Fill Out Your Health Insurance Application Form

Completing the Health Insurance Application form is an important step in securing suitable coverage for your medical needs. This application helps you determine your qualifications for various health insurance options, including Marketplace plans that provide extensive coverage and potential tax credits to reduce your premium costs. Additionally, the form allows you to explore eligibility for free or low-cost programs through Medicaid and the Children’s Health Insurance Program (CHIP), particularly if your household income falls within certain thresholds. To facilitate your application, it is essential to include information about everyone in your household, even if some members already have health coverage. This ensures accurate assessment for any additional assistance you may qualify for. At the outset, you will be asked to provide details about yourself, including your contact information, household composition, and employment status. You will also need to gather relevant documentation, such as Social Security numbers and income details. While this may seem daunting, it's crucial to remember that your information will be kept private and secure as mandated by law. After submitting your application, the process doesn't end there; you can expect follow-up communication within a couple of weeks regarding your eligibility. Support is readily available through various channels, including online resources and phone assistance, ensuring you have the help you need throughout the process.

Health Insurance Application Example

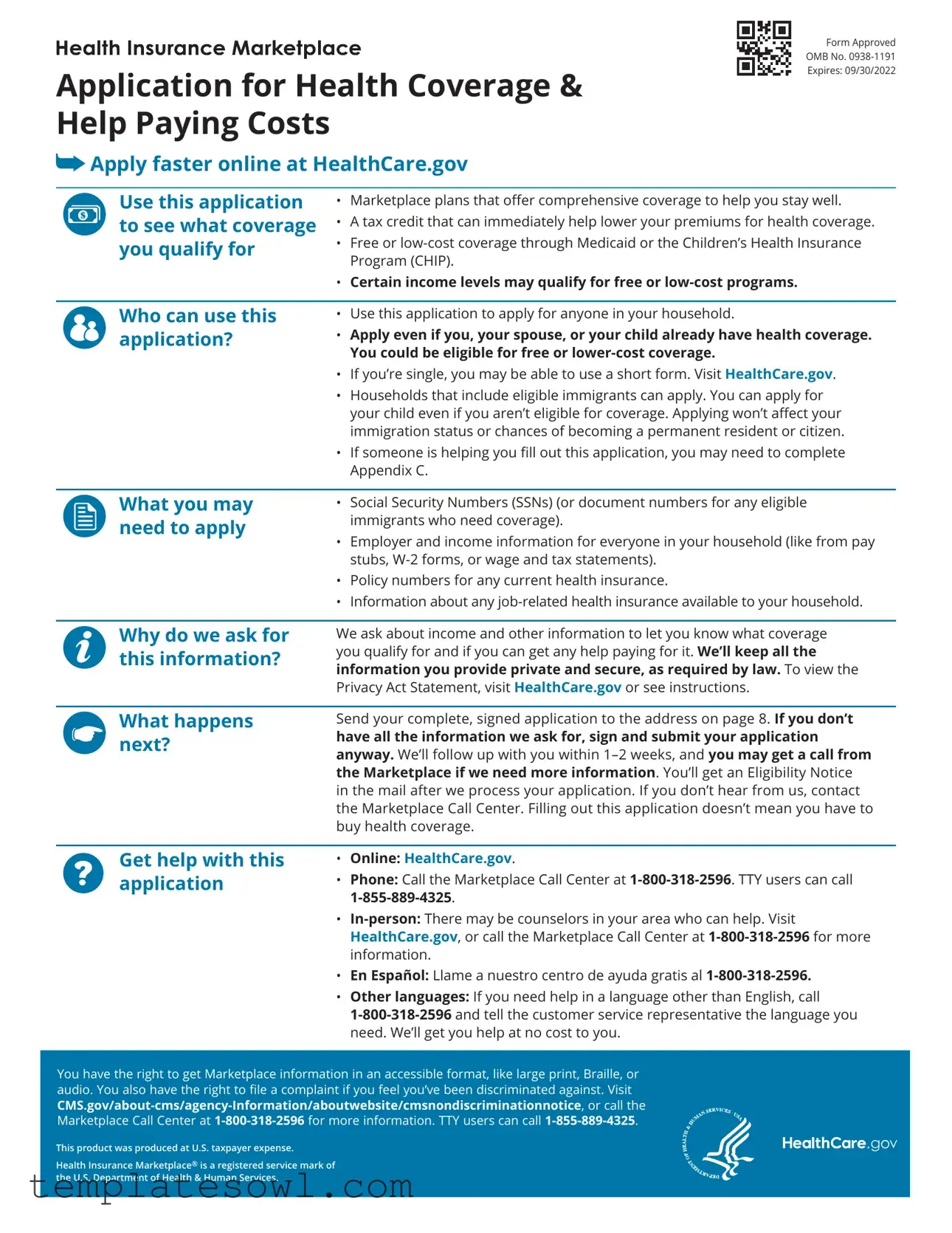

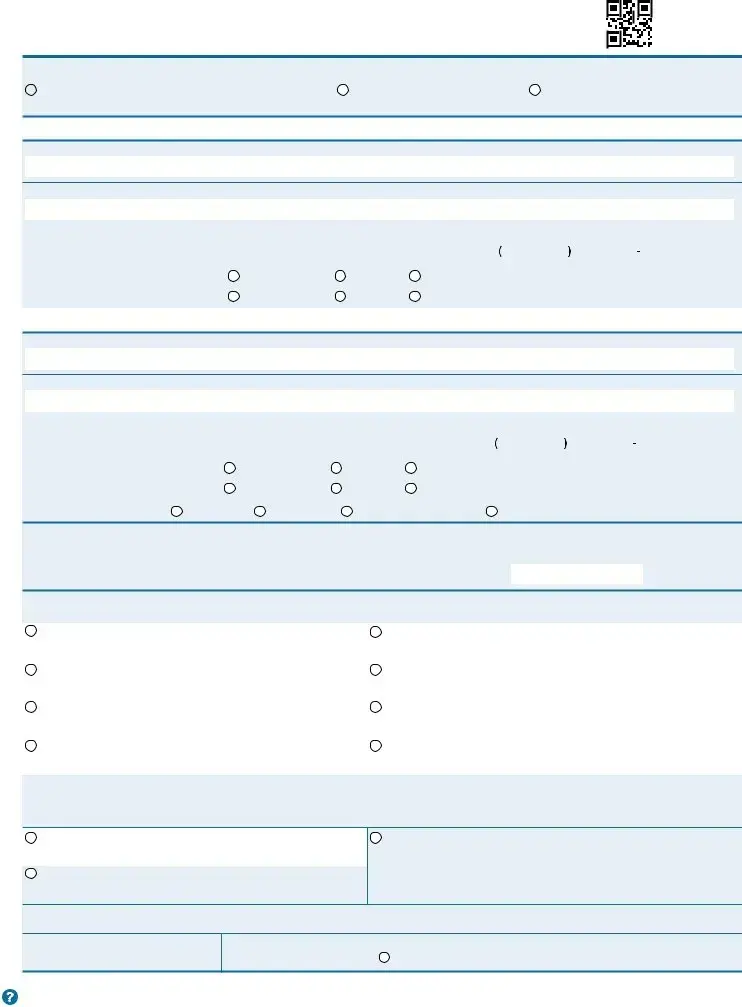

Application for Health Coverage & Help Paying Costs

Apply faster online at HealthCare.gov

Apply faster online at HealthCare.gov

Form Approved

OMB No.

