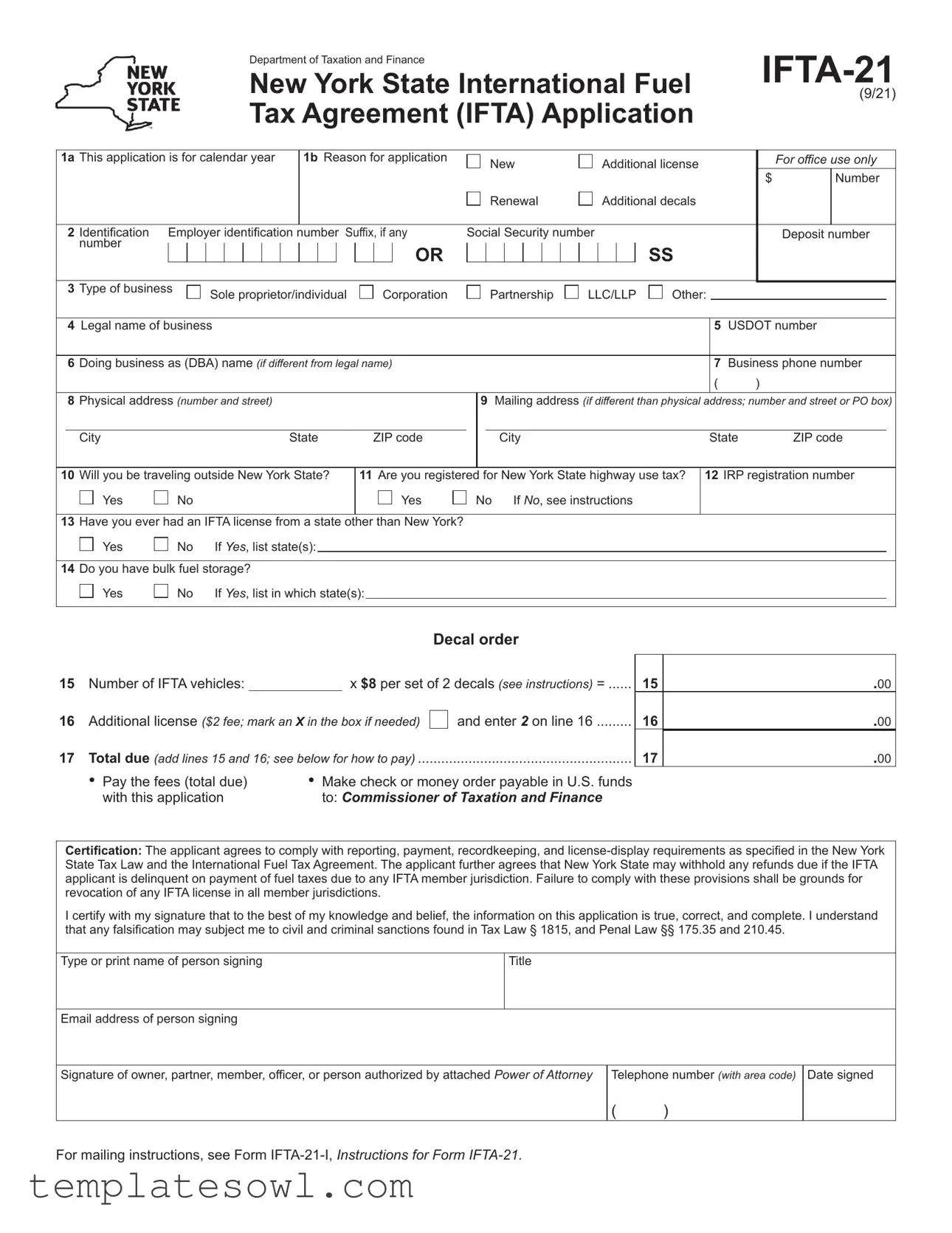

Fill Out Your Ifta 21 Form

The IFTA-21 form plays a crucial role for businesses involved in interstate and international transportation within New York State. This application facilitates the registration for the International Fuel Tax Agreement (IFTA) and addresses the necessary licensing and decal requirements for commercial vehicles. Each applicant must provide vital information including their legal business name, type of entity—be it a corporation, partnership, or sole proprietorship—and their USDOT number. The form also inquires about the applicant's history with IFTA licenses, whether they have bulk fuel storage, and their registration for the New York State highway use tax. Additionally, it details the costs associated with licensing, allows for the request of extra decals, and requires certification of compliance with the associated tax laws. Completeness and accuracy are paramount; any falsification in the application process could have serious legal consequences. As businesses prepare for the upcoming calendar year, it is essential to adhere to these guidelines to ensure compliance and avoid unnecessary disruptions in operations.

Ifta 21 Example

Department of Taxation and Finance |

|

New York State International Fuel |

(9/21) |

Tax Agreement (IFTA) Application |

|

1a |

This application is for calendar year |

|

1b Reason for application |

|

|

New |

|

|

Additional license |

|

|

|

For office use only |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Renewal |

|

|

Additional decals |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Identification |

Employer identification number Suffix, if any |

Social Security number |

|

|

|

|

Deposit number |

|||||||||||||||||||||||||||

|

|

number |

|

|

|

|

|

|

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

|

|

SS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Type of business |

Sole proprietor/individual |

|

|

Corporation |

|

|

Partnership |

|

LLC/LLP |

Other: |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Legal name of business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 USDOT number |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Doing business as (DBA) name (if different from legal name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 Business phone number |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( ) |

|

|

|

|

8 |

Physical address (number and street) |

|

|

|

|

|

|

|

|

|

9 Mailing address (if different than physical address; number and street or PO box) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

|

ZIP code |

|

|

|

City |

|

|

|

|

|

|

|

State |

ZIP code |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

10 |

Will you be traveling outside New York State? |

11 Are you registered for New York State highway use tax? |

