Fill Out Your I 765Ws Form

The Form I-765WS, officially known as the I-765 Worksheet, serves a crucial role in the employment authorization process for individuals applying under specific categories such as Deferred Action or Deferred Action for Childhood Arrivals (DACA). This worksheet assists U.S. Citizenship and Immigration Services (USCIS) in determining an applicant's economic need for work. Applicants are required to provide essential financial information, detailing their current annual income, expenses, and the overall value of their assets. While the submission of supporting documents is optional, any relevant documentation provided will be considered by USCIS as part of the evaluation process. Importantly, individuals only need to disclose their own financial situation; information about other household members is not necessary for establishing economic necessity. The form further allows applicants to include a brief explanation of their financial circumstances, offering an opportunity to clarify their need for employment authorization.

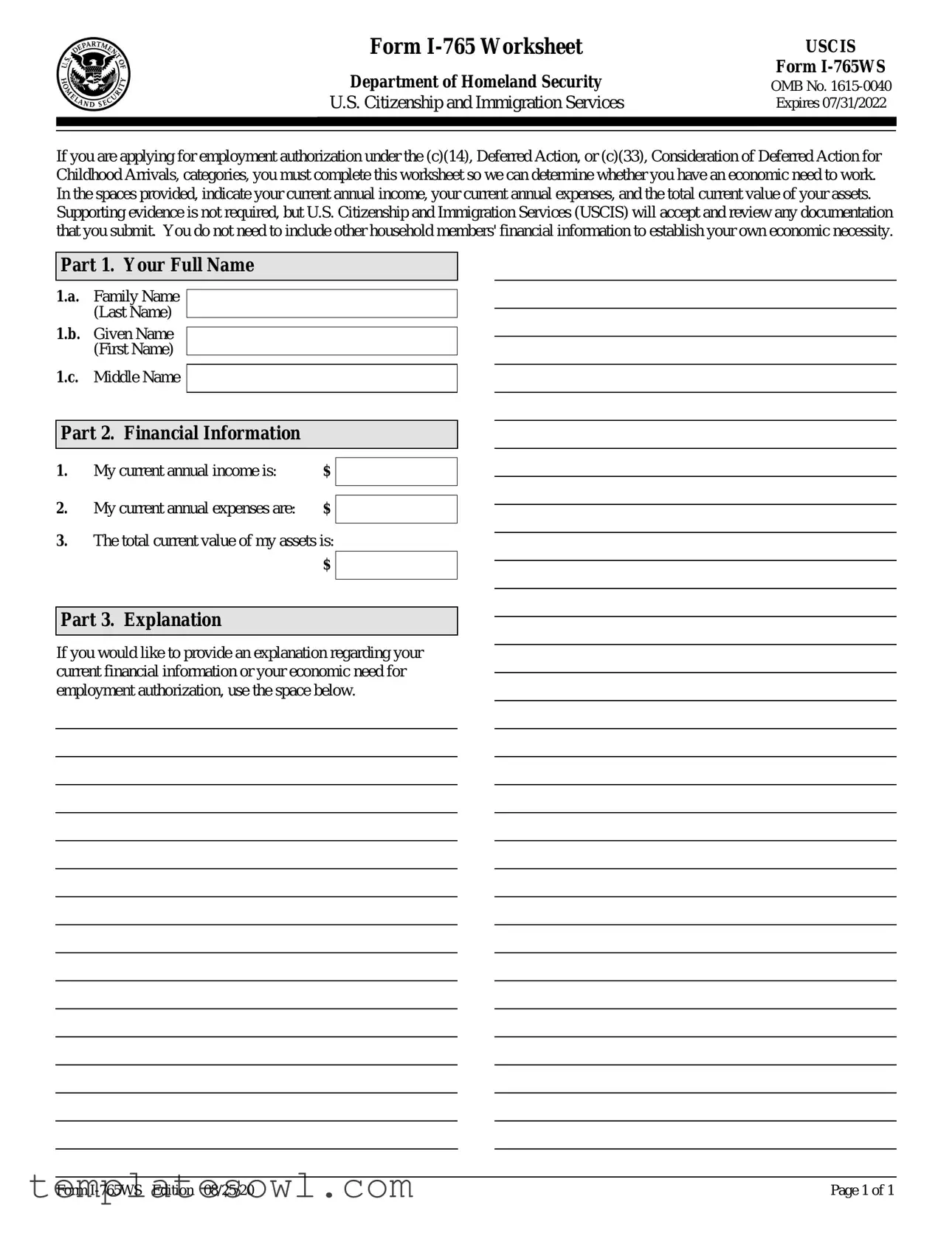

I 765Ws Example

Form |

USCIS |

Department of Homeland Security |

Form |

OMB No. |

|

U.S. Citizenship and Immigration Services |

Expires 07/31/2022 |

If you are applying for employment authorization under the (c)(14), Deferred Action, or (c)(33), Consideration of Deferred Action for Childhood Arrivals, categories, you must complete this worksheet so we can determine whether you have an economic need to work. In the spaces provided, indicate your current annual income, your current annual expenses, and the total current value of your assets.

Supporting evidence is not required, but U.S. Citizenship and Immigration Services (USCIS) will accept and review any documentation that you submit. You do not need to include other household members' financial information to establish your own economic necessity.

Part 1. Your Full Name

1.a. Family Name

(Last Name)

1.b. Given Name

(First Name)

1.c. Middle Name

Part 2. Financial Information

1. |

My current annual income is: |

$ |

|

2. |

My current annual expenses are: |

$ |

|

|

|||

|

|||

3. |

The total current value of my assets is: |

|

|

|

|||

|

|

$ |

|

|

|

|

|

Part 3. Explanation

If you would like to provide an explanation regarding your current financial information or your economic need for employment authorization, use the space below.

Form |

Page 1 of 1 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form helps U.S. Citizenship and Immigration Services (USCIS) assess an applicant's financial need for employment authorization. |

| Application Categories | It is specifically for applicants under categories (c)(14) for Deferred Action and (c)(33) for Deferred Action for Childhood Arrivals (DACA). |

