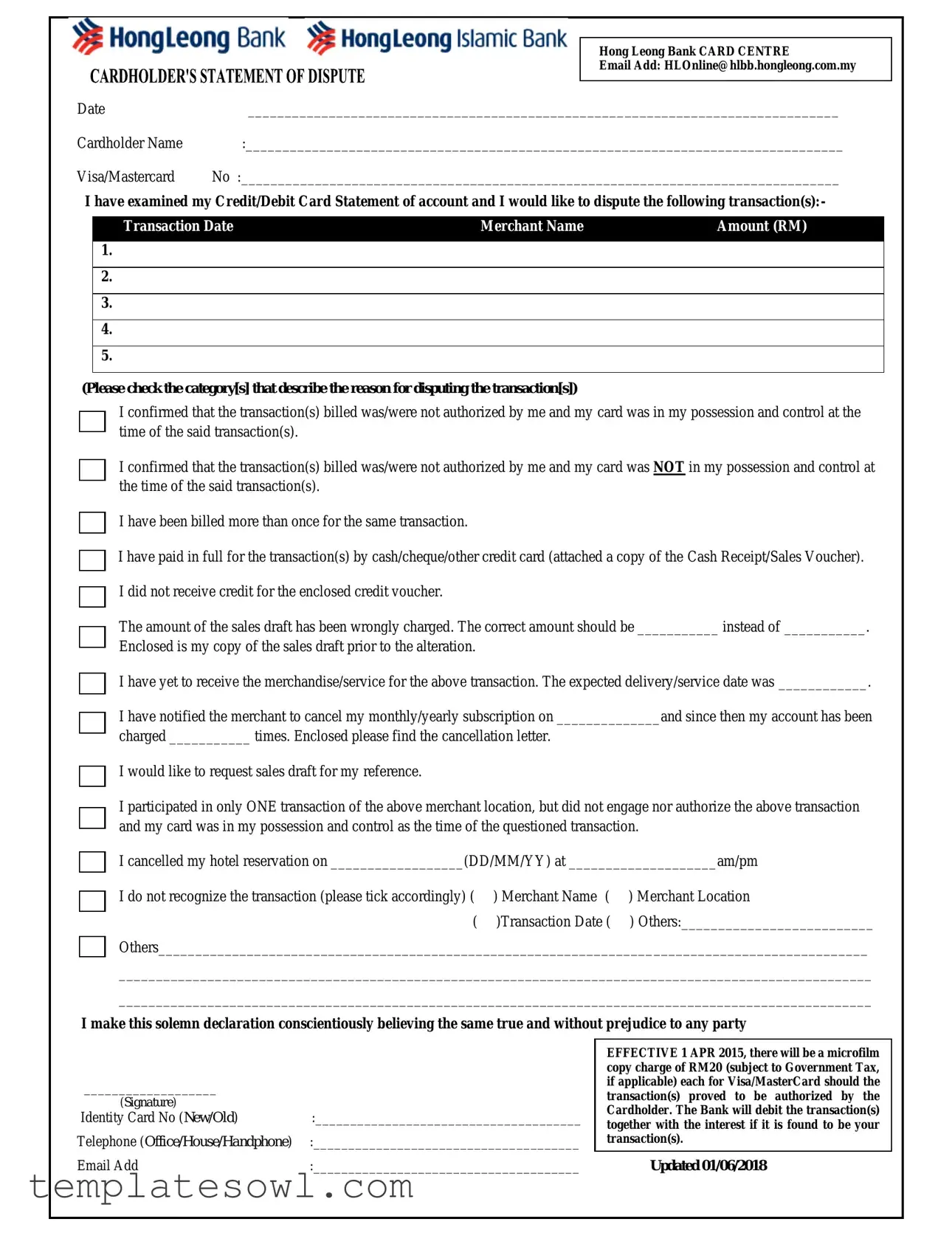

Fill Out Your Hong Leong Bank Dispute Form

When dealing with discrepancies on your Hong Leong Bank credit or debit cards, having a clear avenue for resolution is essential. The Hong Leong Bank Dispute form facilitates this process by enabling cardholders to formally contest transactions that seem erroneous or unauthorized. Often, it includes sections for detailing the date, merchant, and dollar amount of disputed charges, allowing for a comprehensive overview of the issue at hand. Cardholders are prompted to specify their reasons for the dispute, ranging from unauthorized transactions to billing errors or undelivered services. The form also requests important supporting documents, such as receipts or cancellation letters, to bolster the cardholder's claims. Additionally, specific declarations are mandated to affirm the cardholder's position—whether their card was in their possession during the transaction or if multiple charges were made in error. Finally, it’s worth noting that starting April 1, 2015, a microfilm copy fee may apply if the dispute is found to be the cardholder's responsibility, underscoring the importance of submitting accurate and truthful information with this form.

Hong Leong Bank Dispute Example

|

|

Hong Leong Bank CARD CENTRE |

|

|

Email Add: HLOnline@hlbb.hongleong.com.my |

|

|

|

Date |

________________________________________________________________________________ |

|

Cardholder Name |

:_________________________________________________________________________________ |

|

Visa/Mastercard |

No :_________________________________________________________________________________ |

|

I have examined my Credit/Debit Card Statement of account and I would like to dispute the following transaction(s):-

Transaction DateMerchant NameAmount (RM)

1.

2.

3.

4.

5.

(Please check the category[s] that describe the reason for disputing the transaction[s])

I confirmed that the transaction(s) billed was/were not authorized by me and my card was in my possession and control at the time of the said transaction(s).

