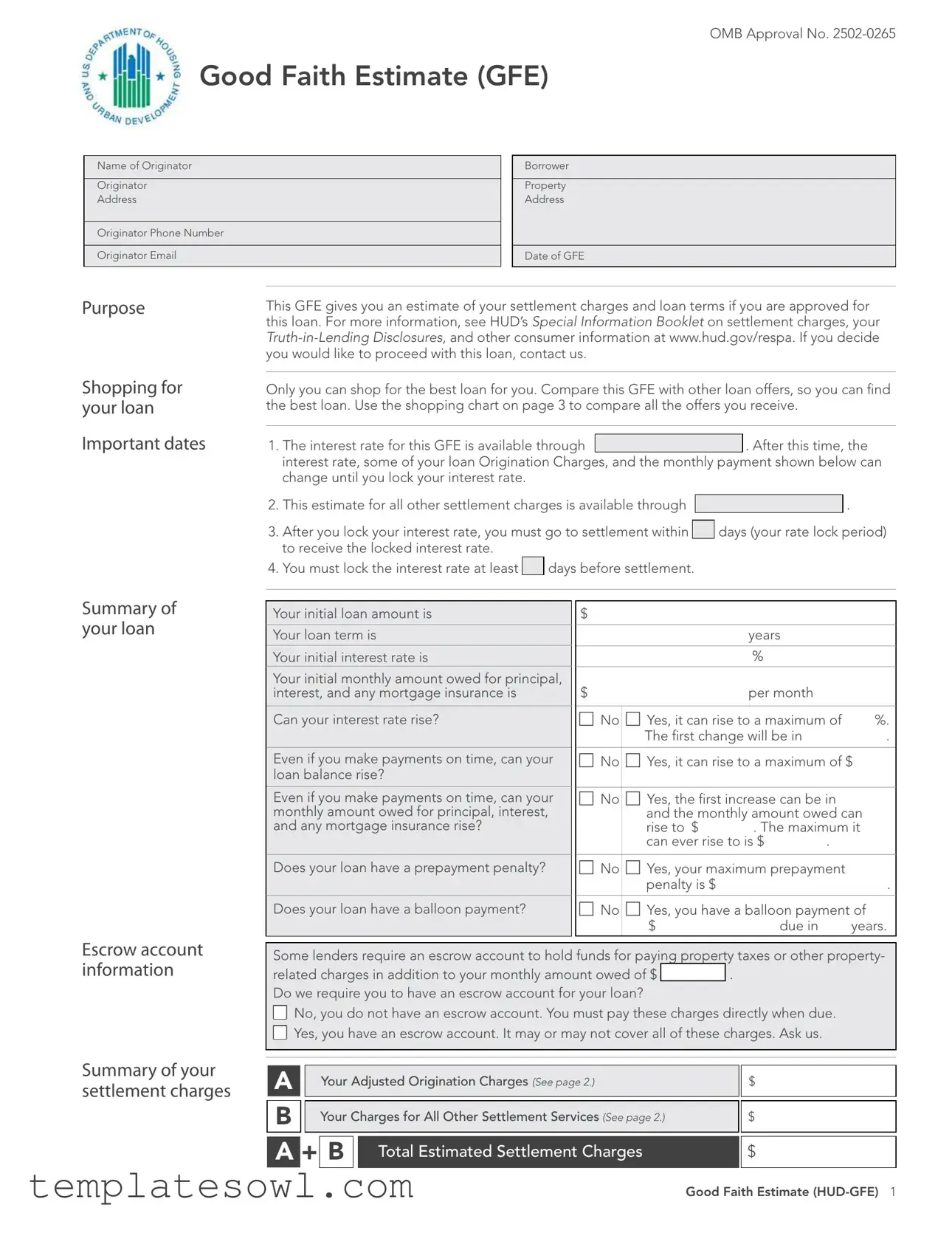

Fill Out Your Good Faith Estimate Form

Navigating the home loan process can feel overwhelming, but understanding the Good Faith Estimate (GFE) form is a key step toward making informed financial decisions. This crucial document serves as an estimating tool that outlines the potential costs and terms associated with a mortgage if you choose to proceed with a particular loan. It typically includes essential information such as the name and contact details of the loan originator, your personal property address, and the date the GFE was issued. Most importantly, the GFE breaks down important figures you’ll want to be aware of: the estimated loan amount, interest rate, monthly payments, and settlement charges. Moreover, you’ll find important dates regarding how long the interest rate is valid and when you must lock it in. The form encourages you to shop around, comparing different offers, so you can choose the loan that best fits your needs. Understanding elements such as adjusted origination charges, various settlement service fees, and potential changes in your loan terms will better prepare you for an eventual settlement. Not only does the GFE aim to make the borrowing process more transparent, but it also empowers you to question and compare different opportunities, ultimately leading to a more confident borrowing experience.

