Fill Out Your Homeowner Assumption Hudfha Form

Navigating the complexities of homeownership can often lead to unfamiliar documentation, one of which is the Homeowner Assumption HUD/FHA form. This essential document plays a crucial role when selling your home, particularly for those with FHA-insured mortgages. It informs homeowners about their ongoing obligations under the mortgage, highlighting the importance of continuing to make monthly payments—even after the title has been transferred. Homeowners should be aware that if they sell their property to someone who does not meet HUD's credit requirements or will not occupy the home as their primary residence, the mortgage lender may demand full repayment of the loan. This could leave sellers unexpectedly responsible for debts they believed were settled. However, there is a way to release yourself from this liability: obtaining a release from your mortgage lender. When selling to a creditworthy buyer, the HUD-92210-1 form—found within the Homeowner Assumption process—facilitates this release. It’s important to ask for this form if it’s not provided automatically; without it, you could remain legally tied to the mortgage even after the sale. Understanding these details is vital for protecting your financial interests during a property transaction.

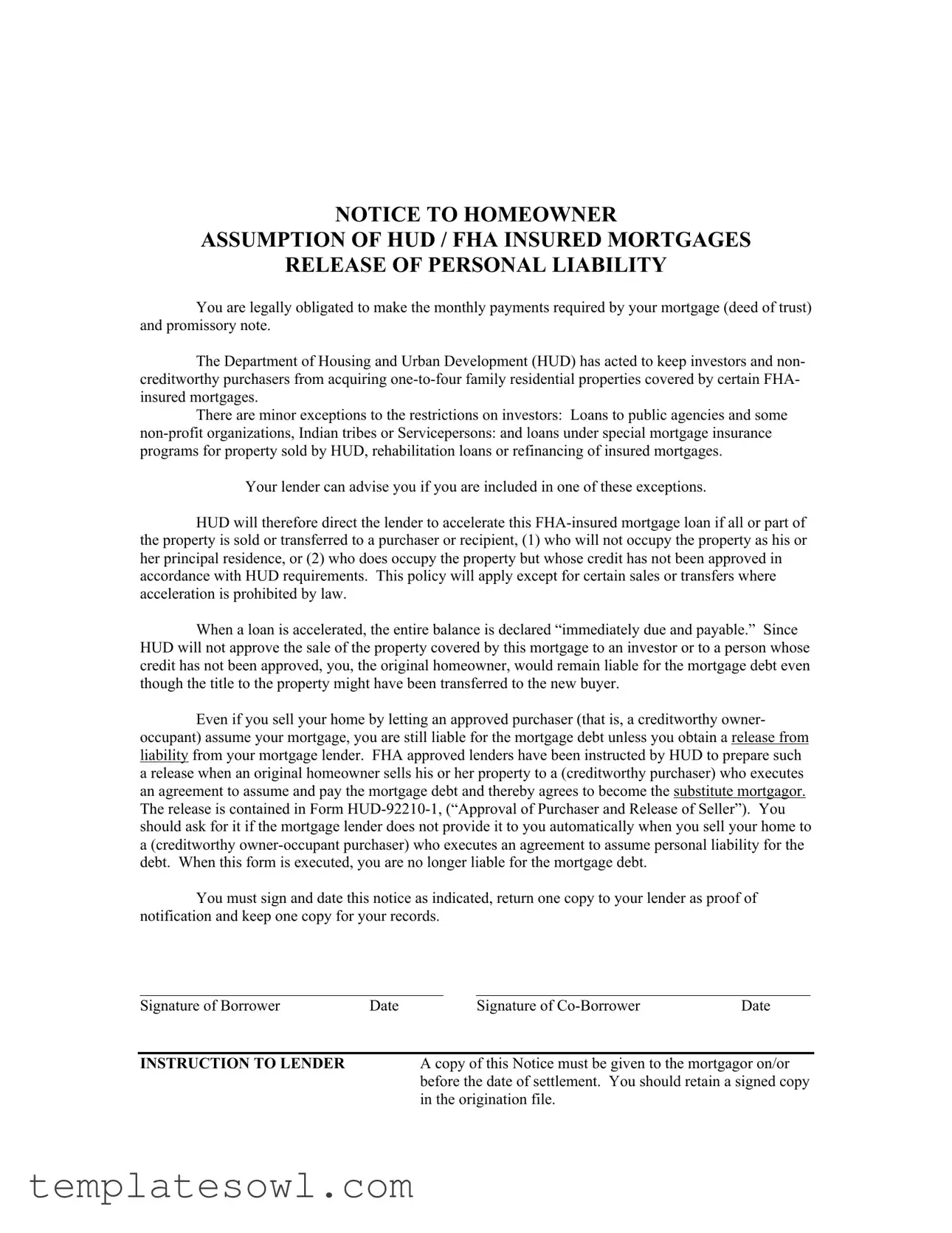

Homeowner Assumption Hudfha Example

NOTICE TO HOMEOWNER

ASSUMPTION OF HUD / FHA INSURED MORTGAGES

RELEASE OF PERSONAL LIABILITY

You are legally obligated to make the monthly payments required by your mortgage (deed of trust) and promissory note.

The Department of Housing and Urban Development (HUD) has acted to keep investors and non- creditworthy purchasers from acquiring

There are minor exceptions to the restrictions on investors: Loans to public agencies and some

Your lender can advise you if you are included in one of these exceptions.

HUD will therefore direct the lender to accelerate this

When a loan is accelerated, the entire balance is declared “immediately due and payable.” Since HUD will not approve the sale of the property covered by this mortgage to an investor or to a person whose credit has not been approved, you, the original homeowner, would remain liable for the mortgage debt even though the title to the property might have been transferred to the new buyer.

Even if you sell your home by letting an approved purchaser (that is, a creditworthy owner- occupant) assume your mortgage, you are still liable for the mortgage debt unless you obtain a release from liability from your mortgage lender. FHA approved lenders have been instructed by HUD to prepare such a release when an original homeowner sells his or her property to a (creditworthy purchaser) who executes an agreement to assume and pay the mortgage debt and thereby agrees to become the substitute mortgagor. The release is contained in Form

