Fill Out Your Hmda Data Collection Form

The HMDA Data Collection Form is a crucial instrument for ensuring compliance with the Home Mortgage Disclosure Act (HMDA), which aims to promote transparency in the lending process and enhance fair lending practices. It requires loan officers to provide comprehensive information on various aspects of loan applications, including borrower details, loan type, and property information. Key inquiries on the form include whether the loan is categorized as a home purchase, improvement, or refinance, which sets the stage for all subsequent data collection. Additionally, the form captures essential dates such as when credit was pulled and when the application was received, thereby establishing a timeline for the loan process. It further prompts loan officers to document income details and occupancy status, helping to create a complete borrower profile. Furthermore, details such as loan amounts, actions taken on the application, and property locations play a significant role in HMDA reporting. Each section of the form is designed to ensure that all necessary information is accurately collected and retained, reducing the likelihood of incomplete submissions and potential scrutiny during compliance reviews. Accurate completion of this form is not just advisable; it is essential for meeting federal regulatory standards and supporting lenders in their commitment to fair lending practices.

Hmda Data Collection Example

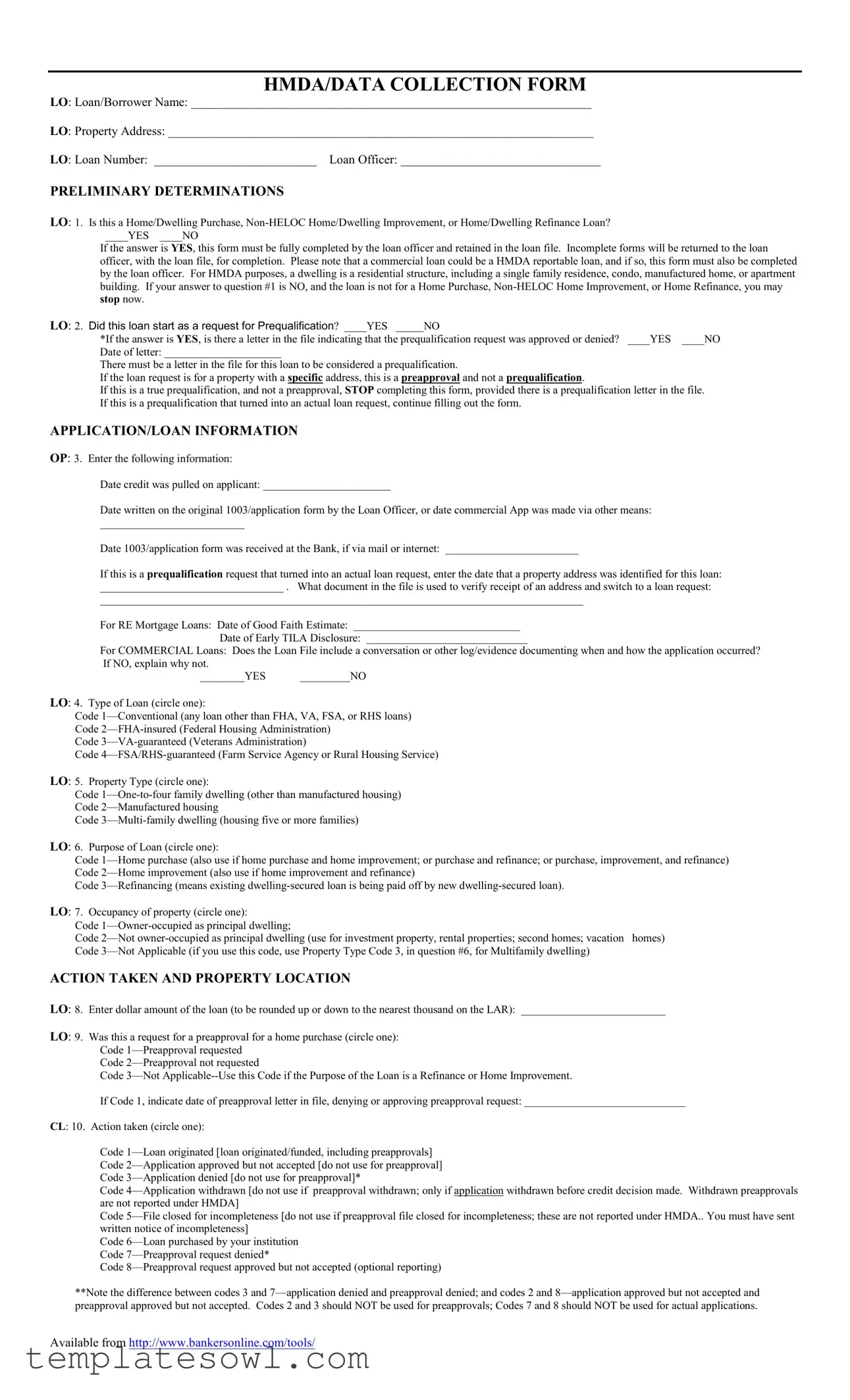

HMDA/DATA COLLECTION FORM

LO: Loan/Borrower Name: ________________________________________________________________

LO: Property Address: ____________________________________________________________________

LO: Loan Number: __________________________ Loan Officer: ________________________________

PRELIMINARY DETERMINATIONS

LO: 1. Is this a Home/Dwelling Purchase,

____YES ____NO

If the answer is YES, this form must be fully completed by the loan officer and retained in the loan file. Incomplete forms will be returned to the loan officer, with the loan file, for completion. Please note that a commercial loan could be a HMDA reportable loan, and if so, this form must also be completed by the loan officer. For HMDA purposes, a dwelling is a residential structure, including a single family residence, condo, manufactured home, or apartment building. If your answer to question #1 is NO, and the loan is not for a Home Purchase,

LO: 2. Did this loan start as a request for Prequalification? ____YES _____NO

*If the answer is YES, is there a letter in the file indicating that the prequalification request was approved or denied? ____YES ____NO

Date of letter: _____________________

There must be a letter in the file for this loan to be considered a prequalification.

If the loan request is for a property with a specific address, this is a preapproval and not a prequalification.

