Fill Out Your Hdfc Bank Account Opening Form

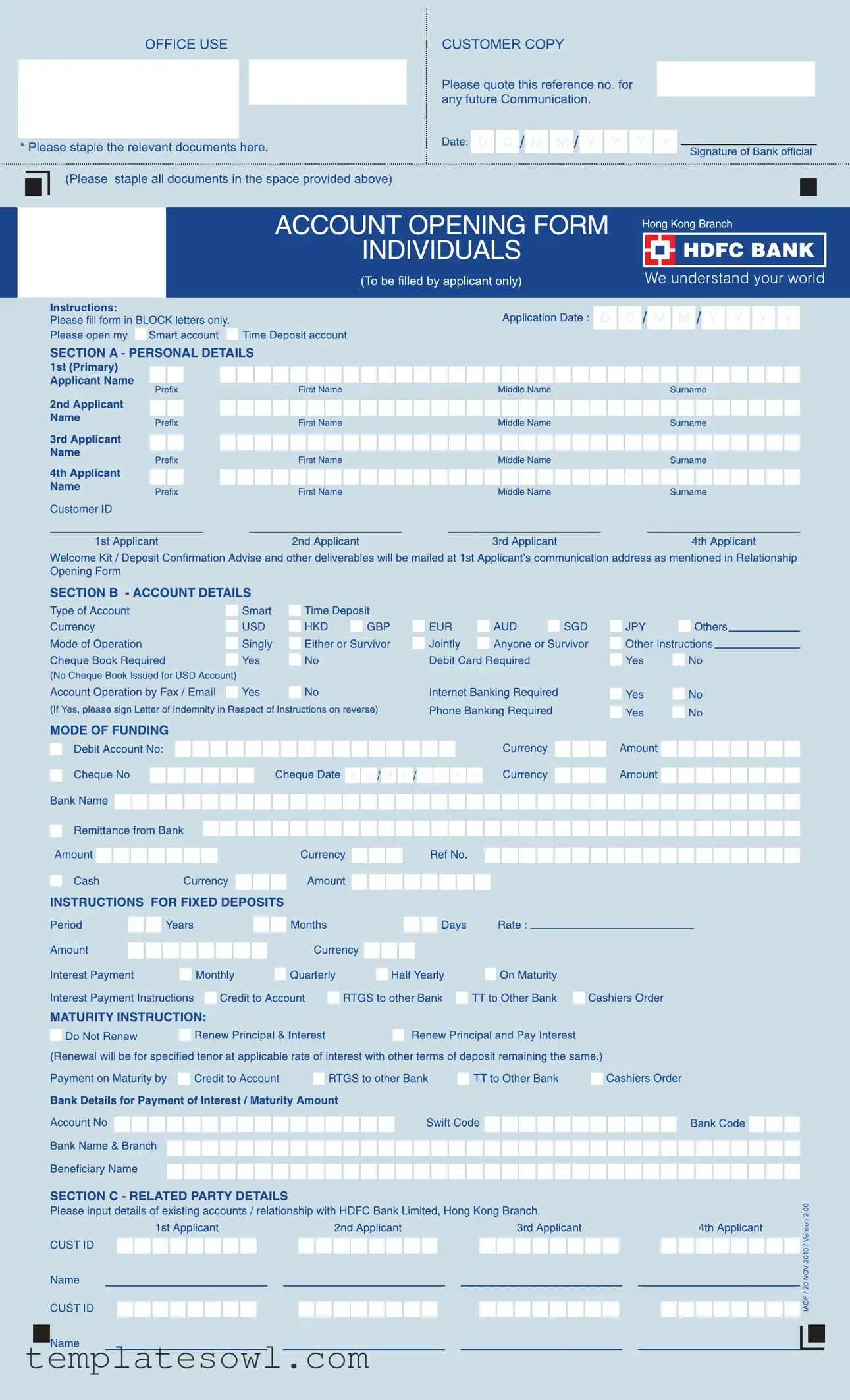

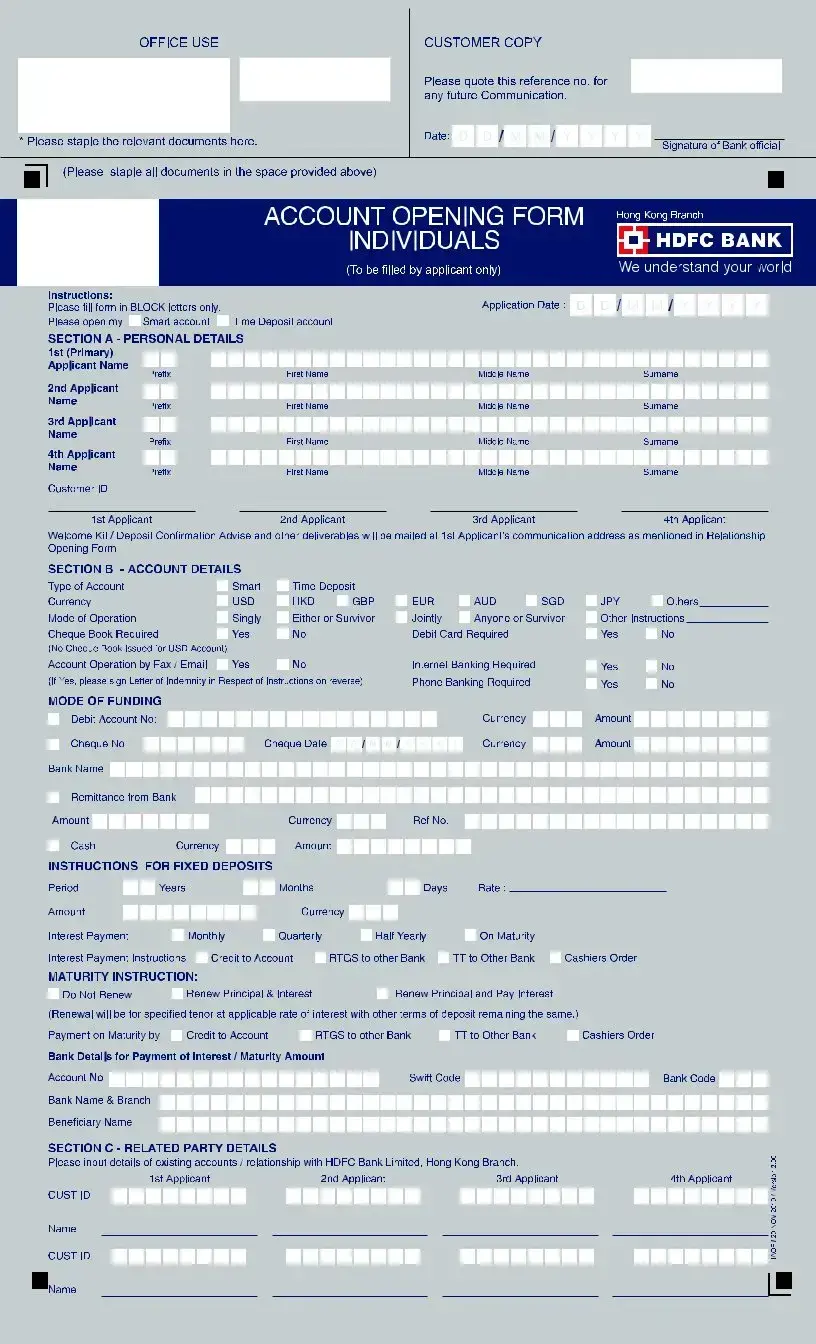

Opening a bank account is a critical step in managing your finances, and the HDFC Bank Account Opening form is designed to facilitate this process for individuals looking to establish a relationship with the bank. This comprehensive form, tailored for the bank's Hong Kong branch, requires you to provide essential personal details such as your name, customer ID, and contact information. It's vital to complete the form using block letters to ensure clarity. The document includes sections that outline the type of account you wish to open, whether it be a Smart account, a Time Deposit, or another option, along with the preferred currency and mode of operation. You will also need to specify whether you want additional features like a cheque book, debit card, or internet banking. Importantly, the form captures your consent and understanding of the terms and conditions governing your account, along with important privacy and security permissions that HDFC Bank must adhere to. Through various sections, the form emphasizes the need for your accurate information and offers a declaration acknowledging your agreement with the bank's policies, including the protections offered under the Hong Kong Deposit Protection Scheme. Completing this form accurately is not just a bureaucratic step; it lays the groundwork for a secure and beneficial banking experience.

Hdfc Bank Account Opening Example

Form Characteristics

| Fact Title | Description |

|---|---|

| Form Purpose | The HDFC Bank Account Opening form is designed for individuals looking to open a bank account at HDFC Bank's Hong Kong Branch. |

| Personal Details Required | Applicants must provide their personal information such as names, communication address, and customer ID in block letters. |

| Types of Accounts | Users can request different types of accounts, including Smart USD and Time Deposit accounts, each with various operational modes. |

| Interest Payment Instructions | Applicants can choose how they wish to receive interest payments, either credited to their account or via other means such as RTGS or Cashier's Order. |

| Documentation | All required supporting documents should be stapled in the designated space, ensuring that the application is complete. |

| Joint Accounts | The form allows for the opening of joint accounts, requiring details for up to four applicants. |

