Fill Out Your Harvard University Expense Form

The Harvard University Expense Form serves as a crucial tool for employees, affiliates, and invited guests to accurately document and request reimbursement for expenses incurred while conducting university-related activities. The form accommodates various payment methods, including out-of-pocket expenses and corporate card charges, allowing users to indicate their affiliation with Harvard clearly. A well-defined business purpose must accompany each expense, ensuring that sufficient details are provided for review and approval. This includes information on travel or entertainment costs, such as the individuals or organizations visited, along with specified dates. Importantly, receipts are required to be submitted within 60 days of incurring the costs, reinforcing accountability and proper financial documentation. The form also emphasizes the need for signatures from both the reimbursee and their department approver, alongside the account details necessary for processing payments. Users are guided through various sections with options for additional expenses and business purposes, making it adaptable and thorough. Supporting notes and tips are included to facilitate a smoother submission process, highlighting available resources for policy clarification. Understanding the structure and requirements of this form can greatly enhance compliance and expediency in managing university expenses.

Harvard University Expense Example

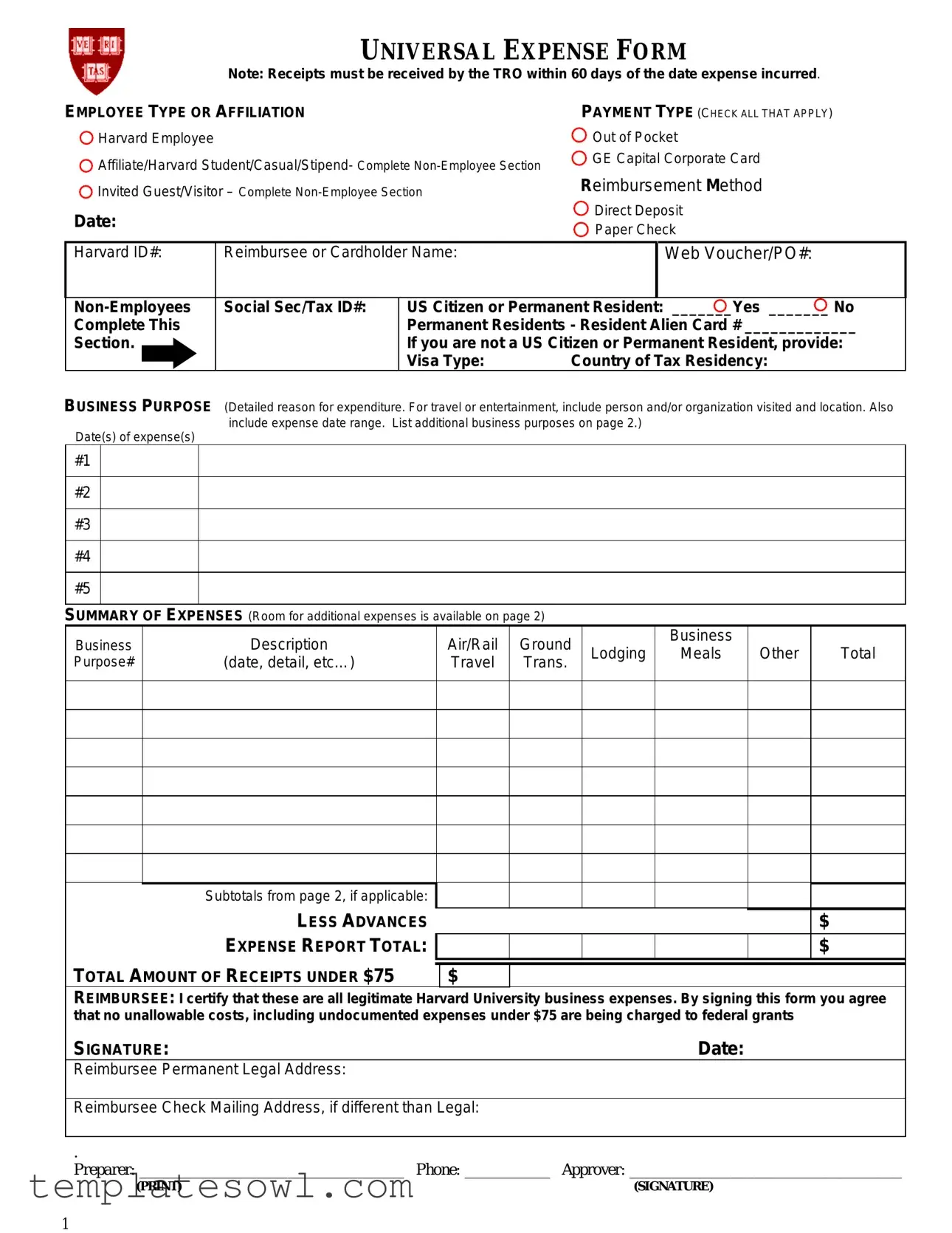

UNIVERSAL EXPENSE FORM

Note: Receipts must be received by the TRO within 60 days of the date expense incurred.

