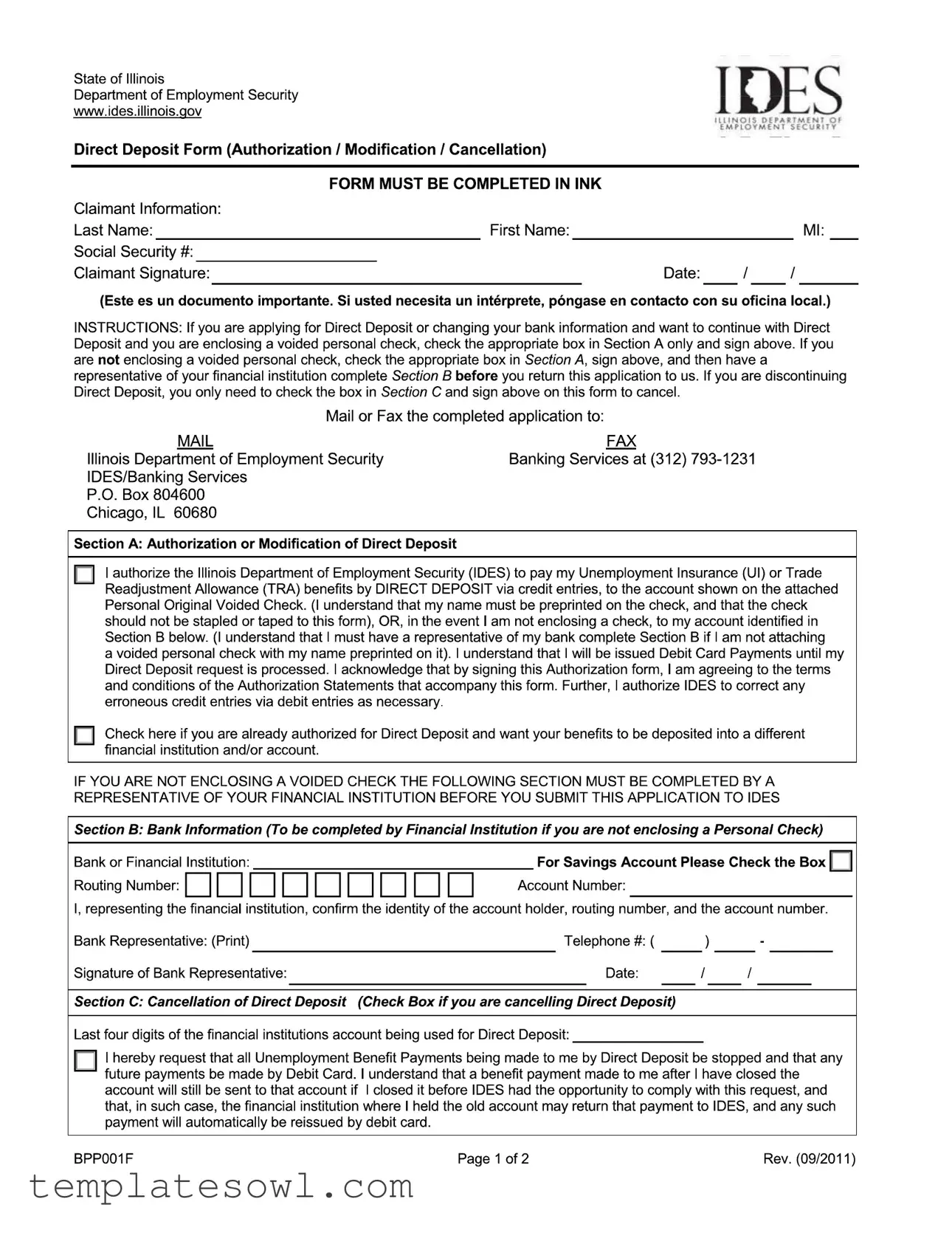

Fill Out Your Ides Direct Deposit Form

The Ides Direct Deposit Form is an essential document for claimants receiving unemployment insurance or trade readjustment allowance benefits in Illinois. It streamlines the process of receiving benefits directly into a personal bank account, enabling quicker and more convenient access to funds. The form includes crucial sections for authorization or modification of deposit details, as well as provisions for canceling direct deposits. Claimants must provide personal information such as their name and Social Security number, and they have the option to include a voided personal check or have their bank complete a separate section if a check is not available. In addition, the form outlines the steps for discontinuing direct deposit, ensuring that claimants understand the implications of such a decision. Clear instructions guide users through each step, while the option to update mailing addresses and bank information maintains the integrity of financial transactions. Furthermore, a variety of statements highlight the claimant's responsibility for accurate reporting and the potential consequences of providing false information. The entire process is designed to facilitate direct deposit while ensuring that claimants remain informed about their rights and responsibilities.