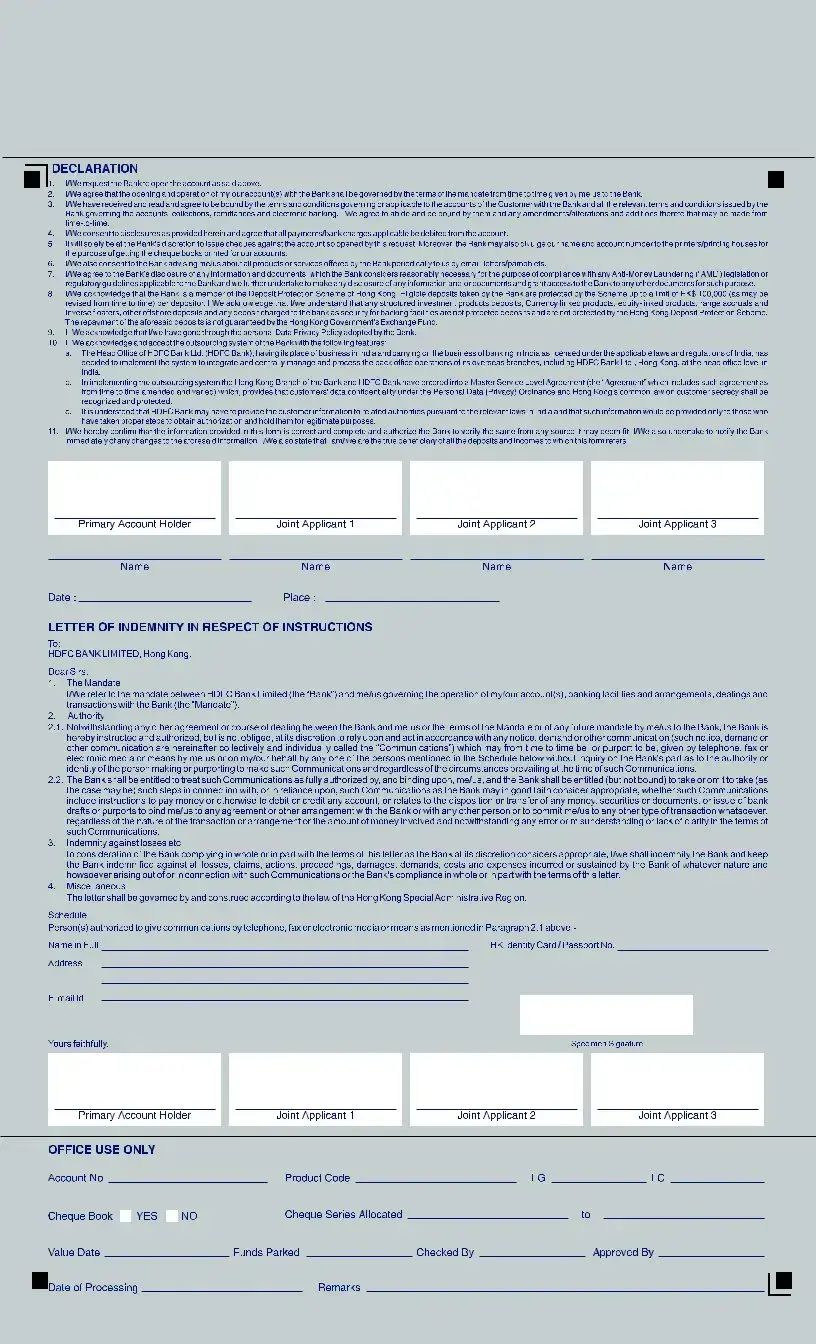

| Declaration Section | Applicants must read and agree to the bank's terms and comply with Anti-Money Laundering regulations, indicated in a declaration section. |

| Governing Law | The terms of the account operation are governed by the laws of the Hong Kong Special Administrative Region. |

Guidelines on Utilizing Hdfc Bank Account Opening

Filling out the HDFC Bank Account Opening form is a necessary step to establish your banking relationship. It's important to provide accurate information to avoid any delays in processing your application. Follow the steps below to complete the form effectively.

- Personal Details: In Section A, fill in your personal details in BLOCK letters. Include your name as it appears on your identification, application date, and customer ID.

- Other Applicants: If there are joint applicants, enter their names, middle names, and surnames as required.

- Communication Address: Ensure that the communication address for the welcome kit and other documents is clear and correct, listed under the first applicant’s information.

- Account Details: In Section B, choose the type of account you want to open (e.g., Smart account, Time Deposit). Select the account currency, operation mode, and whether you require a cheque book, debit card, and internet/phone banking.

- Interest Payment Instructions: Specify how you wish to receive interest payments (e.g., credited to your account, RTGS to another bank).

- Maturity Instruction: Provide instructions regarding the renewal or payment of your deposits on maturity.

- Related Party Details: Complete Section C by disclosing any existing relationships with HDFC Bank Hong Kong, providing names and details as needed.

- Declaration: Read and accept the declarations in Section E, confirming your agreement to the terms and conditions imposed by the bank.

- Signature: Sign and date the form. If there are joint applicants, ensure they also sign where indicated.

- Document Submission: Staple all required documents in the designated area before submission to the bank.

What You Should Know About This Form

What is the HDFC Bank Account Opening Form?

The HDFC Bank Account Opening Form is a document that individuals must complete to open a new bank account with HDFC Bank’s Hong Kong branch. This form collects important personal details, account preferences, and agreements related to the operation and management of the account.

What types of accounts can I open using this form?

This form allows you to open various types of accounts, including a Smart account in different currencies, as well as a Time Deposit account. Each type of account offers specific features, so it’s important to select one that meets your financial needs.

What personal information is required on the form?

When filling out the form, you are required to provide personal information for yourself and any joint applicants. This includes names, customer IDs, and other identification details. Accuracy is crucial to ensure proper processing and compliance with banking regulations.

What should I do if I have an existing relationship with HDFC Bank?

If you are already a customer of HDFC Bank, the form instructs you to provide details of your existing accounts or relationships with the bank. This information helps in understanding your banking history and ensures a smoother account opening process.

