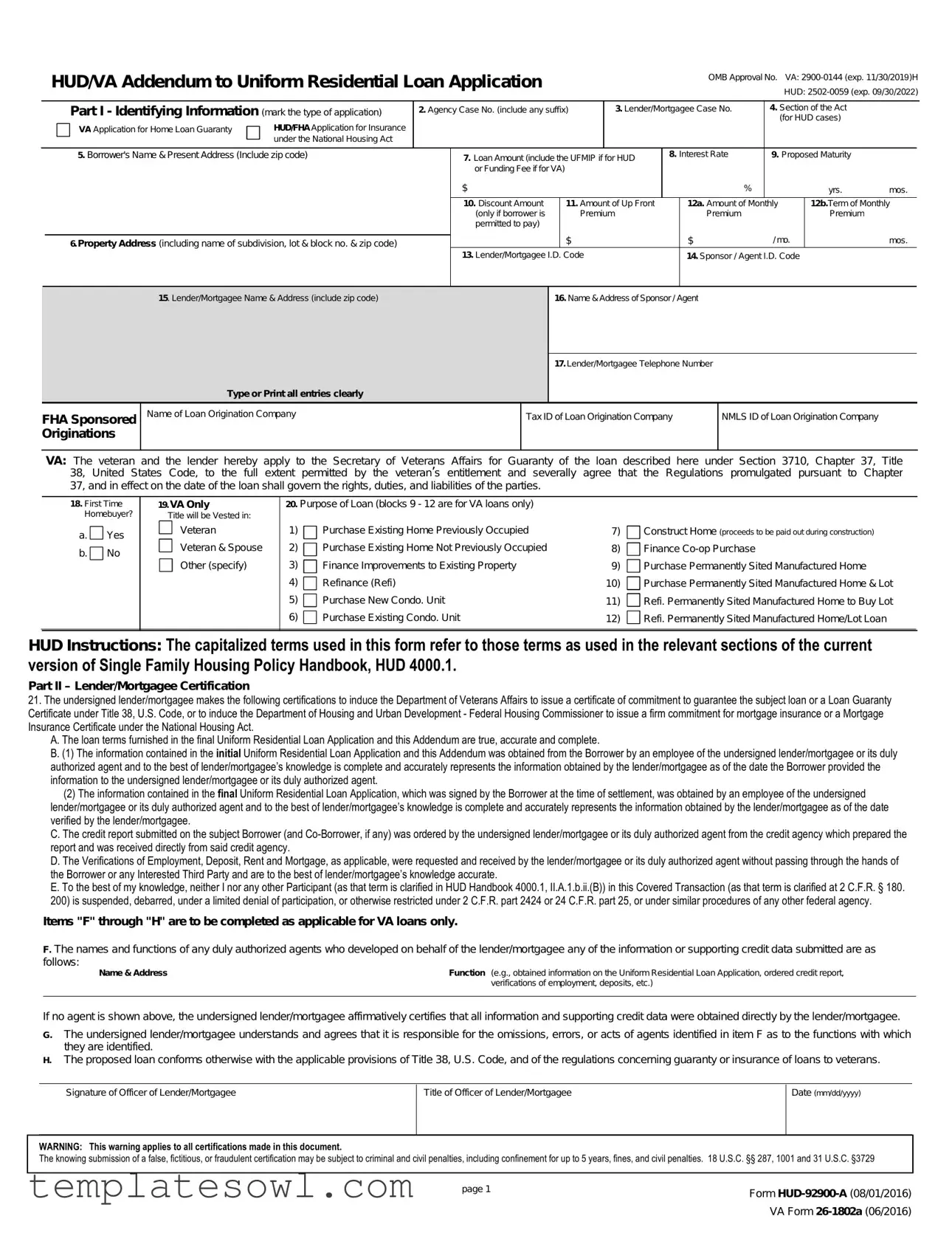

Fill Out Your Hud 92900 A Form

The HUD 92900 A form, officially known as the HUD/VA Addendum to the Uniform Residential Loan Application, plays a crucial role in the home loan process, particularly for veterans and those seeking FHA insurance. It serves as a supplemental document that provides essential information about the borrower's identity and the specifics of the loan application. This form consists of multiple sections, each designed to collect pertinent details such as the type of application, the loan amount, interest rate, and terms related to the loan. It also includes a section for lender certifications, ensuring that all provided information is accurate and complete, which is vital for the approval process. Importantly, the form guides applicants regarding their obligations and rights, with clear statements about their responsibilities if the loan is granted. It also outlines the risks associated with mortgage loans, emphasizing the importance of timely payments. Overall, the HUD 92900 A form is a foundational document in securing mortgage approvals, and it facilitates understanding for both lenders and borrowers, ensuring compliance with federal regulations.