If this is a true prequalification, and not a preapproval, STOP completing this form, provided there is a prequalification letter in the file. If this is a prequalification that turned into an actual loan request, continue filling out the form.

APPLICATION/LOAN INFORMATION

OP: 3. Enter the following information:

Date credit was pulled on applicant: _______________________

Date written on the original 1003/application form by the Loan Officer, or date commercial App was made via other means:

__________________________

Date 1003/application form was received at the Bank, if via mail or internet: ________________________

If this is a prequalification request that turned into an actual loan request, enter the date that a property address was identified for this loan:

_________________________________ . What document in the file is used to verify receipt of an address and switch to a loan request:

_______________________________________________________________________________________

For RE Mortgage Loans: Date of Good Faith Estimate: ______________________________

Date of Early TILA Disclosure: _____________________________

For COMMERCIAL Loans: Does the Loan File include a conversation or other log/evidence documenting when and how the application occurred? If NO, explain why not.

________YES _________NO

LO: 4. Type of Loan (circle one):

Code

Code

Code

Code

LO: 5. Property Type (circle one):

Code

Code

Code

LO: 6. Purpose of Loan (circle one):

Code

Code

LO: 7. Occupancy of property (circle one):

Code

Code

ACTION TAKEN AND PROPERTY LOCATION

LO: 8. Enter dollar amount of the loan (to be rounded up or down to the nearest thousand on the LAR): __________________________

LO: 9. Was this a request for a preapproval for a home purchase (circle one):

Code

Code

Code

If Code 1, indicate date of preapproval letter in file, denying or approving preapproval request: _____________________________

CL: 10. Action taken (circle one):

Code

Code

Code

Code

Code

**Note the difference between codes 3 and

Available from http://www.bankersonline.com/tools/

CL: 11. Date of Action Taken: __________________________________________

What document in the file is used to verify the Action Taken date?_____________________________________________

PR: 12. Property Location (Circle appropriate County and fill in Census Tract Number): |

|

|

MSA/MD: |

|

County: |

42020= San Luis Obispo County |

079=San Luis Obispo County |

|

42060= Santa Barbara County |

083=Santa Barbara County |

|

41500= Monterey County |

053=Monterey County |

|

12540=Kern County |

029=Kern County |

|

Other= _______________ |

111=Ventura County |

|

State: |

|

Other: ______________________ |

06=California |

|

|

Other= _______________ |

Census Tract Number: ________________ |

|

If the property location data is not pulled automatically by software, is there an FFIEC geocode [or Flood Certification] printout/verification in the file? |