Good Faith Estimate Example

OMB Approval No.

Good Faith Estimate (GFE)

Name of Originator

Originator

Address

Originator Phone Number

Originator Email

Borrower

Property

Address

Date of GFE

Purpose

Shopping for your loan

Important dates

This GFE gives you an estimate of your settlement charges and loan terms if you are approved for this loan. For more information, see HUD’s Special Information Booklet on settlement charges, your

Only you can shop for the best loan for you. Compare this GFE with other loan offers, so you can find the best loan. Use the shopping chart on page 3 to compare all the offers you receive.

1.The interest rate for this GFE is available through

. After this time, the interest rate, some of your loan Origination Charges, and the monthly payment shown below can change until you lock your interest rate.

. After this time, the interest rate, some of your loan Origination Charges, and the monthly payment shown below can change until you lock your interest rate.

2.This estimate for all other settlement charges is available through

.

.

3.After you lock your interest rate, you must go to settlement within

days (your rate lock period) to receive the locked interest rate.

days (your rate lock period) to receive the locked interest rate.

4.You must lock the interest rate at least

days before settlement.

days before settlement.

Summary of your loan

Your initial loan amount is

Your loan term is

Your initial interest rate is

Your initial monthly amount owed for principal, interest, and any mortgage insurance is

Can your interest rate rise?

Even if you make payments on time, can your loan balance rise?

Even if you make payments on time, can your monthly amount owed for principal, interest, and any mortgage insurance rise?

Does your loan have a prepayment penalty?

Does your loan have a balloon payment?

$

years

%

$ |

|

per month |

|

|

|

|

|||

c No |

c Yes, it can rise to a maximum of |

%. |

||

|

The first change will be in |

|

. |

|

c No |

c Yes, it can rise to a maximum of $ |

|||

|

|

|

||

c No |

c Yes, the first increase can be in |

|

||

|

and the monthly amount owed can |

|||

|

rise to $ |

. The maximum it |

||

|

can ever rise to is $ |

. |

|

|

c No |

c Yes, your maximum prepayment |

|

||

|

penalty is $ |

|

|

. |

c No |

c Yes, you have a balloon payment of |

|||

|

$ |

due in |

|

years. |

Escrow account information

Summary of your settlement charges

Some lenders require an escrow account to hold funds for paying property taxes or other property-

related charges in addition to your monthly amount owed of $

. Do we require you to have an escrow account for your loan?

. Do we require you to have an escrow account for your loan?

c

No, you do not have an escrow account. You must pay these charges directly when due. c

No, you do not have an escrow account. You must pay these charges directly when due. c

Yes, you have an escrow account. It may or may not cover all of these charges. Ask us.

Yes, you have an escrow account. It may or may not cover all of these charges. Ask us.