EMPLOYEE TYPE OR AFFILIATION |

PAYMENT TYPE (CHECK ALL THAT APPLY) |

|||

Harvard Employee |

|

Out of Pocket |

||

Affiliate/Harvard Student/Casual/Stipend- Complete |

GE Capital Corporate Card |

|||

Reimbursement Method |

||||

Invited Guest/Visitor – Complete |

||||

Date: |

|

Direct Deposit |

||

|

Paper Check |

|||

|

|

|||

Harvard ID#: |

Reimbursee or Cardholder Name: |

|

Web Voucher/PO#: |

|

|

|

|

|

|

Complete This

Section.

Social Sec/Tax ID#:

US Citizen or Permanent Resident: _______Yes _______ No

Permanent Residents - Resident Alien Card # _____________

If you are not a US Citizen or Permanent Resident, provide:

Visa Type: |

Country of Tax Residency: |

BUSINESS PURPOSE (Detailed reason for expenditure. For travel or entertainment, include person and/or organization visited and location. Also include expense date range. List additional business purposes on page 2.)

Date(s) of expense(s)

#1

#2

#3

#4

#5

SUMMARY OF EXPENSES (Room for additional expenses is available on page 2)

Business |

Description |

Air/Rail |

Ground |

|

Purpose# |

(date, detail, etc…) |

Travel |

Trans. |

|

|

|

|

|

|

Lodging

Business

Meals

Other

Total

Subtotals from page 2, if applicable:

LESS ADVANCES

EXPENSE REPORT TOTAL:

TOTAL AMOUNT OF RECEIPTS UNDER $75

$

$

$

REIMBURSEE: I certify that these are all legitimate Harvard University business expenses. By signing this form you agree that no unallowable costs, including undocumented expenses under $75 are being charged to federal grants

SIGNATURE: |

Date: |

Reimbursee Permanent Legal Address:

Reimbursee Check Mailing Address, if different than Legal:

