Fill Out Your Highmark Enrollment Form

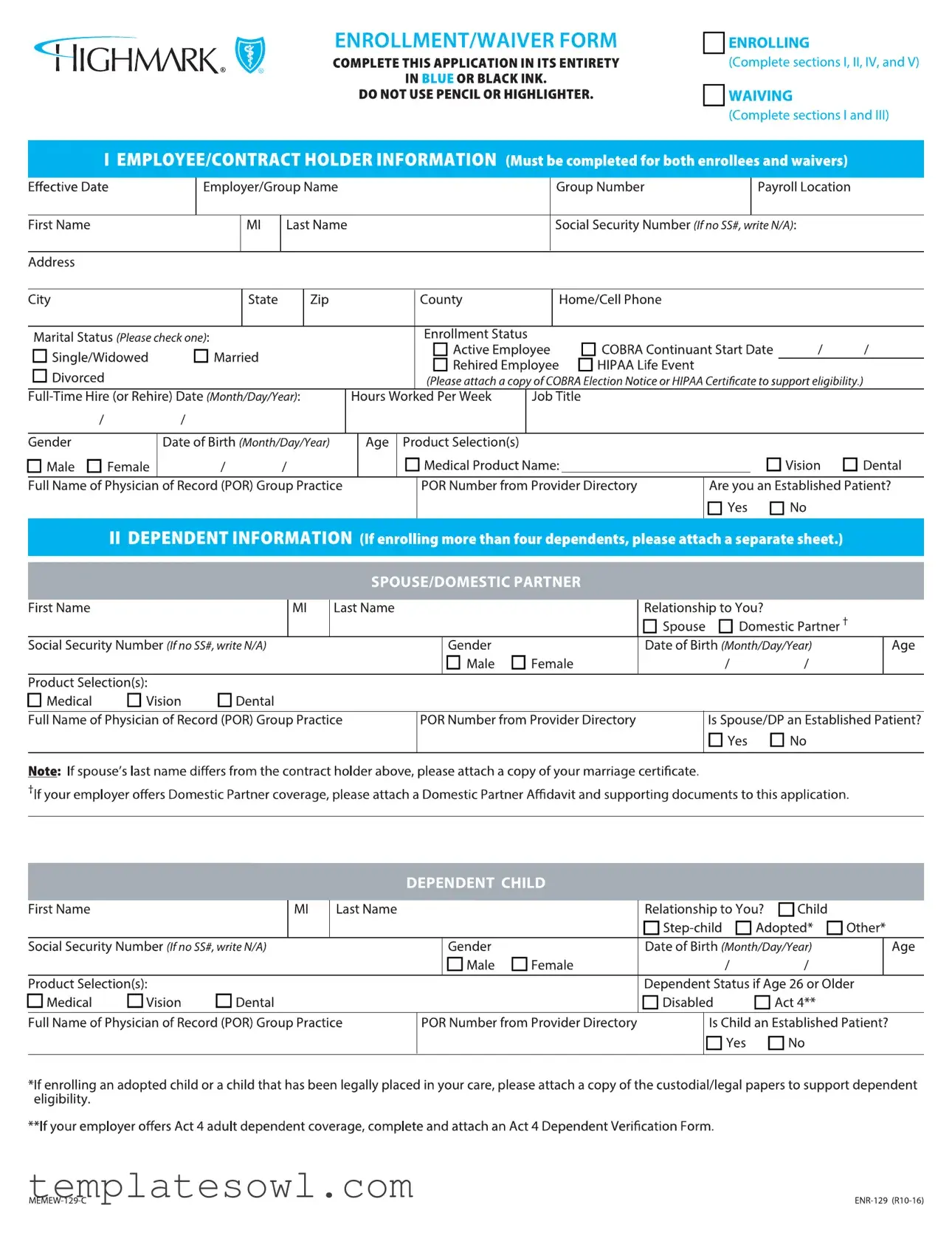

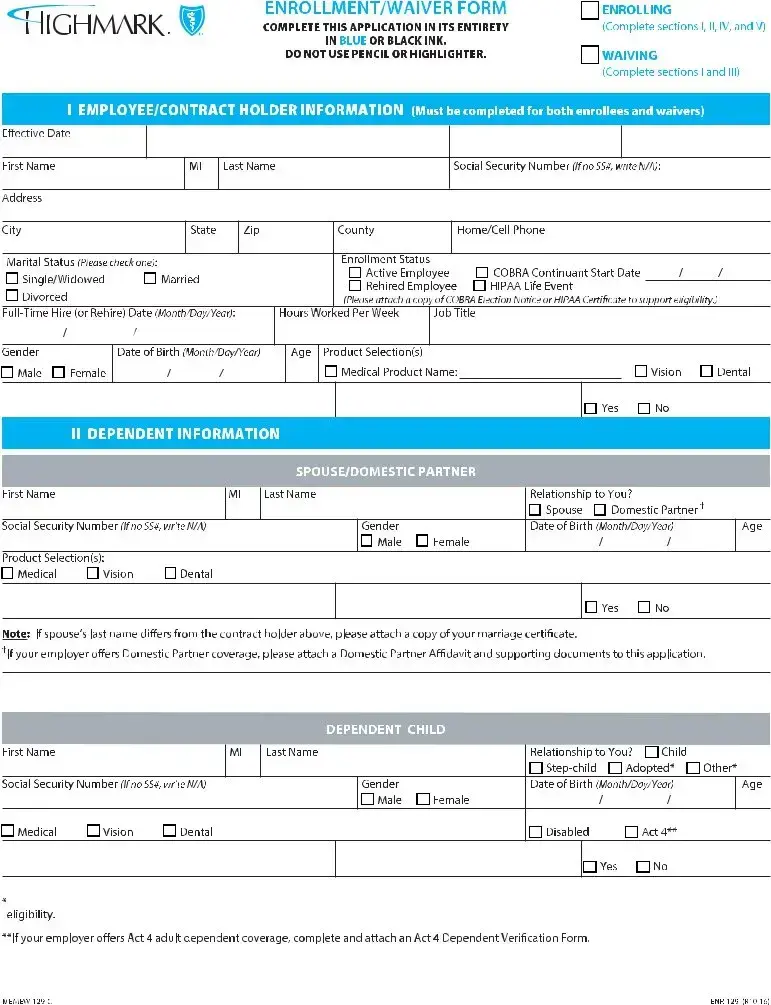

Completing the Highmark Enrollment Form is a crucial step for employees looking to secure health coverage through their employer’s benefits plan. This form provides vital details such as the effective enrollment date, personal identification information, and decision points regarding participation in coverage options like medical, dental, and vision plans. Key sections require individuals to indicate their marital status, submit their employment status, and list covered dependents, ensuring that all eligible family members are accounted for. Furthermore, the form addresses the circumstances under which the employee may choose to waive coverage, requiring an explanation for the decision. For dependents aged over 26 or those qualifying under special circumstances, specific coding is provided to facilitate proper categorization. Understanding each aspect of this form is essential, as it lays the groundwork for future insurance claims and ensures compliance with necessary documentation, particularly for special relationships like domestic partnerships. Importantly, the form also underscores the obligation to report any pre-existing conditions that might affect coverage. As individuals navigate through the details, attention to accuracy is paramount, as misrepresentations can have consequences. Familiarizing oneself with the components of the Highmark Enrollment Form not only streamlines the enrollment process but also empowers employees to make informed decisions about their health coverage.