Hud 92900 A Example

HUD/VA Addendum to Uniform Residential Loan Application

OMB Approval No. VA:

|

Part I - Identifying Information (mark the type of application) |

2. Agency Case No. (include any suffix) |

|

3. Lender/Mortgagee Case No. |

4. Section of the Act |

|

|

|||||||

|

|

|

|

|

|

|

|

|

(for HUD cases) |

|

|

|||

|

VA Application for Home Loan Guaranty |

HUD/FHA Application for Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

under the National Housing Act |

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Borrower's Name & Present Address (Include zip code) |

|

7. Loan Amount (include the UFMIP if for HUD |

8. Interest Rate |

9. Proposed Maturity |

|

|

|||||||

|

|

|

|

or Funding Fee if for VA) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

% |

|

yrs. |

mos. |

|

|

|

|

|

|

10. Discount Amount |

|

11. Amount of Up Front |

|

12a. Amount of Monthly |

12b.Term of Monthly |

|

||||

|

|

|

|

(only if borrower is |

|

Premium |

|

|

Premium |

|

Premium |

|

|

|

|

|

|

|

permitted to pay) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

$ |

/ mo. |

|

mos. |

|

|

|

6. Property Address (including name of subdivision, lot & block no. & zip code) |

|

|

|

|

|

|

|

||||||

|

|

|

|

13. Lender/Mortgagee I.D. Code |

|

|

14. Sponsor / Agent I.D. Code |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. Lender/Mortgagee Name & Address (include zip code)

16.Name & Address of Sponsor / Agent

17. Lender/Mortgagee Telephone Number

Type or Print all entries clearly

FHA Sponsored Originations

Name of Loan Origination Company

Tax ID of Loan Origination Company

NMLS ID of Loan Origination Company

VA: The veteran and the lender hereby apply to the Secretary of Veterans Affairs for Guaranty of the loan described here under Section 3710, Chapter 37, Title 38, United States Code, to the full extent permitted by the veteran’s entitlement and severally agree that the Regulations promulgated pursuant to Chapter 37, and in effect on the date of the loan shall govern the rights, duties, and liabilities of the parties.

18. First Time |

19. VA Only |

20. Purpose of Loan (blocks 9 - 12 are for VA loans only) |

|

|

||

Homebuyer? |

Title will be Vested in: |

|

|

|

|

|

a. |

Yes |

Veteran |

1) |

Purchase Existing Home Previously Occupied |

7) |

Construct Home (proceeds to be paid out during construction) |

Veteran & Spouse |

2) |

Purchase Existing Home Not Previously Occupied |

|

|

||

b. |

No |

8) |

Finance |

|||

Other (specify) |

3) |

Finance Improvements to Existing Property |

|

|

||

|

|

9) |

Purchase Permanently Sited Manufactured Home |

|||

|

|

|

4) |

Refinance (Refi) |

10) |

Purchase Permanently Sited Manufactured Home & Lot |

|

|

|

5) |

Purchase New Condo. Unit |

11) |

Refi. Permanently Sited Manufactured Home to Buy Lot |

|

|

|

6) |

Purchase Existing Condo. Unit |

12) |

Refi. Permanently Sited Manufactured Home/Lot Loan |

Purchase New Condo. Unit

HUD Instructions: The capitalized terms used in this form refer to those terms as used in the relevant sections of the current version of Single Family Housing Policy Handbook, HUD 4000.1.

Part II – Lender/Mortgagee Certification

21.The undersigned lender/mortgagee makes the following certifications to induce the Department of Veterans Affairs to issue a certificate of commitment to guarantee the subject loan or a Loan Guaranty Certificate under Title 38, U.S. Code, or to induce the Department of Housing and Urban Development - Federal Housing Commissioner to issue a firm commitment for mortgage insurance or a Mortgage Insurance Certificate under the National Housing Act.

A.The loan terms furnished in the final Uniform Residential Loan Application and this Addendum are true, accurate and complete.

B.(1) The information contained in the initial Uniform Residential Loan Application and this Addendum was obtained from the Borrower by an employee of the undersigned lender/mortgagee or its duly authorized agent and to the best of lender/mortgagee’s knowledge is complete and accurately represents the information obtained by the lender/mortgagee as of the date the Borrower provided the information to the undersigned lender/mortgagee or its duly authorized agent.

(2)The information contained in the final Uniform Residential Loan Application, which was signed by the Borrower at the time of settlement, was obtained by an employee of the undersigned lender/mortgagee or its duly authorized agent and to the best of lender/mortgagee’s knowledge is complete and accurately represents the information obtained by the lender/mortgagee as of the date verified by the lender/mortgagee.

C.The credit report submitted on the subject Borrower (and

D.The Verifications of Employment, Deposit, Rent and Mortgage, as applicable, were requested and received by the lender/mortgagee or its duly authorized agent without passing through the hands of the Borrower or any Interested Third Party and are to the best of lender/mortgagee’s knowledge accurate.

