Fill Out Your Gtb Account Opening Form

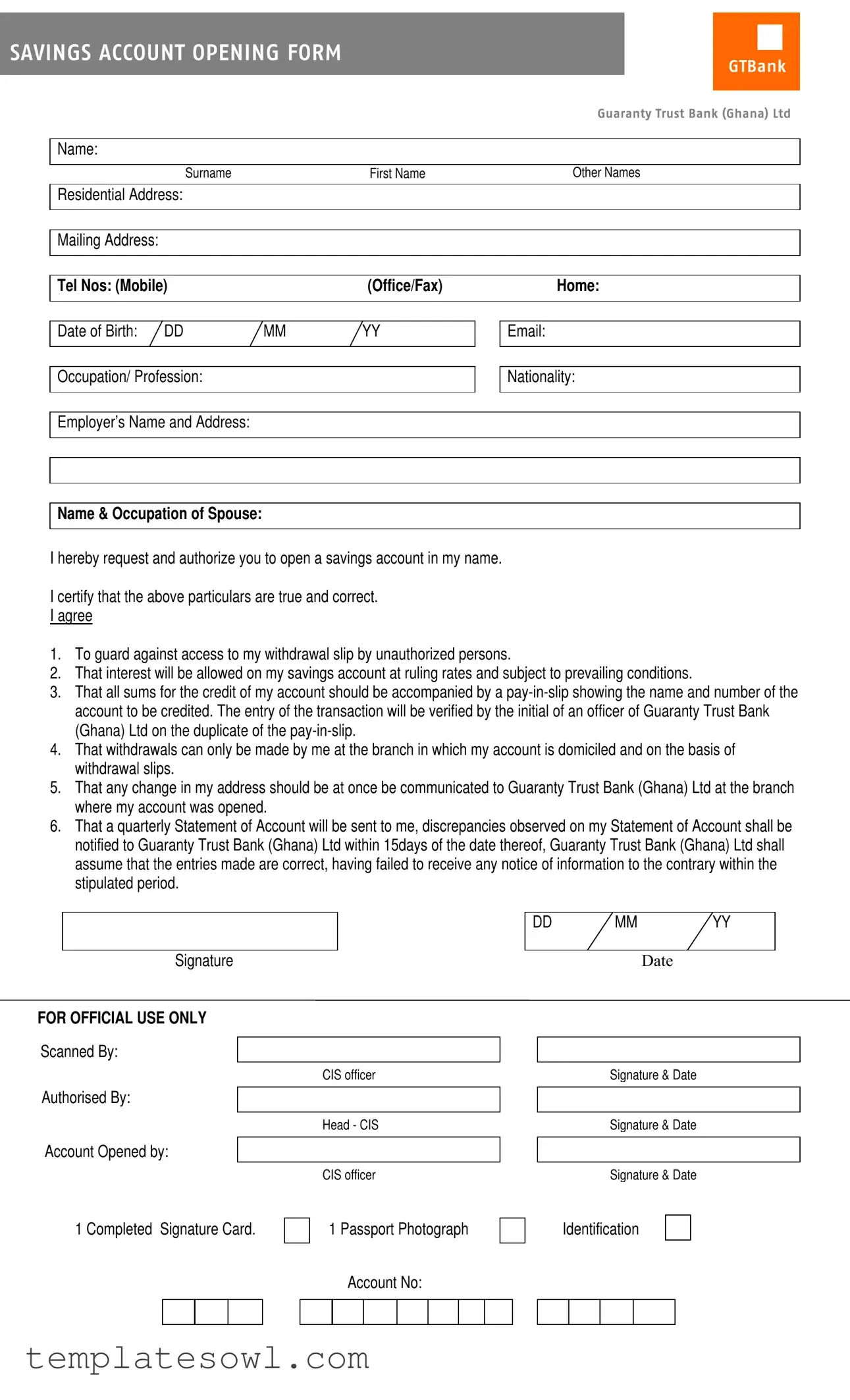

The GTB Account Opening Form is a comprehensive document designed to facilitate the establishment of a savings account with Guaranty Trust Bank (Ghana) Ltd. It requires various personal details to ensure accurate record-keeping and compliance with banking regulations. Essential information includes the applicant's name, residential address, and contact information, such as mobile and office telephone numbers, along with an email address. The form also necessitates the applicant's date of birth, nationality, and occupation, as well as details regarding their employer. Additionally, there is a section for spousal information that asks for the spouse's name and occupation. By submitting this form, the applicant authorizes the bank to open a savings account and certifies the accuracy of the provided information. Important terms of agreement are included, covering aspects such as withdrawal procedures, the handling of statements, and conditions for crediting the account. Attention is drawn to the safety of withdrawal slips and the need for prompt communication of any address changes. Furthermore, the form mandates the provision of a completed signature card and a passport photograph, both of which are crucial for account verification and security purposes. In essence, the GTB Account Opening Form serves as a vital step toward accessing banking services while ensuring the bank has the necessary information to manage the account effectively.

Gtb Account Opening Example

SAVINGS ACCOUNT OPENING FORM

GTBank

Guaranty Trust Bank (Ghana) Ltd

Name:

Surname |

First Name |

Other Names |

Residential Address:

Mailing Address:

Tel Nos: (Mobile) |

(Office/Fax) |

Home: |

|

|

|

Date of Birth: DD |

MM |

YY |

|

|

|

Email:

Occupation/ Profession:

Nationality:

Employer’s Name and Address:

Name & Occupation of Spouse:

I hereby request and authorize you to open a savings account in my name.

