Fill Out Your Hsbc Telegraphic Transfer Slip Form

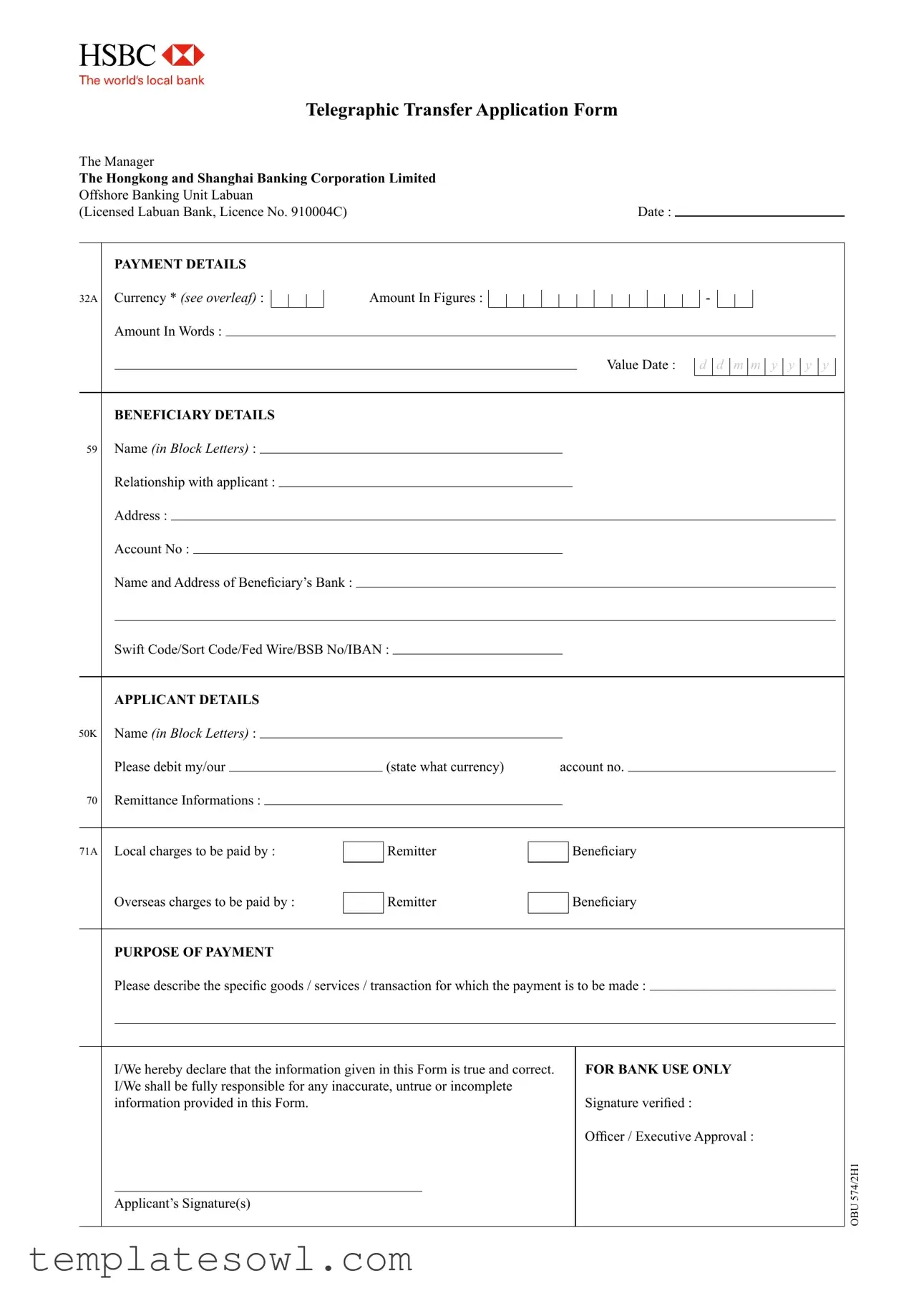

The HSBC Telegraphic Transfer Slip form is a crucial document that facilitates the process of transferring funds internationally. This form captures essential payment details, including the currency type, amount in figures and words, and the value date. Additionally, it requires information about the beneficiary, such as their name, relationship with the applicant, and bank details. The applicant section mandates the individual’s identity and account particulars, ensuring that the funds are debited correctly. It also specifies the remittance information and indicates who is responsible for local and overseas charges. Accurately describing the purpose of the payment is imperative for compliance. Each section must be completed with precision to enhance the efficiency of the transaction. The form is not just a transactional tool; it also includes terms and conditions that set out the obligations of both the applicant and the bank, highlighting the critical nature of meticulousness when providing information. Applicants are reminded of the commitments involved, as inaccuracies can lead to delays or financial repercussions. Therefore, completing the HSBC Telegraphic Transfer Slip form correctly is of utmost importance for a smooth and successful remittance process.