E.To the best of my knowledge, neither I nor any other Participant (as that term is clarified in HUD Handbook 4000.1, II.A.1.b.ii.(B)) in this Covered Transaction (as that term is clarified at 2 C.F.R. § 180. 200) is suspended, debarred, under a limited denial of participation, or otherwise restricted under 2 C.F.R. part 2424 or 24 C.F.R. part 25, or under similar procedures of any other federal agency.

Items "F" through "H" are to be completed as applicable for VA loans only.

F. The names and functions of any duly authorized agents who developed on behalf of the lender/mortgagee any of the information or supporting credit data submitted are as follows:

Name & Address |

Function (e.g., obtained information on the Uniform Residential Loan Application, ordered credit report, |

|

verifications of employment, deposits, etc.) |

|

|

If no agent is shown above, the undersigned lender/mortgagee affirmatively certifies that all information and supporting credit data were obtained directly by the lender/mortgagee.

G.The undersigned lender/mortgagee understands and agrees that it is responsible for the omissions, errors, or acts of agents identified in item F as to the functions with which they are identified.

H.The proposed loan conforms otherwise with the applicable provisions of Title 38, U.S. Code, and of the regulations concerning guaranty or insurance of loans to veterans.

Signature of Officer of Lender/Mortgagee

Title of Officer of Lender/Mortgagee

Date (mm/dd/yyyy)

WARNING: This warning applies to all certifications made in this document.

The knowing submission of a false, fictitious, or fraudulent certification may be subject to criminal and civil penalties, including confinement for up to 5 years, fines, and civil penalties. 18 U.S.C. §§ 287, 1001 and 31 U.S.C. §3729

page 1 |

Form |

|

|

|

VA Form |

Part III - Notices to Borrowers

Public reporting burden for this collection of information is estimated to average 6 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. This agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless that collection displays a valid OMB control number can be located on the OMB Internet page at http://www.reginfo.gov/public/do/PRAMain. Privacy Act Information: The information requested on the Uniform Residential Loan Application and this Addendum is authorized by 38 U.S.C. 3710 (if for DVA) and 12 U.S.C. 1701 et seq. (if for HUD/FHA). The Debt Collection Act of 1982, Pub. Law

Part IV - Borrower Consent for Social Security Administration to Verify Social Security Number

I authorize the Social Security Administration to verify my Social Security number to the Mortgagee identified in this document and HUD/FHA, through a computer match conducted by HUD/FHA. I understand that my consent allows no additional information from my Social Security records to be provided to the Mortgagee, and HUD/FHA and that verification of my Social Security number does not constitute confirmation of my identity. I also understand that my Social Security number may not be used for any other purpose than the one stated above, including resale or redisclosure to other parties. The only other redisclosure permitted by this authorization is for review purposes to ensure that HUD/FHA complies with SSA's consent requirements.

I am the individual to whom the Social Security number was issued or that person's legal guardian. I declare and affirm under the penalty of perjury that the information contained herein is true and correct. I know that if I make any representation that I know is false to obtain information from Social Security records, I could be punished by a fine or imprisonment or both.

This consent is valid for 180 days from the date signed, unless indicated otherwise by the individual(s) named in this loan application.

Read consent carefully. Review accuracy of social security number(s) and birth dates provided on this application.

Signature(s) of Borrower(s) |

Date Signed |

Signature(s) of Co - Borrower(s) |

Date Signed |

||

|

/ |

/ |

|

/ |

/ |

Part V - Borrower Certification

22. Complete the following for a HUD/FHA Mortgage. |

|

|

Is it to be sold? |

|

||

|

|

|

|

|

||

22a. Do you own or have you sold other real estate within the |

Yes |

No |

Yes |

No |

NA |

|

past 60 months on which there was a HUD/FHA mortgage? |

||||||

|

|

|

|

|

||

22d. Address:

22b. Sales Price

$

22c. Original Mortgage Amt

$

22e. If the dwelling to be covered by this mortgage is to be rented, is it a part of, adjacent or contiguous to any project subdivision or group of concentrated rental properties involving

eight or more dwelling units in which you have any financial interest? |

Yes |

No If “Yes” give details. |

|

23. Complete for |

Yes |

No |

|

IMPORTANT: If you are certifying that you are married for the purpose of VA benefits, your marriage must be recognized by the place where you and/ or your spouse resided at the time of marriage, or where you and/or your spouse resided when you filed your claim (or a later date when you become eligible for benefits) (38 U.S.C. § 103(c)). Additional guidance on when VA recognizes marriages is available at http://www.va.gov/opa/marriage/.

