Fill Out Your Ifta 101Mn Form

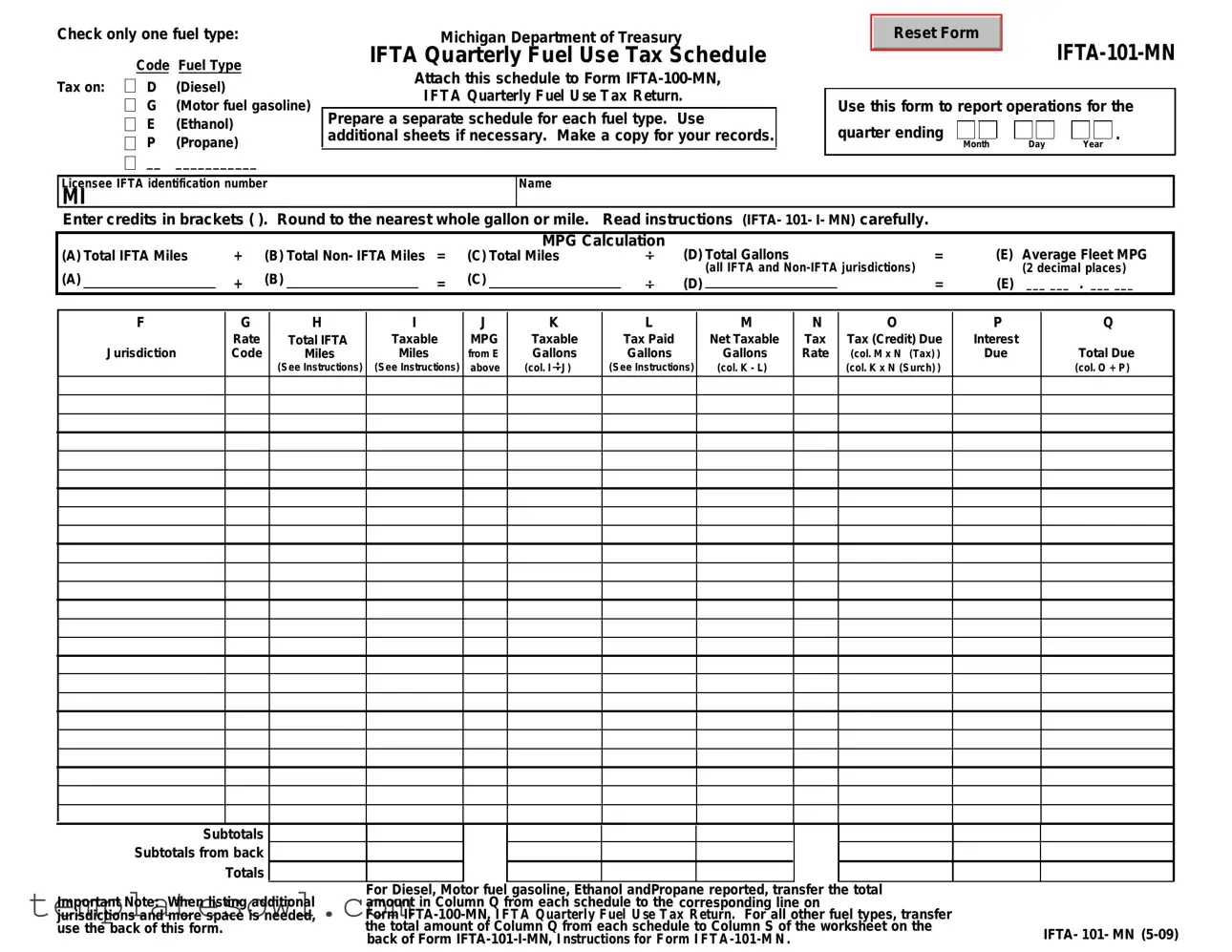

The IFTA 101Mn form is a crucial document for those who operate heavy vehicles across state lines, particularly in terms of fuel tax reporting. This form serves as the Quarterly Fuel Use Tax Schedule and must be used alongside the IFTA-100-MN, which is the overarching tax return for the International Fuel Tax Agreement. When filling it out, it is essential to check the appropriate fuel type—options include Diesel, Motor Fuel Gasoline, Ethanol, and Propane. Each fuel type requires a separate schedule, ensuring that all operations and fuel usage are accurately reported. Details such as total IFTA miles, total non-IFTA miles, and total gallons consumed are necessary components. To aid in this process, jurisdictions, rate codes, and MPG calculations are detailed within the form, guiding users on how to substantiate their fuel usage and applicable taxes. Maintaining accuracy is important; thus, round all figures to the nearest whole number as specified. Additionally, this form requires careful record-keeping and must be accompanied by a copy for personal records. Each step, from entering mileage to calculating tax, plays a vital role in the smooth administration of fuel taxes under IFTA. It’s a process that might seem burdensome, but with careful attention, it can be managed efficiently.

Ifta 101Mn Example

Check only one fuel type:

Tax on: |

Code Fuel Type |

|

D |

(Diesel) |

|

|

G |

(Motor fuel gasoline) |

|

E |

(Ethanol) |

|

P |

(Propane) |

|

__ |

___________ |

Michigan Department of Treasury

IFTA Quarterly Fuel Use Tax Schedule

Attach this schedule to Form

