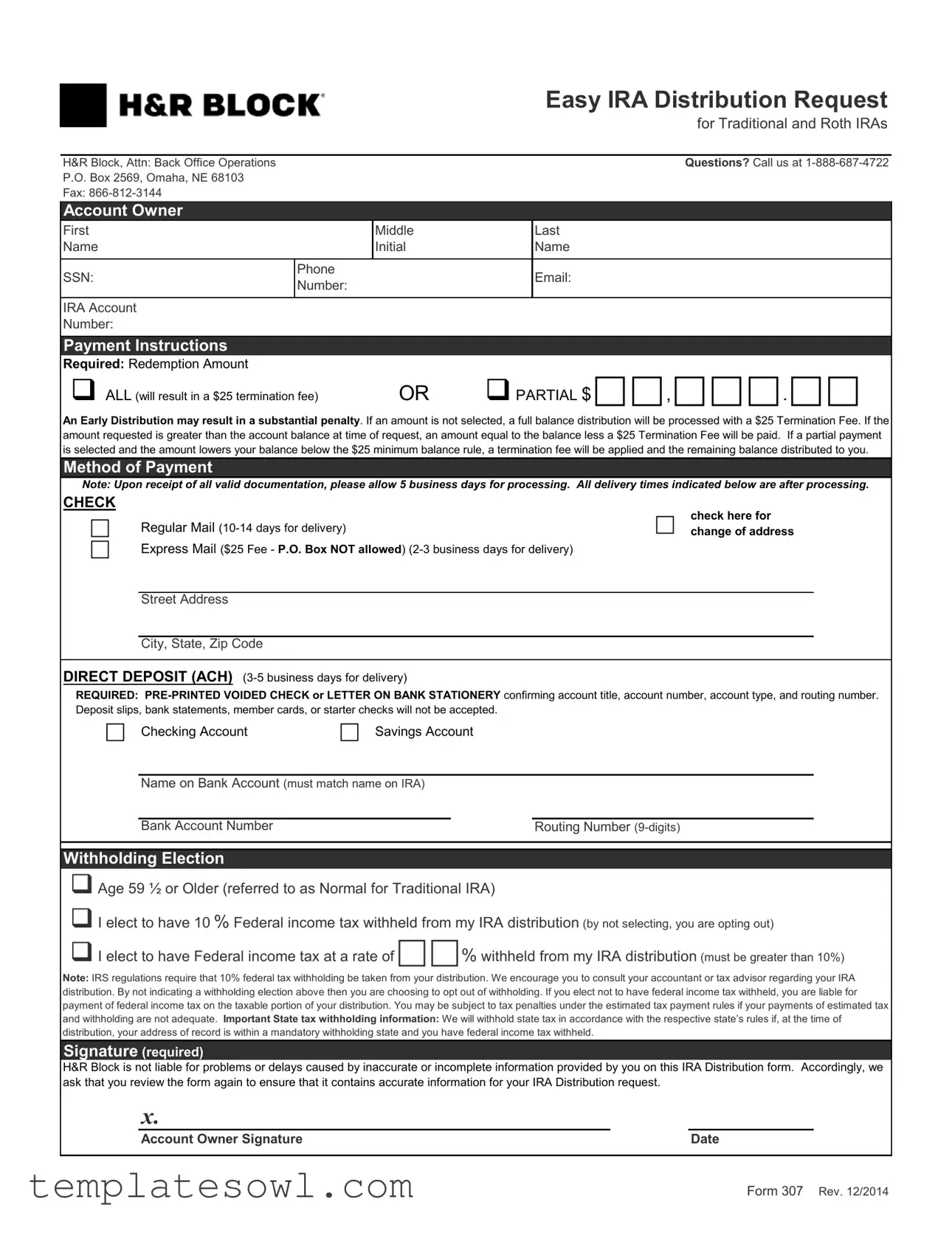

Fill Out Your Hr Block Ira Form

The H&R Block IRA Distribution Request form serves a crucial role for account owners seeking to manage their Traditional or Roth IRA funds. This comprehensive form allows individuals to request either a full or partial distribution from their retirement accounts, providing options that cater to various financial circumstances. Important details are required, including the account owner's personal information and the specific amount being requested for distribution. When completing the form, it is essential to be aware of potential penalties for early distributions and to ensure that the amount chosen does not trigger additional fees. The document includes options for how funds will be delivered, whether through check or direct deposit, with specific guidelines for each method. Additionally, there are sections addressing federal and state tax withholding, emphasizing that proper selections can affect tax liabilities. It is vital for account owners to review the form carefully to avoid issues due to inaccuracies. A signature is required to validate the request, and users are reminded that H&R Block cannot be held responsible for any complications arising from incorrect information. Understanding these key aspects can streamline the distribution process and help individuals make informed decisions regarding their retirement savings.

Hr Block Ira Example

|

Easy IRA Distribution Request |

|

for Traditional and Roth IRAs |

|

|

H&R Block, Attn: Back Office Operations |

Questions? Call us at |

P.O. Box 2569, Omaha, NE 68103 |

|

Fax: |

|

Account Owner

First

Name

SSN:

IRA Account Number:

|

Middle |

Last |

|

|

Initial |

Name |

|

|

|

|

|

Phone |

Email: |

||

Number: |

|||

|

|||

|

|

|

|

Payment Instructions

Required: Redemption Amount

ALL (will result in a $25 termination fee)OR PARTIAL $ , .

An Early Distribution may result in a substantial penalty. If an amount is not selected, a full balance distribution will be processed with a $25 Termination Fee. If the amount requested is greater than the account balance at time of request, an amount equal to the balance less a $25 Termination Fee will be paid. If a partial payment is selected and the amount lowers your balance below the $25 minimum balance rule, a termination fee will be applied and the remaining balance distributed to you.

