Fill Out Your Iaa Fsa Hra Claim Form

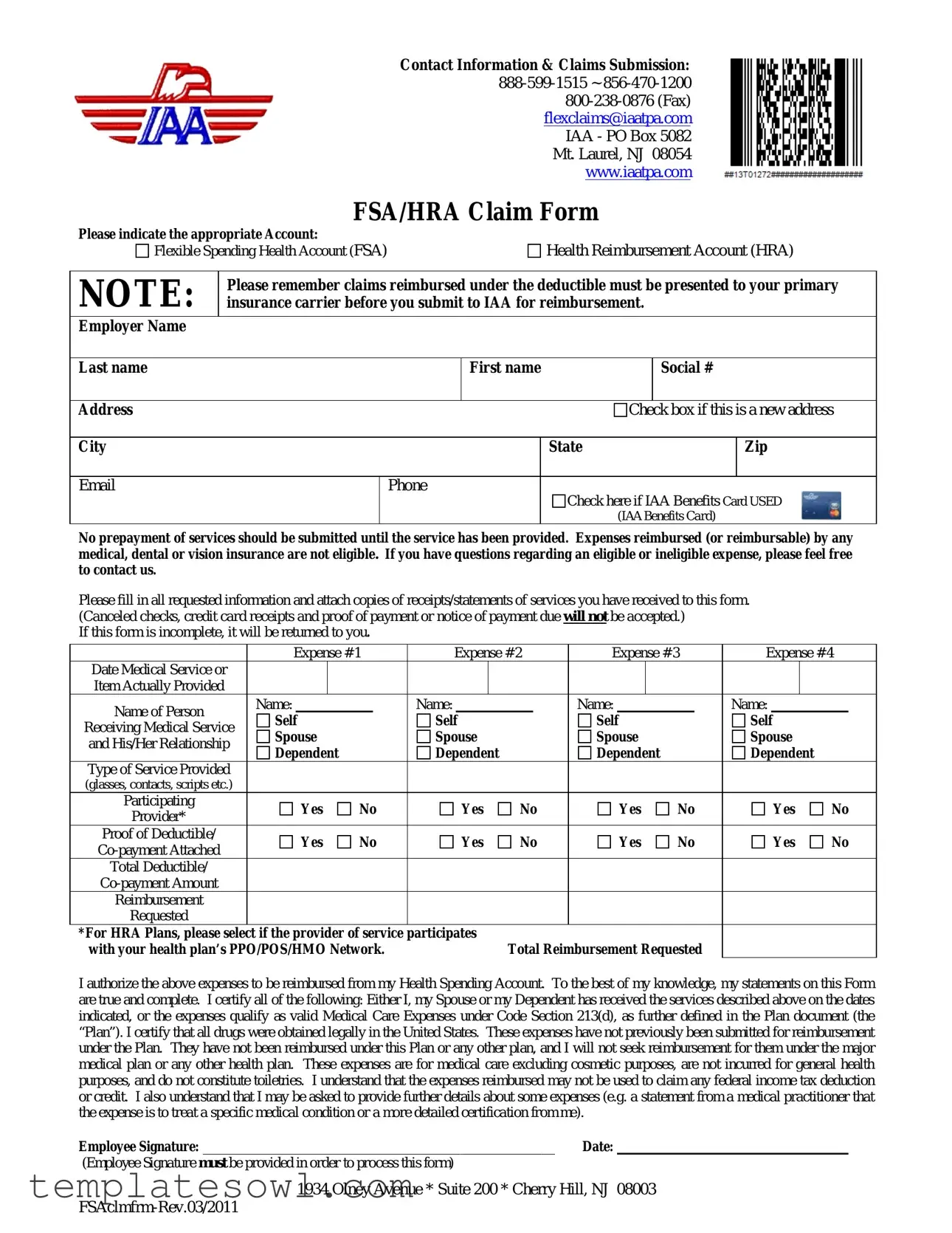

The IAA FSA HRA Claim Form is a crucial document for individuals seeking reimbursement for qualified medical expenses under Flexible Spending Accounts (FSA) or Health Reimbursement Accounts (HRA). Proper completion of this form ensures that claims are processed efficiently and accurately. Users must first select the appropriate account type, either FSA or HRA, and provide detailed personal information, including their name, employer name, and contact information. Specific instructions emphasize that claims submitted for reimbursement must first be presented to primary insurance providers, particularly for expenses incurred under a deductible. The form requires the submission of supporting documentation such as receipts and itemized bills; it's important to note that canceled checks or credit card receipts are insufficient. Each medical expense must be clearly noted, detailing the date of service, type of service, and the relationship of the individual receiving the service. Additionally, users must certify that the provided information is true and complete, particularly regarding the legality of drug purchases and the uniqueness of the claims, ensuring they have not been submitted elsewhere for reimbursement. Completing this form accurately and attaching all necessary documentation will facilitate a smoother reimbursement process.

Iaa Fsa Hra Claim Example

Contact Information & Claims Submission:

flexclaims@iaatpa.com

IAA - PO Box 5082

Mt. Laurel, NJ 08054

|

|

|

|

www.iaatpa.com |

|

|

|

FSA/HRA Claim Form |

|

||||

Please indicate the appropriate Account: |

|

|

|

|||

Flexible Spending Health Account (FSA) |

Health Reimbursement Account (HRA) |

|||||

|

|

|

|

|

|

|

NOTE: |

Please remember claims reimbursed under the deductible must be presented to your primary |

|||||

insurance carrier before you submit to IAA for reimbursement. |

|

|||||

Employer Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Last name |

|

|

First name |

|

Social # |

|

|

|

|

|

|

|

|

Address |

|

|

|

Check box if this is a new address |

||

|

|

|

|

|

|

|

City |

|

|

|

State |

Zip |

|

|

|

|

|

|

|

|

|

Phone |

Check here if IAA Benefits Card USED |

||||

|

|

|

|

|||

|

|

|

|

(IAA Benefits Card) |

|

|

No prepayment of services should be submitted until the service has been provided. Expenses reimbursed (or reimbursable) by any medical, dental or vision insurance are not eligible. If you have questions regarding an eligible or ineligible expense, please feel free to contact us.

Please fill in all requested information and attach copies of receipts/statements of services you have received to this form. (Canceled checks, credit card receipts and proof of payment or notice of payment due will not be accepted.)