||

__________YES |

________ NO If NO, one should be printed out and included in the file. |

|

APPLICANT INFORMATION

LO: 13. For RE Mortgage Loans, is the Government Monitoring Information

how the application was received? |

______YES ____NO |

|

|

|

|

|

|

|||

CL: |

The GMI in the initial and final 1003s must be identical. |

|

|

|

|

|

|

|||

|

Does the GMI in the initial and final 1003s match? _________ YES ________ NO |

|

|

|

|

|

||||

|

If NO, the loan officer must make appropriate notations to ensure that the GMI matches. |

|

|

|

|

|

||||

|

If the loan officer marked GMI information based on visual observation, is that notation included on the 1003, along with the date the visual |

|||||||||

|

observation was made?________ YES |

__________ NO |

|

|

|

|

|

|

||

For Commercial Loans, was a separate Monitoring Information Form completed? _______ YES _______ NO |

|

|

|

|

||||||

COMPLETE CHART BELOW WITH FINAL GMI: |

|

|

|

|

|

|

||||

Ethnicity – 1= Hispanic or Latino |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

2 = Not Hispanic or Latino |

|

|

Ethnicity |

Race |

|

Sex |

|||

|

3 = Information not provided |

|

|

|

Co- |

|

Co- |

|

|

Co- |

|

4 = N/A |

|

|

Applicant |

Applicant |

Applicant |

Applicant |

Applicant |

|

Applicant |

|

5 = No |

|

|

|

|

|

|

|

|

|

Race – 1 |

= American Indian or Alaska Native |

|

|

|

|

|

|

|

|

|

2 = Asian |

|

|

|

|

|

|

|

|

|

|

3= African American |

|

Sex – 1 = Male |

|

|

|

|

|

|

||

4 = Native Hawaiian or Pacific Islander |

2 = Female |

|

|

|

|

|

|

|||

5 |

= White |

|

3 = Information Not Provided |

|

|

|

|

|

||

6 |

= Information not Provided |

|

4 = N/A |

|

|

|

|

|

|

|

7 |

= N/A |

|

5 = No |

|

|

|

|

|

||

8 |

= No |

|

|

|

|

|

|

|

|

|

LO: 14. Income of

thousand on the LAR). If the applicant is not a natural person (i.e., loan to a business entity), or for a multifamily dwelling, enter N/A:_________________

CL: 15. Type of purchaser (circle one):

Code

Code

Code

Code

Code

Code

PR: 16. Lender should indicate the following data regarding the loan, as documented in the file:

Rate Lock Date: ________________

Term: ___________________

Final APR: ___________________

If loan did not originate, circle N/A here: N/A

CL: 17. Rate Spread:

Using the rate lock date, term, and final APR set forth above, obtain the rate spread through the ffiec.gov website’s rate spread calculator. Indicate Rate Spread from website, or N/A if applicable: _________________________

LO: 18: Lien Status (circle

Code

Code

Code

Code

***********************************************************************************************************

___________________________________________________________________________

LOAN OFFICER’S SIGNATUREDate

___________________________________________________________________________

LOAN PROCESSOR’S SIGNATURE |

Date |

(Including verification of loan officer’s reported data) |

|

___________________________________________________________________________

SIGNATURE OF INDIVIDUAL VERIFING CORRECTNESS OF THIS FORM TO FILE Date

____________________________________________________________________________

SIGNATURE OF INDIVIDUAL INPUTTING HMDA LAR DATA |

Date |

After verification of Loan Officer Data, information should be input into the HMDA LAR, and this form should be retained in the Loan File for future compliance oversight reviews and FDIC examination and external audit purposes.

Available from http://www.bankersonline.com/tools/

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of HMDA | The Home Mortgage Disclosure Act (HMDA) is designed to provide transparency in lending practices and help identify patterns of discrimination. |

| Loan Officer Role | The loan officer must complete and retain the HMDA Data Collection form in the loan file for reportable loans. |

| Types of Loans | Loans that require this form include home purchases, home improvements, and refinancing loans. |

| Prequalification Requests | A request for prequalification must be documented and a letter indicating approval or denial should be in the loan file. |

| Document Verification | The loan officer must verify the date of action taken and ensure all required documents are in the file. |

| Government Monitoring Information | Government Monitoring Information (GMI) regarding race, ethnicity, and sex must be recorded accurately in the form. |

| Income Reporting | The applicant's annual income must be reported accurately, rounded to the nearest thousand if applicable. |

| Loan Amount Reporting | The loan amount should be rounded to the nearest thousand dollars when reported in the form. |

| Action Taken Codes | Various codes indicate the action taken on the loan, which must be circled for clarity on the application status. |

| Local Laws | State-specific laws may apply for completing HMDA forms. It is important to check local regulations for compliance. |

Guidelines on Utilizing Hmda Data Collection

Completing the HMDA Data Collection Form is crucial for compliance with regulatory standards. After filling out the form accurately, the data will be utilized in the HMDA LAR, contributing to regulatory oversight and transparency in lending practices.