Method of Payment

Note: Upon receipt of all valid documentation, please allow 5 business days for processing. All delivery times indicated below are after processing.

CHECK

|

Regular Mail |

|

check here for |

change of address |

Express Mail ($25 Fee - P.O. Box NOT allowed)

Street Address

City, State, Zip Code

DIRECT DEPOSIT (ACH)

REQUIRED:

Checking Account |

Savings Account |

|||

|

|

|

||

|

Name on Bank Account (must match name on IRA) |

|||

|

|

|

|

|

|

Bank Account Number |

|

|

Routing Number |

Withholding Election

Age 59 ½ or Older (referred to as Normal for Traditional IRA)

I elect to have 10 % Federal income tax withheld from my IRA distribution (by not selecting, you are opting out)

I elect to have Federal income tax at a rate of % withheld from my IRA distribution (must be greater than 10%)

Note: IRS regulations require that 10% federal tax withholding be taken from your distribution. We encourage you to consult your accountant or tax advisor regarding your IRA distribution. By not indicating a withholding election above then you are choosing to opt out of withholding. If you elect not to have federal income tax withheld, you are liable for payment of federal income tax on the taxable portion of your distribution. You may be subject to tax penalties under the estimated tax payment rules if your payments of estimated tax and withholding are not adequate. Important State tax withholding information: We will withhold state tax in accordance with the respective state’s rules if, at the time of distribution, your address of record is within a mandatory withholding state and you have federal income tax withheld.

Signature (required)

H&R Block is not liable for problems or delays caused by inaccurate or incomplete information provided by you on this IRA Distribution form. Accordingly, we ask that you review the form again to ensure that it contains accurate information for your IRA Distribution request.

X.