24.Applicable for Both VA & HUD. As a home loan borrower, you will be legally obligated to make the mortgage payments called for by your mortgage loan contract. The fact that you dispose of your property after the loan has been made will not relieve you of liability for making these payments. Payment of the loan in full is ordinarily the way liability on a mortgage note is ended. Some home buyers have the mistaken impression that if they sell their homes when they move to another locality, or dispose of it for any other reasons, they are no longer liable for the mortgage payments and that liability for these payments is solely that of the new owners. Even though the new owners may agree in writing to assume liability for your mortgage payments, this assumption agreement will not relieve you from liability to the holder of the note which you signed when you obtained the loan to buy the property. Unless you are able to sell the property to a buyer who is acceptable to VA or to HUD/FHA and who will assume the payment of your obligation to the lender, you will not be relieved from liability to repay any claim which VA or HUD/FHA may be required to pay your lender on account of default in your loan payments. The amount of any such claim payment will be a debt owed by you to the Federal Government. This debt will be the object of established collection procedures.

25.I, the Undersigned Borrower(s) Certify that:

(1)I have read and understand the foregoing concerning my liability on the loan and Part III Notices to Borrowers.

(2)Occupancy: HUD Only (CHECK APPLICABLE BOX)

I, the Borrower or

I do not intend to occupy the property as my primary residence. Occupancy: VA Only

(a.) I now actually occupy the

(b.) My spouse is on active military duty and in his or her absence; I occupy or intend to occupy the property securing this loan as my home.

(b.) My spouse is on active military duty and in his or her absence; I occupy or intend to occupy the property securing this loan as my home.

(c.) I previously occupied the property securing this loan as my home. (for interest rate reduction loans).

(c.) I previously occupied the property securing this loan as my home. (for interest rate reduction loans).

(d.) While my spouse was on active military duty and unable to occupy the property securing this loan, I previously occupied the property that is securing this loan as my home. (for interest rate reduction loans).

(d.) While my spouse was on active military duty and unable to occupy the property securing this loan, I previously occupied the property that is securing this loan as my home. (for interest rate reduction loans).

Note: If box 2b or 2d is checked, the veteran's spouse must also sign below.

(e.) The veteran is on active military duty and in his or her absence, I certify that a dependent child of the veteran occupies or will occupy the property securing this loan as their home.

(e.) The veteran is on active military duty and in his or her absence, I certify that a dependent child of the veteran occupies or will occupy the property securing this loan as their home.

Note: This requires that the veteran's

(f.) While the veteran was on active military duty and unable to occupy the property securing this loan, the property was occupied by the veteran's dependent child as his or her home (for interest rate reduction loans).

Note: This requires that the veteran’s

(3)Mark the applicable box (not applicable for Home Improvement or

Refinancing Loan) I have been informed that ($ |

) is : |

The reasonable value of the property as determined by VA or;

The statement of appraised value as determined by HUD / FHA

Note: If the contract price or cost exceeds the VA “Reasonable Value" or HUD/FHA "Statement of Appraised Value", mark either item (a) or item (b), whichever is applicable. (a.) I was aware of this valuation when I signed my contract and I have paid or will pay in

cash from my own resources at or prior to loan closing a sum equal to the difference between the contract purchase price or cost and the VA or HUD/FHA established value. I do not and will not have outstanding after loan closing any unpaid contractual obligation on account of such cash payment;

(b.) I was not aware of this valuation when I signed my contract but have elected to complete the transaction at the contract purchase price or cost. I have paid or will pay in cash from my own resources at or prior to loan closing a sum equal to the difference between contract purchase price or cost and the VA or HUD/FHA established value. I do not and will not have outstanding after loan closing any unpaid contractual obligation on account of such cash payment.

(4)I and anyone acting on my behalf are, and will remain, in compliance with the Fair Housing Act, 42 U.S.C. 3604, et seq., with respect to the dwelling or property covered by the loan and in the provision of services or facilities in connection therewith. I recognize that any restrictive covenant on this property related to race, color, religion, sex, disability, familial status, national origin, marital status, age, or source of income is illegal and void. I further recognize that in addition to administrative action by HUD, a civil action may be brought by the Attorney General of the United States in any appropriate U.S. court against any person responsible for a violation of the applicable law.

(5)All information in this application is given for the purpose of obtaining a loan to be insured under the National Housing Act or guaranteed by the Department of Veterans Affairs and the information in the Uniform Residential Loan Application and this Addendum is true and complete to the best of my knowledge and belief. Verification may be obtained from any source named herein.

(6)For HUD Only (for properties constructed prior to 1978) I have received information on

lead paint poisoning. |

Yes |

Not Applicable |

(7)I am aware that neither HUD / FHA nor VA warrants the condition or value of the property.

Signature(s) of Borrower(s) – Do not sign unless this application is fully completed. Read the certifications carefully and review accuracy of this application.

Signature(s) of Borrower(s)Date SignedSignature(s) of Co - Borrower(s)Date Signed

/ / |

/ / |

page 2 |

Form |

|

VA Form |

Direct Endorsement Approval for a |

U.S. Department of Housing |

and Urban Development |

1. Borrower's Name & Present Address (Include zip code) |

2. Property Address |

|

|

Approved:

3. Agency Case No. (include any suffix)

Date Mortgage Approved |

Date Approval Expires |

Modified & approved as follows:

Loan Amount (include UFMIP)

$

Interest Rate

%

Proposed Maturity

Yrs. Mos.