If this form is incomplete, it will be returned to you.

|

Expense # 1 |

Expense # 2 |

Expense # 3 |

Expense # 4 |

||||||||||||||||

Date Medical Service or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item Actually Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Person |

Name: |

|

|

|

Name: |

|

|

|

Name: |

|

|

|

Name: |

|

|

|

||||

Self |

|

|

Self |

|

|

Self |

|

|

Self |

|

|

|||||||||

Receiving Medical Service |

|

|

|

|

|

|

|

|

||||||||||||

Spouse |

|

|

Spouse |

|

|

Spouse |

|

|

Spouse |

|

|

|||||||||

and His/Her Relationship |

|

|

|

|

|

|

|

|

||||||||||||

Dependent |

|

|

Dependent |

|

|

Dependent |

|

|

Dependent |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

||||||||||||

Type of Service Provided |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(glasses, contacts, scripts etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participating |

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

||||||||

Provider* |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proof of Deductible/ |

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

|

Yes |

No |

||||||||

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Deductible/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reimbursement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Requested |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*For HRA Plans, please select if the provider of service participates |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

with your health plan’s PPO/POS/HMO Network. |

|

|

|

Total Reimbursement Requested |

|

|

|

|

|

|||||||||||

I authorize the above expenses to be reimbursed from my Health Spending Account. To the best of my knowledge, my statements on this Form are true and complete. I certify all of the following: Either I, my Spouse or my Dependent has received the services described above on the dates indicated, or the expenses qualify as valid Medical Care Expenses under Code Section 213(d), as further defined in the Plan document (the “Plan”). I certify that all drugs were obtained legally in the United States. These expenses have not previously been submitted for reimbursement under the Plan. They have not been reimbursed under this Plan or any other plan, and I will not seek reimbursement for them under the major medical plan or any other health plan. These expenses are for medical care excluding cosmetic purposes, are not incurred for general health purposes, and do not constitute toiletries. I understand that the expenses reimbursed may not be used to claim any federal income tax deduction or credit. I also understand that I may be asked to provide further details about some expenses (e.g. a statement from a medical practitioner that the expense is to treat a specific medical condition or a more detailed certification from me).