Ides Direct Deposit Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The IDES Direct Deposit form is used to authorize, modify, or cancel direct deposit for unemployment benefits in Illinois. |

| Claimant Information | It requires personal details such as last name, first name, middle initial, social security number, signature, and date. |

| Sections Overview | The form contains three main sections: Authorization/Modification, Bank Information, and Cancellation. |

| Voided Check Requirement | Claimants must provide a voided personal check unless a bank representative completes Section B. |

| Cancellation Process | To cancel direct deposit, the claimant only needs to check the cancellation box and sign the form. |

| Mailing Instructions | The completed application must be mailed or faxed to IDES Banking Services in Illinois. |

| Processing Time | Allow time for IDES to process the request; payments may initially be issued via a debit card. |

| Governing Laws | This form is governed by the laws pertaining to Electronic Funds Transfer and Automated Clearing House (ACH) rules in Illinois. |

Guidelines on Utilizing Ides Direct Deposit

Completing the IDES Direct Deposit form is a straightforward process that involves providing personal and banking information. It is important to fill out the form accurately to ensure that your benefits are deposited into the correct account. Follow these steps for a successful submission.

- Obtain the IDES Direct Deposit form.

- Fill in your personal information in the Claimant Information section, including your last name, first name, middle initial, and Social Security number.

- Sign and date the form in the designated area.

- In Section A, determine if you are enclosing a voided personal check.

- If yes, check the appropriate box, attach the voided check, and ensure your name is preprinted on it.

- If no, check the appropriate box, leave Section B blank, and obtain a bank representative’s signature later.

- If you did not attach a check, take the form to your bank. Request a representative to fill out Section B, including the bank’s name, routing number, and account number.

- Make sure the bank representative prints their name, signs the form, and provides a contact number.

- If you are canceling direct deposit, check the box in Section C and provide the last four digits of the account number.

- Mail or fax the completed form to the Illinois Department of Employment Security at the specified address or fax number provided on the form.

After submitting the form, the IDES will process your request. Ensure you keep a copy for your records and monitor your bank account for the timely deposit of your benefits. If there are any issues, reaching out to your bank or IDES for assistance is advisable.

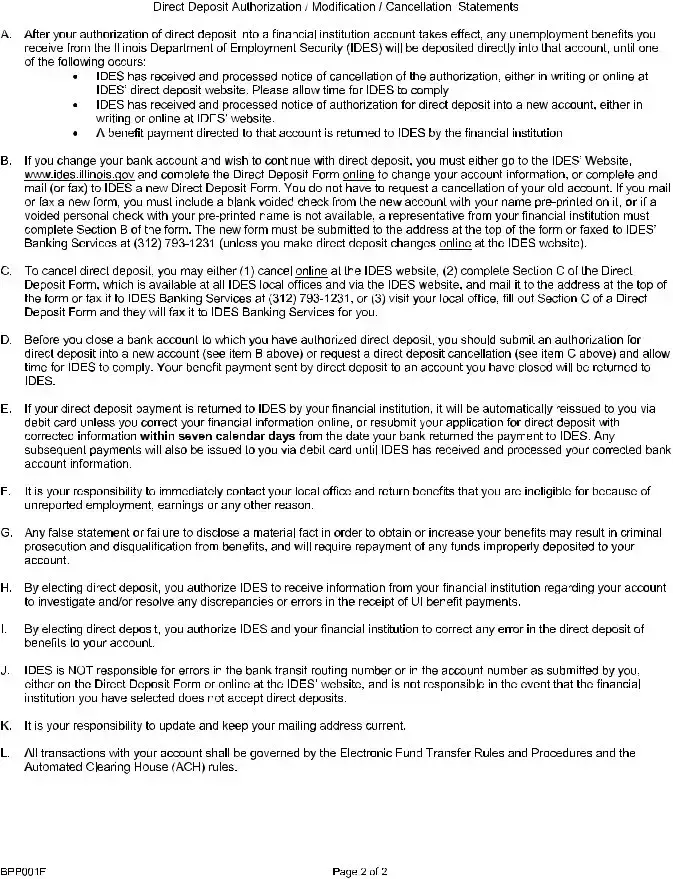

What You Should Know About This Form

What is the purpose of the IDES Direct Deposit form?

