Fill Out Your Hud 92458 Form

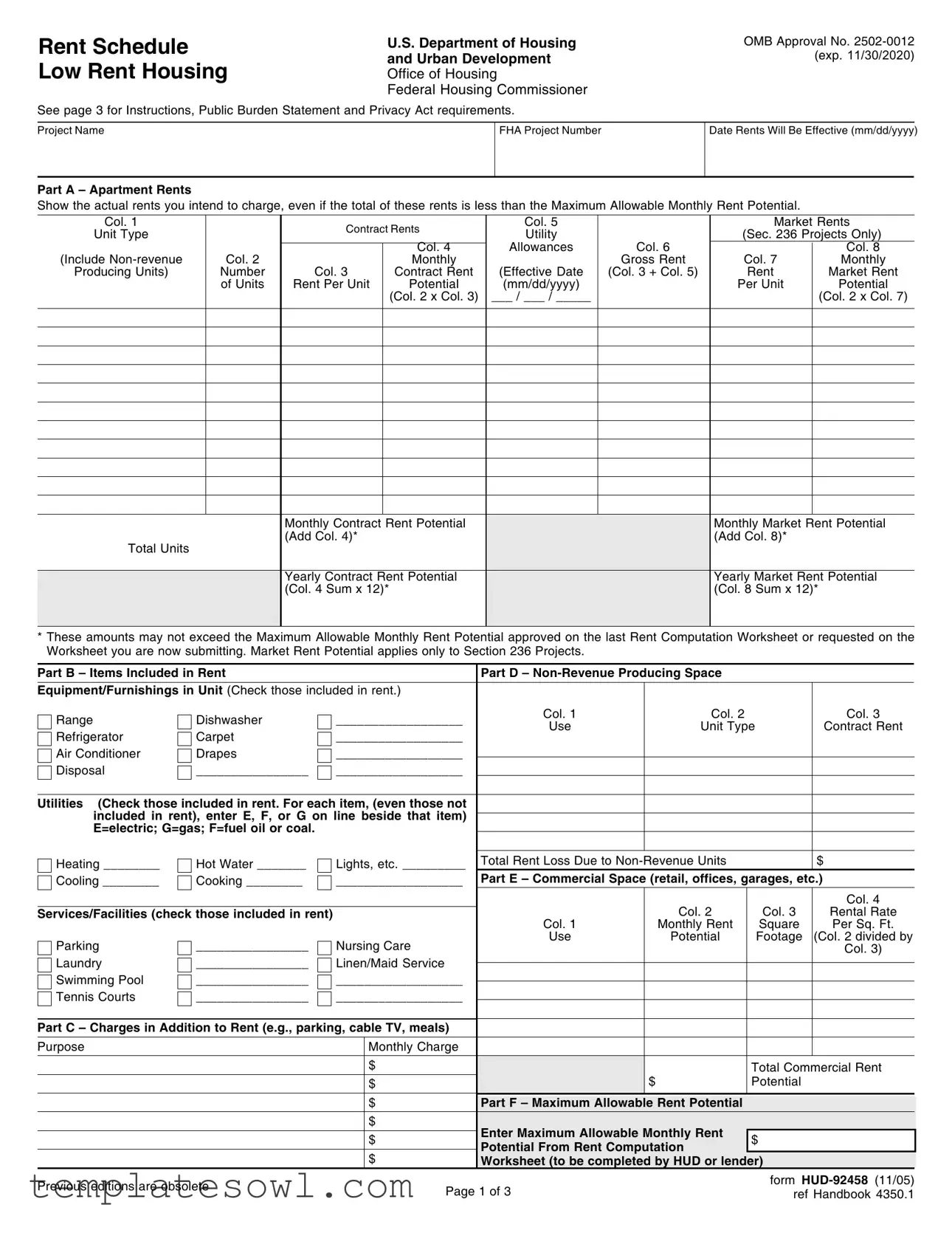

The HUD 92458 form plays a critical role in the management of rental properties within low-income housing programs. This form is used by project owners to submit and request adjustments to apartment rents, ensuring that charges remain compliant with federal regulations. The form outlines various sections including rental rates for different unit types, what items are included in rent, and additional charges like parking or laundry services. It requires detailed information about the project's rent schedule, including effective dates for new rates and the maximum allowable rents determined by the U.S. Department of Housing and Urban Development (HUD). Owners must carefully report the actual rents they plan to charge and provide essential details about principal entities involved in management. Moreover, the form reinforces HUD’s oversight by collecting necessary data to prevent overcharging tenants and to maintain clear records of rent parameters. Approvals and signatures are required at multiple stages, underscoring the importance of accurate reporting and compliance. This comprehensive approach ensures that both tenants and property owners are protected and informed throughout the rental process. Additionally, the form reminds owners of the legal implications of providing false information, which highlights the significance of integrity in housing management practices.

Hud 92458 Example

Rent Schedule Low Rent Housing

U.S. Department of Housing |

OMB Approval No. |

and Urban Development |

(exp. 11/30/2020) |

Office of Housing |

|

Federal Housing Commissioner |

|

See page 3 for Instructions, Public Burden Statement and Privacy Act requirements.

Project Name

FHA Project Number

Date Rents Will Be Effective (mm/DD/yyyy)

Part A – Apartment Rents

Show the actual rents you intend to charge, even if the total of these rents is less than the Maximum Allowable Monthly Rent Potential.

Col. 1 |

|

Contract Rents |

Col. 5 |

|

Market Rents |

||||

