Fill Out Your Gratuity Form

The Gratuity form is a crucial document for employees, enabling them to specify their nominees for gratuity payments in the event of their passing. This form, specifically Form 'F', under the Payment of Gratuity Act of 1972, outlines the necessary information an individual must provide, including personal details such as name, sex, and marital status. It also requires clarity on the nominee's relationship to the employee, their age, and how the gratuity will be divided among them. The form addresses the importance of family designation as well, where the employee must certify that their nominees are family members or declare exclusion where applicable. Additionally, modifications to nominations can be communicated through Form 'H', allowing employees to update details as their circumstances change, such as acquiring a new family or deciding to exclude certain individuals. This flexibility ensures that the employee's wishes regarding gratuity payments are honored, even as life circumstances evolve. Acknowledgment by the employer and witness signatures serve to validate the process, ensuring that the document is officially recognized by the establishment. Clear guidelines within the form help to eliminate ambiguity, protecting both the employee’s intentions and the interest of the nominees in the long run.

Gratuity Example

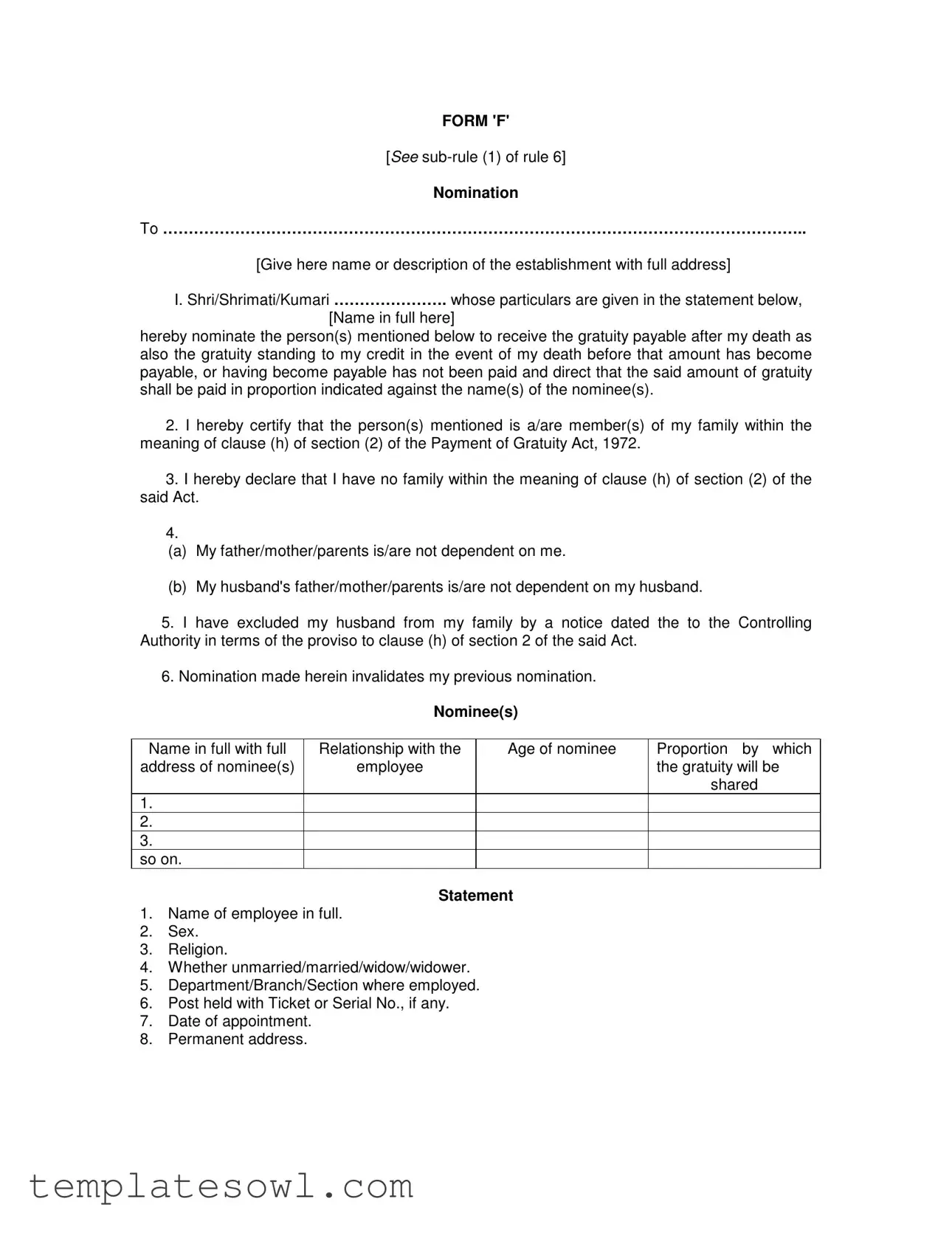

FORM 'F'

[See

Nomination

To ……………………………………………………………………………………………………………..

