Fill Out Your Hdfc Bank Card Reactivation Form

When it comes to managing your finances, having access to a credit card can be invaluable. If your HDFC credit card has been deactivated and you wish to reactivate it, completing the HDFC Bank Card Reactivation form is a crucial first step. This form requires your personal information, including your name, existing card number, and contact details, ensuring that you are easily identifiable as the account holder. Additionally, you'll need to provide your residential address and, if applicable, your company’s information along with a brief description of your job title. To process your request, HDFC Bank mandates the submission of two important documents: proof of your current address and a valid ID that includes your signature. The list of acceptable documents is thorough, ranging from a passport to a utility bill, so make sure you check which options suit you best. By completing this form and enclosing the necessary documentation, you are indicating your desire to reactivate your card under the same credit limit as your previous account. Furthermore, you’ll confirm your residency status in India and acknowledge the terms and conditions associated with HDFC credit cards. Once you’ve filled out the form and gathered the required proofs, you simply mail it to the specified HDFC Bank address to kick-start the reactivation process. Understanding the components of this form helps streamline your application, ensuring a smoother journey back to using your credit card for daily transactions.

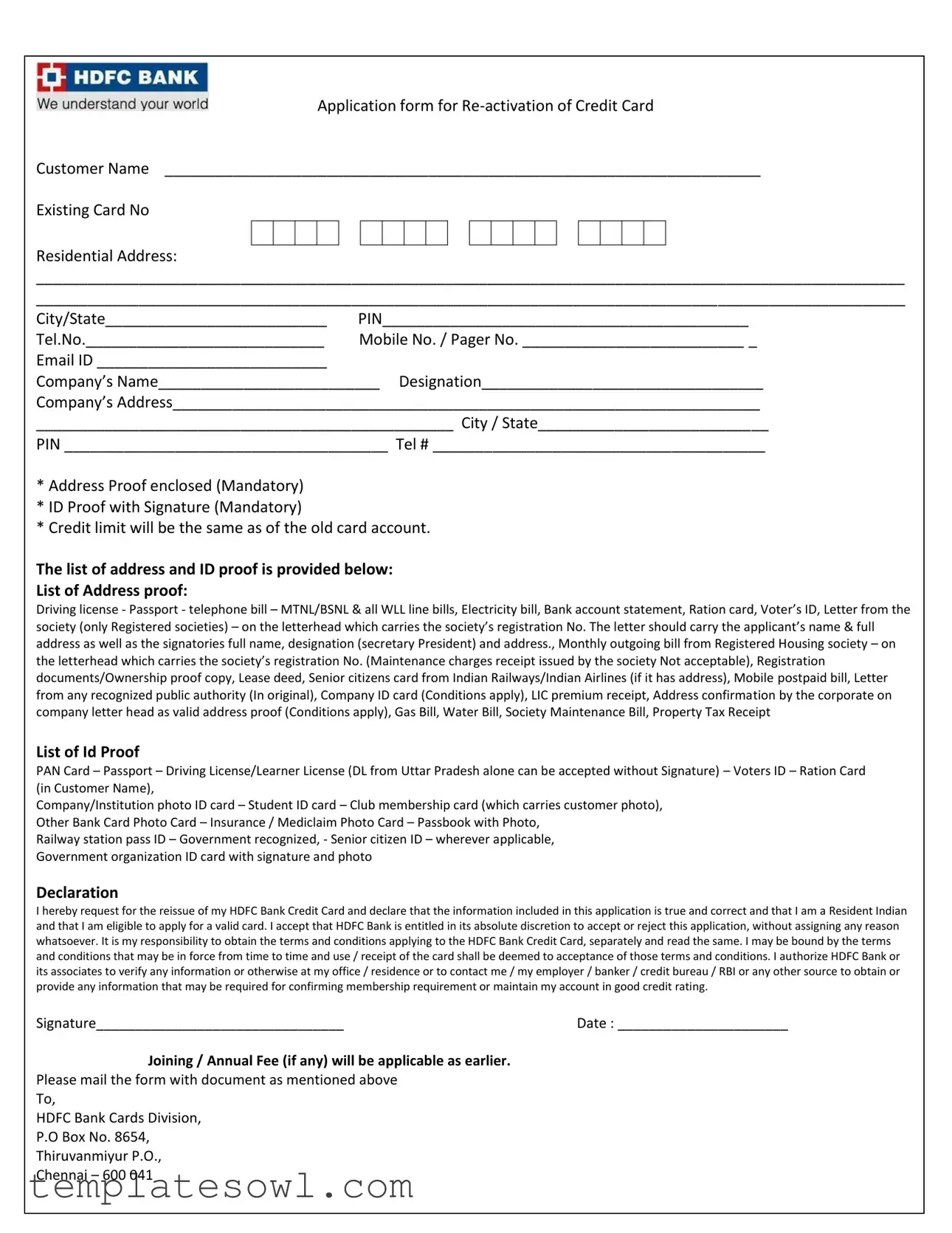

Hdfc Bank Card Reactivation Example

Application form for

Customer Name ______________________________________________________________________

Existing Card No

Residential Address:

______________________________________________________________________________________________________

______________________________________________________________________________________________________

City/State__________________________ |

PIN___________________________________________ |

||

Tel.No.____________________________ |

Mobile No. / Pager No. __________________________ _ |

||

Email ID ___________________________ |

|

||

Co |

pa |

y’s Na e__________________________ Desig atio _________________________________ |

|

Co |

pa |

y’s Address_____________________________________________________________________ |

|

_________________________________________________ City / State___________________________

PIN ______________________________________ Tel # _______________________________________

* Address Proof enclosed (Mandatory) * ID Proof with Signature (Mandatory)

