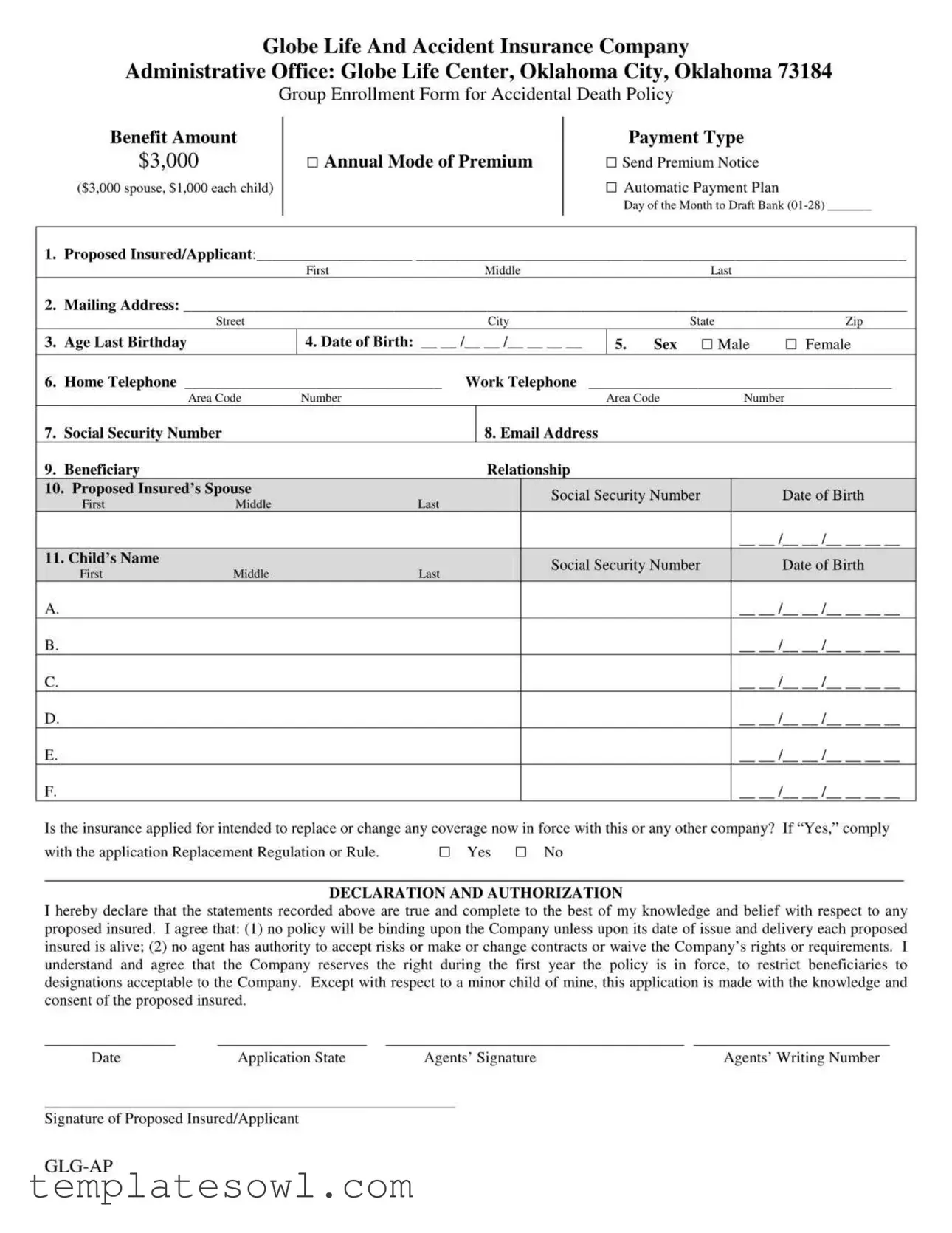

Fill Out Your Globe Life And Accident Insurance Form

Understanding the Globe Life And Accident Insurance form is crucial for anyone considering this specific insurance policy. This form encompasses several key components necessary for enrolling in the Accidental Death Policy. At the outset, it facilitates the collection of essential personal information from the proposed insured and their family, including the applicant's name, age, sex, and contact details. Additionally, individuals will provide information regarding their payment preferences, selecting from options such as an automatic payment plan to simplify premium payments. The form also includes sections dedicated to beneficiary designation, which ensures that the insurance benefits are directed appropriately upon fulfillment of the policy terms. The applicant must disclose the proposed insured's social security number, further affirming identity verification. Moreover, it is imperative to declare whether the insurance aims to replace any existing coverage, adhering to specific regulations. As applicants complete the declaration and authorization section, they affirm the accuracy of the information provided and consent to the insurance company's guidelines regarding coverage initiation. Overall, this form serves as a foundational document that guides individuals through the enrollment process while outlining their obligations and rights regarding the insurance policy.

Globe Life And Accident Insurance Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Administrative Office Location | Globe Life Center, Oklahoma City, Oklahoma 73184 |

| Group Enrollment Form Type | Group Enrollment Form for Accidental Death Policy |

| Benefit Amount | $3,000 |

| Premium Payment Options | Annual Mode of Premium ($3.(XX) Spouse, SI,(XX) each child) |

| Required Age Information | Age Last Birthday is required from the proposed insured |

| Address Information | Mailing Address includes Street, City, State, and Zip code |

| Beneficiary Designation | The application requires the identification of a beneficiary |

| Regulatory Compliance | Must comply with the application Replacement Regulation or Rule if changing coverage |

Guidelines on Utilizing Globe Life And Accident Insurance

Please follow these steps to fill out the Globe Life And Accident Insurance form. Make sure you have all necessary information handy. This will help ensure the process goes smoothly. You will need personal details for the proposed insured, the beneficiary, and any dependents.

- Start with the section labeled "Proposed Insured/Applicant." Fill in the first, middle, and last name of the applicant.

- Enter the mailing address, including street, city, state, and ZIP code.