[Give here name or description of the establishment with full address]

I. Shri/Shrimati/Kumari …………………. whose particulars are given in the statement below,

[Name in full here]

hereby nominate the person(s) mentioned below to receive the gratuity payable after my death as also the gratuity standing to my credit in the event of my death before that amount has become payable, or having become payable has not been paid and direct that the said amount of gratuity shall be paid in proportion indicated against the name(s) of the nominee(s).

2.I hereby certify that the person(s) mentioned is a/are member(s) of my family within the meaning of clause (h) of section (2) of the Payment of Gratuity Act, 1972.

3.I hereby declare that I have no family within the meaning of clause (h) of section (2) of the said Act.

4.

(a)My father/mother/parents is/are not dependent on me.

(b)My husband's father/mother/parents is/are not dependent on my husband.

5.I have excluded my husband from my family by a notice dated the to the Controlling Authority in terms of the proviso to clause (h) of section 2 of the said Act.

6.Nomination made herein invalidates my previous nomination.

Nominee(s)

Name in full with full

address of nominee(s)

1.

2.

3.

so on.

Relationship with the

employee

Age of nominee

Proportion by which the gratuity will be

shared

Statement

1.Name of employee in full.

2.Sex.

3.Religion.

4.Whether unmarried/married/widow/widower.

5.Department/Branch/Section where employed.

6.Post held with Ticket or Serial No., if any.

7.Date of appointment.

8.Permanent address.

Village ……………… Thana ………………

District ………………. State…………………

Place |

Signature/Thumb impression |

Date |

of the employee |

Declaration by witnesses

Nomination signed/thumb impressed before me.

Name in full and full |

Signature of witnesses. |

address of witnesses. |

|

1. |

1. |

2. |

2. |

Place

Date

Certificate by the employer

Certified that the particulars of the above nomination have been verified and recorded in this establishment.

Employer's Reference No., if any.

|

Signature of the employer/ |

|

officer authorised |

|

Designation |

Date |

Name and address of the |

|

establishment or rubber stamp |

|

thereof. |

|

Acknowledgement by the employee |

Received the duplicate copy of nomination in Form 'F' filed by me and duly certified by the employer.

Date |

Signature of the employee |

Note: Strike out the words and paragraphs not applicable.

FORM 'G'

[See

Fresh Nomination

To ………………………………………………………………………………………………………….

[Give here name or description of the establishment with full Address]

I, Shri/Shrimati ………………… [Name in full here] whose particulars are given in the

statement below, have acquired a family within the meaning of clause (h) of section (2) of the Payment of Gratuity Act, 1972 with effect from the …………………… [date here] in the manner

indicated below and therefor nominate afresh the person(s) mentioned below to receive the gratuity payable after my death as also the gratuity standing to my credit in the event of my death before that amount has become payable, or having become payable has not been paid direct that the said amount of gratuity shall be paid in proportion indicated against the name(s)

of the nominee(s).

2.I hereby certify the person(s) nominated is a/are member(s) of my family within the meaning of clause (h) of section 2 of the said Act.

3.

(a)My father/mother/parents is/are not dependent on me.

(b)My husband's father/mother/parents is/are not dependent on my husband.

4.I have excluded my husband from my family by a notice dated the ………………. to the controlling authority in terms of the proviso to clause (h) of section 2 of the said Act.

Nominee(s)

Name in full with full

address of nominee(s)

(1)

1.

2.

3.

4.

so on.

Relationship with the

employee

(2)

Age of nominee

(3)

Proportion by which the gratuity will be shared

(4)

Manner of acquiring a "family"

[Here give details as to how a family was acquired, i.e., whether by marriage or parents being rendered dependant or through other process like adoption].

Statement

1.Name of the employee in full.

2.Sex.

3.Religion.

4.Whether unmarried/married/widow/widower.

5.Department/Branch/Section where employed.

6.Post held with Ticket No. or Serial No., if any.

7.Date of appointment.

8.Permanent address.

Village ……………. Thana ……………..

District ……………….. State ……………….

Place |

Signature/Thumb impression |

Date |

of the employee. |

Declaration by witnesses

Fresh nomination signed/thumb impressed before me.

Name in full and full |

Signature of witnesses. |

addresses of witnesses. |

|

1. |

1. |

2. |

2. |

Place |

|

Date |

|

|

Certificate by the employer |

Certified that the particulars of the above nomination have been verified and recorded in this establishment.