Highmark Enrollment Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Effective Date | The form should indicate the date when the enrollment or waiver is effective. |

| Employer Information | Includes the employer’s name and group number, which are essential for identification. |

| Enrollment Status | Applicants must choose to either enroll in the insurance plan or waive coverage. |

| Personal Details | Collects vital information like the individual's name, social security number, marital status, and contact details. |

| Cobra Coverage | Options are provided for employees who are eligible for COBRA coverage, including reasons for COBRA eligibility. |

| Dependent Coverage | Applicants can list covered dependents, including their specific information and relationship to the subscriber. |

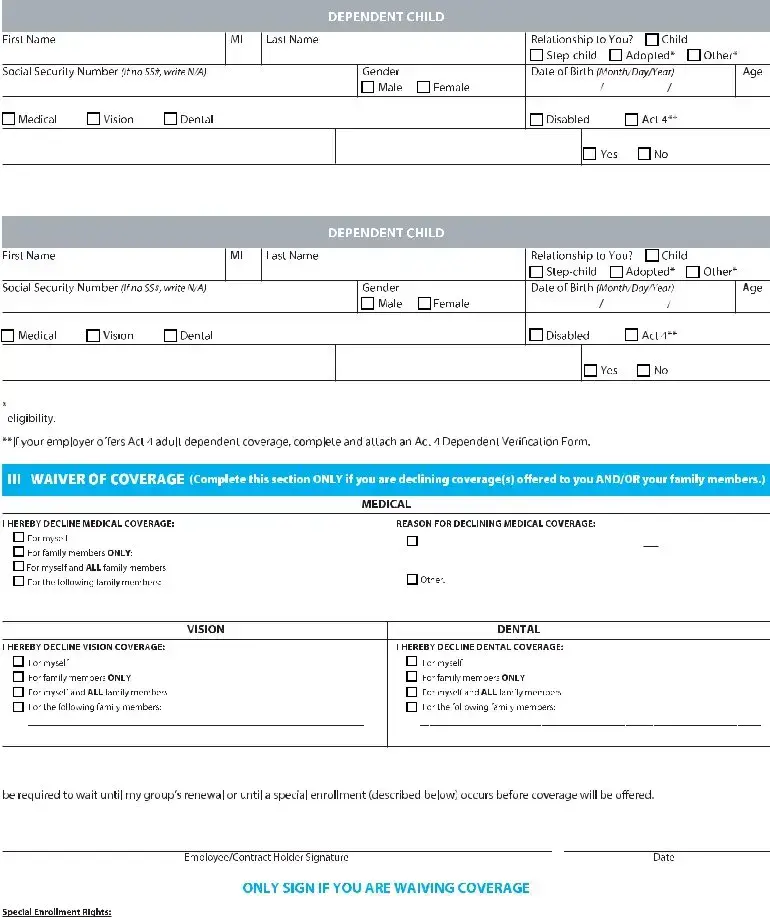

| Declining Coverage | Individuals can decline medical, vision, and dental coverages; reasons for waiving coverage must be specified. |

| Signature Requirements | Both employee and employer signatures are needed to validate the waiver of coverage. |

| Governing Law | Specific state laws govern the use and processing of this enrollment form, often including healthcare privacy regulations. |

Guidelines on Utilizing Highmark Enrollment

Filling out the Highmark Enrollment form is a crucial step for obtaining health insurance coverage through your employer. This process involves providing personal information, selecting coverage options, and submitting the completed form to your employer. Ensure that all the information is accurate to avoid any issues with your enrollment.

- Gather Required Information: Collect all necessary personal details including your full name, Social Security number, and contact information.

- Begin with Employer and Group Details: Fill in the employer’s name and group number at the top of the form.

- Enrollment or Waiver Selection: Indicate whether you are enrolling or waiving coverage by checking the appropriate box.

- Personal Information: Complete your personal details such as marital status, address, home and work phone numbers, employment status, and full-time hire date.

- List Covered Dependents: For each dependent, fill in their first name, middle initial, last name, Social Security number, birthdate, sex, height, weight, and relationship to you.

- Medical, Vision, and Dental Coverage: Indicate your choices regarding medical, vision, and dental coverage. If declining, provide a reason.