Unit Type |

|

Utility |

|

(Sec. 236 Projects Only) |

|||||

|

|

|

|

|

|||||

|

|

|

|

|

Allowances |

Col. 6 |

|

|

Col. 8 |

|

|

|

|

Col. 4 |

|

|

|||

(Include |

Col. 2 |

|

|

Monthly |

|

Gross Rent |

Col. 7 |

|

Monthly |

Producing Units) |

Number |

Col. 3 |

|

Contract Rent |

(Effective Date |

(Col. 3 + Col. 5) |

Rent |

|

Market Rent |

|

of Units |

Rent Per Unit |

|

Potential |

(mm/dd/yyyy) |

|

Per Unit |

|

Potential |

|

|

|

|

(Col. 2 x Col. 3) |

___ / ___ / _____ |

|

|

|

(Col. 2 x Col. 7) |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Contract Rent Potential |

|

|

Monthly Market Rent Potential |

||||

|

|

(Add Col. 4)* |

|

|

|

(Add Col. 8)* |

|

||

Total Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Yearly Contract Rent Potential |

|

|

Yearly Market Rent Potential |

||||

|

|

(Col. 4 Sum x 12)* |

|

|

|

(Col. 8 Sum x 12)* |

|

||

|

|

|

|

|

|

|

|

|

|

*These amounts may not exceed the Maximum Allowable Monthly Rent Potential approved on the last Rent Computation Worksheet or requested on the Worksheet you are now submitting. Market Rent Potential applies only To Section 236 Projects.

Part B – Items Included in Rent |

|

|

Part D – |

|

|

||

|

|

|

|

|

|

||

Equipment/Furnishings in Unit (Check those included in rent.) |

|

|

|

|

|||

Range |

Dishwasher |

__________________ |

|

Col. 1 |

Col. 2 |

|

Col. 3 |

|

Use |

Unit Type |

|

Contract Rent |

|||

Refrigerator |

Carpet |

__________________ |

|

|

|||

|

|

|

|

|

|||

Air Conditioner |

Drapes |

__________________ |

|

|

|

|

|

|

|

|

|

|

|||

Disposal |

________________ |

__________________ |

|

|

|

|

|

|

|

|

|

|

|||

Utilities (Check those included in rent. For each item, (even those not |

|

|

|

|

|||

included in rent), enter E, F, or G on line beside that item) |

|

|

|

|

|

||

|

|

|

|

|

|||

E=electric; G=gas; F=fuel oil or coal. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Heating ________ |

