Fill Out Your How To Fill Out Bank Application Form

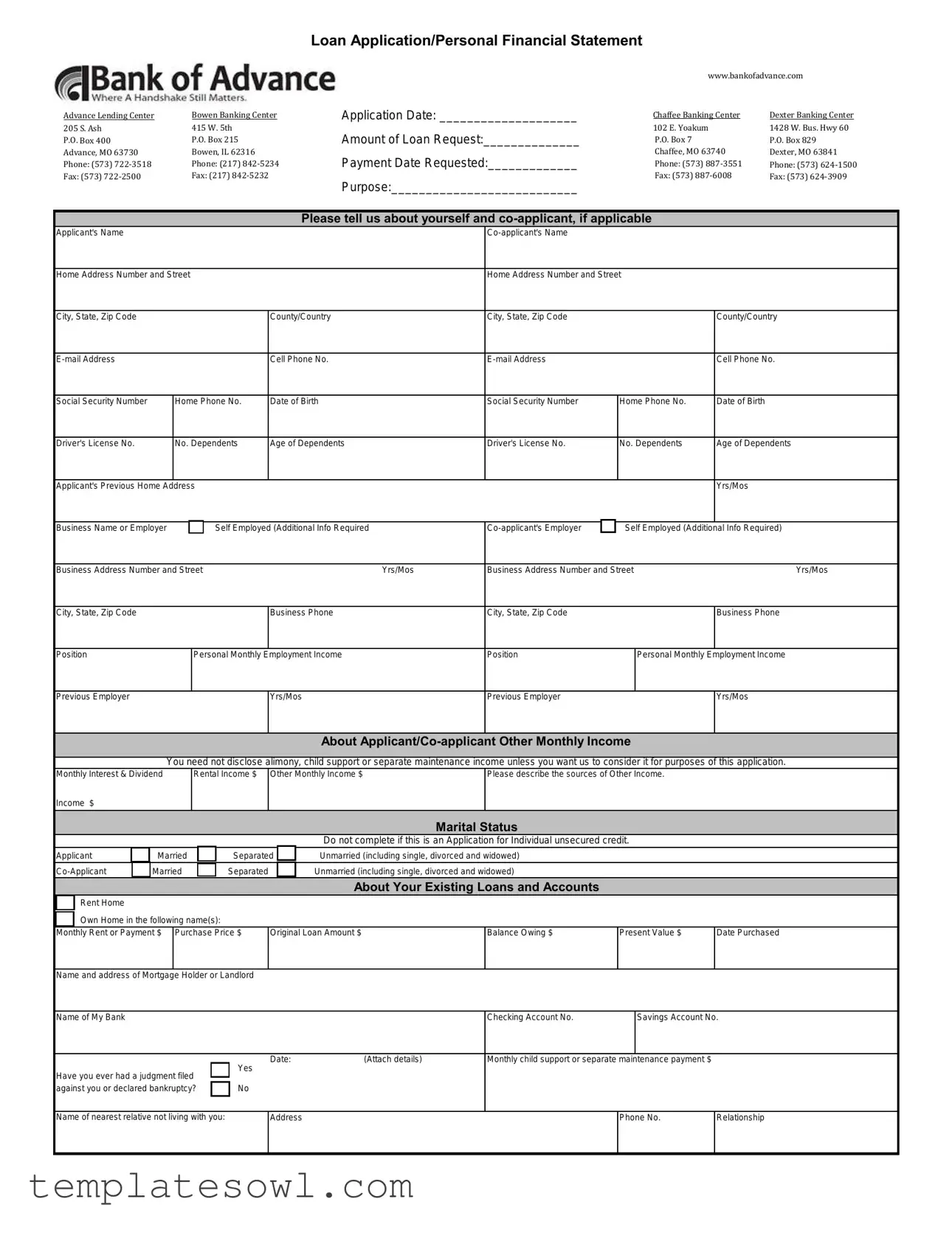

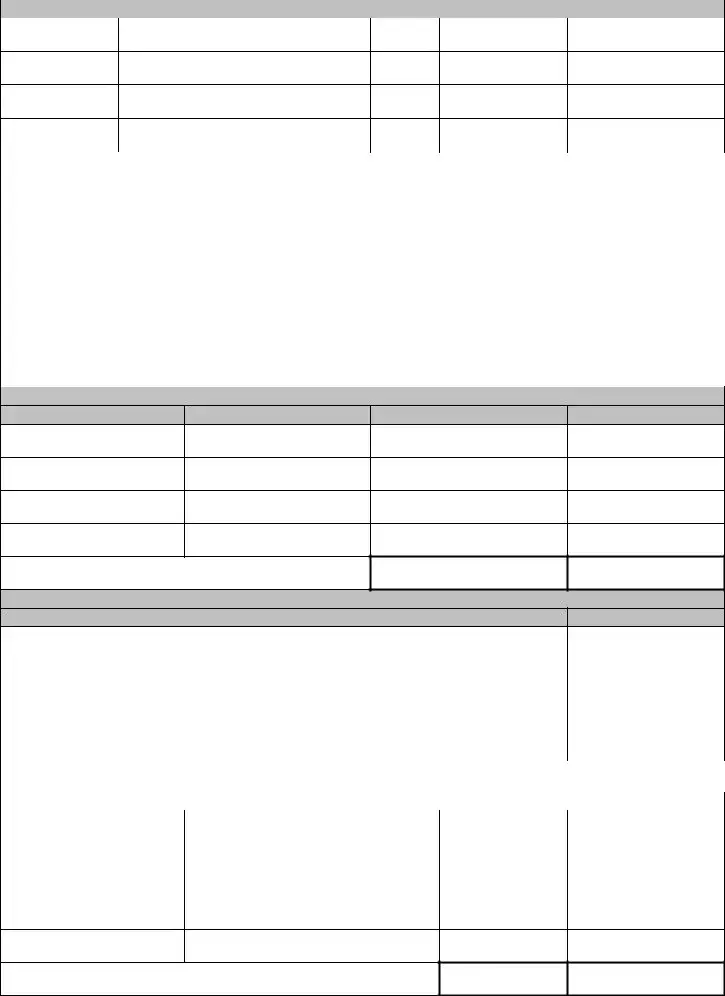

When embarking on the journey to secure a bank loan, filling out the bank application form is a pivotal first step. This form requires an array of information to evaluate your financial background and establish your eligibility for the requested loan amount. Key aspects of the form include personal details such as your name, address, and social security number, as well as information regarding your current employment and income. For those with a co-applicant, similar details are also needed. The application further asks about your existing financial obligations, assets, and a summary of monthly income from various sources. You’ll find sections dedicated to assets like real estate, vehicles, and bank accounts, requiring their respective values and any outstanding debts. Additionally, you will have the opportunity to provide insights into your previous financial history, including any judgments or bankruptcies, and share any pertinent details that may strengthen your application. Completing this form accurately and thoroughly lays a solid foundation for your loan request and reflects your financial condition on the day of application.

How To Fill Out Bank Application Example

Loan Application/Personal Financial Statement

www.bankofadvance.com

Advance Lending Center |

