Fill Out Your Ihss Direct Deposit Form

Navigating payroll procedures can often be a daunting task, especially for In-Home Supportive Services (IHSS) providers in California who rely on timely payments for their vital work. The IHSS Direct Deposit form serves as a crucial tool, allowing these providers to authorize automatic deposits of their paychecks directly into their personal bank accounts. This streamlined process not only saves time by eliminating the need to deposit checks manually but also helps ensure that funds are consistently available without delay. The form requires essential details such as the provider's name, case number, and account information, including the bank routing number and account number for either checking or savings accounts. By checking appropriate boxes, providers can indicate whether they are enrolling in Direct Deposit for the first time, changing existing bank account information, or canceling their Direct Deposit altogether. Complete information is necessary; incomplete forms will be returned for revision. Furthermore, it’s important for providers who work with multiple recipients to remember that a separate form is needed for each recipient. Should changes be necessary, such as updating banking details or canceling the service, the provider must submit a new form. The process might seem intricate, but detailed instructions are readily available, ensuring providers can efficiently access their hard-earned wages without hassle.

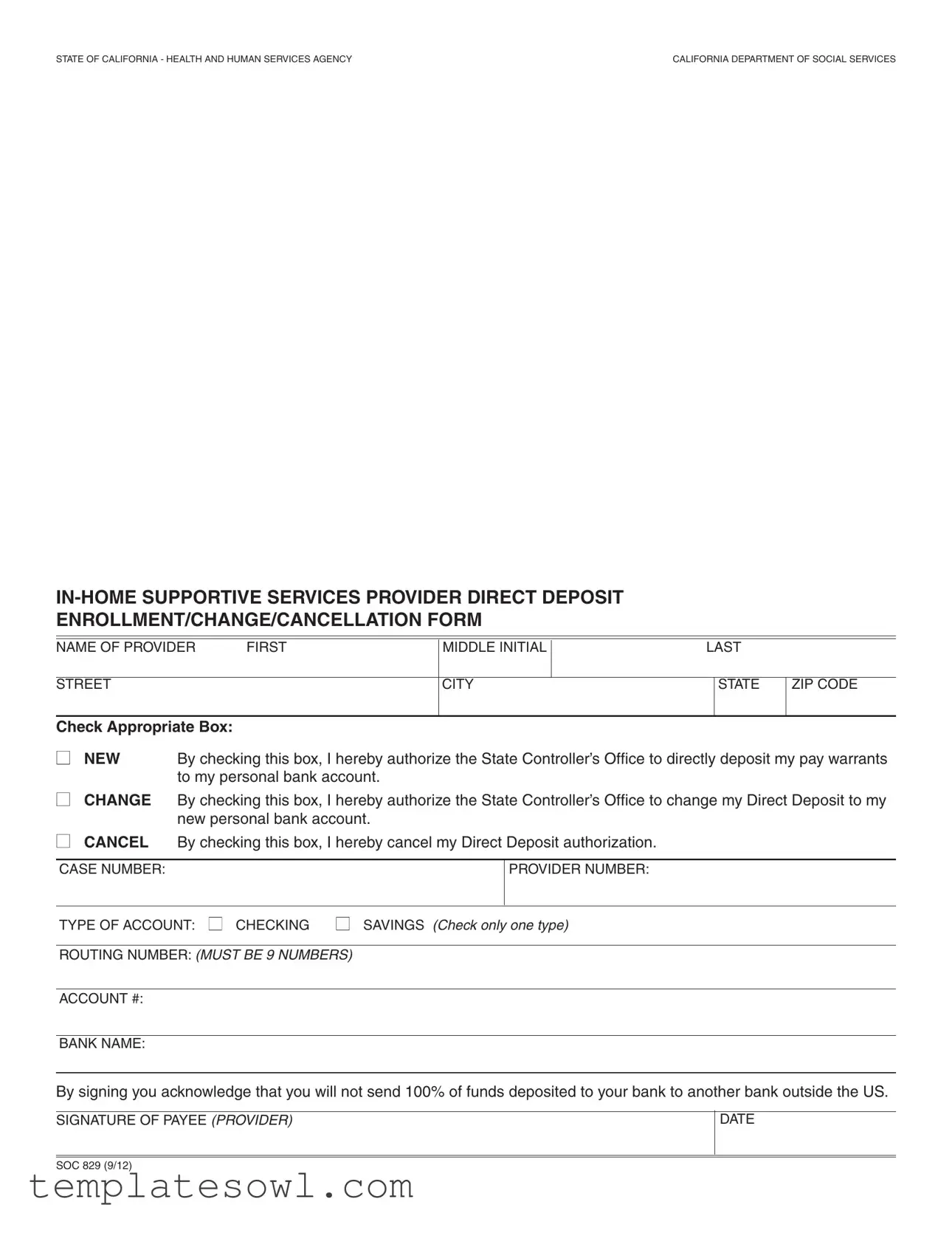

Ihss Direct Deposit Example

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY |

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES |

ENROLLMENT/CHANGE/CANCELLATION FORM

NAME OF PROVIDER |

FIRST |

MIDDLE INITIAL

LAST

STREET

CITY

STATE

ZIP CODE

Check Appropriate Box:

■ NEW By checking this box, I hereby authorize the State Controller’s Office to directly deposit my pay warrants to my personal bank account.

■CHANGE By checking this box, I hereby authorize the State Controller’s Office to change my Direct Deposit to my new personal bank account.

■CANCEL By checking this box, I hereby cancel my Direct Deposit authorization.