Hot Water _______ |

Lights, etc. _________ |

|

Total Rent Loss Due to |

|

$ |

|

Cooling ________ |

Cooking ________ |

__________________ Part E – Commercial Space (retail, offices, garages, etc.) |

|||||

|

|

|

|

|

|

|

Col. 4 |

Services/Facilities (check those included in rent) |

|

|

Col. 1 |

Col. 2 |

Col. 3 |

Rental Rate |

|

|

|

|

|

Monthly Rent |

Square |

Per Sq. Ft. |

|

Parking |

________________ |

Nursing Care |

Use |

Potential |

Footage |

(Col. 2 divided by |

|

|

|

|

Col. 3) |

||||

Laundry |

________________ |

Linen/Maid Service |

|

|

|

|

|

|

|

|

|

|

|||

Swimming Pool |

________________ |

__________________ |

|

|

|

|

|

|

|

|

|

|

|||

Tennis Courts |

________________ |

__________________ |

|

|

|

|

|

|

|

|

|

|

|||

Part C – Charges in Addition to Rent (e.g., parking, cable TV, meals)

Purpose |

Monthly Charge |

|

|

|

|

|

|

|

|

|

$ |

|

|

Total Commercial Rent |

|

$ |

|

$ |

Potential |

|

$ |

Part F – Maximum Allowable Rent Potential |

|

|

|

$ |

Enter Maximum Allowable Monthly Rent |

|

|

|

$ |

$ |

||

|

Potential From Rent Computation |

|||

|

$ |

|

||

|

Worksheet (to be completed by HUD or lender) |

|||

Previous editions are obsolete |

Page 1 of 3 |

form |

|

ref Handbook 4350.1 |

|||

|

Part G – Information on Mortgagor Entity

Name of Entity

Type of Entity |

|

|

|

Individual |

General Partnership |

Joint Tenancy/Tenants in Common |

Other (specify) |

Corporation |

Limited Partnership |

Trust |

|

List all Principals Comprising Mortgagor Entity: provide name and title of each principal. Use extra sheets, if needed. If mortgagor is a:

•corporation, list: (1) all officers; (2) all directors; and (3) each stockholder having a 10% or more interest.

•partnership, list: (1) all general partners; and (2) limited partners having a 25% or more interest in the partnership.

•trust, list: (1) all managers, directors or trustees and (2) each beneficiary having at least a 10% beneficial interest in the trust.

Name and Title

Name and Title

Name and Title

Name and Title

Name and Title

Name and Title

Name and Title

Name and Title

Name and Title

Name and Title

Name and Title

Part H – Owner Certification

To the best of my knowledge, all the information stated herein, as well as any information provided in the accompaniment herewith, is true and accurate. Warning: HUD will prosecute false claims and statements. Conviction may result in criminal and/or civil penalties. (18 U.S.C. 1001, 1010, 1012; 31 U.S.C. 3729, 3802)

Name and Title

Authorized Official's Signature

Date (mm/dd/yyyy)

Part I – HUD/Lender Approval

Addendum Number

Branch Chief/Lender Official Signature

HAP Contract Number

Date (mm/dd/yyyy)

Exhibit Number

Director, Housing Management Division Signature

Loan Servicer Signature |

Date (mm/dd/yyyy) |

Date (mm/dd/yyyy)

Previous editions are obsolete |

Page 2 of 3 |

form |

|

ref Handbook 4350.1 |

|||

|

Public reporting burden for this collection of information is estimated to average 20 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. This agency may not collect this information, and you are not required to complete this form, unless it displays a currently valid OMB control number.

This collection of information is authorized under Section 207 of the National Housing Act. The information is necessary for the Department to ensure that project owners are not overcharging their tenants and to ensure that the rent levels approved by the Department are not exceeded. The Department uses this information to enforce rent regulations which otherwise would be difficult because there would be no clear record of the rents and charges that the Department had approved. In addition, the Department needs to periodically collect information regarding project principals, so unauthorized participation by previously excluded or otherwise undesirable owners can be detected. This information is required to obtain benefits. HUD may disclose certain information to Federal, State, and local agencies when relevant to civil, criminal, or regulatory investigations and prosecutions. It will not be otherwise disclosed or released outside of HUD, except as required and permitted by law.

