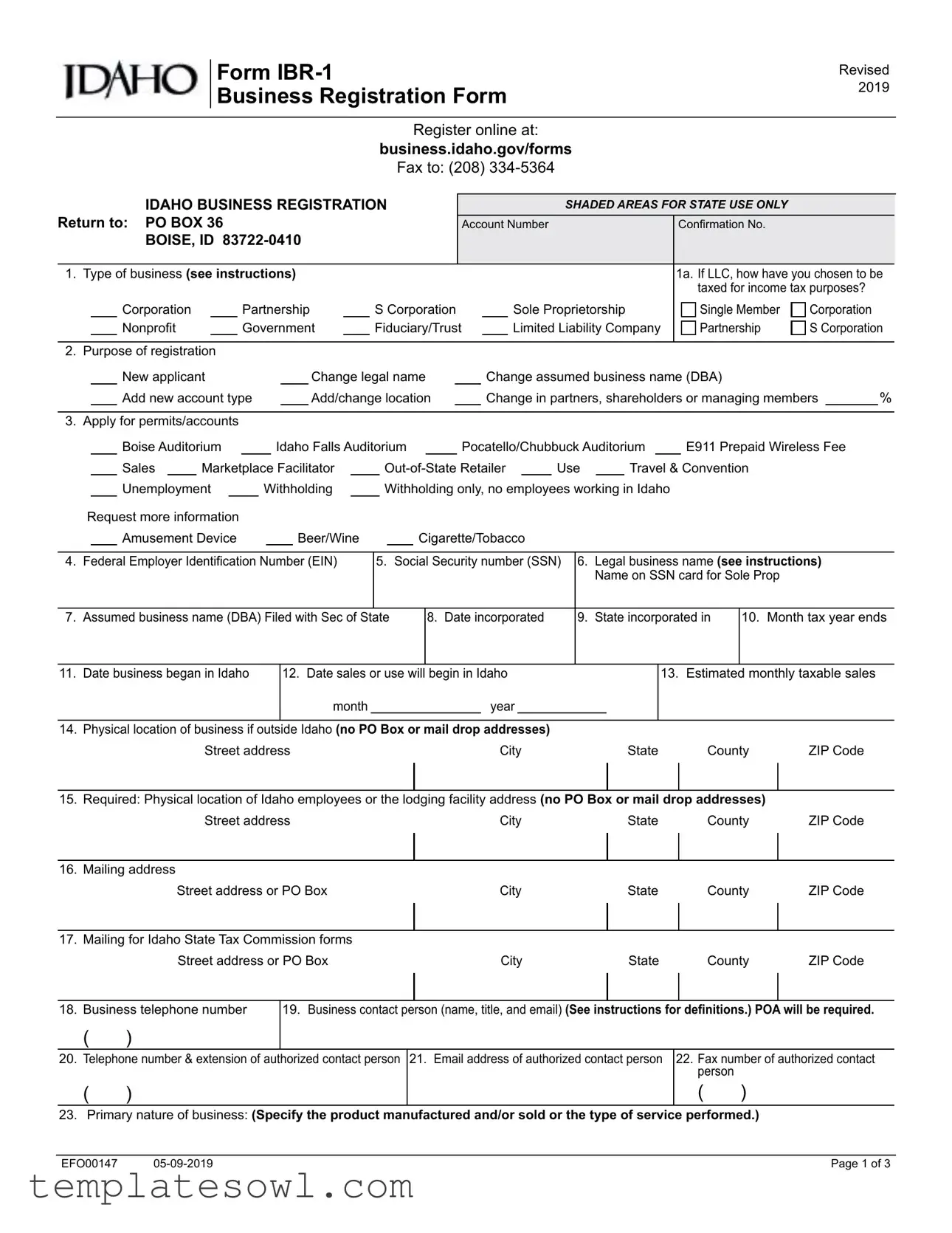

Fill Out Your Idaho Business Registration Form

When starting a business in Idaho, completing the Idaho Business Registration form is a critical step. This form, officially known as Form IBR-1, covers various essential aspects of your business, including its legal structure, location, and purpose. Whether you are registering a new business or making changes to an existing one, you will need to provide information such as the type of business entity—be it a corporation, limited liability company (LLC), partnership, or sole proprietorship. Additionally, you’ll indicate how your LLC has chosen to be taxed. The form requests details about your business activities, estimated sales, and any necessary permits or accounts you may need, ranging from sales tax to unemployment insurance. Importantly, you will also need to include your Federal Employer Identification Number (EIN) or Social Security Number (SSN), depending on your business type. Furthermore, you should provide accurate contact information for the business, including the physical location of your operations, and details about key individuals involved in the business. Completing the form accurately will ensure that your registration process goes smoothly and complies with state regulations.