I confirmed that the transaction(s) billed was/were not authorized by me and my card was NOT in my possession and control at the time of the said transaction(s).

I have been billed more than once for the same transaction.

I have paid in full for the transaction(s) by cash/cheque/other credit card (attached a copy of the Cash Receipt/Sales Voucher).

I did not receive credit for the enclosed credit voucher.

The amount of the sales draft has been wrongly charged. The correct amount should be ___________ instead of ___________.

Enclosed is my copy of the sales draft prior to the alteration.

I have yet to receive the merchandise/service for the above transaction. The expected delivery/service date was ____________.

I have notified the merchant to cancel my monthly/yearly subscription on ______________and since then my account has been

charged ___________ times. Enclosed please find the cancellation letter.

I would like to request sales draft for my reference.

I participated in only ONE transaction of the above merchant location, but did not engage nor authorize the above transaction and my card was in my possession and control as the time of the questioned transaction.

I cancelled my hotel reservation on __________________(DD/MM/YY) at ____________________am/pm

I do not recognize the transaction (please tick accordingly) ( |

) Merchant Name ( |

) Merchant Location |

( |

)Transaction Date ( |

) Others:__________________________ |

Others________________________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

I make this solemn declaration conscientiously believing the same true and without prejudice to any party

___________________

(Signature) |

|

Identity Card No (New/Old) |

:______________________________________ |

Telephone (Office/House/Handphone) :______________________________________ |

|

Email Add |

:______________________________________ |

EFFECTIVE 1 APR 2015, there will be a microfilm copy charge of RM20 (subject to Government Tax, if applicable) each for Visa/MasterCard should the transaction(s) proved to be authorized by the Cardholder. The Bank will debit the transaction(s) together with the interest if it is found to be your transaction(s).