Instructions

All project owners must submit the form

General. For projects with

Part A. If the monthly rent potential you are proposing is less than or equal to the Maximum Allowable Monthly Rent Potential approved by HUD/lender on your original Rent Formula or on your most recent Rent Computation Worksheet, complete all of Part A according to the instructions below. If the monthly rent potential you are requesting exceeds the Maximum Allowable Monthly Rent Potential approved by HUD/lender on your original Rent Formula or on your most recent Rent Computation Worksheet, complete only Columns 1 and 2 according to the instructions below. Show your proposed rents and monthly rent potential in the cover letter transmitting your rent increase request.

Column 1. Show each type of unit for which rents will vary. Show the number of bedrooms and bathrooms and other features that cause rents to vary (e.g., 2 BDM, 1 B, DA, KETTE, vs 2 BDM, 2B, DR, K). Use the following symbols:

BDM |

- Bedroom |

LR - Living Room |

B |

- Bath |

DR - Dining Room |

K |

- Kitchen |

DA - Dining Alcove |

KETTE - Kitchenette

Column 2. Show the number of units for each unit type. Include non- revenue producing units.

Column 3. For unsubsidized projects, show the rent you intend to charge for each unit type. For subsidized projects, show the contract rent (as defined in HUD Handbook 4350.3) for each unit type.

Column 4. For each line, multiply the contract rent in Column 3 by the number of units in Column 4. Add monthly contract rent potentials for each unit size to compute the total monthly contract rent potential. Multiply the monthly total by 12 to compute the annual contract rent potential.

Columns 5 and 6. Complete the Columns only if the project has a subsidy contract with HUD and some utilities are not included in the rent. In Column 5, show the utility allowance for each unit type. Compute the gross rent for each unit type by adding the contract rent in Column 3 and the utility allowance in Column 5. Show this amount in Column 6.

Columns 7 and 8. Complete these Columns only if the project is receiving Section 236 Interest Reduction Payments. In Column 7, show the market rent for each unit type. In Column 8, for each line multiply the market rent in Column 7 by the number of units in Column

2.Add the monthly market rent potentials for each unit size to compute the total monthly market rent potential. Multiply the monthly total by 12 to compute the annual market rent potential.

Parts B, C, D and E. Complete these Parts according to the instructions on the Rent Schedule.

Part F. Do not complete this Part. The HUD Field Office/lender will complete this Part.

Parts G and H. Complete these Parts according to the instructions on the Rent Schedule.

Part I. Do not complete this Part. The HUD Field Office/lender will complete this part.

Previous editions are obsolete |

Page 3 of 3 |

form |

|

ref Handbook 4350.1 |

|||

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The HUD 92458 form is used by project owners to request adjustments to rents for low-income housing projects. |

| Applicable Projects | This form applies to projects with HUD-insured mortgages and those held by HUD. |

| Utility Allowances | Utility allowances are included in the rent schedule to ensure tenants are not overcharged for utilities. |

| Part Structure | The form has multiple parts, including sections on apartment rents, items included in rent, and charges in addition to rent. |

| Governing Law | The submission is governed by Section 207 of the National Housing Act. |

| Reporting Burden | Completing the form is estimated to take about 20 minutes, covering the time to gather necessary information. |

| Certification | Owners must certify the accuracy of the information provided, with penalties for false statements. |

| Approval Process | The form requires approval from HUD or the lender, dependent on the project type. |

Guidelines on Utilizing Hud 92458

Completing the HUD 92458 form is an important part of the rent adjustment process for housing projects. After filling out this form, you will submit it to the appropriate HUD Field Office or lender, depending on the type of mortgage your project has. Make sure all information is accurate to avoid delays.

- Project Details: At the top of the form, fill in the Project Name, FHA Project Number, and the Date Rents Will Be Effective in the specified format (mm/DD/yyyy).

- Part A - Apartment Rents: Enter the actual rents you plan to charge, regardless of whether they are less than the maximum allowable rents. Complete the columns for Contract Rents, Market Rents, and Utilities.