You must sign and date this notice as indicated, return one copy to your lender as proof of notification and keep one copy for your records.

_______________________________________ |

___________________________________________ |

||

Signature of Borrower |

Date |

Signature of |

Date |

|

|

||

INSTRUCTION TO LENDER |

A copy of this Notice must be given to the mortgagor on/or |

||

|

before the date of settlement. You should retain a signed copy |

||

|

in the origination file. |

|

|

Form Characteristics

| Fact Title | Description |

|---|---|

| Payment Obligation | The homeowner remains legally obligated to pay monthly mortgage payments as per their deed of trust and promissory note, even after selling or transferring the property. |

| HUD's Role | The Department of Housing and Urban Development (HUD) aims to prevent non-creditworthy buyers and investors from acquiring properties under certain FHA-insured mortgages. |

| Exceptions to Restrictions | Specific exceptions allow loans to public agencies, non-profit organizations, Indian tribes, or service personnel as well as special programs sold by HUD. |

| Mortgage Acceleration | If the property is sold or transferred to anyone who does not meet HUD's credit requirements, the lender must accelerate the loan, making the entire balance due immediately. |

| Seller Liability | Even after a sale, the original homeowner remains liable for the mortgage debt unless a release from liability is obtained from the lender. |

| FHA Lender Instructions | HUD mandates that FHA-approved lenders prepare a release of liability when the original homeowner sells to a creditworthy purchaser who assumes the mortgage. |

| Form HUD-92210-1 | This form contains the “Approval of Purchaser and Release of Seller” provision, facilitating the release of the original homeowner from liability when the mortgage is assumed by an approved buyer. |

| Documentation Requirement | Homeowners must sign and return one copy of the notice to their lender as proof of notification while keeping another for their records. |

| Settlement Instructions | Lenders must provide a copy of the Notice to the mortgagor before or on the settlement date and keep a signed copy in the origination file. |

| Applicable State Laws | The form adheres to federal laws governing FHA loans. State-specific laws may apply and should be reviewed for compliance during the transfer process. |

Guidelines on Utilizing Homeowner Assumption Hudfha

Filling out the Homeowner Assumption HUD/FHA form is straightforward but requires careful attention to detail. Following the steps below will ensure that you complete the form accurately and fulfill your obligations as a homeowner.