Account Owner Signature |

Date |

Form 307 Rev. 12/2014

Form Characteristics

| Fact | Description |

|---|---|

| Type of Distributions | This form facilitates requests for distributions from both Traditional and Roth IRAs. It's important to understand the tax implications of each type before proceeding. |

| Termination Fee | A $25 termination fee applies if you request a full distribution without specifying an amount. This fee will be deducted from your account balance. |

| Processing Time | H&R Block typically processes requests within 5 business days after they receive all valid documentation. Be mindful of this timeline when planning your distribution. |

| Payment Methods | You can choose from several payment methods: regular mail, express mail for a fee, or direct deposit to your bank account. Each method has its own delivery timeline. |

| Tax Withholding Requirements | IRS regulations require a minimum of 10% federal income tax withholding on distributions. State tax may also be withheld based on your residency and state laws. |

Guidelines on Utilizing Hr Block Ira

Once you've gathered the necessary information, you can begin filling out the H&R Block IRA Distribution Request form. It's important to ensure that all details are accurate to avoid any issues with processing your request. Below, you'll find step-by-step instructions to guide you through completing the form correctly.

- Personal Information: Fill in your first name, middle initial, last name, and Social Security Number (SSN).

- Contact Information: Provide your phone number and email address.

- IRA Account Details: Enter your IRA account number.

- Payment Instructions: Choose whether you want to redeem ALL of your balance (which includes a $25 termination fee) or a PARTIAL amount. Specify the amount if you choose partial.

- Method of Payment: Select how you want to receive your funds: via a check in regular mail (10-14 days), express mail (2-3 business days for a $25 fee), or direct deposit (3-5 business days).

- Address Information: If you opted for a check, provide your street address, city, state, and zip code. If you prefer direct deposit, ensure you have a pre-printed voided check or a letter from your bank.

- Bank Account Details: Indicate whether the payment should go to a checking or savings account. Also, enter your name on the bank account, bank account number, and routing number.

- Tax Withholding Elections: Specify your age and indicate if you want 10% federal tax withheld or another percentage. It’s advisable to consult with a tax advisor at this point.

- Signature: Lastly, sign and date the form. Treat this as a confirmation that all information is correct and complete.

After completing the form, it’s recommended to review everything carefully one last time before submitting. This step helps safeguard against any mistakes that could delay your processing. Good luck with your distribution request!

What You Should Know About This Form

What is the purpose of the H&R Block IRA Distribution Request Form?

The H&R Block IRA Distribution Request Form is used to request distributions from Traditional and Roth Individual Retirement Accounts (IRAs). This form allows account owners to specify whether they want to take a full distribution, a partial distribution, and how they would like to receive their funds. Properly completing and submitting this form ensures that the request is processed accurately and efficiently.

What are the options for redeeming funds from my IRA?

You can choose to redeem all of your funds or a specified partial amount. If you select "ALL," be aware that a $25 termination fee will apply. For partial distributions, ensure that the amount you request does not lower your account balance below the required $25 minimum. If it does, a termination fee will still apply, and the remaining balance will be distributed to you.

What methods of payment are available for IRA distributions?

Distributions can be received via check or direct deposit (ACH). If you choose check, you have the option of regular mail or express mail, with the latter incurring a $25 fee. For direct deposit, a pre-printed voided check or a letter on bank stationery is required to confirm your account details. Delivery times for checks and direct deposit vary between 2-14 business days, depending on the method chosen.

How does federal income tax withholding work for IRA distributions?

When requesting a distribution, you must indicate if you want federal income tax withheld. If you are 59½ or older, you can opt for withholding at a rate of 10% or greater. You may also choose to not have any federal income tax withheld. If no selection is made, you will be opting out of withholding, and you may face tax penalties later if your payment contributions are insufficient against your tax liabilities.

What should I do if I have moved since opening my IRA?

If your address has changed, make sure to update this information when submitting your distribution request. You may check the box for change of address on the form. Accurate address details are important, especially regarding applicable state tax withholding, which varies based on your location. Your distribution will follow the withholding rules of whichever state you are currently a resident of.

What steps should I take to ensure my request is processed without issues?

Carefully review all the information provided on the distribution form before submitting it. Ensure your name, Social Security Number, and account details are accurate. Double-check the amount requested, the method of payment, and your withholding elections. Inaccurate or incomplete information can lead to delays or issues in processing your request.

