Fill Out Your Hr Block Drop Off Checklist Form

The H&R Block Drop Off Checklist form streamlines the process of submitting your tax documents, ensuring that clients provide all necessary information accurately. This form guides taxpayers through three straightforward steps: completing the checklist to the best of their ability, choosing between leaving the documents with a Client Service Professional or meeting with a tax professional, and finally, selecting how to finalize the tax return once prepared. Key sections include not only client information, such as names, birth dates, and Social Security numbers, but also critical details regarding income sources, expenses, and potential tax credits. Whether you're a returning client or a first-time visitor, you'll find spaces to specify your preferred tax professional and turnaround expectations. The form also covers important disclosure items and offers options for following up with your tax return review. By thoroughly filling out this checklist, clients help ensure an efficient and accurate tax preparation experience.

Hr Block Drop Off Checklist Example

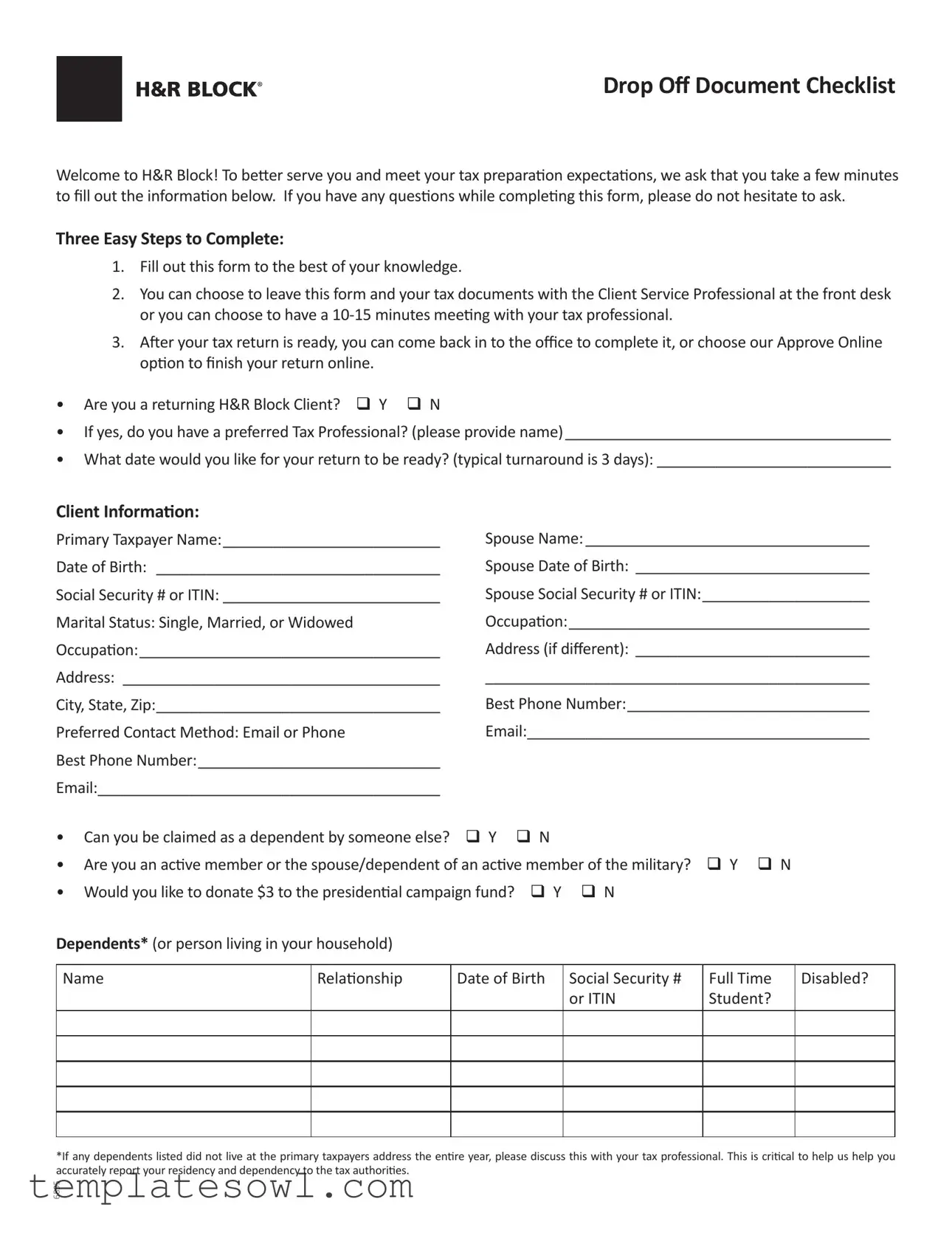

Drop Of Document Checklist

Welcome to H&R Block! To beter serve you and meet youR tax preparaion expectaions, we ask that you take a few minutes to ill out the informaion below. If you have any quesions while compleing this form, please do not hesitate to ask.

