Fill Out Your Horizon Claim Form

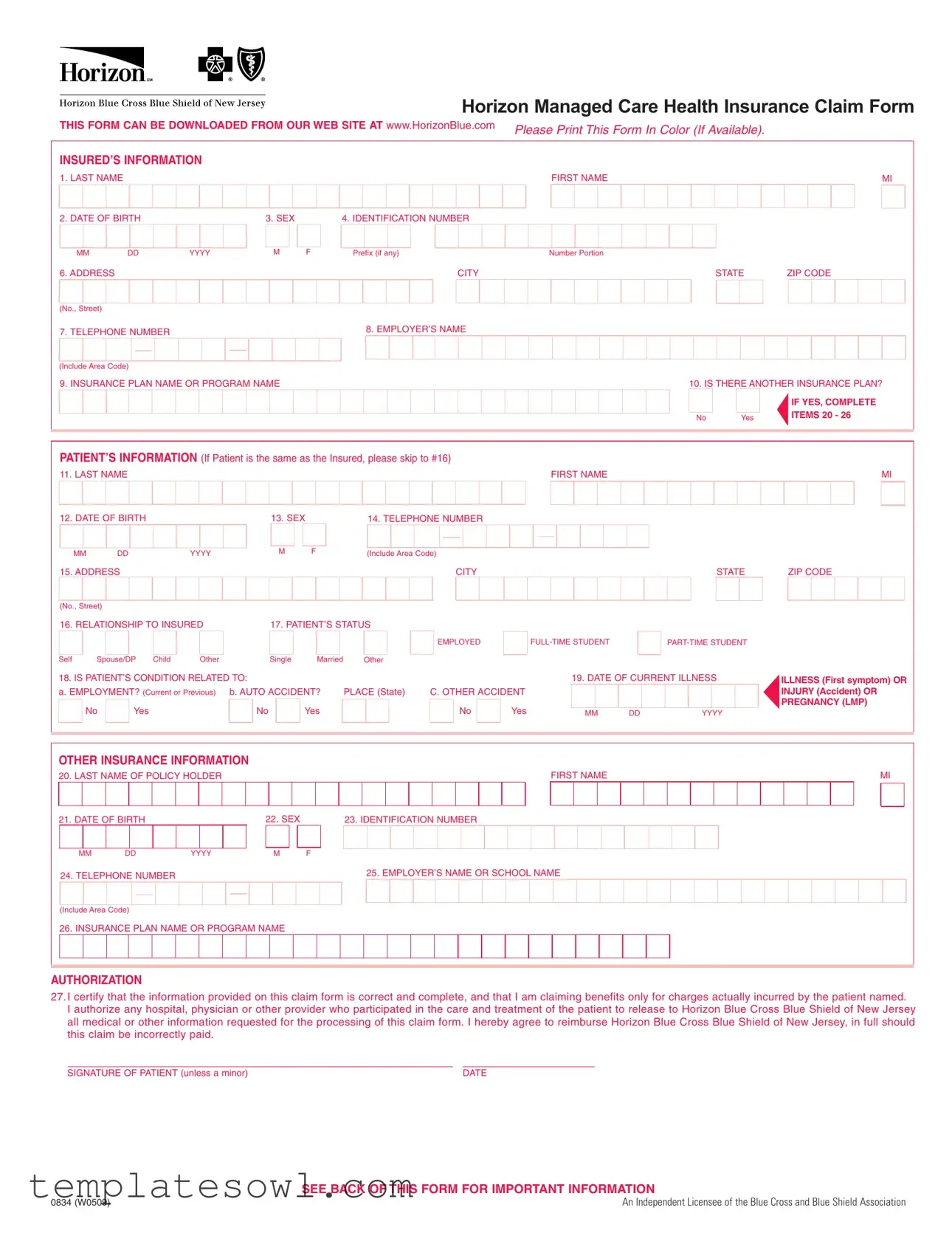

Submitting a claim for healthcare expenses is a crucial step in managing health insurance efficiently, and the Horizon Claim form plays a significant role in this process. This form collects essential information, such as the insured individual's details, including their name, date of birth, and identification number, alongside patient specifics, if applicable. Clarity and accuracy are vital; individuals must ensure that itemized bills for medical services are attached, providing all necessary data, from service dates to diagnosis. Additionally, there are important sections that address other insurance coverage and Medicare eligibility, ensuring that all relevant information is considered for processing the claim. The form also requires a signed authorization, affirming the correctness of the provided information. Failing to complete any part of the form can lead to delays, so it’s crucial to read through the instructions carefully. Accessible online and user-friendly, this form is designed to simplify the claims process, while also maintaining a strict emphasis on compliance and accuracy.