A |

|

|

Your Adjusted Origination Charges (See page 2.) |

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

Your Charges for All Other Settlement Services (See page 2.) |

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

+ |

B |

|

Total Estimated Settlement Charges |

$ |

|

|

|

|

|

|

|

|

Good Faith Estimate

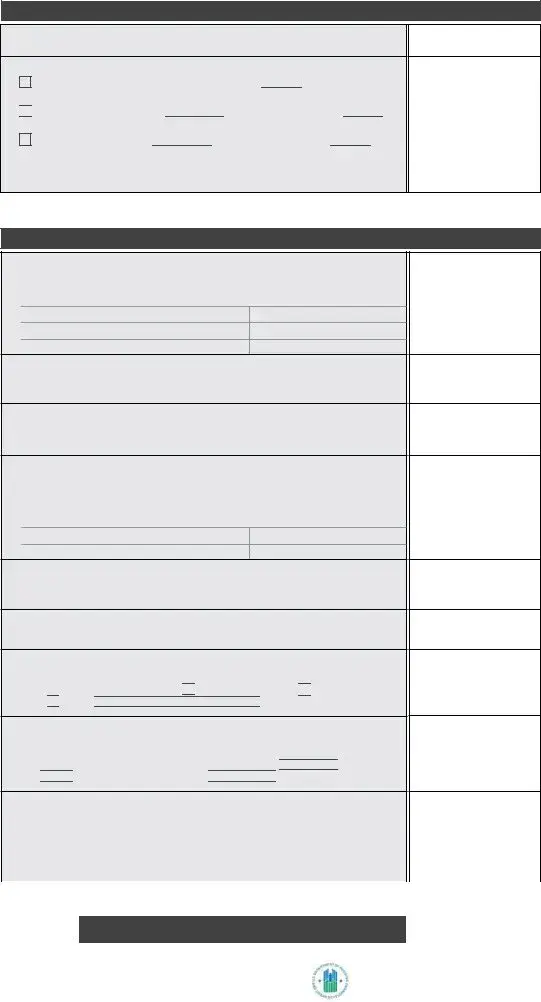

Understanding your estimated settlement charges

Some of these charges can change at settlement. See the top of page 3 for more information.

Your Adjusted Origination Charges

1.Our origination charge

This charge is for getting this loan for you.

2.Your credit or charge (points) for the specific interest rate chosen

c The credit or charge for the interest rate of  % is included in “Our origination charge.” (See item 1 above.)

% is included in “Our origination charge.” (See item 1 above.)

c

You receive a credit of $

You receive a credit of $  for this interest rate of

for this interest rate of

%. This credit reduces your settlement charges.

%. This credit reduces your settlement charges.

c You pay a charge of $  for this interest rate of

for this interest rate of  %. This charge (points) increases your total settlement charges.

%. This charge (points) increases your total settlement charges.

The tradeoff table on page 3 shows that you can change your total settlement charges by choosing a different interest rate for this loan.

A |

|

Your Adjusted Origination Charges |

$ |

|

|

|

|

Your Charges for All Other Settlement Services

3.Required services that we select

These charges are for services we require to complete your settlement. We will choose the providers of these services.

Service |

Charge |

4.Title services and lender’s title insurance

This charge includes the services of a title or settlement agent, for example, and title insurance to protect the lender, if required.

5.Owner’s title insurance

You may purchase an owner’s title insurance policy to protect your interest in the property.

6.Required services that you can shop for

These charges are for other services that are required to complete your settlement. We can identify providers of these services or you can shop for them yourself. Our estimates for providing these services are below.

Service |

Charge |

7.Government recording charges

These charges are for state and local fees to record your loan and title documents.

8.Transfer taxes

These charges are for state and local fees on mortgages and home sales.

9.Initial deposit for your escrow account

This charge is held in an escrow account to pay future recurring charges

on your property and includes c

all property taxes, c

all property taxes, c

all insurance,

all insurance,

and c

other

other

.

.

10.Daily interest charges

This charge is for the daily interest on your loan from the day of your settlement until the first day of the next month or the first day of your

normal mortgage payment cycle. This amount is $

per day

per day

for

days (if your settlement is

days (if your settlement is

).

).

11.Homeowner’s insurance

This charge is for the insurance you must buy for the property to protect from a loss, such as fire.