Three Easy Steps to Complete:

1.Fill out this form to the best of your knowledge.

2.You can choose to leave this form and your tax documents with the Client Service Professional at the front desk or you can choose to have a

3.Ater your tax return is ready, you can come back in to the oice to complete it, or choose our Approve Online opion to inish your return online.

• Are you a returning H&R Block Client? Y N

•If yes, do you have a preferred Tax Professional? (please provide name) _______________________________________

•What date would you like for your return to be ready? (typical turnaround is 3 days): ____________________________

Client Informaion:

Primary Taxpayer Name:__________________________ |

Spouse Name: __________________________________ |

Date of Birth: __________________________________ |

Spouse Date of Birth: ____________________________ |

Social Security # or ITIN: __________________________ |

Spouse Social Security # or ITIN:____________________ |

Marital Status: Single, Married, or Widowed |

Occupaion:____________________________________ |

Occupaion:____________________________________ |

Address (if diferent): ____________________________ |

Address: ______________________________________ |

______________________________________________ |

City, State, Zip:__________________________________ |

Best Phone Number:_____________________________ |

Preferred Contact Method: Email or Phone |

Email:_________________________________________ |

Best Phone Number:_____________________________

Email:_________________________________________

• |

Can you be claimed as a dependent by someone else? Y |

N |

• |

Are you an acive member or the spouse/dependent of an acive member of the military? Y N |

|

• |

Would you like to donate $3 to the presidenial campaign fund? |

Y N |

Dependents* (or person living in your household)

Name

Relaionship

Date of Birth

Social Security # or ITIN

Full Time Student?

Disabled?

*If any dependents listed did not live at the primary taxpayers address the enire year, please discuss this with your tax professional. This is criical to help us help you accurately report your residency and dependency to the tax authoriies.

6895

Drop Of Document Checklist

Document Checklist

Income: Check all that apply and include requested documents, if available

Income From: |

Yes |

|

Yes |

Employer |

|

|

|

|

|

|

|

Interest |

|

Social Security/Reirement |

|

|

|

|

|

Dividends |

|

Rental Property* |

|

Stock or Mutual Fund sale |

|

Unemployment |

|

|

|

|

|

Expenses: Check all that apply and include requested documents, if available |

|||

|

|

|

|

Expenses From: |

Yes |

|

Yes |

|

|

|

|

Self Employment* |

|

|

|

Educaion |

|

Rental Property* |

|

|

|

|

|

Medical/Dental care |

|

Union Dues |

|

|

|

|

|

Credits and Deducions: Check all that apply and include requested documents, if available |

|||

Did you or your spouse: |

Yes |

|

Yes |

|

|

|

|

Donate cash or goods to a charity? |

|

Pay Student Loan interest? |

|

|

|

|

|

Pay Child/Dependent Care expense? |

|

Have a Mortgage Payment? (1098) |

|

|

|

|

|

Make an IRA Contribuion |

|

Make a major taxable purchase? |

|

|

|

|

|

Pay Property Taxes? |

|

|

|

|

|

|

|

Miscellaneous*: Check all that apply |

|

|

|

|

|

|

|

Did you or your spouse: |

Yes |

|

Yes |

|

|

|

|

Sell a home? |

|

Take an IRA or 401(k) distribuion? |

|

|

|

|

|

Pay/Receive alimony? |

|

Adopt a child? |

|

|

|

|

|

Sufer catastrophic loss? |

|

Have gambling winnings/losses? |

|

|

|

|

|

*If this applies, we recommend you meet with your tax professional to discuss your tax situaion before dropping of your informaion.

Tax Professional or Client Service Professional Complete the secion below:

Legal Disclaimers

Client received Privacy Policy, Consent to Use and Consent to Disclose Service Provider documents, and the documents were explained and executed as applicable. Y N

Did the client review and sign the Client Service Agreement? Y N

Follow Up

How would the client like to review and approve their tax return?