Updated 01/06/2018

Form Characteristics

| Fact Name | Description |

|---|---|

| Contact Information | The dispute form includes a designated email address: HLOnline@hlbb.hongleong.com.my for inquiries and submissions. |

| Date Field | An area is provided for the cardholder to fill in the date of the dispute submission. |

| Cardholder Identification | The form requires the cardholder's name and their Visa/MasterCard number for identification purposes. |

| Transaction Details | The form includes fields for the cardholder to list transaction dates, merchant names, and amounts related to the dispute. |

| Authorization Confirmation | The cardholder must confirm whether the disputed transactions were authorized or not. |

| Duplicate Billing | One of the reasons for disputing a transaction is if the cardholder has been billed multiple times for the same transaction. |

| Merchandise/Service Issues | The form allows cardholders to report issues such as non-receipt of merchandise or services. |

| Cancellation Confirmation | Cardholders are required to provide details if they have canceled subscriptions or reservations. |

| Microfilm Copy Charge | As of April 1, 2015, the bank will charge RM20 for microfilm copies if disputed transactions are found authorized by the cardholder. |

Guidelines on Utilizing Hong Leong Bank Dispute

Filling out the Hong Leong Bank Dispute form requires careful attention to detail. This document is essential for addressing any discrepancies you may have noticed with your credit or debit card transactions. Once completed and submitted, the bank will review your claim and respond accordingly.

- Begin by entering the date at the top of the form.

- Write your full name in the designated field for the Cardholder Name.

- Fill in your Visa or Mastercard number accurately.

- Review your Credit/Debit Card Statement and list all transactions you wish to dispute, including:

- Transaction Date

- Merchant Name

- Amount (RM)

- Check the box(es) for the reasons that apply to your dispute.

- Complete the declaration by signing your name.

- Provide your Identity Card number, whether it is a new or old ID.

- Include your contact numbers (office, home, and/or mobile).

- Enter your email address in the designated area.

Once all steps have been thoroughly completed, review the form for accuracy. Ensure you have all supporting documents ready before submitting your dispute. This streamlined approach will help facilitate a more efficient review process by the bank.

What You Should Know About This Form

What is the Hong Leong Bank Dispute form used for?

The Hong Leong Bank Dispute form is designed for cardholders who wish to contest specific transactions on their credit or debit card statements. It allows you to declare any discrepancies, unauthorized transactions, or issues related to payments that you believe were charged in error.

How do I fill out the Dispute form?

First, ensure you have your card details and the relevant statements at hand. Fill in your name, card number, and the date. Then, list the transactions you wish to dispute, providing details such as transaction dates and merchant names. Finally, check the appropriate reason(s) for the dispute and sign the form.

What types of disputes can I file using this form?

The form covers several dispute reasons, including unauthorized transactions, double charges, incorrect amounts, and transactions for which you did not receive goods or services. It can also be used to address subscription issues or to request documentation related to a transaction.

What should I do if I have multiple disputed transactions?

You can include up to five transactions on the same Dispute form. Simply list each transaction’s details—date, merchant name, and amount. If you have more than five transactions to dispute, consider submitting a separate form for those additional entries.

How long does it take to resolve a dispute?

The processing time for disputes can vary depending on the complexity of the issue and the merchant's response. Generally, you can expect to receive updates within 30 to 45 days. Keep an eye on your email for any communication from Hong Leong Bank regarding your claim.

Will I be charged for filing a dispute?

As of April 1, 2015, there is a microfilm copy charge of RM20 if the disputed transaction is found to have been authorized by you. This fee is subject to government tax, if applicable. Therefore, be sure to review your statements carefully before submitting a dispute.

What if I don’t recognize the merchant for a transaction?

If you don’t recognize a transaction, indicate this on the form. You will need to check the appropriate boxes for the merchant name, location, and transaction date. Providing as much clarity as possible will aid in the investigation of your dispute.

Is there a deadline for submitting the Dispute form?

Common mistakes

Filling out the Hong Leong Bank Dispute form can be straightforward, but there are common mistakes that people often make. One frequent error is providing incomplete information. Some individuals may forget to fill in critical fields such as the cardholder name or the Visa/Mastercard number. Omitting this information can delay the processing of the dispute.