Prepare a separate schedule for each fuel type. Use additional sheets if necessary. Make a copy for your records.

|

Reset Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use this form to report operations for the |

|||

quarter ending Month |

Day |

Year . |

|

Licensee IFTA identification number |

|

|

|

Name |

|

|

|

|

|

|

|

|

|||||

MI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter credits in brackets ( ). Round to the nearest whole gallon or mile. |

Read instructions |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

MPG Calculation |

|

|

|

|

(E) |

Average Fleet MPG |

||

(A) Total IFTA Miles |

+ |

(B) Total |

= |

(C) Total Miles |

|

: |

(D) Total Gallons |

= |

|||||||||

(A) |

|

|

(B) |

|

|

|

(C) |

|

|

|

|

|

(all IFTA and |

|

|

(2 decimal places) |

|

|

+ |

|

|

= |

|

|

|

: |

(D) |

|

|

= |

(E) |

___ ___ . ___ ___ |

|||

|

|

|

|

|

|||||||||||||

F

Jurisdiction

G

Rate Code

H |

I |

Total IFTA |

Taxable |

Miles |

Miles |

(See Instructions) |

(See Instructions) |

J

MPG

from E above

K

Taxable Gallons

(col. I : J)

L

Tax Paid

Gallons

(See Instructions)

M

Net Taxable

Gallons

(col. K - L)

N

Tax Rate

O

Tax (Credit) Due

(col. M x N (Tax) ) (col. K x N (Surch) )

P

Interest

Due

Q

Total Due

(col. O + P)

Subtotals

Subtotals from back

Totals

Important Note: When listing additional jurisdictions and more space is needed, use the back of this form.

For Diesel, Motor fuel gasoline, Ethanol andPropane reported, transfer the total |

|

amount in Column Q from each schedule to the corresponding line on |

|

Form |

|

the total amount of Column Q from each schedule to Column S of the worksheet on the |

