Fill Out Your Hcjfs 3050 Form

The HCJFS 3050 form serves a crucial role in the verification process for employment in relation to Hamilton County Job and Family Services Child Care Services. This form is primarily utilized by both employees seeking assistance and employers needing to confirm employment details for child care benefit eligibility. It requires a month's worth of current pay stubs if the employee has been in their position for over a month, ensuring that the verification reflects the most recent income status. It is applicable not only for new hires but also for individuals returning from a leave of absence or requiring clarification of their employment status. Employers must complete specific sections that verify essential data such as company information, the employee’s role and status, and income details, including pay rates and hours worked. Additionally, the signature of the employer is mandatory to attest to the accuracy of the information provided. The form emphasizes transparency and cooperation between employers and the HCJFS, facilitating the efficient provision of necessary child care services to eligible families. Compliance with the guidelines set forth in this form helps streamline the application process for those in need of child care support.

Hcjfs 3050 Example

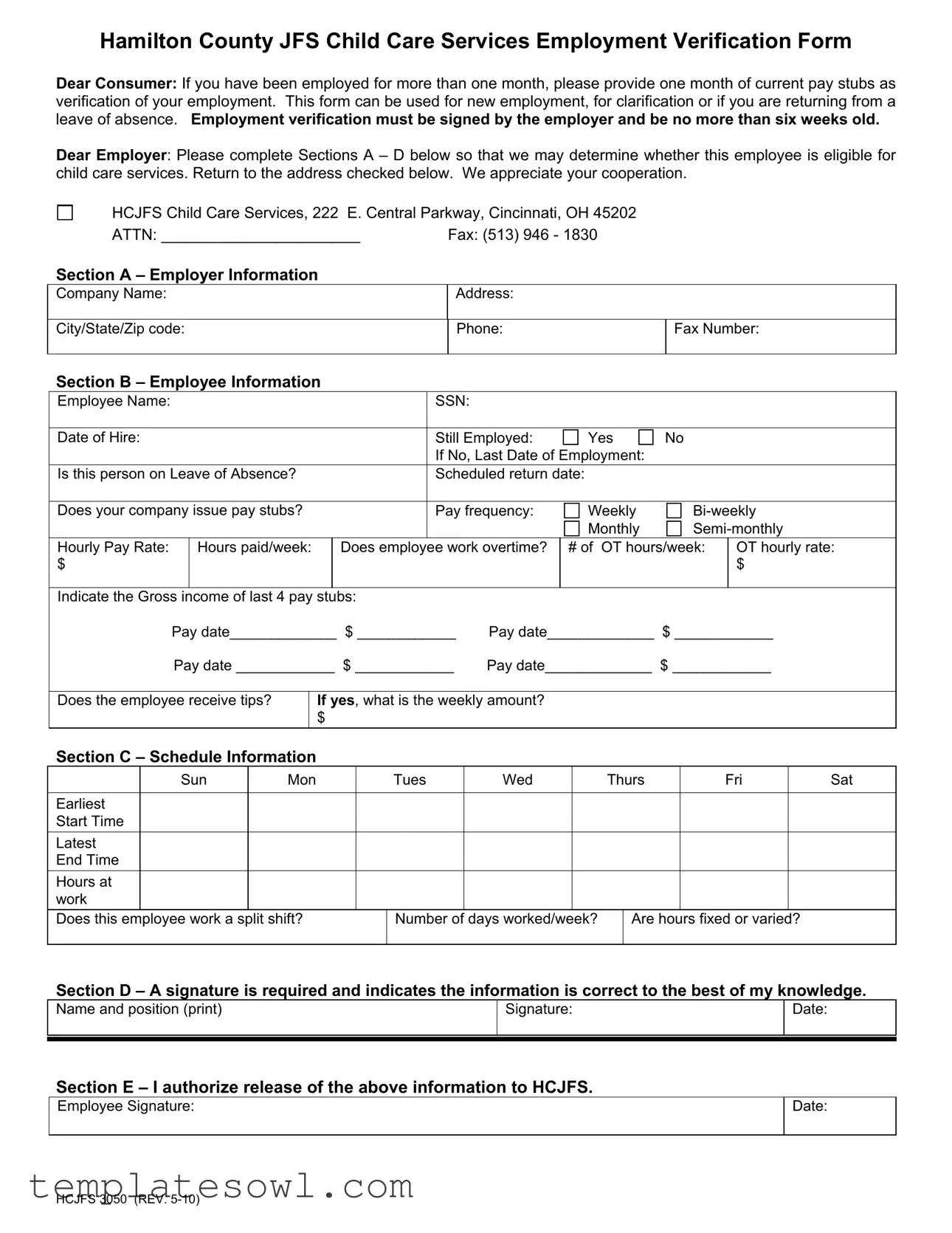

Hamilton County JFS Child Care Services Employment Verification Form

Dear Consumer: If you have been employed for more than one month, please provide one month of current pay stubs as verification of your employment. This form can be used for new employment, for clarification or if you are returning from a leave of absence. Employment verification must be signed by the employer and be no more than six weeks old.

Dear Employer: Please complete Sections A – D below so that we may determine whether this employee is eligible for child care services. Return to the address checked below. We appreciate your cooperation.

HCJFS Child Care Services, 222 E. Central Parkway, Cincinnati, OH 45202

ATTN: _______________________ |

Fax: (513) 946 - 1830 |

Section A – Employer Information

Company Name:

Address:

City/State/Zip code:

Phone:

Fax Number:

Section B – Employee Information

Employee Name: |

|

|

|

|

|

SSN: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Hire: |

|

|

|

|

|

Still Employed: |

Yes |

No |

|

|

|

|

|

|

|

|

If No, Last Date of Employment: |

|

|

||

Is this person on Leave of Absence? |

|

|

Scheduled return date: |

|

|

|||||

|

|

|

|

|

|

|

|

|

||

Does your company issue pay stubs? |

|

|

Pay frequency: |

Weekly |

||||||

|

|

|

|

|

|

|

|

Monthly |

||

Hourly Pay Rate: |

|

Hours paid/week: |

|

Does employee work overtime? |

# of OT hours/week: |

OT hourly rate: |

||||

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||

Indicate the Gross income of last 4 pay stubs: |

|

|

|

|

||||||

|

Pay date_____________ $ ____________ |

Pay date_____________ $ ____________ |

||||||||

|

Pay date ____________ $ ____________ |