Bowen Banking Center |

205 S. Ash |

415 W. 5th |

P.O. Box 400 |

P.O. Box 215 |

Advance, MO 63730 |

Bowen, IL 62316 |

Phone: (573) |

Phone: (217) |

Fax: (573) |

Fax: (217) |

Application Date: ____________________

Amount of Loan Request:______________

Payment Date Requested:_____________

Purpose:___________________________

Chaffee Banking Center |

Dexter Banking Center |

102 E. Yoakum |

1428 W. Bus. Hwy 60 |

P.O. Box 7 |

P.O. Box 829 |

Chaffee, MO 63740 |

Dexter, MO 63841 |

Phone: (573) |

Phone: (573) |

Fax: (573) |

Fax: (573) |

Please tell us about yourself and

|

Applicant's Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Home Address Number and Street |

|

|

|

|

Home Address Number and Street |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip Code |

|

|

|

|

|

County/Country |

|

City, State, Zip Code |

|

|

County/Country |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cell Phone No. |

|

|

|

Cell Phone No. |

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Social Security Number |

|

|

Home Phone No. |

Date of Birth |

|

Social Security Number |

Home Phone No. |

Date of Birth |

||||

|

|

|

|

|

|

|

|

|

|

||||

|

Driver's License No. |

|

|

No. Dependents |

Age of Dependents |

|

Driver's License No. |

No. Dependents |

Age of Dependents |

||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Applicant's Previous Home Address |