I certify that the above particulars are true and correct.

I agree

1.To guard against access to my withdrawal slip by unauthorized persons.

2.That interest will be allowed on my savings account at ruling rates and subject to prevailing conditions.

3.That all sums for the credit of my account should be accompanied by a

4.That withdrawals can only be made by me at the branch in which my account is domiciled and on the basis of withdrawal slips.

5.That any change in my address should be at once be communicated to Guaranty Trust Bank (Ghana) Ltd at the branch where my account was opened.

6.That a quarterly Statement of Account will be sent to me, discrepancies observed on my Statement of Account shall be notified to Guaranty Trust Bank (Ghana) Ltd within 15days of the date thereof, Guaranty Trust Bank (Ghana) Ltd shall assume that the entries made are correct, having failed to receive any notice of information to the contrary within the stipulated period.

|

|

|

|

|

|

DD |

MM |

YY |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

DATE |

|

|

|||||||

FOR OFFICIAL USE ONLY |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|||

Scanned By: |

|

|

|

|

|

|

|

|

|||

|

|

CIS officer |

Signature & Date |

|

|

||||||

|

|

|

|

|

|

|

|

||||

Authorised By: |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||

|

|

Head - CIS |

Signature & Date |

|

|

||||||

|

|

|

|

||||||||

Account Opened by: |

|

|

|

|

|

|

|||||

|

|

CIS officer |

Signature & Date |

|

|

||||||

1 Completed Signature Card.

1 Passport Photograph

Identification

Account No:

SPECIMEN SIGNATURE (INDIVIDUAL)

Guaranty Trust Bank (Ghana) Limited

RC

Account No:

Account Name:

Address:

Tel No.(Mobile):

Tel No.(Office/Home):

Class |

Photograph |

Title (Mr, Mrs etc):

Name:

Surname |

First Name |

Middle Name |

Signature:

Authorised

Combination:

(For Joint Account Holders)