. |

|

Preparer: __________________________________ |

Phone: ___________ Approver: ___________________________________ |

(PRINT) |

(SIGNATURE) |

1

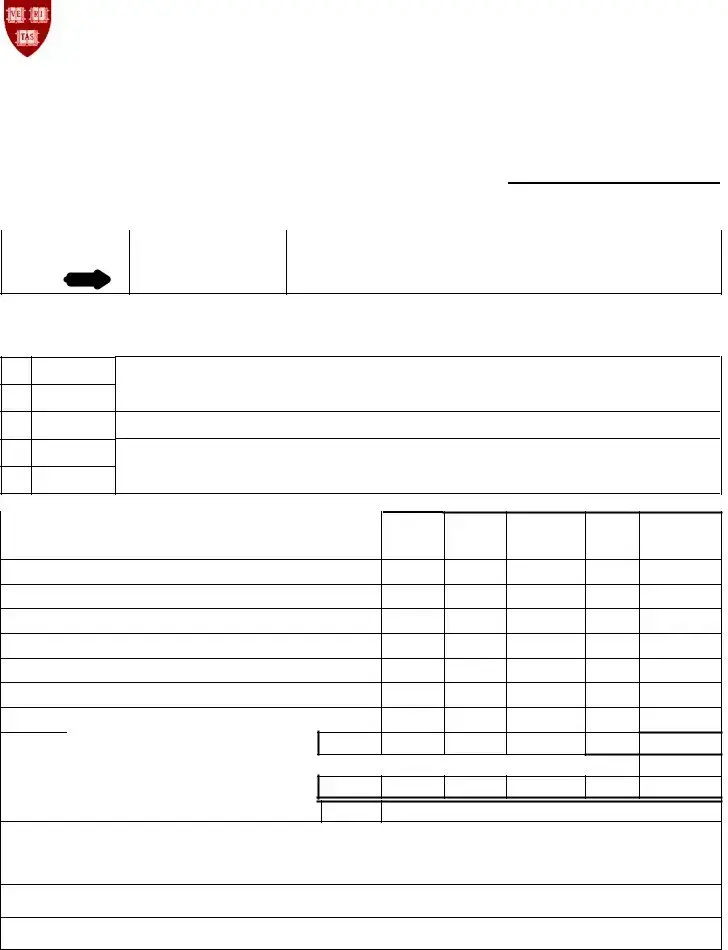

HARVARD UNIVERSITY UNIVERSAL EXPENSE FORM – SUPPLEMENTAL INFORMATION PAGE ____OF ___

Reimbursee or Cardholder Name: |

Web Voucher/PO#: |

Departmental Accounting

The area below is for departments whose financial office requires this information for processing purposes.

This information will be captured in the Web Voucher System.

Business Purpose#

Amount

Tub (3)

Org (5)

Object (4)

Fund (6)

Activity (6)

Sub (4)

Root (5)

$

ADDITIONAL BUSINESS PURPOSES OR INFORMATION

Date(s) of expense(s)

#6

#7

#8

#9

ADDITIONAL EXPENSES

Business |

Description |

Air/Rail |

Ground |

Lodging |

Business |

Other |

Total |

|

Purpose# |

(date, detail, etc.) |

Travel |

Trans |

Meals |

||||

|

|

|

Subtotals, carry to first sheet

Hints and policy notes:

1.You may attach an GE statement in lieu of completing the description section.

2.Please refer to the Policy at a Glance or the complete travel policy at www.travel.harvard.edu.

3.To expedite processing, contact the Travel and Reimbursement Office (TRO) at

2

Form Characteristics

| Fact Name | Description |

|---|---|

| Submission Timeline | Receipts must be received by the Travel Reimbursement Office (TRO) within 60 days of the expense incurred. |

| Employee Eligibility | The form is used by various employee types, including Harvard Employees, Affiliates, Harvard Students, and Invited Guests. |

| Payment Methods | Eligible payment types include Out of Pocket, GE Capital Corporate Card, and Direct Deposit. |

| Business Purpose Requirement | A detailed business purpose must be provided for all expenditures, particularly for travel and entertainment. |

| Amount Documentation | Expenses under $75 do not require receipts but must still be documented as legitimate business expenses. |

| Reimbursement Certification | The form requires the reimbursee's signature to certify the legitimacy of the expenses. |

| Departmental Accounting | Departments may require additional information for processing, which needs to be captured in the Web Voucher System. |

| Policy References | Users are encouraged to refer to Harvard's travel policy and contact the TRO for questions regarding policy compliance. |

Guidelines on Utilizing Harvard University Expense

Completing the Harvard University Expense form requires careful attention to detail. Follow these steps to ensure accurate submission and reimbursement. Keep in mind that receipts should be submitted within 60 days from when the expense was incurred.

- Begin by identifying your employee type or affiliation. Check the appropriate box for either Harvard Employee or a Non-Employee category, such as an Affiliate or Invited Guest.