Another mistake involves misidentifying the reasons for the dispute. The form has specific categories to describe the reasons for disputing transactions. It is essential to check all relevant boxes. Failing to do so may lead to confusion and could result in the dispute being dismissed due to a lack of clarity.

Careless errors in transaction details can also create problems. People may incorrectly write down the transaction date or the merchant name. These mistakes can make it difficult for the bank to identify the transactions in question. Providing accurate and clear details is critical for an efficient review.

Additionally, some may forget to include necessary attachments. For example, if disputing a transaction due to not receiving merchandise or services, a related cancellation letter should be included. Omitting supporting documents can weaken the case and prolong the resolution process.

Another common issue is the failure to sign the form. A signature is a crucial part of the submission process. Without it, the form may be considered incomplete, and the dispute might face delays or complications.

Lastly, neglecting to keep a copy of the submitted form can be detrimental. Having a copy for personal records helps track the dispute's progress and can provide a reference if further communication with the bank is needed. This simple step can avoid future confusion and help maintain organization throughout the dispute process.

Documents used along the form

When managing a dispute regarding transactions with Hong Leong Bank, you may need to gather several additional documents. Each of these documents serves a specific purpose and helps to support your claim. It’s important to be thorough in your preparation to ensure your dispute is processed smoothly.

- Credit Card Statement: This document provides a detailed record of your transactions for a specific period. Reviewing your statement can help you identify unauthorized charges, duplicate transactions, or billing errors, which will be necessary for your dispute.

- Transaction Receipts: Keep copies of any sales receipts related to the disputed transaction. These receipts can serve as evidence of what you purchased, the amount charged, and whether you're eligible for a refund or dispute.

- Cancellation Letter: If you canceled a service or subscription that involved a charge, having a copy of the cancellation letter is essential. It shows that you informed the merchant about stopping future payments.

- Merchant Communication Records: Include any correspondence you have had with the merchant regarding the disputed transaction. Email exchanges or documented phone conversations can demonstrate your attempts to resolve the issue directly.

- Identity Verification Documents: A government-issued ID or proof of address can help establish your identity and ownership of the card in question. It is particularly useful if there are concerns about unauthorized use of your account.

Being organized and thorough in collecting these documents can significantly impact the resolution of your dispute. Each piece of information contributes to a clearer picture of your situation, improving the chances of a favorable outcome.

Similar forms

- Credit Card Dispute Letter: Similar to the Hong Leong Bank Dispute form, this letter is used by cardholders to formally dispute a charge on their credit card statement. It requests an explanation for the disputed transaction and often includes similar details, such as the transaction date and amount.

- Fraudulent Transaction Report: This document is filed when unauthorized charges appear on a bank account. Like the Hong Leong Dispute form, it requires details about the transaction, including dates and amounts, to initiate an investigation.

- Merchant Refund Request: When a customer seeks reimbursement from a merchant, they may complete a refund request form. It aligns closely with the dispute form, detailing the reason for the refund and providing transaction data.

- Chargeback Request Form: Similar in function, this form is submitted to the card issuer to reverse a transaction. It typically requires proof of the transaction's illegitimacy or error, mirroring the information sought in the Hong Leong Bank Dispute form.

- Billing Error Complaint: Customers often use this form to report discrepancies in their billing statements. It functions similarly by outlining the specific errors and requiring evidence of the claimed discrepancies.

- Cancellation Confirmation Form: This document serves to confirm the cancellation of services or transactions. Like the dispute form, it captures relevant details, including dates and reasons for cancellation.

- Unauthorized Use Affidavit: This affidavit is completed when a cardholder attests that their card was used without authorization. It typically contains similar elements, including the nature of the unauthorized transaction and personal identification details.

- Service Complaint Form: Customers fill out this form to register complaints about services received. The data required, such as transaction details and issues encountered, is comparable to the information in the Hong Leong Bank Dispute form.

- Transaction Verification Form: This form is used to confirm the authenticity of a transaction in dispute. Like the Hong Leong Dispute form, it requests essential details and supporting evidence to validate the claim.

