Fill Out Your Hhs 722 Form

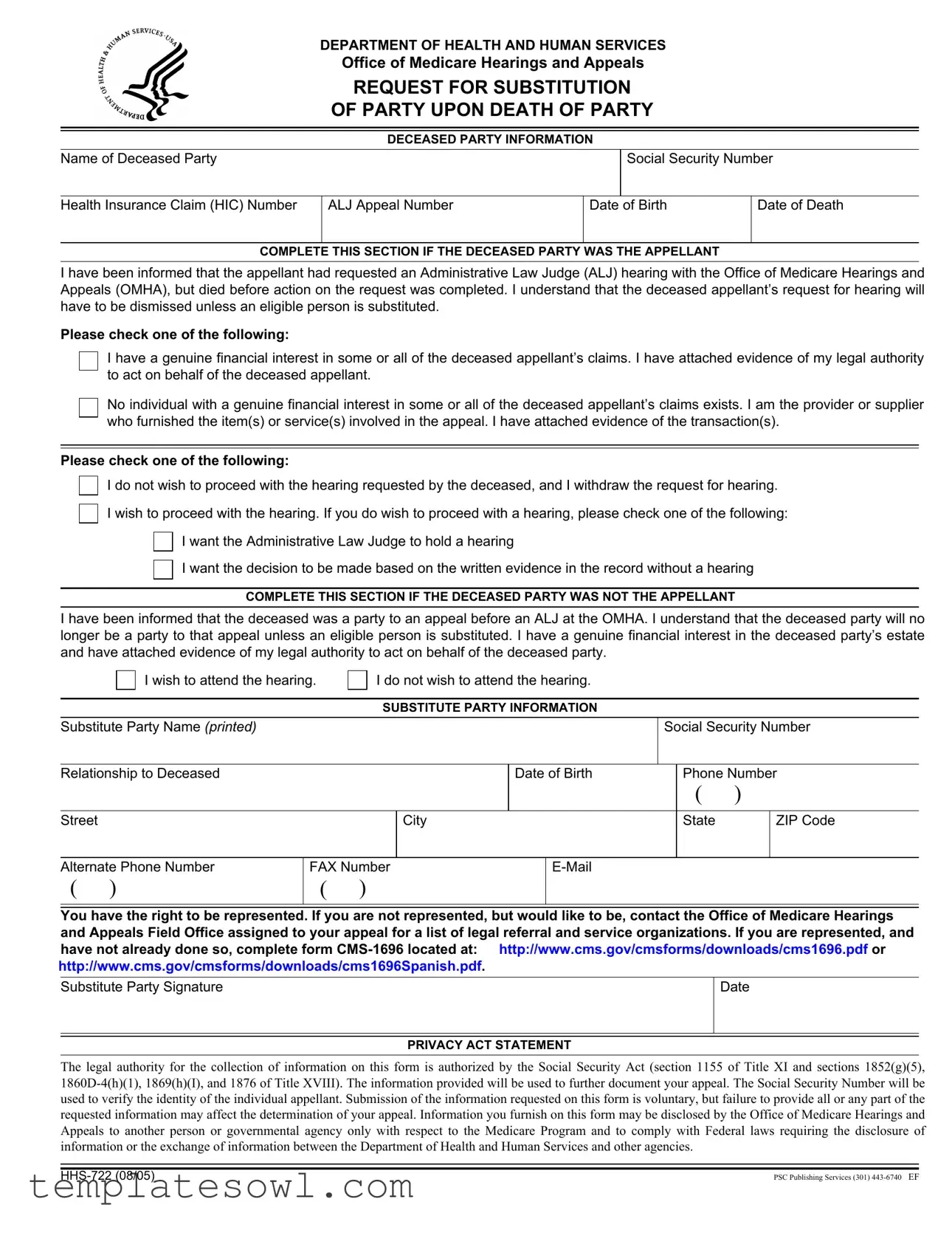

The HHS 722 form, designed by the Department of Health and Human Services, serves as a crucial document during the sensitive process of requesting a substitution of party following the death of an individual involved in an appeal with the Office of Medicare Hearings and Appeals (OMHA). This form is specifically tailored for situations where an appellant has passed away before their appeal reaches completion, laying out the necessary steps for eligible parties wishing to take their place. Information about the deceased party, such as their name, Social Security Number, and Health Insurance Claim Number, must be provided. It requires the substitute party to disclose their relationship to the deceased and any financial interest they may have in the ongoing claims. Additionally, the form presents various options for the substitute party to express whether they wish to continue the hearing or to withdraw the appeal entirely. This ensures that the voice of the deceased party is honored, while also adhering to legal protocols. The HHS 722 form is an essential tool in facilitating the continuation of appeals, allowing for a smooth transition of legal representation during a difficult time.