- Start with the loan/borrower details. Fill in the fields for Loan/Borrower Name, Property Address, and Loan Number. Also, enter the Loan Officer's name.

- For the Preliminary Determinations, answer question 1 regarding the type of loan. If the answer is "YES," ensure the form is completed fully.

- Proceed to question 2. Indicate if this loan started as a request for prequalification and provide any necessary documentation dates.

- For Application/Loan Information, fill in the following dates: the date credit was pulled, the date written on the original 1003/application form, and the date the application was received at the Bank.

- If this is a prequalification turning into a loan request, record the date the property address was identified.

- Indicate the type of loan by circling the appropriate code in question 4. Follow with question 5, circling the correct property type.

- Next, for the purpose of the loan in question 6, circle the code that reflects the loan's intent.

- In question 7, specify the property occupancy by selecting the appropriate code.

- Enter the dollar amount of the loan in question 8, rounding to the nearest thousand.

- For question 9, determine if this was a request for preapproval and provide any corresponding dates if applicable.

- For question 10, circle the action taken on the loan application and document the date of action taken in question 11.

- Complete question 12 by indicating the property location, including the appropriate county and census tract number.

- Address question 13 to confirm if the Government Monitoring Information was completed on the initial 1003 form.

- Provide details for question 14 regarding the applicant's annual income. Enter N/A if not applicable.

- Identify the type of purchaser in question 15 by circling the appropriate code.

- For question 16, document the rate lock date, term, and final APR related to the loan.

- In question 17, utilize the FFIEC website’s rate spread calculator and indicate the rate spread or N/A.

- Lastly, circle the lien status in question 18 and complete all necessary signatures at the bottom of the form, ensuring verification of accuracy.

Once all the steps are completed, it's essential to retain the form in the loan file. This ensures availability for future compliance reviews and regulatory audits.

What You Should Know About This Form

What is the HMDA Data Collection Form?

The HMDA Data Collection Form is a crucial document for loan officers when processing applications for certain types of residential loans. It collects specific information needed to comply with the Home Mortgage Disclosure Act (HMDA). This form helps ensure transparency in lending practices and supports fair lending efforts by tracking how loans are distributed across different communities.

Who needs to complete the HMDA Data Collection Form?

The loan officer is responsible for fully completing the HMDA Data Collection Form. It is essential that all relevant sections are filled out accurately, as incomplete forms will be returned for completion. This diligence ensures compliance with regulations that govern mortgage lending practices.

What types of loans require this form?

The HMDA Data Collection Form is required for home purchases, non-HELOC home improvements, and home refinances. Additionally, commercial loans may also require this form if they are reportable under HMDA standards. A dwelling, in this context, refers to various types of residential structures, including single-family homes, condominiums, manufactured homes, and multi-family buildings.

What happens if I mark "No" for the loan types?

If you mark "No" for the types of loans mentioned, you can stop filling out the form. It will not be necessary to complete the HMDA Data Collection Form for loans that do not fall within the specified categories, such as those not intended for home purchases, improvements, or refinances.

Is prior prequalification information necessary for the HMDA Data Collection Form?

If the loan started as a request for prequalification, yes, this information is vital. You must confirm whether there is a letter in the file indicating the prequalification request's approval or denial. Without this documentation, the loan cannot proceed as a prequalification, but rather it may need further completion.

What kind of information is documented in the applicant's section?

This section requires the Government Monitoring Information (GMI), which includes details like the applicant's race, ethnicity, and sex. It is important that this information is consistent across the documents submitted. If there is a variation, the loan officer must make appropriate notations for clarity and compliance.

What does the loan officer need to document regarding the loan's action taken?

The loan officer must indicate what action was taken on the loan. This could include whether the loan was originated, approved but not accepted, denied, or withdrawn. Each of these outcomes has specific codes that must be selected accurately to reflect the loan's status.