Common mistakes

Completing the H&R Block IRA Distribution Request form requires attention to detail. Mistakes can lead to processing delays or unwanted penalties. Here are ten common errors people make when filling out this form.

First, some users forget to enter their Social Security Number (SSN). It is crucial to include this information. Without it, processing the request may be impossible.

Second, individuals often neglect to provide a specific redemption amount. Instead of indicating a full or partial distribution, they might leave this section blank. Consequently, this will trigger a full balance distribution, along with a $25 termination fee.

Third, a common mistake involves the method of payment selection. Some people fail to clearly mark the desired option for receiving their funds. This can lead to processing errors and delayed payments, as the necessary information must be clear.

Fourth, individuals may not include the required pre-printed voided check or bank letter for direct deposit. Without this documentation, the requested payment cannot be processed via direct deposit.

Fifth, many do not review the withholding election section carefully. People may skip indicating whether to withhold federal income tax. If this section remains empty, it could mean they are opting out of withholding entirely, which may come back to haunt them during tax season.

Sixth, inaccurate account information is frequently provided. Errors related to the bank account number or routing number can lead to rejected transactions and necessitate resubmission of the request.

Seventh, some applicants forget to sign and date the form. A missing signature makes the entire request invalid and can result in unnecessary delays.

Additionally, it is essential to ensure the contact information matches what is on file. When a discrepancy arises with names or addresses, it can complicate the process, causing further delays.

Lastly, individuals often overlook the timing of their request. Submitting forms during peak processing periods may extend the timeline for receiving distributions, as noted on the form itself.

Taking care to avoid these frequent mistakes can streamline the process, ensuring that individuals receive their IRA distributions without unnecessary complications or delays.

Documents used along the form

When completing the H&R Block IRA Distribution Request form, several additional documents may be necessary to ensure a smooth process. These documents provide essential information related to the IRA account, tax withholding, and other relevant details. Below is a brief overview of commonly used forms alongside the IRA request form.

- W-4P Form: This IRS form allows account holders to specify the amount of federal income tax to be withheld from their IRA distributions. It is essential for determining the proper tax treatment of withdrawals.

- Bank Verification Letter: A letter from the financial institution that confirms the account holder's bank details, including account number, routing number, and type of account. This is often required for direct deposit requests.

- Withdrawal Authorization Form: This document grants permission for a financial advisor or representative to initiate withdrawals from the IRA on behalf of the account holder. It includes the advisor's details and the specific terms of withdrawal.

- State Tax Withholding Form: Depending on residency, this form indicates how state tax should be handled in conjunction with federal tax withholding. It ensures compliance with state regulations during distributions.

Including these documents with the H&R Block IRA Distribution Request will facilitate the processing of your request. Ensuring accurate completion helps prevent delays and ensures compliance with tax regulations.

Similar forms

- IRA Distribution Request Form: Similar in purpose, this document allows account holders to request distributions from their Individual Retirement Accounts, detailing the amount and method of withdrawal.

- 401(k) Distribution Request Form: Like the IRA form, this document permits employees to request distributions from their employer-sponsored 401(k) plans, outlining the procedure and implications of early withdrawal.

- Roth IRA Conversion Form: This form is used for converting a Traditional IRA to a Roth IRA, sharing similar sections on account holder information and tax implications, especially regarding withholding options.

- Request for Direct Rollover: This document allows the transfer of funds from one retirement plan to another, mimicking the distribution form's focus on account details and tax considerations.

- Tax Withholding Election Form: This form specifically addresses the withholding of taxes from retirement distributions. It is similar to the IRA form's section on federal and state withholding elections.

- Early Withdrawal Request Form: This document is used in cases where account holders wish to access funds before reaching retirement age, detailing the penalties, much like the H&R Block IRA form.

- Beneficiary Distribution Request Form: When a beneficiary receives funds from a deceased account holder’s IRA, this form is required to process distributions, reflecting similar instructions and options on distributions.

- Withdrawal Authorization Form: This document is often used to authorize withdrawals from savings or investment accounts, sharing the essential characteristics of identifying account types and payment methods.