Expires: 09/30/2022

Use this application to see what coverage you qualify for

•Marketplace plans that offer comprehensive coverage to help you stay well.

•A tax credit that can immediately help lower your premiums for health coverage.

•Free or

•Certain income levels may qualify for free or

|

|

Who can use this |

• Use this application to apply for anyone in your household. |

|

|

application? |

• Apply even if you, your spouse, or your child already have health coverage. |

|

|

|

You could be eligible for free or |

|

|

|

• If you’re single, you may be able to use a short form. Visit HealthCare.gov. |

|

|

|

• Households that include eligible immigrants can apply. You can apply for |

|

|

|

your child even if you aren’t eligible for coverage. Applying won’t affect your |

|

|

|

immigration status or chances of becoming a permanent resident or citizen. |

|

|

|

• If someone is helping you fill out this application, you may need to complete |

|

|

|

Appendix C. |

|

|

|

|

|

|

What you may |

• Social Security Numbers (SSNs) (or document numbers for any eligible |

|

|

||

|

|

need to apply |

immigrants who need coverage). |

|

|

• Employer and income information for everyone in your household (like from pay |

|

|

|

|

|

|

|

|

stubs, |

|

|

|

• Policy numbers for any current health insurance. |

|

|

|

• Information about any |

|

|

|

|

|

|

Why do we ask for |

We ask about income and other information to let you know what coverage |

|

|

this information? |

you qualify for and if you can get any help paying for it. We’ll keep all the |

|

|

information you provide private and secure, as required by law. To view the |

|

|

|

|

|

|

|

|

Privacy Act Statement, visit HealthCare.gov or see instructions. |

What happens next?

Send your complete, signed application to the address on page 8. If you don’t have all the information we ask for, sign and submit your application anyway. We’ll follow up with you within

Get help with this application

•Online: HealthCare.gov.

•Phone: Call the Marketplace Call Center at

•

•En Español: Llame a nuestro centro de ayuda gratis al

•Other languages: If you need help in a language other than English, call

You have the right to get Marketplace information in an accessible format, like large print, Braille, or audio. You also have the right to file a complaint if you feel you’ve been discriminated against. Visit

This product was produced at U.S. taxpayer expense.

Health Insurance Marketplace® is a registered service mark of the U.S. Department of Health & Human Services.

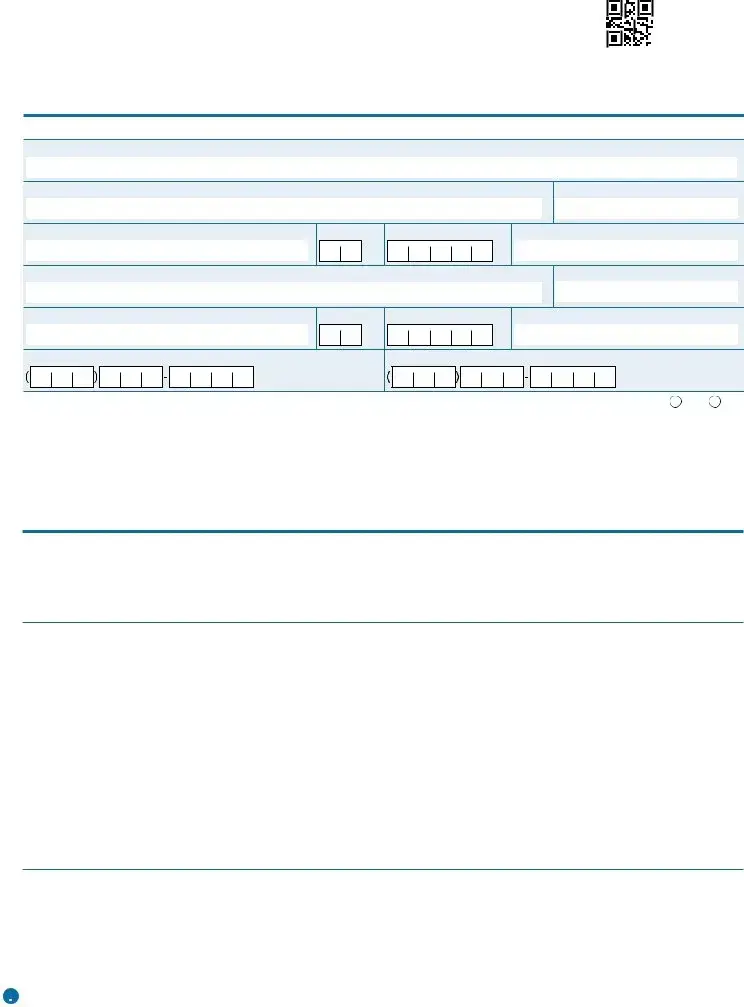

Print in capital letters using black or dark blue ink only.

Fill in the circles (  ) like this

) like this

.

.

Page 1 of 9

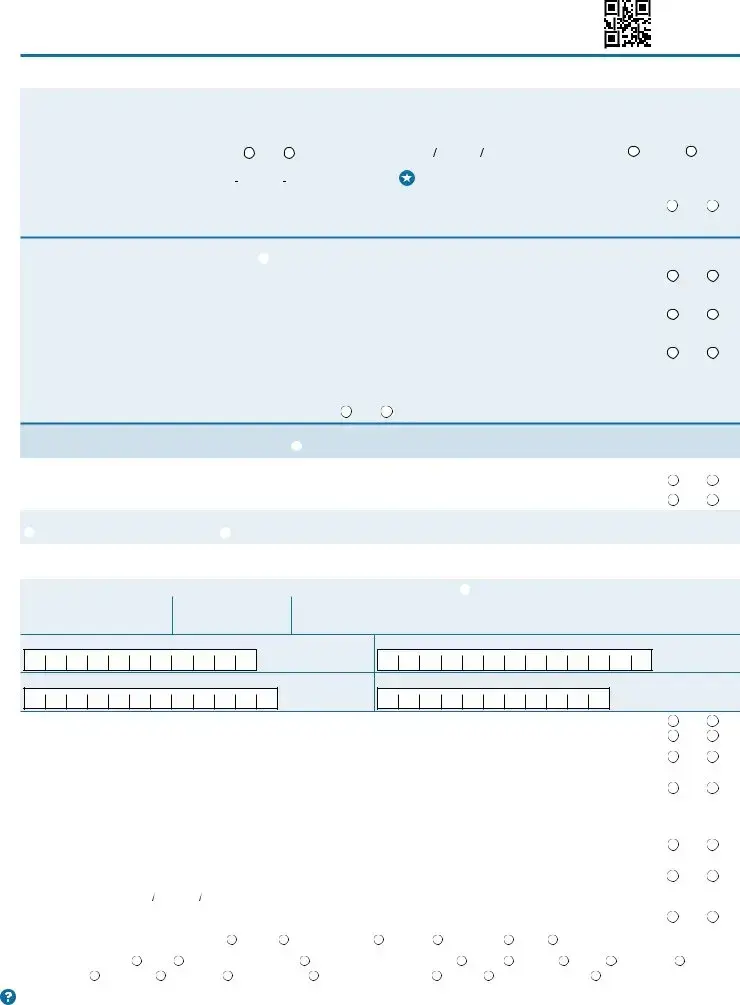

Step 1: Tell us about yourself.

(We need one adult in the household to be the contact person for your application.)