12 IRP registration number |

||||||||||||||||||||||||||||||||

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

No |

|

If No, see instructions |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

Have you ever had an IFTA license from a state other than New York? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Yes |

No |

If Yes, list state(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

Do you have bulk fuel storage? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Yes |

No |

If Yes, list in which state(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Decal order |

|

15 |

Number of IFTA vehicles: |

x $8 per set of 2 decals (see instructions) = |

15 |

|

16 |

Additional license ($2 fee; mark an X in the box if needed) |

and enter 2 on line 16 |

16 |

|

17 |

Total due (add lines 15 and 16; see below for how to pay) |

17 |

||

|

• Pay the fees (total due) |

• Make check or money order payable in U.S. funds |

|

|

|

with this application |

to: Commissioner of Taxation and Finance |

|

|

.00

.00

.00

Certification: The applicant agrees to comply with reporting, payment, recordkeeping, and

I certify with my signature that to the best of my knowledge and belief, the information on this application is true, correct, and complete. I understand that any falsification may subject me to civil and criminal sanctions found in Tax Law § 1815, and Penal Law §§ 175.35 and 210.45.

Type or print name of person signing

Title

Email address of person signing

Signature of owner, partner, member, officer, or person authorized by attached Power of Attorney

Telephone number (with area code)

( )

Date signed

For mailing instructions, see Form

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The IFTA-21 form is used to apply for the International Fuel Tax Agreement license in New York. |

| Application Types | Applicants can choose to apply for a new license, renew an existing one, or request additional decals. |

| Identification Requirements | Applicants must provide an Employer Identification Number (EIN) or Social Security number along with the business's legal name. |

| Travel Outside New York | The form requires applicants to state whether they will travel outside New York State, which is critical for tax purposes. |

| Legal Compliance | By signing the form, applicants agree to comply with New York State Tax Law and IFTA requirements. Non-compliance can result in license revocation. |

Guidelines on Utilizing Ifta 21

Completing the IFTA 21 form is an important step for businesses involved in international fuel tax agreements. Ensure you have your business information handy as you move through the necessary fields. Taking your time to fill it out accurately will help prevent any delays in processing your application.

- Begin by specifying the calendar year at the top of the form.