CASE NUMBER:

PROVIDER NUMBER:

TYPE OF ACCOUNT: ■ CHECKING ■ SAVINGS (Check only one type)

ROUTING NUMBER: (MUST BE 9 NUMBERS)

ACCOUNT #:

BANK NAME:

By signing you acknowledge that you will not send 100% of funds deposited to your bank to another bank outside the US.

SIGNATURE OF PAYEE (PROVIDER)

DATE

SOC 829 (9/12)

PROVIDER DIRECT DEPOSIT ENROLLMENT INSTRUCTIONS

You are not eligible for Direct Deposit if you are planning to send 100% of funds deposited to your bank to another bank outside the US.

You will need the following information to complete the Direct Deposit Enrollment Form:

1.The name of your Bank.

2.The Bank Routing Number

3.Your Checking or Savings Account Number. If you need help identifying this information please ask your Bank for assistance.

CHECK APPROPRIATE BOX

Please check the box to tell us what you want to do. Check the Box: NEW to enroll in direct deposit; CHANGE to change your bank account; and CANCEL to cancel direct deposit.

Check the box to tell us whether you want your paycheck deposited in your Checking or Savings account.

IDENTIFICATION INFORMATION

Provide your Case and Provider number. You will find the case and provider numbers on your IHSS Statement of Earnings (pay stub).

BANKING INFORMATION

Provide the information requested on the form. You may find the bank information you will need to complete the enrollment form on your personal checks or your bank may assist you. Below is an example of a check and where to find the necessary information.

Check Example:

Your Name |

|

Check NO. 4444 |

Pay to the Order of _________________________________ |

||

I112145678 I: |

5765432109812 |

4444 |

|

|

|

{ |

{ |

{ |

Routing No. |

Your Acct. No. |

Ck. No. |

If you prefer to have your money deposited into your savings account, please contact your bank for assistance.

PROVIDE ALL REQUESTED INFORMATION

All information requested on the form must be provided. Incomplete forms will be returned. To enroll in Direct Deposit you must complete all fields on an Enrollment/Change/Cancellation form. Your signature authorizing Direct Deposit must be an ORIGINAL SIGNATURE, photocopies will not be accepted.