1. First name |

Middle name |

Last name |

Suffix |

2. Home address (Leave blank if you don’t have one.)

3. Home address 2

4. City

5. State

6. ZIP code

7. County

8. Mailing address (if different from home address)

9. Mailing address 2

10. City

11. State

12. ZIP code

13. County

14. Phone number

15. Second phone number

16. Do you want to get information about this application by email? |

Yes No |

||||

|

|

|

|

|

|

Email address: |

|

|

|

|

|

|

|

|

|

|

|

17. Preferred language: Written |

Spoken |

||||

|

|

|

|

|

|

|

|

|

|

|

|

Step 2: Tell us about your household.

Who do you need to include on this application?

Complete the Step 2 pages for each person in your household, even if the person has health coverage already. The information in this application helps us make sure everyone gets the best coverage they can. The amount of help or type of program you qualify for is based on the number of people in your household and your household income. If you don’t include someone, even if they already have health coverage, your eligibility results could be affected.

For adults who need coverage:

Include these people even if they aren’t applying for health coverage for themselves:

•Any spouse

•Any child under age 21 they live with, including stepchildren

•Any other person on the same federal income tax return (including any children over age 21 who are claimed on a parent’s tax return). You don’t need to file taxes to get health coverage.

For children under age 21 who need coverage:

Include these people even if they aren’t applying for health coverage themselves:

•Any parent (or stepparent) they live with

•Any sibling they live with

•Any child they live with, including stepchildren

•Any spouse they live with

•Any other person on the same federal income tax return. You don’t need to file taxes to get health coverage.

Complete Step 2 for each person in your household.

Start with yourself, then add other adults and children. If you have more than 2 people in your household, you’ll need to make a copy of the pages and attach them.

You don’t need to provide immigration status or SSNs for household members who don’t need health coverage. We’ll keep all the information you provide private and secure, as required by law. We’ll use personal information only to check if you’re eligible for health coverage.

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

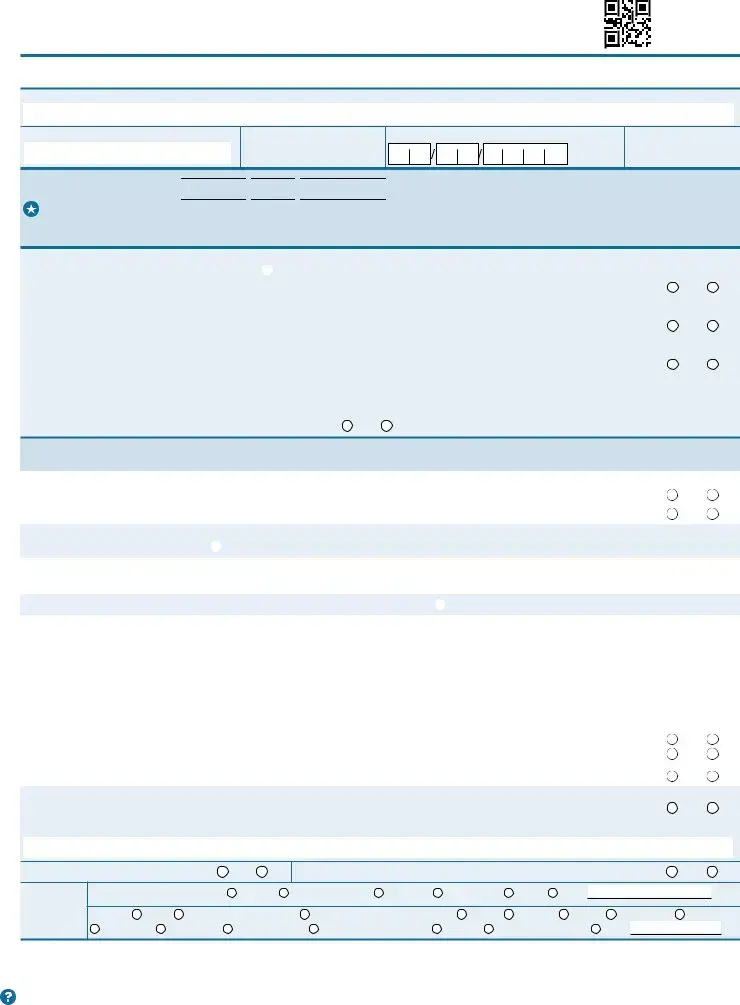

Step 2: PERSON 1 (Start with yourself.)

Page 2 of 9

Complete Step 2 for yourself, your spouse/partner and dependents who live with you, and/or anyone on your same federal income tax return if you file one. See page 1 for more information about who to include. If you don’t file a tax return, remember to still add the people in your household.

1. First name |

Middle name |

Last name |

Suffix |

2. Relationship to PERSON 1?

SELF

3.Are you married?  Yes

Yes  No

No

4. Date of birth (mm/dd/yyyy)

5. Sex

Female

Female  Male

Male

6.Social Security Number (SSN)

We need an SSN if you want health coverage and have an SSN or can get one. We use SSNs to check income and other information to see who’s eligible for help paying for health coverage. For more information on getting an SSN, visit socialsecurity.gov, or call Social Security at

7.Do you plan to file a federal income tax return NEXT YEAR? You can still apply for coverage even if you don’t file a federal income tax return.

YES. If yes, answer items a through c.

YES. If yes, answer items a through c.  NO. If no, skip to item c.

NO. If no, skip to item c.

a. Will you file jointly with a spouse? |

|

|

Yes |

No |

|||||

|

If yes, write name of spouse: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Will you claim any dependents on your tax return? |

|

|

Yes |

No |

|||||

|

|

|

|

|

|

|

|

||

|

If yes, list name(s) of dependents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

c. Will you be claimed as a dependent on someone’s tax return? |

|

|

Yes |

No |

|||||

|

If yes, list the name of the tax filer: |

|

How are you related to the tax filer? |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Are you pregnant? |

Yes No a. If yes, how many babies are expected during this pregnancy? |

|

|

||||||

|

|

||||||||

9.Do you need health coverage? Even if you have coverage, there might be a program with better coverage or lower costs.

YES. If yes, answer all the questions below.

YES. If yes, answer all the questions below.

NO. If no, SKIP to the income questions on page 3. Leave the rest of this page blank.

NO. If no, SKIP to the income questions on page 3. Leave the rest of this page blank.

10. Do you have a physical, mental, or emotional health condition that causes limitations in activities (like bathing, |

|

|

dressing, daily chores, etc.), a special health care need, or live in a medical facility or nursing home? |

Yes |

No |

11. Are you a U.S. citizen or U.S. national? |

Yes |

No |

|

|

|

12.Are you a naturalized or derived citizen? (This usually means you were born outside the U.S.)  YES. If yes, complete a and b.

YES. If yes, complete a and b.  NO. If no, continue to question 13.

NO. If no, continue to question 13.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Alien number: |

|

b. Certificate number: |

After you complete a and b, |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SKIP to question 14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. If you aren’t a U.S. citizen or U.S. national, do you have eligible immigration status?  YES. Enter document type and ID number. See instructions.

YES. Enter document type and ID number. See instructions.