- Indicate the payment type. Choose between sending a premium notice or selecting the automatic payment plan. If you choose the automatic payment plan, specify the day of the month to draft.

- Provide the proposed insured's age as of the last birthday.

- Enter the date of birth in the designated format.

- Select the sex of the proposed insured from the options provided: Male or Female.

- Fill in the home and work telephone numbers, including area codes.

- Enter the social security number for the proposed insured.

- Provide the name and social security number of the beneficiary. Also, include their relationship to the proposed insured.

- If applicable, provide details about the proposed insured's spouse, including their first, middle, and last names, social security number, and date of birth.

- List the names and dates of birth of all children needing coverage. Include fields labeled A, B, C, D, E, F for up to six children.

- Answer the question about whether the insurance applied for is intended to replace or change existing coverage. Circle "Yes" or "No."

- Read the declaration and authorization section carefully. Ensure the statements you provided are accurate. You will need to sign and date this section.

- If applicable, provide the agent's signature and writing number in the corresponding section.

What You Should Know About This Form

What is the purpose of the Globe Life and Accident Insurance form?

The Globe Life and Accident Insurance form is designed to allow individuals to apply for an accidental death policy with the Globe Life Insurance Company. This form captures essential information about the proposed insured, such as personal details, beneficiaries, and payment preferences, ensuring a smooth process for enrollment in the insurance policy.

What information is required on the application form?

Applicants must provide several key pieces of information on the form. This includes the proposed insured’s name, date of birth, sex, social security number, mailing address, and contact numbers. Additionally, details about the insured's spouse and children are required, including their names, dates of birth, and social security numbers. It is also necessary to indicate whether the insurance being applied for is intended to replace any existing coverage.

What are the payment options available for the premium?

There are two primary payment options available for premium payments under this insurance policy. Applicants can choose to receive a premium notice by mail or enroll in an automatic payment plan. For the automatic payment plan, individuals must specify the day of the month they would like the draft to occur, selecting a date from 01 to 28 for the automatic deductions from their bank account.

How does the beneficiary designation work?