|

|

|

|

|

|

|

Yrs/Mos |

||||

|

|

|

|

|

|

|

|

|

|

||||

|

Business Name or Employer |

|

|

Self Employed (Additional Info Required |

|

Self Employed (Additional Info Required) |

|||||||

|

|

|

|

|

|

|

|

||||||

|

Business Address Number and Street |

|

|

Yrs/Mos |

|

Business Address Number and Street |

Yrs/Mos |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip Code |

|

|

|

|

|

Business Phone |

|

City, State, Zip Code |

|

|

Business Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Position |

|

|

|

Personal Monthly Employment Income |

|

Position |

|

Personal Monthly Employment Income |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Previous Employer |

|

|

|

|

|

Yrs/Mos |

|

|

Previous Employer |

|

|

Yrs/Mos |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About |

Other Monthly Income |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

You need not disclose alimony, child support or separate maintenance income unless you want us to consider it for purposes of this application. |

||||||||||

|

Monthly Interest & Dividend |

|

|

Rental Income $ |

Other Monthly Income $ |

|

Please describe the sources of Other Income. |

|

|||||

|

Income $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marital Status |

|

|

|

|

|

|

|

|

|

|

|

|

Do not complete if this is an Application for Individual unsecured credit. |

|

||||

|

Applicant |

Married |

Separated |

Unmarried (including single, divorced and widowed) |

|

|

|

||||||

|

Married |

Separated |

|

Unmarried (including single, divorced and widowed) |

|

|

|

||||||

|

|

|

|

|

|

|

|

About Your Existing Loans and Accounts |

|

|

|

||

|

Rent Home |

|

|

|

|

|

|

|

|

|

|

|

|

|

Own Home in the following name(s): |

|

|

|

|

|

|

|

|

||||

|

Monthly Rent or Payment $ |

|

Purchase Price $ |

Original Loan Amount $ |

|

Balance Owing $ |

Present Value $ |

Date Purchased |

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

Name and address of Mortgage Holder or Landlord |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of My Bank |

|

|

|

|

|

|

|

|

Checking Account No. |

|

Savings Account No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

Date: |

(Attach details) |

|

Monthly child support or separate maintenance payment $ |

|

||

|

Have you ever had a judgment filed |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

