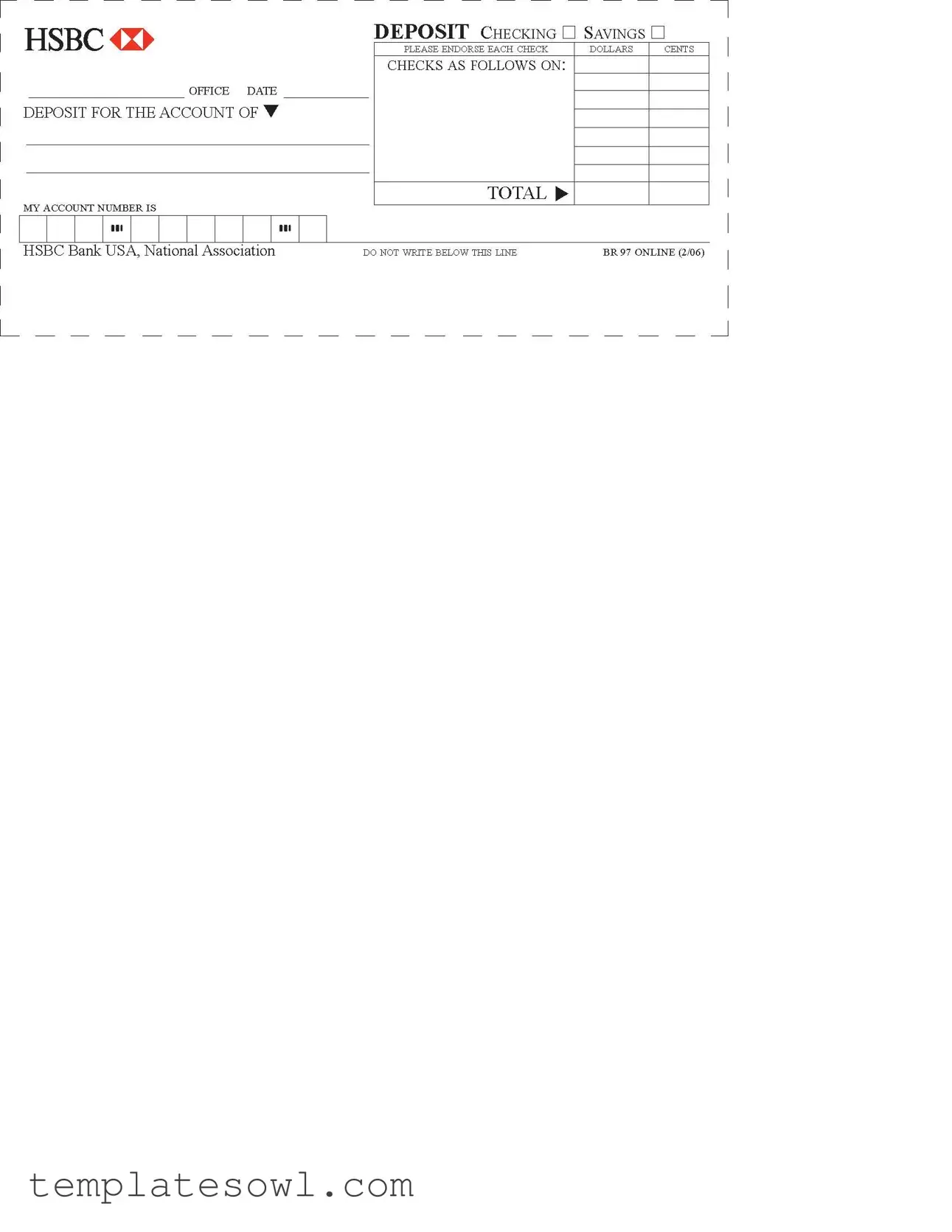

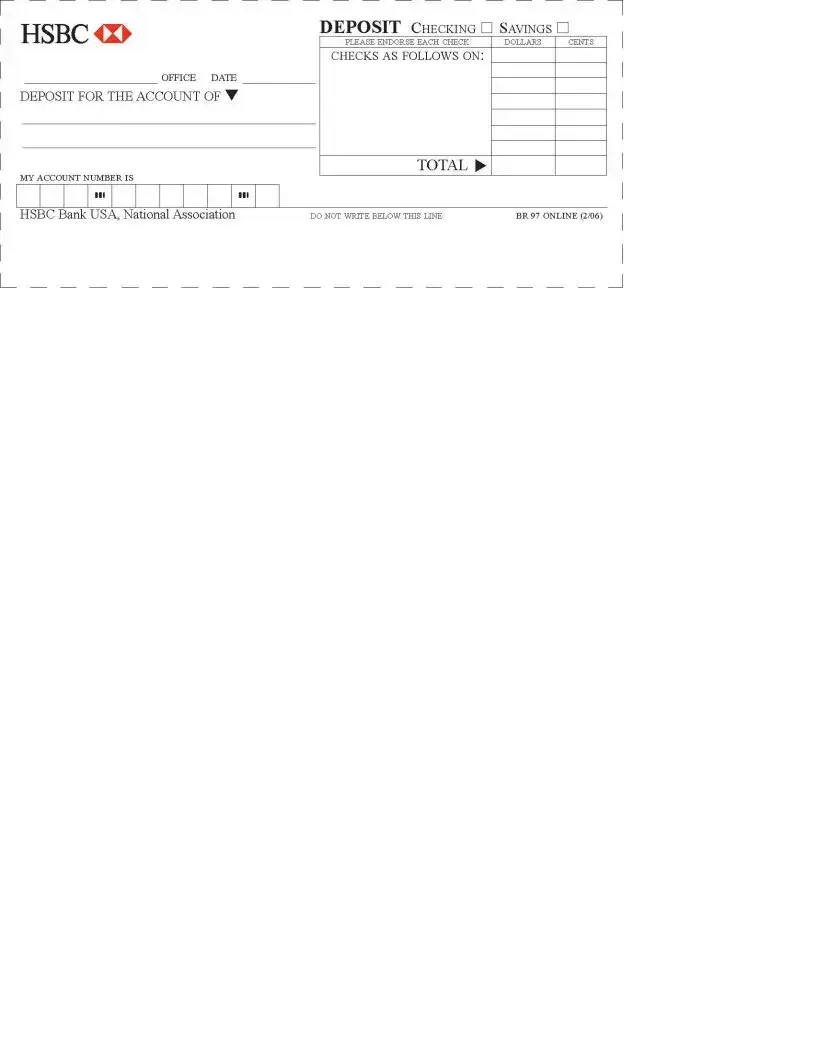

Fill Out Your Hsbc Bank Deposit Slip Form

The HSBC Bank Deposit Slip form is a vital tool for customers looking to manage their banking transactions efficiently. Within this simple yet essential document, users indicate whether they are making deposits into a checking or savings account. It is crucial to properly endorse each check submitted, as clarity in transactions promotes a smooth banking experience. Customers must fill in the amount being deposited, breaking it down into dollars and cents, which helps ensure accurate processing of the deposit. Additionally, there is a designated area for indicating the specific checks being submitted, with a space provided for the date and location of the deposit. Importantly, the form requires the account holder to specify their account number, ensuring the funds are allocated correctly. A note at the bottom advises not to write below a specific line, emphasizing the need for organization and intended use of the form. Understanding the structure and requirements of the HSBC deposit slip can greatly enhance a customer's interaction with their banking services, ensuring that deposits are logged correctly and without delay.

Hsbc Bank Deposit Slip Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Name | HSBC Bank Deposit Slip |

| Account Types | Supports Checking and Savings accounts |

| Endorsement Requirement | All checks must be endorsed before deposit |

| Currency Format | Requires separate entries for Dollars and Cents |

| Deposit Date | Depositor must fill in the date of deposit |

| Account Identification | Depositor must provide their account number |

| Processing Instruction | Do not write below the designated line |

| Bank Information | Issued by HSBC Bank USA, National Association |

| Document Version | Current version dated online as of February 2006 |

| Governing Laws | Governed by federal banking regulations and New York state law |

Guidelines on Utilizing Hsbc Bank Deposit Slip

After gathering your checks and cash, you are ready to fill out the HSBC Bank Deposit Slip. This step ensures that your funds are correctly credited to your account. Follow these steps to complete the deposit slip accurately.

- Start by selecting the appropriate account type. Choose either Checking or Savings at the top of the slip.

- Write the date of the deposit in the designated space.