Are there specific instructions for filling out the form?

Yes, the form must be filled out in BLOCK letters only. This ensures clarity and minimizes the risk of errors. It is also advisable to staple all necessary documents in the designated area on the form to ensure that nothing is overlooked during submission.

What happens after I submit the account opening form?

After submission, the bank will process your application using the information provided. You may receive confirmation of your account details, a welcome kit, and any additional products or services you may have selected, like debit cards or internet banking.

What are the terms of account operation once opened?

Once your account is opened, it will be governed by the terms and conditions you agreed to while filling out the form. This includes provisions regarding transactions, charges, and any applicable laws regulating bank operations in Hong Kong.

Common mistakes

Opening a bank account can be a straightforward process, but some common mistakes can create complications. Here are eight frequent errors people often make when filling out the HDFC Bank Account Opening form.

One common mistake is failing to use block letters. The instructions clearly state the form must be completed in block letters. If handwritten portions are difficult to read, this can delay account processing, or worse, lead to inaccuracies in the account information.

Another mistake is incomplete details regarding personal information. Individuals sometimes leave out essential information such as middle names or prefix titles. Ensure that every section of the personal details is fully completed, as missing data can result in processing delays.

Providing incorrect communication address poses another issue. The welcome kit and important correspondence will be sent to the address listed by the primary applicant. Double-check that this address is current and correct to avoid any complications in receiving your account materials.

People often overlook the section for related party details. It is crucial to include information about any existing accounts with HDFC Bank. Not providing these details can impact future transactions or account linkage.

When it comes to choosing the type of account, applicants sometimes disregard stipulations regarding the required attributes of their account, such as whether a cheque book will be issued. Individuals must clearly state whether or not a cheque book is necessary, especially for specific currency types mentioned in the form.

Another error involves payment instructions. Applicants might skip or mislabel how they wish to receive interest payments or maturity amounts. It's essential to indicate if you want these amounts credited to your account or through another method, such as RTGS or TT.

Additionally, signatures can be a significant source of errors. Ensure that the correct individuals sign the form, and that signatures match those on identification documents. Mismatched signatures might lead to account creation difficulties.

Finally, individuals may fail to read and acknowledge the declaration section properly. It's important to understand that signing the form indicates agreement with the bank's terms and conditions. Ignoring this can lead to misunderstandings about responsibilities and rights related to the account.

By avoiding these eight mistakes, you can ensure a smoother experience when opening your account with HDFC Bank. Prioritize accuracy, compliance with instructions, and thoroughness. Doing so will not only facilitate the account opening process but also enhance your overall banking experience.

Documents used along the form

When opening a bank account at HDFC Bank, there are several additional forms and documents that need to be submitted alongside the HDFC Bank Account Opening form. These documents help the bank verify your identity and provide the necessary information to set up your account properly. Below is a list of commonly required documents:

- Proof of Identity: Typically involves submitting a government-issued ID such as a passport or driver's license. This document verifies your identity and ensures compliance with banking regulations.

- Proof of Address: A utility bill or lease agreement is often required to confirm your residential address. This document should display your name and current address.

- Tax Identification Number: Providing your Social Security Number (SSN) or Tax Identification Number (TIN) is essential for tax reporting and regulatory compliance.

- Income Documents: This can include payslips, tax returns, or bank statements that demonstrate your income source. The bank may require this information to assess your financial standing.

- Employment Verification: A letter from your employer or a recent employment contract may be requested. This reassures the bank that you have a stable source of income.

- Joint Account Holder Information: If opening a joint account, documentation similar to the primary applicant will be needed for each additional account holder.

- Signature Verification: A sample signature may be needed, which ensures that the bank can verify transactions and prevent unauthorized access to your account.

- Application for Cheque Book: If a cheque book is desired, a specific request form must be filled out. This document authorizes the issuance of cheques linked to your account.

