation of repayment, either in cash or through other services. |

| Signatures Required | Both donors must sign and date the letter to validate the transaction. |

| Governing Law | This form is subject to state laws, which may vary, so it’s essential to consult local regulations. |

Guidelines on Utilizing Gift Of Equity Letter

Once you've gathered all the necessary information, filling out the Gift Of Equity Letter form is straightforward. Follow these steps to ensure that all details are correctly entered and formatted.

- Print the form or have a digital copy ready for completion.

- In the first blank, write the full name of the donor (yourself or the person granting the gift).

- In the second blank, insert the name of the borrower (the person receiving the gift).

- Next, indicate your relationship to the borrower (like parent, sibling, etc.).

- Fill in the amount of the gift of equity. Make sure to write the exact dollar amount in the designated space.

- Provide the property address where the gift of equity will be applied. Be specific, including the street, city, and zip code.

- In the next section, acknowledge that this is a genuine gift with no expectation of repayment. You may write a simple note stating this, or just refer to the sentence given in the form.

- Have the donor sign and date the form in the appropriate spaces provided. If there are multiple donors, ensure both signatures are obtained.

What You Should Know About This Form

What is a Gift of Equity Letter?

A Gift of Equity Letter is a formal document that serves to declare a financial gift made by a property owner to a relative or close friend. This gift is presented in the form of equity, often allowing the recipient to use this capital toward the purchase of real estate. The letter outlines the details of the transaction and provides the necessary declarations that the gift is genuine, with no expectation of repayment.

Who needs a Gift of Equity Letter?

This letter is particularly useful for those looking to assist family members or friends in acquiring a home. If you are selling a property to someone close to you below its total market value, a Gift of Equity Letter can help document the intent and clarify financial matters for lending institutions or legal authorities.

What information should be included in the letter?

The Gift of Equity Letter should contain specific elements. Typically, it includes the names of the donor and borrower, their relationship, the amount of the gift, a brief description of the property being purchased, and the clear statement that the gift is non-repayable. Signatures from the donor are also necessary to validate the document.

Is a Gift of Equity Letter legally binding?

While the Gift of Equity Letter helps formalize the intention of gifting equity, it is not a legally binding contract in the same way that sale agreements are. However, it provides important documentation that can be used to clarify the nature of the transaction to lenders or for tax purposes.

Are there tax implications for gifting equity?

Yes, gifting equity can have tax implications. The IRS allows a certain amount to be gifted each year without incurring gift tax. As of now, this limit is set at a substantial amount, but it is essential to stay updated on the current figures. For amounts exceeding the annual exclusion, filing a gift tax return may be required. Consulting a tax professional can provide clarity on any potential ramifications.

How is a Gift of Equity used in a real estate transaction?

In a real estate transaction, a Gift of Equity is applied as part of the buyer’s down payment. Lenders may require the Gift of Equity Letter to proceed with the mortgage application. This letter not only verifies the source of the down payment but also reinforces that the funds were a gift and not a loan, which might affect the borrower’s qualifications.

Common mistakes

Filling out the Gift of Equity Letter form can seem straightforward, but it's easy to make mistakes that could complicate the process. One common mistake is failing to clearly print the donor's name. Without clear identification, there can be confusion about who is giving the gift. It's essential to ensure that the name stands out and is legible, preventing potential issues down the line.

Another frequent error is neglecting to specify the relationship between the donor and the borrower. The form asks for this information for a reason. It helps lenders understand the context of the transaction. If this relationship is left blank or filled out inaccurately, it might raise questions about the legitimacy of the gift.

Moreover, many people overlook the need to provide the exact amount of the gift of equity. This figure must be clearly written in both numerical and written forms to avoid any ambiguity. Inaccuracies in this section could lead to discrepancies that may affect the loan approval process.

Additionally, some forget to include the address of the property in question. Omitting this critical detail can create confusion regarding which property the gift applies to. A complete address ensures that there is no misunderstanding and that all parties are on the same page.

Another mistake is not clearly stating that the gift is indeed a bona fide gift with no repayment expected. This assurance is crucial for lenders to validate the transaction. Neglecting to include this statement can raise concerns about the authenticity of the gift, potentially complicating the approval process.

Finally, many individuals fail to sign and date the form accurately. Both donors must provide their signatures and the date of the transaction. Signatures authenticate the document, and missing them can render the form invalid. Each of these aspects plays a vital role in ensuring a smooth process, so attention to detail is essential.

Documents used along the form

When executing a transfer of property involving a Gift of Equity, several documents accompany the Gift of Equity Letter to ensure clarity and legality in the transaction. These documents play crucial roles in the property transfer process, helping to protect both the donor and the recipient.

- Purchase Agreement: This document outlines the terms and conditions of the sale between the buyer and seller. It includes details such as purchase price, financing terms, and closing date. It ensures both parties are in agreement about the specifics of the transaction.

- Deed: The deed is a legal document that formally transfers ownership of the property from the seller to the buyer. It contains a description of the property and must be executed by the current property owner for the transfer to be valid.

- Title Report: This report provides information on the property's ownership history, any encumbrances, and claims against the property. A title report ensures that the seller has the right to sell the property and that there are no unexpected issues affecting ownership.