Employer's reference No., if any.

|

Signature of the employer/ |

|

officer authorised |

|

Designation |

Date |

Name and address of the |

|

establishment or rubber |

|

stamp thereof. |

|

Acknowledgement by the employee |

|

Received the duplicate copy of the nomination in Form ………… filed by me on ………… |

duly certified by the employer. |

|

Date |

Signature of the employer |

Note: Strike out the words and paragraphs not applicable.

FORM 'H'

[See

Modification of Nomination

To ………………………………………………………………………………………………

[Give here name or description of the establishment with full address]

I, Shri/Shrimati/Kumari ………………… [Name in full here] whose particulars are given in the

statement below, hereby give notice that the nomination filed by me on [date] and recorded under your reference No………. dated ……………… shall stand modified in the following manner:

[Here give details of the modifications intended]

Statement

1.Name of the employee in full.

2.Sex.

3.Religion.

4.Whether unmarried/married/widow/widower.

5.Department/Branch/Section where employed.

6.Post held with Ticket No. or Serial No., if any.

7.Date of Appointment.

8.Address in full.

Place |

Signature/Thumb impression |

Date |

of the employee |

Declaration by witnesses

Modification of nomination signed/thumb impressed before me.

Name in full and full |

Signature of witnesses. |

addresses of witnesses. |

|

1. |

1. |

2. |

2. |

Place |

|

Date |

|

|

Certificate by the employer |

Certified that the above modification have been recorded. |

|

Employer’s reference No., if any. |

Signature of the employer/ |

|

Officer authorised |

|

Designation |

|

Name and address of the |

Establishment or rubber

Stamp thereof.

Acknowledgement by the employee

Received the duplicate copy of the notice for modification in Form ‘H’ filed by me on …………

…and duly certified by the employer. |

|

Date |

Signature of the employee |

Note: Strike out the words and paragraphs not applicable. |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Name of the Form | The Gratuity form is designed for employees to nominate individuals to receive gratuity payments upon their death. |

| Legal Basis | This form operates under the Payment of Gratuity Act, 1972, which governs gratuity payments in India. |

| Types of Nomination | There are different forms for various purposes: Form 'F' for initial nomination, Form 'G' for fresh nomination, and Form 'H' for modifications of nominations. |

| Dependence Requirement | Individuals nominated must be family members, as defined in the Act. The employee must certify their relationship and dependency status. |

| Witness Requirement | The form must be signed in the presence of witnesses. Their signatures and addresses must also be recorded. |

Guidelines on Utilizing Gratuity

Completing the Gratuity form involves several detailed steps to ensure that your nomination is correctly recorded. This process is crucial as it designates who will receive your gratuity should anything happen to you. Below is a clear guide to assist you in filling out the form accurately.

- Begin by writing the name and address of the establishment at the top of the form.

- Enter your full name in the designated section.

- Nominate one or more individuals to receive the gratuity after your passing. Provide their full names and addresses in the specified areas.

- Indicate your relationship with each nominee and specify their ages.

- Detail the proportion of gratuity that each nominee will receive.

- Fill in your details in the statement section: your sex, religion, marital status, department, position held, date of appointment, and your permanent address.

- Sign or provide your thumb impression at the bottom of the form and include the date.

- Next, have two witnesses sign the form. Their names and addresses should also be included.

- The employer or an authorized officer must certify the nomination. They should enter the establishment’s reference number and sign with their designation and date.

- Finally, acknowledge receipt of the duplicate copy of your nomination form by signing it.

What You Should Know About This Form

What is the Gratuity form used for?

The Gratuity form is a crucial document that enables employees to nominate individuals who will receive their gratuity benefits upon their death. It also serves to assert any modifications to previous nominations. This ensures that the right beneficiaries can claim the gratuity, providing peace of mind for employees regarding their financial legacy.

Who can be nominated on the Gratuity form?

The individuals who can be nominated typically include family members, such as spouses, children, or parents, as defined under the Payment of Gratuity Act. It’s essential that those nominated are considered family within the legal context of the Act. If an employee does not have any family members who qualify, they can specify that in the form.

How do I fill out the Gratuity form?

Filling out the Gratuity form requires careful attention to detail. Start by entering the name and address of your establishment at the top. Next, provide your full name and the details of the nominees, including their full addresses, relationship to you, age, and the proportion of gratuity they will receive. Additionally, the employee's statement section must be completed accurately, detailing your personal information and status.

Can I change my nominee after submitting the Gratuity form?