- Select the reason for your application. Mark "New," "Renewal," or "Additional license" as applicable.

- Provide your Employer Identification Number (EIN) or your Social Security number. If applicable, include any suffix as well.

- Check the box that indicates your type of business: Sole proprietor, Corporation, Partnership, LLC/LLP, or Other.

- Enter the legal name of your business.

- Fill in your USDOT number.

- If applicable, list your Doing Business As (DBA) name if it differs from your legal name.

- Provide your business phone number.

- List your physical address (number and street).

- If different from your physical address, provide your mailing address.

- Answer whether you will be traveling outside New York State.

- Indicate if you are registered for New York State highway use tax.

- If applicable, enter your IRP registration number.

- Answer if you have ever had an IFTA license from another state.

- Indicate whether you have bulk fuel storage.

- For the decal order, indicate the number of IFTA vehicles you have and calculate the total cost.

- If you need an additional license, mark the box and enter $2 on the designated line.

- Calculate the total due by adding the costs from the previous steps.

- Make payment for the total due by writing a check or money order to the Commissioner of Taxation and Finance.

- Sign and certify the application, confirming that all information is accurate and complete.

- Type or print your name, title, email address, and telephone number of the person signing the form.

- Finally, indicate the date signed.

Once you've completed the form, follow the mailing instructions provided with the Form IFTA-21 and ensure your application gets sent in a timely manner.

What You Should Know About This Form

What is the IFTA-21 form?

The IFTA-21 form is an application for the International Fuel Tax Agreement (IFTA) in New York State. This document must be completed by businesses that engage in interstate travel to report and pay fuel taxes across multiple jurisdictions. It serves to register for a license and acquire decals for their vehicles, enabling compliant fuel tax reporting and payment.

Who needs to fill out the IFTA-21 form?

Any entity that operates a fleet of vehicles and travels outside New York State for commercial purposes may need to complete the IFTA-21 form. This includes sole proprietors, corporations, partnerships, and limited liability companies. If your business transports goods or passengers across state lines, compliance with IFTA regulations is crucial.

What information is required on the IFTA-21 form?

The IFTA-21 form necessitates several key pieces of information. Applicants must provide their business identification numbers, legal name, and contact details. Additionally, the form asks for details regarding their business type, USDOT number, and whether they have previously held an IFTA license. This information helps establish your eligibility and compliance with tax regulations.

What is the fee associated with submitting the IFTA-21 form?

There are specific fees tied to the IFTA-21 form. The cost for decals is \$8 for every two sets. If you require an additional license, a fee of \$2 is also applicable. The total due is calculated by adding these amounts, and payment must be included with the application. Be sure to verify the total and ensure payment is made in U.S. funds.

What should I do if I have previously held an IFTA license?

If you have previously held an IFTA license from a state other than New York, you will need to disclose that on the IFTA-21 application. This information might help authorities assess your tax compliance history. If applicable, simply list the other state(s) where you had a license to ensure transparency.

How long does it take to process the IFTA-21 application?

The processing time for the IFTA-21 application can vary based on the workload of the Department of Taxation and Finance. Generally, applicants can expect a few weeks for processing. It is advised to submit the application well in advance of any travel plans to ensure that you receive your decals and license in a timely manner.

Can I travel outside of New York State without an IFTA license?

Traveling outside of New York State without an IFTA license may lead to complications or penalties. If your business requires interstate travel, securing an IFTA license is vital. It ensures compliance with fuel tax regulations in other states, thereby protecting your business from potential fines and ensuring that fuel taxes are paid appropriately.

What happens if I do not comply with IFTA requirements?

Failure to comply with IFTA requirements can result in significant consequences. These may include revocation of your IFTA license, fines, and potential legal repercussions. In some cases, New York State may withhold any refunds due to you if you are delinquent on fuel tax payments. Therefore, maintaining compliance is essential for operating your business smoothly and avoiding disruptions.

How do I submit the IFTA-21 form?

The IFTA-21 form can be submitted by mailing it to the Commissioner of Taxation and Finance along with your payment. Be sure to check the instructions provided on the form for specific mailing procedures. It is important to ensure that all information is complete and accurate to avoid delays in processing your application.