Idaho Business Registration Example

Form

Business Registration Form

Revised 2019

Register online at:

business.idaho.gov/forms

Fax to: (208)

|

|

|

IDAHO BUSINESS REGISTRATION |

|

|

|

|

|

|

|

|

|

|

SHADED AREAS FOR STATE USE ONLY |

|

|

|

|

|||||||||||||||||||||||||

Return to: PO BOX 36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Number |

|

|

|

|

|

|

Confirmation No. |

|

|

|

|

|||||||||||||||

|

|

|

BOISE, ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

1. |

Type of business (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1a. If LLC, how have you chosen to be |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

taxed for income tax purposes? |

|

|

|||

|

|

|

Corporation |

|

|

|

|

Partnership |

|

|

S Corporation |

|

|

Sole Proprietorship |

|

Single Member |

Corporation |

|

|

||||||||||||||||||||||||

|

|

|

Nonprofit |

|

|

|

|

Government |

|

|

Fiduciary/Trust |

|

|

Limited Liability Company |

|

Partnership |

S Corporation |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2. |

Purpose of registration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

New applicant |

|

|

|

|

|

Change legal name |

|

|

Change assumed business name (DBA) |

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

Add new account type |

|

|

|

|

|

Add/change location |

|

|

Change in partners, shareholders or managing members |

|

% |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

3. |

Apply for permits/accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Boise Auditorium |

|

|

|

Idaho Falls Auditorium |

|

|

Pocatello/Chubbuck Auditorium |

|

E911 Prepaid Wireless Fee |

|

|

|||||||||||||||||||||||||||||

|

|

|

Sales |

|

Marketplace Facilitator |

|

|

|

|

Use |

|

Travel & Convention |

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

Unemployment |

|

Withholding |

|

|

|

Withholding only, no employees working in Idaho |

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Request more information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Amusement Device |

|

|

|

|

Beer/Wine |

|

|

|

|

|

Cigarette/Tobacco |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

4. |

Federal Employer Identification Number (EIN) |

|

5. |

Social Security number (SSN) |

|

6. |

Legal business name (see instructions) |

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name on SSN card for Sole Prop |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

7. |

Assumed business name (DBA) Filed with Sec of State |

|

|

8. Date incorporated |

|

|

9. |

State incorporated in |

10. Month tax year ends |

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

11. |

Date business began in Idaho |

|

|

|

12. Date sales or use will |

begin in Idaho |

|

|

|

13. |

Estimated |

monthly taxable sales |

|

|

|||||||||||||||||||||||||||||

monthyear

14.Physical location of business if outside Idaho (no PO Box or mail drop addresses)

Street address |

City |

State |

County |

ZIP Code |

15.Required: Physical location of Idaho employees or the lodging facility address (no PO Box or mail drop addresses)

Street address |

City |

State |

County |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

16. Mailing address |

|

|

|

|

Street address or PO Box |

City |

State |

County |

ZIP Code |

17.Mailing for Idaho State Tax Commission forms

Street address or PO Box |

City |

State |

County |

ZIP Code |

18.Business telephone number 19. Business contact person (name, title, and email) (See instructions for definitions.) POA will be required.

( |

) |

|

|

20. Telephone number & extension of authorized contact person 21. Email address of authorized contact person |

22. Fax number of authorized contact |

||

|

|

person |

|

( |

) |

( |

) |

23.Primary nature of business: (Specify the product manufactured and/or sold or the type of service performed.)

EFO00147 |

Page 1 of 3 |

Form |

Revised 2019 |

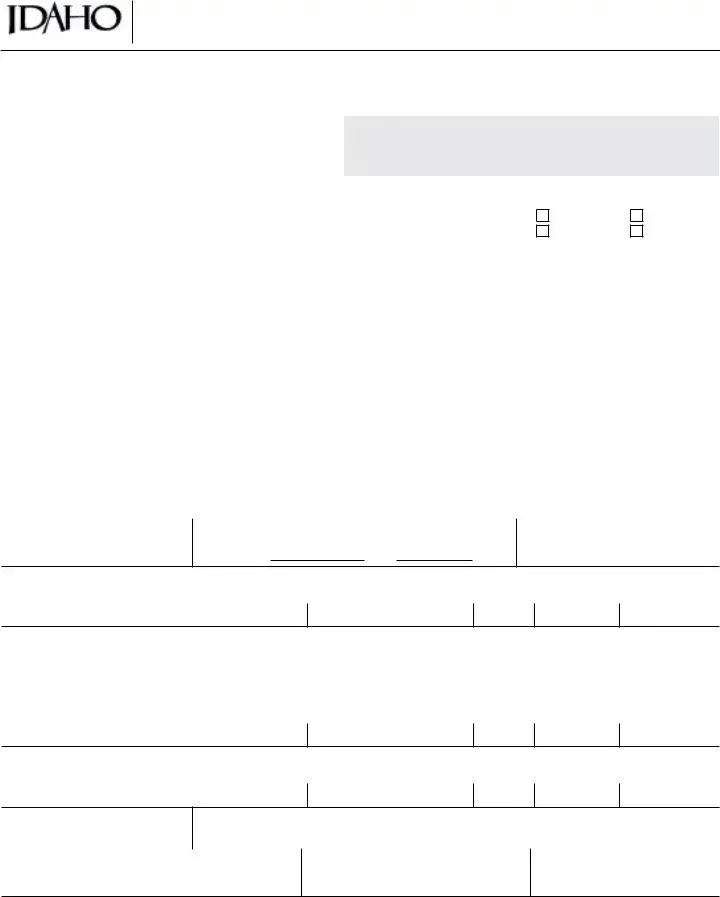

24.Have you ever had a withholding, sales, use, workers’ compensation or unemployment insurance number in Idaho? If yes, list all permit, account or policy numbers. (It is your responsibility to cancel any existing accounts you no longer need. Failure to provide previous account/policy numbers could result in delays and/or duplicate accounts.)