|

back of Form |

IFTA- |

|

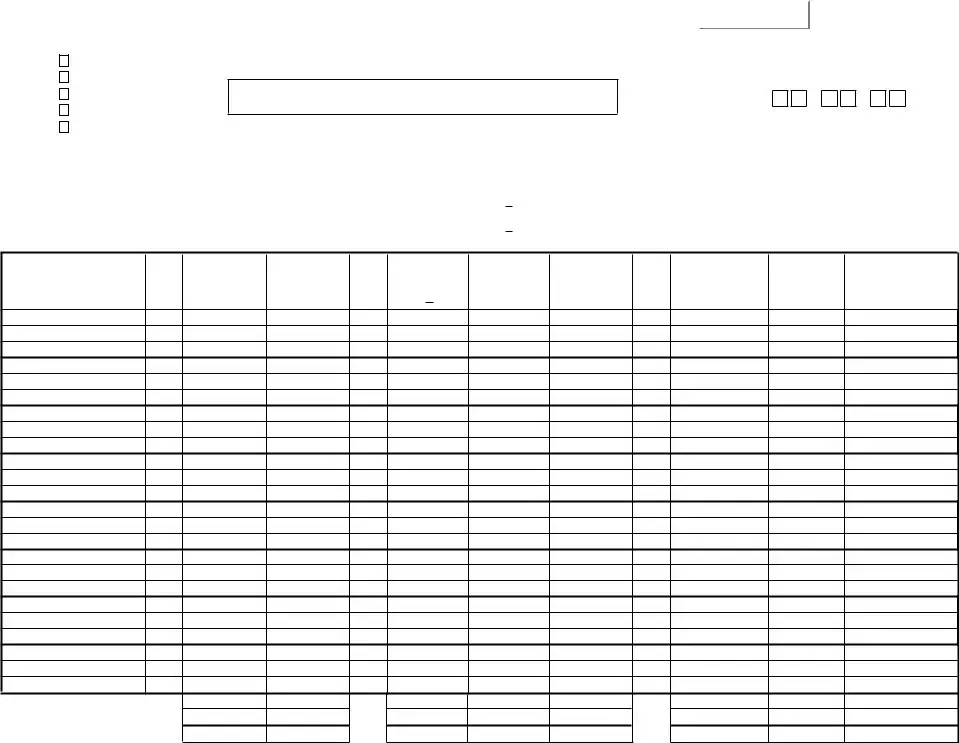

F |

|

||

101- |

|

Jurisdiction |

MN (4/08) (back) |

|

|

|

|

|

Transfer the subtotal amounts to the front of this schedule.