- Obtain the form: Make sure you have the Homeowner Assumption HUD/FHA form on hand. You can usually request this from your lender or find it on the HUD website.

- Read the instructions: Familiarize yourself with the guidelines provided on the form. This will help you understand what information is needed and why it is important.

- Fill in your details: Enter your name as the borrower in the appropriate section. If applicable, include the co-borrower's name as well.

- Provide the date: Write the date next to your signature in the designated area. It is crucial to timestamp your action correctly.

- Review your information: Double-check all entries for accuracy. Ensure that names and dates are spelled correctly, as mistakes can lead to delays.

- Sign the form: Sign and date the form as the borrower and, if necessary, the co-borrower. This step is essential as it signifies your approval and understanding of the terms.

- Submit the form: Return one copy of the completed form to your lender. This acts as proof that you have notified them of the proposed transaction.

- Keep a copy: Retain one signed copy for your records. This is important for future reference and ensures you have documentation of your notification.

After completing these steps, you will have fulfilled your obligations regarding the Homeowner Assumption HUD/FHA form. It's advisable to follow up with your lender to confirm they received the completed document, ensuring a smooth transition for all parties involved.

What You Should Know About This Form

What is the Homeowner Assumption HUD/FHA Form?

The Homeowner Assumption HUD/FHA Form is used when a homeowner sells their property to a creditworthy buyer who assumes the existing FHA-insured mortgage. This form helps ensure that the original homeowner can be released from liability for the mortgage debt after the transfer of the property.

Why is this form necessary?

This form is required because original homeowners remain responsible for the mortgage debt even if they sell their property. The form, specifically Form HUD-92210-1, allows the original borrower to be released from responsibility upon a successful transfer to a creditworthy buyer who agrees to assume the mortgage.

Who needs to sign the form?

Both the original homeowner (borrower) and the lender must sign the form. The original homeowner will need to complete the steps to ensure they are no longer liable for the mortgage debt once the property has sold.

What happens if the buyer does not meet HUD's credit requirements?

If the buyer does not meet HUD's credit requirements, the lender is required to accelerate the mortgage loan. This means that the full remaining balance of the mortgage becomes immediately due and payable. The original homeowner will still be liable for the mortgage, regardless of the property's transfer.

Are there any exceptions to the rules regarding FHA-insured mortgages?

Yes, there are some exceptions. Loans to public agencies, certain non-profit organizations, Indian tribes, service members, and special mortgage insurance programs are among those that may not require adherence to these restrictions.

How can I obtain a release of liability?

To obtain a release of liability, the homeowner should request it from their mortgage lender when selling the property. If the lender does not provide this release at the time of sale, the homeowner must ensure to ask for Form HUD-92210-1 to be completed upon the sale to a creditworthy purchaser.

What should I do after signing the notice?

After signing the notice, the original homeowner should return one copy to the lender as proof of notification. It is also important to keep another copy for personal records. This documentation helps provide proof of the liability release once the transaction is complete.

What is the lender's responsibility regarding this form?

The lender must provide a copy of this notice to the mortgagor prior to the settlement date. Additionally, they should retain a signed copy in the origination file for their records.

When can I sell my home to an investor?

What happens to the mortgage if the homeowner does not sell to a creditworthy purchaser?

If the homeowner sells to someone who does not meet the credit approval criteria, the borrower remains liable for the mortgage, and the loan may be accelerated. This emphasizes the importance of ensuring that the new buyer is creditworthy and capable of assuming the mortgage responsibility.