25. |

Are you a Professional Employer Organization (PEO)? |

Yes |

No |

||||

|

If Yes, Name |

|

|

|

|||

26. |

If Yes, are you a Certified PEO? |

Yes |

No |

||||

27. |

Are you an employer joining a Professional Employer Organization? |

Yes |

No |

||||

|

Name of PEO |

|

|

|

|||

28. |

Are you an employer leaving a Professional Employer Organization? |

Yes |

No |

||||

|

Name of PEO |

|

|

|

|||

|

|

|

|

||||

29. |

Are you a Common Paymaster? |

Yes |

No |

||||

|

If Yes, Name |

|

|

|

|||

30. |

Are you an employer joining a Common Paymaster? |

Yes |

No |

||||

|

Name of Common Paymaster |

|

|

|

|||

31. |

Are you an employer leaving a Common Paymaster? |

Yes |

No |

||||

|

Name of Common Paymaster |

|

|

|

|||

|

|

|

|

||||

32. |

Are you a IRS 3504 Pay Agent? |

Yes |

No |

||||

|

If Yes, Name |

|

|

|

|||

33. |

Are you an employer joining a IRS 3504 Pay Agent? |

Yes |

No |

||||

|

Name of Common IRS 3504 Pay Agent |

|

|

|

|||

34. |

Are you an employer leaving a IRS 3504 Pay Agent? |

Yes |

No |

||||

|

Name of Common IRS 3504 Pay Agent |

|

|

|

|||

35.List (a) owner and spouse of sole proprietorship, (b) all partners of partnership, (c) all corporate officers of corporation, (d) trustee or responsible party of fiduciary or trust, or (e) all members of limited liability companies. Social Security number required for every individual listed. (Use additional sheet if necessary.)

Name |

Address of Residence |

SSN/EIN, Phone Number and Email |

Corp Title |

% |

Director? Compensated? |

||

Owned |

Yes/No |

Yes/No |

|||||

|

|

|

|

||||

|

|

|

|

|

|

select |

select |

|

|

|

|

|

|

NoYes |

NoYes |

|

|

Officer |

|

Shareholder |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

select |

select |

|

|

|

|

|

|

NoYes |

NoYes |

|

|

Officer |

|

Shareholder |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

select |

select |

|

|

|

|

|

|

NoYes |

NoYes |

|

|

Officer |

|

Shareholder |

|

||

CERTIFICATION: I certify that I am authorized as an owner, partner, corporate officer, member or representative to sign this document and that the statements made are correct and true to the best of my knowledge. (This form must also be signed by the spouse of a sole proprietor.)