G |

H |

I |

J |

K |

L |

M |

N |

O |

P |

Q |

||

Rate |

Total IFTA |

Taxable |

MPG |

Taxable |

Tax Paid |

Net Taxable |

Tax |

Tax (Credit) Due |

Interest |

Total Due |

||

Code |

Miles |

Miles |

from E |

Gallons |

Gallons |

Gallons |

Rate |

(col. M x N (Tax)) |

Due |

|||

|

(See Instructions) (See Instructions) |

on front |

(col. I |

: |

J) |

(See Instructions) |

(col. K - L) |

|

(col. K x N (Surch)) |

|

(col. O + P) |

|

Subtotals

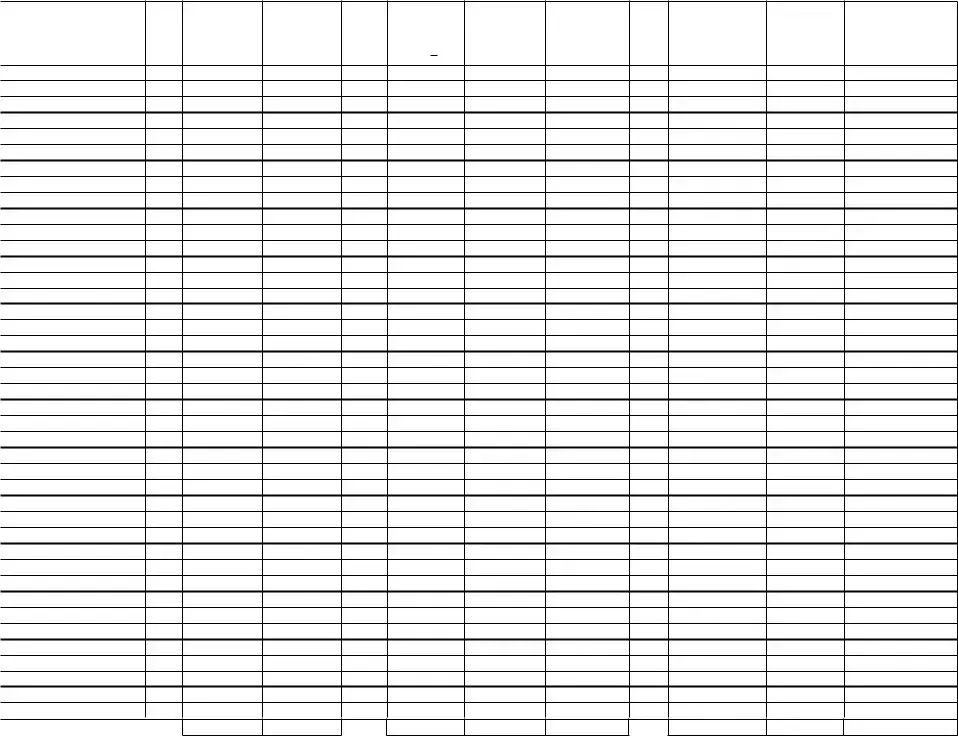

Instructions for Form |

|

IFTA Quarterly Fuel Use Tax Schedule |

|

A separate Form

Enter your licensee IFTA identification number. This is your federal employer identification number, social security number or other jurisdiction assigned identification number as it appears on your IFTA license.

Enter your legal name as it appears on your IFTA License.

(A) Total IFTA Miles - Enter the total miles traveled in IFTA jurisdictions by all qualified motor vehicles in your fleet using the fuel type indicated on each form/schedule (total from column H). Report all miles traveled whether the miles are taxable or nontaxable. Round mileage to the nearest whole miles

(e.g., 1234.5 = 1235).

(B) Total

(C)Total Miles - Add the amount in item (A) and the amount in item (B) to determine total miles traveled by all qualified motor vehicles in your fleet.

(D)Total Gallons - Enter the total gallons of fuel placed in the propulsion tank in both IFTA and

(e.g., 123.4 = 123).

(E)Average Fleet MPG - Divide item (C) by item (D). Round to 2 decimal places (e.g., 4.567 = 4.57).

Column F - Enter the name of each IFTA jurisdiction that you operated in during the period. Enter the jurisdiction's name on two(2) consecutive lines if the traveled jurisdiction administers a surcharge1in addition to their regular fuel tax. Enter the jurisdiction's two letter abbreviation from Form

Column G - Enter the rate code of the appropriate fuel type for each IFTA jurisdiction from Form

Column H - Enter the total miles traveled (taxable and nontaxable) in each IFTA jurisdiction for this fuel type only. Enter '0' on a surcharge line. Round mileage to the nearest whole miles (e.g., 1234.5 = 1235).

Column I - Enter the IFTA taxable miles for each IFTA jurisdiction. Do not include fuel use trip permit miles. Enter '0' on a surcharge line. Round mileage to the nearest whole miles (e.g., 1234.5 = 1235).

Column J - Enter your average fleet miles per gallon (mpg) from item (E) above. Enter '0' on a surcharge line.

1Jurisdictions with surcharge: Indiana, Kentucky and Virginia.

Column K - Divide the amount in column I by the amount in column J to determine the total taxable gallons of fuel consumed in each IFTA jurisdiction. For surcharge1taxable gallons, enter the taxable gallons from the same jurisdiction's fuel use tax line, Column K. Round gallons to the nearest whole gallon

(e.g., 123.4 = 123.).

Column L - Enter the total

Round gallons to the nearest whole gallon (e.g., 123.4 = 123). Column M - Subtract the amounts in column L from column K for each jurisdiction. Enter '0' on a surcharge line.

-If column K is greater than column L, enter the taxable gallons.

-If column L is greater than column K, enter the credit gallons. Use brackets to indicate credit gallons.