Title (Mr, Mrs etc): |

|

|

|

Class |

Photograph |

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

Surname |

First Name |

Middle Name |

|

|

Signature: |

|

|

|

|

|

|

|

|

|

|

|

Title (Mr, Mrs etc): |

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

Surname |

First Name |

Middle Name |

|

|

Signature: |

|

|

|

|

|

|

|

|

|

|

|

Title (Mr, Mrs etc): |

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

Surname |

First Name |

Middle Name |

|

|

Signature: |

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Bank Name | Guaranty Trust Bank (Ghana) Ltd is the financial institution associated with this account opening form. |

| Account Type | The form is designed specifically for opening a savings account. |

| Personal Information Required | Applicants must provide their full name, residential address, contact numbers, date of birth, email, and occupation. |

| Authorization Agreement | The applicant grants authorization to open the account and certifies that the provided information is accurate. |

| Withdrawal Conditions | Withdrawals are restricted to the branch where the account is opened and require specific withdrawal slips. |

| Interest Rate Notification | Interest on the savings account is subject to prevailing rates and conditions set by the bank. |

| Quarterly Statements | Account holders will receive quarterly statements, and discrepancies must be reported within 15 days. |

| Official Use Only | Sections in the form must be completed by Guaranty Trust Bank staff for internal processing. |

Guidelines on Utilizing Gtb Account Opening

Filling out the GTB Account Opening form is a straightforward process that requires accurate information so the bank can properly establish your account. Follow these steps to ensure your application is completed correctly.

- Personal Information: Enter your surname, first name, and other names in the designated fields.

- Addresses: Provide your residential address and mailing address. Make sure they are current and accurate.

- Contact Details: Fill in your phone numbers, including mobile and office/fax numbers, along with your home phone number.

- Date of Birth: Input your date of birth in the format DD MM YY.

- Email Address: Write down a valid email address for communication purposes.

- Occupation/Profession: State your current occupation or profession.

- Nationality: Select your nationality from the list or write it down if required.

- Employer Information: Provide the name and address of your employer.

- Spouse Details: Include the name and occupation of your spouse, if applicable.

- Account Authorization: Review the authorization statement and make sure to check the agreements listed.

- Signature and Date: Sign and date the form in the designated area to confirm the accuracy of the information provided.

- Supporting Documents: Attach a completed signature card and a passport photograph.

Once the form is completed, it can be submitted to Guaranty Trust Bank (Ghana) Ltd for processing. The bank will review your application, and an account officer will guide you through the next steps. Keep a copy of the submitted form for your records.

What You Should Know About This Form

What is the purpose of the GTB Account Opening form?

The GTB Account Opening form is designed to gather essential information from individuals who wish to open a savings account at Guaranty Trust Bank (Ghana) Ltd. This includes personal details such as your name, address, and contact information, as well as your employment and marital status. Additionally, it serves as your authorization for the bank to establish the account in your name.

What information do I need to provide on the form?

You will need to provide a variety of personal details. This includes your surname, first name, and other names, along with your residential and mailing addresses. Contact numbers, date of birth, email address, occupation, and nationality are also required. Don’t forget to include information about your employer and your spouse, if applicable.

How do I ensure my information is accurate?

Before submitting the form, double-check all the entered information. Make sure that your name, contact details, and any other personal data are correct. The form includes a certification statement that you will sign, confirming that all details are true and accurate. This is important to avoid any issues with account operations later on.

Will I need to provide identification?

Yes, along with the account opening form, you will need to submit a completed signature card and a passport photograph. This identification helps the bank verify your identity and prevents fraud. Ensure that your documents are up-to-date and legible.

How will I gain access to my account?

Withdrawals from your account can only be made at the branch where your account is opened and will require a withdrawal slip. It’s important to guard against unauthorized access to your withdrawal slips to protect your funds. You can check your account balance and access statements through the bank’s online portal, if available.

What happens if I change my address?

If you change your residential or mailing address, you must notify GTB at the branch where you opened the account. This ensures that your bank statements and other important correspondence are sent to the correct location, thereby preventing any potential issues or delays in receiving crucial information.

How often will I receive account statements?

You will receive a quarterly Statement of Account from GTB. It’s essential to review these statements regularly. If you notice discrepancies, you should inform the bank within 15 days of receipt. If you do not do so, the bank will assume that the entries made in the statement are correct.

What should I do if I encounter difficulties opening my account?