The IDES Direct Deposit form allows individuals to authorize the Illinois Department of Employment Security to deposit their unemployment benefits directly into their bank accounts. This method is often faster and more convenient than receiving a paper check. The form can also be used to modify existing direct deposit information or to cancel the direct deposit service entirely.

What should I include with the Direct Deposit form if I am applying for new direct deposit?

If you are applying for new direct deposit and wish to attach a voided personal check, make sure the check has your name preprinted on it. In this case, check the appropriate box in Section A and sign the form. If you do not have a voided check, you will need to have a representative from your financial institution complete Section B of the form instead.

How do I cancel my Direct Deposit authorization?

What happens to my benefit payments after I cancel Direct Deposit?

Once you cancel direct deposit, all future unemployment payments will be made using a debit card. Be aware that if you cancel your direct deposit but have payments already issued, those will still go to the old account. If that account is closed, the payment could be returned to IDES, and you will receive your benefits via debit card instead.

Can I change the bank account for my Direct Deposit without cancelling the old one?

Yes, you can change the bank account for direct deposit without needing to cancel the old account. Simply submit a new Direct Deposit form with your updated bank information, including a voided check or a completed Section B from your financial institution if you do not have a voided check. You do not need to request cancellation of your old account; IDES will process the change.

What should I do if my direct deposit payment is returned to IDES?

If your direct deposit payment is returned because of an error in your bank information, it will automatically be reissued to you via debit card. To avoid this, it is important to promptly submit a new Direct Deposit form with the correct information within seven days following the return of the payment.

Common mistakes

Filling out the IDES Direct Deposit form may seem straightforward, but several common mistakes can delay your benefits. One significant error occurs when individuals fail to enclose a voided check. If you're opting for direct deposit and not providing a voided personal check, Section B must be completed by a representative of your financial institution. Omitting this step can lead to a rejected application, causing unnecessary delays in receiving your unemployment benefits.

An equally important oversight is rushing through the process without ensuring accuracy. Errors in personal information, such as misspelling your name or incorrectly entering your Social Security number, can prevent proper identification of your account. Even minor mistakes can create complications, resulting in missed payments and frustration. Double-checking all details before submission is crucial.

Another common pitfall is not thoroughly reading the instructions provided on the form. Familiarizing yourself with each section before you begin filling it out helps to avoid misunderstandings about the requirements. For instance, many people mistakenly assume that checking the cancellation box will also transfer their benefits rather than stopping them altogether. Understanding the purpose of each section of the form can save you from future confusion.

Moreover, not signing the form can lead to immediate rejection. Every application requires an official signature to validate the request. It’s a simple yet critical step that many overlook, causing delays in processing. Completeness, including a signature, cannot be underestimated in ensuring timely action on your request.

Finally, failing to communicate with your financial institution can lead to issues with account information. Ideally, the bank representative should confirm your account's authenticity in Section B when you do not include a voided check. Without this confirmation, your application risks being deemed incomplete. Keeping the lines of communication open can help ensure that the information provided is accurate, reducing potential delays.

Documents used along the form

When applying for or modifying direct deposit through the Ides Direct Deposit form, several other forms and documents may also be needed. These documents assist in ensuring the proper processing of your application and maintaining accurate records. Below is a list of some commonly used forms and documents.

- Voided Check: This document provides your bank account information, which is needed for setting up direct deposit. It confirms that the account exists under your name and that it can receive deposits.

- Bank Account Information Form: If you are not providing a voided check, this form must be completed by a bank representative. It details the routing and account numbers needed for direct deposit.

- Unemployment Benefits Claim Form: This form initiates your claim for unemployment benefits. It provides essential information about your employment history and eligibility for benefits.

- Proof of Identity Document: Sometimes, you may need to provide documentation that verifies your identity, such as a driver’s license or state ID. This helps ensure the security of your financial information.

- W-2 Forms or Pay Stubs: These documents show proof of your income and employment status. They may be required in cases where verifying your earnings is necessary for benefit calculations.

- Change of Address Form: If you have recently moved, this form updates your address with the relevant authorities. Keeping your address current ensures you receive important notices about your benefits.

- Cancellation of Direct Deposit Confirmation: If you decide to cancel your direct deposit, submitting this confirmation form formally notifies the department and stops future deposits.

Each of these documents serves a specific purpose, ensuring accurate processing and safeguarding your benefits. Always check for the required forms when dealing with direct deposit issues to streamline your application process.