When should the HMDA Data Collection Form be retained?

The HMDA Data Collection Form should be retained in the loan file after it has been filled out and verified. This is crucial for compliance oversight and to prepare for potential examinations, audits, or reviews by regulatory agencies such as the FDIC.

Is there any training available for completing the HMDA Data Collection Form?

Yes, many institutions and organizations offer training sessions and resources to help loan officers accurately complete the HMDA Data Collection Form. These trainings focus on understanding the importance of compliance, ensuring proper documentation, and familiarizing oneself with the specific requirements set out by HMDA.

Common mistakes

Completing the HMDA Data Collection Form can seem like a straightforward process, but there are common pitfalls that can lead to errors. One frequent mistake is failing to answer the preliminary determinations accurately. For instance, if theloan officer does not clearly establish whether the loan in question is a purchase, improvement, or refinance, it can cause complications later on. A simple "yes" or "no" is insufficient if the explanation of the loan's purpose isn't clear. Therefore, ensuring that the correct type of loan is selected right from the start is crucial.

In addition, another common error occurs when verifying if a prequalification request has proper documentation. If the loan started as a prequalification request, there must be a letter indicating whether that request was approved or denied. Without this letter, the application process may be jeopardized. It's important that all necessary documentation is gathered before continuing with the form, as this step is foundational for the application's integrity and compliance.

The third mistake often involves the applicant information section. When completing the Government Monitoring Information (GMI), one may overlook the requirement for consistency between the initial and final application forms. If discrepancies occur, this can lead to significant delays and might necessitate additional explanations from the loan officer. The GMI should match precisely to avoid unnecessary complications. Therefore, taking time to double-check this section is fundamental.

Finally, many individuals fail to provide complete property location information. If software does not automatically extract this data, it is crucial to ensure it’s filled out correctly with the necessary census tract number and other details. Omissions or inaccuracies in property location can invalidate the data collected and impacts compliance reporting significantly. Therefore, taking the time to verify details can save a lot of headaches down the line.

Documents used along the form

The Home Mortgage Disclosure Act (HMDA) Data Collection Form is vital for monitoring lending practices and ensuring fair access to credit. However, several other forms and documents accompany this primary form in the loan processing journey. Each of these documents has a specific purpose, contributing to the comprehensive understanding of the borrower's information and the loan's nature.

- Loan Application (1003 Form): This is the standard mortgage application form used to collect detailed information about the borrower's financial status, employment, and property interest. It serves as the basis for the lending decision.

- Good Faith Estimate (GFE): This document outlines the estimated costs associated with the mortgage, including closing costs and other fees. It helps borrowers understand the financial implications of the loan before finalizing any agreements.

- TILA Disclosure: Required by the Truth in Lending Act, this disclosure provides borrowers with essential information about the terms of credit agreements, enabling them to make informed decisions about their loans.

- Government Monitoring Information (GMI) Form: This form collects demographic data such as race, ethnicity, and sex of borrowers. It allows lenders to comply with HMDA regulations and assess potential discriminatory lending practices.

- Prequalification Letter: This document indicates the lender's initial assessment of the borrower's creditworthiness for a loan. It is typically provided before formal loan processing begins and is crucial for buyers in a competitive housing market.

- Loan Estimate (LE): A more streamlined version of the GFE, this form provides detailed information on the costs and terms of the mortgage, ensuring borrowers receive clear and pertinent financial guidance early in the process.

- Credit Report: The credit report gives lenders a comprehensive view of the borrower's credit history, informing decisions about loan approval and terms based on creditworthiness.

- Loan Commitment Letter: Once a loan is approved, this letter details the terms and conditions of the loan commitment before the funds are disbursed. It serves as an agreement between the lender and the borrower, outlining what's expected moving forward.

- Closing Disclosure (CD): Provided before the final loan closing, this document discloses all final loan terms, projected monthly payments, and costs associated with the completion of the transaction. It ensures that borrowers are fully informed before signing on the dotted line.

Each of these documents plays a significant role in the loan application process, enhancing transparency and ensuring that both the lender and borrower are aligned in their understanding of the loan's terms and conditions. Thorough documentation allows for better compliance and ultimately leads to smoother transactions, safeguarding the interests of all parties involved.