Employee Signature: ____________________________________________________ |

Date: |

(Employee Signature must be provided in order to process this form) |

|

1934 Olney Avenue * Suite 200 * Cherry Hill, NJ 08003

Contact Information & Claims Submission:

FSA/HRA Claim Form Documentation

Medical Payments

All documentation should show date of service, procedure performed and should prove the claim was initially processed by your health care carrier. Acceptable documentation includes: a copy of the Explanation of Benefits (EOB) from your health care carrier and/or an itemized bill indicating services received for that person have been applied to the applicable deductible.

Dental and Vision

All documentation should show date of service, procedure performed or item(s) purchased and name of person receiving services/items.

The submission should include: copy of statement, itemized bill, or detailed receipt.

Prescription Drugs (Rx)

Provide a copy of the pharmacy receipt for the prescriptions(s). Usually, this is stapled to the bag containing your prescription(s). This will provide details, such as prescription name, price and fill date. In some Plans, the prescription benefits are subject to a calendar year deductible, before

All documentation should include the itemized register receipt from the store of purchase. If your register receipt prints abbreviated product names, please provide unabbreviated product name to quicken processing time. All medication purchases incurred after 12/31/2010 must be accompanied by a doctor’s prescription.

This plan is governed by IRS guidelines. In order to satisfy IRS requirements documentation is needed to process your claim(s). When submitting for reimbursement, please complete and provide necessary documentation. This will quicken the processing time of your claim(s). Please visit our website www.iaatpa.com for additional forms.

1934 Olney Avenue * Suite 200 * Cherry Hill, NJ 08003

Form Characteristics

| Fact Name | Details |

|---|---|

| Contact Information | Claims can be submitted via phone at 888-599-1515 or 856-470-1200. Fax submissions can be sent to 800-238-0876. |

| Email and Website | For inquiries, use flexclaims@iaatpa.com. More information can be found at www.iaatpa.com. |

| Account Types | The form accommodates two account types: Flexible Spending Account (FSA) and Health Reimbursement Account (HRA). |

| Provider Documentation | For HRA claims, the provider should be a participant in your health plan’s network. |

| Eligible Expenses | Expenses reimbursed or reimbursable by other insurance plans are not eligible for reimbursement under this claim process. |

| Receipt Requirements | Receipts or statements must show the date of service and item details. Canceled checks or credit card receipts will not be accepted. |

| Employee Signature | The employee's signature is required for processing the claim. Incomplete forms may be returned. |

| IRS Compliance | This claim form adheres to IRS guidelines, necessitating specific documentation for different types of expenses. |

| Over-the-Counter Purchases | For OTC medications, an itemized receipt is mandatory. A doctor’s prescription is required for items purchased after 12/31/2010. |

| Processing Time | To expedite processing, ensure all necessary documentation accompanies your claim form. |

Guidelines on Utilizing Iaa Fsa Hra Claim

Filling out the IAA FSA HRA Claim Form requires attention to detail to ensure all necessary information is included. This will help facilitate a smooth review and processing of your claim. Follow these steps carefully, and make sure to attach the required documentation to support your request for reimbursement.

- Select the appropriate account type: Flexible Spending Health Account (FSA) or Health Reimbursement Account (HRA).

- Provide your Employer Name.

- Enter your Last Name, First Name, and Social Security Number.

- Fill in your Address, City, State, and Zip Code.

- Indicate your Email address and Phone number.

- If you have a new address, check the corresponding box.

- Check if you USED the IAA Benefits Card.

- Ensure all services were provided before submitting any prepaid expenses.

- List out the expenses, starting with Expense #1,

- Enter the Date when the service was provided.

- Write the Name of Person Receiving Medical Service.

- Indicate the Type of Service Provided.

- Specify if the provider participates in the plan’s network.

- Attach the proof of deductible if applicable.

- Enter the Total Deductible/Co-payment Amount.

- Check the box for further expenses as needed.

- Complete any remaining expense sections as detailed above.

- Authorizing the reimbursement by providing your Employee Signature and the Date.

- Ensure all documentation showing services rendered and payment are attached.

Make sure to keep a copy of your completed form and attached receipts for your records. If any information is missing or unclear, the form may be returned, delaying your reimbursement process.