Column N - Enter the rate for the appropriate fuel type from Form

Column O - Multiply the amount in column M by the tax rate for that jurisdiction in column N to determine the tax or credit. Enter any credit amount in brackets. Where a surcharge1is applicable, multiply the amount in Column K by the surcharge rate for that jurisdiction in Column N. Column P - If you file late, compute interest on any tax due for each jurisdiction for each fuel type indicated on each form/schedule. Interest is computed on tax due from the due date of the return until the date payment is received. Interest is computed at 1% per month or part of a month, to a maximum of 12% per year. Returns must be postmarked no later than the last day of the month following the end of the quarter to be timely.

Column Q - For each jurisdiction add the amounts in column O and column P, and enter the total dollar amount due or credit amount. Enter any credit amount in brackets. Subtotals - Add the amounts in columns H, O, P and Q on the front of the schedule and enter on the Subtotals line in the appropriate columns. Add the amounts in columns H, O, P and Q on the back of the schedule and enter in the applicable columns on the Subtotals line below. Enter these amounts in the applicable columns on the front of the schedule on the Subtotals from back line.

Totals - Add the Subtotals and the Subtotals from back to determine the Totals. The total in column Q is the difference of all credits and taxes due for all jurisdictions. Transfer the Totals from Column Q for each fuel type reported to the corresponding line of Form

Make a copy of this return for your records.

(All Other) Fuel Types Worksheet

Worksheet Instuctions

For each fuel type listed below, enter the total for that fuel from column Q of Form

Fuel Type |

(R) |

(S) |

Code |

(Other) Fuel Type |

Total from Column (Q) of |

C |

CNG |

|

A |

|

|

B |

|

|

F |

|

|

H |

Gasohol |

|

L |

LNG |

|

M |

Methanol |

|

|

TOTAL AMOUNT |

|

Transfer this amount to line 5 of Form |

|

|

Need Help?

The Michigan Department of Treasury has compiled a manual with additional information on IFTA credentials, record keeping and tax reporting, payments and refunds and other frequently asked questions. This manual is available on our Web site at www.michigan.gov/treasury. Select Motor Carrier forms and then form #2838 under Related Documents.

If you have questions or need assistance, contact the Motor Carrier section at (517)

Requests for refunds under $1.00 will carry forward to your next return.

If you need to write, address your letter to:

MICHIGANMichigan DepartmentDEPARTMENTof OFTreasuryTREASURY

SPECIALCustomerTAXESContactDIVISIONDivision, Special Taxes

PP.OO. BOXBox 30474

LANSING,Lansing MI

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | This form is used to report fuel use for the International Fuel Tax Agreement (IFTA) in Michigan. |

| Submission Requirement | Attach the IFTA-101Mn form with the IFTA-100-MN, which is the quarterly tax return. |

| Quarterly Reporting | It needs to be completed for operations during the quarter ending on a specific date. |

| Fuel Types | You can report multiple fuel types: Diesel (D), Motor Fuel Gasoline (G), Ethanol (E), and Propane (P). |

| MPG Calculation | The average fleet MPG is calculated using total miles and total gallons of fuel used. |

| Credits and Taxes | Credits are entered in brackets. The form assists in calculating tax due or credits for prepaid taxes. |

| Governing Law | Compliance with the Michigan Department of Treasury regulations is mandatory for IFTA reporting. |

Guidelines on Utilizing Ifta 101Mn

Completing the IFTA 101Mn form is crucial for ensuring compliance with fuel tax regulations. This form needs to be filled out accurately for each fuel type used during the reporting quarter and submitted along with the IFTA-100-MN return. The following steps outline how to properly fill out the IFTA 101Mn form.

- Select the Fuel Type: Begin by checking only one box corresponding to the type of fuel used: Diesel (D), Motor Fuel Gasoline (G), Ethanol (E), or Propane (P).

- Enter Quarter Ending Date: Clearly write the end date of the quarter in the designated space.

- Licensee Information: Fill in your IFTA identification number and your legal name as it appears on your IFTA license.

- Report Mileage:

- In Section A, input the total miles traveled in IFTA jurisdictions (Total IFTA Miles).

- In Section B, enter the total miles traveled in non-IFTA jurisdictions (Total Non-IFTA Miles).