Similar forms

Uniform Residential Loan Application (Form 1003): This application captures essential details about the borrower and the property, similar to the HMDA Data Collection form which requires comprehensive borrower information and loan specifics. Both forms serve as foundational documents in the loan application process.

Loan Estimate (LE): The LE provides key details about loan terms and costs, paralleling the HMDA form's requirement to disclose estimated costs and timelines associated with securing a loan, helping borrowers understand financial implications.

Closing Disclosure (CD): Like the HMDA form, the CD lays out the final terms of the loan and costs. Both documents aim to ensure transparency and provide borrowers with clear information about the financial obligations associated with the loan.

Government Monitoring Information (GMI): The GMI is often included on the 1003 form, gathering applicant demographics, just like the HMDA Data Collection form aims to collect data for analyzing lending practices, ensuring compliance with fair lending laws.

Mortgage Application Fraud Detection Forms: These forms include details used to detect potential inaccuracies or fraud in mortgage applications. Similar to the HMDA Data Collection form, they require detailed borrower and property information to assess the legitimacy of the loan request.

Fair Lending Compliance Report: This report reviews loan data to ensure compliance with fair lending laws, akin to the purpose of the HMDA Data Collection form, which is designed to ensure equitable lending practices by collecting vital loan and borrower information.

Dos and Don'ts

Do's and Don'ts for Completing the HMDA Data Collection Form

- Do ensure that the form is fully completed by the loan officer.

- Do verify that a prequalification letter is included in the loan file if applicable.

- Do document all dates accurately regarding loan actions and applications.

- Do check for matching Government Monitoring Information (GMI) on both initial and final 1003 forms.

- Don’t leave any fields incomplete, as this may result in the return of the form.

- Don’t confuse prequalification with preapproval; understand their differences.

- Don’t neglect to include supporting documents that validate the actions taken on the loan.

Misconceptions

Misconception 1: The HMDA data collection form is only for residential loans.

This is not true. While most commonly associated with residential loans, the form can also apply to some commercial loans if they meet certain criteria for HMDA reporting.

Misconception 2: Only the loan officer needs to complete the form.

Actually, all relevant parties involved in the loan process play a role. Accurate information must be gathered from various sources to ensure the form is complete and correct.

Misconception 3: If a loan is denied, the data collection form does not need to be filled out.

This is incorrect. Even for denied loans, certain data must be collected and reported if they meet the HMDA reporting thresholds.

Misconception 4: The form does not need to be retained once the loan process is complete.

In fact, the form must be kept in the loan file for future audits and compliance reviews. It is an important part of the documentation.

Misconception 5: Completion of the form is optional for prequalifications.

This is a misunderstanding. If the prequalification turns into an actual loan request, the form must be completed to comply with HMDA regulations.

Misconception 6: Using the wrong codes on the form doesn’t really matter.

On the contrary, using incorrect codes can lead to reporting issues and potential compliance violations. It is essential to select the correct codes based on the loan details.

Key takeaways

When filling out and utilizing the HMDA Data Collection Form, consider the following key takeaways to ensure compliance and accuracy:

- Completion Requirement: The form must be fully completed if the loan is a Home Purchase, Non-HELOC Home Improvement, or Home Refinance. Incomplete forms will be returned.

- Documentation of Prequalification: If the loan started as a prequalification, a letter must be included in the file indicating the approval or denial of that request.

- Accurate Dates: Record several important dates, such as when credit was pulled, when the application was received, and specific disclosures were dated. This information is crucial for tracking the loan's progress.

- Loan Type Identification: Clearly identify the type of loan being processed, whether it’s conventional, FHA-insured, VA-guaranteed, or FSA/RHS-guaranteed. This affects reporting requirements.

- Property Information: Document the property type, occupancy status, and precise property location, including county and census tract number, to ensure accurate reporting.

- Government Monitoring Information: Ensure that the Government Monitoring Information (GMI) regarding race, ethnicity, and sex is completed accurately on the initial 1003 form as well as the final one. Match the details to avoid discrepancies.

- Verification and Retention: After ensuring all data is accurate, retain the completed form in the loan file for compliance reviews and audits. Verification signatures from both the loan officer and processor are essential.

Browse Other Templates

Lic9282 - The form includes a section dedicated to any relevant courses of study undertaken by the applicant.

Allied Benefits Timely Filing Limit - Joining the Flex Chek program allows you to manage your finances more effectively.

Imm5707 Canada - Attach an additional form if more space is needed for family information.