Common mistakes

When completing the IFTA-21 form, individuals often make avoidable mistakes that can delay their application or even lead to penalties. One common error is failing to provide complete identification details. Specifically, they might leave out the employer identification number or the social security number. Such omissions can cause significant delays in processing the application, as tax authorities rely on this information to verify the applicant's identity and compliance with tax regulations.

Another frequent mistake is misunderstandings regarding the type of business. Applicants may select the wrong option, such as choosing “Sole Proprietor” when their business is a corporation. This can have implications for tax responsibilities and eligibility. Clarity in this section is crucial, as each business type has distinct requirements under tax law.

Many applicants also neglect to check their answers before submitting the form. In particular, they may overlook necessary details like whether they plan to travel outside New York State or if they are registered for New York State highway use tax. Failing to address these questions correctly can hinder compliance efforts and may result in additional costs.

Lastly, inaccuracies in the total fees due can lead to complications. For example, applicants might miscalculate the amount owed based on the number of vehicles listed. A minor arithmetic error could lead to further inquiries from tax authorities, potentially delaying the issuance of the IFTA license. Ensuring that all calculations are double-checked before submission is essential for a smooth application process.

Documents used along the form

The IFTA 21 form is essential for entities operating vehicles that travel across state lines and participate in the International Fuel Tax Agreement. However, several other forms and documents can be integral to the application process and compliance with related regulations. Here’s a list of key forms often used alongside the IFTA 21 form, along with brief descriptions of each.

- IFTA Quarterly Fuel Use Tax Return (IFTA-100): This form is used by IFTA licensees to report the fuel consumption for all qualified vehicles in multiple jurisdictions. It provides crucial information for calculating taxes owed to various states and provinces based on mileage and fuel use.

- IFTA License Renewal Form: This document is necessary for renewing an existing IFTA license. It contains details about the applicant's business operations and ensures continued compliance with IFTA requirements.

- IRP Application for Vehicle Registration (Form IRP-1): This application is utilized for registering vehicles under the International Registration Plan (IRP). It is often completed alongside the IFTA 21 form to ensure overlapping compliance regarding vehicle operations across state lines.

- Fuel Tax Exemption Application: This form is for those seeking an exemption from fuel tax. It must be filled out and submitted in instances where a company or individual qualifies for exemptions within specific jurisdictions.

- Power of Attorney Form: If someone else is handling the application or reporting process on behalf of the business, this form grants the necessary authority. It ensures that the designated individual can act on behalf of the business entity for all IFTA-related matters.

Understanding the relationship between the IFTA 21 form and these associated documents is crucial for seamless compliance and operational efficiency. For businesses relying on interstate travel, these forms help navigate the complexities of fuel taxation and vehicle regulations.

Similar forms

- IFTA 1000 Form: This form serves a similar purpose in the context of the International Fuel Tax Agreement but specifically focuses on reporting fuel use and taxes paid. Like the IFTA 21, it requires business identification and details specific to fuel consumption, making it essential for compliance.

- New York State Highway Use Tax (HUT) Form: Both forms involve declarations related to transportation and fuel usage. The HUT form is specifically for reporting highway use tax for heavy vehicles operating in New York State, similar to the IFTA 21's requirement for roadway usage reporting.

- Motor Carrier Permit Application: This document is required for operating commercial vehicles across state lines. Both this application and the IFTA 21 involve business identification and operational details, providing authorities with the necessary information to grant permits for transportation.

- International Registration Plan (IRP) Application: This application pertains to registering commercial vehicles in multiple jurisdictions. Like the IFTA 21, it focuses on compliance across state lines and requires detailed business and vehicle information to ensure proper taxation and registration.

- Annual Tax Return for Fuel Tax: This document summarizes a company's total fuel usage and taxes owed for a given period. Similar to the IFTA 21, it involves calculations based on fuel consumption and mandates accurate reporting to state tax agencies.

Dos and Don'ts

Filling out the IFTA-21 form can seem overwhelming, but keeping a few essential tips in mind can make the process smoother. Below is a list of things you should and shouldn't do when completing this form.