Hhs 722 Example

DEPARTMENT OF HEALTH AND HUMAN SERVICES

Office of Medicare Hearings and Appeals

REQUEST FOR SUBSTITUTION

OF PARTY UPON DEATH OF PARTY

DECEASED PARTY INFORMATION

Name of Deceased Party

Social Security Number

Health Insurance Claim (HIC) Number

ALJ Appeal Number

Date of Birth

Date of Death

COMPLETE THIS SECTION IF THE DECEASED PARTY WAS THE APPELLANT

I have been informed that the appellant had requested an Administrative Law Judge (ALJ) hearing with the Office of Medicare Hearings and Appeals (OMHA), but died before action on the request was completed. I understand that the deceased appellant’s request for hearing will have to be dismissed unless an eligible person is substituted.

Please check one of the following:

I have a genuine financial interest in some or all of the deceased appellant’s claims. I have attached evidence of my legal authority to act on behalf of the deceased appellant.

No individual with a genuine financial interest in some or all of the deceased appellant’s claims exists. I am the provider or supplier who furnished the item(s) or service(s) involved in the appeal. I have attached evidence of the transaction(s).

Please check one of the following:

I do not wish to proceed with the hearing requested by the deceased, and I withdraw the request for hearing. I wish to proceed with the hearing. If you do wish to proceed with a hearing, please check one of the following:

I want the Administrative Law Judge to hold a hearing

I want the decision to be made based on the written evidence in the record without a hearing

COMPLETE THIS SECTION IF THE DECEASED PARTY WAS NOT THE APPELLANT

I have been informed that the deceased was a party to an appeal before an ALJ at the OMHA. I understand that the deceased party will no longer be a party to that appeal unless an eligible person is substituted. I have a genuine financial interest in the deceased party’s estate and have attached evidence of my legal authority to act on behalf of the deceased party.

I wish to attend the hearing.

I do not wish to attend the hearing.

SUBSTITUTE PARTY INFORMATION

Substitute Party Name (printed) |

|

|

|

|

|

Social Security Number |

|

||||

|

|

|

|

|

|

|

|

|

|||

Relationship to Deceased |

|

|

|

Date of Birth |

|

Phone Number |

|

||||

|

|

|

|

|

|

|

|

( |

) |

|

|

Street |

|

|

|

City |

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

||

Alternate Phone Number |

FAX Number |

|

|

|

|

|

|

||||

( |

) |

( |

) |

|

|

|

|

|

|

|

|

You have the right to be represented. If you are not represented, but would like to be, contact the Office of Medicare Hearings and Appeals Field Office assigned to your appeal for a list of legal referral and service organizations. If you are represented, and have not already done so, complete form

Substitute Party Signature

Date

PRIVACY ACT STATEMENT

The legal authority for the collection of information on this form is authorized by the Social Security Act (section 1155 of Title XI and sections 1852(g)(5),

PSC Publishing Services (301) |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The HHS 722 form is used to request a substitution of party in cases where the original party has died. |

| Governing Law | This form complies with the Social Security Act, specifically sections 1155 and 1869. |

| Eligibility Criteria | The form can be completed by an eligible person who has a financial interest in the deceased party's claims. |

| Sections of the Form | The form includes sections to complete for both when the deceased was the appellant and when they were not. |

| Submission Requirement | Submission of the HHS 722 form is voluntary, but incomplete forms may impact appeal determinations. |

| Evidence Attachment | Individuals must attach evidence of their legal authority to act on behalf of the deceased when requested. |

| Signature Requirement | The substitute party must sign and date the form to validate the request. |

| Privacy Act Statement | The information collected is subject to privacy protections under the Privacy Act and is used to document appeals. |

| Representation | Individuals have the right to be represented and can contact the Office of Medicare Hearings and Appeals for assistance. |

| Form Update Date | The current version of the HHS 722 form dates back to August 2005. |

Guidelines on Utilizing Hhs 722

Filling out the HHS 722 form is a crucial step in the substitution of a party following the death of a party involved in an appeal. Properly completing the form ensures that the appeal is appropriately managed and allows eligible individuals to continue proceedings without undue delay.