Immigration document type |

Status type (optional) |

Write your name as it appears on your immigration document. |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alien or |

|

|

|

|

|

|

|

|

Card number or passport number |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SEVIS ID or expiration date (optional) |

|

Other (category code or country of issuance) |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Have you lived in the U.S. since 1996? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||||||||||||||

b. Are you, or your spouse or parent, a veteran or an |

Yes |

No |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Do you want help paying for medical bills from the last 3 months? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||||||||||||||

15. |

Do you live with at least one child under the age of 19, and are you the main person taking care of this child? |

|

|

|

|||||||||||||||||||||||||||||

(Fill in “yes” if you or your spouse takes care of this child.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||||||||||||||

List the names and relationships of any children under 19 that live with you in your household:

16. Are you a |

Yes No |

17. Were you in foster care at age 18 or older? |

Yes No |

||||

Optional: |

18. |

If Hispanic/Latino, ethnicity: |

Mexican |

Mexican American Chicano/a |

Puerto Rican |

Cuban |

Other |

(Fill in all that |

19. |

Race: White Black or African American American Indian or Alaska Native Filipino |

Japanese |

Korean Asian Indian Chinese |

|||

apply.) |

Vietnamese Other Asian |

Native Hawaiian Guamanian or Chamorro |

Samoan Other Pacific Islander Other |

||||

|

|||||||

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

Step 2: PERSON 1 (Continue with yourself.)

Page 3 of 9

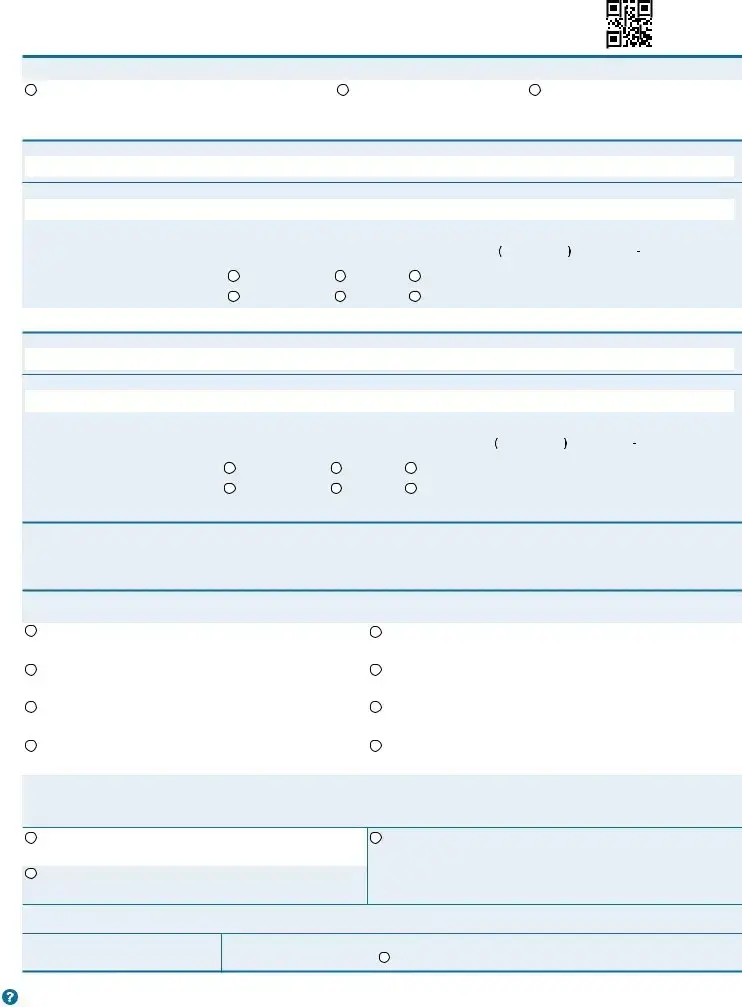

Current job & income information

Employed: If you’re currently employed, tell us |

Not employed: |

|

about your income. Start with item 20. |

Skip to item 30. |

Skip to item 29. |

Current job 1:

20. Employer name

a. Employer address (optional)

|

b. City |

|

|

|

c. State |

|

|

d. ZIP code |

|

|

|

21. |

Employer phone number |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. Wages/tips (before taxes) |

Hourly |

Weekly |

Every 2 weeks |

23. |

Average hours worked each WEEK |

||||||||||||||||||||||||||

$ |

|

Twice a month |

Monthly |

Yearly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current job 2: (If you have additional jobs and need more space, attach another sheet of paper.) 24. Employer name

a. Employer address (optional)

|

b. City |

|

|

|

c. State |

|

|

d. ZIP code |

|

|

|

25. |

Employer phone number |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

Wages/tips (before taxes) |

Hourly |

Weekly |

Every 2 weeks |

27. |

Average hours worked each WEEK |

||||||||||||||||||||||||||||

$ |

|

|

Twice a month |

Monthly |

Yearly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28. |

In the past year, did you: |

Change jobs Stop working |

|

|

Start working fewer hours |

|

|

None of these |

||||||||||||||||||||||||||

29.If

a. Type of work:

b. How much net income (profits once business expenses are paid) will you get from this $

30.Other income you get this month: Fill in all that apply, and give the amount and how often you get it. Fill in here if none.  NOTE: You don’t need to tell us about income from child support, veteran’s payments, or Supplemental Security Income (SSI).

NOTE: You don’t need to tell us about income from child support, veteran’s payments, or Supplemental Security Income (SSI).

Unemployment |

|

|

|

Alimony received (Note: Only for divorces finalized before 1/1/2019.) |

|||||||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|

|

Pension |

|

|

|

Net farming/fishing |

|||||||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|

|

Social Security |

|

|

|

Net rental/royalty |

|

|

|

|

|

||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|

|

Retirement accounts |

Other income, type: |

|

|

||||||||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31.Deductions: Fill in all that apply, and give the amount and how often you pay it. If you pay for certain things that can be deducted on a federal income tax return, telling us about them could make the cost of health coverage a little lower.

NOTE: You shouldn’t include child support that you pay, or a cost already considered in your answer to net

Alimony paid (Note: Only for divorces finalized before 1/1/2019.) |

|

Other deductions, type: |

|

|

|

||||||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

||

Student loan interest |

|

|

|

|

|

|

|

||||

$ |

|

|

|

|

|

|

|

|

|||

|

How often? |

|

|

|

|

|

|

|

|

|

|

32.Complete this question if your income changes during the year, like if you only work at a job for part of the year or receive a benefit for certain

months. If you don’t expect changes to your monthly income, skip to the next person.

this yearYour total income next year (if you think it’ll be different)Your total income

$ |

|

$ |

|

Fill in if you think your income will be hard to predict. |

|

|

Thanks! This is all we need to know about you.

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

Step 2: PERSON 2 |

Note: If this person doesn’t need health coverage, just answer questions |

page. Make a copy of pages |

Page 4 of 9

Complete this page for your spouse/partner and children who live with you, and/or anyone on your same federal income tax return if you file one. If you don’t file a tax return, remember to still add household members who live with you. See page 1 for more information about who to include.

1. |

First name |

Middle name |

Last name |

Suffix |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Relationship to PERSON 1? See instructions. |

3. Is PERSON 2 married? |

|

|

4. Date of birth (mm/dd/yyyy) |

5. Sex |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Yes No |

|

|

|

|

|

|

|

|

|

|

|

|

|

Female Male |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Social Security Number (SSN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We need this if you want health coverage for PERSON 2, |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and PERSON 2 has an SSN. |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

7. |

Does PERSON 2 live at the same address as PERSON 1? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes No |

|||||||||||||||

|

|

If no, list address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8.Does PERSON 2 plan to file a federal income tax return NEXT YEAR? (You can still apply for coverage even if PERSON 2 doesn’t file a federal income tax return.)  YES. If yes, answer items a through c.

YES. If yes, answer items a through c.  NO. If no, skip to item c.