•H&R Block Tax Oice – Appointment ime and date: ________________________________

•Approve Online: (Refund Anicipaion Loans and Emerald Card not available with this opion)

Tax Pro: If Approve Online is selected, you must verify Taxpayer and Spouse (if applicable) Ideniicaion

Taxpayer ID Type:_______________Exp. Date: __________

Place of Issuance, if any ____________________________

Date of Issuance, if any _____________________________

6895

Spouse ID Type:_________________Exp. Date: _________

Place of Issuance, if any ____________________________

Date of Issuance, if any _____________________________

DOP12006

Form Characteristics

| Fact Name | Details |

|---|---|

| Document Submission | Clients can submit their completed Drop Off Checklist and tax documents either at the front desk or have a brief meeting with a tax professional. |

| Client Information Requirements | Essential information includes taxpayer and spouse names, Social Security numbers, dates of birth, marital status, occupations, and contact details. |

| Income and Expense Documentation | Clients should check all applicable sources of income and expenses, providing documentation like W-2s, 1099s, and receipts upon submission. |

| Review Process | Clients must complete a Client Service Agreement and have the option to review their tax return either in person or online after preparation. |

| Military Status Inquiry | Clients are asked whether they or their spouse/dependent are active members of the military, which may affect their tax situation under the Servicemembers Civil Relief Act. |

Guidelines on Utilizing Hr Block Drop Off Checklist

Filling out the H&R Block Drop Off Checklist form is an essential step in the tax preparation process. By providing the necessary information, clients set the stage for a smooth experience during their tax filing. Once the form is completed, clients can either leave the documents with a Client Service Professional or schedule a brief meeting with a tax professional to discuss their situation.

- Complete Client Information: Fill in your primary taxpayer name, spouse name, dates of birth, and social security numbers or ITINs. Indicate your marital status and occupations.

- Provide Contact Information: Fill out your address, city, state, zip code, best phone number, and preferred contact method (email or phone).

- Answer Key Questions: Indicate if you can be claimed as a dependent, if you are a current or dependent military member, and if you want to donate to the presidential campaign fund.

- List Dependents: Provide names, relationships, dates of birth, social security numbers or ITINs, and indicate if they are full-time students or disabled.

- Document Checklist: Check all applicable sources of income, expenses, credits, deductions, and miscellaneous items. Make sure to include any available supporting documents.

- Client Verification: Indicate if you received privacy policies and other necessary documentation. Confirm if you reviewed and signed the Client Service Agreement.

- Follow-Up Preferences: Decide how you want to review and approve your tax return, either through an in-office appointment or online. Provide all required identification information for yourself and your spouse, if applicable.

What You Should Know About This Form

What is the purpose of the H&R Block Drop Off Checklist form?

The H&R Block Drop Off Checklist form serves multiple functions, helping both the client and the tax professional. It facilitates the collection of essential tax-related information from the client, such as personal details, income sources, expenses, and possible deductions or credits. By filling out this form, clients can prepare for their tax appointment, ensuring that all necessary documentation is provided or identified upfront. This streamlines the process and enhances accuracy during tax preparation.

How do I complete the H&R Block Drop Off Checklist form?

Completing the form involves several straightforward steps. First, clients should fill out their personal information as accurately as possible. This includes details about themselves, their spouse, and any dependents. Next, clients need to indicate the sources of their income and expenses by checking the relevant boxes and providing any available supporting documents. Finally, there are sections for indicating preferences, such as preferred contact method and review options for the completed tax return. The completed form can then be left with a Client Service Professional or discussed during a brief meeting.

Can I choose to meet with my tax professional instead of dropping off my documents?

Yes, clients have the option to meet with their tax professional for a brief session of about 10-15 minutes. During this meeting, clients can discuss their tax situation, clarify any concerns, and ensure that their documents are complete and accurately reflect their financial circumstances. This personal interaction can be beneficial for clients seeking guidance or clarification about the tax preparation process.

What should I do if I have dependents that did not live with me for the entire year?

If any dependents lived with the primary taxpayer for only part of the year, it is crucial to address this on the form. Clients should discuss any such circumstances with their tax professional to ensure accurate reporting of residency and dependency. This is important for determining eligibility for certain credits and deductions, which can significantly impact the final tax return.

Is there any legal disclaimer associated with the form?