| Financial Information | Applicants must provide their current annual income, annual expenses, and total value of assets directly on the form. |

| Documentation | While supporting evidence is not mandatory, applicants can submit any relevant documentation they feel might support their case. |

| Household Income | Only the financial information of the applicant is needed; details from other household members are not required. |

| Expiration Date | The I-765WS form is valid until July 31, 2022, which may prompt the need for updates or renewals. |

| USCIS Review | USCIS will evaluate the financial information provided to determine the applicant's economic necessity for obtaining work authorization. |

Guidelines on Utilizing I 765Ws

Completing the I-765WS form is a crucial step for individuals applying for employment authorization under specific categories. Once the form is filled out, it typically accompanies the main application submitted to USCIS. The following guidelines outline the necessary steps to accurately complete this worksheet.

- Begin with Part 1: Your Full Name.

- In section 1.a., enter your Family Name (Last Name).

- Next, in section 1.b., input your Given Name (First Name).

- Then, in section 1.c., provide your Middle Name if applicable.

- Proceed to Part 2: Financial Information. In section 1, state your current annual income in the designated space.

- In section 2, indicate your current annual expenses.

- In section 3, note the total current value of your assets.

- Finally, move to Part 3: Explanation. Use the provided space to elaborate on your financial situation or your need for employment authorization, if desired.

Once all sections are completed, review the information for accuracy before submission. This ensures that all financial details accurately reflect your situation, which is essential for the review process by USCIS.

What You Should Know About This Form

What is the purpose of Form I-765WS?

Form I-765WS, or the I-765 Worksheet, is required for individuals applying for work permits under specific categories, including Deferred Action (c)(14) and Consideration of Deferred Action for Childhood Arrivals (c)(33). This form helps the U.S. Citizenship and Immigration Services (USCIS) determine if applicants demonstrate an economic need to work. By providing information on income, expenses, and assets, individuals can present their financial circumstances effectively.

Who needs to complete the I-765WS?

If you are applying for employment authorization under the Deferred Action or DACA programs, you are required to complete the I-765WS. This form is important for establishing your economic necessity to work, which USCIS reviews as part of your application.

What information do I need to provide on the I-765WS?