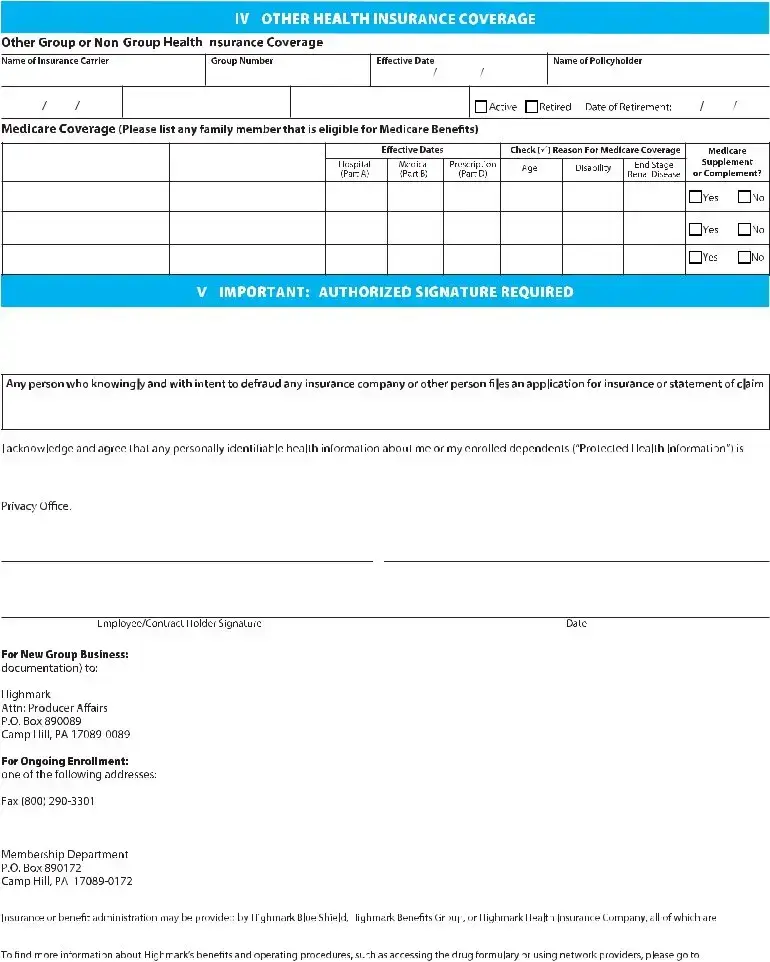

- Medicare Information: If applicable, include the names of any family members eligible for Medicare benefits, along with their coverage details.

- Medical Conditions: Answer all questions regarding medical conditions for yourself and your dependents accurately.

- Authorization: Sign the form to confirm the accuracy of the information provided. Ensure an employer signature is present if waiving coverage.

- Submit the Form: Send the completed form to the designated address provided at the end of the form.

What You Should Know About This Form

What is the purpose of the Highmark Enrollment form?

The Highmark Enrollment form is designed for employees to enroll in or waive group health insurance coverage provided by their employer. It allows individuals to indicate their health plan preferences and to list their eligible dependents, ensuring everyone who is eligible for coverage can be included or opted out as needed.

How do I fill out the section for covered dependents?

In the covered dependents section, provide the first name, middle initial, last name, social security number, birthdate, sex, height, and weight of each dependent. If any dependent is over age 26, be sure to indicate their medical status. The form requires you to specify the relationship of each dependent to the primary subscriber. If applicable, please note if the dependent is a domestic partner or falls under another specified category.

What should I do if I am declining coverage?

If you choose to decline coverage, instruct that section clearly on the form. You can decline for yourself or your dependents. You’ll need to provide a reason for declining, such as being insured under another plan. It’s important to remember that declining coverage doesn’t mean you can't enroll later; you usually have a specified window to request coverage again if certain conditions apply.

What are qualifying events for enrollment?

Qualifying events include loss of other health coverage, marriage, birth, adoption, or placement for adoption. If you or your dependents experience these changes, you may request enrollment within a specific time frame—generally 30 days after the event. This allows you to add coverage without having to wait for the normal enrollment period.

Is there any medical information I need to provide?

Yes, the form includes a section where you disclose specific medical conditions and treatments for you and your dependents. This information is vital, as it helps the insurance company assess your coverage needs without affecting eligibility. Only include current and relevant medical conditions; avoid providing any genetic information.