Monthly Payment

$

Amount of

Up Front Premium

$

Amount of Monthly Premium

$

Term of Monthly Premium

Mos.

Owner Occupancy NOT required

All conditions of Approval have been satisfied

_____ |

This mortgage was rated as an “accept” or “approve” by FHA's TOTAL Mortgage Scorecard. As such, the undersigned representative of the |

|

mortgagee certifies that the mortgagee reviewed the TOTAL Mortgage Scorecard findings and that this mortgage meets the Final Underwriting |

|

Decision (TOTAL) requirements for approval. The undersigned representative of the mortgagee also certifies that all information entered into |

|

TOTAL Mortgage Scorecard is complete and accurately represents information obtained by the mortgagee, that the information was obtained by the |

|

mortgagee, pursuant to FHA requirements, and that there was no defect in connection with the approval of this mortgage such that the result |

|

reached in TOTAL should not have been relied upon and the mortgage should not have been approved in accordance with FHA requirements. |

|

Mortgagee Representative: |

|

Signature:__________________________________ Printed Name/Title: ____________________________________ |

And if applicable:

This mortgage was rated as an “accept” or “approve” by FHA's TOTAL Mortgage Scorecard and the undersigned Direct Endorsement underwriter certifies that I have personally reviewed and underwritten the appraisal according to standard FHA requirements.

|

__________________________________ |

_________________ |

|

OR |

Direct Endorsement Underwriter Signature |

DE's CHUMS ID Number |

|

|

|

|

|

_____ |

This mortgage was rated as a “refer” by a FHA's TOTAL Mortgage Scorecard, or was manually underwritten by a Direct Endorsement underwriter. |

||

|

As such, the undersigned Direct Endorsement Underwriter certifies that I have personally reviewed and underwritten the appraisal report (if |

||

|

applicable), credit application, and all associated documents used in underwriting this mortgage. I further certify that: |

||

|

• |

I have approved this loan and my Final Underwriting Decision was made having exercised the required level of Care and Due Diligence and in |

|

|

|

performing my underwriting review; |

|

|

• |

I have performed all Specific Underwriter Responsibilities for Underwriters and my underwriting of the borrower’s Credit and Debt, Income, |

|

|

|

Qualifying Ratios and Compensating Factors, if any, and the borrower’s DTI with Compensating Factors, if any, are within the parameters |

|

|

|

established by FHA and the borrower has assets to satisfy any required down payment and closing costs of this mortgage; and |

|

|

• |

I have verified the Mortgage Insurance Premium and Mortgage Amount are accurate and this loan is in an amount that is permitted by FHA for |

|

|

|

this loan type, property type, and geographic area. |

|

|

• |

There was no defect in connection with my approval of this mortgage such that my Final Underwriting Decision should have changed and the |

|

|

|

mortgage should not have been approved in accordance with FHA requirements. |

|

__________________________________ |

_________________ |

Direct Endorsement Underwriter Signature |

CHUMS ID Number |

The Mortgagee, its owners, officers, employees or directors |

(do) |

(do not) have a financial interest in or a relationship, by affiliation or ownership, with the |

|

builder or seller involved in this transaction. |

|

|

|

|

|

|

|

|

|

page 3 |

Form |

|

|

|

VA Form |

Borrower's Certification:

The undersigned certifies that:

(a.) I will not have outstanding any other unpaid obligations contracted in connection with the mortgage transaction or the purchase of the said property except obligations which are secured by property or collateral owned by me independently of the said mortgaged property, or

obligations approved by the Commissioner;

(b.) One of the undersigned intends to occupy the subject property (note: this item does not apply if

Down Payment Assistance program funds, and no other charges have been or will be paid by me in respect to this transaction.

Borrower'(s) Signature(s) & Date

Mortgagee's Certification:

The Mortgagee by and through the undersigned certifies that to the best of its knowledge:

(a)The loan terms, loan type, property address, Borrower information including names, social security number, credit scores, marital status, employment status, and Borrower occupancy status, in its application for insurance and in this Certificate are true and correct;

(b)All loan approval conditions appearing in any outstanding commitment issued under the above case number have been fulfilled and this loan closed in a manner consistent with the mortgagee’s approval;

(c)Complete disbursement of the loan has been made to the Borrower, or to his/her creditors for his/her account and with his/her consent and any escrow has been established in accordance with applicable law;

(d)The note and security instruments are in a form acceptable to HUD and the security instrument has been recorded and is a good and valid first lien on the property described;

(e)No charge has been made to, or paid by the Borrower, except as permitted under HUD regulations;

(f)The copies of the note and security instruments which are submitted herewith are true and exact copies as executed and filed for record;

(g)It has not paid any kickbacks, fee or consideration of any type, directly or indirectly, to any party in connection with this transaction except as permitted under HUD regulations and administrative instructions; and

(h)The Mortgagee has exercised due diligence in processing this mortgage and in reviewing the file documents listed at HUD Handbook 4000.1, II.A.7.b. and the documents contain no defect that should have changed the processing or documentation and the mortgage should not have been approved in accordance with FHA requirements.