Print name |

|

Signature |

|

Date |

Print name |

|

Signature |

|

Date |

EFO00147 |

Page 2 of 3 |

|

Form |

Revised 2019 |

|

|

|

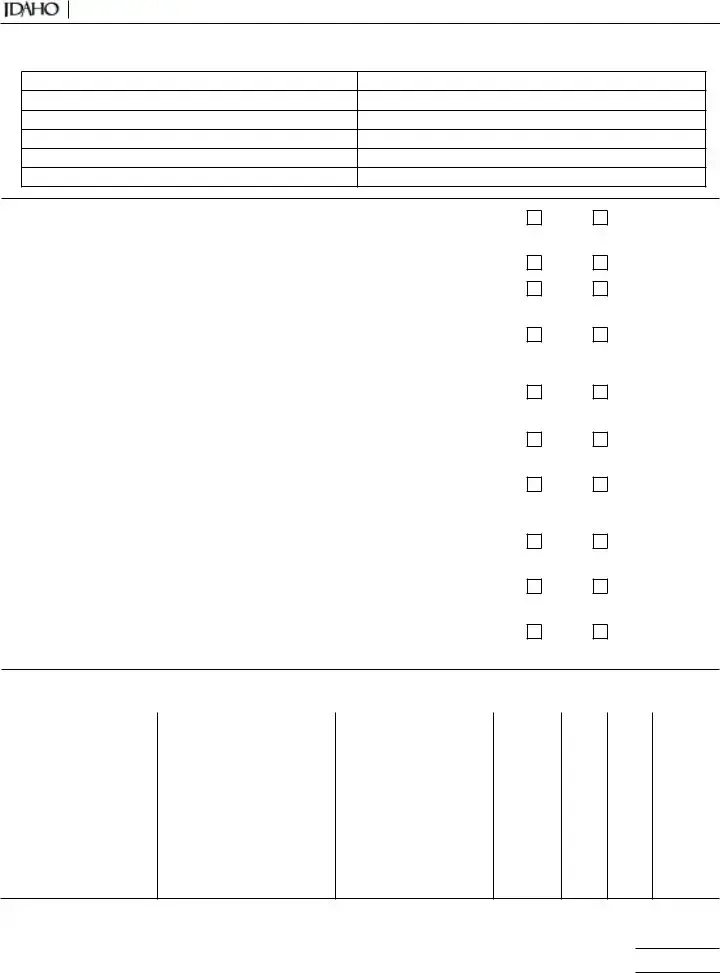

36. Date employees first hired to work in Idaho 37. Date of employees’ first paycheck in Idaho |

38. Expected number of Idaho employees |

|

|

|

(Include corporate officers working in Idaho) |

39.Enter the amount of wages you have paid or estimate to pay in Idaho. If you haven’t paid or don’t plan to pay wages during one of the periods listed, enter “NONE.”

Jan. 1 to March 31 |

April 1 to June 30 |

July 1 to Sept. 30 |

Oct. 1 to Dec. 31 |

Current

Year

Preceding

Year

40. If you estimated wages in #39, enter the date you plan to begin paying wages.

41. |

Will corporate officers receive compensation, salary or distribution of profits? |

Yes |

|

No |

|

|

|

|

|

||||

|

|

|

|

|||

42. |

Is this an organization exempt from income tax under Internal Revenue Service Code 501(c)(3)? |

Yes |

No |

|||

43. Is workers’ compensation insurance needed? (see instructions) |

Yes |

CAUTION: This is not an application for workers’ compensation insurance

No, explain why:

44.Do you have a workers’ compensation insurance policy?

45.Have you notified your insurance company that you have or expect to have Idaho payroll?

46.Insurance agent’s name and telephone number

|

Yes |

No |

In process |

|

|

Yes |

No |

|

( |

) |

||

47. |

Insurance company name |

48. Policy |

number |

49. Effective date |

50. If applying for insurance with the Idaho State Insurance Fund, |

|||||||

|

|

|

|

|

|

|

|

|

list application number: |

|

||

|

|

|

|

|

|

|

|

|

||||

51. |

Do you plan to perform work in other states using your existing Idaho employees? |

Yes |

No |

|

||||||||

|

If Yes, will you withhold Idaho Income Tax? select |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NoYes |

|

|

|

|

|

|

|

ACQUIRING AN EXISTING BUSINESS OR CHANGING TYPE OF LEGAL BUSINESS ENTITY |

|

|

||||||||||

If you buy an existing business, or change your business entity, Idaho law requires you to withhold enough of the purchase money to pay any sales tax and, in most cases, unemployment insurance due or unpaid by the previous owner/entity until the previous owner/entity produces a receipt from the Idaho Department of Labor and the Idaho State Tax Commission showing the taxes have been paid. If you fail to withhold the required purchase money and the taxes remain due and unpaid after the business is sold or converted to another entity type, you may be liable for the payment of the taxes collected or unpaid by the former owner/entity. When there is a change in the legal entity, you must notify your workers’ compensation insurance company.

|

52. Did you acquire all or part of an existing business? |

|

53. Did you change your legal business entity? |

||||

|

All |

Part |

None |

|

Yes |

No |

|

|

|

|

|

||||

|

54. Previous owner’s name |

55. |

Business name at time of purchase |

||||

|

|

|

|

|

|||

|

56. Date acquired/changed |

57. Account/permit numbers of the business |

acquired/changed |

58. Was there a change in owners, members, or partners? |

|||

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

If Yes, are any of the former owners, members, or |

|

|

|

|

|

|

|

partners still operating/managing the business for the |

|

|

|

|

|

|

|

new owner(s)? |

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

If No, is the owner of the new business ALSO a former |

|

|

|

|

|

|

|

employee of the old business who had authority to |

|

|

|

|

|

|

|

make financial or hiring/firing decisions? |

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

PUBLICATION CONSENT

59.Yes, I agree to publish my business by category both in print and on the Internet in the Business Director of Idaho at Iml.idaho.gov and any publication produced by the Idaho Department of Labor. This will increase visibility of my business to a larger pool of job applicants, will allow my business to be included when the Department of Labor responds to questions about the availability of products and services in the community, and expand the opportunity for additional sales. I acknowledge the Idaho Department of Labor’s files will be accessed to obtain my company name, address, phone number, NAICS (industry) code and range of employment.

Signature

EFO00147 |

Page 3 of 3 |

Form

Revised 2019

For faster service, you can register online at: business.idaho.gov

For more help, contact:

Idaho Department of Labor – (208)

All information must be provided or your registration can’t be processed.

Instructions are provided only for items that may need clarification.