- Calculate total miles (C) by adding A and B together and log that figure.

- Total Gallons: In Section D, enter the total gallons of fuel put into the propulsion tank.

- Calculate Average Fleet MPG: In Section E, divide the total miles (C) by the total gallons (D) and round to two decimal places.

- Fill in Jurisdictions: For Section F, name the IFTA jurisdictions where you operated, and list them accordingly.

- Complete Columns G through Q:

- Enter the rate code for each jurisdiction in Column G.

- Input total miles and IFTA taxable miles in Columns H and I, respectively.

- Transfer your average fleet MPG from Section E to Column J.

- Calculate taxable gallons in Column K by dividing IFTA taxable miles (I) by MPG (J).

- Log tax-paid gallons (if applicable) in Column L.

- Calculate net taxable gallons in Column M, giving special attention to credits.

- Enter the correct tax rate in Column N and compute taxes due in Column O.

- If applicable, calculate interest due in Column P.

- Add Columns O and P to determine the total amount due or credit in Column Q.

- Calculate Subtotals: Add relevant columns and enter these amounts in the subtotals section provided.

- Determine Totals: Perform final calculations by summarizing subtotals, which you will transfer to Form IFTA-100-MN as instructed.

- Make Copies: Ensure that you create copies of the form for your records before submission.

Following these steps carefully will help ensure that the IFTA 101Mn form is filled out accurately and helps in smooth verification processes with the Michigan Department of Treasury. Always remember to consult the instructions sheet, if necessary, for further clarifications on specific requirements for each fuel type.

What You Should Know About This Form

What is the purpose of the IFTA 101Mn form?

The IFTA 101Mn form is used by motor carriers to report fuel usage for the International Fuel Tax Agreement (IFTA). It helps calculate the tax due on fuel consumed in the jurisdictions listed within IFTA. This form needs to be submitted along with the IFTA Quarterly Fuel Use Tax Return, Form IFTA-100-MN.

How do I fill out the fuel type section of the form?

You must check only one fuel type at a time, selecting from diesel, motor fuel gasoline, ethanol, or propane. If you are reporting a different type of fuel, check the blank line and enter the fuel type and its code as specified in the back of the form. Make sure the correct box is checked before proceeding.

What information do I need to calculate average fleet MPG?

To calculate average fleet Miles Per Gallon (MPG), you will need the total IFTA miles and non-IFTA miles traveled, as well as the total gallons of fuel consumed. Use the formula: Average Fleet MPG = Total Miles (IFTA + Non-IFTA) divided by Total Gallons. Round the result to two decimal places during your calculations.

When is the IFTA 101Mn form due?

The form needs to be postmarked by the last day of the month following the end of each quarter. Therefore, if the quarter ends on March 31, the due date would be April 30. Late submissions may incur interest charges.

What should I do if I need more space for jurisdictions?

If you need additional space to list more jurisdictions, you can use the back of the form. Be sure to also transfer any important subtotal amounts back to the front of the schedule once you finish filling it out.

How do I calculate the total amount due on the form?

To calculate the total amount due, add together the amounts from the 'Tax Due' and 'Interest Due' columns on the form. This total should reflect any credits or debts for each jurisdiction. Ensure that credit amounts are shown in brackets.

Where can I find additional help or resources for completing this form?

The Michigan Department of Treasury offers a manual with further details about IFTA credentials, record keeping, and more related topics. This manual is available online on their website. You can also contact the Motor Carrier section directly for assistance during business hours.

Common mistakes

When completing the IFTA 101MN form, individuals often make several common mistakes that can lead to inaccuracies in their submissions. One frequent error is failing to check only one fuel type. The form clearly requests that only one box be checked for fuel type (Diesel, Motor fuel gasoline, Ethanol, or Propane). Selecting more than one may complicate the reporting and could result in delays or errors in processing.

Miscalculating totals is another mistake that can occur during the form-filling process. For example, when entering the Total IFTA Miles or Total Non-IFTA Miles, some individuals incorrectly add or round the numbers. It is essential to ensure that these figures are carefully calculated and rounded to the nearest whole mile to avoid discrepancies.