- Part B - Items Included in Rent: Check the items that are included in the rent, like appliances and utilities. Indicate the type of utility for each item (E, F, or G).

- Part C - Charges in Addition to Rent: List any additional monthly charges, like for parking or cable TV, along with their respective amounts.

- Part D - Non-Revenue Producing Space: Provide details for any non-revenue generating spaces, including their monthly rents and charges.

- Part E - Commercial Space: If applicable, fill in the information regarding any commercial spaces under your management, including rental rates and square footage.

- Part F: Do not complete; this will be filled out by HUD or the lender.

- Part G - Information on Mortgagor: Provide the entity name, type of entity, and a list of all principals involved with the mortgagor entity.

- Part H - Owner Certification: Sign and date the certification to ensure all information is true and accurate.

- Part I: Leave this part blank; it will be completed by HUD or the lender.

What You Should Know About This Form

What is the HUD 92458 form used for?

The HUD 92458 form is used by project owners to request adjustments to rents for low-rent housing. This form allows owners to itemize rents, utility allowances, and other charges associated with different unit types. It ensures that rent levels comply with federal guidelines and that tenants are not overcharged.

Who needs to submit the HUD 92458 form?

Any project owner seeking to adjust rents for properties with FHA-insured or HUD-held mortgages must submit this form. This includes all types of housing projects where rent adjustments are necessary.

What information is included in Part A of the form?

Part A of the HUD 92458 form details the apartment rents you intend to charge. You'll need to show actual rent amounts, potential market rents, and utility allowances for various unit types. It captures important data like the number of units and their respective rent potential, ensuring transparency and compliance with federal guidelines.

What should I do if my proposed rents exceed the maximum approved amount?

If your proposed rents exceed the Maximum Allowable Monthly Rent Potential, complete only Columns 1 and 2 of Part A. You should clearly outline your proposed rents in the cover letter that accompanies your rent increase request.

What types of units does the form ask about?

The form asks about various unit types based on the number of bedrooms and bathrooms. You can specify details like living rooms and kitchens to classify the units accurately. It's essential for determining appropriate rents for each type of unit and ensuring proper approval.

What should I include in Part B regarding items included in rent?

In Part B, you will list items in each unit that are covered by the rent. This includes appliances like ranges and refrigerators, as well as utilities included in rent. Make sure to clearly indicate what is and isn’t included to avoid any confusion among tenants and regulatory bodies.

What is Part D about and how do I complete it?

Part D addresses non-revenue producing spaces, like common areas or facilities not generating income. You’ll need to provide details about these spaces, including any services or amenities that are included in the rent, like parking or laundry facilities. Understanding how to fill this out accurately prevents misreporting and clarifies your rental offerings.

What happens if I provide false information on this form?

Providing false information on the HUD 92458 form can lead to serious consequences, including criminal or civil penalties. It's crucial to ensure all details are accurate. HUD takes such claims seriously, as they aim to protect both tenants and the integrity of the housing program.

How is the information on this form used by HUD?

HUD uses the information submitted via the HUD 92458 form to monitor compliance with rent regulations and ensure that owners are not overcharging tenants. The data helps HUD maintain accurate records and enforce regulations, making it an important part of housing administration.

Common mistakes

Filling out the HUD 92458 form can be a straightforward process, but many individuals make common mistakes that can lead to delays or complications. One frequent error is skipping the important instruction page. This page contains crucial guidelines that ensure a complete and accurate submission. Without referring to these instructions, important sections may be overlooked entirely.

Another common mistake is incorrect calculations. Calculating monthly contract rent potential can be tricky. It's essential to multiply the correct figures, but sometimes, figures are entered incorrectly or irrelevant cells are combined. Each column requires careful attention to detail. Double-checking your math can prevent unnecessary errors.

People also frequently neglect to list non-revenue producing units. These units, though not generating income, must be included to provide a full picture of your project’s structure and financial standing. Omitting them can lead to skewed data and possible compliance issues.

Failing to provide accurate unit descriptions is another pitfall. It’s important to specify the correct unit types, including the number of bedrooms and bathrooms. Vague descriptions may delay processing and could lead to misunderstandings regarding rent calculations.