Hsbc Telegraphic Transfer Slip Example

Telegraphic Transfer Application Form

The Manager

The Hongkong and Shanghai Banking Corporation Limited

Offshore Banking Unit Labuan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

(Licensed Labuan Bank, Licence No. 910004C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

PAYMENT DETAILS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

32A |

Currency * (see overleaf) : |

|

|

|

|

|

|

Amount In Figures : |

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Amount In Words : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value Date : |

d |

d |

m |

m |

y |

y |

y |

y |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

BENEFICIARY DETAILS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

59 |

Name (in Block Letters) : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Relationship with applicant : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Address : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Account No : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Name and Address of Beneiciary’s Bank : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Swift Code/Sort Code/Fed Wire/BSB No/IBAN : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

APPLICANT DETAILS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

50K |

Name (in Block Letters) : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Please debit my/our |

|

|

|

|

|

|

|

|

(state what currency) |

account no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

70 |

Remittance Informations : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

71A |

Local charges to be paid by : |

|

|

Remitter |

|

|

|

|

Beneiciary |

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneiciary |

|

||||||||||||||||||||||||||||||||||||

|

Overseas charges to be paid by : |

|

|

Remitter |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

PURPOSE OF PAYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Please describe the speciic goods / services / transaction for which the payment is to be made : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

I/We hereby declare that the information given in this Form is true and correct. |

|

|

|

|

|

FOR BANK USE ONLY |

|

||||||||||||||||||||||||||||||||||||||||||||

|

I/We shall be fully responsible for any inaccurate, untrue or incomplete |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

information provided in this Form. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature veriied : |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oficer / Executive Approval : |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

574/2H1 |

|

Applicant’s Signature(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OBU |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TERMS & CONDITIONS

1.The applicant agrees to be bound by The Hongkong and Shanghai Banking Corporation Limited, Offshore Banking Unit Labuan’s

(“the Bank”) Tariff and Charges (available at www.hsbc.com.my/1/2/offshore) (as updated from time to time).

2.Apart from these Terms and Conditions, the Bank's Generic Terms and Conditions also applies.

3.All applications for remittances, are subject to daily

remittances received after the respective

4.All charges incurred for remittances are to be debited from the relevant account. The Bank shall not be liable for any loss or delay which may occur in the transfer, transmission and/or application of funds or, in the case of remittance by Telegraphic Transfer (whether instructed by the Customer or whenever the Bank deems necessary) for any error, omission or mutilation which may occur in the transmission of the message (either literally or in cipher) or for its misinterpretation by the receiving party when received, and the Customer agrees to indemnify the Bank against any actions, proceedings, claims and/or demands that may arise in connection with such loss, delay, error, omission, mutilation and/or misinterpretation.

5.All payment instructions, once transmitted, shall be deemed inalised. Any request for cancellation / recall of a payment instruction must be made in writing and shall only be cancelled / recalled at the Bank's sole option and discretion and provided that such payment instruction has not yet been transmitted by the Bank.

6.In the absence of any speciic instructions to the contrary the Telegrahic Transfer will be effected in the currency in which payment is to be made.

7.The Bank reserves the rights to draw this Telegrahic Transfer on a different place from that speciied by the remitter if operational circumstances so require.

8.Telegrahic Transfer is to be despatched entirely at the remitter's own risk.

9.Where the Bank is unable to provide a irm exchange rate quotation, the Bank shall effect the remittance on the basis of a provisional exchange rate which shall be subject to adjustment when the actual exchange rate is ascertained. Any difference between the provisional rate and the actual rate shall be debited/credited (as the case may be) from/to the Applicant account.