Yes, you can modify your nominee on the Gratuity form. To do this, you must fill out a separate modification form highlighting the changes. It is vital to inform the employer of any modifications to ensure the updated nomination record is accurately maintained within your establishment.

What should I do if I want to exclude someone from my family in the nomination?

If you wish to exclude a family member, you must provide a notice to the controlling authority, as specified in the Gratuity Act. This exclusion needs to be formally documented, ensuring that your wishes are respected when the gratuity is processed.

What happens if I do not fill out a Gratuity form?

If a Gratuity form is not completed and filed, beneficiaries may face challenges claiming the gratuity upon the employee's death. Without a designated nominee, the gratuity may be disbursed according to statutory guidelines, which might not reflect the employee’s intended wishes. Thus, timely submission of the form is vital.

Is the Gratuity form necessary for all employees?

Common mistakes

When filling out the Gratuity form, many individuals face a range of challenges that can lead to errors. One common mistake is failing to mention a complete and accurate name and address of the establishment. This information is crucial for the processing of both nominations and for any future communication regarding gratuity. Missing this detail may result in delays or complications in receiving benefits.

Another frequent error arises from the incorrect nomination of the beneficiaries. It's essential to specify the full name, relationship, and age of the nominee(s). Omitting any of these details can leave the nomination incomplete and may lead to challenges in the payment process later on.

People often overlook the importance of the certification clause. It is vital to confirm that the nominees are indeed members of the employee's family as defined by the Payment of Gratuity Act. Misunderstanding this definition can complicate matters greatly, as incorrect nominations can invalidate a request.

Furthermore, many applicants fail to provide a clear statement regarding their family status. This includes specifying whether they are married, single, widowed, or widower. Confusion about this status can cause issues down the line, particularly with the treatment of putative family members.

Providing an inconsistent or incorrect date can lead to significant issues as well. Each date in the application, from appointment to last nomination, must be accurate. A discrepancy could lead to complications in record-keeping or result in delays in the processing of the gratuity.

Signature clarity is another area where mistakes frequently occur. All signatures or thumb impressions must be unmistakable. Ensuring a clear signature affirms authenticity and can expedite the process of verifying the nomination.

Some individuals may neglect the witness section altogether or provide incomplete witness details. This section validates the employee's nomination and should not be overlooked. A missing witness signature may put a halt on the process, requiring resubmission.

Lastly, people often forget to acknowledge the receipt of the nomination copy from their employer. This acknowledgment is important. It serves as proof of submission and is necessary for ensuring that an employee's records reflect the nomination correctly.

By addressing these common mistakes, individuals can navigate the Gratuity form process more efficiently. Understanding and rectifying these areas can help avoid unnecessary delays and complications in receiving gratuity benefits.

Documents used along the form

The Gratuity form is crucial for employees to nominate beneficiaries who will receive gratuity payments after their death. However, this form is often used in conjunction with other documents that help clarify and update the nomination process. Below are some important related forms that employees may also need to consider.

- Form 'G': This document serves as a fresh nomination form. It allows an employee to nominate new beneficiaries if their family status changes, such as through marriage or the birth of a child. The form requires similar details as the Gratuity form.

- Form 'H': This form is used to modify previous nominations. If an employee wishes to change their nominees or the proportions in which gratuity should be distributed, this form captures those modifications.

- Certificate by the Employer: Employers must provide a certificate confirming that the nomination has been recorded in their establishment. This verification helps ensure compliance with the requirements of the Payment of Gratuity Act.

- Acknowledgement by the Employee: This document serves as proof that the employee has received a duplicate copy of their nomination certificate. It further confirms that the nomination has been duly certified by the employer.

These forms and documents work together to ensure that an employee’s wishes regarding gratuity payments are accurately recorded and can be updated as life circumstances change. Understanding each form's purpose is vital for effective estate planning and beneficiary designation.

Similar forms

The Gratuity form shares similarities with several other important documents that help manage employee benefits and ensure clear communication about nominations and modifications. Here are eight documents that bear resemblance to the Gratuity form:

- Beneficiary Designation Form: This document allows employees to designate individuals who will receive certain benefits, much like the Gratuity form where nominees are named to receive gratuity payments upon the employee's death.

- Life Insurance Policy Beneficiary Form: Similar to the Gratuity form, this form enables individuals to select who will receive the insurance payout after their passing. Both require clear identification of the beneficiary and their relationship to the policyholder.

- Retirement Plan Beneficiary Form: This form specifies who will inherit funds from a retirement account after an employee’s death. It parallels the Gratuity form in that it addresses the distribution of funds and ensures that wishes regarding who receives benefits are documented.