Common mistakes

When filling out the Homeowner Assumption HUD/FHA form, it's crucial to avoid certain common pitfalls that can complicate the process. First and foremost, many homeowners neglect to read through the entire form carefully. Skimming through the document may lead to misunderstandings about the obligations and liabilities that still apply after transferring the mortgage. This oversight can create confusion down the line, especially if there are unexpected financial repercussions.

Another frequent mistake is failing to obtain a release of liability from the lender. Homeowners often assume that once they sell their property, they are automatically relieved of their mortgage debt. However, without this important release, the original homeowner remains liable for the mortgage—even if they are no longer the property owner. There’s a critical need to request this release formally, as it protects the homeowner from future financial obligations associated with the property.

In addition, some individuals forget to keep a copy of the signed notice for their own records. After submitting the Homeowner Assumption HUD/FHA form, having a personal copy is essential. It serves as proof of their compliance and can be helpful if disputes arise later regarding the mortgage or property ownership.

Furthermore, incorrect or missing signatures can cause delays in processing. Homeowners occasionally overlook signing or dating the form correctly. It’s vital to ensure that all designated signatures are present and that the dates are accurate, as this can affect the validity of the submission and lead to unnecessary complications.

Lastly, misunderstanding or not verifying the creditworthiness of the purchaser can be detrimental. If a homeowner transfers the mortgage to someone whose credit has not been approved according to HUD requirements, the lender may accelerate the loan. This means the entire mortgage balance becomes due immediately. Therefore, ensuring that the buyer is indeed creditworthy is essential for a smooth transaction and for avoiding future liability issues.

Documents used along the form

The Homeowner Assumption HUD/FHA form is an essential document in the process of transferring mortgage liability when selling a home. However, there are several other important forms and documents often used in conjunction with it. These documents help clarify various aspects of the mortgage agreement, ensure compliance with federal regulations, and give protection to both sellers and buyers.

- Form HUD-92210-1: Approval of Purchaser and Release of Seller - This document is crucial for a homeowner selling their property. It officially releases the original seller from personal liability for the mortgage once a qualified buyer assumes the loan. The homeowner must request this from their lender to safeguard their interests.

- Loan Assumption Agreement - This agreement outlines the terms under which a buyer can assume the seller's mortgage. It details responsibilities and obligations, including payment terms, to ensure clarity for both parties involved in the transaction.

- Good Faith Estimate (GFE) - A GFE provides prospective homeowners with an estimate of the closing costs and other expenses they can expect in the transaction. It promotes transparency and informed decision-making for buyers considering assuming a mortgage.

- Transfer of Ownership Document - This document officially records the transfer of ownership from the seller to the buyer. It is typically filed with the county recorder's office to update public records and solidify the buyer's claim to the property.

- FHA Case Number Assignment - For homes under FHA insurance, obtaining an FHA case number is mandatory. This number tracks the mortgage loan throughout its life and is essential for processing the assumption or any modifications related to the loan.

Utilizing these forms and documents alongside the Homeowner Assumption HUD/FHA form ensures a smoother transition during the sale or transfer of property. Each plays an integral role in protecting the interests of all parties involved and maintaining compliance with FHA guidelines.

Similar forms

The Homeowner Assumption HUD/FHA form has similarities with several other important documents related to real estate transactions and mortgage agreements. Below is a list of five such documents and their similarities:

- Loan Assumption Agreement: This document allows a buyer to take over the existing mortgage from the seller. Like the Homeowner Assumption form, it outlines the buyer's obligation to make mortgage payments and specifies that the original borrower remains liable unless a formal release is obtained.

- Deed in Lieu of Foreclosure: This document allows homeowners facing foreclosure to transfer the property's title to the lender in exchange for avoiding foreclosure proceedings. Similar to the Homeowner Assumption form, it addresses liability and the impact of property transfer on the homeowner's financial responsibilities.

- Subordination Agreement: This document changes the priority of liens on a property. While primarily used in refinancing scenarios, it can relate to the Homeowner Assumption form in situations where loan terms are modified, impacting homeowner obligations during ownership transfer.