10.* Please use standard currency abbreviation e.g. USD for United States Dollars, GBP for Pound Sterling, AUD for Australian Dollar,

SGD for Singaporean Dollar, JPY for Japanese Yen, EUR for Euro Unit, etc

11.The Bank is hereby irrevocably authorised to disclose any information deemed necessary by the Bank, including but not limited to the applicant's name, account number and address (or in lieu of the address, to disclose the applicant's national identiicatio or passport number, or date and place of birth) in all outgoing foreign currency telegraphic transfers.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The HSBC Telegraphic Transfer Slip is used to request a money transfer in foreign currency. It outlines the details of the payment and the beneficiaries involved. |

| Bank Information | This form is managed by The Hongkong and Shanghai Banking Corporation Limited, Offshore Banking Unit Labuan. They hold a specific banking license. |

| Cost Responsibility | Local and overseas charges can be paid by either the remitter or the beneficiary. The applicant must declare who will bear these costs. |

| Signature Requirement | The applicant must sign the form. This signature verifies that the provided information is accurate, and the applicant accepts the bank's terms. |

| Timeframes | All applications are subject to daily cut-off times. Late submissions will be processed on the next banking day, which may affect the timing of the transfer. |

Guidelines on Utilizing Hsbc Telegraphic Transfer Slip

Once you’ve gathered all necessary information, getting started on the HSBC Telegraphic Transfer Slip form should be straightforward. By following these steps, you can ensure your transfer request is correctly completed and submitted for processing.

- Date: Write the current date at the top of the form.

- Currency: In the “32A Currency” field, enter the currency abbreviation (e.g., USD, EUR) you wish to use for the transfer.

- Amount in Figures: Enter the amount you are transferring in numbers.

- Amount in Words: Spell out the amount you are transferring in words to avoid any confusion.

- Value Date: Fill in the date when you want the transfer to take effect (format: dd/mm/yyyy).

- Beneficiary Name: In the “59 Name” field, write the beneficiary’s name in block letters.

- Relationship with Applicant: State your relationship to the beneficiary.

- Address: Provide the complete address of the beneficiary.

- Account No: Fill in the beneficiary’s account number.

- Beneficiary’s Bank: Include the name and address of the bank where the beneficiary holds the account.

- Swift Code/Sort Code/Fed Wire/BSB No/IBAN: Enter the appropriate code for the beneficiary’s bank to ensure the funds go to the correct institution.

- Applicant Name: Under “50K,” write your name in block letters.

- Account No: Specify the account number you want the amount to be debited from.

- Remittance Information: Provide any necessary details regarding the remittance in the “70 Remittance Information” section.

- Local Charges: Indicate who will pay for local charges by selecting either the remitter or beneficiary.

- Overseas Charges: Select who will bear the overseas charges, again either the remitter or beneficiary.

- Purpose of Payment: Clearly describe the purpose of the payment or the goods/services involved.

- Declaration: Confirm the accuracy of the information by signing the form under “I/We hereby declare that the information given in this Form is true and correct.”

- Applicant Signature(s): Provide your signature(s) at the bottom of the form.

Once you've completed the form, review it for any errors. Ensure all fields are filled out clearly and correctly before submitting. This will help prevent any delays or issues with your transfer request.

What You Should Know About This Form

What is a Telegraphic Transfer Slip form?

The Telegraphic Transfer Slip form is a document used to initiate a telegraphic transfer of funds from one bank account to another. It contains essential information such as the payment details, beneficiary details, and applicant details necessary for processing the transfer.

What information is required to complete the form?

You will need to provide several details, including the currency and amount of the transfer, the beneficiary's name and address, account number, and details of the beneficiary’s bank. Additionally, you must fill in your own information, including your account number and any remittance information required.

Who should fill out the form?

The form should be filled out by the applicant, who is the individual or business requesting the transfer. The applicant must ensure that all information is accurate and complete to avoid delays in processing.

What happens if I provide inaccurate information?

Providing inaccurate or incomplete information can lead to delays or errors in the transfer. The bank will not be liable for any consequences arising from such inaccuracies. The applicant is responsible for ensuring all details are correct before submission.

Are there any charges associated with the transfer?

Yes, there are charges associated with telegraphic transfers. These charges will be debited from your account. You can find the applicable tariffs and charges in the bank's terms and conditions available online.

How can I cancel or recall a payment instruction?