How do I ensure my dependents are covered?

To ensure your dependents are covered, you must formally list them on the enrollment form. Each dependent’s information should be complete and accurate. If you fail to include them on the form, they will not receive coverage. It's also essential for both you and your employer to sign the form to validate the enrollment.

What happens if I don’t submit the form on time?

If you do not submit the Enrollment/Waiver form by the due date, you may miss the chance to enroll in coverage for the year. Typically, you will need to wait until the next open enrollment period or to experience a qualifying event to apply for coverage again. Timely submission is crucial to secure health benefits for yourself and your dependents.

Common mistakes

Completing the Highmark Enrollment form can be a straightforward process, but many individuals make common mistakes that can lead to problems later on. One prevalent error is failing to provide accurate personal details. For instance, omitting or incorrectly entering the Social Security Number can delay processing or result in complications with coverage. It is essential that every field is filled out precisely to ensure that the application is not delayed.

Another frequent mistake involves misunderstanding the marital status options. The form offers multiple categories, including Single/Widowed, Married, and Divorced. Misclassification can lead to inappropriate coverage decisions for dependents. Clearly indicating the correct status is crucial not just for accuracy but also for ensuring that dependents receive the right benefits.

Many individuals overlook the section requiring information about covered dependents. Information such as the birthdate, Social Security Number, and relationship to the subscriber must be meticulously completed. Failing to include all required dependents or providing incorrect details can result in a lack of coverage when it is needed most.

In addition, applicants sometimes forget to sign the form where necessary. The Highmark form requires signatures from both the employee and employer for waivers of coverage. A missing signature can delay enrollment or lead to denial of benefits. It is vital to review the form before submission to ensure all signatures are present.

Finally, applicants may neglect to provide necessary documentation for dependents. For those listed as a domestic partner or under “other," applicable legal documentation must accompany the application. Not providing this documentation can cause confusion and hinder processing. Understanding the documentation requirements is integral to a smooth enrollment experience.

Documents used along the form

When enrolling in a healthcare plan, it's essential to have the right forms and documents on hand. The Highmark Enrollment Form is just one part of the process. Below is a list of other forms and documents commonly used alongside it, which can help ensure a smooth enrollment.

- Dependents Information Form: This document collects detailed information about each dependent that will be covered under the health plan, including their relationship to the subscriber and eligibility verification.

- Proof of Other Insurance Coverage: If a participant is waiving enrollment for themselves or their dependents due to existing insurance, this form is needed to provide proof of that coverage, ensuring compliance with enrollment rules.

- Waiver of Coverage Form: Participants who choose to decline coverage must submit this form. It records their decision and provides a space for them to explain their reasons for waiving, which is important for future enrollment opportunities.

- Authorization to Release Medical Information: This allows the plan administrator to obtain necessary medical records from healthcare providers. It is essential for determining eligibility and coverage for pre-existing conditions if applicable.

- Notice of Privacy Practices: This document outlines how personal health information will be used and safeguarded by the insurance company, ensuring that participants are informed of their rights under HIPAA.

- Medicare Enrollment Form: For individuals who are eligible for Medicare, this form allows for the enrollment into the Medicare program, detailing which parts they wish to enroll in (A, B, and/or D).

- Special Enrollment Period Application: If a participant experiences a qualifying life event such as marriage or the birth of a child, this form is necessary for enrolling at times outside of the regular enrollment period.

- Health Questionnaire: Sometimes required by insurers, this document collects medical history and conditions of the applicant and dependents to assess risk and eligibility for certain types of coverage.

- Claim Submission Form: If any healthcare claims arise, this form is needed to formally submit those claims and ensure that reimbursement is processed correctly.

- Employment Verification Letter: This document is often required to confirm employment status and details, ensuring adherence to eligibility criteria set by the insurance provider.

Having these documents prepared and understood can significantly streamline the enrollment process. It is always wise to consult with your HR department if there are any questions or specific requirements related to your situation.