When filling out the I-765WS, you need to disclose your current annual income and expenses, along with the total value of your assets. This information helps USCIS assess your financial situation. Additionally, there is a section where you can provide an explanation of your economic need, though this is optional.

Is supporting evidence necessary when submitting the I-765WS?

Supporting documentation is not required for the I-765WS. However, USCIS accepts and reviews any evidence you choose to include to help clarify your financial situation. While it is not mandatory, including relevant documentation can strengthen your application.

Do I need to include financial information about my household members?

No, when completing the I-765WS, you do not need to provide financial details about other household members. You should focus on your own financial information to demonstrate your economic necessity for employment authorization.

What should I do if I want to explain my financial situation further?

If you have additional details regarding your financial situation or economic need that you want USCIS to consider, use the explanation section on the form. This area allows you to provide context or elaborate on any points you believe are important for your application.

How is the information on the I-765WS used?

The information you provide in the I-765WS is used by USCIS to evaluate your request for employment authorization. It helps them understand your financial needs and whether you qualify for the programs associated with your application, such as DACA or Deferred Action.

What happens if I provide inaccurate information on the I-765WS?

Providing inaccurate information, either intentionally or unintentionally, can have serious consequences for your application. It may lead to denial or delays. Always ensure the information you submit is accurate and reflects your true financial situation to avoid any potential issues.

When will the I-765WS form expire?

The I-765 Worksheet currently has an expiration date of July 31, 2022. While this date indicates the form may need to be updated, ensure you are using the most current version by checking with USCIS. Regularly reviewing their website ensures you comply with any new requirements or changes to the form.

Common mistakes

Filling out the Form I-765WS can be a critical step for those seeking employment authorization. However, many make mistakes that can delay their applications or lead to confusion. One common error is related to incomplete information. Some applicants fail to provide all required details, such as their current annual income or expenses. Inaccurate or missing figures may not only jeopardize the application but also leave USCIS unable to assess the financial need adequately.

Another mistake arises from misunderstanding how to present their income and expenses. Some individuals might forget to include all sources of income or misinterpret what counts as an expense. For instance, personal expenses related to hobbies or unnecessary memberships should not be included. Ensuring clarity and accuracy is key to demonstrating one’s economic situation, so it is essential to think critically about what financial details truly reflect your current situation.

Furthermore, individuals often overlook the importance of an explanation. While it's not mandatory to provide an explanation regarding financial information, doing so can add valuable context to the numbers presented. Forgetting to elaborate on specific challenges or unique circumstances may lead USCIS to misunderstand your financial needs. Providing additional context helps them see the complete picture.

Lastly, many applicants assume they need to include the financial information of other household members. This is a misconception. The form specifically states that you do not need to include others' financial details to establish your economic necessity. This misunderstanding can lead to unnecessary complications in the application process, which could further delay the review. Simplifying your application by focusing solely on your own financial situation is vital.

Documents used along the form

When applying for employment authorization with the I-765WS form, it is often necessary to include additional forms and documents. Below is a list of commonly used forms that may be relevant during the application process.

- Form I-765: This is the main application for employment authorization. Completing this form is essential to request work permission from USCIS.

- Form I-912: The Request for Fee Waiver form is used to ask USCIS to waive the application fees, based on demonstrated financial hardship.

- Form I-94: This document records an individual’s arrival and departure to the U.S. It serves as proof of current immigration status.

- Form I-131: Known as the Application for Travel Document, this form is for those who need to apply for advance parole, allowing temporary travel outside the U.S.

- Form I-797: This is a Notice of Action that may be sent by USCIS. It serves as proof of the receipt, approval, or rejection of your application or petition.

- Employment Verification Letter: This document is provided by your employer and confirms your job and salary. It's helpful to demonstrate your economic need.

Including the right forms and documents will strengthen your application for employment authorization. Make sure to review each requirement carefully and consult with professionals if necessary.

Similar forms

The Form I-765WS serves as a critical tool for applicants seeking employment authorization based on their economic needs. Several other documents share similarities with this form, particularly in their intent to assess financial circumstances or verify eligibility for specific benefits. Here is a list of seven such documents:

- Form I-485: This application for a Green Card requires applicants to demonstrate their eligibility, which often includes financial disclosures related to income and assets.