To cancel or recall a payment instruction, you must submit a written request. However, the bank will only process this request at its discretion and only if the payment instruction has not been transmitted yet.

When will my transfer be processed?

Your transfer will be processed on the same day if it is submitted before the bank's cut-off time. Transfers received after this time will be processed on the next banking day. Be aware that transfers are subject to processing times of other banks involved.

What currency will my funds be transferred in?

Unless specified otherwise, the telegraphic transfer will be conducted in the currency indicated in the payment details. Be sure to use the correct currency abbreviation, such as USD for United States Dollars or EUR for Euros.

Can I track my transfer once it is submitted?

Tracking capabilities depend on your bank's services. Contact your bank for specific tracking options available for telegraphic transfers to stay updated on the status of your funds.

What if I have more questions about the form?

If you have further questions, it’s best to reach out directly to your bank's customer service department. They can provide personalized assistance and clarify any doubts you may have regarding the process or the form itself.

Common mistakes

Filling out the HSBC Telegraphic Transfer Slip form can be straightforward, but several common mistakes can lead to delays or complications. One significant error occurs when applicants fail to provide accurate beneficiary details. This includes the beneficiary’s name, address, and account number. Discrepancies in this information can cause the transfer to be rejected or delayed.

Another frequent mistake is incorrect currency selection. The form requires applicants to specify the currency, and overlooking this detail can result in the transaction not proceeding. Furthermore, individuals often provide incomplete amounts. The form asks for both figures and words; omitting one can create confusion for bank staff.

Incorrect date entries also contribute to issues. The form requires the value date to be written in a specific format (dd/mm/yyyy). Miswriting the date could bring about processing delays. Additionally, applicants might misunderstand the local and overseas charges section. Clearly indicating who will bear the charges is essential, as ambiguity might lead to the wrong party being billed.

Another common error involves the purpose of payment. Applicants sometimes do not provide a clear description of the transaction. Insufficient information can hinder the processing of the transfer and may require further clarification from the bank.

Providing inaccurate account information for debiting can also lead to problems. This applies to the applicant’s own account number and the type of currency. Errors can result in funds being transferred incorrectly or not at all. Lastly, neglecting to read the terms and conditions associated with the transfer may yield unintended consequences. The agreement outlines the responsibilities and potential liabilities involved, and understanding these can help prevent future disputes.

Documents used along the form

The HSBC Telegraphic Transfer Slip form is typically accompanied by several other important forms and documents. Each of these documents serves a distinct purpose in ensuring that the transfer process goes smoothly. Here’s a brief overview of some commonly used documents alongside the Telegraphic Transfer Slip.

- Proof of Identity: A document such as a passport or driver's license is often required to verify the applicant's identity. This helps the bank in complying with regulations and preventing fraud.

- Bank Statement: Recent bank statements may be requested to confirm the applicant's account details and ensure sufficient funds are available for the transfer.

- Beneficiary's Account Verification: Documents or forms that confirm the beneficiary's account details, including their address and bank information, may be required to avoid errors in processing the transaction.

- Source of Funds Declaration: Depending on the amount being transferred, banks might require a declaration to verify the legitimate origin of the funds. This is important for compliance with anti-money laundering laws.

- Transfer Request Confirmation: Some banks require a formal request or letter specifying the terms of the transfer. This document often includes details such as the purpose of the transfer and the agreed amount.

- Currency Conversion Agreement: If the transfer involves different currencies, a form may be necessary to confirm the exchange rate and any applicable fees. This ensures both parties understand the rates being applied to the transaction.

- Compliance Forms: Various compliance documents may be necessary to ensure adherence to regional and international banking laws. This can include forms pertaining to the Foreign Account Tax Compliance Act (FATCA) or anti-money laundering regulations.

Each document plays a vital role in ensuring that the telegraphic transfer is executed efficiently and in accordance with relevant regulations. Having all necessary forms completed and submitted can streamline the transfer process and help avoid potential delays.

Similar forms

-

Wire Transfer Form: This document is used to request a wire transfer, much like the HSBC Telegraphic Transfer Slip. It includes details such as recipient information, amount, and bank details, ensuring the funds are directed accurately.

-

International Money Transfer Form: Similar to the telegraphic transfer slip, this form facilitates sending money across borders. It typically requires information about the sender, recipient, amount, and purpose of the transfer.