1.Mark the type of legal business entity. If you have questions about types of legal business entities, contact the Idaho Secretary of State, (208)

1a. Mark the correct box to indicate how the Limited Liability Company has chosen to be taxed for income tax purposes.

2.Mark the item(s) that best describes your purpose in filing this form:

New applicant. If the business is not currently registered with the Idaho State Tax Commission, the Idaho Industrial Commission, or the Idaho Department of Labor.

Change legal name. If the business is changing its legal name, include a copy of proof, i.e. amended articles of incorporation or federal documentation.

Change assumed business name. If the business is changing its assumed business name (DBA).

Add new account type. If you already have one of the permits listed on the application and now need another permit. (Example: You have a sales permit and now need a withholding and/or unemployment account.)

Add/change location. If the business has changed its physical business location or added other locations.

Change in partners, shareholders, or managing members. List the percentage of change if

the business has new or additional partners, shareholders, or managing members. Be sure to list all of the partners, shareholders, or managing members in box 24.

Regardless of your purpose in filing this form, the following boxes must be completed: 1, 2, 3, 4 or 5, 6, 10, 11, 14, 15, 17, 18, 19, 22, and 24.

3.Mark the type of permits or accounts you would like to apply for:

•Employees. Mark Unemployment and Wthholding.

•Retail sales. Mark Sales.

•Indicate if you are a Marketplace Facilitator or

•Renting rooms for 30 days or less. Mark Sales and Travel and Convention.

•Renting rooms in an Auditorium District for 30 days or less. Mark the appropriate auditorium district these rooms are located in.

•Using, consuming, or storing items in Idaho on which you have not paid sales tax. Mark Use.

•Withholding only. Mark the box if you have no employees physically working in Idaho, but you wish to withhold Idaho income tax as a convenience to an employee whose income is taxable in Idaho, even though it is earned in another state. Complete all applicable questions through line 34.

•Selling prepaid wireless service. Mark E911 Prepaid Wireless Fee.

Mark the type of permits or accounts you would like additional information for:

•Operating currency or

•Producing or wholesaling beer. Producing, distributing, or direct shipping wine. Mark Beer/Wine.

•Wholesaling, distributing, subjobbing, or delivery selling of cigarettes or tobacco. Mark Cigarette/Tobacco.

You can find a permit application for amusement devices, beer, wine, cigarette, and tobacco at tax.idaho.gov, or contact the Tax Commission.

EIN00059 |

Page 1 of 3 |

|

Form |

Revised 2019 |

|

|

|

4.List your federal Employer Identification Number

(EIN) if one has been issued to you by the Internal Revenue Service. If you have employees, or the business is other than a sole proprietorship, you must have a federal EIN. If you have applied

for your EIN, but have not received it yet, enter “applied for.” If you are not required to have an EIN, leave this box blank.

5.Enter your Social Security number if the type of business entity is a sole proprietorship.

6.List the legal name of the business. If the business is owned by a sole proprietor, list the name shown on the owner’s Social Security card.

If the business is owned by a corporation, limited liability company or partnership, list the legal name as registered with the Secretary of State.

7.List the assumed business name (DBA), if different than the legal business name. (Example: Legal name Karan Jones - DBA Karan’s Flowers.) This name must also be registered with the Secretary of State, (208)

8.If your business is a corporation, enter the date incorporated.

9.If your business is a corporation, enter the state in which it was incorporated.

10.If the business files income tax returns on a calendar year basis, enter December. If the business files income tax returns on a fiscal year basis, enter the month the business’ fiscal year ends.

11.Enter the date this business began operating in Idaho.

13.Estimate the highest amount of taxable sales the business will have in any month.

14.List the business’ physical location in Idaho. If you have more than one location, include a separate page listing the additional locations.

(Don’t use a PO Box or mail drop address.)

15.List the physical location where employees will perform work or the lodging facility where the accommodations are located.

17.If you wish to have the Idaho State Tax Commission report forms mailed to an address different than the one listed on line 15 (such as your accountant’s address), list that address.

23.Describe in detail the products and/or services your business in Idaho will provide. (Example: Retail sales: clothing, food. Agricultural crops: corn, beets. General Contractor: building single- family homes.)

24.If this business entity or its owner, partners or members has ever had a withholding, sales, use, workers’ compensation or unemployment insurance number in Idaho, list all permits, accounts, or policy numbers.

35.List the appropriate information:

If you marked government on number 1, line 24 is optional.

(a)If you marked Sole Proprietorship on number 1, list the requested information for the owner and spouse.

(b)If you marked Partnership on number 1, list the requested information for each partner. If the partner is an individual, list the Social Security number. If the partner is another business entity, list the EIN. If there are more than three partners, include an additional page listing them.

(c)If you marked S Corporation, Corporation, or Nonprofit on line 1, list the requested information for each officer. Indicate if the officer is on the board of directors by writing

“yes,” “no,” or “not applicable” (NA). If there are more than three officers, include an additional page listing them.

(d)If you marked Fiduciary/Trust, list the trustees or responsible parties. If there are more than three trustees or responsible parties, include an additional page listing them.