I, the undersigned authorized representative of the mortgagee certify that I have personally reviewed the mortgage documents, closing statements, application for insurance endorsement, and all accompanying documents and request the endorsement of this mortgage for FHA insurance.

Mortgagee

Name and Title of the Mortgagee's Officer

Signature of the Mortgagee's Officer |

Date |

|

|

Note: If the approval is executed by an agent in the name of the mortgagee, the agent must enter the mortgagee’s code number and type.

Code Number (5 digits) |

Type |

page 4 |

Form |

|

|

|

VA Form |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The HUD 92900 A form is designed to serve as an addendum to the Uniform Residential Loan Application for veterans seeking home loan guarantees from the U.S. Department of Veterans Affairs (VA) or insurance from the U.S. Department of Housing and Urban Development (HUD). |

| Information Required | This form collects essential details such as the borrower's personal information, loan amount, interest rate, and purpose of the loan, among other key data necessary for processing the application. |

| Legal Authority | The form is governed by Title 38 of the U.S. Code for VA loans and Title 12 of the U.S. Code for HUD/FHA loans, ensuring compliance with federal regulations. |

| Expiration Dates | The OMB approval for this form indicates that it is subject to periodic review; for example, VA approval expired on November 30, 2019, and HUD approval expired on September 30, 2022, necessitating updates for continued use. |

Guidelines on Utilizing Hud 92900 A

Filling out the HUD 92900 A form requires careful attention to detail. This document is essential for applying for home loan guaranties through the Department of Veterans Affairs or insurance under HUD regulations. Accurate and complete information is critical to ensure smooth processing of the application.

- Section 1 - Identifying Information:

- Mark the type of application you are submitting.

- Provide your Agency Case Number, if applicable.

- Enter the Lender/Mortgagee Case Number.

- Identify the Section of the Act applicable to your application (VA or HUD).

- Fill in the Borrower's Name and Present Address, including the zip code.

- Provide the Property Address, including subdivision, lot & block number, and zip code.

- Input the Loan Amount, including UFMIP if for HUD.

- Specify the Interest Rate, Proposed Maturity, and any applicable Discount Amount.

- Detail the Amount of Up Front Premium and Monthly Premium, if applicable.

- List the Term of Monthly Premium.

- Provide Lender/Mortgagee ID Code, Name, and Address, including telephone number.

- Include the Name and Address of Sponsor/Agent, if applicable.

- Indicate if the borrower is a First Time Homebuyer and the Purpose of the Loan.

- Section 2 - Lender/Mortgagee Certification:

- Certify that the loan terms provided in the application are true and complete.

- State that the information was obtained from the borrower by a representative of the lender.

- Provide details on credit reports and any Verifications of Employment, Deposit, Rent, or Mortgage.

- Declare any agents involved in gathering this information.

- Sign and date the certification, including the title of the officer signing.

- Section 3 - Notices to Borrowers:

- Read various notices regarding the implications of default and the disclosure of loan information.

- Understand the potential consequences of missed payments.

- Section 4 - Borrower Consent:

- Authorize the Social Security Administration to verify your Social Security number.

- Sign and date the consent.

- Section 5 - Borrower Certification:

- Confirm understanding of liability on the loan and conditions related to occupancy.

- Provide any previous ownership information and disclosures regarding real estate.

- Sign the Borrower Certification, making sure to date it.

- Final Steps:

- Review all entries for accuracy and completeness.

- Submit the form along with any required supporting documentation.

After completing the HUD 92900 A form, ensure that all necessary sections are filled out correctly. Gather any supporting documentation if required. This will assist the lender in processing the application efficiently. Timely submission can help expedite the review and potential approval of your loan application.

What You Should Know About This Form

What is the purpose of the HUD-92900 A form?

The HUD-92900 A form serves as an addendum to the Uniform Residential Loan Application, primarily used for federally insured or guaranteed loans. It is designed to collect borrower information needed for applications under either the Department of Housing and Urban Development (HUD) or the Department of Veterans Affairs (VA). This form helps lenders assess loan eligibility based on various factors such as income, credit history, and the intended use of the mortgage.

Who needs to fill out the HUD-92900 A form?

Borrowers who are applying for HUD/FHA or VA loans must complete the HUD-92900 A form. This includes first-time homebuyers, veterans looking for a home loan guaranty, or individuals seeking mortgage insurance under the National Housing Act. The information you provide will help determine your eligibility for these federally backed loans.

What information is required on the HUD-92900 A form?