NO. If no, skip to item c.

a. Will PERSON 2 file jointly with a spouse? |

|

|

Yes |

No |

|||||

|

If yes, write name of spouse: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Will PERSON 2 claim any dependents on his or her tax return? |

|

|

Yes |

No |

|||||

|

If yes, list name(s) of dependents: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

c. Will PERSON 2 be claimed as a dependent on someone’s tax return? |

Yes |

No |

|||||||

|

If yes, list the name of the tax filer: |

|

How is PERSON 2 related to the tax filer? |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Is PERSON 2 pregnant? |

Yes |

No a. If yes, how many babies are expected during this pregnancy? |

|

|

|||||

|

|

||||||||

10.Does PERSON 2 need health coverage? (Even if PERSON 2 has coverage, there might be a program with better coverage or lower costs.)

YES. If yes, answer all the questions below.

YES. If yes, answer all the questions below.

NO. If no, SKIP to the income questions on page 5. Leave the rest of this page blank.

NO. If no, SKIP to the income questions on page 5. Leave the rest of this page blank.

11. Does PERSON 2 have a physical, mental, or emotional health condition that causes limitations in activities |

|

|

(like bathing, dressing, daily chores, etc.), a special health care need, or live in a medical facility or nursing home? |

Yes |

No |

12. Is PERSON 2 a U.S. citizen or U.S. national? |

Yes |

No |

|

|

|

13.Is PERSON 2 a naturalized or derived citizen? (This usually means they were born outside the U.S.)  YES. If yes, complete a and b.

YES. If yes, complete a and b.  NO. If no, continue to question 14.

NO. If no, continue to question 14.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Alien number |

|

b. Certificate number |

After you complete a and b, |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SKIP to question 15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. If PERSON 2 isn’t a U.S. citizen or U.S. national, do they have eligible immigration status?  YES. Enter document type and ID number. See instructions.

YES. Enter document type and ID number. See instructions.

Immigration document type: |

|

Status type (optional): |

|

Write PERSON 2’s name as it appears on their immigration document. |

|

|

|

|

|

|

|

|

|

|

Alien or

Card number or passport number

SEVIS ID or expiration date (optional)

Other (category code or country of issuance)

a. Has PERSON 2 lived in the U.S. since 1996? |

............................................................................................................................................................................ |

|

|

|

|

|

|

|

|

|

Yes |

No |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

b. Is PERSON 2, or PERSON 2’s spouse or parent, a veteran or an |

|

|

|

Yes |

No |

|||||||||||||||||||

15. |

Does PERSON |

2 want help paying for medical bills from the last 3 months? |

|

|

|

|

Yes |

No |

||||||||||||||||

16. |

Does PERSON |

2 live with at least one child under the age of 19, and is PERSON 2 the main person taking care of this child? |

|

|

||||||||||||||||||||

(Fill in “yes” if PERSON 2 or their spouse takes care of this child.) |

|

|

|

|

|

Yes |

No |

|||||||||||||||||

17. |

Tell us the names and relationships of any children under 19 that live with PERSON 2 in their household: (These can be the same children listed on page 2.) |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Was PERSON 2 in foster care at age 18 or older? |

|

|

|

|

|

Yes |

No |

|||||||||||||||||

Answer these questions if PERSON 2 is 22 or younger: |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

18. |

Did PERSON 2 have insurance through a job and lose it within the past 3 months? |

|

|

|

|

Yes |

No |

|||||||||||||||||

a. If yes, end date: |

|

|

|

|

|

|

|

|

|

|

b. Reason the insurance ended: |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

19. Is PERSON 2 a |

|

|

|

|

|

|

|

|

|

Yes |

No |

|||||||||||||

Optional: |

20. |

If Hispanic/Latino, ethnicity: |

Mexican Mexican American Chicano/a |

Puerto Rican |

Cuban |

Other |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|||||||||||||||||||

(Fill in all that |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

21. |

Race: White Black or African American |

American Indian or Alaska Native Filipino |

Japanese |

Korean Asian Indian Chinese |

|

|

||||||||||||||||||

|

apply.) |

Vietnamese Other Asian |

Native Hawaiian |

Guamanian or Chamorro |

Samoan Other Pacific Islander Other |

|

|

|

|

|||||||||||||||

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

Step 2: PERSON 2 |

Tell us about any income PERSON 2 gets. Complete this page even if PERSON 2 doesn’t |

need health coverage. |

Page 5 of 9

Current job & income information

Employed: If PERSON 2 is currently employed, |

Not employed: |

|

tell us about his/her income. Start with item 22. |

Skip to item 32. |

Skip to item 31. |

|

|

|

Current job 1:

22. Employer name

a. Employer address (optional)

|

b. City |

|

|

|

c. State |

|

|

d. ZIP code |

|

|

|

23. |

Employer phone number |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. Wages/tips (before taxes) |

Hourly |

Weekly |

Every 2 weeks |

25. |

Average hours worked each WEEK |

||||||||||||||||||||||||||

$ |

|

Twice a month |

Monthly |

Yearly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current job 2: (If PERSON 2 has more jobs, attach another sheet of paper.) 26. Employer name

a. Employer address (optional)

|

b. City |

|

|

|

c. State |

|

|

d. ZIP code |

|

|

|

27. |

Employer phone number |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28. Wages/tips (before taxes) |

Hourly |

Weekly |

Every 2 weeks |

29. |

Average hours worked each WEEK |

||||||||||||||||||||||||||

$ |

|

Twice a month |

Monthly |

Yearly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30.In the past year, did PERSON 2:  Change jobs

Change jobs  Stop working

Stop working  Start working fewer hours

Start working fewer hours  None of these

None of these

31.If PERSON 2 is

a. Type of work: |

|

|

|

|

b. How much net |

|

|

|

|

income (profits once business expenses are paid) will PERSON 2 get from this |

$ |

|

|

|

|

|

|||

|

|

|||

|

|

|

||

32.Other income PERSON 2 gets this month: Fill in all that apply, and give the amount and how often PERSON 2 gets it. Fill in here if none.  NOTE: You don’t need to tell us about PERSON 2’s income from child support, veteran’s payments, or Supplemental Security Income (SSI).

NOTE: You don’t need to tell us about PERSON 2’s income from child support, veteran’s payments, or Supplemental Security Income (SSI).

Unemployment |

|

|

|

Alimony received (Note: Only for divorces finalized before 1/1/2019.) |

|||||||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|

|

Pension |

|

|

|

Net farming/fishing |

|||||||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|

|

Social Security |

|

|

|

Net rental/royalty |

|

|

|

|

|

||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|

|

Retirement accounts |

Other income, type: |

|

|

||||||||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33.Deductions: Fill in all that apply, and give the amount and how often PERSON 2 gets it. If PERSON 2 pays for certain things that can be deducted on a federal income tax return, telling us about them could make the cost of health coverage a little lower.

NOTE: You shouldn’t include child support that PERSON 2 pays, or a cost already considered in the answer to net

Alimony paid (Note: Only for divorces finalized before 1/1/2019.) |

|

Other deductions, type: |

|

|

|

|

||||||

$ |

|

How often? |

|

|

$ |

|

How often? |

|

|

|||

Student loan interest |

|

|

|

|

|

|

|

|

||||

$ |

|

|

|

|

|

|

|

|

|

|||

|

How often? |

|

|

|

|

|

|

|

|

|

|

|

34.Complete only if PERSON 2’s income changes during the year, like if PERSON 2 only works at a job for part of the year or receives a

benefit for certain months. If you don’t expect changes to PERSON 2’s monthly income, skip to the next person.

this year PERSON 2’s total income next yearPERSON 2’s total income

$ |

|

$ |

|

Fill in if you think your income will be hard to predict. |

|

|

Thanks! This is all we need to know about PERSON 2.