Another significant error is improperly handling tax calculations. Column O requires multiplying the net taxable gallons in Column M by the tax rate in Column N. Missteps can happen here, such as using the wrong rate code or failing to consider applicable credits. Such mistakes can lead to overpayment or underpayment of taxes, which can create complications with state authorities.

Additionally, many people forget to read the instructions that accompany the IFTA 101MN form. Ignoring the guidelines can result in mistakes related to entering data in the correct columns, failing to include necessary information, or misunderstanding how to handle surcharges. It is crucial to carefully review the instructions before submission to ensure compliance.

Finally, individuals often neglect to keep copies of their completed forms and associated documentation for their records. Having a copy can assist in future filings or serve as a reference if questions arise regarding previous submissions. It is essential to maintain accurate records to facilitate accurate reporting and accountability.

Documents used along the form

When dealing with the IFTA 101Mn form, it is important to understand the additional documents that may be necessary for a complete submission. Each one serves a specific purpose and contributes to meeting tax obligations and maintaining compliance. Below are key documents often used alongside the IFTA 101Mn form.

- Form IFTA-100-MN: This is the main tax return form for reporting fuel use tax for all jurisdictions. It summarizes the information reported on the IFTA 101Mn forms and is essential for determining overall tax liability.

- Form IFTA-105: This form provides the final fuel use tax rate and rate code table. It’s crucial for filling out the IFTA 101Mn correctly, as it contains the applicable rates for each fuel type across different jurisdictions.

- Form IFTA-101-I-MN: The instructions for completing the IFTA 101Mn form. This document offers guidance on how to accurately report data and ensure compliance with IFTA regulations.

- Fuel Purchase Receipts: Keeping receipts of fuel purchases is necessary to validate tax-paid gallons claimed. These records are important for audits and demonstrating compliance.

- Record of Mileage: A well-maintained logbook detailing total miles traveled in IFTA and non-IFTA jurisdictions helps ensure accurate reporting and supports claims made on the IFTA 101Mn form.

- Quarterly Tax Payment Documentation: Evidence of tax payments made for previous quarters may be required during audits or in case of discrepancies in reported taxes.

- Schedule of Jurisdictional Operations: This document lists all jurisdictions where fuel was consumed. It helps in reporting accurate taxable miles as required on the IFTA 101Mn form.

- Form IFTA-111: This form is used for filing an amended return when there are errors on previous IFTA forms. It’s critical for correcting any discrepancies in reported data.

- Fuel Type Code List: This reference list provides various fuel type codes necessary for indicating the fuel type used on the IFTA 101Mn form. Accurate coding is essential for correct reporting.

Maintaining accurate records and submitting the relevant documents enhances compliance with IFTA regulations. Being thorough can prevent future issues and ensure an efficient reporting process. If unsure about any forms or processes, do not hesitate to seek help from tax professionals or the appropriate state department.

Similar forms

The IFTA 101Mn form serves an important function in the reporting of fuel usage and taxes for commercial motor vehicles across jurisdictions. It is beneficial to understand how this form compares to other similar documents. Below is a concise list that highlights five documents similar to the IFTA 101Mn form, along with explanations of their corresponding functions.

- IFTA-100: This is the primary tax return form used by carriers to report total miles traveled and fuel purchased for the entire quarter. Like the IFTA 101Mn, it requires detailed tracking of fuel type and movement, consolidating data submitted on the IFTA 101Mn for comprehensive tax calculations.

- IFTA-105: This form provides the fuel tax rate information necessary for completing the IFTA 101Mn. Similar to the IFTA 101Mn, it ensures that carriers are referencing the correct rates for the various fuel types they operate, establishing a necessary link for accurate tax reporting based on jurisdiction-specific rates.