Yes, the H&R Block Drop Off Checklist form includes disclaimers related to client privacy and consent. Clients are informed about the Privacy Policy and the Consent to Use and Consent to Disclose Service Provider documents. It is also noted that the client should review and sign the Client Service Agreement before proceeding. This ensures that the client's rights and privacy are protected while using H&R Block services.

Common mistakes

When filling out the H&R Block Drop Off Checklist form, it's easy to make mistakes that can delay your tax preparation. One common mistake is leaving out important information about your dependents. This section is vital for determining who qualifies as a dependent and can significantly impact your tax return. If you've had any dependents who did not live with you for the entire year, it's essential to note that. Be sure to fill in their names, relationships, dates of birth, and Social Security numbers.

Another frequent error is failing to indicate whether you can be claimed as a dependent by someone else. This question is crucial for establishing your tax situation and ensuring the accuracy of your return. If you neglect to answer this question, it may lead to complications later on. Always double-check your responses to ensure you're providing the fullest picture of your tax status.

Many people also forget to check all sources of income when completing the checklist. Whether it's a W-2 from your employer, self-employment income, or any social security benefits, all applicable income sources should be checked off and documented. Missing income can lead to underreporting, which could raise flags with the IRS. So, go through your documents meticulously before submitting.

Another common oversight involves the documentation of expenses related to self-employment. If you're self-employed, it's important to include any unreimbursed expenses from your employer. People often skip this section, which can be detrimental, as valid business expenses can help lower your taxable income. Collect any receipts or records you may have to support these claims.

Providing the wrong contact information is a mistake that can easily be avoided. Make sure that your phone number and email are correct. This will facilitate smooth communication with your tax professional regarding any updates or questions they might have. If they can’t reach you, it might lead to delays or misunderstandings in the tax preparation process.

It's not uncommon for individuals to overlook the section for credits and deductions. Questions regarding charitable donations, student loan interest, or mortgage payments need attention. Not taking full advantage of credits available to you could mean you are leaving money on the table. Be thorough in reviewing your financial records for any possible deductions.

Another pitfall is neglecting to discuss any significant life changes that could affect your tax situation, such as selling a home or experienced a catastrophic loss. These situations can have various implications on your taxes. Therefore, having a conversation with your tax professional before dropping off your information can prove invaluable.

People also sometimes forget to review the legal disclaimers and consent forms. These forms contain essential information about privacy policies and your rights as a client. Signature and acknowledgment of these documents ensure that you understand how your information will be handled, which is important for your security.

Finally, many clients simply rush through the checklist without taking the time to carefully review their entries. Taking a few extra moments to go over each section can make all the difference. Errors or incomplete sections can lead to delays and additional stress, which is the last thing anyone wants during tax season. Patience and attention to detail will serve you well.

Documents used along the form

When preparing your taxes, the H&R Block Drop Off Checklist is a helpful resource that streamlines the process. However, several other forms and documents often accompany it, ensuring you provide the necessary information for accurate tax preparation. Here’s a brief overview of those documents.

- W-2 Form: This form reports the annual wages you earned from your employer and the taxes withheld from your paycheck. It is essential for anyone who has had traditional employment and is required for tax filings.

- 1099-MISC Form: This form is used for reporting various types of income received outside traditional employment, such as freelance work or rent. If you're self-employed or received any other miscellaneous income, this document is crucial.

- 1099-INT Form: If you earned interest on savings or other accounts, this form will report the amount to include on your tax return. It's important to keep track of any interest income to ensure proper reporting.

- 1098 Form: This form is used to report mortgage interest you paid during the year. It can help you potentially deduct this interest on your tax return, making it a beneficial document for homeowners.

- Taxpayer Identification number (TIN): You will need to provide this number if you are not eligible for a Social Security number. It ensures accurate identification for tax purposes.

- Schedule C: If you are self-employed, this form reports income and expenses related to your business. It plays a vital role in accurately reflecting your business earnings on your tax return.

- IRS Form 8862: This form is for individuals who have previously lost the ability to claim the Earned Income Tax Credit (EITC) and are seeking to reclaim it. Completing this form is necessary if you want to prove your eligibility again.

Combining these forms with the H&R Block Drop Off Checklist can significantly enhance your tax preparation experience. This organized approach not only helps you remain efficient but also ensures you have all necessary documentation to maximize any potential deductions or credits.