* Credit limit will be the same as of the old card account.

The list of address and ID proof is provided below:

List of Address proof:

Driving license - Passport - telephone bill – MTNL/BSNL & all WLL li e ills, Ele tri ity ill, Ba |

k a ou t state e t, Ratio ard, Voter’s ID, Letter fro the |

society (only Registered societies) – o the letterhead whi h arries the so iety’s registratio |

No. The letter should arry the appli a t’s a e & full |

address as well as the signatories full name, designation (secretary President) and address., Monthly outgoing bill from Registered Housing society – on the letterhead whi h arries the so iety’s registratio No. (Maintenance charges receipt issued by the society Not acceptable), Registration

documents/Ownership proof copy, Lease deed, Senior citizens card from Indian Railways/Indian Airlines (if it has address), Mobile postpaid bill, Letter from any recognized public authority (In original), Company ID card (Conditions apply), LIC premium receipt, Address confirmation by the corporate on company letter head as valid address proof (Conditions apply), Gas Bill, Water Bill, Society Maintenance Bill, Property Tax Receipt

List of Id Proof

PAN Card – Passport – Driving License/Learner License (DL from Uttar Pradesh alone can be accepted without Signature) – Voters ID – Ration Card (in Customer Name),

Company/Institution photo ID card – Student ID card – Club membership card (which carries customer photo), Other Bank Card Photo Card – Insurance / Mediclaim Photo Card – Passbook with Photo,

Railway station pass ID – Government recognized, - Senior citizen ID – wherever applicable, Government organization ID card with signature and photo

Declaration

I hereby request for the reissue of my HDFC Bank Credit Card and declare that the information included in this application is true and correct and that I am a Resident Indian and that I am eligible to apply for a valid card. I accept that HDFC Bank is entitled in its absolute discretion to accept or reject this application, without assigning any reason whatsoever. It is my responsibility to obtain the terms and conditions applying to the HDFC Bank Credit Card, separately and read the same. I may be bound by the terms and conditions that may be in force from time to time and use / receipt of the card shall be deemed to acceptance of those terms and conditions. I authorize HDFC Bank or its associates to verify any information or otherwise at my office / residence or to contact me / my employer / banker / credit bureau / RBI or any other source to obtain or provide any information that may be required for confirming membership requirement or maintain my account in good credit rating.