- Next, select the payment type that applies to your situation. Indicate if payment was made out of pocket, through the GE Capital Corporate Card, or specify if it's for reimbursement.

- Fill in the date of the expense and your Harvard ID number, if applicable.

- Provide the name of the reimburse or cardholder. Non-employees should complete the Social Security or Tax ID section.

- Answer whether you are a US Citizen or Permanent Resident, and provide the relevant Visa Type and Country of Tax Residency if not.

- Detail the business purpose of the expense thoroughly. Include specifics such as the people or organizations involved, and the date range of expenses related to travel or entertainment.

- List the specific dates of the expenses, tagging them #1 through #5 for reference.

- Complete the summary of expenses. Breakdown the expenses into categories like travel, lodging, meals, and other expenses. Fill in subtotals where necessary, and indicate any advances you may have received.

- Calculate the total amount of receipts under $75 and enter it into the specified area.

- Upon certification, sign the form in the designated area to affirm that all expenses are legitimate Harvard business expenses.

- Fill in your permanent legal address, and if different, the mailing address for where checks should be sent.

- Finally, ensure the preparer’s contact information is noted and obtain approval signatures as required.

Once the form is completed, it is advisable to review all entries for accuracy before submission. This will help mitigate any delays in the reimbursement process and ensure compliance with Harvard University's policies. If there are any questions during this time, consider reaching out to the Travel and Reimbursement Office for clarification.

What You Should Know About This Form

What is the purpose of the Harvard University Expense Form?

The Harvard University Expense Form is designed to document and request reimbursement for expenses incurred during official university activities. This includes travel, meals, lodging, and other business-related expenses. It ensures that all expenses are properly categorized and justified according to university policies.

How long do I have to submit my receipts?

Receipts must be submitted to the Travel and Reimbursement Office (TRO) within 60 days from the date the expense was incurred. Failure to submit receipts within this timeframe may result in denial of reimbursement.

What information do I need to provide on the form?

You must provide detailed information regarding the business purpose of the expenses, including specifics such as the organizations or individuals visited and the corresponding locations. Additionally, you should list the dates of the expenses and any other relevant descriptions. Each expense should be categorized accurately, and subtotals should be calculated if necessary.

Can non-employees use the expense form?

Yes, non-employees such as invited guests or visitors can complete the non-employee section of the form. It is essential that they provide their Social Security or Tax ID number, along with information regarding their residency status.

Is it possible to attach a statement instead of filling out the description section?

Yes, you can attach a GE statement in lieu of completing the detailed description section. However, you must cross-reference the business purpose number to each item on the statement to ensure clarity and compliance with university guidelines.

What should I do if I have additional business purposes or expenses to report?

If you have additional business purposes or expenses, you can list them on page two of the expense form. It is advisable to keep the information organized and ensure all entries are clear and concise to avoid delays in processing.

Who should I contact if I have questions about the policy before submitting my form?

If you have questions regarding the expense policy, you can contact the Travel and Reimbursement Office (TRO) at 495-7760. It's best to reach out before submitting the form to resolve any uncertainties and expedite the processing of your expenses.

Common mistakes

Filling out the Harvard University Expense Form can be a straightforward process if you pay attention to the details. However, there are common mistakes people often make that could lead to delays or issues with reimbursement. Here are eight pitfalls to avoid.

One frequent error involves missing receipts. It’s crucial to submit receipts for all expenses, especially those over $75. If receipts are not attached, reimbursement could be significantly delayed. Always double-check that you have all necessary documentation before submission.

Another mistake is incomplete business purpose descriptions. The form requires a detailed explanation of your expenses, particularly for travel or entertainment. Simply stating “business meeting” is insufficient. Include specifics such as the date, location, and the individuals or organizations involved. This context helps justify the expense.

People often forget to include the correct payment type. Check all applicable boxes regarding how you incurred the expenses. Omitting this information can lead to confusion and processing delays. Be diligent in specifying whether the payment was made out of pocket or with a corporate card.