|

Policy |

|

Charge |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

B |

|

|

Your Charges for All Other Settlement Services |

$ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

+ |

B |

|

Total Estimated Settlement Charges |

$ |

|||

|

|

|

|

|

|

|

|

|

Good Faith Estimate

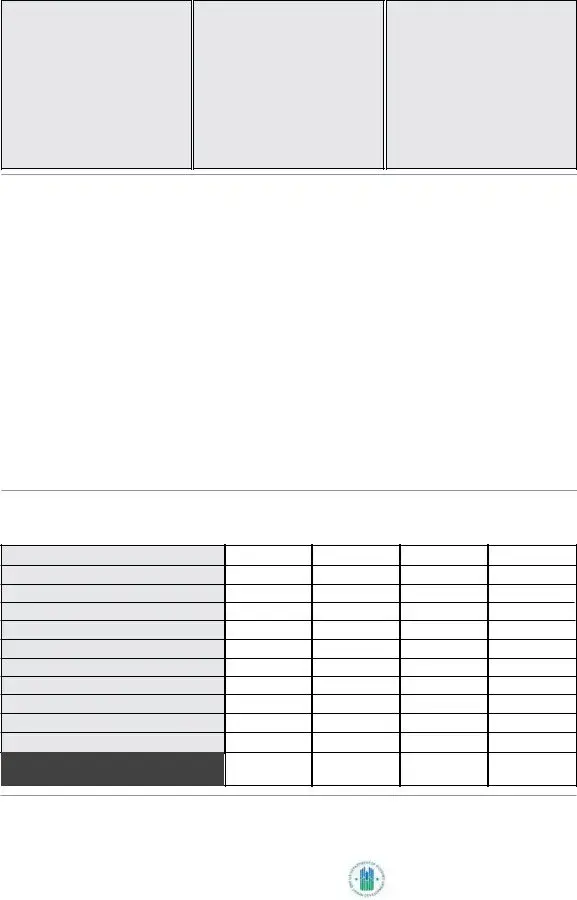

Instructions

Understanding which charges can change at settlement

This GFE estimates your settlement charges. At your settlement, you will receive a

These charges |

|

The total of these charges |

|

These charges |

cannot increase |

|

can increase up to 10% |

|

can change |

at settlement: |

|

at settlement: |

|

at settlement: |

|

|

|

|

|

gOur origination charge

gYour credit or charge (points) for the specific interest rate chosen (after you lock in your interest rate)

gYour adjusted origination charges (after you lock in your interest rate)

gTransfer taxes

gRequired services that we select

gTitle services and lender’s title insurance (if we select them or you use companies we identify)

gOwner’s title insurance (if you use companies we identify)

gRequired services that you can shop for (if you use companies we identify)

gGovernment recording charges

gRequired services that you can shop for (if you do not use companies we identify)

gTitle services and lender’s title insurance (if you do not use companies we identify)

gOwner’s title insurance (if you do not use companies we identify)

gInitial deposit for your escrow account

gDaily interest charges

gHomeowner’s insurance

Using the tradeoff table

In this GFE, we offered you this loan with a particular interest rate and estimated settlement charges. However:

gIf you want to choose this same loan with lower settlement charges, then you will have a higher interest rate.

gIf you want to choose this same loan with a lower interest rate, then you will have higher settlement charges.

If you would like to choose an available option, you must ask us for a new GFE.

Loan originators have the option to complete this table. Please ask for additional information if the table is not completed.

|

The loan in this GFE |

|

The same loan with |

The same loan with a |

|

|

lower settlement charges |

lower interest rate |

|

|

|

|

||

Your initial loan amount |

$ |

|

$ |

$ |

|

|

|

|

|

Your initial interest rate1 |

|

% |

% |

% |

|

|

|

|

|

Your initial monthly amount owed |

$ |

|

$ |

$ |

|

|

|

|

|

Change in the monthly amount owed from |

No change |

|

You will pay $ |

You will pay $ |

this GFE |

|

|

more every month |

less every month |

|

|

|

|

|

Change in the amount you will pay at |

No change |

|

Your settlement charges |

Your settlement |

settlement with this interest rate |

|

|

will be reduced by |

charges will increase by |

|

|

|

$ |

$ |

|

|

|

|

|

How much your total estimated settlement |

$ |

|

$ |

$ |

charges will be |

|

|

|

|

|

|

|

|

|

1For an adjustable rate loan, the comparisons above are for the initial interest rate before adjustments are made.

Using the shopping chart

Use this chart to compare GFEs from different loan originators. Fill in the information by using a different column for each GFE you receive. By comparing loan offers, you can shop for the best loan.

This loan |

|

Loan 2 |

|

Loan 3 |

|

Loan 4 |

|

|

|

|

|

|

|

Loan originator name

Initial loan amount

Loan term

Initial interest rate

Initial monthly amount owed

Rate lock period

Can interest rate rise?

Can loan balance rise?

Can monthly amount owed rise?

Prepayment penalty?

Balloon payment?