- Gift Tax Return (Form 709): The donor may need to file this form with the IRS to report the gift for tax purposes. Although gifts under a certain limit may not incur taxes, proper documentation is essential for compliance with tax regulations.

- Affidavit of Title: This is a sworn statement by the seller confirming that they own the property and providing assurances regarding liens, disputes, or legal issues. This document is crucial for establishing clear ownership and titles.

- Closing Statement (HUD-1 or Closing Disclosure): This document itemizes all the financial aspects of the transaction. It details the costs involved, including taxes, fees, and any adjustments for the buyer and seller. It helps ensure transparency and clarity in the financial exchange.

In conclusion, each document serves a specific purpose in facilitating a seamless property transfer. Understanding their significance can help both donors and recipients prepare effectively for the transaction ahead. Ensuring all necessary paperwork is in order lays a strong foundation for this significant financial gift.

Similar forms

The Gift of Equity Letter serves a specific function in real estate transactions, particularly when family members or close relations are involved. Here are ten other documents that share similarities with the Gift of Equity Letter, highlighting their functions and features:

- Gift Letter: Much like a Gift of Equity Letter, a Gift Letter documents a monetary gift given to a borrower. It confirms that the funds do not need to be paid back, ensuring clarity for lenders.

- Affidavit of Support: An Affidavit of Support is a legal document often used to demonstrate financial backing. It assures entities, like immigration services, of ongoing assistance but is not intended for repayment.

- Loan Application: Similar in purpose, a Loan Application provides information about a borrower's financial status and may reference gifts, such as equity, that can support their creditworthiness.

- Quitclaim Deed: A Quitclaim Deed transfers ownership rights from one party to another without a warranty of title. While not a gift document, it establishes property ownership relationships, much like equity gifts do.

- Deed of Gift: This legal form allows a property owner to transfer property to another person as a gift, clearly stating that no compensation is expected, akin to a Gift of Equity Letter.

- Grant Deed: A Grant Deed conveys property from one party to another and implies that the property is being transferred without expectations of repayment or further claims, resembling the nature of a gift.

- Real Estate Purchase Agreement: This document outlines the terms of a property sale. If equity is gifted toward the purchase, its role in the transaction aligns with what is detailed in a Gift of Equity Letter.

- Real Estate Transfer Disclosure Statement: This statement provides crucial information about a property's condition. While it involves legalities, understanding gifts like equity can affect how buyers perceive property value in these disclosures.

- Promissory Note: Though a Promissory Note usually involves repayment, it can relate to equity gifts as a reference point concerning cash gifts tied to property transactions.

- Closing Disclosure: A Closing Disclosure document gives a final accounting of a real estate transaction. It reflects any equity contributions or gifts, ensuring all parties understand the financial implications.

Each of these documents plays a role in financial agreements and relationships, often clarifying the nature of gifts and ownership in real estate transactions.

Dos and Don'ts

When filling out the Gift of Equity Letter form, consider the following dos and don'ts:

- Do ensure all names and relationships are printed clearly to avoid confusion.

- Do include the exact amount of the equity gift in the designated space.

- Do specify the property address accurately for proper identification.

- Do sign and date the document to validate your intention.

- Don't leave any blank spaces on the form that could lead to uncertainty.

- Don't imply any expectation of repayment or services in exchange for the gift.

Misconceptions

Understanding the Gift of Equity Letter form is essential for both donors and recipients. However, several misconceptions often arise regarding its purpose and implications. Below are six common misconceptions about this form, along with clarifications.

- It only applies to family members. While many people use the Gift of Equity Letter between relatives, it is not limited to family. Friends or other acquaintances can also utilize this letter to formalize a gift of equity.

- It creates a loan. Some believe that providing a gift of equity establishes a loan agreement. In reality, the letter explicitly states that the gift is non-repayable, meaning no financial obligation is created.

- It can be verbal. A common misconception is that a verbal agreement suffices. The Gift of Equity Letter must be documented in writing to ensure clarity and to serve as proof of the gift.

- It affects tax status of the donor. Many think that providing a gift of equity automatically results in tax implications for the donor. While gifts may be subject to gift tax laws, the applicability depends on the amount and the donor’s overall gift strategy.

- It must involve cash. Some people believe that the gift must be in cash. However, the gift can also be in the form of equity built up in a property, making it flexible in its application.

- Only one donor can make the gift. Some assume that only a single donor is allowed to give equity. In fact, multiple parties can provide gifts of equity, and these contributions can be documented concurrently on the form.

Addressing these misconceptions helps clarify the purpose and use of the Gift of Equity Letter form, facilitating smoother transactions for both parties involved.

Key takeaways

When filling out and using a Gift of Equity Letter form, consider the following key points:

- The form must include the full names of both the donor and the borrower.

- Clearly state the relationship between the donor and the borrower.

- Specify the exact amount of equity being gifted.

- Provide the complete address of the property involved in the transaction.

- Emphasize that this is a genuine gift, with no repayment expected.

- Signatures from both donors are required to validate the document.

- The date of signing should be included to track when the gift was formally acknowledged.

- Keep a copy of the letter for personal records and future reference.

Browse Other Templates

P60 - For students, the P45 includes provisions for Student Loan deductions, if applicable.

Naccrra - Be aware of local market rates for child care as this may affect your assistance eligibility.

Parents Plus Loan Application - Parents can choose their repayment options during the application phase.