against you or declared bankruptcy? |

No |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||||

|

Name of nearest relative not living with you: |

|

Address |

|

|

|

Phone No. |

Relationship |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

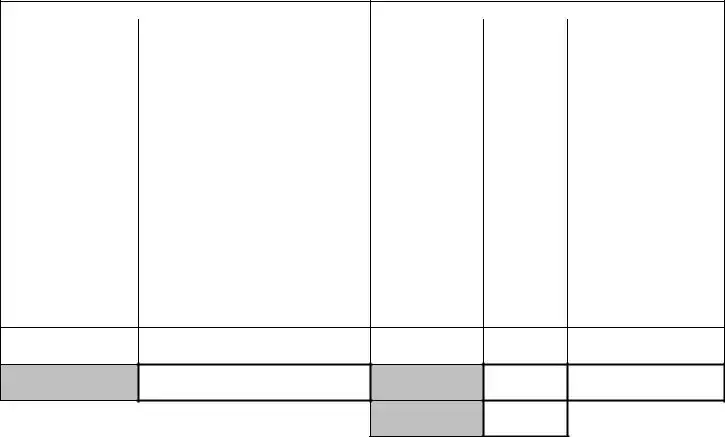

ASSETS |

|

OBLIGATIONS |

|

|

Description |

Amount |

|

Amount Owed |

Monthly Pmts |

1. |

Cash, |

|

10. |

Bank |

|

Complete Schedule 1 (on back) |

|

|

|||

|

|

$ |

|

$ |

$ |

2. |

Stocks or Bonds |

|

11. |

Bank |

|

Complete Schedule 2 (on back) |

|

Loans- Secured |

|

||

|

|

$ |

|

$ |

$ |

3. |

Real Estate Complete Schedule 3 |

|

12. |

Real Estate Loans Complete |

|

(on back) |

|

Schedule 3 (on back) |

|

||

|

|

$ |

|

$ |

$ |

4. |

Automobile(s) |

|

13. |

Auto Loans or Lease Pmts |

|

Complete Schedule 4 (on back) |

|

Complete Schedule 4 (on back) |

|

||

|

|

$ |

|

$ |

$ |

5. |

Cash Value of Life Insurance |

|

14. |

Life Ins. Loans |

|

(face value) $_______________ |

|

Complete Schedule 5 |

|

||

Complete Schedule 5 (on back) |

$ |

(on back) |

$ |

||

|

|

|

$ |

||

6. |

Notes Receivable |

|

15. |

Credit Cards |

|

|

|

|

Complete Schedule 7 (on back) |

|

|

|

|

$ |

|

$ |

$ |

7. |

IRA, Keogh or Retirement Funds |

|

16. |

Other Liabilities |

|

Complete Schedule 6 (on back) |

|

Complete Schedule 9 (on back) |

|

||

|

|

$ |

|

$ |

$ |

8. |

Other Assets Complete Schedule 8 |

|

|

|

|

(on back) |

|

|

|

|

|

|

|

$ |

|

$ |

$ |

9.Networth of Business (attach financial statement)

$ |

$ |

$ |

TOTAL ASSETS

$

TOTAL LIABILITIES

$

$

NET WORTH

$

Please attach any additional information that will be helpful in approving your application.

I/We represent that this application is complete and accurate and fully reflects my/our financial condition on the date shown below. I/We authorize Lender to obtain a credit report and any other information it deems necessary about my/our credit worthiness. I/We agree to notify Lender immediately, in writing, of any adverse change in my/our financial condition. I/We understand that Lender will retain this applicaiton whether or not it is approved. Lender may share transaction and experience information about me/us with its affiliates/subsidiaries. ___Lender does not share other information such as applicaiton or consumer report information. ___Lender may share other information such as application or consumer report information unless I/We direct Lender not to do so by initialing here. ____________