IF YOU WORK FOR MULTIPLE RECIPIENTS

You must complete a separate Provider Enrollment/Change/Cancellation form for EACH Recipient with whom you are employed. When you begin work for a new recipient you will need to complete a new form.

CHANGING OR CANCELLING YOUR DIRECT DEPOSIT

Your Direct Deposit will continue to be deposited into the bank account you have chosen until you request a change. If you wish to change or cancel your Direct Deposit authorization for any recipient for whom you work, you must submit an Enrollment/Change/Cancellation form with a check next to the box for Change or Cancel. You may access our website at www.dss.cahwnet.gov to download additional forms or contact the Direct Deposit Help desk toll free at (866)

Please send your COMPLETED Enrollment/Change/Cancellation Form to:

PROVIDER ENROLLMENT PROCESSING CENTER

P.O. BOX 1120

ROSEVILLE, CA 95678

SOC 829 (9/12)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The IHSS Direct Deposit form is used by providers to enroll, change, or cancel their direct deposit authorization for payments from the State Controller’s Office. |

| Eligibility | Providers are not eligible for direct deposit if they intend to send 100% of funds deposited to a bank outside the US. This requirement ensures proper management of funds. |

| Completion Requirements | All requested information on the form must be completed. Incomplete forms will be returned, and original signatures are required; photocopies are not accepted. |

| Multiple Recipients | Providers working for multiple recipients must fill out a separate form for each recipient. A new form is necessary when beginning work for a new recipient. |

Guidelines on Utilizing Ihss Direct Deposit

Filling out the IHSS Direct Deposit form is an important step to ensure that your payments reach you accurately and on time. Once the form is successfully submitted, the State Controller’s Office will begin the process of depositing your pay directly into your specified bank account. This means no more waiting for checks to arrive in the mail! Here’s a clear and simple guide to assist you in completing the form.

- Gather required information. Collect your bank's name, routing number, and your account number. If needed, ask your bank for assistance in locating this information.

- Identify your purpose. Choose one of the options at the top of the form by checking the appropriate box: NEW to enroll, CHANGE to update your bank information, or CANCEL to stop direct deposit.

- Specify account type. Indicate whether you want the deposit into a CHECKING or SAVINGS account by checking the corresponding box.

- Fill in identification information. Write down your Case Number and Provider Number. You can find these numbers on your IHSS Statement of Earnings (your pay stub).

- Complete banking information. Enter the routing number (ensure it has 9 digits), your account number, and the name of the bank where you hold your account.

- Provide your signature. Sign the form with your original signature. Remember that photocopies of your signature will not be accepted.

- Check for completeness. Make sure you’ve filled in all the requested fields; incomplete forms will be returned.

- Submit the form. Mail your completed form to the specified address: PROVIDER ENROLLMENT PROCESSING CENTER, P.O. BOX 1120, ROSEVILLE, CA 95678.

After your form is submitted, keep an eye out for confirmation of your enrollment. If anything seems amiss or if you have any questions during the process, you can contact the Direct Deposit Help Desk for assistance.

What You Should Know About This Form

What is the IHSS Direct Deposit form used for?

The IHSS Direct Deposit form allows In-Home Supportive Services (IHSS) providers to authorize the State Controller’s Office to deposit their pay directly into their bank accounts. This service offers convenience and ensures timely payment. Providers can use the form to enroll in direct deposit, change their bank account information, or cancel existing direct deposit arrangements.

What information do I need to fill out the IHSS Direct Deposit form?

To complete the IHSS Direct Deposit form, you will need several pieces of information. This includes the name of your bank, the bank routing number (a 9-digit number), and your account number for a checking or savings account. You can generally find this information on your personal checks or by asking your bank for help. In addition, you will need to provide your Case Number and Provider Number, which can be located on your IHSS Statement of Earnings or pay stub.

What should I do if I want to change or cancel my direct deposit?