Total Estimated Settlement Charges

If your loan is sold in the future

Some lenders may sell your loan after settlement. Any fees lenders receive in the future cannot change the loan you receive or the charges you paid at settlement.

Good Faith Estimate

Form Characteristics

| Fact Name | Description |

|---|---|

| OMB Approval | This form carries OMB Approval No. 2502-0265, certifying its compliance with federal regulations. |

| Purpose | The Good Faith Estimate (GFE) provides an estimate of settlement charges and loan terms, helping consumers compare loan options. |

| Active Shopping | Consumers are empowered to shop for loans, as only they can determine the best financial option for themselves. |

| Estimate Validity | The interest rate and some associated loan charges are only guaranteed until a specified time, after which they may change. |

| Rate Lock Period | There is a defined period for locking in the interest rate, which must occur a certain number of days before settlement. |

| Changes at Settlement | Many charges on the GFE can change at settlement, some by up to 10%, depending on various factors. |

| State-Specific Forms | The GFE is governed by the Real Estate Settlement Procedures Act (RESPA), which may have state-specific variations. |

Guidelines on Utilizing Good Faith Estimate

After completing the Good Faith Estimate (GFE) form, it's important to review your information carefully. This document provides critical details regarding your loan estimate and associated settlement charges. Pay attention to the dates and figures, as they will guide your next steps in the loan process.

- Begin by entering the Name of Originator at the top of the form.

- Fill in the Originator Address, ensuring you include all necessary address details.

- Provide the Originator Phone Number along with the Originator Email.

- Next, enter your Borrower Property Address where the property is located.

- Include the current Date of GFE to document when this estimate was created.

- Indicate the Purpose for this GFE, typically by stating you are shopping for a loan.

- Fill out the important dates regarding your loan offer’s validity period to lock in the interest rate.

- Provide your initial loan amount, loan term, and initial interest rate.

- List the expected initial monthly amount owed for principal, interest, and any mortgage insurance.

- Answer the questions regarding whether the interest rate, loan balance, or monthly payment could rise during the term.

- Specify if there is a prepayment penalty or a balloon payment associated with the loan.

- Include information about whether you require an escrow account for property taxes and other charges.

- Calculate your Adjusted Origination Charges and Charges for All Other Settlement Services.

- Sum these amounts to get the Total Estimated Settlement Charges.

- Verify all entries before submitting or keeping a copy for your records.

Following these steps will ensure that your Good Faith Estimate form is completed accurately, providing you with a clear understanding of your potential loan and fees. Ensure that you check the details carefully before proceeding to the next stage of your loan application process.

What You Should Know About This Form

What is a Good Faith Estimate (GFE) and why do I need it?

A Good Faith Estimate (GFE) is a form provided by lenders to give you an idea of the costs associated with your loan. It includes estimates for settlement charges and loan terms if you are approved. This document helps you understand what you are getting into. By having the GFE in hand, you can compare different loan offers and make an informed decision. It is essential for shopping around, which can save you money in the long run.

What kind of charges are included in the GFE?

The GFE lists several key charges that you may incur when taking out a loan. These include origination charges for getting the loan, credit or points related to your chosen interest rate, and charges for required services such as title insurance and recording fees. It also covers estimates for homeowner’s insurance and daily interest charges up to the day of the settlement. Understanding these charges enables you to anticipate your overall expenses better.

Can the estimates on the GFE change by settlement time?

Yes, some charges can change by the time you reach settlement. For most cases, these charges can increase by up to 10%. However, your origination charge and certain other charges must remain the same unless you decide to use a different service provider than the ones identified in the GFE. It’s important to review the final HUD-1 form you receive at settlement to compare it against your GFE and ensure you understand any changes.

How can I use the GFE to compare offers from different lenders?

The GFE is designed to help you compare offers easily. Look at key components such as the loan amount, interest rate, and estimated settlement charges. Use the provided shopping chart to fill out details from different GFEs you receive. This straightforward comparison will help you find the most favorable terms. Remember, shopping around can lead to significant savings, so take your time in reviewing all your options.

Common mistakes

Filling out the Good Faith Estimate (GFE) form is an important step for anyone seeking a mortgage. Mistakes in this process can lead to confusion and unexpected costs. Here are seven common errors people often make.