We intend to apply for joint credit. |

_____________________________________________ |

__________________________________ |

|

|

Applicant |

|

|

_____________________________________________________ |

____________________________________________________ |

||

X Applicant's Signature |

Date |

X |

Date |

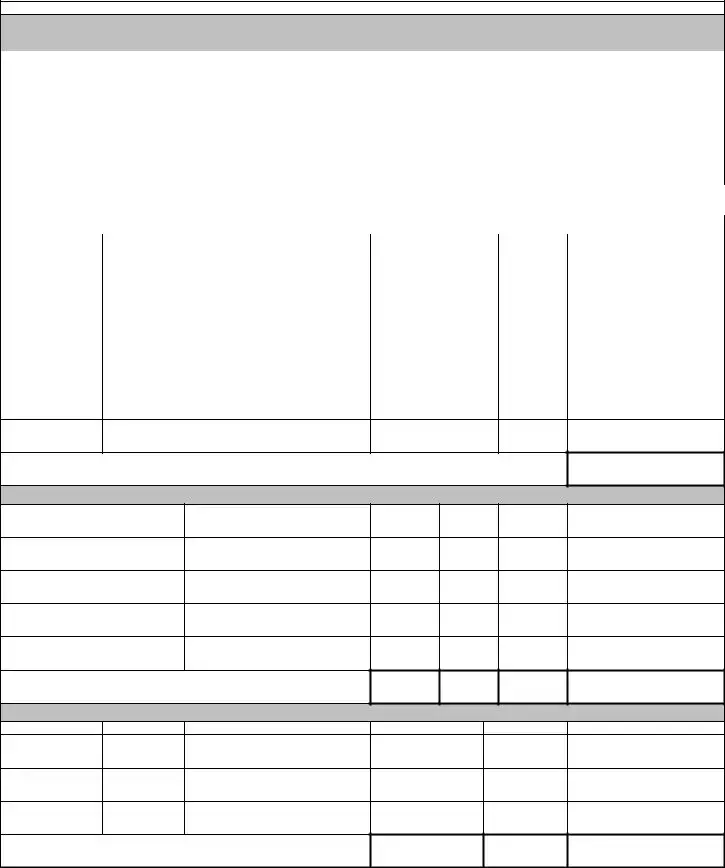

ASSETS AND LIABILITIES SCHEDULE

SCHEDULE 1 - CASH DEPOSITS

|

FINANCIAL INSTITUTION |

|

ACCOUNT NUMBER |

|

|

AMOUNT |

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

TOTAL |

$ |

|

|

|

SCHEDULE 2 - STOCKS AND BONDS OWNED |

|

|

|

|

NO. OF SHARES |

COMPANY |

|

REGISTERED IN NAME(S) OF: |

MKT VALUE |

MARKET VALUE |

|

|

|

|

|

PER SHARE |

|

|

|

|

$ |

$ |

|

||

|

|

$ |

$ |

|

||

|

|

$ |

$ |

|

||

|

|

$ |

$ |

|

||

|

|

$ |

$ |

|

||

$

$

TOTAL $

SCHEDULE 3 - REAL ESTATE OWNED

DESCRIPTION OF PROPERTY

ORIGINAL LOAN AMOUNT

EQUITY

MARKET

VALUE

MONTHLY PMT

PRESENT BALANCE

TOTAL$

$ |

$ |

$ |

|

|

YEAR

MAKE

SCHEDULE 4 - AUTOMOBILES AND OTHER TITLED VEHICLES |

|

|

MODEL |

VALUE |

MONTHLY PMT |

PRESENT BALANCE

TOTAL

$

$$

SCHEDULE 5 - LIFE INSURANCE

COMPANY |

BENEFICIARY |

FACE VALUE |

CASH VALUE OF LIFE |

POLICY LOANS |

|

|

|

INSURANCE |

|

$

$

$

$

$

$

$

$

$

TOTAL |

$ |

$ |

|

$ |

SCHEDULE 6 - IRA, KEOGH OR RETIREMENT FUNDS |

|

|

||

FINANCIAL INSTITUTION |

|

|

VESTED INTEREST |

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

TOTAL |

$ |

SCHEDULE 7 - CREDIT CARDS |

|

|

|

|

COMPANY

ACCOUNT NUMBER

MONTHLY PMTS

PRESENT BALANCE

TOTAL $

SCHEDULE 8 - OTHER ASSETS

$

DESCRIPTION

VALUE

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

TOTAL |

$ |

|

SCHEDULE 9 - OTHER LIABILITIES |

|

|

|

DESCRIPTION |

SECURITY |

MONTHLY PMT |

|

PRESENT BALANCE |

|

$ |

|

$ |

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

$

$

TOTAL $

$

Form Characteristics

| Fact Name | Description |

|---|---|

| Application Date | Be sure to fill in the date when you are completing the loan application. This helps the bank track your application timeline. |

| Loan Amount | Clearly state the amount you wish to borrow. An accurate figure will facilitate processing your request. |

| Email and Phone | Provide your current email address and phone numbers for prompt communication. This step is crucial for updates regarding your application. |

| Co-Applicant Information | If applicable, include details about your co-applicant. Their financial background may strengthen your application. |

| Assets and Liabilities | Detail your financial situation by listing all assets and liabilities. Accurate records can positively influence your loan approval. |

| Marital Status | Indicate your marital status accurately. It can affect the lender's assessment of your application. |

| State-Specific Forms | Some states have specific regulations or required forms. Familiarize yourself with local laws to ensure compliance. |

Guidelines on Utilizing How To Fill Out Bank Application

Successfully completing a bank application form is essential for securing a loan or financial product. It’s important to provide accurate information, as this ensures a smooth review process. Follow these steps to fill out the form efficiently and effectively.

- Application Date: Write the current date at the top of the form.

- Loan Request: Specify the amount you are requesting.

- Payment Date: Indicate the date you would like your first payment to be due.

- Purpose: State the reason for the loan.

- Applicant Information: Fill in your name, address, contact details, Social Security Number, date of birth, driver’s license number, and any dependents.

- Co-Applicant Information: If applicable, provide the same details for your co-applicant.

- Employment Details: List your current employer, position, income, and previous employer history.

- Other Monthly Income: Include any additional income sources, and clarify them as necessary.

- Marital Status: Indicate your marital status and that of your co-applicant if applicable.