(e)If you marked Limited Liability Company on number 1, list the requested information for all members. If there are more than three members, include an additional page listing them.

41.The Internal Revenue Service grants or denies 501(c)(3) status. The granting of this status doesn’t exempt a business from unemployment insurance tax, sales tax, withholding or workers’ compensation insurance.

42.The Idaho Department of Labor offers businesses granted 501(c)(3) status three methods for paying state unemployment insurance tax liabilities.

EIN00059 |

Page 2 of 3 |

|

Form |

Revised 2019 |

|

|

|

THIS IS NOT AN APPLICATION FOR INSURANCE. YOU WILL NEED TO CONTACT YOUR INSURANCE AGENT OR COMPANY REPRESENTATIVE FOR ASSISTANCE.

If you answer no to this question, explain in detail why you believe workers’ compensation insurance is not needed for your business. (Include additional page if necessary.)

If your business is reorganizing, you must notify your workers’ compensation insurance carrier of the new type of business, including EIN numbers, if applicable.

If additional assistance is needed, contact the Idaho Industrial Commission Compliance Division, (208)

If you are in the process of obtaining a workers’ compensation insurance policy, complete boxes 46 and 47.

50.If you have applied for insurance with the State

Insurance Fund, list the application identification number.

59.Data is maintained by the Idaho Department of Labor. Data can consist of name, address, phone number, and NAICS (industry) code. Employment figures are published in predetermined size ranges. Exact employment figures are not published.

EIN00059 |

Page 3 of 3 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Name | The official title of the document is the Idaho Business Registration Form, designated as Form IBR-1. |

| Revision Date | This form was last revised in 2019, indicating the most recent updates to the requirements. |

| Online Registration | Individuals can register their business online through the Idaho Department of Labor's website at business.idaho.gov/forms. |

| Fax Submission | If preferred, the form can be submitted via fax to the number (208) 334-5364. |

| Types of Businesses | The form requires applicants to specify the type of business, including options such as LLC, corporation, partnership, and nonprofit. |

| Purpose of Registration | Applicants must indicate whether they are applying as a new entity, changing a legal name, adding account types, or making other adjustments. |

| Tax Identification Numbers | Businesses must provide a Federal Employer Identification Number (EIN) or Social Security Number, depending on the business structure. |

| Physical Location Requirements | The form mandates the submission of a physical address for the business, excluding P.O. Boxes or mail drops. |

| State Law Reference | The Idaho Business Registration process is governed under Idaho state law, requiring compliance with regulations set forth by the Idaho State Tax Commission. |

| Certification Requirement | Certifications are mandatory on the form, confirming that the registrant is authorized to file and that all information is accurate. |

Guidelines on Utilizing Idaho Business Registration

Filling out the Idaho Business Registration form involves gathering specific information about your business and entering it accurately on the form. Be prepared to provide personal details, business structure, and tax information. Once you complete the form, you can submit it online or by mail for processing.

- Visit the Idaho Business Registration form site at business.idaho.gov/forms.

- Select the type of business entity from the options provided (Corporation, LLC, Partnership, etc.).

- If you're registering an LLC, indicate your chosen tax classification in the designated area.

- Choose your purpose for registering (new application, name change, etc.).

- Apply for the necessary permits or accounts (e.g., Sales, Unemployment, etc.).

- Enter your Federal Employer Identification Number (EIN) or your Social Security Number (if you're a sole proprietor).

- Provide the legal name of your business as registered.

- If applicable, include your assumed business name (DBA) that has been filed with the Secretary of State.

- Fill in the date of incorporation and the state where incorporated, if applicable.

- Specify the month your tax year ends and the date your business began in Idaho.

- List the physical location of your business and the address for Idaho employees.

- Provide your mailing address and separate mailing address for the Idaho State Tax Commission forms.

- Enter your business telephone number and contact person’s details (name, email, etc.).

- Describe the primary nature of your business, including products or services offered.

- If you have previously registered accounts under a different name or number in Idaho, list those account numbers.

- Complete sections related to employees, wages, and any necessary workers’ compensation insurance.

- Review all entries for accuracy and completeness.

- Sign and date the certification section confirming that the information provided is true.

- Submit your completed form online or by fax to the Idaho State Tax Commission.

Make sure to retain a copy of the submitted form for your records. This will be essential for future reference regarding your business registration in Idaho.

What You Should Know About This Form

What is the Idaho Business Registration form, and who needs to fill it out?

The Idaho Business Registration form, also known as Form IBR-1, is designed for new businesses looking to register in the state of Idaho. It's specifically tailored for sole proprietorships, partnerships, corporations, and limited liability companies. If you plan on conducting business in Idaho—whether you are starting fresh, changing your business structure, or altering an existing business name—this form will help you officially register your business with the state.

How can I submit the Idaho Business Registration form?

You have a couple of convenient options for submitting your registration form. First, you can register online through the Idaho Secretary of State's website at business.idaho.gov/forms. If you prefer traditional methods, you can print the form, fill it out, and then fax it to (208) 334-5364. Alternatively, you can mail it directly to PO BOX 36, Boise, ID 83722-0410. Choose the method that works best for you!