Similar forms

- Health Insurance Application: Similar to the Highmark Enrollment form, this document gathers necessary information about the applicant and their dependents, including personal details, coverage choices, and relevant health history.

- COBRA Enrollment Form: This form specifically addresses the continuation of health insurance coverage for employees who have left their job. It mirrors the Highmark form in requiring personal and health information.

- Medicaid Application: Like the Highmark Enrollment form, this application collects detailed information about income, household size, and medical needs to determine eligibility for health benefits.

- Medicare Enrollment Form: This document shares similarities with the Highmark form by requesting beneficiary and dependent information, along with choices about specific Medicare coverages.

- Family Medical Leave Act (FMLA) Forms: These forms require personal details and medical reasons for leave, similar to the way the Highmark form gathers health-related information for enrollment.

- Dependent Care Benefits Application: This application collects information on dependents, paralleling the Highmark form’s need for family data and coverage selections.

- Health Savings Account (HSA) Enrollment Form: The HSA form requires personal and family information to set up accounts, similar to the requirements in the Highmark Enrollment form.

- Short-Term Disability Claim Form: This document needs personal and medical details about the claimant, akin to the Highmark form’s requirement for health disclosures.

- Long-Term Care Insurance Application: This application includes a detailed personal and health history section, mimicking the Highmark form’s approach to assessing eligibility.

- Vision and Dental Insurance Applications: These documents request similar personal and dependent information while offering choices about coverage, reflecting the same process as the Highmark form.

Dos and Don'ts

- Check all required boxes, such as enrolling or waiving, to ensure clarity in your intentions.

- Fill in your full legal name and accurate contact information, including your Social Security number.

- List all eligible dependents accurately, ensuring their information matches official documents.

- Provide explanations for any medical conditions marked on the form; details matter.

- Use clear and legible handwriting to avoid misinterpretation of your answers.

- Do not include any genetic information, such as family medical histories or genetic testing results.

- Do not forget to sign and date the form; missing signatures can lead to delays in processing.

Misconceptions

- Misconception 1: The Highmark Enrollment form is only for new employees.

- Misconception 2: Completing the form is optional.

- Misconception 3: Waiving insurance coverage means permanent loss of eligibility.

- Misconception 4: The medical information section impacts my eligibility for basic coverage.

- Misconception 5: Dependents can be added at any time.

- Misconception 6: Only one signature is required on the form.

This form is essential not just for new hires but also for current employees who may wish to enroll dependents, change coverage, or waive benefits. It’s a crucial tool for managing coverage throughout your employment.

Submitting the Highmark Enrollment form is not optional if you wish to enroll in the health insurance plan. It is necessary to ensure that you and your dependents have the coverage you need.

Waiving coverage does not equal permanent loss of eligibility. If you decline coverage due to other insurance, you may still enroll later if you do so within the specified time frames after losing that insurance.

While the medical information section is important, it will not be used to determine your eligibility for enrollment. Instead, it serves to provide Highmark with a comprehensive understanding of your current health situation.

There are specific timeframes for adding dependents, usually tied to events such as marriage or birth. Missing these windows may result in a delay in coverage for your dependents.

Both the employee and employer must sign the form. This requirement underscores the importance of mutual agreement on the coverage being elected or waived.

Key takeaways

Carefully complete all sections of the Highmark Enrollment form. Accurate information ensures proper coverage and avoids delays.

Signatures from both the employee and employer are required, especially if the employee is waiving coverage. Missing signatures may result in processing issues.

Indicate marital status and any covered dependents. Include their details accurately, as this information affects the coverage options available to you.

If declining coverage, be aware of the rules regarding future enrollment. You can enroll yourself or dependents within specified time frames after losing other insurance.

Do not disclose genetic information or family medical history. This type of information is not needed on the enrollment form and may pose privacy issues.

Browse Other Templates

Testamentary Trust Beneficiary Designation - By completing this form, policy owners verify their understanding of the terms and conditions related to beneficiary changes.

Dot Forms - Violations of transportation regulations can lead to penalties.

Guard/Reserve Position Form - Document your military grade and specialty on the form.