- Existing Loans and Accounts: Provide details regarding your current monthly payments, mortgage holder or landlord information, and checking or savings account details.

- Assets and Liabilities: Complete the sections detailing your assets, monthly payments, and any obligations.

- Signature: Both applicant and co-applicant must sign and date the application to validate it.

- Attachments: Include any additional information that may help in the application review.

After completing the form, reviewing all entries for accuracy is crucial. Ensure that all required fields are filled out before submitting your application. This careful attention to detail can facilitate a faster processing time.

What You Should Know About This Form

1. What information do I need to provide about myself on the bank application form?

On the bank application form, you are required to provide personal details such as your full name, home address, email address, social security number, date of birth, and driver's license number. If you have a co-applicant, you will need to provide the same information for them as well, including their relationship to you. Make sure to include reliable contact numbers and the number of dependents, if applicable.

2. How do I indicate the purpose of my loan request?

In the designated section of the application form, you will find a line to specify the purpose of your loan request. This can include options like home improvement, debt consolidation, or education expenses. Clearly stating the purpose helps the bank understand your needs and make appropriate decisions regarding your application.

3. What should I include in the income section of the form?

This section is crucial for assessing your financial situation. You should provide your monthly employment income, details of any other monthly income sources, and whether these include benefits such as alimony or child support. Remember, it's not mandatory to disclose child support unless you want it considered for your loan application.

4. How can I report existing loans and obligations?

You'll need to fill out the section that asks for details about your existing loans and obligations. This includes your bank accounts, mortgage or rent payments, and any loans you currently have. Make sure to include information about the lender, the balance owing, and the monthly payments for each account. Proper documentation helps in creating a clear picture of your financial obligations.

5. What are assets, and why do I need to report them?

Assets refer to items of value that you own. This can include cash, stocks, real estate, automobiles, and retirement accounts. Reporting these assets allows the bank to assess your overall financial status, ensuring they have a full understanding of your economic standing. Be thorough while documenting each asset, including its estimated value.

6. What is a credit report, and why does the lender need it?

A credit report contains your credit history and reflects your creditworthiness. When you authorize the lender to obtain your credit report, they will assess your past borrowing behavior, like how timely you are with payments. A good credit score can play a significant role in the approval process of your loan application.

7. Are joint applications treated differently?

Yes, joint applications are typically considered together as a single financial entity. This means that the incomes, debts, and credit histories of both applicants are evaluated. Make sure both parties are comfortable with sharing their financial information, as it could impact the overall loan approval and terms offered.

8. What should I do if I need more space to provide additional information?

If the provided sections on the application form do not allow you enough space for details, feel free to attach extra pages. Clearly label any additional documents or information with your name and application date to ensure the lender associates them correctly with your application. Ensure all supplementary information enhances your overall application.

9. What happens after I submit my application?

Once your application is submitted, the lender will review the information provided and may reach out for additional details or documents. They will check your credit report and assess your financial status based on the information you've given, and then communicate their decision regarding your loan application. Remember to keep an eye on your email and phone for any updates.

Common mistakes

Filling out a bank application form may seem straightforward, but many people make common mistakes that can delay the process or result in rejection. One frequent error is incomplete information. When applicants leave out portions of their financial history or personal details, it raises red flags. Banks scrutinize every piece of information to assess creditworthiness, so ensuring complete answers is vital.

Another common mistake is miscalculating financial figures. Figures related to income, existing loans, and assets should be accurate. Even minor errors can lead to confusion or mistrust. Take the time to double-check numbers before submitting the application.

Many applicants also fail to provide accurate identification. Using the correct Driver's License Number or Social Security Number is critical. An error here might result in delays or an inability to verify identity, which is essential for loan approval.

Equally important is the failure to disclose all sources of income. Many applicants are uncertain whether to include forms of income like alimony or child support. It’s often beneficial to list all income, even if not required; this can provide a fuller picture of financial stability.

While it is crucial to include all relevant financial information, omitting additional explanations for complex situations can be detrimental. If you have specifics that might affect your overall financial picture, such as a large influx of cash or an impending job change, communicating this can work in your favor.

Furthermore, some people underestimate the importance of timing the application. Submitting an application at an inopportune time, like soon after a recent job loss or financial downturn, can lead to unfavorable outcomes. Assess your financial health before applying.