- Form I-130: When sponsoring a relative for immigration, this form collects financial information to show the sponsor's ability to support their family member.

- Form I-864: Known as the Affidavit of Support, it requires a detailed examination of the sponsor's finances, similar to the economic assessments in the I-765WS.

- Form I-9: While primarily for employment verification, this form requires employers to ascertain an employee's eligibility for work, indirectly reflecting the need to understand the applicant's financial status.

- Form N-400: The application for naturalization includes questions about income and assets, paralleling the economic considerations found in the I-765WS.

- Form I-821D: This is the request for Deferred Action for Childhood Arrivals (DACA) status, which involves financial assessments similar to those in the I-765WS for economic necessity.

- Form I-912: The Request for Fee Waiver looks into the applicant's financial condition to determine if they qualify for fee exemptions, much like the financial inquiries in the I-765WS.

Understanding these documents can aid in navigating the complexities of the application process and ensure the submission of necessary information to illustrate economic need effectively.

Dos and Don'ts

When filling out the Form I-765WS, attention to detail is crucial. Here’s a list of important things to keep in mind to ensure your application is complete and accurate:

- Do provide accurate figures for your current annual income, expenses, and assets.

- Do write clearly and legibly to avoid any confusion for the reviewer.

- Do use the space provided to include any relevant explanation about your financial situation.

- Do double-check all information before submitting to ensure accuracy.

- Don’t include financial information of other household members unless it directly relates to your application.

- Don’t submit supporting evidence unless you believe it will strengthen your explanation—it’s not mandatory.

- Don’t leave any sections blank; if a section doesn’t apply, indicate that instead.

By following these guidelines, you enhance the likelihood of a smooth review process for your I-765WS form, which can ultimately assist in securing employment authorization.

Misconceptions

- Misconception: Form I-765WS is only for certain types of applicants. Many people think this form is limited to specific immigration categories. However, it applies primarily to those seeking employment authorization under the (c)(14) and (c)(33) categories, like Deferred Action and DACA recipients.

- Misconception: You must include financial information from all household members. It is a common belief that you need to provide financial details for everyone living in your home. In reality, you only need to present your own financial information to demonstrate your economic need for employment.

- Misconception: Supporting documents are mandatory. Some individuals think that they must provide supporting evidence when filing the form. While supporting documents can be helpful, they are not required. USCIS reviews any additional documentation that you choose to submit.

- Misconception: The form is complicated and difficult to fill out. While it may seem daunting at first, the I-765WS is straightforward. The sections require only basic financial information, making it manageable for most applicants.

- Misconception: You cannot provide additional explanations. Some applicants believe they can submit only numbers. However, there is a space provided for you to explain your financial situation or the need for work. Providing context can be beneficial.

- Misconception: Form completion guarantees employment authorization. Many assume that merely submitting the I-765WS will lead to employment authorization. This is not true. USCIS will review the information, but approval depends on various factors beyond this form.

Key takeaways

Filling out the I-765WS form is a critical step for individuals applying for certain types of employment authorization. Here are nine key takeaways to consider:

- Identifying Categories: This form is specifically for applicants under categories (c)(14) and (c)(33) related to Deferred Action and DACA, respectively.

- Assessing Economic Need: The form is designed to help USCIS determine if you have an economic necessity to work.

- Financial Information Required: You must provide details about your current annual income, expenses, and the value of your assets.

- Documentation Optional: While submitting supporting documents is not mandatory, USCIS will review any evidence you choose to provide.

- Individual Information: The form only requires information about your financial situation, not that of other household members.

- Clear Identification: Ensure you correctly input your full name, including the last name, first name, and middle name as applicable.

- Opportunity for Explanation: You can include a personal explanation about your economic need, which can provide valuable context.

- Watch the Expiration Date: Be mindful of the form's expiration date and ensure you are using the most current version.

- Important for Employment: This form is a key document in proving your eligibility for employment authorization, so accuracy is essential.

Browse Other Templates

Oklahoma Department of Corrections Visitation Application - The document contributes to the orderly management of visitor requests.

Articles of Organization Pa - Consulting professional advice can benefit those unfamiliar with the registration process.

Policy Brief - Reasoning explains the thought process behind the court’s conclusion, providing context for the ruling.