Horizon Claim Example

Horizon Managed Care Health Insurance Claim Form

THIS FORM CAN BE DOWNLOADED FROM OUR WEB SITE AT www.HorizonBlue.com |

PLEASE PRINT THIS FORM IN COLOR (IF |

AVAILABLE). |

|

|||||

|

|

|

|

|

|

|

||

INSURED’S INFORMATION |

|

|

|

|

|

|

||

1. LAST NAME |

|

|

|

|

|

FIRST NAME |

|

MI |

2. DATE OF BIRTH |

|

3. SEX |

|

4. IDENTIFICATION NUMBER |

|

|

|

|

MM |

DD |

YYYY |

M |

F |

Prefix (if any) |

Number Portion |

|

|

6. ADDRESS |

|

|

|

|

CITY |

|

STATE |

ZIP CODE |

(No., Street) |

|

|

|

|

|

|

|

|

7. TELEPHONE NUMBER |

|

|

|

8. EMPLOYER’S NAME |

|

|

|

|

|

|

|

|

|

|

|

||

(Include Area Code) |

|

|

|

|

|

|

|

|

9. INSURANCE PLAN NAME OR PROGRAM NAME |

|

|

10. IS THERE ANOTHER INSURANCE PLAN? |

|||||

|

|

|

|

|

|

|

|

IF YES, COMPLETE |

|

|

|

|

|

|

No |

Yes |

ITEMS 20 - 26 |

|

|

|

|

|

|

|

||

PATIENT’S INFORMATION (If Patient is the same as the Insured, please skip to #16)

11. LAST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

MI |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. DATE OF BIRTH |

|

|

|

|

|

13. SEX |

|

|

|

|

|

14. TELEPHONE NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MM |

DD |

|

YYYY |

M |

F |

|

|

(Include Area Code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

15. ADDRESS |

|

CITY |

|

STATE |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP CODE

(No., Street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. RELATIONSHIP TO INSURED |

|

|

|

17. PATIENT’S STATUS |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Spouse/DP Child |

|

Other |

|

|

|

Single |

|

|

Married |

|

Other |

|||||

18. IS PATIENT’S CONDITION RELATED TO: |

|

|

|

|

|

|

|||||||||||

a. EMPLOYMENT? (Current or Previous) |

|

b. AUTO ACCIDENT? |

PLACE (State) |

||||||||||||||

|

No |

|

Yes |

|

|

|

|

No |

|

|

Yes |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYED |

|

|

||

|

|

|

|

|

19. DATE OF CURRENT ILLNESS

C. OTHER ACCIDENT |

|

|

|

|

No |

Yes |

MM |

DD |

YYYY |

ILLNESS (First symptom) OR INJURY (Accident) OR PREGNANCY (LMP)

OTHER INSURANCE INFORMATION

20. LAST NAME OF POLICY HOLDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FIRST NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MI |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. DATE OF BIRTH |

|

|

|

|

|

22. SEX |

|

|

|

|

23. IDENTIFICATION NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MM |

DD |

|

YYYY |

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

24. TELEPHONE NUMBER |

|

25. EMPLOYER’S NAME OR SCHOOL NAME |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Include Area Code)

26. INSURANCE PLAN NAME OR PROGRAM NAME

AUTHORIZATION

27.I certify that the information provided on this claim form is correct and complete, and that I am claiming benefits only for charges actually incurred by the patient named.

I authorize any hospital, physician or other provider who participated in the care and treatment of the patient to release to Horizon Blue Cross Blue Shield of New Jersey all medical or other information requested for the processing of this claim form. I hereby agree to reimburse Horizon Blue Cross Blue Shield of New Jersey, in full should this claim be incorrectly paid.