Additionally, many applicants overlook the signature section. It’s surprising how many forget to sign or date the application, thereby rendering it invalid. Be sure to check this before handing it in for review.

Providing poor quality documentation is another slip-up. When attaching financial statements or other necessary documents, ensure they are clear and easy to read. Photos or unclear scans can lead to misunderstandings about your financial situation.

Finally, not following up after submission can cost some applicants time and stress. After submitting your bank application, keep a record of your submission and check in with the bank. This ensures that everything is moving along and allows you to address any issues that may arise early in the process.

Documents used along the form

When completing a bank application, several other forms and documents may be required to support your request. These documents help the bank understand your financial situation better and ensure they make informed decisions. Here are some commonly needed documents you might encounter.

- Proof of Income: This document verifies your income, which could include recent pay stubs, tax returns, or bank statements. It's crucial for demonstrating your ability to repay the loan.

- Credit Report: A summary of your credit history, including any debts and payment records, helps banks assess your creditworthiness. You might be asked to provide a recent report or authorize the bank to obtain one.

- Identification: Providing a government-issued ID, such as a driver's license or passport, is essential for confirming your identity and preventing fraud.

- Asset Documentation: This includes documents related to your assets, such as property deeds, investment statements, or vehicle titles, to prove your financial stability.

- Business Financial Statements: If you are self-employed, you may need to submit profit and loss statements or balance sheets for your business. These documents help the bank assess business performance.

- Loan Statements: For existing debts, such as mortgages or auto loans, recent statements will show your current balance and payment history. This information is key in calculating your debt-to-income ratio.

- Rental Agreements: If you rent your living space, providing a copy of your lease can help clarify your housing situation and monthly obligations.

- Bank Statements: Recent statements from your checking and savings accounts help illustrate your financial habits and cash flow.

- Authorization Form: A form allowing the lender to collect your credit information ensures compliance with privacy regulations and helps streamline the approval process.

- Additional Notes: If there are unique aspects of your financial situation, such as a recent job loss or significant expense, include a letter explaining these factors to provide context for your application.

Gathering these documents can streamline your application process and improve your chances of securing the loan you need. Being prepared not only demonstrates your responsibility as a borrower but also helps the bank provide you with the best possible terms.

Similar forms

- Loan Application: The bank application form is very similar to a loan application. Both documents require personal details, income information, and details about existing obligations. Each serves as a formal request for financial assistance from a lender.

- Personal Financial Statement: Like the bank application form, the personal financial statement outlines an individual's financial condition. It includes information on assets, liabilities, income, and expenses to give a clear picture of financial health.

- Mortgage Application: A mortgage application shares similarities in format and content. It requires information about property ownership, employment, income, and existing debts, all of which are critical for lenders evaluating home loans.

- Credit Card Application: This type of application also requests personal information and financial details. Both forms assess the applicant's creditworthiness by asking about income, employment status, and existing debts.

- Business Loan Application: Similar to the bank application form, a business loan application collects information about financial stability and business operations. It involves providing financial statements and disclosing business debts.

- Grant Application: A grant application often includes financial information and project details similarly to a bank application. Both require applicants to justify their financial needs and provide supporting documents.

- Lease Application: This document is like a bank application in that it requires personal and financial information from the applicant. Landlords often focus on income and credit history to assess the applicant's ability to pay rent.

- Insurance Application: An insurance application gathers details about the applicant’s financial situation and personal history, similar to the bank application. Both assess risk and require comprehensive personal disclosures.

- Financial Aid Application: Like a bank application, financial aid forms require information about income, family details, and financial dependence. Both applications aim to determine eligibility for financial support.

Dos and Don'ts

When filling out the bank application form, there are several important guidelines to keep in mind. Here’s a straightforward list of things to do and avoid to help you complete the application smoothly.

- Double-check all information: Ensure that everything you provide is accurate and complete.

- Use clear handwriting: If filling out the form by hand, write legibly to avoid any misunderstandings.

- Provide all required documents: Attach any necessary supporting materials to back up your application.

- Be honest about your finances: Transparency helps speed up the approval process.

- Ask for help if needed: Don’t hesitate to reach out to customer service for clarification.