Utilizing the wrong column for rent entries often occurs as well. For instance, mixing up contract rents and market rents can distort the overall data reported. Each column has a specific purpose, and keeping these separate is vital to accuracy.

In addition, people sometimes rush through the signature section and fail to include names and titles for all authorized individuals. Each person listed should be clearly identified to ensure accountability and compliance with HUD standards.

Another oversight is not providing complete contact information. This data is essential for communication regarding any follow-ups or required clarifications after submission. Skipping this detail can hinder the processing of your form.

Some individuals fill out the form without considering the effective date of the rents. Entering an incorrect date could affect budget planning and compliance. Always ensure the effective date aligns with the proposed adjustment period.

Lastly, missing the deadline for submission can cause serious issues. Waiting too long can lead to missed opportunities for rent adjustments. Mark important dates on your calendar, and submit the form on time to avoid unnecessary setbacks.

Documents used along the form

The HUD 92458 form is essential for requesting rent adjustments in low-rent housing projects. Various other forms and documents often accompany it to ensure compliance and proper processing. Below is a list of these documents, each serving a specific purpose.

- HUD 92466: This form is used to document any requests for adjustments to the Maximum Allowable Rent for Section 236 projects. It ensures that rent increases stay within HUD guidelines.

- HUD 92451: Known as the "Rent Computation Worksheet," it captures detailed information on the rent calculations for each unit. This form helps maintain transparency in rent determinations.

- HUD 50059: This document is necessary for reporting tenant information and certifications. It is vital for ensuring that tenants are receiving the appropriate benefits and subsidies.

- HUD 92006: This "Application for Commitment" form is essential for submitting requests for federal housing assistance. It outlines the project's specifics and funding requirements.

- HUD 90103: The "Owner-Developer's Statement" provides essential information regarding the property’s development and ownership structure, helping validate ownership claims.

- Form 50058-EV: This is the "Family Report" that tracks changes in tenant income and family composition, essential for adjusting their assistance levels.

- Bond Documentation: Required for projects with financing through HUD. It outlines terms, conditions, and financial responsibilities of all parties involved.

- Owner's Certification: This document attests that the information provided in all submitted documents is accurate and complete. It's crucial for fraud prevention.

- Project Data Form: This form consolidates information about the housing project, including location, target population, and statistical details vital for HUD analysis.

These accompanying documents help ensure that the HUD 92458 form is processed correctly and that housing projects comply with all regulatory requirements. Each plays a role in the overall rent and tenant assistance process, contributing to effective and transparent management of low-income housing programs.

Similar forms

HUD 92457: This form, known as the “Rent Computation Worksheet,” is used to determine the maximum allowable rents for housing projects. Much like the HUD 92458, it requires detailed information about proposed rents and utility allowances. Both forms aim to ensure compliance with HUD regulations.

HUD 92264: The “Multifamily Housing Owner's Certification” is similar in that it seeks verifiable information from property owners. This document focuses on income and expenses, similar to how the HUD 92458 analyzes rent structures.

HUD 92013: Known as the “Application for the Approval of a Rental Agreement,” this form requires details about rental agreements for housing projects, similar to how the HUD 92458 outlines rents and allowances.

Form 50059: The “Owner Certification” form provides information on tenant income and rent calculation, similar to how the HUD 92458 calculates potential rents and utility costs.

HUD 236: This document pertains to interest reduction payments for Section 236 projects. Like the HUD 92458, it involves determining maximum rents and utility costs to comply with HUD standards.

Form 4700: This application form for the release of funds in housing projects requires a thorough presentation of financial particulars, akin to the financial data requested in the HUD 92458.

HUD 92456: As a “Schedule of Rents,” this form overlaps with the HUD 92458 by requiring detailed information about apartments, including market rents and charges.

Form HUD-9839: This is the “Rent Comparability Study” used to analyze and compare various rental properties. Similar to the HUD 92458, it considers the striving for fair and reasonable rents.