Similar forms

The H&R Block Drop Off Checklist form plays a crucial role in guiding clients through the tax preparation process. Its organized layout helps individuals gather necessary information. Several other documents share similar functions, enhancing the efficiency of this process. Below is a list of seven related documents:

- Tax Organizer: This document, like the H&R Block Checklist, helps taxpayers collect and organize their financial information for filing. It often contains sections for income, deductions, and credits, making it user-friendly.

- Client Intake Form: Similar to the checklist, a client intake form gathers personal and financial details. It is crucial for tax professionals to understand the client's situation at the start of the engagement.

- Document Submission Form: This form functions like the H&R Block Checklist by specifying the documents needed for tax completion. It ensures that clients provide all requisite paperwork to facilitate a smooth process.

- Tax Preparation Worksheet: This worksheet helps taxpayers itemize their income and expenses, much like the checklist. It allows for a detailed view of financial situations and deductions available.

- Dependency Verification Form: This document, used in conjunction with the checklist, ensures clarity around who qualifies as a dependent. It is essential for maximizing tax benefits associated with dependents.

- Prior Year Tax Return Form: Review of a prior year's return often complements the H&R Block Checklist. It helps identify carryover items and ensures consistency in reporting income and deductions.

- Signature Authorization Form: This form, crucial for tax filings, parallels the checklist’s purpose by confirming that the taxpayer authorizes the filing of their return. It ensures compliance with legal requirements.

Dos and Don'ts

When filling out the H&R Block Drop Off Checklist form, it is important to proceed with care. Here are some essential do’s and don’ts to help guide you:

- Do fill out the form to the best of your knowledge.

- Do provide accurate contact information, including your preferred method of contact.

- Do check all applicable boxes for income sources, expenses, and deductions.

- Do include necessary documents, such as W-2s, 1099s, and receipts when possible.

- Do discuss non-standard situations, like residency and dependents, with your tax professional.

- Don't leave out any required information—it could delay your tax preparation.

- Don't be vague about your income sources or expenses; clarity is key.

- Don't ignore any sections of the form; ensure everything is checked or filled out.

- Don't hesitate to ask questions if you're unsure about any part of the form.

- Don't forget to retain a copy of the completed form for your records.

Misconceptions

Understanding the H&R Block Drop Off Checklist form is essential for a smooth tax preparation process. However, several misconceptions can lead to confusion. Below are common myths surrounding the form along with clarifications.

- Misconception 1: The form must be completed in full before dropping off.

- Misconception 2: Returning clients don't need to fill out the form again.

- Misconception 3: All documents listed are required for tax preparation.

- Misconception 4: You cannot make changes to your form after dropping it off.

Many believe that every field on the form is mandatory. While it is encouraged to fill out the checklist to the best of your knowledge, certain fields may not apply to your situation. It is acceptable to leave sections blank if they do not pertain to you.

Returning clients may assume that previous information is already on file and thus do not need to fill out the form. Despite prior submissions, every year brings changes in personal circumstances or tax laws. Providing updated information ensures accurate filing.

Some individuals think that they must submit every document listed in the Drop Off Checklist. In reality, only the relevant documents that apply to your income and expenses need to be provided. Discussing your specific circumstances with a tax professional can clarify what is necessary.

It is a common belief that once the checklist is submitted, there are no further options to amend the information. Clients are encouraged to inform the tax professional of any updates or changes, even after the form has been submitted. Open communication can greatly improve the accuracy of your tax return.

Key takeaways

When utilizing the H&R Block Drop Off Checklist form, there are several essential points to consider for a seamless tax preparation experience.

- Take the time to fill out the form accurately. Providing correct information ensures your tax professional understands your situation and can assist you effectively.

- Consider leaving your completed form and tax documents with the Client Service Professional at the front desk. Alternatively, you can schedule a brief meeting to discuss your tax situation directly with a tax professional.

- Check the appropriate boxes regarding your status as a returning client, your preferred tax professional, and your readiness for document submission.

- Be aware of the type of documentation requested. Categories include income, expenses, credits, deductions, and miscellaneous items. Each item aids in constructing a comprehensive tax return.

- After submitting your documents, decide how you would like to review your completed tax return. Options include an in-office appointment or the online approval method, each with its respective verification processes.

Browse Other Templates

What Does Umr Stand for - Submitting the EZ Claim Form allows for quick resolution of healthcare reimbursement issues.

Behind the Wheel Practice Log - It includes sections for different types of driving lessons and practice sessions.