Signature________________________________ |

Date : ______________________ |

Joining / Annual Fee (if any) will be applicable as earlier.

Please mail the form with document as mentioned above

To,

HDFC Bank Cards Division,

P.O Box No. 8654,

Thiruvanmiyur P.O.,

Chennai – 600 041

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Purpose | This form is for the reactivation of an existing HDFC Bank credit card. |

| Mandatory Documents | Address proof and ID proof with signature are mandatory for the application. |

| Address Proof Options | Options include utility bills, passport, driver’s license, and voter’s ID. |

| ID Proof Options | Accepted ID proofs include PAN card, passport, and company ID card among others. |

| Existing Card Number | The form requires the existing credit card number to process the request. |

| Geographic Relevance | The governing laws applicable are Indian laws, as HDFC Bank operates under Indian regulations. |

| Signature Requirement | A signature is needed on the form and on the provided ID proof for validation. |

| Eligibility Confirmation | The applicant confirms they are a resident Indian and eligible for the reissue of the card. |

| Submission Address | The completed form should be mailed to HDFC Bank Cards Division, Chennai. |

Guidelines on Utilizing Hdfc Bank Card Reactivation

Completing the HDFC Bank Card Reactivation form is an essential step if you wish to get your credit card revived. After submitting the form with the required documents, you can expect a review from the bank, which will assist you in reactivating your account smoothly.

- Download or print the HDFC Bank Card Reactivation form.

- Fill in your personal details: Write your name, existing card number, and residential address accurately.

- Provide your contact information: Include your telephone number, mobile number, and email ID.

- Company details: If applicable, enter your company’s name, designation, and company address.

- Prepare the mandatory documents: Ensure you attach proof of address and ID proof with your signature.

- Review the list of acceptable proofs: Check the document types for address and ID proof that you will provide.

- Sign the declaration: Confirm that all provided information is correct and that you accept the bank’s terms.

- Mail the form: Send your completed form along with the documents to the specified address: HDFC Bank Cards Division, P.O Box No. 8654, Thiruvanmiyur P.O., Chennai – 600 041.

What You Should Know About This Form

What is the purpose of the HDFC Bank Card Reactivation form?

The HDFC Bank Card Reactivation form is used by customers who wish to reactivate their existing credit card. This process may be necessary if the card is expired, suspended, or otherwise inactive. Completing this form allows customers to request a reinstatement of their credit card privileges with HDFC Bank.

What information do I need to provide in the form?

You will need to fill out several details in the form, including your name, existing card number, residential address, and contact numbers. Additionally, you must provide proof of address and identity with your application, which are mandatory for processing your request.

What types of address proof are accepted?

Accepted forms of address proof include a driving license, passport, utility bills (telecom, electricity, gas), bank statements, voter ID, and several other documents listed in the form. Ensure that the document you provide clearly shows your name and address.

What types of ID proof do I need to submit?

The required ID proof can be a PAN card, passport, driving license, voter ID, or any other government-issued photo ID. It's important that the ID contains your photo and signature, as these are necessary for identity verification.

Is there a fee associated with reactivating my credit card?

Yes, any joining or annual fee applicable to your credit card will be charged as it was with your previous account. This information should have been provided in your initial agreement with HDFC Bank.

How should I submit the reactivation form?

You must mail the completed form along with the required documents to the HDFC Bank Cards Division. The mailing address is detailed in the form: P.O Box No. 8654, Thiruvanmiyur P.O., Chennai – 600 041. Ensure that you have included all necessary documents to avoid delays.

How long will it take for my card to be reactivated?

The time it takes to reactivate your card can vary. Once HDFC Bank receives your completed form and documents, they will process your request. Generally, it may take a few business days for the reactivation to be completed, but you will be notified if any further action is required.

What happens if my application is rejected?