What types of businesses can register using this form?

This form accommodates a variety of business types. Whether you're a sole proprietor, a partnership, a corporation, a limited liability company, or a nonprofit organization, you can use the Idaho Business Registration form. Each type of entity has specific tax advantages and legal structures, so be sure to select the one that best suits your needs when filling out the form.

What if I need to change my business information after registering?

If you need to make changes, such as altering your legal name or adding a new account type, you can do so by filling out another Business Registration form. It’s essential to keep your information up to date to avoid penalties or complications with state regulations. Make sure to mark the purpose of the registration accurately to ensure that your changes are processed correctly.

Who should I contact if I have questions about filling out the form?

If you have questions or need assistance, don't hesitate to reach out to the Idaho Department of Labor. They provide services at (208) 332-3576 in the Boise area or you can call toll free at (800) 448-2977. The Idaho Secretary of State’s office is also a great resource at (208) 334-2300, especially for questions about the legal aspects of your business entity.

Is there a fee associated with filing the Business Registration form?

The Idaho Business Registration form itself does not require a filing fee. However, other permits or licenses that may be required based on your business type could come with their own fees. Make sure to review all potential costs associated with starting or modifying your business operation in Idaho.

What happens after I submit the Idaho Business Registration form?

After you submit your form, the state will process your registration. Once everything is approved, you will receive confirmation of your business registration along with any applicable account numbers for tax purposes. Keep this information safe, as you will need it for future filings and correspondence with state tax authorities.

Common mistakes

When filling out the Idaho Business Registration form, one common mistake is neglecting to include the correct legal business name as it appears on official documents. This can lead to discrepancies that may delay the processing of the application. It is essential to ensure that the name used matches the name registered with the Secretary of State.

Another frequent error involves providing incomplete or incorrect contact information for the authorized contact person. Missing or incorrect phone numbers, email addresses, or titles can prevent state authorities from reaching out with important information. Businesses should take care to verify that all listed details are accurate and up to date before submission.

Many applicants also overlook the need to mark the appropriate type of business box in Section 1, which specifies the business entity. Failing to do so may result in incorrect classifications, leading to potential issues with taxation and permits. It’s advisable to read through the instructions carefully to ensure the correct entity type is selected.

Additionally, some applicants forget to indicate their tax classification for Limited Liability Companies (LLCs) in Section 1a. This is crucial information that affects how the business will be taxed at the federal level. Without this detail, processing may be stalled or declined altogether.

Another common mistake is failing to list all required permits or accounts being applied for in Section 3. Individuals should carefully review this section and mark all that apply to their business. Omitting necessary permits can lead to fines or legal complications down the line.

Lastly, many individuals neglect to sign the form, which officially certifies the information provided. Both the applicant and, in the case of sole proprietorships, their spouse, must sign the document. Without these signatures, the registration process cannot proceed.

Documents used along the form

When registering a business in Idaho, the completion of the Idaho Business Registration form (Form IBR-1) is often accompanied by additional documents. These documents serve various purposes related to legal compliance, operational structure, and tax obligations. Below is a list of commonly associated forms and documents that businesses may need to submit or retain.

- Articles of Incorporation: This document is filed to officially create a corporation in Idaho. It includes essential details such as the business name, purpose, and registered agent. Approval by the Idaho Secretary of State is necessary for the corporation to exist legally.

- Operating Agreement: For Limited Liability Companies (LLCs), this document outlines the management structure and operating procedures. It specifies the rights and responsibilities of members, helping to prevent disputes down the line.

- Employer Identification Number (EIN) Application (Form SS-4): This form is required to obtain a federal EIN, which is essential for tax purposes. The EIN serves as a business's identification number with the Internal Revenue Service (IRS) and is necessary for businesses that have employees or operate as a corporation or partnership.

- Sales Tax Permit Application: Those businesses engaged in selling tangible goods or services in Idaho must apply for a sales tax permit. This permit allows the business to collect sales tax from customers and remit it to the state, ensuring compliance with Idaho tax laws.

- Licenses and Permits: Depending on the nature of the business, various local, state, or federal licenses and permits may be required. This could include health permits for restaurants, professional licenses for service providers, or environmental permits for specific industries.

- Bylaws: Similar to an operating agreement, bylaws are applicable for corporations. They outline the governance of the corporation, including rules for the board of directors, shareholder meetings, and voting procedures. Bylaws help ensure that corporate operations align with statutory obligations and internal policies.

Businesses must ensure that the correct forms and documents accompany the Idaho Business Registration form. Retaining proper documentation not only facilitates effective operation but also helps maintain compliance. Engaging with the appropriate state agencies and legal professionals for guidance may be prudent as business needs evolve.

Similar forms

The Idaho Business Registration Form shares characteristics with several other key documents involved in business operations. Each document serves a unique purpose within the framework of business compliance and registration. Here’s how they compare:

- IRS Form SS-4: Just like the Idaho Business Registration form, IRS Form SS-4 regulates the application for an Employer Identification Number (EIN). Both forms collect necessary identifying information about a business before it can fully operate.