If you wish to change or cancel your direct deposit, you will need to fill out a new Enrollment/Change/Cancellation form. Be sure to check the appropriate box on the form to indicate your intention to change or cancel your direct deposit authorization. It's essential to provide all required information, as incomplete forms will be returned. After you complete the form, send it to the Provider Enrollment Processing Center at the specified address.

Can I have direct deposit if I'm sending all funds to another bank outside the U.S.?

No, you are not eligible for direct deposit if you plan to send 100% of your deposited funds to a bank outside the United States. This eligibility requirement is in place to ensure that all deposited funds remain in the U.S. banking system. If you require international banking services, please discuss your options with your bank directly.

Common mistakes

Filling out the IHSS Direct Deposit form can be straightforward, but several common mistakes can lead to delays and complications. Addressing these errors quickly is crucial. Here are six frequent mistakes that individuals make when completing the form.

One major mistake is failing to check the appropriate box to indicate whether you are enrolling in Direct Deposit, changing your account, or canceling a previous enrollment. Each box must be clearly checked to avoid confusion, as incomplete selections could result in processing delays.

Another error involves providing incorrect bank information. Ensure that the routing number is exactly nine digits long, as incomplete or incorrect information can lead to issues with deposits. It is also essential to double-check your account number for accuracy.

Many forget to include all required identification information, such as your case number and provider number. This information can typically be found on your IHSS statement of earnings. If these identifiers are missing, your form may be returned.

Using a photocopy of your signature can also hinder the processing of your form. The signature must be original. This requirement is strict, so take care to provide your actual signature to prevent any disruptions to your Direct Deposit.

Some people mistakenly assume one form covers multiple recipients. If you work for more than one recipient, you must complete a separate form for each. Submitting multiple requests is necessary to ensure that each recipient’s payments are processed correctly.

Lastly, remember to send the completed form to the correct address. If your form is sent to the wrong location, it will not be processed. Make sure to verify the mailing address provided in the instructions and confirm that your form is complete before sending it.

Being aware of these common mistakes can streamline your experience with the IHSS Direct Deposit process. Attention to detail is vital to avoid unnecessary delays and ensure timely payments.

Documents used along the form

The In-Home Supportive Services (IHSS) program offers essential support for individuals in need. The Direct Deposit form is often used alongside various other documents to ensure smooth processing. Below are some of the key forms and documents frequently associated with the IHSS Direct Deposit process.

- IHSS Statement of Earnings: This document details your earnings as a provider, including hours worked and pay rate. It is crucial for verifying your case and provider numbers when filling out the Direct Deposit form.

- Provider Enrollment Application: This form allows new providers to enroll in the program. It collects essential information, including background checks and personal details necessary for employment verification.

- W-9 Form: This IRS form requests your taxpayer information. It's essential for reporting earnings to the government, ensuring you are compliant with tax regulations.

- Direct Deposit Cancellation Form: If you wish to discontinue your direct deposit, this form specifically addresses that need. It allows you to formally cancel the previous authorization with ease.

- Change of Address Form: If you move and need to update your address for mailing purposes, this form should be completed. It ensures that all future communications and documents reach you without delay.

- Time Sheet: This document is used to record the hours you work as a provider. It's important for calculating your pay and must be submitted regularly as part of the payment process.

By understanding these associated documents, you can navigate the IHSS system more effectively. Having the right forms ready and knowing their purposes can ease communication and ensure that you receive the support you need and deserve.

Similar forms

W-4 Form: Similar to the IHSS Direct Deposit form, the W-4 form allows individuals to provide information to their employer regarding how much federal income tax to withhold from their paychecks. Both require personal and financial details to ensure accurate processing.

Direct Deposit Authorization Form: This document also authorizes direct deposits into a bank account. Like the IHSS Direct Deposit form, it asks for personal identification, bank account details, and an authorization signature.

State Employment Application: An employment application collects personal information, work history, and references. Similar to the IHSS form, it is fundamental for processing employment and payment issues.