Dos and Don'ts

When it comes to filling out the H&R Block IRA Distribution Request Form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do double-check your personal information. Make sure your name, Social Security Number, and contact details are accurate.

- Do specify the correct redemption amount. Clearly indicate whether you want a full or partial distribution and be cautious about any associated fees.

- Do consult with a tax advisor. Understanding the tax implications of your distribution can save you from unexpected penalties.

- Do ensure proper payment instructions are provided. Choose a delivery method that fits your needs and confirm your banking information if opting for direct deposit.

- Don't leave any sections blank. Completing every part of the form prevents delays in processing your request.

- Don't ignore the withholding election. Not indicating your choice could leave you responsible for significant tax liabilities later.

- Don't forget to sign and date the form. An unsigned form is not valid and will prevent your request from being processed.

- Don't rely solely on assumptions. Review all instructions carefully to avoid any errors or misinterpretations.

Taking the time to follow these guidelines can make the process smoother and ensure that your IRA distribution request is handled efficiently.

Misconceptions

-

Misconception 1: H&R Block's IRA form is only for Traditional IRAs.

In reality, the H&R Block IRA form serves both Traditional and Roth IRAs. This means that regardless of the type of account you hold, you can use this form for distribution requests. It's essential to ensure you're selecting the appropriate options corresponding to your specific IRA type.

-

Misconception 2: There is no penalty for early withdrawal from an IRA.

This assumption is misleading. An early distribution from an IRA, especially before age 59 ½, can often result in a significant penalty. Understanding the implications of withdrawing funds early is crucial for maintaining your retirement savings.

-

Misconception 3: The form guarantees a rapid distribution of funds.

While the form outlines processing times, such as five business days for processing, distribution cannot be guaranteed to occur immediately once the form is submitted. Factors like incomplete information or required verification can delay processing.

-

Misconception 4: Selecting a partial withdrawal avoids any fees.

This is not necessarily true. If a partial distribution lowers the account balance below the required minimum, a termination fee may apply. Participants should be aware of their account balance before making a distribution selection.

-

Misconception 5: You can choose any withdrawal amount without limitations.

Constraints exist regarding the amounts you can withdraw. If an amount greater than the account balance is requested, the institution will only process the account's balance minus any applicable fees. It is critical to have a clear understanding of your account's current balance before submitting a request.

Key takeaways

When filling out the H&R Block IRA Distribution Request Form, consider the following key takeaways:

- Personal Information: Ensure that all personal information, such as your name, Social Security Number, and IRA account number, is provided accurately. This information is crucial for processing your request.

- Redemption Amount: You have the option to request a full distribution or a partial withdrawal. If you select a partial distribution, ensure it does not lower your balance below the minimum required amount, as this could result in a termination fee.

- Early Distribution Penalties: Be aware that taking an early distribution (before age 59½) may result in a substantial penalty. Always consider the financial implications before proceeding.

- Payment Method: Choose your preferred payment method carefully. Options include check by regular or express mail and direct deposit. Each has different processing times and potential fees.

- Tax Withholding: Understand the tax implications of your withdrawal. You can elect to have federal income tax withheld, or you can choose to opt-out. It's advisable to consult with a tax advisor for tailored advice.

- State Tax Compliance: If you reside in a state with mandatory withholding rules, state tax will be withheld according to those regulations when federal tax is also withheld.

- Review for Accuracy: Before submitting the form, carefully review all entries for accuracy. Incomplete or incorrect information may cause delays or complications in processing your request.

By keeping these takeaways in mind, you can ensure that your IRA distribution request is filled out correctly and meets your financial needs.

Browse Other Templates

Meta Ad Specs - Character Name: Chris Martin, an adventurous soul who seeks thrill and excitement.

What Is an Apportioned Tag - Fleet owners benefit from streamlined registration processes under the IRP, reducing administrative burdens.

Pompano Beach Fire Rescue - The contractor's notarized signature serves as a legal commitment to the project plans.