What You Should Know About This Form

What is the Iaa Fsa Hra Claim form used for?

The Iaa Fsa Hra Claim form allows individuals to request reimbursement for eligible medical expenses under their Flexible Spending Accounts (FSA) or Health Reimbursement Accounts (HRA). It provides a structured way to document expenses, ensuring that you can recoup costs for qualified medical services, prescriptions, and other eligible items.

How do I submit my claim using this form?

To submit your claim, complete the form by providing all requested information, including your personal details, the nature of the expenses, and the necessary documentation, such as receipts. Attach copies of these documents to the form, as canceled checks or credit card receipts will not be accepted. Once everything is filled out correctly, mail the form and attachments to IAA at PO Box 5082, Mt. Laurel, NJ 08054, or send them via fax to 800-238-0876.

What types of expenses can I claim with this form?

Eligible expenses primarily include out-of-pocket costs for medical, dental, and vision care. Examples are copayments for doctor visits, prescription medications, and certain over-the-counter items, provided a doctor's prescription accompanies these purchases. It's crucial to ensure that the items sought for reimbursement comply with IRS guidelines outlined in your plan documentation.

What documentation do I need to provide with my claim?

Documentation must include specific details such as the date of service, the procedure or item provided, and proof that the claim was processed by your healthcare insurance carrier. Depending on the type of expense, this documentation might take the form of an Explanation of Benefits (EOB), an itemized bill, or pharmacy receipts that detail the drugs purchased.

What happens if I submit an incomplete claim form?

The Iaa Fsa Hra Claim form needs to be fully completed to be processed. If you omit any information or fail to include the appropriate documentation, IAA will return the form to you for completion. To avoid delays, double-check that all required sections are filled out accurately and that necessary attachments are included before submission.

Can I use the same expense for reimbursement from multiple accounts?

No, you cannot submit the same expense for reimbursement from both the FSA and HRA, as this would violate the terms of your accounts. Each expense must be reimbursed only once under the respective plan. Carefully check which account holds the funds and what the specific guidelines are for each plan before submitting your claims.

How can I contact IAA if I have questions about my claim?

If you have questions, you can reach IAA's customer service team at 888-599-1515, or you can send an email to flexclaims@iaatpa.com. They are equipped to assist with inquiries about the claim process, documentation requirements, and other related concerns, ensuring you have the support needed to navigate your reimbursement requests effectively.

What should I do if my claim is denied?

If your claim is denied, you will receive a notification detailing the reason for the denial. Common reasons include missing documentation or ineligible expenses. Review the explanation provided, and if you believe the claim meets the criteria, gather any additional necessary information and resubmit your claim with the required documentation. For further guidance, don't hesitate to contact IAA directly.

Common mistakes

Submitting the IAA FSA HRA Claim form is a crucial step in ensuring that you receive reimbursement for eligible medical expenses. However, many people make common mistakes during the process. Recognizing these pitfalls can help streamline your experience and avoid unnecessary delays.

One frequent mistake is failing to attach the proper documentation. Receipts or statements of services must clearly indicate the date of service, the procedure performed, and correlate with the expenses claimed. Acceptable documentation includes Explanation of Benefits (EOB) from your health care provider or an itemized bill. Unfortunately, many submit incomplete or incorrect documentation, such as canceled checks or generic credit card receipts. These do not meet the requirements outlined in the form, leading to rejection of the claim.

Another area where mistakes arise is not providing complete information. All fields in the form, particularly the account selection, personal information, and details of the services rendered, should be filled out entirely. A blank space or an incomplete entry can result in the form being returned for corrections. Inattention to these relatively straightforward details often complicates an otherwise simple process.

People also tend to overlook the necessity of understanding their insurance coverage. Before submitting claims, it is essential to consult with your primary insurance carrier. Claims reimbursed under the deductible must first be presented to the primary insurance provider. Failing to do so can lead to significant delays in reimbursement. Understanding your insurance policy and its requirements can save you a lot of time and frustration.

Lastly, the importance of reading the eligibility criteria for expenses cannot be overstated. Some individuals misinterpret what expenses qualify for reimbursement. Medical expenses must be directly related to care rather than general health purposes, cosmetic procedures, or toiletries. Submitting a claim for ineligible expenses will result in rejection, which can be disheartening. Familiarizing yourself with the regulations around qualified claims will ensure a smoother process.