-

Payment Instruction Form: This form instructs a bank to make a payment on behalf of the account holder. It is similar because it also requests specific details about the payment, including beneficiary information and amounts.

-

ACH Transfer Authorization Form: Used for automated clearing house transactions, this form shares similarities with the telegraphic transfer slip by requiring specific account and routing information to process an electronic funds transfer.

Dos and Don'ts

When filling out the HSBC Telegraphic Transfer Slip form, attention to detail is crucial. Here are ten essential dos and don'ts to ensure your transfer is processed smoothly.

- Do use block letters when entering names and addresses to ensure clarity.

- Do double-check the currency code you are using; make sure it’s the standard abbreviation.

- Do clearly specify the amount both in figures and words to avoid any mistakes.

- Do indicate the purpose of the payment clearly to comply with banking regulations.

- Do sign the form where indicated to authorize the transaction.

- Don't leave any required fields blank; all sections must be filled out completely.

- Don't use informal abbreviations or slang in descriptions. Stick to formal language.

- Don't forget to include the beneficiary's full name and accurate details to avoid delays.

- Don't assume the bank has your previous information; always provide complete details.

- Don't make any alterations or corrections without initialing next to the change.

By adhering to these guidelines, you can help ensure that your telegraphic transfer is processed efficiently and without complications.

Misconceptions

Many people have misconceptions about the HSBC Telegraphic Transfer Slip form. Here is a list of common misunderstandings:

- The form is only for large transactions. This is not true. The Telegraphic Transfer Slip can be used for both small and large transfers, depending on your needs.

- The form must be filled out in person. While this is a common belief, many banks allow you to fill out the form online or submit it via email, depending on their policies.

- The remittance will be processed immediately. In reality, remittances are subject to cut-off times. If submitted after the cut-off, processing may take longer.

- All charges are the same for every transaction. Charges can vary based on the amount, destination, and local or overseas fees. Always check with the bank for specifics.

- You cannot cancel a transfer once it is submitted. While it is true that cancellations are not always guaranteed, they can sometimes be made if you act quickly. Always check with your bank.

- Only the applicant is responsible for errors. Both the applicant and the bank share responsibility for processing the transaction correctly. Errors on either side can lead to issues.

- The transfer will always occur at the current exchange rate. This is misleading. If the bank cannot provide a firm rate, the transfer might use a provisional rate, which could differ when finalized.

- You must provide the full address of the beneficiary's bank. While it is important to provide accurate information, some banking institutions may accept alternative forms of identification, like a SWIFT code.

- The form asks for too much personal information. This information is necessary for compliance and security reasons. Your privacy is important, and banks take steps to protect your data.

Understanding these misconceptions can help you navigate the process more easily and confidently.

Key takeaways

When filling out the HSBC Telegraphic Transfer Slip form, it is essential to ensure accuracy and completeness. Below are key takeaways to keep in mind:

- Provide the currency for the transfer in the designated section to avoid processing delays.

- Fill out both amount in figures and amount in words to confirm the transfer amount.

- Include the beneficiary details clearly, using block letters for easy readability.

- When listing the beneficiary's bank, ensure to provide the correct SWIFT code or its equivalent.

- Indicate the account from which the funds will be debited by specifying the currency.

- Identify whether local or overseas charges will be covered by the remitter or beneficiary.

- Describe the purpose of payment, specifying the goods or services involved.

- Understand that all instructions become final once transmitted and cancellation is at the bank's discretion.

- Note the daily cut-off times for processing remittances, which may affect transaction timing.

- Be aware that the bank is not liable for any transfer errors once payment instructions are finalized.

Following these guidelines carefully can assist in ensuring a smooth transaction process with the HSBC Telegraphic Transfer service.

Browse Other Templates

Fictitious Business Name Renewal Form,Fictitious Name Permit Renewal Notification,California Fictitious Name Update Application,Permit Renewal for Fictitious Medical Practice,Fictitious Name Permit Hold Release Form,California Fictitious Name Mainten - Submissions should ideally meet deadlines set by the Medical Board to ensure uninterrupted service.

Lost Savings Bonds - The process is designed to assist owners in efficiently managing and updating their savings bonds.

Rental Application Form Oklahoma - It underscores the importance of maintaining open dialogue between landlords and tenants.