- IFTA-102: Used for reporting fuel use for prior years, the IFTA 102 form allows taxpayers to correct mistakes made in previous quarterly filings. This document parallels the IFTA 101Mn in that it focuses on reconciliation of data but emphasizes the necessity of accuracy over time, aiding in correcting past discrepancies.

- IFTA-103: This is a supplemental document that provides additional details on fuel purchases, especially when carriers deal with multiple jurisdictions. Much like the IFTA 101Mn, it aids in the finer details of reporting, ensuring that all aspects of fuel use are documented for tax purposes.

- IFTA-104: Similar in nature, this form is intended for those who are discontinuing their participation in the IFTA program. It requires information that mirrors the reporting necessary on the IFTA 101Mn, providing a final audit of fuel usage and taxes owed or credits available before exiting the program.

Understanding these similarities aids in grasping the interconnectedness of various documents related to fuel taxes. Each form plays its role in ensuring compliance and accurate reporting, working together in the larger framework of the International Fuel Tax Agreement.

Dos and Don'ts

When filling out the IFTA 101Mn form, it’s essential to adhere to some best practices to ensure accurate reporting. Below are seven things you should and shouldn’t do while completing the form.

- Do check only one fuel type at the beginning of the form.

- Don't forget to round mileage and gallons to the nearest whole number.

- Do prepare a separate form for each type of fuel you are reporting.

- Don't leave blank spaces; enter '0' where applicable, especially for surcharge lines.

- Do carefully read the instructions provided with the form to understand all requirements.

- Don't submit your form late; ensure it is postmarked by the deadline.

- Do keep a copy of the completed form for your records after submitting.

Following these guidelines will help ensure that your submission is complete and accurate, reducing the possibility of any issues with your IFTA tax reporting.

Misconceptions

- Misconception 1: All fuel types can be reported on a single IFTA-101Mn form.

- Misconception 2: You can estimate your miles instead of reporting actual miles.

- Misconception 3: You don't need to keep receipts for fuel purchases.

- Misconception 4: You do not incur interest if your return is late as long as you send it eventually.

- Misconception 5: Only taxes owed need to be reported; credits do not need to be included.

- Misconception 6: You can submit the IFTA-101Mn form electronically.

This is incorrect. Each fuel type requires a separate IFTA-101Mn form. So, whether you're using diesel, gasoline, ethanol, or propane, a distinct form is needed for each one.

Actual miles must be reported. Whether they are taxable or non-taxable, all miles traveled need to be documented accurately. Rounding to the nearest whole mile is allowed, but rounding isn't a substitute for accurate reporting.

This is false. You must keep all receipts for tax-paid gallons of fuel purchased. Without proper documentation, you risk not being able to claim these expenses and could face penalties.

Both taxes due and any credits must be reported. Ensure to enter credit amounts in brackets to differentiate them from tax amounts that are due.

Submission methods can vary by jurisdiction. While some places may offer electronic filing, others may require you to mail in your forms. Always check with your local treasury for their submission requirements.

Key takeaways

When filling out the IFTA 101Mn form, here are five essential points to remember:

- One Form Per Fuel Type: Use a separate IFTA 101Mn form for each fuel type you are reporting, such as Diesel, Motor Fuel Gasoline, Ethanol, or Propane.

- Accurate Calculations: Ensure that all mileage and fuel gallon entries are rounded to the nearest whole number, and calculate your average fleet miles per gallon correctly. This accuracy is crucial for your reporting.

- Tax Reporting: After completing the form, transfer your totals accurately to Form IFTA-100-MN for tax submission. This includes calculating the total tax due or credits available for each jurisdiction.

- Keep Records: Save a copy of the completed form for your records. Also, keep all receipts for fuel purchases, as these may be necessary for verification.

- Timely Filing: Submit the form by the last day of the month following the end of the quarter. Late submissions could incur interest charges on any taxes due.

Browse Other Templates

3521 - This form plays a critical role in the statewide initiative to alleviate housing shortages.

Utah Abandoned Vehicle Form - It includes a declaration under the penalties of perjury regarding the truthfulness of the information provided.