Documents used along the form

The IAA FSA HRA Claim form is an essential document for individuals seeking reimbursement for qualified medical expenses. It is typically submitted alongside various other documents to provide comprehensive evidence of incurred costs. The following is a list of forms and documents commonly used in conjunction with the claim form.

- Medical Explanation of Benefits (EOB): This document outlines services provided, detailing what the insurance company has covered and what remains the responsibility of the patient.

- Itemized Bills: Bills from healthcare providers that break down services rendered, including item descriptions, dates, and costs associated with the care received.

- Prescription Receipts: Detailed pharmacy receipts that provide information on the prescription name, price, and date filled. These are crucial for claims involving prescription medication.

- Dental Treatment Statements: Documentation from dental providers showing the type of services performed, dates, and the patient’s name. This supports claims for dental expenses.

- Vision Care Receipts: Similar to dental statements but focused on vision services. These documents often include costs for exams, glasses, or contact lenses.

- Over-the-Counter (OTC) Receipts: Store receipts for OTC items that include an itemized list of products purchased. A doctor’s prescription may also be required for certain items.

- Dependent Care Claims: Forms or invoices that detail expenses related to dependent care services. These can be submitted alongside the claim to verify additional qualifying costs.

- Deductible Statements: Documents that confirm amounts of deductibles already met or paid, which may be needed to justify claims for other services.

- Provider Network Confirmation: Evidence that a provider is part of the patient’s health plan network. This can help validate the use of in-network services for reimbursement.

Having these documents ready can significantly ease the claims process and ensure that all eligible expenses are accounted for. Being thorough and accurate in providing supporting documentation can expedite reimbursement and reduce the likelihood of issues arising during the review process.

Similar forms

Understanding documentation related to healthcare expenses can sometimes be overwhelming. The IAA FSA HRA Claim form is a vital tool, but it's not alone. Here are ten other documents that share similarities with this form, serving specific purposes in health claims and reimbursements.

- Explanation of Benefits (EOB): This document outlines what services were covered under an insurance plan. Similar to the claim form, it requires details like date of service and type of treatment received, ensuring that claims are properly verified by the insurer.

- Itemized Medical Bills: These bills, which list each service provided and its cost, are comparable to the claim form. They must be submitted along with the claim to clarify what expenses are being reimbursed.

- Prescription Receipts: When requesting reimbursement for medications, prescription receipts specify what was purchased. Just like the claim form, they require exact dates and the names of medications.

- Dental Claim Forms: Used specifically for dental expenses, these forms parallel the FSA HRA Claim form in that they document treatments and require similar validating information for reimbursement.

- Vision Claim Forms: Similar to dental forms, vision claim forms detail eye care expenses. They must include service dates and costs, resembling the structure of the FSA HRA Claim form.

- Over-the-Counter Claim Forms: These forms document purchases of over-the-counter health products. Like the FSA HRA Claim form, they require proof of purchase and specific details about the items bought.

- Health Savings Account (HSA) Claim Forms: HSA forms facilitate the reimbursement process for medical expenses. They share a similar purpose with the FSA HRA Claim form but are specific to health savings accounts.

- Dependent Care Expense Claims: These documents detail costs related to dependent care, often required for tax deduction purposes. They reflect a similar structure to the FSA HRA Claim form in documenting expenses and required attestation.

- Flex Spending Account (FSA) Claim Forms: Like the FSA HRA Claim form, FSA forms need basic information about expenses, including services provided and reimbursement requests, for funds set aside in a flexible spending account.

- Form 1040 Schedule A (Itemized Deductions): While this is a tax form, it requests detailed expenses, including medical costs. It parallels the claim form in that it necessitates accurate documentation of expenses to claim deductions effectively.

By familiarizing yourself with these documents, navigating the complex world of healthcare reimbursements may become less daunting. Each document plays a unique role in ensuring that your medical expenses are properly accounted for and reimbursed.

Dos and Don'ts

When filling out the IAA FSA HRA Claim form, there are several essential dos and don'ts to keep in mind. Following these guidelines can make the process smoother and ensure that your claim is processed without unnecessary delays.