Pay date_____________ $ ____________ |

||||||||

|

|

|

|

|

|

|||||

Does the employee receive tips? |

|

If yes, what is the weekly amount? |

|

|

|

|||||

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section C – Schedule Information

|

Sun |

Mon |

|

Tues |

Wed |

|

Thurs |

Fri |

|

Sat |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earliest |

|

|

|

|

|

|

|

|

|

|

|

Start Time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Latest |

|

|

|

|

|

|

|

|

|

|

|

End Time |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hours at |

|

|

|

|

|

|

|

|

|

|

|

work |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Does this employee work a split shift? |

|

Number of days worked/week? |

|

Are hours fixed or varied? |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Section D – A signature is required and indicates the information is correct to the best of my knowledge.

Name and position (print)

Signature:

Date:

Section E – I authorize release of the above information to HCJFS.

Employee Signature:

Date:

HCJFS 3050 (REV.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The HCJFS 3050 form is used to verify employment for individuals seeking child care services in Hamilton County, Ohio. |

| Eligibility Criteria | To be eligible, the employee must have been employed for more than one month and provide one month of current pay stubs. |

| Signature Requirement | The form must be signed by the employer, validating the information provided is accurate. |

| Timeliness of Form | All information must be current, with the verification not being older than six weeks. |

| Sections Overview | The form consists of multiple sections, including employer information, employee information, scheduling details, and a signature area. |

| Pay Stubs | Employees must submit gross income from their last four pay stubs as part of this verification process. |

| Return Address | Completed forms should be returned to HCJFS Child Care Services at 222 E. Central Parkway, Cincinnati, OH 45202. |

| Governing Law | This form is subject to the regulations governing child care services in Hamilton County, Ohio. |

Guidelines on Utilizing Hcjfs 3050

To complete the HCJFS 3050 form, ensure that you have all necessary information ready, including employment details and pay stubs. This form facilitates verification of employment for child care services, and it must be accurately filled out and signed by your employer. Follow the steps below to fill out the form properly.

- Obtain the Form: Download the HCJFS 3050 form from the appropriate source or request it from Hamilton County Job and Family Services.

- Complete Section A – Employer Information: Fill in the company name, address, city/state/zip code, phone, and fax number.

- Complete Section B – Employee Information: Provide your name, Social Security Number, date of hire, and indicate if you are still employed. If not, enter the last date of employment. Answer whether you are on a leave of absence and, if so, include the scheduled return date.