- List each check you are depositing. Write the amount in DOLLARS and CENTS boxes next to each check.

- Ensure each check is endorsed before listing it on the slip. This means you need to sign the back of each check.

- Fill in the line that reads DEPOSIT FOR THE ACCOUNT OF with your name as it appears on the account.

- Provide your account number in the specified area, making sure to include all digits accurately.

- Sum up the total deposit amount and write it in the TOTAL box.

- Leave the section labeled DO NOT WRITE BELOW THIS LINE empty. It is meant for bank use only.

What You Should Know About This Form

What is the purpose of the HSBC Bank Deposit Slip form?

The HSBC Bank Deposit Slip form is designed to facilitate the deposit of funds into an account. When you fill out this form, you are providing essential information to ensure that the deposited amounts are accurately credited to your account. Typically, it helps streamline the transaction process for both customers and bank personnel. This form is particularly useful for deposits that involve checks or cash, as it helps organize and track the deposits made at the bank.

How do I correctly fill out the HSBC Bank Deposit Slip form?

Filling out the HSBC Bank Deposit Slip form involves a few key steps. First, indicate whether the deposit is for a checking or savings account. Next, write the total amount in dollars and cents for the deposit being made. If you are depositing multiple checks, it's important to endorse each check on the back as indicated. Additionally, you'll need to provide your account number, which can usually be found on your bank statements. The form should be completed neatly to ensure clarity and minimize errors during processing.

What information should I provide on the deposit slip?

Your deposit slip should contain specific information to ensure that your deposit is processed correctly. This includes your account number, the type of account (checking or savings), and the total amount being deposited. If you are including checks, list each check under the designated area labeled "CHECKS AS FOLLOWS." Moreover, date the deposit and include any notes or references, if necessary, directly on the form. Accurate information is crucial to prevent delays in processing your deposit.

What happens if I make a mistake on the deposit slip?

If you happen to make a mistake on the deposit slip, it’s generally advised to start with a new form to avoid confusion. Mistakes can lead to processing errors, which could impact the timely crediting of funds to your account. However, if only a minor error occurs, such as a small clerical mistake, some banks may allow you to correct it directly on the slip, provided it remains clear. It is always wise to double-check your entries before submitting the deposit for processing.

Common mistakes

Filling out a bank deposit slip may seem straightforward, but many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to include all necessary information. If the account number is incorrect or not included, the bank may not be able to process the deposit correctly. Always double-check that the account number matches what’s on your banking documents.

Another common mistake is miscalculating the total amount being deposited. It is crucial to add up the deposits accurately. If there is a discrepancy between the amount written on the deposit slip and what is actually deposited, it can lead to confusion during processing. Take extra time to verify each amount and ensure the totals are correct.

Many people overlook the importance of endorsing checks. The slip instructs depositors to endorse each check, yet some forget this essential step. Without a proper signature on the back of each check, the bank might reject the deposit. This oversight can often delay access to funds, causing frustration for all parties involved.

Inattention to details can also lead to an incorrectly filled-out section for Dollars and Cents. When listing the amount of the deposit, it is important to separate dollars and cents clearly. Mixing these values up can result in incorrect processing and may require additional time to resolve.

People often fail to use the correct deposit type, whether it be for checking or savings. It is necessary to mark the appropriate box clearly. If the wrong option is selected, funds could be allocated incorrectly, affecting the account holder’s expectations and financial planning.

Not writing down the date of the deposit is another mistake. Completing the date section is critical for record-keeping and helps track transactions. Omitting this information creates unnecessary complications when reviewing banking statements in the future.

Many customers neglect to include details in the 'deposit for the account of' section. This section should clearly indicate whose account the deposit is intended for, especially in cases where accounts are joint or multiple accounts exist. Failing to provide clear identification can lead to financial errors.

Lastly, ignoring the instruction “DO NOT WRITE BELOW THIS LINE” is a common misstep. This area is reserved for bank use only, and any marks made in this section can interfere with the processing of the deposit. Always respect this guideline to ensure that the transaction goes smoothly.

Documents used along the form

When managing banking transactions, several documents complement the HSBC Bank Deposit Slip. Each of these forms serves a distinct purpose and aids in ensuring smooth financial operations. Below is a list of commonly used forms and documents that often accompany the deposit slip.