- Do fill in all requested information completely. An incomplete form will be returned, slowing down your reimbursement.

- Do attach copies of receipts or statements of services provided. Remember, canceled checks or credit card receipts are not accepted.

- Do indicate whether your health service provider is part of your plan's network. This is important for HRA claims.

- Do ensure that the claims you submit have not been reimbursed under any other plan.

- Don't submit claims for services that have not yet been provided. Reimbursements should only be for completed services.

- Don't forget to sign and date the claim form. Your signature is required for the processing of the claim.

By adhering to these simple yet critical steps, you can help expedite your claims process and avoid common pitfalls. For further guidance, do not hesitate to reach out using the contact information provided in the claim form.

Misconceptions

There are several misconceptions surrounding the IAA FSA HRA Claim Form. Understanding the facts can help ensure a smoother claims process. Here are ten common misconceptions and the truths behind them:

-

Misconception 1: Claims can be submitted before services are provided.

Many believe they can submit a claim for reimbursement in advance of receiving medical services. In reality, no claims should be submitted until the service has been rendered.

-

Misconception 2: All medical receipts are eligible for reimbursement.

Not every receipt is eligible. Expenses fully covered by insurance, or those that include items meant for general health or cosmetic purposes, are not eligible for reimbursement.

-

Misconception 3: Canceled checks can be used as proof of payment.

This is incorrect. Canceled checks and credit card slips are not accepted as documentation. Only itemized receipts and statements are valid.

-

Misconception 4: Submitting the claim form is enough for reimbursement.

Simply submitting the claim form is insufficient. It requires complete information and must have all necessary receipts attached to avoid delays.

-

Misconception 5: You can claim expenses that have been reimbursed by another plan.

This is a misunderstanding. Expenses cannot be submitted for reimbursement if they have previously been claimed under any other health plan.

-

Misconception 6: Employee signatures are optional on the claim form.

An employee's signature is essential for processing the form. Without it, claims will not be reviewed.

-

Misconception 7: FSA and HRA accounts function the same way.

While both are used for healthcare expenses, their rules and eligibility criteria often differ. Understanding each account's specific guidelines is important.

-

Misconception 8: Over-the-counter (OTC) items qualify for reimbursement without restrictions.

This is misleading. OTC purchases now require a doctor's prescription to be eligible for reimbursement under recent IRS guidelines.

-

Misconception 9: It’s okay to submit unverified charges.

All expenses must be documented, showing details like the date and type of service. Invalid or unverified claims will cause delays or denials.

-

Misconception 10: The claim submission process is always quick and straightforward.

The speed of claim processing can vary widely based on how complete the submission is. Providing accurate information and required documentation helps prevent delays.

By clearing up these misconceptions, individuals can enhance their experience with the IAA FSA HRA Claim Form, making the reimbursement process more efficient.

Key takeaways

When utilizing the IAA FSA HRA Claim Form, consider these key points:

- Fill Out Completely: Ensure all fields on the form are completed. Incomplete forms will be returned, delaying your reimbursement process.

- Attach Proper Documentation: Always include copies of receipts or statements showing services received. Acceptable documents vary based on the type of service.

- Understand Eligibility: Be aware that expenses reimbursed by any other medical or dental insurance are not eligible for reimbursement through the FSA or HRA accounts.

- Use the Right Account: Clearly indicate whether you are claiming through a Flexible Spending Account (FSA) or a Health Reimbursement Account (HRA) on the form.

- Keep Copies for Your Records: Always keep a personal copy of the submitted claim forms and documentation in case you need to reference them later.

Contact information is available for any questions or clarifications needed while completing the claim form:

Phone: 888-599-1515 or 856-470-1200

Fax: 800-238-0876

Email: flexclaims@iaatpa.com

Mail: IAA - PO Box 5082 Mt. Laurel, NJ 08054

Website: www.iaatpa.com

Browse Other Templates

Unemployment for Cut Hours - The DE 2063 requires employers to certify the accuracy of earnings reported for the indicated week.

Ca $800 Llc Fee Due Date - The 3557 LLC form is for Limited Liability Companies in California.

Ppvt-5 Score Interpretation - It is suitable for preschool children and individuals with language impairments.