1. Not Understanding the Purpose of the GFE: The first mistake is failing to grasp what the GFE is designed for. Many borrowers think it's a final document, but it's only an estimate. Understanding that the GFE provides an approximation of expected costs can help you make better decisions.

2. Ignoring Important Dates: Missing deadlines can adversely affect your loan terms. The GFE states specific timelines for locking in interest rates and proceeding with settlements. Be sure to track these dates carefully to avoid missing out on favorable terms.

3. Not Comparing Offers: Borrowers sometimes forget to compare multiple GFEs from different lenders. Each lender may offer different rates and fees. Without comparisons, you may not realize you could have a better deal elsewhere.

4. Misunderstanding the Charge Components: Many people do not fully understand the charges outlined in the GFE. Each component, such as origination fees, title services, and insurance, plays a crucial role in the total cost. Lack of understanding can result in overspending.

5. Failing to Lock the Interest Rate: A common error is not locking in an interest rate when it is favorable. If rates rise before locking, you could end up with higher payments over the life of the loan. Timing is essential in this process.

6. Neglecting to Ask Questions: Many borrowers fill out the GFE form without asking important questions. If something is unclear, it is essential to seek clarification from the lender. Not doing so can lead to misunderstandings later on.

7. Overlooking Escrow Account Requirements: Finally, some borrowers are not aware of whether their loan requires an escrow account. This can affect monthly payment calculations. Being informed about the need for an escrow account can help you prepare better for the ongoing costs of homeownership.

Being diligent when filling out the GFE can save you time and money in the long run. Take the time to understand the form and ask for help when you need it. This approach can lead to a more favorable loan experience.

Documents used along the form

When pursuing a loan, understanding the associated documents is crucial. Alongside the Good Faith Estimate (GFE) form, several other documents can provide essential information about your loan terms and settlement charges. Familiarize yourself with these documents to make informed decisions.

- Loan Estimate (LE): This form provides a more detailed breakdown of loan terms, including interest rates, monthly payments, and estimated closing costs. It is delivered to borrowers within three business days of applying for a loan.

- Closing Disclosure (CD): Issued three days before a closing, this document outlines the final terms of the loan and the exact costs associated with the transaction. It compares the information initially provided in the Loan Estimate with the final terms.

- HUD-1 Settlement Statement: This is a document that lists all the actual costs and fees in the transaction as they occur at settlement. It allows borrowers to see precisely what they owe and what they’re receiving for their loan.

- Truth in Lending Disclosure (TIL): This form offers borrowers important details about the cost of borrowing, including the annual percentage rate (APR), finance charges, and payment schedule, helping to clarify the overall cost of the loan.

- Loan Application (Form 1003): Also known as the Uniform Residential Loan Application, this form gathers information regarding the borrower's financial situation, employment history, and the property being financed, which is essential for loan approval.

In conclusion, reviewing these documents in conjunction with the Good Faith Estimate will enhance your understanding of the loan process. Ensure you ask questions if any terms or figures are unclear. Being informed will help you secure the most beneficial loan for your needs.

Similar forms

-

Loan Estimate (LE): Similar to the Good Faith Estimate, the Loan Estimate is a standardized form that provides borrowers with clear information about their mortgage terms and estimated charges. Both documents aim to help borrowers understand and compare mortgage offers, ensuring an informed decision.

-

HUD-1 Settlement Statement: This document outlines the actual costs incurred at closing, contrasting with the Good Faith Estimate, which provides an estimate. While the GFE gives preliminary numbers, the HUD-1 provides final figures, allowing borrowers to verify their costs against initial estimates.

-

Truth in Lending Disclosure (TIL): The TIL statement complements the GFE by detailing the costs associated with borrowing, including interest rates and terms. Both documents serve educational purposes, informing borrowers of their rights and the nature of their loan obligations.

-

Closing Disclosure: Like the HUD-1, the Closing Disclosure provides a detailed breakdown of the final costs associated with closing a loan. The Closing Disclosure must be given to borrowers three days before closing, allowing them to compare these numbers with the Good Faith Estimate.

-

Pre-Approval Letter: This letter indicates the loan amount a borrower may qualify for based on their financial profile. While the GFE estimates costs and terms, the pre-approval letter expresses the lender's willingness to grant a loan, helping borrowers understand their budget and options.