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

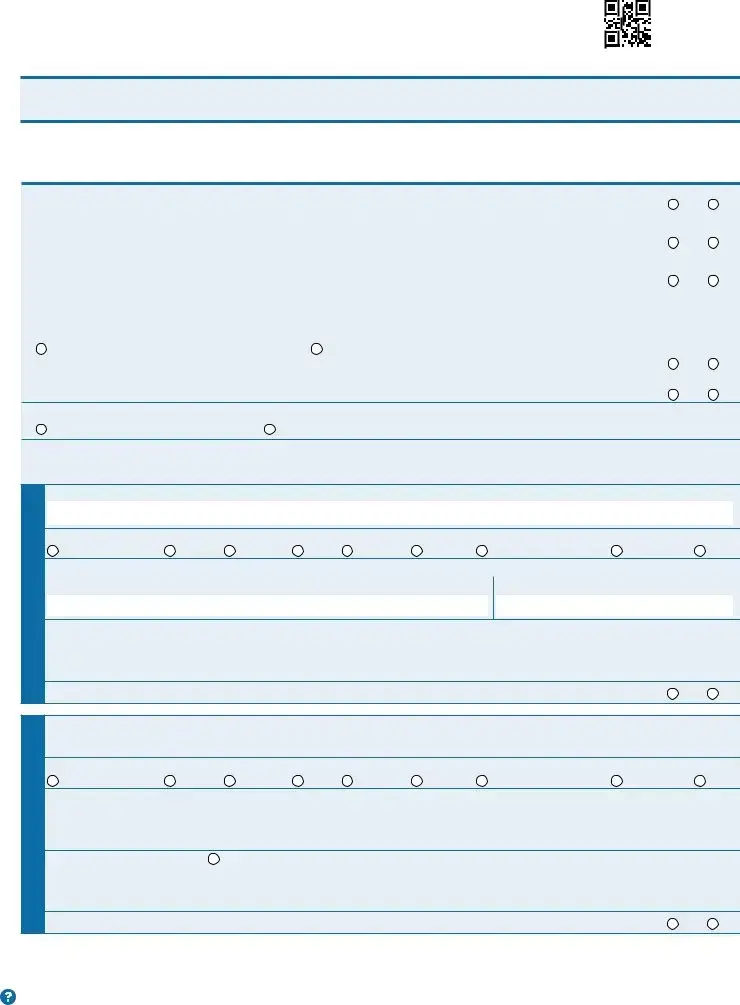

Step 3: American Indian or Alaska Native (AI/AN) household member(s)

Page 6 of 9

1.Are you or is anyone in your household American Indian or Alaska Native?

NO. If no, continue to Step 4.

NO. If no, continue to Step 4.  YES. If yes, continue to Step 4, plus complete Appendix B and include with application.

YES. If yes, continue to Step 4, plus complete Appendix B and include with application.

Step 4: Your household’s health coverage

1.Was anyone on this application found not eligible for Medicaid or the Children’s Health Insurance Program (CHIP) in the

past 90 days? (Select yes only if someone was found not eligible for this coverage by your state, not by the Marketplace.) |

Yes |

No |

||||

|

|

|

|

|

|

|

Who? |

|

Date: |

|

|

|

|

Or, was anyone on this application found not eligible for Medicaid or CHIP due to their immigration status in the last 5 years? |

Yes |

No |

||||

Who? |

|

|

|

|

|

|

Did anyone on this application apply for coverage during the Marketplace Open Enrollment Period or after a qualifying life event? .... |

Yes |

No |

||||

Who? |

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Is anyone listed on this application offered health coverage from a job? Check yes even if the coverage is from someone else’s job, like a parent or spouse, even if they don’t accept the coverage. Check no if the only coverage offered is COBRA.

YES. Continue and then complete Appendix A. |

NO. |

|

If yes, is this a state employee benefit plan? |

Yes |

No |

Is anyone listed on the application offered an individual coverage Health Reimbursement Arrangement (HRA) |

|

|

or a Qualified Small Employer HRA (QSEHRA)? |

Yes |

No |

3.Is anyone enrolled in health coverage now?

YES. If yes, continue to question 4. |

NO. If no, SKIP to Step 5. |

4.Information about current health coverage. (Make a copy of this page if more than 2 people have health coverage now.)

Write the type of coverage, like employer insurance, COBRA, Medicaid, CHIP, Medicare, TRICARE, VA health care program, Peace Corps, or other. (Don’t tell us about TRICARE if you have Direct Care or Line of Duty.)

PERSON 1:

PERSON 2:

Name of person enrolled in health coverage

Type of coverage: |

|

Employer insurance COBRA Medicaid CHIP Medicare TRICARE |

VA health care program Peace Corps Other |

If it’s employer insurance: (You’ll also need to complete Appendix A.) |

|

Name of health insurance company |

Policy/ID number |

If it’s another kind of coverage:  Fill in if this is Marketplace health coverage.

Fill in if this is Marketplace health coverage.

Name of health insurance company |

|

Policy/ID number |

|

|

|

|

|

|

|

|

|

Is this a |

|

Yes No |

|

Name of person enrolled in health coverage |

|

|

|

|

|

|

|

|

|

|

|

Type of coverage: |

|

|

|

Employer insurance COBRA Medicaid CHIP Medicare TRICARE |

VA health care program Peace Corps Other |

||

If it’s employer insurance: (You’ll also need to complete Appendix A.) |

|

|

|

Name of health insurance company |

|

|

Policy/ID number |

|

|||

|

|

|

|

|

|

|

|

If it’s another kind of coverage: Fill in if this is Marketplace health coverage. |

|

|

|

Name of health insurance company |

|

|

Policy/ID number |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

Is this a |

Yes No |

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

Step 5: Your agreement & signature

Page 7 of 9

1.Do you agree to allow the Marketplace to use income data, including information from tax returns,

for the next 5 years? .......................................................................................................................................................................................... Yes

Yes  No

No

To make it easier to determine your eligibility for help paying for coverage in future years, you can agree to allow the Marketplace to use updated income data, including information from tax returns. The Marketplace will send a notice and let you make any changes. The Marketplace will check to make sure you’re still eligible, and may have to ask you to confirm that your income still qualifies. You can opt out at any time.

If no, automatically update my information for the next: 5 years

5 years  4 years

4 years  3 years

3 years  2 years

2 years  1 year

1 year

Don’t use my tax data to renew my eligibility for help paying for health coverage (selecting this option may impact your ability to get help paying for coverage at renewal.)

Don’t use my tax data to renew my eligibility for help paying for health coverage (selecting this option may impact your ability to get help paying for coverage at renewal.)

2. Is anyone applying for health insurance on this application incarcerated (detained or jailed)? |

Yes No |

If yes, tell us the person’s name. The name of the incarcerated person is: |

|

Fill in here if this person is facing disposition of charges.

Fill in here if this person is facing disposition of charges.

If anyone on your application is enrolled in Marketplace coverage and is later found to have other qualifying health coverage (like Medicare, Medicaid, or CHIP), the Marketplace will automatically end their Marketplace plan coverage. This will help make sure that anyone who’s found to have other qualifying coverage won’t stay enrolled in Marketplace coverage and have to pay full cost.

I agree to allow the Marketplace to end the Marketplace coverage of the people on my application in this situation.

I don’t give the Marketplace permission to end Marketplace coverage in this situation. I understand that the affected people on my application will no longer be eligible for financial help and must pay full cost for their Marketplace plan.