- Identity Theft Report: When fraud is suspected, this report is completed to notify authorities. This document parallels the dispute form by gathering comprehensive transaction records and the identity of the affected party.

Dos and Don'ts

When filling out the Hong Leong Bank Dispute form, here are some important dos and don'ts to consider:

- Do review your statement carefully to ensure you dispute valid transactions.

- Do provide detailed information about the disputed transaction(s), including date, merchant name, and amount.

- Do include copies of any relevant documents, such as receipts or cancellation letters.

- Do check the appropriate category that describes your reason for disputing the transaction(s).

- Don't submit the form without verifying all the information for accuracy.

- Don't forget to sign the form and include your contact details.

- Don't delay submitting your dispute, as there may be time limits.

- Don't submit a dispute for unauthorized transactions if your card was in your possession during the transaction.

Misconceptions

- Misconception 1: The Hong Leong Bank Dispute form is only for credit card transactions.

- Misconception 2: You can dispute any transaction without any evidence.

- Misconception 3: Submitting the form guarantees a refund.

- Misconception 4: Once you submit the dispute, you don’t need to do anything else.

- Misconception 5: You cannot dispute a transaction if your card was physically present.

- Misconception 6: The dispute form is only relevant for fraudulent transactions.

- Misconception 7: You can submit the dispute form at any time after a transaction.

- Misconception 8: The bank absorbs all costs associated with disputes.

This form can be used for both credit and debit card disputes. It is essential for cardholders to know that any unauthorized transaction or billing errors can be addressed using this form.

While you can report a dispute, it is advisable to include supporting documentation when possible. Evidence, such as receipts or cancellation letters, strengthens your case and helps expedite the review process.

Submission of the form initiates the dispute process, but it does not guarantee that the transaction will be reversed. The bank will investigate the matter based on the provided information and evidence.

Cardholders should monitor their email and phone for any communication from the bank. Additional information may be required to resolve the dispute efficiently.

Even if you had your card in your possession, you can dispute unauthorized transactions if you believe they were still not authorized by you. The reason for the dispute should be clearly indicated on the form.

This form is not limited to fraud. It also covers various issues like double billing, incorrect charges, and disputes over goods or services not received.

There are typically deadlines for submitting dispute forms. It's crucial to act promptly and adhere to any timeframes set by the bank to ensure that your dispute is considered.

If a submitted transaction is ultimately deemed authorized, the cardholder may be charged for the investigation process, including a microfilm copy fee. Awareness of potential costs can help avoid surprises later.

Key takeaways

Filling out the Hong Leong Bank Dispute Form can be straightforward if you understand the key elements involved. Here are some important takeaways to keep in mind:

- Accurate Information: Ensure all required fields are filled out accurately, including your name, card number, and transaction details.

- Transaction Disputes: Clearly identify the transaction(s) you are disputing and provide the relevant dates and amounts.

- Reason for Dispute: Check all applicable categories that describe your reason for disputing the transaction to provide a clear basis for your claim.

- Documentation: Attach any necessary documents, such as copies of receipts or cancellation letters, to strengthen your dispute.

- Signature Requirement: Make sure to sign the form and provide your identification number; this confirms the authenticity of your request.

- Charges: Be aware of potential charges associated with the dispute process, including a microfilm copy fee if the transaction is deemed authorized.

These takeaways can help ensure that your dispute is processed efficiently and effectively.

Browse Other Templates

Hot Topic Career Form,Employment Request Form,Join the Hot Topic Team,Hot Topic Job Application,Hot Topic Employment Inquiry,Application for Employment at Hot Topic,Hot Topic Candidate Form,Hot Topic Workforce Application,Become a Part of Hot Topic,H - Falsifying information may have consequences for your employment status.

Form Wh-58 - The form must be carefully reviewed before acceptance to ensure accuracy.