-

Credit Report: A credit report provides a detailed account of a borrower’s credit history. This document is crucial in determining loan terms included in the Good Faith Estimate. Both documents assess the borrower’s creditworthiness, which plays a significant role in securing favorable loan conditions.

-

Loan Commitment Letter: This document assures borrowers that a lender is ready to provide a loan under specific terms. The commitment letter is similar to the Good Faith Estimate in that it outlines loan details, confirming the lender’s commitment after initial underwriting processes.

-

Memorandum of Understanding (MOU): An MOU can outline the borrower’s understanding of key loan terms. While not standardized, it serves a similar purpose to the Good Faith Estimate in confirming mutual understanding of the proposed loan terms before final agreement.

-

Borrower Acknowledgment Form: This document signifies that borrowers understand their loan terms, resembling the GFE in its focus on transparency. Both documents play a role in ensuring that borrowers are aware of their financial commitments and associated risks.

Dos and Don'ts

Things You Should Do:

- Fill out all required information accurately, including your name, property address, and loan details.

- Use the shopping chart to compare offers from different lenders to find the best loan for you.

- Ask questions if you don't understand any part of the estimate or terms of the loan.

- Lock your interest rate as soon as you are comfortable to avoid changes that could increase your costs.

Things You Shouldn't Do:

- Leave any sections blank; this can lead to misunderstandings or delays.

- Ignore the importance of understanding settlement charges; they can vary significantly.

- Assume all lenders provide the same terms without comparing their offers.

- Wait too long to lock in your interest rate after you receive the estimate.

Misconceptions

Misconceptions about the Good Faith Estimate (GFE) form can lead to confusion for borrowers. Here are seven common misunderstandings, clarified:

- The GFE is a binding contract. Many borrowers think that the GFE locks them into specific loan terms. In reality, it is merely an estimate of potential costs and terms. You can shop around and compare offers.

- The interest rate is guaranteed. Some individuals mistakenly believe that the interest rate presented in the GFE is set in stone. However, the rate is only guaranteed until you lock it in, which typically must happen before settlement.

- All fees are fixed and won't change. Borrowers often assume the fees listed won't change. However, certain charges may adjust based on which service providers you select or if the circumstances change before settlement.

- Your loan must have an escrow account. A common misconception is that all loans require an escrow account for paying taxes and insurance. This is not true, as some loans may allow you to pay those expenses directly.

- The GFE is the same for every lender. Many people believe that GFEs from different lenders are truly comparable. However, each lender may have different ways of calculating fees and terms, so direct comparisons are necessary to find the best deal.

- You cannot negotiate fees. Some borrowers think that the fees listed on the GFE are non-negotiable. In fact, many lenders are open to discussions about fees, particularly for settlement services.

- It is unnecessary to review the HUD-1 Settlement Statement. Finally, many borrowers overlook the importance of comparing the GFE with the HUD-1 Settlement Statement received at closing. The HUD-1 itemizes your actual costs and can reveal discrepancies from the GFE that need to be addressed.

Understanding these misconceptions can empower borrowers to make informed decisions when navigating the loan process.

Key takeaways

When filling out and using the Good Faith Estimate (GFE) form, consider the following key takeaways to ensure a successful experience:

- Understand Your Estimates: The GFE provides an estimate of your settlement charges and loan terms. Pay close attention to these figures as they are critical for your decision-making process.

- Shop Around: Use the GFE to compare offers from multiple lenders. You should not settle for the first option; take time to evaluate different loans and their associated costs.

- Know Your Rate Lock Period: Be aware of the timelines related to locking your interest rate. This is crucial as changes can occur before the lock is established.

- Review Settlement Charges: Understand which charges can change at closing. These can be critical in determining your final costs, so comparing these with your HUD-1 form afterwards is advisable.

- Ask Questions: If there are parts of the GFE that you don’t understand or if specific information is missing, don’t hesitate to reach out for clarification. Your understanding is paramount before you proceed with any loan.

Browse Other Templates

5914 - The form can be updated periodically as military guidelines evolve.

Kaplan University Online Transcripts - It’s advised to follow up as needed to ensure the successful delivery of transcripts.