If anyone on this application is eligible for Medicaid:

•I’m giving to the Medicaid agency our rights to pursue and get any money from other health insurance, legal settlements, or other third parties. I’m also giving to the Medicaid agency rights to pursue and get medical support from a spouse or parent.

• Does any child on this application have a parent living outside of the home? |

Yes No |

•If yes, I know I’ll be asked to cooperate with the agency that collects medical support from an absent parent. If I think that cooperating to collect medical support will harm me or my children, I can tell Medicaid and I may not have to cooperate.

•I’m signing this application under penalty of perjury, which means I’ve provided true answers to all the questions on this form to the best of my knowledge. I know that I may be subject to penalties under federal law if I intentionally provide false or untrue information.

•I know that I must tell the Health Insurance Marketplace® within 30 days if anything changes (and is different than) what I wrote on this application. I can visit HealthCare.gov or call

•I know that under federal law, discrimination isn’t permitted on the basis of race, color, national origin, sex, age, sexual orientation, gender identity, or disability. I can file a complaint of discrimination by visiting hhs.gov/ocr/office/file.

•I know that information on this form will be used only to determine eligibility for health coverage, help paying for coverage (if requested), and for lawful purposes of the Marketplace and programs that help pay for coverage.

We need this information to check your eligibility for help paying for health coverage if you choose to apply. We’ll check your answers using information in our electronic databases and databases from the Internal Revenue Service (IRS), Social Security, the Department of Homeland Security, and/or a consumer reporting agency. If the information doesn’t match, we may ask you to send us confirmation.

What should I do if I think my Eligibility Notice is wrong?

If you don’t agree with what you qualify for, in many cases, you can ask for an appeal. Review your Eligibility Notice to find appeals instructions specific to each person in your household who applies for coverage, including how many days you have to request an appeal. Here’s important information to consider when requesting an appeal:

•You can have someone request or participate in your appeal if you want to. That person can be a friend, relative, lawyer, or other individual. Or, you can request and participate in your appeal on your own.

•If you request an appeal, you may be able to keep your eligibility for coverage while your appeal is pending.

•The outcome of an appeal could change the eligibility of other members of your household.

To appeal your Marketplace eligibility results, visit

PERSON 1 should sign this application. If you’re an authorized representative, you may sign here as long as PERSON 1 signed Appendix C.

Signature

Date signed (mm/dd/yyyy)

If you’re signing this application outside of Open Enrollment (between November 1 and January 15), make sure you review Appendix D (“Questions about life changes”).

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

Step 6: Mail completed application

Page 8 of 9

Mail your signed application to:

Health Insurance Marketplace

Dept. of Health and Human Services

465 Industrial Blvd.

London, KY

If you want to register to vote, you can complete a voter registration form at eac.gov.

Get help in a language other than English

If you, or someone you’re helping, has questions about the Health Insurance Marketplace®, you have the right to get help and information in your language at no cost to you. To talk to an interpreter, call

Here’s a listing of the available languages and the same message provided above in those languages:

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

Get help in a language other than English (Continued)

Page 9 of 9

PRA Disclosure Statement: According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

NEED HELP WITH YOUR APPLICATION? Visit HealthCare.gov, or call us at

Form Characteristics

| Fact Name | Details |

|---|---|

| Approval Status | The Health Insurance Application form is approved by the Office of Management and Budget (OMB) with the number 0938-1191. |

| Expiration Date | The form is set to expire on September 30, 2022, which means it is essential to use an updated version for applications. |

| Eligibility for Coverage | Individuals can apply for health coverage for all members of their household, even if some already have insurance. |

| Required Information | Applicants must provide Social Security Numbers (SSNs), income information, and details about current health insurance. |

| Privacy Assurance | Information provided on the form is kept private and secure, adhering to legal requirements to protect applicant data. |

| Language Assistance | Help is available in multiple languages, including Spanish, at no extra cost to the applicant. |

| State-Specific Regulations | In states like California, applicants must comply with California Health and Safety Code § 1399.850 et seq., which governs health coverage applications. |

Guidelines on Utilizing Health Insurance Application

Once you have gathered the necessary documents and information, it’s time to fill out the Health Insurance Application form. Completing this form allows you to determine the health coverage options available to you and your household.

- Provide your information in Step 1: Enter your first name, middle name, last name, and any suffix. Fill out your home address, including city, state, ZIP code, and county. If your mailing address is different, include that as well. Enter your phone numbers and email address, if you’d like to receive updates via email. Choose your preferred language.

- Move to Step 2: Start detailing household members. Include all adults, children, or anyone on your federal income tax return. Begin with yourself and add additional members as needed. Ensure you complete this step for each member of your household, regardless of their current health coverage.

- For each person, list their first name, middle name, last name, and suffix. Indicate the relationship to the primary applicant. Provide marital status, date of birth, sex, and Social Security Number if applicable. Confirm their plan to file a federal income tax return and ask if they require health coverage.

- Detail any physical, mental, or emotional health conditions affecting the individual, alongside their citizenship status. If the individual is not a U.S. citizen, provide information about their immigration status.

- Gather income information for each household member in Step 3. If employed, provide employer details and income amounts. If self-employed, report net income. Fill out necessary income sources and deductions.

- Ensure accuracy by reviewing each section after completion. Make corrections if necessary.

- Sign and date the application. Keep a copy for your records.

- Submit your application to the address provided on the form, even if you do not have all requested information. You may follow up later for additional updates.

What You Should Know About This Form

What is the purpose of the Health Insurance Application form?

The Health Insurance Application form is designed to help you determine what health coverage you qualify for. This includes Marketplace plans that provide comprehensive coverage, potential tax credits that could lower your premiums, and free or low-cost options through Medicaid or CHIP. By completing the application, you can find out what assistance is available to you based on your household size and income.

Who can apply using this form?

This application can be used for anyone in your household. This includes yourself, your spouse, and any children under 21 living with you. You can apply even if someone in your household has health coverage. Free or lower-cost coverage options are available for eligible immigrants and for children, regardless of the parent's coverage status. Applying doesn’t affect your immigration status.

What information do I need to complete the application?

You will need Social Security Numbers (or document numbers for eligible immigrants), employer and income information for everyone in your household, current health insurance policy numbers, and details about any job-related health insurance available. Make sure to have accurate documentation ready for a smooth application process.

Why is my income information required?

Income information helps determine what coverage options and financial assistance you qualify for. The Marketplace needs to assess your eligibility for different programs and see if you can get help with paying for health coverage. All information provided is kept private and secure.

What should I do after I submit my application?

Once you submit your completed and signed application, it will be processed by the Marketplace. You should expect to receive a follow-up within 1 to 2 weeks. If the Marketplace needs more information, they may contact you. An Eligibility Notice will be mailed to you once your application has been processed. Don’t worry; filling out this application does not obligate you to purchase health coverage.

How can I get help with my application?

You have several options for assistance. You can visit HealthCare.gov for online help, or call the Marketplace Call Center at 1-800-318-2596. TTY users can contact 1-855-889-4325 for support. Additionally, you can seek in-person help from local counselors. Free assistance is available in other languages upon request.

Is there a specific way I must fill out the application?

Yes, use capital letters and black or dark blue ink only. Fill in circles clearly when required. This ensures your application is easy to read and process. Keep your responses truthful and complete for the best assistance.

What if I forget to include someone in my household?

If you leave someone out, even if they already have health coverage, it could affect your eligibility results. It’s best to include everyone who lives with you to ensure you receive all potential benefits.