Paycheck Authorization/Envelope: When receiving paychecks, individuals often sign forms confirming their preferred payment methods. This mirrors the IHSS Direct Deposit form’s purpose in ensuring proper payment channels.

Bank Account Change Request Form: Banks often require a specific form to change account details. This functions similarly to the IHSS form by ensuring up-to-date and correct banking information for all transactions.

Payroll Deduction Form: This form is used to authorize deductions from a paycheck for various reasons, such as insurance or retirement plans. Like the IHSS Direct Deposit form, it collects necessary information to facilitate correct payroll transactions.

Dos and Don'ts

When filling out the IHSS Direct Deposit form, it’s important to follow some guidelines to ensure a smooth process. Here is a list of things to do and avoid:

- Provide Accurate Information: Double-check all details entered on the form, including your name and account numbers.

- Use an Original Signature: Make sure to sign the form with your original signature; photocopies will not be accepted.

- Check the Appropriate Box: Clearly mark whether you are enrolling, changing, or canceling your direct deposit.

- Confirm Your Routing and Account Numbers: Ensure that the routing number and account number are correct to avoid payment errors.

- Leave Out Information: Do not skip any fields on the form; missing information will lead to delays.

- Use a P.O. Box for Bank Details: Avoid using a P.O. Box; provide your physical address for the bank's requirements.

- Submit Multiple Forms for One Recipient: Do not use one form for multiple recipients; complete a separate form for each employer.

- Assume Your Previous Information is Still Valid: Always update your information when changing banks or account details.

Misconceptions

Misconception 1: You can only use the Direct Deposit form for a new account.

Many believe that the form can only be used to set up a new direct deposit account. In reality, the form serves multiple purposes. You can use it to enroll in direct deposit, change your bank account, or cancel your existing direct deposit altogether. It's crucial to check the appropriate box to indicate what you need.

Misconception 2: You cannot change your bank account after initial enrollment.

Some people think that once they have enrolled in direct deposit, they are locked into their original account. This is not true. The form allows you to change your direct deposit information whenever necessary. Just remember to fill out the form again and check the box for "Change." This ensures your pay will go to the new, designated account.

Misconception 3: Photocopies of signatures are acceptable.

There is a common misunderstanding that it is acceptable to submit a photocopy of your signature. However, the form requires an original signature to authorize direct deposit. If you submit a photocopy, your enrollment or change request will not be processed, leading to delays in receiving your funds.

Misconception 4: All information is optional on the form.

Some individuals may assume that they can skip certain sections of the form. Unfortunately, this is not the case. All fields must be completed for the form to be valid. Incomplete forms will be returned, which could result in a lapse in payment. It is essential to provide all requested information accurately to ensure a smooth process.

Key takeaways

When filling out the IHSS Direct Deposit form, several key points must be taken into consideration to ensure a smooth process. Here are essential takeaways:

- Complete the appropriate box indicating whether you are enrolling, changing, or canceling Direct Deposit.

- Provide your first name, middle initial, last name, street address, city, state, and zip code.

- Include your unique case number and provider number; these numbers can be found on your IHSS Statement of Earnings.

- Indicate the type of account (checking or savings) by checking the corresponding option.

- Ensure your bank routing number has exactly 9 digits.

- Write down the account number and the name of your bank accurately.

- Every field on the form must be filled out; incomplete submissions will be returned.

- Use an original signature; photocopies are not accepted.

- For those working with multiple recipients, a separate form is required for each.

- To process a change or cancellation, submit a new form marked accordingly and send it to the designated address.

Being meticulous while completing this form can help avoid delays in your payments.

Browse Other Templates

How Much Is a Llc in California - The optional certification fee ensures that you receive an official record of the cancellation.

File Ny State Tax Extension - Take note of any changes in filing requirements announced by the department.

Las Vegas Workers Compensation Case - The implications of denial are serious; understanding the requirements listed in the C-4 Auth helps mitigate risks.