Incorrect signatures also pose a problem. Ensure that the right individuals sign the form. Check not only for the reimbursee's signature but also for any necessary approvals. Missing or incorrect signatures can halt the reimbursement process altogether, causing unnecessary frustrations.

Another common error is not providing a valid mailing address. If the reimbursement is to be sent via paper check, it’s vital to list your mailing address. If this information is inaccurate or omitted, your reimbursement could be sent to the wrong location, leading to additional delays.

People may also neglect to carry subtotals over correctly from additional pages of the expense report. If you list extra expenses on the supplemental information page, make sure to accurately transfer these amounts to the main form. Inaccurate totals can raise red flags during processing.

Sometimes, individuals do not indicate lesser expenses properly. According to policy, expenses under $75 don’t need detailed receipts. However, you must still itemize them correctly on the form. Incorrectly categorizing these expenses can lead to issues with compliance and processing.

Finally, some forget to follow the 60-day receipt rule. Receipts must be submitted within 60 days of incurring the expense. Missing this deadline can result in disqualification of the reimbursement request. Staying organized and mindful of deadlines will ensure smoother processing.

By avoiding these common mistakes, your experience with the Harvard University Expense Form can be much more efficient. Double-checking the details can make all the difference in getting reimbursed quickly and without hassle.

Documents used along the form

The Harvard University Expense form serves as a critical document for employees seeking reimbursement for business-related expenses. Alongside this form, several other documents may be required to ensure a smooth reimbursement process. Understanding these complementary forms is essential for compliance and efficiency.

- Detailed Receipts: These are required to substantiate claims made in the Expense form. Each receipt must clearly show the date, amount, and nature of the expense. They should be submitted within the stipulated timeframe to avoid delays.

- Travel Itinerary: This document outlines the travel plans for business trips. It should include dates, times, and destinations. The itinerary helps verify the purpose of travel expenses claimed.

- Conference Registration Receipts: If the expense relates to attending a conference, including this receipt is vital. It documents registration fees paid and can clarify the business purpose of the trip.

- Approval Emails: Any correspondence that confirms approval for expenses, especially for non-standard costs, should be included. This adds a level of transparency to the claims process.

- Credit Card Statements: For expenses paid using a corporate card, relevant statements can be provided. These should highlight specific transactions that align with the business purpose listed on the Expense form.

- Travel and Reimbursement Policies: A copy of relevant policies can help employees confirm validity when incurring expenses. Reference to these policies can strengthen the justification for claims made.

- Pre-Approval Forms: When certain expenses require prior approval, including these forms ensures that reimbursement aligns with Harvard’s spending guidelines.

- Supplemental Information Sheets: These sheets provide additional space for detail when more entries are needed than the main Expense form can accommodate. Comprehensive descriptions facilitate faster processing.

Each of these documents plays a vital role in ensuring that expense claims are substantiated and processed efficiently. Accurate completion and timely submission of both the main Expense form and the associated documents can significantly impact the reimbursement timeline and compliance with institutional policies.

Similar forms

The Harvard University Expense form shares similarities with several other documents used for expense reporting, reimbursement requests, and travel claims. Below is a list highlighting nine documents that exhibit comparable elements.

- Employee Reimbursement Form: This form is used by employees to claim back expenses related to work. Like the Harvard form, it requires detailed information about the expenses and often mandates receipts.

- Travel Expense Report: Used specifically for travel-related expenses, this report also asks for documentation such as flight receipts and hotel invoices, similar to the requirements of the Harvard form.

- Company Credit Card Reimbursement Request: Employees who use a company credit card for business expenses complete this form to report their spending, much like how the Harvard form functions for reimbursements.

- Out-of-Pocket Expense Claim: This document enables individuals to report expenses incurred while performing business duties. It also requires a breakdown of costs and supporting documentation, resembling the Harvard Expense form.

- Supplier Invoice Payment Request: When a supplier provides services or products, this form is used to request payment. It similarly requires detail on the business purpose and documentation.