The form requires various pieces of information, including the borrower’s name, present address, loan amount, interest rate, and the property address. Additionally, it asks for certification that the loan terms are accurate, the borrower’s employment and credit verification, and any relevant details about the loan’s intended purpose. All entries must be clear and accurate to support the loan application process.

How long will it take to complete the HUD-92900 A form?

Completing the HUD-92900 A form typically takes around 6 minutes on average. This includes the time spent reviewing instructions, collecting necessary information, and filling out the form. It is advisable to gather all relevant documents beforehand to ensure a smooth and efficient application process.

What happens if I provide false information on the form?

Providing false information on the HUD-92900 A form carries significant consequences. You may face criminal and civil penalties, including fines or imprisonment. It is crucial to ensure all information is true and accurate to avoid these potential legal issues and to secure your loan properly.

Is my personal information safe when filling out the HUD-92900 A form?

Your personal information is strictly regulated and protected under privacy laws. The data collected is used solely for evaluating your qualification for the mortgage and may only be shared as required or permitted by law. Ensuring that your lender adheres to confidentiality practices is important for safeguarding your information throughout the application process.

Common mistakes

Filling out the HUD 92900 A form accurately is crucial to ensure a smooth loan application process. However, many individuals make common mistakes that can lead to delays or even denials. One significant error occurs when borrowers fail to provide complete identifying information. Missing elements like the agency case number or lender/mortgagee case number can create confusion and slow down the processing of the application. Always double-check that every required field is filled out clearly and completely before submitting the form.

Another frequent pitfall is incorrect loan details. Borrowers may overestimate or underestimate the loan amount, interest rate, or terms. This oversight can have serious implications, as lenders rely on accurate figures to assess eligibility and potential risks. It's essential to verify these numbers with your lender to ensure they align with your financial situation and the specifics of the mortgage.

Many applicants also make the mistake of assuming that all required documents are self-explanatory. For instance, not providing sufficient information about the property address or failing to clarify the purpose of the loan can hinder the review process. Each field on the form exists for a reason, and misunderstandings can lead to unnecessary complications. Including additional details when needed can clarify your intentions and expedite the review.

Inconsistent or unclear handwriting presents yet another obstacle. When applicants rush through completing the form, it can result in sloppy writing that's hard to read. This can frustrate lenders who need to request follow-up information for verification. Utilizing typed entries or carefully printed handwriting can mitigate this issue and help maintain clarity.

Finally, many individuals underestimate the importance of signatures. Skipping the signature or providing it incorrectly can invalidate the application. Every borrower and co-borrower must sign off on the document as detailed. Make it a point to consult with your lender or agent to ensure that all signatures are present before submission.

Documents used along the form

The HUD 92900 A form is a crucial document often accompanied by several other forms and documents during mortgage transactions. Here’s a list of other commonly used forms that facilitate the process for both lenders and borrowers.

- Uniform Residential Loan Application (URLA): This is the primary application form used to apply for a mortgage loan. It collects personal and financial information about the borrower to assess their eligibility.

- VA Loan Eligibility Certificate (COE): This document confirms a veteran's eligibility for a VA loan. It outlines their entitlement and can be obtained from the Department of Veterans Affairs.

- FHA Case Number Assignment: Assigned by the FHA, this number is essential for processing HUD loans. It tracks the loan through the FHA system and must be included in the loan application.

- Credit Report Authorization: This form gives permission for the lender to obtain a credit report. It is essential for evaluating the borrower’s creditworthiness and financial stability.

- Verification of Employment: Lenders use this document to confirm a borrower’s employment and income. This verification helps assess their ability to repay the loan.

- Appraisal Report: This evaluates the value of the property being purchased. The appraisal ensures that the loan amount aligns with the property's fair market value.

- Good Faith Estimate (GFE): This form provides borrowers with an estimate of the closing costs associated with the loan, helping them understand their financial obligations.

- Debt-to-Income (DTI) Ratio Worksheet: This worksheet calculates the borrower’s DTI ratio, allowing lenders to assess their ability to manage monthly payments.

- HUD Settlement Statement (Form HUD-1): This document outlines all costs involved in the settlement process. It details the financial transactions occurring at closing.

Incorporating these forms alongside the HUD 92900 A ensures a comprehensive approach to the mortgage application process. Always review each document carefully to ensure accuracy, as they play a vital role in the approval and funding of your loan.

Similar forms

The HUD 92900 A form serves as an important document in the process of applying for loans through the Department of Housing and Urban Development (HUD) and the Department of Veterans Affairs (VA). Several other documents share similar purposes and structures. Here are five documents that are similar to the HUD 92900 A form:

- Uniform Residential Loan Application (URLA): The URLA, also known as Form 1003, is used by borrowers to apply for residential mortgages. Like the HUD 92900 A, it collects detailed information about the borrower, the property, and the loan terms. Both forms are essential steps in the mortgage application process.