When completing the application, it is crucial to designate a beneficiary who will receive the benefit amount in the event of the proposed insured's accidental death. The form requires the name, relationship, and social security number of the beneficiary. This ensures that the proceeds from the policy are directed to the appropriate person. Keep in mind that the company has restrictions on beneficiary designations during the first year the policy is in effect.

Is there a stipulation regarding current insurance coverage?

Yes, the application form specifically asks whether the insurance being applied for is intended to replace or change any existing coverage with this or another insurance provider. If the answer is “Yes,” the applicant must adhere to the application Replacement Regulation or Rule. This information is important for ensuring compliance with regulatory standards and protecting the applicant’s interests.

What should I understand about the declaration and authorization section?

The declaration and authorization section of the form holds significant importance. By signing this section, applicants confirm that the information provided is accurate to the best of their knowledge. They acknowledge that the insurance policy will not be binding unless the proposed insured is alive at the date of issue and delivery. Additionally, it reiterates that agents do not have the authority to modify contracts or waive any rights required by the company.

Common mistakes

Filling out the Globe Life And Accident Insurance form can be straightforward, yet many applicants make common mistakes that can lead to complications or delays in processing. One frequent error is omitting essential personal information. Applicants might forget to include details such as their social security number, which is critical for verification purposes. Not providing complete information can slow down the application process.

Another mistake involves inaccuracies in age or date of birth. These entries must accurately reflect the applicant's age as of their last birthday. Failure to enter the correct date can lead to issues with eligibility and benefits later on. It is crucial to double-check these details before finalizing the application.

Some people overlook the importance of selecting the correct beneficiary. The form requires applicants to list the beneficiary’s relationship to them, which is essential for establishing the payout process. Incorrect or unclear beneficiary information can complicate claims in the future.

Applicants sometimes fail to read the declaration and authorization section thoroughly. This section outlines key aspects of the policy, including requirements for acceptance. Not understanding these terms may cause applicants to unknowingly agree to conditions that could affect future coverage or claims.

Many individuals neglect to check the box regarding whether the insurance is intended to replace or change existing coverage. This could lead to regulatory issues. Inaccurate responses in this section can have significant implications for coverage rights and responsibilities.

Lastly, failing to sign the application can halt the entire process. Both the applicant and any proposed insured individuals must provide their signatures for the application to be valid. A missing signature will generally result in an application being rejected or returned for completion, extending the time it takes to secure coverage.

Documents used along the form

When considering a policy such as the Globe Life And Accident Insurance, it is important to understand that several other forms and documents may accompany the application process. These additional documents serve to clarify details, establish terms, and ensure all parties have a thorough understanding of the insurance being offered. Below is an overview of some commonly used forms that may be relevant.

- Beneficiary Designation Form: This document allows the policyholder to specify who will receive the death benefit in the event of the insured's passing. Proper completion ensures that the intended beneficiaries are recognized, helping to prevent disputes or delays in dispersal of funds.

- Medical Questionnaire: A medical questionnaire often accompanies the insurance application. This form requires details regarding the health history of the proposed insured. It assists the insurer in assessing risk and determining premium rates based on the individual’s health status.

- Replacement Notice: When the insurance being applied for is intended to replace or change existing coverage, a replacement notice is required. This document informs the applicant of the potential consequences of switching policies, ensuring they fully understand their decisions and associated risks.

- Payment Authorization Form: This form might be necessary for automatic premium payments. By signing this document, the policyholder authorizes the insurance company to withdraw premiums directly from their bank account, simplifying the payment process and reducing the likelihood of missed payments.

Understanding these related forms and their functions can significantly ease the experience of obtaining insurance. Each document plays a vital role in ensuring clarity, compliance, and security for all parties involved. It is advisable to review each form carefully and seek assistance if needed, fostering a confident and informed approach to your insurance choices.

Similar forms

The Globe Life and Accident Insurance form bears similarities to several other documents commonly associated with insurance and financial agreements. Below is a list of those documents and a brief explanation of their similarities with the Globe Life form.

- Health Insurance Enrollment Form: Like the Globe Life form, this document collects personal information about the insured, including age, gender, and contact details to determine eligibility and premium rates.