- Obtain the form: Access the HHS 722 form online or request a physical copy from the Office of Medicare Hearings and Appeals.

- Fill out the deceased party information:

- Name of deceased party

- Social Security Number

- Health Insurance Claim (HIC) Number

- ALJ Appeal Number

- Date of Birth

- Date of Death

- If the deceased party was the appellant:

- Check the box indicating whether you have a genuine financial interest or if you are the provider/supplier.

- Attach any relevant evidence of legal authority if applicable.

- Indicate whether you wish to withdraw the request for hearing or proceed with the hearing.

- If proceeding, specify if you want a hearing or a decision based on written evidence.

- If the deceased party was not the appellant:

- Indicate your genuine financial interest in the deceased party’s estate and attach evidence if applicable.

- Specify your desire to attend the hearing or not.

- Complete substitute party information:

- Name (printed)

- Social Security Number

- Relationship to deceased

- Date of Birth

- Phone Number

- Address including Street, City, State, and ZIP Code

- Alternate Phone Number, FAX Number, and E-Mail

- Sign and date the form: Ensure the substitute party signature and date are provided at the bottom of the form.

After completing the form, it is essential to submit it according to the instructions provided. Failure to provide accurate information may impact the outcome of the appeal. Keep a copy of the completed form for your records.

What You Should Know About This Form

What is the HHS 722 form?

The HHS 722 form is a document used by the Office of Medicare Hearings and Appeals. It is primarily for situations where a person who has requested a hearing before an Administrative Law Judge (ALJ) has passed away. The form requests a substitution of a party to continue the appeal process on behalf of the deceased individual.

Who needs to fill out the HHS 722 form?

The HHS 722 form needs to be filled out by a person who has a genuine financial interest in the claims of the deceased, or by a provider or supplier involved in the appeal. This may include family members, legal representatives, or business associates connected to the deceased party's Medicare claims.

What information is required on the form?

The form requires several pieces of information, including the deceased party's name, Social Security number, Health Insurance Claim number, date of birth, and date of death. If you are the substitute party, you must provide your own personal information, including your name, Social Security number, relationship to the deceased, and contact details.

What should I do if I want to proceed with the hearing?

If you wish to continue with the hearing originally requested by the deceased, you must indicate that clearly on the form. You can choose whether you want the ALJ to hold a hearing or if you prefer a decision based on written evidence only.

What if I do not want to proceed with the hearing?

If you decide not to proceed with the hearing, you can withdraw the request by checking the appropriate box on the form. This will formally inform the Office of Medicare Hearings and Appeals that you no longer wish to continue the appeal.

What kind of evidence do I need to provide?

You will need to attach evidence that supports your claim of having a financial interest in the deceased's claims or evidence that shows your legal authority to act on behalf of the deceased. This could include legal documents, financial statements, or other relevant paperwork.

Can I have representation while filling out the form?

Yes, you have the right to be represented in this process. If you are not represented and would like legal assistance, you can contact the Office of Medicare Hearings and Appeals Field Office associated with your claim to obtain a list of legal referral service organizations.

What happens if I do not include all requested information?

While sharing your information on the HHS 722 form is voluntary, failing to provide complete information may affect the outcome of your appeal. It's essential to fill out the form as thoroughly as possible to avoid any delays or issues.

How is my personal information protected?

Your personal information on the form is protected under the Privacy Act. The information collected is used solely to document your appeal and verify identities. It is disclosed only when necessary to comply with federal laws related to Medicare.

Where can I find additional resources or assistance?

If you need more guidance, you can visit the Centers for Medicare and Medicaid Services (CMS) website or contact their offices directly. They can provide helpful resources and support for navigating the appeals process effectively.

Common mistakes

Completing the HHS 722 form is crucial for ensuring the proper handling of appeals after the death of a party. However, individuals often encounter several mistakes that can hinder the process. One common error is failing to include complete and accurate information about the deceased party. Omissions such as the full name or correct Social Security Number can lead to delays or complications in processing the request.