If your application is rejected, HDFC Bank will not provide specific reasons for the decision. It is important to ensure that all information is accurate and that you meet the eligibility requirements to increase your chances of acceptance. You may reapply if you address any issues noted in the rejection.

Who do I contact if I have questions about the reactivation process?

If you have questions or need assistance with the reactivation process, you can contact HDFC Bank's customer service. They can provide guidance and clarify any aspects of your application that may be confusing.

Common mistakes

Applying for the reactivation of a credit card is a straightforward process, but individuals often make mistakes when completing the HDFC Bank Card Reactivation form. One common error is the failure to provide complete personal information. Customers sometimes leave sections blank, particularly in the residential address and contact information fields. Incomplete forms can lead to delays or outright rejection of the application, as the bank needs accurate and complete details to process it effectively.

Another frequent oversight involves the omission of necessary proof documents. The application specifies that both address proof and ID proof with a signature are mandatory. However, applicants may neglect to enclose these documents or provide proof that does not meet the bank's requirements. For example, individuals might submit a receipt or bill that does not clearly display their name or address. This error can hinder the verification process and leave the application in limbo.

Some people also fail to sign the application. The declaration section of the form states that the applicant must sign and date the document. Without a signature, the application is considered incomplete. Many feel that their personal information alone suffices, but a signature is critical for verifying the applicant's identity and consent to the terms outlined in the form.

Finally, applicants often misinterpret the conditions regarding the reactivation of their credit limit. The application states that the credit limit will be the same as that of the old card account. Some individuals mistakenly believe they can request a higher limit during the reactivation process, leading to confusion and disappointment when they receive a card with the same limit. Understanding this clause is essential to set appropriate expectations when reactivating a credit card.

Documents used along the form

The HDFC Bank Card Reactivation form accompanies several other documents, which are crucial for processing your request. These documents serve to verify your identity and current address, ensuring that the bank complies with regulatory standards and maintains the security of your account. Below is a list of commonly used supplementary forms and documents.

- Address Proof: This document verifies your current residential address. Acceptable forms include utility bills, bank statements, and government-issued IDs that feature your address. It is mandatory to provide such proof to process the reactivation request.

- ID Proof with Signature: Identity verification is a critical step in the reactivation process. A valid document, such as a passport, driving license, or voter ID card, must include your signature and personal details for this purpose.

- Letter of Authorization: In certain scenarios, a letter granting permission to HDFC Bank may be required. This letter authorizes the bank to contact relevant parties, such as your employer or financial institutions, to confirm your details and support your application.

- Corporate Identity Proof: If employed, a company-issued ID card may be requested. This proof must clearly state your full name and position within the company, validating your employment status, which can also support your application for credit.

Collecting and submitting these documents alongside the HDFC Bank Card Reactivation form is crucial in facilitating a smooth and efficient reactivation process. Make sure to review all requirements carefully before submission to ensure prompt processing of your request.

Similar forms

-

Loan Application Form: Like the HDFC Bank Card Reactivation form, a loan application form requires personal details, contact information, and documentation proving identity and residence. Both forms aim to verify the applicant's identity and ensure compliance with financial regulations.

-

Account Opening Form: This document requests similar information regarding customer identity, address, and contact details. Both require proof of identification and residence, ensuring that the bank verifies new customers thoroughly.

-

Change of Address Form: When a customer needs to update their residential address with the bank, this form gathers updated contact information and may also require supporting documents. Similarities lie in the necessity for accuracy and proper validation of identity.

-

Credit Card Application Form: This document functions similarly to the reactivation form, requesting personal and financial information. Both require the applicant to verify their identity and status to determine eligibility for credit facilities.

-

Debit Card Application Form: Just as with the credit card reactivation process, applying for a debit card involves submitting identity verification documents and personal details. The focus remains on confirming the customer’s identity and account status.

-

Insurance Policy Application: Applying for insurance often requires personal details, proof of identity, and contact information. Like the HDFC Bank Card Reactivation form, it validates the applicant for eligibility and necessary documentation.