- Fill Out Pay Information: Indicate if your company issues pay stubs and specify the pay frequency. Provide your hourly pay rate, average hours worked per week, any overtime hours worked per week, and the overtime hourly rate. Include the gross income from your last four pay stubs with pay dates and amounts.

- Indicate Tips: If applicable, state whether you receive tips and include the weekly amount.

- Complete Section C – Schedule Information: Fill in the earliest start time, latest end time, and total hours at work. Indicate whether you work a split shift and number of days worked per week. Specify if your hours are fixed or varied.

- Section D – Employer Signature: The employer should print their name and position, sign the form, and date it. This indicates the information provided is accurate.

- Section E – Employee Signature: Sign and date the form to authorize the release of the information to HCJFS.

- Submit the Form: Return the completed form to the address provided in Section D or send it via fax to the number listed.

Ensure all sections are filled out completely and accurately to avoid any delays in processing your request. Keep a copy for your records before submission.

What You Should Know About This Form

What is the HCJFS 3050 form used for?

The HCJFS 3050 form is an Employment Verification Form designed for use by Hamilton County Job and Family Services (HCJFS). It helps verify employment status for individuals applying for child care services. The form captures information about the employee and their earnings, which are necessary to determine eligibility for these services.

Who needs to complete the HCJFS 3050 form?

Both the employee and their employer must complete sections of the HCJFS 3050 form. The employer fills out sections that detail the company's information and the employee's employment details. The employee must also authorize the release of this information to HCJFS.

What information do I need to provide as an employer?

As an employer, you need to provide comprehensive information about your company, including your company's name, address, phone number, and fax number. You'll also need to fill out details regarding the employee, including their name, social security number, date of hire, pay information, and schedule. Finally, a signature certifying that the information is accurate is essential.

How recent must the employment verification be?

The employment verification provided on the HCJFS 3050 form must be signed by the employer and dated within the last six weeks. This ensures that HCJFS has the most up-to-date information about the employee's current employment status.

Where do I send the completed HCJFS 3050 form?

Once completed, the form can be sent to the HCJFS Child Care Services office located at 222 E. Central Parkway, Cincinnati, OH 45202. You may also fax it to (513) 946 - 1830. Make sure to send it to the address indicated on the form to ensure it reaches the right department.

Common mistakes

Completing the HCJFS 3050 form can appear straightforward, but several common mistakes often arise during this process. Paying attention to detail can make a significant difference in ensuring that the form is processed smoothly.

One frequent error individuals make is failing to provide accurate pay stubs. The form requests verification of employment through one month of current pay stubs, which must be no more than six weeks old. Providing outdated stubs can delay approval, as this requirement is in place to affirm current employment status and income levels.

Another common oversight is not having the employer's signature on the form. Sections A through D must be completed by the employer, including accurate company information and confirmation of employment details. The absence of a signature indicates that the information has not been verified, which can lead to complications in securing child care services.

Inaccuracy in the employee information section can also cause issues. It is essential to fill out the Employee Name, SSN, Date of Hire, and whether the individual is still employed or not. Discrepancies in this section may result in the denial of services or a lengthened review process.

Lastly, neglecting to complete Section D, which requires an employer's confirmation of the provided information, is a critical mistake. This section plays a vital role in validating the details to the best of the employer's knowledge. Without this confirmation, the application may be deemed incomplete, hindering assistance that could be vital for the employee’s family.

Documents used along the form

The HCJFS 3050 form is a crucial document used for employment verification in relation to child care services in Hamilton County, Ohio. Several other forms and documents often accompany this form to support the verification process, ensuring that all necessary information is collected accurately. The following list details five common forms and documents that may be used alongside the HCJFS 3050.

- HCJFS 3080 - Child Care Application: This form is filled out by the consumer seeking child care services. It collects personal information and income details to determine eligibility for assistance.

- HCJFS 2000 - Employment Information Form: Employers complete this document to provide additional details about an employee's work status and income, supporting the HCJFS 3050 verification process.

- Pay Stubs: Copies of recent pay stubs are required for income verification. They help verify the employee's earnings and must be current and comprehensive.

- Form W-2: This form summarizes an employee's annual earnings and taxes withheld. It is often used to verify income for the entire year, complementing other employment documentation.

- Leave of Absence Documentation: If an employee is on a leave of absence, documents explaining the nature of the leave may be needed. They help clarify the employee's current employment status.