- Keep a copy for yourself: Always retain a copy of your completed application for your records.

- Read all instructions: Pay attention to every section of the application to avoid missing crucial details.

- Don’t rush the process: Take your time to review every section carefully before submitting.

- Don’t leave blanks: Fill in all fields as required unless the instructions indicate otherwise.

- Don’t provide inaccurate information: Misleading details can lead to application denial.

- Don’t forget to sign: Ensure that both you and any co-applicant sign where needed.

- Don’t ignore deadlines: Be mindful of any time limits for submission.

- Don’t submit incomplete applications: Avoid sending in an application without all necessary documentation.

- Don’t hesitate to follow up: After submission, check in to make sure your application is being processed.

Misconceptions

Filling out a bank application form can sometimes feel daunting. Many individuals make assumptions that may lead to mistakes or misconceptions. Understanding these common misunderstandings can clarify the process and help ensure a smooth application experience. Here are nine misconceptions about filling out a bank application form:

- Misconception 1: The application needs to be perfectly filled out on the first try.

- Misconception 2: All income must be disclosed in detail.

- Misconception 3: You need excellent credit to apply.

- Misconception 4: You cannot apply if you have previous financial issues.

- Misconception 5: The application is only about financial information.

- Misconception 6: You need to fill out every section of the application.

- Misconception 7: Only the applicant's information is needed.

- Misconception 8: You have to provide all financial documents upfront.

- Misconception 9: The application process is the same for all banks.

Many people believe they must submit a flawless application. In reality, it's acceptable to make adjustments before submission. Take your time to review each section carefully.

You are not required to disclose alimony, child support, or separate maintenance income unless you wish for it to be considered. Focus on the income you want the bank to take into account.

While having good credit can be advantageous, it is not a strict requirement for submitting an application. Banks often consider various factors, including your financial history and current obligations.

Many individuals assume that past financial problems, like bankruptcies or judgments, disqualify them from borrowing. Banks evaluate applications on a case-by-case basis, considering your overall financial situation.

While financial details are essential, personal information such as your name, address, and employment history is also crucial. This context helps banks understand your profile better.

Some sections of the bank application may not apply to your situation. It is perfectly fine to leave certain fields blank if they do not pertain to you.

If you have a co-applicant, their information is equally important. Including their details can strengthen your application and provide a fuller financial picture.

While some documentation is typically required with your application, banks often allow you to provide additional information later if any gaps exist. Always check with your lender on their requirements.

Different banks and financial institutions may have unique requirements and processes. It is beneficial to familiarize yourself with specific guidelines for the bank you are applying to.

By addressing these misconceptions, individuals can navigate the bank application process with greater ease and confidence. Understanding the form and the bank's expectations often leads to a more successful experience.

Key takeaways

Filling out a bank loan application form is a critical step that can significantly impact your financial future. To help you navigate this process, here are key takeaways:

- Accuracy Matters: Ensure all information is accurate. False information can lead to disqualification or legal issues.

- Complete the Application: Do not leave any parts of the application form blank. Complete every section to avoid delays.

- Provide Supporting Documents: Attach any required documents, such as financial statements, to support your application.

- List All Income Sources: Include all types of income, such as alimony or child support, but clarify if you do not want them considered.

- Specify Loan Purpose: Clearly state the purpose of the loan. Specificity aids the review process.

- Check and Double-Check: Review the entire application for errors before submission. Small mistakes can lead to misunderstandings or denials.

- Understand Your Obligations: Be aware of how existing debts may impact your new loan eligibility.

- Read the Fine Print: Understand the terms regarding your credit report and information sharing by the lender.

Taking these steps seriously can streamline your application process and improve your chances of approval. Act promptly and efficiently to enhance your financial prospects.

Browse Other Templates

How to Get a Birth Certificate in Texas Without Id - Document originals must be submitted; alterations or strike-throughs void the application.

Ku Official Transcript - Contact information is vital for processing and addressing any potential issues.

Assistance Disclosure Form,Recipient Update Report,HUD Assistance Summary,Project Funding Disclosure,Government Assistance Application,Recipient Information Report,Financial Interest Disclosure,Assistance Request Form,Application Assistance Disclosur - Comprehensive reporting on all government assistance helps maintain program integrity and accountability.