- VA Form 26-1802a: This form is specifically for VA home loan applications. Similar to the HUD 92900 A, it gathers information necessary for the processing of a loan designation and terms for veterans. Both forms serve to certify loan eligibility and provide key borrower details.

- FHA Loan Application: This application is used for loans insured by the Federal Housing Administration. It requires borrower information and compliance with FHA guidelines, mirroring the purpose of the HUD 92900 A in determining eligibility for government-backed financing.

- Loan Estimate (LE): Issued by lenders within three days of receiving a mortgage application, the Loan Estimate outlines the loan terms, projected payments, and costs. Similar to the HUD 92900 A, it provides critical information to borrowers about the loan they are applying for, ensuring informed decisions.

- Mortgage Insurance Application: This document is completed to apply for mortgage insurance through HUD. It requires similar personal and financial information, helping lenders assess the risk of insuring the loan. Thus, it functions like the HUD 92900 A in determining borrower qualifications and loan terms.

Dos and Don'ts

When filling out the HUD 92900 A form, adhere to the following guidelines to ensure accuracy and compliance:

- Do fill out each section completely and accurately, as incomplete forms can lead to delays.

- Do use clear and legible handwriting or type the information to avoid misinterpretation.

- Do double-check all numerical information, especially loan amounts and interest rates.

- Do sign and date the form appropriately to validate your application.

- Don’t leave any fields blank, as this can result in processing issues or rejection.

- Don’t provide false or misleading information, as this may lead to severe penalties.

- Don’t assume that prior information is correct; verify all details at the time of submission.

- Don’t forget to include contact information for your lender and any necessary agents for clarity.

Misconceptions

Here are nine common misconceptions about the HUD 92900 A form:

- Misconception 1: The HUD 92900 A form is only for VA loans.

- Misconception 2: You can submit the HUD 92900 A form without completing other loan application documents.

- Misconception 3: Borrowers do not need to provide their Social Security Number (SSN) on the form.

- Misconception 4: The form guarantees loan approval.

- Misconception 5: The information provided is only for federal use.

- Misconception 6: All applicants must be first-time homebuyers to use the form.

- Misconception 7: There are no consequences for providing inaccurate information.

- Misconception 8: Lenders are not responsible for the information contained in the form.

- Misconception 9: The form can only be used for purchasing homes.

This form is used for both FHA and VA loans. It serves as an addendum to the Uniform Residential Loan Application for borrowers seeking FHA insurance or VA loan guaranty.

The form must be submitted alongside the complete Uniform Residential Loan Application. It is not a standalone document.

Providing your SSN is mandatory for completing the HUD 92900 A form. It is crucial for identity verification and processing.

Completing the HUD 92900 A form does not guarantee loan approval. The lender must still evaluate your creditworthiness and other qualifications.

While the information is used by federal agencies, it is also shared with lenders as part of the approval process. They rely on this data to assess your application.

First-time homebuyers may use the form, but it is not limited to them. Any eligible borrower applying for FHA or VA loans can complete it.

Providing inaccurate information can lead to serious consequences, including fines and penalties. The form includes a warning against such actions.

Lenders certify the accuracy of the information on the HUD 92900 A form. They are responsible for ensuring that the details provided are true and complete.

The HUD 92900 A form is versatile. It applies to purchases, refinances, and various types of loans, including improvements to existing properties.

Key takeaways

- The HUD 92900 A form is known as the HUD/VA Addendum to the Uniform Residential Loan Application. It is essential for federal loan applications issued by the Department of Housing and Urban Development (HUD) and the Department of Veterans Affairs (VA).

- Identifying Information must be accurately filled out. This includes the borrower’s name, address, loan amounts, interest rates, and property details. Make sure to include zip codes and specific details about the property.

- Separate Sections are designated for HUD and VA applications. Ensure that you select the appropriate section for your loan type.

- Loan Purpose should be articulated clearly. The form includes various options such as purchasing an existing home or refinancing. Choose the correct purpose to avoid processing delays.

- Certification from the Lender is crucial. The lender must certify that the information provided is accurate and representative of the borrower’s financial standing.

- Social Security Administration Verification is part of the process. Borrowers authorize verification of their Social Security numbers through a computer match, which is essential for processing federal loans.

- Notice to Borrowers informs applicants of their rights and responsibilities, particularly regarding liability for mortgage payments even after selling the property.

- Understanding Liability is essential. Borrowers remain responsible for the mortgage payments even if they sell the property unless they find a buyer who assumes the loan.

- Signature and Date are required in multiple sections. Both the borrower and co-borrower need to review the document carefully before signing to ensure all information is correct.

Browse Other Templates

License Suspension Nc - This form reinforces the essential partnership between learner drivers and their supervising adults.

What Is an Hvac System - Record the date the filters were last changed and their current condition.

Laboratory Field Services - Notify the department of any changes in name or address within 30 days using the appropriate email.