Similar forms

- Bank Account Authorization Form: Similar to the IDES Direct Deposit form, this document is used to provide authorization for automatic transactions from an account. It includes personal and banking information, requiring the signature of the account holder and sometimes a financial representative.

- ACH Authorization Form: This form permits a business to withdraw funds from a customer's account for payments. Like the IDES form, it requires detailed account information and consent from the account holder, ensuring compliance with ACH network rules.

- Direct Payment Request Form: Used by customers to set up recurring payments, this document shares similarities with the IDES form by needing the payer’s signature and bank details. Both forms facilitate automatic deposits or deductions from bank accounts.

- Electronic Funds Transfer (EFT) Authorization Form: This document allows individuals to authorize the transfer of funds electronically. Similar to the IDES form, it includes account information and requires both the customer's and a bank representative's signatures if necessary.

- Payment Cancellation Notice: Similar in purpose to Section C of the IDES form, this document allows a client to stop automatic payments. It outlines details about previous transactions to ensure they are canceled accurately.

- Online Banking Account Change Form: This form is often completed to update banking information for online accounts, mirroring the process in the IDES form. Changes require personal identification and verification to protect against unauthorized modifications.

Dos and Don'ts

When filling out the IDES Direct Deposit form, there are several key actions to keep in mind to ensure a smooth process. Here are seven important things to do and avoid.

- Do use ink. Fill out the form using blue or black ink to ensure clarity.

- Do double-check your information. Verify all details, including your name, Social Security number, and account information, to prevent any mistakes.

- Do ensure your name is printed on the check. If submitting a voided personal check, it is critical that your name appears preprinted on it.

- Do have a bank representative sign Section B. If you are not enclosing a voided check, make sure a bank official completes this section.

- Don’t omit the required signatures. Your signature is necessary for authorization, as is the bank representative’s if applicable.

- Don’t forget to check the right boxes. Make sure you indicate whether you are authorizing a new deposit, modifying an existing one, or canceling your direct deposit.

- Don’t assume IDES has your updated information. If you change your bank account, always submit a new form to prevent payment disruptions.

Taking these steps will help ensure that your direct deposit process is as efficient as possible. Attention to detail is vital, and clarity in your communication can prevent unnecessary issues down the road.

Misconceptions

Understanding the Ides Direct Deposit form is essential for a smooth payment process. However, some common misconceptions can lead to confusion. Below are seven misconceptions clarified for better understanding.

- Misconception 1: You must always provide a voided check for direct deposit.

- Misconception 2: Cancelling direct deposit requires a lengthy process.

- Misconception 3: Direct deposit payments cannot be changed once set up.

- Misconception 4: If your payment is returned, you will not receive it again.

- Misconception 5: Once I cancel direct deposit, I will not receive benefits.

- Misconception 6: Direct deposit is processed immediately.

- Misconception 7: You cannot receive assistance if you need help with the form.

While enclosing a voided check is one way to set up direct deposit, it is not the only method. If you do not have a voided check, you can ask a representative from your bank to fill out the required section of the form.

You can cancel direct deposit quickly. Simply check the box in Section C of the form, sign it, and return it to IDES. You can also cancel online for added convenience.

This is incorrect. You can change your bank information at any time. Just complete a new Direct Deposit Form and submit it to IDES with the necessary details.

If your direct deposit payment is returned, IDES will issue payment via a debit card automatically. This means you will still receive your funds even if there was an issue with your account.

After cancelling direct deposit, your benefits will be issued via a debit card instead. You will continue to receive your benefits without interruption.

The processing of direct deposit requests may take some time. During this period, benefits will be issued through a debit card until your request is fully processed.

Help is available if you require assistance. Reach out to your local IDES office for guidance. They can provide support and answer any questions you may have.

Key takeaways

- Complete the form in ink. Use a blue or black pen to fill out all required sections. Be sure your signature and date are included.

- Voided checks are crucial. If you are enclosing a personal check, ensure your name is preprinted. Avoid staples or tape on the check.

- Cancellation is straightforward. If you no longer wish to use direct deposit, simply check the cancellation box and sign the form.

- Always update your bank details. If you change accounts, fill out a new form and include a blank voided check or have your bank complete Section B.

Browse Other Templates

Lausd Benefits Enrollment - For dependents aged 19-25, contact Benefits Administration for eligibility details.

Sample Letter for Leave of Absence From Work - A clear understanding of your leave entitlements is encouraged before submitting the form.