- Release of Liability Agreement: This document formally releases the original borrower from mortgage obligations after a sale. Like the Homeowner Assumption form, it is crucial for ensuring that the former owner's liability is eliminated once the mortgage is assumed by a qualified buyer.

- FHA Case Number Assignment: This document is assigned during loan processing for FHA-insured loans. Similar to the Homeowner Assumption process, it tracks the mortgage and ensures that all guidelines are followed throughout any transfer or assumption of the loan.

Dos and Don'ts

When filling out the Homeowner Assumption HUD/FHA form, there are important dos and don'ts to keep in mind. This will help ensure a smoother process.

- Do read the entire form carefully before filling it out.

- Do provide accurate and up-to-date information about the property and borrower.

- Do sign and date the notice as indicated on the form.

- Don't leave any sections blank that are required to be filled out.

- Don't ignore the need for a release of liability from your lender if applicable.

- Don't forget to retain a copy of the completed form for your records.

Misconceptions

Misconception 1: Completing the Homeowner Assumption HUD/FHA form releases the original homeowner from all liabilities.

This is incorrect. The original homeowner remains liable for the mortgage debt unless they obtain a formal release from liability from the lender, even if the property is sold to an approved buyer.

Misconception 2: Any buyer can assume the FHA-insured mortgage.

In reality, only creditworthy buyers who will occupy the property as their primary residence are eligible to assume the mortgage. Investors and those with unapproved credit cannot assume the loan.

Misconception 3: The HUD/FHA form is optional and not crucial to the assumption process.

This is misleading. Completing and submitting the form is essential to ensure the original homeowner is officially released from liability after the property is sold to a creditworthy buyer.

Misconception 4: Lenders automatically provide a release of liability when the property is sold.

This assumption can lead to complications. Homeowners must explicitly request the release from their lender when selling to ensure they are no longer liable for the mortgage debt.

Misconception 5: All FHA-insured loans allow for easy transfer to new buyers.

This is not accurate. There are specific restrictions and conditions that apply, which can vary depending on the type of FHA loan and the buyer's qualifications.

Misconception 6: The lender must grant permission for the sale to go through.

While lenders must be notified about the sale and the assumption, they cannot deny a sale if the terms of the mortgage allow for it. However, they can deny the assumption of the mortgage if the buyer is not creditworthy.

Misconception 7: The assumption agreement is enough to eliminate a homeowner's financial responsibility.

This is a significant misunderstanding. An assumption agreement alone does not absolve the original homeowner of responsibility for the mortgage debt unless a formal release is executed by the lender.

Key takeaways

Here are key takeaways about filling out and using the Homeowner Assumption HUD/FHA form:

- The homeowner is responsible for making monthly mortgage payments as outlined in the mortgage and promissory note.

- HUD safeguards FHA-insured properties by restricting certain transactions, particularly to investors and non-creditworthy buyers.

- Exceptions may exist for public agencies, non-profits, Indian tribes, service members, and specific mortgage insurance programs. Consult your lender for details.

- When a property is sold or transferred to a non-occupying buyer or one without approved credit, the lender may accelerate the loan, making the total balance due immediately.

- Even if the property title transfers, the original homeowner remains liable for the mortgage debt without a formal release from the lender.

- The FHA-approved lender must provide a release of liability (Form HUD-92210-1) when the property sells to a creditworthy purchaser who assumes the mortgage.

- Complete the required notice, sign, date, return a copy to the lender, and keep one for personal records to ensure liability release.

Browse Other Templates

Vehicle Ownership Declaration,Watercraft Title Certification,ORV Registration Affidavit,Snowmobile Ownership Affidavit,Michigan Vehicle Certification Form,Title Recovery Statement,Ownership Verification Form,Certificate of Vehicle Custody,Vehicle Tit - Use the form to certify that the vehicle was inspected thoroughly, meeting state requirements.

Signs of Neglect - All information submitted on the LDSS-2221A is kept confidential as per law.

De6 Form - The form serves as a tool for maintaining accurate employer records with the EDD.