SIGNATURE OF PATIENT (unless a minor) |

DATE |

SEE BACK OF THIS FORM FOR IMPORTANT INFORMATION

0834 (W0509) |

An Independent Licensee of the Blue Cross and Blue Shield Association |

PLEASE READ THIS IMPORTANT INFORMATION

WHEN YOU ARE SUBMITTING EXPENSES FOR MORE THAN ONE FAMILY MEMBER, PLEASE USE A SEPARATE CLAIM FORM FOR EACH PERSON. ITEMIZED BILLS FOR COVERED SERVICES OR SUPPLIES MUST BE ATTACHED TO THIS FORM AND INCLUDE THE FOLLOWING:

Check that each itemized bill is legible and contains ALL of the following information:

☑NAME & ADDRESS of person or institution rendering the service or supplying the item

☑Health Care Professional Federal Tax Identification Number (Required)

☑Health Care Professional NPI Number

☑PATIENT’S FULL NAME

☑TYPE of service rendered/produced or item supplied

☑DATE each service rendered or item supplied

☑AMOUNT charged for each service rendered or item supplied

☑DIAGNOSIS of ailment

BILLS MISSING ANY OF THIS INFORMATION MAY BE RETURNED TO YOU

Cash register receipts, cancelled checks, money order receipts, personal itemizations, and bills only noting a "balance due" are not acceptable.

COORDINATION OF BENEFITS?

If you or your covered dependent(s) are covered by another health insurance program, please provide the information requested in Section III. Example: Spouse covered by another insurance company or other Horizon Blue Cross Blue Shield of New Jersey coverage.

When submitting charges for services or supplies that have been partially paid or declined by other group health insurance, attach a copy of the Notice of Payment or Explanation of Benefits from the other health care insurer along with itemized bill(s).

MEDICARE?

If PATIENT is eligible for Medicare Benefits, be sure you include the Explanation of Medicare Benefits (EOMB) that was sent to patient explaining the charges paid or not paid by Medicare.

To process a claim for your Horizon Blue Cross Blue Shield of New Jersey, supplementary insurance,we need a copy of the Explanation of Medicare Benefits (EOMB). This EOMB should have been sent to you when Medicare processed your claim. If your EOMB has more than one page, send us copies of all pages. Please write your Horizon Blue Cross Blue Shield of New Jersey identification number clearly on the first page.

CLAIM FORM WILL BE RETURNED TO YOU IF THIS ADDITIONAL INFORMATION IS NOT SUPPLIED

HELPFUL HINTS

When you are submitting expenses for more than one family member, please use a separate claim form for each person. It is suggested that you make copies for your own use before you submit the original bills.

Prescription Drugs? Bills must show the patient’s name and date of service, prescription number and amount paid, name, strength & quantity of drug and the name and address of the pharmacy.

Durable medical equipment? (Wheel chair, crutches, braces, oxygen, etc.) Your doctor’s certification must be submitted indicating the expected length of time the equipment will be in use. If renting, please have your medical equipment supplier also indicate the purchase price of the equipment on the bill.

Please mail completed claim form to: Horizon Managed Care Claims

Horizon Blue Cross Blue Shield of New Jersey

P.O. Box 820

Newark, New Jersey

FRAUD WARNING

ANY PERSON WHO KNOWINGLY FILES A STATEMENT OF CLAIM CONTAINING ANY FALSE OR

MISLEADING INFORMATION IS SUBJECT TO CRIMINAL AND CIVIL PENALTIES

TO REPORT SUSPECTED FRAUD CALL

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Availability | The Horizon Claim form can be downloaded from www.HorizonBlue.com. |

| Color Printing | Participants are encouraged to print the form in color if their printer allows it. |

| Insured's Information | Sections include last name, birth date, sex, address, and insurance plan details. |

| Patient's Relation | Patients can indicate their relationship to the insured as self, spouse, child, or other. |

| Authorization Requirement | Claim submissions include a certification of accuracy and authorization to release information. |

| Itemized Bills | Itemized bills must be attached and include the provider's name, tax ID, and diagnosis. |

| Coordination of Benefits | If applicable, provide information for other health insurance plans covering the patient. |

| Medicare Guidelines | Include the Explanation of Medicare Benefits (EOMB) if the patient is eligible for Medicare. |

| Fraud Warning | Knowingly submitting false claims may result in criminal and civil penalties. |

Guidelines on Utilizing Horizon Claim

When preparing to fill out the Horizon Claim form, gather all necessary documents and information. You will complete sections regarding the insured and patient, and provide any additional required details and signatures. Follow the instructions carefully to ensure that your claim is processed without delays.