- Withdrawal Slip: A document used to request the withdrawal of funds from a bank account. Customers fill in their account information and the amount they wish to withdraw.

- Check: A written order directing a bank to pay a specified sum of money from the writer's account to the person or entity named on the check.

- Direct Deposit Authorization Form: This form allows an individual to authorize their employer or other payer to deposit funds directly into their bank account, thereby eliminating the need for a physical check.

- Transfer Request Form: Used to transfer funds from one bank account to another, either within the same bank or to a different financial institution.

- Account Opening Form: A form used to provide personal information and necessary documentation to open a new bank account.

- Bank Statement: A monthly summary provided by the bank detailing all financial transactions within an account, including deposits, withdrawals, and accrued interest.

- Loan Application Form: This document is essential for individuals seeking to borrow money from a bank or financial institution, detailing personal finances and credit history.

These forms play a crucial role in daily banking functions. Being familiar with them can help facilitate seamless transactions and effective financial management.

Similar forms

Withdrawal Slip: Similar to a deposit slip, a withdrawal slip is used to request funds from your bank account. It usually contains fields for your account information and the amount you wish to withdraw.

Check: A check is another form of payment that instructs your bank to pay a specific amount to a designated person or entity. Like a deposit slip, it requires endorsement and includes account details.

Direct Deposit Authorization Form: This form allows you to authorize your employer or other entities to deposit funds directly into your bank account. It shares similarities with the deposit slip in that it provides necessary account information and requires your signature.

Transfer Request Form: Used to transfer funds between accounts, this form requests a movement of money similar to a deposit slip. It includes details about both the sending and receiving accounts, ensuring clarity in the transaction process.

Dos and Don'ts

When filling out the HSBC Bank Deposit Slip form, it's important to follow specific guidelines to ensure proper processing. Here are some key points to keep in mind:

- Do ensure that all sections of the deposit slip are filled out completely.

- Don't forget to endorse each check before including it in your deposit.

- Do clearly specify the amount in both dollars and cents.

- Don't write in the area labeled "DO NOT WRITE BELOW THIS LINE." This area is reserved for bank use only.

- Do include your account number correctly to avoid delays.

- Don't use any additional marks or scribbles on the slip that could obscure your information.

Misconceptions

- Misconception 1: The deposit slip can be used for any bank, not just HSBC.

- Misconception 2: You can skip endorsing checks if you are depositing cash.

- Misconception 3: The deposit slip is only necessary for large deposits.

- Misconception 4: You do not need to write your account number on the slip.

- Misconception 5: You can write over the printed parts of the deposit slip.

- Misconception 6: Depositing multiple checks requires a separate slip for each check.

The HSBC Bank Deposit Slip is specifically designed for transactions at HSBC. Using a deposit slip intended for another bank may lead to complications in processing your deposit.

Every check included in your deposit must be endorsed, regardless of whether you are also depositing cash. This is a requirement to ensure secure processing of the checks.

Every deposit, no matter the size, requires a completed deposit slip. Whether you’re depositing ten dollars or ten thousand, following the protocol remains essential.

Your account number is crucial for directing the funds to the correct account. Omitting it can delay processing or result in incorrect deposits.

It is important to avoid writing over printed areas on the slip. Doing so can create confusion and may lead to errors in processing your deposit.

You can include multiple checks on a single deposit slip. Just ensure that all checks are properly endorsed and listed on the deposit slip itself.

Key takeaways

Filling out an HSBC Bank Deposit Slip is straightforward, but careful attention to detail is important. Below are key takeaways to help you use the form effectively:

- Always endorse each check before placing it in the deposit slip. This simple action helps prevent any issues with your deposits.

- Clearly write the date of the deposit in the designated area. This ensures accurate processing by the bank.

- Fill in both the dollar and cents amounts accurately. Double-check these amounts to avoid discrepancies.

- Include your account number in the correct field. This directs the deposit to the right account.

- Do not write anything below the line labeled "DO NOT WRITE BELOW THIS LINE." This area is reserved for bank processing.

- Stay organized by using separate deposits slips for checking and savings accounts, if applicable. This simplifies your banking transactions.

Browse Other Templates

Epaystubaccess Login - Provide past residence addresses for the last seven years accurately.

How to Claim Supplemental Nutrition Assistance Program North Carolina - Document any additional income that may affect your benefits.