If you face any challenges while completing the account opening process or have questions about the form, do not hesitate to reach out to a GTB representative at your nearest branch. They are there to assist you and will be happy to guide you through the process.

Who should I contact for further inquiries?

For any further questions or concerns related to the GTB Account Opening form, you can reach out to the customer service team at Guaranty Trust Bank (Ghana) Ltd. They can provide additional guidance and support to ensure a smooth experience as you open your new savings account.

Common mistakes

Filling out a savings account opening form can seem straightforward, but even a small mistake can lead to delays or complications. One common error occurs when individuals fail to provide accurate names. Miswriting or omitting a name can create significant issues down the line, especially when it comes to identification and account verification. It's crucial to double-check the spelling of your surname, first name, and any additional names included in the form.

Another frequent mistake involves the residential and mailing addresses. Often, applicants do not distinguish between these two types of addresses, leading to confusion. If the addresses differ, it’s important to ensure both are clearly indicated. Failing to provide accurate contact information can result in missed communications regarding the account, from notifications to important statements.

People sometimes neglect to update their contact numbers, which can hinder the bank's ability to reach out to you. Whether it's a mobile number, office number, or home number, all contact details should be current and clearly written. Errors or outdated numbers can lead to account management issues, particularly when the bank needs to verify your identity or address queries.

Lastly, many individuals overlook the importance of reviewing the information provided before submission. Rushing through the form can lead to overlooked mistakes or incomplete sections. After filling out the form, take a moment to review it thoroughly. This can save time and avoid frustration in the future, as discrepancies might require additional verification steps. Ensuring that all information is complete and accurate demonstrates responsibility and can streamline the process of opening your new savings account.

Documents used along the form

When opening a savings account with Guaranty Trust Bank (Ghana) Ltd, several other documents often accompany the Gtb Account Opening Form. These documents help verify identity, ensure compliance with banking regulations, and facilitate a smooth account setup process. Below is a list of some commonly required forms and documents.

- Completed Signature Card: This card collects the signatures of all individuals associated with the account. It serves as a reference for the bank to verify signatures on transactions.

- Passport Photograph: A clear passport-sized photo is typically required for identification purposes. This helps the bank confirm the identity of the account holder.

- Identification Document: A government-issued ID, such as a driver's license or passport, is necessary to verify the account holder's identity. The document must be current and readable.

- Proof of Address: Utility bills or bank statements that show the account holder's name and residential address may be requested. This helps the bank ensure the accuracy of the information provided on the application.

- Tax Identification Number (TIN): The TIN is a unique number assigned to individuals for tax purposes. It may be required to comply with financial regulations and tax laws.

- Employment Verification: Providing details about the current employer, such as a letter of employment or recent pay stub, can be necessary to verify the account holder's occupation and source of income.

- Joint Account Authorization: For joint accounts, all holders must provide written consent specifying their agreement to share the account and outline how it will be managed.

- Account Terms and Conditions Agreement: This document outlines the specific rules and conditions governing the account. Acknowledging and signing this agreement is essential for understanding the account's features and limitations.

Completing the account opening process accurately and providing the necessary documents is crucial for a positive banking experience. Each of these documents serves a specific purpose in ensuring the bank can verify identity, confirm account details, and comply with regulations. By preparing these items in advance, account holders can streamline their application process.

Similar forms

- Loan Application Form: Similar to the GTB Account Opening form, this document gathers personal information, including name, address, and employment details, necessary for assessing an applicant's financial eligibility.

- Credit Card Application Form: This document requires the applicant to provide personal and financial information to evaluate their creditworthiness, akin to how the GTB form assesses potential account holders.

- Customer Information Form: Like the GTB Account form, it collects detailed customer data to ensure proper identification and service alignment.

- Insurance Application Form: This form requests essential personal details and background information, paralleling the GTB form's focus on personal identification.

- Employment Application Form: Both forms require a range of information, including contact details and work history, to assess qualifications and eligibility.