- State Business License Application: Similarly, many states require a business license application, which registers a business with the state and grants the legal right to operate. This process may involve providing details on ownership and business activities just like the Idaho form.

- Sales Tax Permit Application: A sales tax permit application instructs businesses on collecting sales tax from customers. The Idaho form also collects information relevant for determining sales tax obligations, reflecting its role in the broader context of tax compliance.

- Operating Agreement for LLCs: When establishing an LLC, an operating agreement outlines the management structure and operational provisions. This resembles the Idaho form that gathers information about how the LLC will be structured and taxed.

- Certificate of Good Standing: This document certifies that a business is legally registered and compliant with state regulations. It similarly validates the standing of a business as compliant, an aspect also addressed by the Idaho form during the registration process.

- DBA Registration Form: When businesses want to operate under a name different from their legal name, they must file a DBA (Doing Business As) registration. The Idaho form also provides a section to register an assumed business name, illustrating this commonality.

- Employer Contributions Report: This document reports a company’s payroll data and tax contributions for employment. Both forms require details about employees and payroll, offering a snapshot of the business’s tax responsibilities.

- Commercial Lease Agreement: A lease agreement outlines the terms for renting business premises, which necessitates clear identification of the business entity. This can be compared with the physical location requirements on the Idaho form, which ensure that business addresses are specified and verified.

- Annual Report: Many states require annual reports that provide updates on a business's status, ownership, and operations. This mirrors the Idaho form's ongoing demand for current information, ensuring that the state maintains a reliable business registry.

Understanding the similarities between these documents can aid business owners in navigating the regulatory landscape and ensure all necessary filings are completed accurately and in a timely manner.

Dos and Don'ts

When completing the Idaho Business Registration form, follow these guidelines:

- Ensure you accurately mark the type of business entity you are registering.

- List your Federal Employer Identification Number (EIN) if applicable, or indicate if you are in the process of obtaining one.

- Provide the legal business name exactly as registered with the Secretary of State.

- Include necessary details for all partners, shareholders, and members in the appropriate sections.

- Specify the physical address of your Idaho business location; do not use a PO Box.

- Clearly indicate the purpose of the registration and the permits/accounts you are applying for.

- Check all completed sections carefully for accuracy before submission.

Here are some common pitfalls to avoid:

- Do not leave any required fields blank; incomplete forms will be rejected.

- Avoid using a PO Box as your business location address.

- Never provide outdated or incorrect Federal Employer Identification Numbers.

- Don’t forget to include your Social Security number if registering as a sole proprietorship.

- Avoid vague descriptions of your business activities; be specific in what your business does.

- Do not forget to sign and date the form; an unsigned form may delay processing.

- Refrain from estimating taxable sales or employee numbers that are not realistic.

Misconceptions

- Online Registration is Optional: Many believe that submitting the Idaho Business Registration form online is just another option, but it is recommended for faster processing. While paper submissions are accepted, online registrations streamline the process significantly.

- All Business Types Require an EIN: A common misconception is that every business entity must have an Employer Identification Number (EIN). However, sole proprietors without employees can operate without an EIN. They can use their Social Security number instead.

- A Change in Business Name Always Requires a New Registration: Some think that changing a business name means they have to completely re-register their business. In reality, you can simply update your assumed business name (DBA) on the existing registration form without starting from scratch.

- Tax Registration is Unrelated to Business Registration: It's often assumed that business registration with the state has nothing to do with taxes. However, business registration is linked to the ability to apply for various tax permits and accounts, such as sales tax or unemployment insurance in Idaho.

- All Owners Must Be Listed on the Form: Many believe that every owner of a business entity must be listed on the form. While transparency is important, if a business is a government entity, only the necessary details may apply, and some information can be optional.

Key takeaways

1. Be sure to identify your business type correctly at the beginning of the form. This is crucial, as the type of business entity will affect your tax obligations and other legal requirements.

2. Double-check that you provide a valid Federal Employer Identification Number (EIN) or Social Security Number if applicable. Leaving this blank can delay your registration process.

3. Clearly state the purpose of your registration. Whether you are a new applicant, changing your business name, or adding a new account type, detailing this accurately will help avoid confusion.

4. Make sure to list all required locations. For businesses operating in Idaho, include a physical address where employees will work and avoid using PO Box addresses.

5. Keep accurate records of any previous accounts or permits. If you had accounts with the Idaho State Tax Commission, include all relevant numbers to prevent duplicate accounts or processing delays.

6. Don’t forget to sign your form. Not only should you sign as the authorized individual, but, for sole proprietorships, the spouse must also sign. This adds an official acknowledgment of the information provided.

Browse Other Templates

Employees Earning Record - The form facilitates accurate calculation of net pay after accounting for all deductions and taxes.

Power of Attorney Form Nj Dmv - It includes sections for personal and organizational information.