-

Beneficiary Designation Form: This form allows account holders to designate beneficiaries, akin to updating credit card information. Both require complete details about the individual(s) involved and supporting documents as proof of identification.

-

Tax Identification Number (TIN) Application: Similar to the HDFC form, the TIN application requests personal information and verification documents to confirm identity. Both documents aim to ensure compliance with legal and fiscal requirements.

-

Membership Application Form: Joining a club or organization usually involves a membership application that gathers similar personal information. Supporting documents for address and identity verification are typically required in both instances.

-

Voter Registration Form: Registering to vote also involves providing personal details and proof of identity and residence. Both processes prioritize accuracy and the submission of valid identification to establish eligibility.

Dos and Don'ts

When you're filling out the HDFC Bank Card Reactivation form, keeping a few important guidelines in mind can make the process smoother. Here’s a concise list of what to do and what to avoid:

What to Do:

- Provide accurate personal information such as your name and contact details.

- Attach the required address and ID proof documents as specified.

- Double-check that all sections of the form are completed.

- Sign and date the form to confirm your request.

What Not to Do:

- Don't leave any essential sections of the form blank.

- Avoid using documents that are not listed as acceptable proofs.

- Do not forget to check your eligibility to apply for the card.

- Never assume that the bank will accept the application without proper documentation.

Misconceptions

Misconception 1: The reactivation form is optional for customers wishing to reactivate their bank card.

In reality, submitting the reactivation form is mandatory. You cannot reactivate your card without it.

Misconception 2: Address and ID proofs are not required.

Address proof and ID proof are essential. Failing to include these can lead to delays or rejection of your application.

Misconception 3: There is no deadline for submitting the reactivation form.

While there may not be a strict deadline, it's best to submit the form as soon as possible. Delays might affect your card status.

Misconception 4: The credit limit will be higher than the previous card.

This is incorrect. The credit limit will remain the same as your old card account, unless specified otherwise.

Misconception 5: Any proof of address or identity is sufficient.

Only specific documents are accepted. For example, documents like a driving license or a utility bill must meet the criteria outlined in the form.

Misconception 6: You do not need to sign the reactivation form.

A signature is mandatory on the form. This confirms your request and the accuracy of the information provided.

Misconception 7: The application can be submitted online without sending documents.

You must mail the completed form along with the required documents to the designated address. Online submission is not an option.

Misconception 8: There are no fees associated with reactivation.

This is not true. Joining or annual fees may still apply, similar to your previous card.

Key takeaways

Filling out the HDFC Bank Card Reactivation form requires attention to detail. Here are key takeaways to ensure a smooth application process:

- Customer Information: Begin by providing accurate personal details such as your name and existing credit card number.

- Address Details: Clearly state your residential address, including city, state, and ZIP code.

- Contact Information: Include your telephone number and mobile number for communication purposes.

- Email ID: Provide an active email address as this will be crucial for confirmations and notifications.

- Employer Information: If applicable, mention your company's name, designation, and address. This may support your application.

- Proof of Address and Identity: Ensure to attach both address proof and ID proof with your application; these are mandatory for processing.

- Same Credit Limit: Be aware that the credit limit on the reissued card will mirror that of your previous card.

- Document Requirements: Familiarize yourself with the acceptable forms of address and ID proof, as listed in the form.

- Declaration: Sign the form to affirm that all provided information is accurate and that you are a Resident Indian.

- Mailing Instructions: After completing the form and compiling the necessary documents, mail them to the specified HDFC Bank address to ensure proper delivery.

By following these steps, you can navigate the reactivation process with greater ease. Remember, accuracy is key to avoiding delays. Good luck with your application!

Browse Other Templates

Aa 600 - You can request a date-stamped copy of your submitted form for a fee.

Illinois Sales Tax on Cars Bought Out of State - Any amendment must be carefully documented to ensure legality and accuracy.