- Will or Trust Document: Both documents can outline how an individual's estate will be distributed upon their death, including who receives certain benefits. The process of naming beneficiaries in a will is similar to the nomination aspect of the Gratuity form.

- Health Savings Account Beneficiary Designation Form: Just like in the Gratuity form, this document allows account holders to specify who will receive their health savings account balance after their death, ensuring that heirs are identified and benefits are not lost.

- Employee Stock Ownership Plan (ESOP) Beneficiary Form: This form designates beneficiaries for stock benefits, similarly ensuring that the intended recipients receive what is due after the employee's death.

- Power of Attorney (POA) Document: While slightly different in function, a POA can allow a designated individual to make decisions regarding financial accounts and benefits, reflecting the importance of clear representation and designation similar to the Gratuity form.

- Nomination Form for Provident Fund: This form is utilized to declare nominees for provident fund benefits, sharing with the Gratuity form the common purpose of ensuring that financial benefits are transferred according to the employee's wishes upon their passing.

Dos and Don'ts

When filling out the Gratuity form, it's essential to follow specific guidelines to ensure the process goes smoothly. Here is a list of things to do and avoid:

- Do: Provide accurate and complete personal details, including full name, sex, and department.

- Do: Clearly identify the nominees, including their full names, addresses, and relationships.

- Do: Confirm that the nominated individuals qualify as family members under the Payment of Gratuity Act.

- Do: Sign the form using your full name or thumbprint, as required.

- Do: Keep a copy of the signed form for your records.

- Do: Double-check that all required fields are completed before submission.

- Do: Notify the employer if you need to make modifications to your nomination in the future.

- Don't: Omit any critical information as this may lead to processing delays.

- Don't: Use unclear or vague language when describing nominees and their proportions.

- Don't: Forget to indicate if you have no family members eligible under the Act.

- Don't: Wait until the last moment to submit the form, as verification may take time.

- Don't: Leave unsigned sections, including witness declarations or employer certification.

- Don't: Ignore specific instructions regarding the completion of the form, such as striking through inapplicable sections.

- Don't: Assume previous nominations remain valid; always confirm the current status before submitting a new form.

Misconceptions

Misconceptions can cloud the understanding of the Gratuity form process. Here are four common misunderstandings:

- Misconception 1: The Gratuity form is only applicable to those nearing retirement.

- Misconception 2: Once I fill out the Gratuity form, I can never change my nominee.

- Misconception 3: My employer has the final say on who receives my gratuity.

- Misconception 4: The Gratuity form only benefits immediate family members.

This is false. The Gratuity form can be relevant to employees at any stage of their employment. It ensures that their gratuity benefits are clearly designated to their chosen nominees in case of unforeseen circumstances.

This is not true. Employees can modify their nominations at any time by submitting a modification form. Life changes, such as marriage or other personal circumstances, may prompt individuals to update their nominee selections.

Actually, the nomination process allows the employee to select their own nominees. While the employer certifies the form, they do not have the authority to change the nominee listed by the employee.

This is a misconception. While many choose to nominate family members, it is not a requirement. Employees are free to nominate any individual or multiple individuals as their nominees, regardless of the relationship.

Key takeaways

When it comes to the Gratuity form, understanding its intricacies is essential for both employees and employers. Here are some key takeaways to guide you through the process:

- Know Your Purpose: The Gratuity form serves as a vital document for nominating individuals who will receive gratuity benefits in the event of an employee's death.

- Identify the Beneficiaries: Clearly list the nominees, along with their full addresses, to ensure that benefits are distributed according to your wishes.

- Family Definition Matters: Only individuals recognized as family members under the Payment of Gratuity Act can be nominated, so be familiar with who qualifies.

- Previous Nominations Void: Any new nomination supersedes older ones, so ensure that your current preferences are accurately documented.

- Certifications Are Key: The form must be certified by an employer, verifying that all information has been checked and recorded properly.

- Witness Signatures Required: To validate the nomination, it is necessary for two witnesses to sign the document, attesting to the authenticity of the nomination.

- Modifications Are Possible: If personal circumstances change, the Gratuity form allows for modifications to your nominations, so keep it current.

- Keep Copies: Retain a duplicate of the submitted form certified by the employer for your records, as it may be needed in the future.

Browse Other Templates

Cosmetology Questions - Georgia does not have reciprocity with some states, including California and New York.

Dl-90a - The affidavit assists in promoting responsible driver education in Texas.

Student Records Release Authorization,CUSD Student Record Transfer Form,Request for Release of Student Records,Pupil Record Transfer Authorization,CUSD Transcript Release Form,Authorization to Access Student Records,CUSD Student Information Disclosur - The request to process records will not be initiated without proper ID.