Another mistake involves not properly indicating the relationship to the deceased party. This section is vital for establishing eligibility to substitute as a party. The absence of this detail can raise questions and may necessitate further documentation. It is essential to ensure that this connection is clearly stated to avoid unnecessary setbacks.

Many people also neglect to attach necessary supporting documents. For example, individuals claiming a financial interest must provide evidence of that interest. Similarly, if acting on behalf of the deceased, legal authority documents must be submitted. Failure to include these can result in the dismissal of the hearing request.

A frequent oversight relates to the preference for proceeding with the hearing. Applicants sometimes forget to indicate whether they wish to continue with the hearing or withdraw the request. This choice must be stated clearly; uncertainty can lead to administrative confusion.

Similarly, misunderstanding the choice between a hearing and a decision based on written evidence is quite common. It is important to understand the implications of each option. Individuals should be specific about their choice to ensure the appropriate procedure is followed.

Another mistake involves incorrect documentation of contact details for the substitute party. Missing or incorrect phone numbers and email addresses can hinder communication. This information is essential for managing the next steps in the appeal process.

Errors can also occur when filling out the fields regarding the deceased party's appeal. Those filling out the form sometimes fail to specify that the deceased was a party to an appeal. This information is critical for establishing the context of the substitution request.

Finally, neglecting to sign and date the form is a significant mistake. The signature validates the request and confirms the intent to proceed with the appeal or substitution. Without it, the submission may be considered incomplete or invalid, prolonging the resolution process.

Documents used along the form

The HHS 722 form serves as a crucial document for requesting a substitution of a party in the event of a deceased individual involved in a Medicare appeal. Along with this form, several other documents are often required to facilitate the process. Here are some of the common forms used alongside the HHS 722 form.

- CMS-1696: Appointment of Representative This form allows individuals to appoint a representative to act on their behalf in matters related to Medicare appeals. Completing this document ensures that the appointed representative can receive information and interact with the Medicare system regarding the deceased's claims.

- Death Certificate A copy of the death certificate is often requested to provide official proof of the deceased's passing. This document is important for verifying that the individual is deceased and for establishing the need for a substitution in the appeal process.

- Proof of Financial Interest This document may include bank statements, property deeds, or other financial records demonstrating the requestor's genuine financial interest in the deceased's claims. Such evidence is critical, particularly if the requestor is asserting a right to proceed with the appeal.

- Legal Authority Documentation Individuals seeking to act on behalf of the deceased may need to provide evidence of their legal authority—perhaps a power of attorney or executor documentation. This is essential for confirming that the substitute party has the right to make decisions regarding the appeal.

In conclusion, when dealing with the HHS 722 form, it is vital to consider the additional documentation that may be necessary. Each of these forms plays a significant role in ensuring the appeals process continues smoothly, honoring the rights and interests of the parties involved in a compassionate and respectful manner.

Similar forms

The HHS 722 form is specifically designed for situations involving the substitution of a party in a Medicare appeal following the death of the original party. Here are six other documents that share similar purposes or features with the HHS 722 form:

- CMS-1696 - Appointment of Representative: This form allows individuals to designate someone to act on their behalf when dealing with Medicare-related issues. Like the HHS 722, it requires information about the appellant and the representative, ensuring that someone is legally recognized to proceed with the case.

- SSDI Application for Benefits: When a person applying for Social Security Disability Insurance (SSDI) passes away, their family can use a document to substitute themselves as claimants. This parallels the process in the HHS 722 where a substitute party must be named to continue the appeal.

- Form SSA-5 - Application for Wife's or Husband's Insurance Benefits: If a spouse passes away, the surviving spouse can fill out this form to claim benefits. Similar to the HHS 722, it requires information that verifies the claimant's relationship and right to benefits.

- Form CMS-855 - Medicare Enrollment Application: This form is for healthcare providers wishing to enroll in Medicare. It includes sections that allow for the designation of authorized representatives, resembling the way the HHS 722 form facilitates the substitution of the deceased party.

- Form 5500 - Annual Return/Report of Employee Benefit Plan: In the context of employee benefits, if the plan sponsor dies, the beneficiaries may need to submit a document that designates a representative for claims. This is akin to the HHS 722's function of allowing a substitute for a deceased party.

- Form 22 - Claim for Compensation: Similar to the HHS 722, this form is used in veterans’ affairs to appoint someone to manage claims if the veteran has died. Both documents ensure the transition of rights and claims management continues smoothly post-death.