- Download the Horizon Claim form from the website www.HorizonBlue.com and print it in color if possible.

- Fill in the insured’s information:

- Last name, first name, and middle initial.

- Date of birth (MM/DD/YYYY).

- Sex (M/F).

- Identification number (Prefix, number, and portion).

- Address (No., street, city, state, ZIP code).

- Telephone number.

- Employer’s name.

- Name of the insurance plan or program.

- Indicate if there is another insurance plan (Yes or No): answer items 20-26 if yes.

- Complete the patient’s information if different from the insured:

- Last name, first name, and middle initial.

- Date of birth (MM/DD/YYYY).

- Sex (M/F).

- Telephone number.

- Address (No., street, city, state, ZIP code).

- Relationship to insured.

- Patient’s status (Self, spouse, child, other).

- Provide information on the patient’s condition:

- Indicate if the condition is related to employment, auto accident, or other accident (Yes or No).

- Date of current illness (First symptom or injury or pregnancy).

- Fill out the other insurance information (if applicable):

- Last name, first name, and middle initial of the policyholder.

- Date of birth (MM/DD/YYYY).

- Sex (M/F).

- Identification number.

- Telephone number.

- Employer’s name or school name.

- Name of the insurance plan or program.

- Sign and date the authorization section, certifying the information provided is correct.

- Attach itemized bills for covered services or supplies, ensuring each bill includes all required details as specified.

- Double-check that all sections of the form are complete and accurate before submission.

- Mail the completed claim form and attachments to:

Horizon Managed Care Claims

Horizon Blue Cross Blue Shield of New Jersey

P.O. Box 820

Newark, New Jersey 07101-0820.

What You Should Know About This Form

What is the Horizon Claim Form and where can I find it?

The Horizon Claim Form is a document used to submit claims for health care services covered by Horizon Managed Care. You can download this form in color from the Horizon Blue website at www.HorizonBlue.com.

What information do I need to fill out on the Horizon Claim Form?

You will need to provide detailed information including the insured's name, date of birth, identification number, address, and employer’s details. Also, you must provide the patient's information, if different from the insured. Details regarding the nature of the medical condition or service provided, and any other insurance plans must also be included, if applicable.

What should I attach to the claim form?

When submitting the claim, make sure to attach itemized bills for the services or supplies covered. These bills should note the provider’s name, diagnosis, dates of service, and amounts charged. Ensure that all necessary details are legible and complete to avoid delays.

What happens if my claim form is missing information?

If any of the required information is missing or incomplete, the claim form may be returned. Bills that do not meet the specified criteria, such as cash register receipts or simply noting a balance due, are not acceptable.

How do I submit claims for multiple family members?

When submitting expenses for more than one family member, it is important to use a separate Claim Form for each individual. This helps ensure that claims are processed correctly for each person.

What information do I need if I have another insurance policy?

If you or your dependents are also covered by another insurance program, you must complete the separate section of the form that requests this information. Include any Notices of Payment or Explanation of Benefits from the other insurer if applicable.

What is required if the patient is eligible for Medicare?

If the patient qualifies for Medicare, you must include the Explanation of Medicare Benefits (EOMB), which outlines the charges that were paid or not paid by Medicare. This document is crucial for processing your claim with Horizon.

Where do I send the completed claim form?

Once you have filled out the claim form and attached all required documents, you should mail it to: Horizon Managed Care Claims, Horizon Blue Cross Blue Shield of New Jersey, P.O. Box 820, Newark, New Jersey 07101-0820.

What should I do if I suspect fraudulent activity related to my claim?