- Petty Cash Reimbursement Form: Employees can use this for small, immediate expenses paid out of pocket. It shares the need for receipts and the documentation of each expense like the Harvard form.

- Grant Expense Form: This form is often used in academia for reporting expenses related to grant-funded projects. It, too, necessitates justification and detailed descriptions of expenditures.

- Expense Claim for Business Meals: This form focuses on meals incurred during business activities, requiring details about the attendees and purpose, similar to the Harvard form's business meals section.

- Travel Authorization Form: Although mainly for pre-approval of travel plans, it requires cost estimates and business reasons, paralleling the expense justification seen in the Harvard form.

Dos and Don'ts

Things to Do When Filling Out the Harvard University Expense Form:

- Ensure that all receipts are submitted within 60 days of incurring the expense.

- Provide a detailed business purpose for each expense, including dates and relevant persons or organizations.

- Use the correct payment type and employee type or affiliation when filling out the form.

- Double-check the totals and signatures before submitting to minimize processing delays.

Things Not to Do When Filling Out the Harvard University Expense Form:

- Do not submit undocumented expenses under $75, as they cannot be charged to federal grants.

- Avoid submitting the form without all required signatures and information.

- Do not neglect to attach receipts for expenses that require them.

- Refrain from using vague descriptions for the business purpose section; specificity is crucial.

Misconceptions

1. All expenses under $75 are automatically reimbursed. This is not true. While expenses under $75 don’t require receipts, they must still be legitimate business expenses related to Harvard activities. Failure to provide necessary documentation can lead to delays or denials.

2. Only Harvard employees can use the expense form. This is a misconception. The form can also be used by affiliates, Harvard students, and non-employees, although non-employees must complete a specific section of the form.

3. You can submit receipts anytime after the expense is incurred. This is incorrect. Receipts must be submitted to the Travel and Reimbursement Office (TRO) within 60 days of the date the expense was incurred. Late submissions may not be reimbursed.

4. The expense form must be completed in pen. There is no specific requirement regarding ink. You can complete the form electronically, which streamlines processing and reduces potential errors in legibility.

5. It’s okay to submit multiple expense reports for the same trip. This is misleading. While you can submit expenses incurred over a trip, it’s best practice to consolidate all related expenses into a single report to avoid confusion and facilitate quicker processing.

6. The Approver's signature can be from anyone. This is not accurate. The Approver must be someone designated within the department who has the authority to approve expenditures. Make sure to check departmental policies to ensure compliance.

Key takeaways

When filling out and using the Harvard University Expense form, keep the following key takeaways in mind:

- Submit Receipts Promptly: Ensure that receipts are submitted to the Travel Reimbursement Office (TRO) within 60 days from the date the expense was incurred to avoid delays.

- Understand Employee Types: Identify your affiliation as either a Harvard employee or a non-employee. This distinction dictates whether you complete additional sections of the form.

- Clarify Payment Methods: Indicate your payment method by checking all applicable options, such as direct deposit or paper check, to ensure proper processing.

- Provide Detailed Information: In the business purpose section, give a thorough explanation for each expense. For travel-related costs, detail the person or organization visited and the location.

- Ensure Accurate Totals: Include a summary of expenses and verify that totals are correct. Subtract any advances received to get the final amount being claimed.

- Ask for Help if Needed: If you have questions about the policy or the form, contact the TRO at 495-7760 before submission to clarify any uncertainties.

Browse Other Templates

What Do You Need to Change Your Address at the Dmv - If you have a commercial license, your address must be a California residence.

Commissioned Officer Application,Army Officer Appointment Request,Warrant Officer Application Form,Military Officer Selection Document,U.S. Army Officer Enrollment Application,Army Reserve Appointment Application,Applicant Information for Army Office - The form requires basic personal data, including the applicant's full name and social security number.

How Do I Get a Direct Deposit Form - Employees are advised to notify Payroll immediately if their bank account is closed.