- Do: Carefully read all instructions provided with the form.

- Do: Ensure that all information matches your business documents to avoid discrepancies.

- Do: Include your employer identification number or Social Security number as required.

- Do: Check the appropriate boxes clearly to indicate your business type and other selections.

- Do: Provide a current phone number and a valid mailing address for correspondence.

- Don't: Skip any sections or leave blanks, as this can delay processing.

- Don't: Use ink that could smudge; opt for a pen with permanent ink for clarity.

- Don't: Forget to sign the application; an unsigned form may be returned.

- Don't: Suppress any previous IFTA licenses or registrations; transparency is crucial.

- Don't: Wait until the last minute to submit your application; allow time for any unexpected issues.

Following these guidelines will help ensure a smoother application process for your IFTA-21 form. This attention to detail can save you from potential delays or complications down the line.

Misconceptions

Misconceptions about the IFTA 21 form can lead to confusion and improper filing. Here are ten common misunderstandings along with clarifications:

- IFTA 21 is only for large trucking companies. This form is applicable to any business that operates qualified motor vehicles while traveling in multiple jurisdictions, regardless of size.

- One license covers all vehicles forever. IFTA licenses need to be renewed annually. Businesses must submit a new application each calendar year.

- You cannot apply for IFTA if you are a sole proprietor. Sole proprietors are eligible to apply for IFTA just like any other type of business.

- Traveling outside New York State is unnecessary for IFTA registration. IFTA is specifically designed for businesses that operate vehicles in multiple jurisdictions, not solely within New York.

- Decals are optional once you have the license. Decals are required and must be displayed on the vehicles covered under the IFTA license.

- All IFTA fees are non-refundable. If an application is denied or if the business ceases operations, some fees may be refundable upon request.

- IFTA registration covers state highway-use tax. IFTA and highway-use taxes are separate, and businesses must ensure they are compliant with both.

- Anyone can sign the application. Only the owner, partner, member, officer, or an authorized individual can sign the application, as specified in the form.

- Bulk fuel storage does not need to be reported. If a business has bulk fuel storage, it must be disclosed on the application.

- Ignorance of tax laws offers immunity from penalties. Under New York State law, all applicants are responsible for understanding their compliance obligations, and ignorance does not exempt them from penalties.

Key takeaways

The IFTA 21 form is essential for businesses operating in New York that participate in the International Fuel Tax Agreement. Here are key takeaways for filling out and using the form:

- Purpose of the Form: The IFTA 21 application is primarily meant to obtain an IFTA license and corresponding decals for vehicles, as well as to facilitate fuel tax reporting.

- Annual Submission: Complete the form annually for each calendar year. This includes selecting the correct reason for application, such as new or renewal.

- Business Identification: Accurately provide identification details like your Employer Identification Number (EIN) and USDOT number. This information is crucial for tax purposes.

- Type of Business: Indicate the type of your business, whether it is a sole proprietorship, corporation, partnership, LLC/LLP, or other.

- Decal Order: Calculate the fee for the decals based on the number of IFTA vehicles. Each set of two decals costs $8.

- Additional Licenses: If you require additional licenses, mark the box and include the corresponding $2 fee on the form.

- Payment Instructions: Make payments via check or money order payable to the Commissioner of Taxation and Finance, as specified on the form.

- Certification Requirement: Certifying the information on the form is mandatory. The applicant is responsible for the accuracy of all provided data.

- Compliance Agreement: By signing, the applicant agrees to comply with all IFTA-related regulations, including timely reporting and payment of fuel taxes.

- Consequences of Falsification: Misrepresenting any information may lead to civil and criminal penalties under state law.

- Contact Information: Ensure that the contact information for the person signing the form is correct, including phone number and email address.

Using this information can help ensure a smoother application process and compliance with IFTA requirements.

Browse Other Templates

Prentice Hall Algebra 1 Textbook - Explore diverse learning options provided through the Prentice Hall Algebra curriculum.

Akc Foreign Registration Form - Contact AKC for questions about the registration process.