- Real Estate Rental Application: Applicants must provide similar personal and financial information to establish trustworthiness and ability to pay, reflecting the content of the GTB Account form.

- Business Registration Form: This document collects identifying and operational details of a business, resembling the personal aspects covered in the GTB form.

- Taxpayer Registration Form: It requires personal identification and important statistics about an individual, mirroring the GTB form's purpose of verifying identity.

- Utility Service Application Form: Applicants supply personal contact information and residential status, similar to the requirements found in the GTB Account Opening form.

- Membership Application Form: Like the GTB Account form, it solicits personal information for identity verification to allow the creation of a new account or membership.

Dos and Don'ts

When completing the GTBank account opening form, it is essential to adhere to specific guidelines. Following these tips can ensure a smooth application process and help avoid potential setbacks.

- Do: Carefully read all instructions provided with the form before beginning.

- Do: Fill out the form in clear, legible writing or type the information where possible.

- Do: Provide accurate information regarding your personal details, such as your name, address, and date of birth.

- Do: Ensure that your contact numbers, including mobile and email, are up to date for follow-up communications.

- Don't: Forget to sign the form at the designated spot; signatures are vital for processing.

- Don't: Use nicknames or abbreviations; provide your full name as it appears on official documents.

- Don't: Leave any required fields blank; incomplete forms can delay your application.

- Don't: Submit the form without attaching a recent passport photograph, as this is a mandatory requirement.

Misconceptions

Here are some common misconceptions about the GTB Account Opening form, along with clarifications.

- Only one account type can be opened. Many people believe they can only open a savings account, but GTBank often offers various account types, depending on the customer's needs.

- Proof of address is unnecessary. Some assume that providing a residential address is sufficient. However, a mailing address is also needed for correspondence and account-related notifications.

- Any adult can open an account with any information. It’s a misconception that anyone can open the account with any details. Accurate information about identity, employment, and contact details must be provided.

- Online forms are the only option. A common belief is that the account can only be opened online. In reality, customers can complete the form in person at a branch as well.

- Once opened, the details can't be changed. Many think their information is set in stone after account creation. In fact, customers can request updates to their details at any time, like changing an address.

- Interest rates are fixed and unchangeable. Some believe the interest rate for savings accounts is permanent. In reality, rates are subject to change based on bank policies and market conditions.

- A spouse's name is mandatory. It’s a misconception that providing information about a spouse is always necessary. This information is only required if applicable.

- Discrepancies can be reported anytime. Many think they can notify the bank of any issues on their account statement whenever they want. However, it’s crucial to report discrepancies within 15 days to avoid assumptions about the account's accuracy.

- Signatures are not important. Some may underestimate the significance of providing a signature. A signature is essential for verifying transactions and authorizing account activities.

Key takeaways

Filling out the GTBank (Ghana) Savings Account Opening Form is a straightforward process, but there are several important aspects to keep in mind. Here are key takeaways to ensure a smooth experience.

- The form requires basic personal details including your surname, first name, and any other names.

- Provide accurate residential and mailing addresses, ensuring they match official documents.

- Include all relevant contact numbers, including mobile and office/fax numbers.

- Your date of birth must be filled in the specified format: DD MM YY.

- State your occupation or profession clearly, as this information is necessary for the bank's records.

- National identity should be provided during the opening; ensure your nationality is accurately indicated.

- A spouse's name and occupation may be requested, so have that information ready.

- By signing the form, you authorize the bank to open an account in your name and confirm your details are correct.

- After opening the account, expect a quarterly statement; review it carefully and report discrepancies within 15 days.

- Remember to keep your withdrawal slip secure to prevent unauthorized access.

These takeaways can help you navigate the account opening process effectively. Pay attention to the details and communicate any changes to the bank promptly.

Browse Other Templates

Hud Application Form for Housing - The form aids in ensuring that all information provided by applicants is consistent with what is reported to government agencies.

Ps Form 3533 - Refunds can be for various reasons, including postage errors or service failures.