If you suspect that fraudulent information has been filed, it is important to report it. You can contact Horizon at 1-800-624-2048 to report suspected fraud. Take this seriously, as filing false claims may lead to criminal and civil penalties.

Common mistakes

Filling out the Horizon Claim form can be a straightforward process, but people often make several common mistakes that can delay their claims or lead to rejections. Understanding these pitfalls is essential for a successful submission.

One significant mistake is providing incomplete or inaccurate patient information. Each section of the form, particularly the insured's and patient's information, requires precise details. Omitting information like the date of birth or sex, or miswriting the identification number, can create confusion. This confusion can lead to delays in processing, as the claims team might need to contact you for clarification.

Another frequent error occurs with the attachment of itemized bills. When submitting claims, it is vital to attach clear itemized invoices from healthcare providers. These invoices must include specific elements such as the patient's full name, the type of service rendered, and the charges associated with those services. If any of this information is missing, the claim may be returned or denied, prolonging the reimbursement process.

Ignoring the coordination of benefits is another mistake that applicants often make. If the patient is covered by another insurance plan, this information must be included in the claim. Failing to properly report existing policies may cause the claim to be processed incorrectly. It can also lead to complications if the services were partly paid by another insurer, as the information is essential for determining how much Horizon should pay.

Lastly, people frequently overlook the importance of including a signature. A signature validates the accuracy of the information provided and confirms that you authorize the release of medical information for processing the claim. Submitting the form without a signature can result in automatic rejection. Each detail on the form is crucial to ensure a smoother experience with your health insurance claim.

Documents used along the form

When filing a claim through the Horizon Claims process, there are several other documents that may be required to ensure complete and accurate processing. Each of these forms serves a distinct purpose and can enhance the effectiveness of your claim. Understanding these documents will facilitate a smoother claims experience.

- Explanation of Benefits (EOB): This document outlines the payments made by your health insurance provider for a particular medical service. It includes details such as the amount billed, the amount covered by insurance, and any remaining balance you may owe. It is essential for coordinating benefits if you have multiple insurance policies.

- Itemized Bill: An itemized bill is a detailed statement from your healthcare provider that lists every charge incurred during your treatment. This bill must include the provider's information, services rendered, and itemized costs. It is crucial for verifying the expenses you are claiming.

- Authorization for Release of Medical Information: This form grants permission for healthcare providers to share your medical records with your insurance company. It's often necessary for claims involving medical treatments that are under review or require additional information.

- Coordination of Benefits Form: If you are covered by more than one health insurance policy, this form helps coordinate the claims process between the different insurers. It ensures that payments are distributed correctly and prevents duplicate billing.

- Medicare Claim Form: If you are a Medicare beneficiary, certain claims may require you to submit a Medicare claim form. This document confirms eligibility and payment details under Medicare, aiding in the claim process with your additional coverage.

- Durable Medical Equipment (DME) Prescription: If your claim involves durable medical equipment, a prescription from your healthcare provider is often necessary. This prescription should detail the specific equipment and state the medical necessity for its use.

- Pharmacy Receipt: For prescription drug claims, maintaining copies of your pharmacy receipts is important. These receipts must include critical information like the drug name, prescription number, and the payment amount.

By familiarizing yourself with these various forms and documents, you stand to improve your chances of a successful claim submission. Always ensure that you gather all necessary information and documentation to streamline the process, and reduce the likelihood of processing delays.

Similar forms

The Horizon Claim form is essential for submitting health insurance claims, but it shares similarities with several other documents in the healthcare and insurance landscape. Here’s a look at four documents that are comparable to the Horizon Claim form:

- CMS-1500 Form: This is another claim form used primarily by healthcare professionals to bill Medicare and private insurers. Both forms require detailed patient and provider information, including diagnosis codes and services rendered, ensuring that claims are processed accurately and timely.

- UB-04 Form: Often used by hospitals and other healthcare facilities, the UB-04 form is for billing inpatient and outpatient services. Like the Horizon Claim form, it necessitates comprehensive details about the patient, services provided, and costs incurred to facilitate reimbursement from insurance companies.

- Explanation of Benefits (EOB): After a claim is processed, patients receive an EOB outlining what services were covered, the total costs, and any amounts owed. Similar to the Horizon Claim form, the EOB provides crucial information regarding the financial responsibility of the patient versus the insurer.