These documents collectively establish a clear and thorough understanding of employment verification for child care services. Ensuring that all necessary forms are completed and submitted can facilitate a smoother application process.

Similar forms

The HCJFS 3050 form serves as a verification tool for employment when applying for child care services. Several other documents hold a similar purpose in confirming employment status or income. Here is a list of five such documents:

- W-2 Form: This document summarizes an employee's earnings, taxes withheld, and year-end income. Like the HCJFS 3050, it provides vital information for verifying employment and income over the previous tax year.

- Pay Stubs: Pay stubs detail an employee's earnings for each pay period, including deductions. These stubs serve as ongoing proof of income, similar to the requirement of recent pay stubs on the HCJFS 3050 form.

- Employment Verification Letter: This letter, provided by an employer, confirms an employee’s job status, position, and salary. It shares a purpose with the HCJFS 3050 form by validating current employment for services like child care assistance.

- 1099 Form: Independent contractors receive this form, which indicates earnings for the year. It records income in a way akin to the earnings reported on the HCJFS 3050 and serves to validate self-employment or contract work.

- Social Security Administration (SSA) Benefit Verification Letter: This letter confirms Social Security benefits, including Supplemental Security Income (SSI). It is similar in that it verifies income but targets a different type of financial support.

Dos and Don'ts

When filling out the HCJFS 3050 form, keep these important points in mind:

- Do provide accurate information about your employment.

- Do include one month of current pay stubs if employed for more than one month.

- Do ensure the employer signs the form.

- Do include gross income from the last four pay stubs.

- Do make sure the information is no more than six weeks old.

However, be cautious and avoid these mistakes:

- Don't leave any sections blank if the information is applicable.

- Don't provide pay stubs that are older than six weeks.

- Don't forget to confirm your employment status, including any leaves of absence.

- Don't submit the form without the required signatures.

- Don't provide incorrect or misleading data about hours worked and pay rate.

Misconceptions

Understanding the HCJFS 3050 form is essential for both employees and employers, especially when it comes to child care services eligibility. However, several misconceptions often arise regarding its purpose and usage. Here are five common misunderstandings explained.

- The form is only for new employees. Many people believe the HCJFS 3050 is solely for individuals starting a new job. In reality, it can also be used to verify employment status for those returning from a leave of absence or for clarification regarding current employment.

- Employers do not need to provide pay stubs. Some think that the HCJFS 3050 form doesn’t require pay stub verification. However, if an employee has been employed for over a month, one month of current pay stubs is mandatory for accurate verification.

- Only the employee can fill out the form. A common misconception is that the employee is solely responsible for completing the HCJFS 3050. In fact, sections of the form require information that must be filled out by the employer to ensure eligibility for child care services.

- Signature is not required. Some might assume that the employer's signature isn’t essential for the HCJFS 3050 form. However, the employer's signature is crucial, as it confirms the accuracy of the information provided regarding employment.

- The information is only kept for a short period. There is a belief that the details submitted with the HCJFS 3050 are erased shortly after processing. In truth, the information may be retained for record-keeping and verification purposes, subject to privacy policies and regulations.

By addressing these misconceptions, it becomes easier for employees and employers to accurately navigate the HCJFS 3050 form, facilitating a smoother process in accessing child care services.

Key takeaways

The HCJFS 3050 form is important for both employees and employers. It serves as a verification tool for employment to determine eligibility for child care services. The accuracy and completeness of this form are crucial for timely processing.

- One month of pay stubs is needed: If you have been employed for over a month, you must provide your most recent pay stubs reflecting a full month's earnings. This helps to establish your current financial situation.

- Employer's signature is mandatory: The form requires the employer to complete several sections and provide a signature. This confirms that the information included regarding the employee’s work status is accurate.

- Timeliness matters: All employment verification information must not be more than six weeks old. This ensures that the data reflects the employee's current situation and pay status.

- Information release authorization: The employee must sign to authorize the release of their information to HCJFS. This step is essential, as it maintains confidentiality while allowing for necessary verification.

Browse Other Templates

PCA Provider Registration Form,Individual PCA Service Provider Change Form,PCA Addition and Termination Form,PCA Individual Service Update Sheet,Blue Cross PCA Provider Data Form,PCA Personnel Change Request,Individualized PCA Service Documentation F - Provide an email address for confirmation or further communication.

Bulk Mail Form - Complete forms should be submitted at the time of mailing.