Each of these documents facilitates a process where the rights and appeals for benefits can be managed, even after the original party can no longer continue. Ensuring proper representation and continuity is key in these situations.

Dos and Don'ts

When completing the HHS 722 form, it's important to follow specific guidelines to ensure your submission is processed without delays. Here are some things you should and shouldn't do:

- DO provide all required information about the deceased party accurately.

- DO attach evidence of your legal authority to act on behalf of the deceased if applicable.

- DO check the appropriate boxes to indicate your intentions regarding the hearing.

- DO make sure your contact information is correct and complete.

- DO submit the form in a timely manner to avoid dismissal of the hearing request.

- DON'T leave sections of the form blank; incomplete forms may be rejected.

- DON'T forge signatures or provide false information.

- DON'T submit the form without reviewing it for completeness and accuracy.

- DON'T forget to ask for assistance if you are unsure about any part of the form.

Taking these steps can help ensure that the process moves smoothly and respects the memory of the deceased party.

Misconceptions

Understanding the HHS 722 form is essential for those involved in the appeals process following the death of a party. However, several misconceptions often arise related to its purpose and procedure. Here are six key misconceptions explained:

- It is only for the deceased party's financial relatives. Many believe that only family members with financial interest can submit the HHS 722 form. In reality, providers or suppliers of healthcare may also substitute themselves as parties in the appeal process, regardless of their relationship to the deceased.

- Once a person dies, the appeal automatically ends. This is not true. The appeal does not simply conclude with the death of a party. Instead, it can continue if an eligible substitute files the HHS 722 form, ensuring that the deceased's requests are still honored.

- Legal representation is unnecessary. Some individuals think that they can navigate the process alone. While it is possible to submit the form without legal assistance, having legal representation can clarify obligations and enhance the chances of a favorable outcome.

- Substitutes do not need to prove authority. Individuals who take on the role of a substitute party must demonstrate their legal authority to act on behalf of the deceased. This involves attaching necessary documentation to the HHS 722 form.

- Procedural options are limited after substitution. Many assume that once a substitute party is designated, the options become fixed. However, the substitute can choose to withdraw the hearing request, proceed with a hearing, or request a decision based solely on written evidence.

- Information shared on the form is not protected. This misconception leads to concerns about privacy. In fact, the form includes a privacy statement outlining how information will be handled, reassuring parties that their details will only be shared in compliance with federal laws.

By clarifying these misconceptions, individuals can better understand their rights and responsibilities when dealing with the HHS 722 form and the appeals process.

Key takeaways

Filling out the HHS 722 form can be a crucial step when dealing with the loss of a loved one who had an appeal pending with the Office of Medicare Hearings and Appeals (OMHA). Here are some important points to consider:

- Identify the Deceased Party: Ensure to gather the deceased party's details, including their name, Social Security number, Health Insurance Claim (HIC) number, and dates of birth and death.

- Clarify Your Role: Determine if you are the appellant or simply a party involved in the appeal process.

- Substitution of Party: Be aware that the form is primarily for substituting the deceased party with an eligible person to continue the appeal.

- Financial Interest: You must affirm your genuine financial interest in the deceased party’s claims. Substituting parties must provide evidence of this interest.

- Withdrawal Option: If you do not wish to proceed with the hearing, indicate clearly that you want to withdraw the request for a hearing.

- Hearing Preferences: Decide whether you want the Administrative Law Judge to hold a hearing or prefer a decision based solely on the written evidence.

- Representative Information: If you need legal representation, the form provides options for contacting organizations that can assist you.

- Accurate Contact Information: Fill in complete substitute party information to ensure that OMHA can reach you regarding the appeal.

- Legal Authority Documentation: Always attach any required documentation to establish your legal authority to act on behalf of the deceased party.

- Privacy Considerations: Understand that your personal information will be protected but may be shared in compliance with certain federal laws.

Completing the HHS 722 form accurately can significantly affect the outcome of the appeal. Carefully consider each section to ensure all necessary information is provided.

Browse Other Templates

Land Contract Template Michigan - This form addresses the handling of insurance proceeds in case of damage to the property.

Medicaid Application Louisiana - Acceptance of Medicaid means agreeing to any necessary reimbursements to the state.

Afrotc Gpa Requirements - Reminds cadets of the importance of reporting medical changes.