Form 53072: The “Tenant Rent Calculation Worksheet” aids in calculating tenant rent amounts based on various factors, a concept mirrored in the rent calculations of the HUD 92458.

Form HUD-92410: The “Application for Project Mortgage Insurance,” which collects information about the project’s financial structure, parallels the comprehensive informational requirements outlined in the HUD 92458.

Dos and Don'ts

- Do review the form carefully before filling it out.

- Do ensure all proposed rents are accurate and reflect the actual rents intended to be charged.

- Do provide all requested information in Parts A through H, unless instructed otherwise.

- Do list all principals comprising the mortgagor entity, including their titles.

- Do check off all included utilities or equipment in the rent section.

- Don't leave any sections blank unless specified in the instructions.

- Don't exceed the Maximum Allowable Monthly Rent Potential approved by HUD or the lender.

- Don't use ambiguous terms; clarity is crucial in the information provided.

- Don't neglect to sign and date the form where required.

- Don't submit the form without a cover letter stating the proposed rents and any relevant details.

Misconceptions

Understanding the HUD 92458 Form is crucial for project owners aiming to adjust their rental charges. Yet, there are several misconceptions surrounding this form that can lead to confusion. Below are seven common misunderstandings, along with clarifications on each.

- Misconception 1: The HUD 92458 form is only for new projects.

- Misconception 2: Owners can set any rent they want without submitting forms.

- Misconception 3: Only subsidized projects need to complete the form.

- Misconception 4: The form only addresses utilities in the rent charges.

- Misconception 5: The information on the form is not subject to verification.

- Misconception 6: Once submitted, the proposed rents are automatically approved.

- Misconception 7: The form is overly complex and difficult to complete.

This form is actually required for any adjustments to rents for existing projects as well. It ensures that all rental charges comply with HUD guidelines, regardless of the project's age.

In reality, project owners cannot arbitrarily set rents; all rent adjustments must be submitted and approved through the HUD 92458 form. This process is designed to protect tenants from potential overcharging.

Both subsidized and unsubsidized projects are required to fill out the HUD 92458 form if they wish to adjust rents. It applies to all types of housing projects under HUD supervision.

While the form does account for utility allowances, its primary purpose is to provide a comprehensive overview of the proposed rents, included services, and any additional charges. Utilities are just one aspect of the rental computation process.

The details submitted on the HUD 92458 form are carefully reviewed and verified by HUD officials. Providing incorrect information can lead to serious penalties, including criminal prosecution.

This is a misconception. Submitting the form does not guarantee approval. HUD will review the proposed rents in relation to the established guidelines before granting any increase or adjustment.

Although the form may seem daunting at first glance, clear instructions are provided. Taking the time to read these guidelines can simplify the process significantly, making it manageable for project owners.

By dispelling these misconceptions, project owners can approach the HUD 92458 form with greater confidence, ensuring compliance and the accurate reflection of rental charges in their housing projects.

Key takeaways

Understanding the HUD 92458 Form is essential for accurate rent scheduling in low rent housing. This form serves as a formal request to adjust project rents and must be filled out with precision. Here are four key takeaways to consider:

- Complete All Relevant Sections: It's crucial to fill out all necessary parts of the form. If your proposed monthly rent is less than or equal to the Maximum Allowable Monthly Rent, provide detailed information in Part A. This includes actual rents, unit types, and other essential details.

- Accurate Calculations Matter: Ensure that all figures are accurate. The total rent potential should not surpass the approved maximum amounts. Errors can lead to complications regarding rent approvals.

- Notify Your Tenants: After submitting the form and receiving approval from HUD or the lender, it is your responsibility to inform tenants of the newly approved rents. Clear communication will help build trust and avoid confusion.

- Understand Reporting Requirements: Familiarize yourself with the public reporting burden and privacy requirements linked to the HUD 92458. Compliance ensures smooth processing and adherence to federal regulations.

Browse Other Templates

Ics 214 Example - The form must reflect the operational period for accuracy in record-keeping.

1095-b Vs 1095-a - The New Health Marketplace Coverage form provides essential information about health insurance options available through the Marketplace.