- Life Insurance Application Form: This form is similar in that it requires detailed information about the applicant and the insured, including health history and the designation of beneficiaries.

- Accidental Death and Dismemberment Insurance Application: This document serves a similar purpose by providing coverage for accidents and requires similar information regarding the applicant and dependents.

- Beneficiary Designation Form: Both documents necessitate the identification of beneficiaries, establishing who will receive benefits in the event of a death, and often require the signer's consent.

- Medicare Enrollment Form: This form collects personal information for eligibility, similar to the Globe Life document, emphasizing the importance of accurate details in securing coverage.

- Insurance Policy Change Request Form: This document often requires information that parallels that of the Globe Life form, ensuring clear communication about any changes to policyholders or coverage.

- Power of Attorney Document: While serving a different purpose, it shares the necessity for personal details and consents, particularly when appointing someone to act on behalf of the insured.

Dos and Don'ts

When completing the Globe Life And Accident Insurance form, it's crucial to approach the process thoughtfully. Here’s a list of things to keep in mind:

- Do ensure accuracy in all personal information. Check names, dates, and addresses carefully to avoid any mistakes.

- Don’t leave any sections blank. If a question does not apply to you, indicate that clearly instead of skipping it.

- Do read all instructions thoroughly. Understanding the guidelines provided will help you avoid common errors.

- Don’t forget to sign and date the form. An unsigned application may delay processing or lead to rejection.

Following these steps can help ensure a smooth application process for your Globe Life insurance coverage.

Misconceptions

Misconception 1: The Globe Life and Accident Insurance form only covers accidental death.

Many people believe that this insurance solely provides benefits for accidental death. In fact, while the primary focus is on accidental death benefits, it may also offer additional options depending on the specific policy selected.

Misconception 2: Completing the form guarantees immediate coverage.

Some assume that submitting the form means they have instant coverage. The truth is that coverage typically starts only after the application is approved and the initial premium is paid.

Misconception 3: The insurance applies to all family members automatically.

Individuals often think that submitting the form also insures all family members without further action. However, each family member must be listed on the application and may require separate coverage details.

Misconception 4: No health questions are asked during enrollment.

Many applicants are surprised to learn that health-related questions may be required. These questions help assess eligibility and determine the terms of coverage.

Key takeaways

Filling out the Globe Life And Accident Insurance form accurately is essential for a smooth application process. Here are key takeaways to keep in mind:

- Provide Complete Information: Ensure that all sections, from the proposed insured's name to the mailing address, are filled out completely. Incomplete forms can lead to delays or unforeseen issues.

- Understand the Coverage: The policy offers a benefit amount of $3,000, and it's crucial to understand the options available for spouse and children. Assess if this coverage meets your family’s needs.

- Payment Method Selection: Decide between receiving a premium notice or opting for an automatic payment plan. Choose a day for the automatic draft carefully, allowing time for funds to be available.

- Disclose Accurate Social Security Numbers: Accurately fill in Social Security numbers for all proposed insured individuals. This information is vital for identity verification and record-keeping.

- Beneficiary Information: Specify the beneficiary clearly. This designation is important, as it determines who receives the benefit in the event of a claim.

- Replacement Regulations: Be mindful of whether the insurance applies to existing coverage. If it does, comply with the application Replacement Regulation. Incorrect responses could lead to further complications.

- Declaration and Authorization Section: Understand and acknowledge the declaration's terms. Confirming that all information is true is a binding statement essential for policy validity.

- Signature Requirements: Make sure both the proposed insured and the application signer have provided their signatures. Missing signatures can jeopardize the application process.

By keeping these key points in mind while filling out the Globe Life And Accident Insurance form, applicants can navigate the process more effectively and ensure that their coverage is set up properly.

Browse Other Templates

Factory Connection Clothing - Provide your supervisor's name and contact details.

Mcsa5889 - Supporting documents may be needed when submitting requests for name changes.

Signa Pharmacy - Use the toll-free number provided for quick assistance regarding your order.