What happens if I am not currently employed?

You can still apply for health coverage even if you are not working. You will need to provide other income details, if applicable, and other household information. Don't worry; everyone is encouraged to apply regardless of employment status.

Common mistakes

Filling out a health insurance application can feel challenging, and many individuals make mistakes that could impact their coverage options. One common error is related to not including all household members. It’s important to remember that the application requires you to list everyone living in your household, even if they already have insurance or don't need coverage. Missing someone could lead to incorrect eligibility determinations or missed opportunities for assistance.

Another frequent mistake involves the omission or inaccuracy of Social Security Numbers (SSNs). If you are applying for health coverage, failure to provide an accurate SSN can hinder the processing of your application. This number helps verify your identity and eligibility for benefits. If you don’t have an SSN, include a document number for eligible immigrants to ensure that your application is considered.

Additionally, applicants often overlook necessary income and job information. It’s essential to provide accurate details about your employment and any other sources of income. If you have more than one job, include information for all jobs, along with any benefits you may receive. Incomplete or inaccurate income reports can lead to incorrect evaluations of your eligibility for financial assistance and health programs.

Lastly, some individuals fail to sign or date their applications. While this may seem minor, a missing signature can result in a delay or rejection of your application entirely. Always double-check that the application is complete and signed before submission to avoid unnecessary holdups. Remember, taking a little extra time to review your application can help ensure you receive the health coverage you need.

Documents used along the form

When applying for health insurance, there are several forms and documents that can be useful in addition to the main Health Insurance Application form. These documents help gather necessary information to determine eligibility for various programs and coverage options. Below is a list of commonly used forms that complement the health insurance application process.

- Income Verification Document: This can include recent pay stubs, W-2 forms, or tax returns. These documents ensure that the income information you provide is accurate, allowing for appropriate coverage and premium calculations.

- Social Security Card: You may need to provide this to verify Social Security Numbers for everyone in your household. It’s an important piece of identification when applying for health coverage.

- Policy Declaration Page: If you currently have health insurance, this document provides details about your existing coverage. This helps assess whether you might qualify for better options or lower-cost programs.

- Medicaid or CHIP Documentation: If you believe you might qualify for Medicaid or the Children’s Health Insurance Program, having documentation related to that can expedite the application process.

- Proof of State Residency: Documents like a utility bill or lease agreement can confirm your residency status. This is particularly relevant for certain state-specific programs and benefits.

- Notice of Eligibility for Other Coverage: If you've received notification about your eligibility for other health coverages, submitting that notice is often crucial for your own application.

- Appendix C Form: If someone is helping you complete your application, this form is often required to ensure they have the authority to assist you.

- Employer Health Insurance Offer Letter: If your employer offers health insurance and you choose not to enroll, this letter can help verify your options and support your application.

- Proof of Citizenship or Immigration Status: Documents like a birth certificate, passport, or immigration documentation are necessary to confirm eligibility based on U.S. citizenship or immigration status.

Having these additional documents ready can streamline your application experience and help ensure you receive the health coverage you need. Always check specific requirements and recommendations from the Marketplace to ensure you're fully prepared.

Similar forms

Medicaid Application Form: Similar in purpose, this form assists individuals in determining their eligibility for Medicaid benefits. Like the Health Insurance Application, it requires personal and household information, including income details and the number of dependents.

Children’s Health Insurance Program (CHIP) Application: This document is used for families seeking low-cost health coverage for children. It also requests similar information about household income and number of dependents, mirroring the Health Insurance Application's structure.

Enrollment Form for Private Health Insurance: This form allows individuals to enroll in private insurance plans. It also collects personal data, income levels, and existing coverage details, similar to the Health Insurance Application's questions.

Medicare Application: For elderly individuals, this form assesses eligibility for Medicare benefits. It incorporates questions about personal details and household income, akin to the structure of the Health Insurance Application.

Tax Credit Application for Health Coverage: This application determines eligibility for tax credits related to health insurance costs. It similarly requires income documentation and personal details, similar to the methods used in the Health Insurance Application.

Employer-Sponsored Health Plan Enrollment Form: Similar to the Health Insurance Application, this form allows employees to select health plans through their employers. It asks for personal information and income verification, just as the Health Insurance Application does.

Long-Term Care Insurance Application: Individuals seeking long-term care coverage must fill out this form, which requests information regarding health history and personal circumstances. This mirrors the requests made in the Health Insurance Application.

Financial Assistance Application for Medical Costs: Similar in intent, this form helps determine eligibility for programs that provide financial aid for medical expenses. It too requires information about income and household composition.

Health Savings Account (HSA) Enrollment Form: Individuals opening an HSA will encounter an application that requests personal and income information, similar to that found in the Health Insurance Application.

Dos and Don'ts

When filling out the Health Insurance Application form, there are important actions to take and avoid to ensure a smooth process.

- Do print clearly and use black or dark blue ink to fill out the form.

- Do include Social Security Numbers (SSNs) for all household members applying for coverage.

- Do provide accurate income information from all sources for everyone in the household.

- Do include anyone living in the household, regardless of their current insurance status.

- Do sign and date the application to confirm the information is complete and accurate.

- Don’t leave any questions blank; if something doesn't apply, indicate that clearly.

- Don’t provide incorrect or misleading information, as it can affect eligibility.

- Don’t forget to submit the application to the correct address listed in the form.

- Don’t hesitate to ask for assistance if you're unsure about any information required.

Misconceptions

Misconception 1: Only uninsured individuals can apply for health coverage through the Health Insurance Application form.

While many believe that only those without any health insurance can apply, this is not true. Even if you, your spouse, or your child currently have health coverage, you may still qualify for free or lower-cost options. This is worth exploring to potentially reduce your healthcare costs.

Misconception 2: Filling out the application obligates you to buy health coverage.

This is a common fear among applicants. However, submitting the form does not mean you are committing to purchasing health insurance. You can complete the application to see what options might be available to you without any obligation.

Misconception 3: Your immigration status affects your ability to apply for health insurance for your family members.

In fact, households that include eligible immigrants can apply. You can also apply for your child, even if you aren't eligible yourself. Additionally, applying for coverage won't impact your immigration status or chances of becoming a permanent resident.

Misconception 4: You need to file taxes to apply for health coverage.

This misconception can deter eligible individuals from applying. You don't need to file a tax return to receive health coverage. Including household members in the application is crucial, even if no taxes are filed.

Misconception 5: The information provided in the application will not be kept confidential.

Many may worry about privacy, but it is important to note that all information you provide is kept private and secure, as required by law. The data collected is essential for determining your eligibility for coverage and possible financial assistance.

Key takeaways

When filling out the Health Insurance Application form, consider the following key takeaways:

- Complete for Everyone: Include all household members, even if they already have health coverage. Your eligibility depends on the information for everyone in your home.

- Prepare Required Information: Have Social Security Numbers, income details, and information about any current health insurance ready before starting the application.

- Income is Crucial: Accurate income reporting is essential as it determines your eligibility for coverage and potential financial assistance.

- Submit Even if Incomplete: If you lack some information, still sign and submit the application. The Marketplace will follow up for missing details within 1-2 weeks.

- Use Available Resources: Seek assistance if needed. You can get help online, by phone, or in-person at designated locations.

Browse Other Templates

Guyana Visa - Avoid submitting an incomplete application to prevent delays.

What Is a Wdir Inspection - A lack of access to certain areas limits the inspector's ability to provide comprehensive evaluations.