- Additional Bank Forms: Other related documents and forms may be required, depending on specific banking services requested, such as internet banking or phone banking.

Providing the correct documentation will ensure a smooth account opening process. Having all necessary forms and documents ready shows preparedness and can expedite the establishment of your banking relationship with HDFC Bank.

Similar forms

The HDFC Bank Account Opening form shares similarities with several other financial documents. Each document serves a particular purpose in the financial or banking industry. Below are four documents that have comparable structures or functions to the HDFC Bank Account Opening form.

- Bank Account Application Form: Like the HDFC form, a Bank Account Application Form requests personal details, identification information, and the type of account desired. Both forms emphasize clarity in providing information for accurate processing.

- Loan Application Form: This form, similar to the account opening form, collects personal and financial information from the applicant. It requires the applicant's consent to terms and conditions, which are also present in the HDFC form. Both forms facilitate the bank's decision-making process.

- Credit Card Application Form: A Credit Card Application Form requests essential details about the applicant's identity and financial status, akin to the HDFC form. Both documents require signatures and declarations of the accuracy of the provided information to proceed with the application.

- Investment Account Opening Form: Like the HDFC account form, this investment form gathers personal and financial details, including the desired investment type. Both emphasize acknowledgment of terms and consent for data confidentiality and regulatory compliance.

Dos and Don'ts

When filling out the HDFC Bank Account Opening form, adhering to a clear set of guidelines can significantly enhance the process. Below is a list of recommended practices and common pitfalls to avoid.

- Do fill out the form in BLOCK letters to ensure clarity.

- Do provide accurate personal and account details as required.

- Do staple all necessary documents in the designated area on the form.

- Do ensure all applicants sign the declaration section.

- Don't leave any fields blank, unless specified.

- Don't use correction fluid on the form; mistakes should be crossed out clearly.

- Don't forget to keep a copy of the completed form for your records.

Misconceptions

Misconceptions about the HDFC Bank Account Opening form can lead to confusion for applicants. Here are seven common misconceptions clarified:

- Only one applicant can open an account: Many people believe that only a single individual can apply for an account. However, the form allows multiple applicants, facilitating joint account options.

- Full details are not necessary: Some may think that providing minimal information suffices. The bank requires complete and accurate personal and financial details for processing the application.

- Documents do not need to be stapled: Applicants often overlook the instruction to staple documents in the specified area. Proper organization of documents is necessary to ensure smooth processing.

- Only residents can open accounts: There is a misconception that only local residents can apply. Non-residents may also open accounts, as long as they fulfill the necessary documentation and requirements.

- Deposit requirements are the same for all account types: Some believe that the deposit requirement is uniform across account types. In reality, different accounts have various minimum balance requirements.

- Internet banking is automatic: Many assume that they will automatically receive internet banking services upon account opening. Applicants must expressly request this feature in the application.

- Total anonymity in banking: Some applicants mistakenly think that their financial activities will remain completely confidential. In fact, certain regulations may require disclosure of information under specific circumstances.

Understanding these misconceptions can help streamline the account opening process and ensure that all applicants are well-prepared.

Key takeaways

Here are some key takeaways about filling out and using the HDFC Bank Account Opening form:

- Ensure all information is provided in BLOCK letters as indicated in the form's instructions.

- Incorporate all required personal details, including the names and Customer ID of all applicants when applicable.

- Be aware of the specific details regarding account types and operational features, such as the need for a cheque book or debit card.

- Review and understand the declaration sections, confirming consent to bank policies and giving proper authority for account operations.

Browse Other Templates

Ngb Form 22 - The NGB 22 is valuable for service members seeking benefits after separation.

Statement of Facts (reg 256) - Claim a smog exemption if the vehicle is being transferred from a close family member using this form.

Bennett Mechanical Comprehension Test Answer Key - John Sample scored 49 out of a possible 68 points on the test.