- Prior Authorization Request Form: This document is submitted to secure approval for specific services or medications before they are provided. While the Horizon Claim form is used post-service, both forms involve detailed patient information and require insurers' review for coverage decisions.

Dos and Don'ts

When filling out the Horizon Claim form, there are some essential guidelines you should follow and some pitfalls to avoid.

- Do: Ensure all information is printed clearly and legibly.

- Do: Use a separate claim form for each family member.

- Do: Attach itemized bills for all covered services or supplies.

- Do: Check that the bills include the patient's full name and service details.

- Do: Include the Explanation of Medicare Benefits if applicable.

- Do: Keep copies of all documents submitted for your records.

- Don't: Forget to sign and date the claim form.

- Don't: Submit cash register receipts or bills that only show a "balance due."

Following these guidelines will help ensure your claim is processed smoothly and efficiently. Stay organized, and don't overlook any details!

Misconceptions

When dealing with the Horizon Claim form, a few misconceptions may lead to confusion or errors in submission. Here are ten common misunderstandings, along with clarification for each.

- All information can be typed: Many assume they can submit the form digitally, but it is required to be printed in color if possible.

- Only the insured’s information is necessary: Patients often think that providing their details is enough. The form requires information about both the insured and the patient if they are different.

- It's acceptable to submit handwritten claims: While some may think that handwritten items are fine, the instructions specify that typed claims are preferred for clarity.

- Itemized bills aren't necessary: Some believe they can submit a simple receipt, but itemized bills with detailed information are mandatory for processing claims.

- Current illnesses need not be reported: Individuals might overlook reporting the date of current illness or injury, but this is critical for claims processing.

- One claim form suffices for the entire family: A common mistake is using a single form for multiple family members. Each family member requires a separate submission.

- Pharmacy receipts are sufficient for prescription claims: Simply providing a pharmacy receipt won't work; the prescription number and other details must be included.

- Medicare information is optional: If the patient has Medicare, including the Explanation of Medicare Benefits (EOMB) is crucial for processing and is not optional.

- Claims can be filed without authorization: Some individuals might neglect signing the authorization section, but it is essential to validate the claim submission.

- Submission methods are flexible: People might think they can submit claims by any means, but the form must be mailed to a specific address provided in the instructions.

Understanding these misconceptions can streamline the claim submission process and help ensure timely reimbursement. Always read guidelines thoroughly to avoid unnecessary delays.

Key takeaways

Here are some key takeaways about filling out and using the Horizon Claim form:

- Download the form: You can find the Horizon Claim form on their website, so ensure you have the latest version.

- Color printing: If possible, print the form in color. This helps with readability and clarity.

- Complete information: Fill in all required fields such as names, dates of birth, and identification numbers to prevent delays.

- Separate claims: If you are claiming expenses for more than one person, use a separate claim form for each individual.

- Attach itemized bills: Ensure that you include complete itemized bills for services rendered. These bills must include specific details like amounts and diagnoses.

- Coordinate benefits: If you have other insurance, provide relevant information as requested in Section III of the form.

- Include Medicare information: If the patient is eligible for Medicare, attach the Explanation of Medicare Benefits to facilitate processing your claim.

- Accurate signatures: The claiming individual must sign the form, as it certifies that the information provided is correct.

- Mailing instructions: After completing the form, mail it to Horizon Managed Care Claims at the address specified on the form.

By following these takeaways, you can help ensure that your claim is processed smoothly and efficiently.

Browse Other Templates

Situation-Background-Assessment-Recommendation,Clinical Update Report,Patient Status Summary,Care Coordination Brief,Healthcare Communication Template,Patient Care Overview,Clinical Insights Report,Diagnosis and Management Summary,Clinical Situation - SBAR fosters a culture of open communication in healthcare environments.

UMWA Address Change Form,Address Update Request Form,Change of Residence Application,Miner's Address Modification Form,Widow's Address Adjustment Request,Health and Retirement Funds Address Notification,Miner/Widow Information Update Form,Address Cor - Clearly print your name and information for processing.